Capital is a big factor required to scale up in the DeFi space. Imagine you want to bridge your tokens to another blockchain or contribute to a liquidity pool to earn interest over time. However, you have limited funds for this. That’s precisely where a flash loan becomes handy.

The introduction of flash loans to the decentralized finance ecosystem is game-changing. They let users borrow assets from a pool without needing collateral. Flash loans also offer super-fast access to liquidity for profitable trading opportunities. Ready to learn more about this revolutionary concept? Please read on to find out more.

What is a Flash Loan?

Flash loans are unique loan types that let users borrow assets without collateral to access a DeFi protocol or service. They are powered by smart contracts, which reverse the entire transaction if users don’t repay quickly.

A flash loan is typically implemented on blockchains like Ethereum and integrated into decentralized applications such as Aave or Uniswap. Many users utilize it for arbitrage purposes. This process involves buying crypto at a lower price in one decentralized exchange and selling it higher at another. These price differences can earn you a profit.

How Do Flash Loans Work?

In traditional lending, borrowers often offer assets as collateral to get a loan. If the borrower defaults on payments, the lender can claim the collateralized assets to cover the loan. However, it’s a different ball game with flash loans – you don’t need any collateral.

Nevertheless, you must repay such a loan within the same transaction. If you don’t, the entire transaction is canceled. Thus, defaulting on a flash loan becomes nearly impossible.

Let’s consider how it works in this scenario: A user wants to take advantage of an arbitrage trade of a newly launched token and needs $100,000 worth of ETH to profit from the token’s price differences. First, the user chooses a DeFi platform that supports flash loans.

Afterward, they link their wallet to the platform, and a smart contract is created. Next, the lender transfers $100,000 worth of ETH to the user. Upon receiving the funds, the user leverages them to arbitrage on the token and makes a profit.

Through the smart contract, the trader returns the borrowed funds plus interest (for instance, 0.3%) to the lender. If they repay in full, they can repeat the process. However, if the user defaults on their payment, the smart contract reverses the transaction by returning the borrowed funds to the lender.

How Do Flash Loans Differ from Normal Loans?

Most users are familiar with the intricacies of a regular loan. Usually, a lender gives money to a borrower and agrees to repay it over time with interest. Flash loans operate similarly, yet they have unique properties that set them apart from their traditional counterparts.

Flash loans use smart contracts, which ensure that loan conditions (such as repayment time and interest charged) are agreed upon before funds move from the lender to the borrower. It’s vital to note that the borrower must repay the loan within the same transaction. If the user defaults on this simple condition, smart contracts swoop to reverse the transaction.

Furthermore, traditional loans often require a safety net for lenders (collateral) in the event a borrower defaults on repayment. Flash loans differ, as the loan’s security comes from its instant repayment requirement. So, the lender’s funds are never at risk at any time.

Notably, the processes involved in getting conventional loans are usually lengthy, as approval, disbursement, and repayment can take weeks, months, or even years. On the flip side, flash loans are instant. The table below reveals a quick comparison between them.

| Features | Traditional Loan | Flash Loan |

| Collateral | Required | Not required |

| Repayment Time | It can be longer. It could take weeks, months, or years. | It is usually instant (within the same transaction) |

| Security Mechanism | Collateral | Smart contracts |

| Use Cases | Long-term investments | Arbitrage or quick, profitable trades |

Notable Platforms That Offer Flash Loans

Flash loans are a remarkable innovation, and it’s not surprising that many platforms are taking advantage of them. Let’s take a closer look at some key players in this space:

Aave

Aave, launched as ETHlend in 2017, was rebranded in 2018. Based on Ethereum, this platform allows users to create money markets and operates with a dual-token system: aToken for interest compounding and LEND for governance. The flash loan fee is currently 0.09%, which is adjustable via governance.

dYdX

dYdX offers flash loans with no default risk. This platform became particularly attractive for large loans when it introduced fee-free loans in February 2020. dYdX is excellent for tech-savvy users looking for quick and efficient loan solutions.

Uniswap

Uniswap is a leading decentralized exchange (DEX) that allows users to trade without intermediaries. It operates on various blockchains, including Ethereum, Binance Smart Chain, and Polygon. Uniswap uses the UNI token for governance, allowing holders to vote on platform decisions.

Equalizer

Equalizer Finance prides itself on being the first DeFi-specific flash loan platform, operating on Ethereum, Polygon, and Binance Smart Chain. It offers loans with a 0% fee, making it attractive for users seeking cost-effective loan solutions.

Solend

Solend is a DeFi platform on the Solana blockchain. It offers loans that don’t require collateral, allowing users to access funds quickly. Solend collaborates with Hawksight and GoblinGold to make its flash loans open source, thus enabling other DeFi protocols to leverage and access them. The current fee for these loans on Solend is 0.3%.

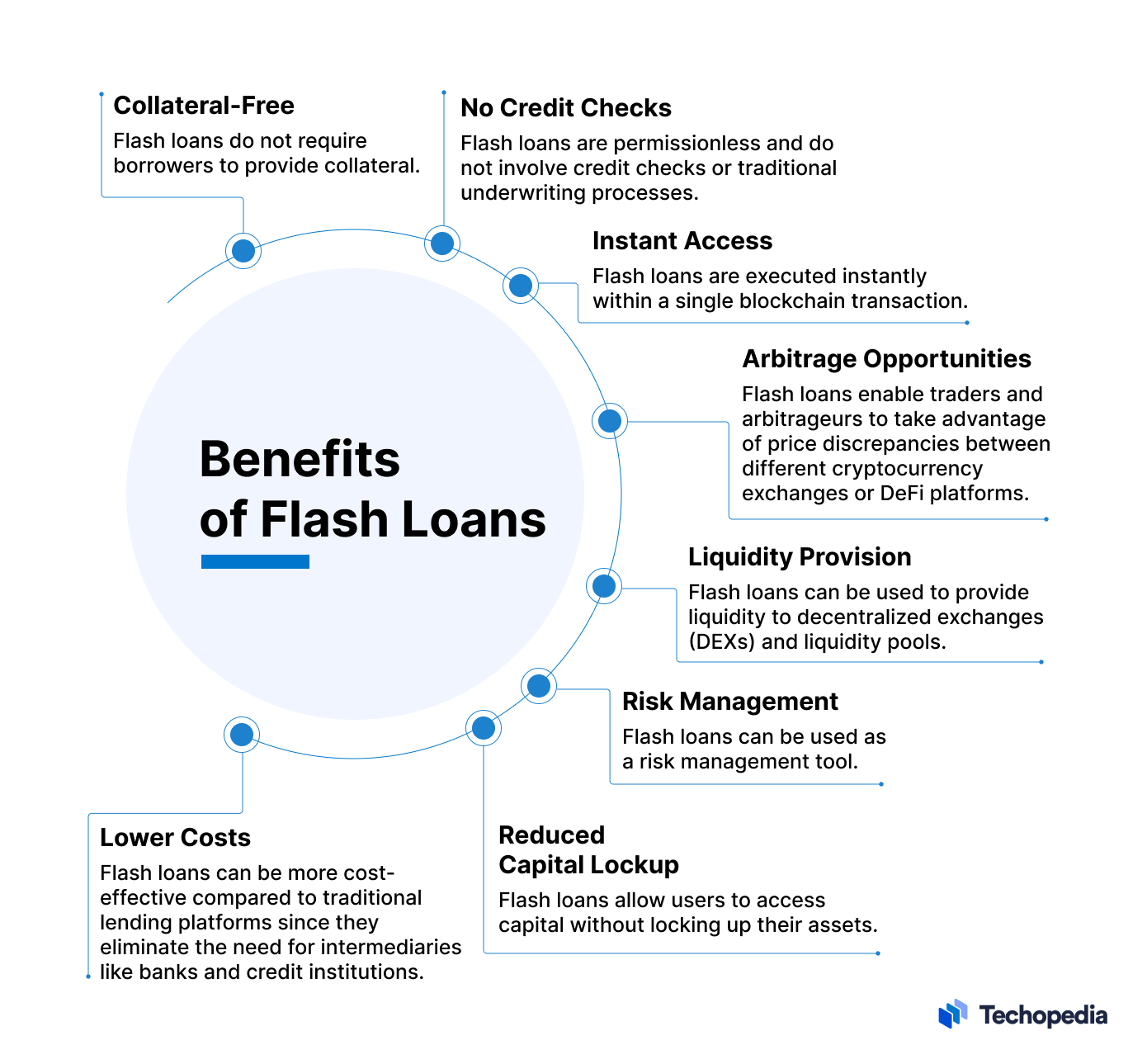

Benefits of a Flash Loan

A flash loan offers exciting benefits in DeFi, which makes it a powerful tool for savvy investors and users. Let’s discuss its perks below:

It is Collateral-free

Flash loans differ from the conventional types as it doesn’t require any collateral. This means you can access huge funds without using your assets as security. This opens up opportunities for users to participate in high-stakes trading and investments without any hassle.

It is Instantly Accessible

Instant access to funds can be a key difference between seizing a profitable opportunity and missing out. As such, a flash loan is executed within a single blockchain transaction, usually within a few seconds or minutes. Thus, you can borrow, use, and repay the loan almost instantly.

It Enables Arbitrage Opportunities

By leveraging this loan type, traders can benefit from price differences between crypto exchanges or DeFi platforms. You can make quick profits within seconds as you buy low in one market and sell high in another.

It Provides Liquidity

A flash loan can provide liquidity to decentralized exchanges and liquidity pools. This assists the platforms in running smoothly by ensuring there’s enough liquidity for trading activities. By contributing to the liquidity pool, you help the exchange’s ecosystem while earning fees or rewards.

It Offers a Lower Cost Advantage

This loan type is more cost-effective than its traditional counterpart because it eliminates centralized entities in the blockchain. Without intermediaries, the cost associated with borrowing is reduced, thus saving the borrower money on fees and interest rates.

Source: Techpedia

Risks Associated with Obtaining a Flash Loan

A flash loan is a fair coin. While it offers incredible benefits, it has its risks. Let’s explore them and see how best you can take advantage of these loans.

Smart Contracts Can Have Vulnerabilities

A flash loan relies on a smart contract to seamlessly move funds from a lender to a borrower. If this code has bugs or vulnerabilities, hackers can exploit them, resulting in loss of funds and wallet hacks. This makes the security of the smart contract crucial in platforms that support these loans.

Price Slippage Can Occur During Transactions

Price slippage can occur when executing a trade or swap. This happens when the price of an asset changes at the time you plan the trade. Since a user trades with a large capital, orders may be difficult to fill.

Thus, repaying the loan becomes challenging, resulting in potential losses. When such losses occur, the borrower bears them via gas fees while the borrowed funds are safely returned to the lender.

High Gas Fees can Reduce Loan Profitability

Although a flash loan is cost-effective (due to no intermediaries), it involves multiple smart contract interactions in a single transaction. On networks like Ethereum, transactions can consume a lot of gas. When gas fees are high, the execution cost can eat into your profits. It’s like paying a high toll fee, which can make your trip less worthwhile.

Market Volatility Can Cause Losses

Leveraging these loans often requires the right market conditions. Rapid changes in prices can impact the success of a flash loan strategy. For example, if the market suddenly becomes bearish, all your planned buy trades might fail, leading to significant losses.

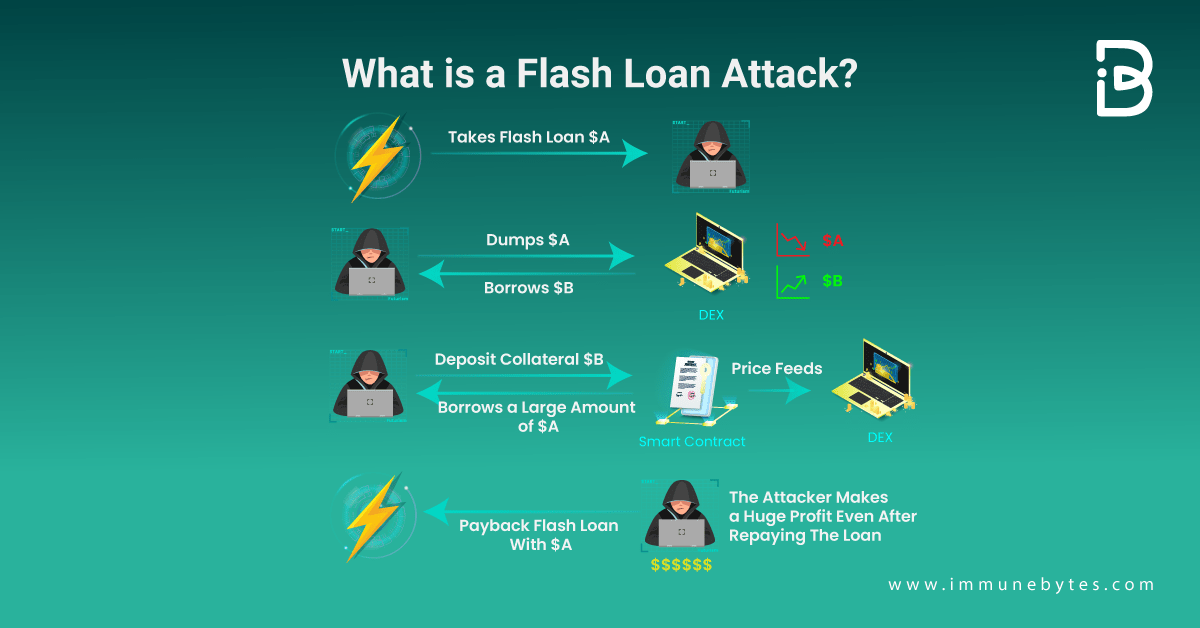

Flash Loan Attacks and Threats to DeFi Security

Source: Immunebytes

Between 2020 and 2022, it was reported that nearly $2.5 billion was stolen from DeFi platforms, with many attacks involving flash loans. While these loan types open doors for clever traders, they also attract bad guys looking to exploit weaknesses in decentralized finance platforms.

Here’s a simplified example of a flash loan attack: An attacker takes out a large flash loan of token A. Afterward, they swap token A for token B on a decentralized exchange (DEX). This action lowers the price of token A (due to large sell orders) and raises the price of token B.

The attacker deposits token B as collateral on another DeFi protocol that uses the inflated DEX price. Using the inflated value of token B, the attacker borrows more token A. They then use the borrowed token A to repay the original flash loan.

Afterward, they keep the rest (the original token A plus collateralized token B) as profit. As prices return to normal, the DeFi protocol is left with an undercollateralized position, leading to significant losses for the platform.

In May 2021, the Pancake Bunny protocol on Binance Smart Chain lost over 7 million BUNNY tokens and 114,000 BNB in a flash loan attack. This led to a 96% drop in BUNNY’s value and a $200 million loss for the platform.

Enjoy Easy Access to Top DeFi Services with Zypto

Indeed, flash loans are transformative financial tools that offer instant borrowing and arbitrage opportunities. This opens up exciting trading possibilities for savvy users. However, with great power comes great responsibility.

The rapid and uncollateralized nature of flash loans is risky. Some protocols may not be as secure as others, making them vulnerable to exploits. Consequently, developers must understand these risks and build stronger, more secure applications.

To successfully navigate this DeFi landscape and mitigate such risks, Zypto is here to help. We offer a secure and user-friendly platform for managing your crypto assets. The Zypto mobile app connects you to secure and reliable DeFi protocols and simplifies complex financial tools. Endeavor to download the app today and confidently experience the future of finance.

What do you think about these loan types? Did we miss out on anything? Please let us know in the comments below.

FAQs

What is a flash loan?

Flash loans are unique loan types that let users borrow assets without collateral to access a DeFi protocol or service. They are powered by smart contracts, which reverse the entire transaction if users don’t repay quickly.

Why do people use flash loans?

People use flash loans for arbitrage trading, allowing them to capitalize on price differences across markets without needing upfront capital.

They can also help to provide liquidity to decentralized exchanges and liquidity pools.

Is a flash loan legit?

Yes, flash loans are legitimate in the DeFi space. They operate through smart contracts on the blockchain.

However, their legitimacy depends on their use; while many use them for ethical financial strategies, they have also been exploited for attacks on vulnerable protocols.

How to borrow a flash loan?

To borrow a flash loan, you must use a DeFi platform that offers them, such as Aave, Solend, or dYdX.

Connect your wallet to the platform and create a smart contract that specifies the loan amount and repayment terms. Then, perform your intended operation and repay your loan in the same transaction.

0 Comments