The crypto world is full of twists and turns, but guess what? That’s what keeps things interesting! This week, significant events have shaped the landscape, starting with the U.S. government transferring $2 billion worth of Silk Road BTC to new accounts. This move comes shortly after President Trump announced plans to create a strategic national Bitcoin stockpile if re-elected, causing Bitcoin prices to dip to $66K, while Solana’s SOL led the major losses.

In other news, Russia’s plans to use cryptocurrency for international payments signal a potential shift away from dependence on the U.S. dollar, potentially increasing the value and wider acceptance of cryptocurrencies.

Meanwhile, WazirX faced criticism over its proposed recovery plan to address the $235 million loss from a security breach, leading to a split from Binance. Additionally, the release of $600 million worth of XRP tokens this August marks significant activity in the crypto market.

US Moves $2B Silk Road BTC to an Unknown Account Shortly After Trump’s Stockpile Pledge

Two days after former President Donald Trump announced his intention to create a “strategic national Bitcoin stockpile” if reelected, the United States government moved $2 billion worth of Bitcoin. During a speech at the Bitcoin conference in Nashville, Tennessee, Trump promised that the U.S. would never sell any of its Bitcoin holdings.

Trump also declared his goal to make the U.S. the “crypto capital of the world” by implementing new policies to favor digital currency if he wins the November presidential election. In his words, “If Bitcoin is going to the moon as they say, I want it to be America that sends it there.”

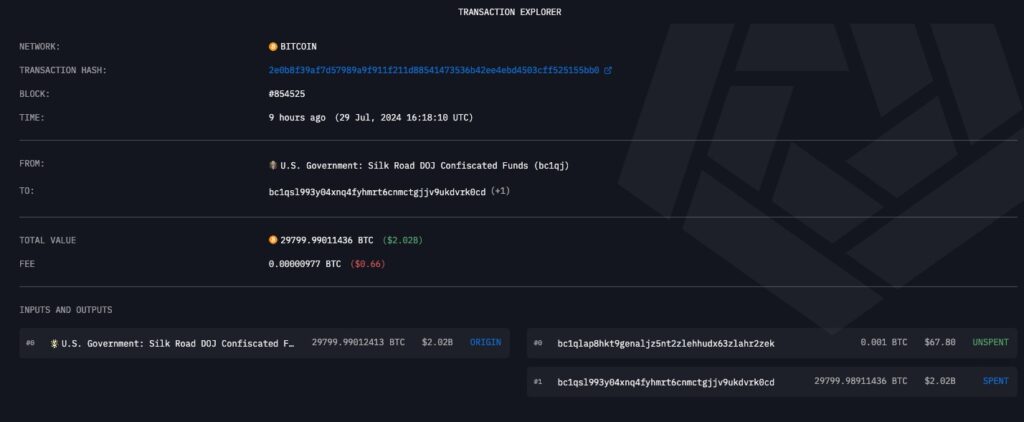

However, approximately 48 hours after Trump’s crypto-friendly declarations, the U.S. government transferred $2 billion worth of Bitcoin to unknown wallets. According to Arkham Intelligence, the tokens originated from the seized Silk Road crypto, with at least one of the wallets likely being a custodial service.

Source: Arkham Intelligence

Galaxy Digital CEO, Mike Novogratz, criticized the move, describing it as “tone-deaf” in a July 29 post on X.

Bitcoin Slides to $66K in Wake of Silk Road BTC Movements, Solana’s SOL Leads Majors Losses

On Tuesday, July 23, Bitcoin’s price dipped to $66,000, erasing the gains from the previous week. The market sentiment took a hit following the news of the movement of a significant amount of BTC from a U.S. government-linked wallet.

“It’s going to be extremely volatile this week, so I will not be surprised to see the BTC price get another 10% drop/pump,” one analyst noted.

Solana’s SOL led the losses among major cryptocurrencies with a 6% decline, reversing gains from Monday. The token had risen as meme coin trading increased on the network over the weekend, with on-chain trading volumes surpassing those of Ethereum. Other major cryptocurrencies also saw losses amid Bitcoin’s decline. Cardano’s ADA dropped 5%, Dogecoin (DOGE) and BNB Chain’s BNB fell 4%, and XRP lost 3%.

Ether showed relative strength with only a 1% decline, despite newly launched spot ETH exchange-traded funds (ETFs) experiencing $97 million in net outflows on Monday, marking the fourth consecutive day of outflows.

Russia to Launch International Payments in Crypto Before the End of 2024

Russia, a country where crypto payments are currently prohibited, is set to change its stance by launching its first international payments in crypto before the end of the year.

According to Elvina Nabiullina, Russia’s Central Bank’s governor, this development will enable them to overcome the payment delays that have greatly challenged the Russian economy. In addition to delayed payments, Nabiullina also highlighted that “the risks of secondary sanctions have grown,” making it difficult to process payments for imports, which affects a wide range of goods.

The lower house of parliament is expected to approve the law on Tuesday, adopting cryptocurrencies as a form of payment and allowing Russian companies to use it for international trade. The new law is expected to come into force this autumn.

WazirX Attracts Backlash over “Socialized” Recovery Plan, Asks Bitcoin for Help

One of the notable Indian crypto exchanges, WazirX which lost about $234 million of funds in a malicious attack, has come up with a recovery plan. The exchange proposed to distribute the loss among all WazirX users. The exchange further initiated a poll, leaving its users with two options;

Option A: Users can trade and hold their crypto with priority for recovery but cannot withdraw it.

Option B: Users can trade and withdraw their crypto but will have lower priority for recovery. Users can switch to Option A before making trades or withdrawals.

While WazirX CEO, Nischal Shetty has clearly stated that this poll is not legally binding on users. WazirX’s approach has however raised controversy from WazirX users and the entire local crypto community. Submit Gupta, CEO and founder of CoinDCX criticized the exchange’s recovery strategy, stating that;

“WazirX is handling this entire situation in a way that isn’t community-first, and this IMO won’t go down well for them. This, sadly, is also hurting other ecosystem participants.”

In an effort to recover losses from the cyberattack, WazirX has reached former partner Binance for help in bailing out affected customers.

As of the date of the cyber attack, Binance regulates nearly $80 million worth of WRX tokens. However, the WazirX appears to be restricted from using its funds to offset some part of the user’s lost assets. This has led to a controversy and eventually an end to the partnership between the both exchanges.

$600M XRP Token Release Marks $1.5B in August Crypto Unlocks

The month of August looks promising for crypto token unlocks, with $1.5 billion in tokens set to be released to the market. Ripple will unlock $609 million in XRP tokens, that’s approximately 1 billion XRP tokens on August 1. Ripple, Since 2017 Ripple has shown consistency in its release of 1 billion tokens on the first day of each month.

However, due to Ripple’s re-escrow process, not all the tokens released enter circulation. The network often re-locks a significant portion of the unlocked tokens, helping to regulate the amount of unlocked tokens that reach the market.

In addition to XRP, other major crypto projects will also be releasing a significant amount of tokens in August. These include Layer-1 network Avalanche and cross-chain bridging platform Wormhole, collectively unlocking $449 million worth of tokens.

Wormhole is set to release 33.3% of its circulating supply, amounting to 600 million wormhole tokens, currently valued at $180.5 million. Avalanche will unlock 2.4% of its circulating supply on August 20, amounting to 9.4 million AVAX tokens, currently valued at $268 million.

Other Tokens Unlocking on August 1

Three other projects will also be unlocking significant amounts of their supply on August 1, including the Layer-1 network Sui, the decentralized exchange dYdX, and the “universal” blockchain ZetaChain. Sui will unlock 2.56% of its circulating supply, equivalent to 64 million tokens with a market valuation of $50 million. On the same day, DYdX will release 8.33 million tokens, worth roughly $11 million, amounting to 3.65% of its circulating supply. These tokens will be distributed among investors, founders, staff, and future employees.

The newly-launched layer-1 network, ZetaChain, will also unlock nearly 18.9% of its circulating supply on the first day of August. This is 53.9 million ZETA tokens, worth about $34.5 million at current market value. This follows its launch in February.

Other Expected August Unlocks

Several other crypto projects, including ImmutableX, Aptos, Sandbox, Starknet, and Arbitrum, are set to unlock their tokens in August. ImmutableX will unlock 2.11% of its circulating supply on August 9, amounting to 32.5 million IMX tokens, valued at $49 million.

Aptos, Sui’s rival, will release $80 million worth of APT tokens on August 12. The Web3 gaming platform Sandbox will unlock $69 million worth of SAND tokens on August 14. Starknet will unlock 64 million of its STRK tokens on August 15, amounting to 4.4% of its circulating supply, valued at $35 million. On August 16, Arbitrum will unlock 92.6 million ARB tokens, amounting to 2.8% of its circulating supply, valued at $67 million.

Summary

In the crypto space, uncertainty is a constant, keeping everyone on tenterhooks. This week, Bitcoin slid to $66,000, indicating a dent in sentiment as a notable amount of the asset was moved from U.S. government-linked wallets. WazirX ended its partnership with Binance following a controversy and faced criticism for its recovery strategy.

Russia’s increased interest in cryptocurrency is part of its efforts to find solutions to the challenges of international trading while reducing the impact of sanctions. This move could potentially strengthen the role of cryptocurrencies in global trade. The extensive token unlocks coming up in August signify continuous development in the crypto ecosystem, which can impact market liquidity and dynamics across blockchain projects.

Do you think WazirX’s proposal for handling the losses is the best? Could there be a better approach? We’d love to hear from you!

With Russia’s plan to legalize crypto, cryptocurrency is likely to gain wider acceptance. Zypto empowers you with modern solutions so that you don’t miss out on the future of payments. With Zypto, you can accept crypto anywhere in the world, swiftly convert to fiat, and enjoy spending with virtual crypto cards. Download the Zypto App to experience seamless cross-border trades.

FAQs

How much Bitcoin is held by the U.S. government?

The U.S. government has periodically seized significant amounts of Bitcoin through law enforcement actions, particularly related to criminal activities.

The exact amount can vary over time, but at certain points, it has been reported to hold thousands of Bitcoins. For instance, after the Silk Road takedown, the U.S. government seized around 144,000 BTC.

Did the US government transfer $2.1 B in seized Bitcoin to Coinbase?

As of recent reports, the U.S. government has not transferred $2.1 billion in seized Bitcoin to Coinbase. However, the government has conducted auctions to sell seized Bitcoin and used various exchanges and platforms to liquidate assets. Specific large transfers would typically be publicly reported due to their significant impact on the market.

Is Russia legalizing crypto?

Russia has had a complex relationship with cryptocurrency regulation. While it has not fully legalized cryptocurrencies as a means of payment, recent moves indicate a trend towards establishing a regulated framework.

Russia passed a law in 2020 recognizing cryptocurrencies as taxable property, but their use for payment remains restricted. Ongoing discussions suggest further regulatory developments could be forthcoming.

What are WazirX issues?

WazirX, one of India’s largest cryptocurrency exchanges, has faced several issues. In August 2021, it came under scrutiny by the Enforcement Directorate (ED) of India for alleged violations of foreign exchange regulations.

Additionally, in 2022, there were disputes between Binance and WazirX regarding ownership and operational control, creating confusion among users about the platform’s future and regulatory compliance. These issues have led to concerns about the exchange’s legal standing and operational stability.

0 Comments