Amidst the general price correction, BTC accumulation increased, and DOGE’s active addresses surged. Trump’s Crypto Reserve Plan gets criticized, while XRP is considered vital. Finally, we consider some major economic events and token unlocks this month.

Come along.

XRP could unlock $1.5 trillion in US liquidity

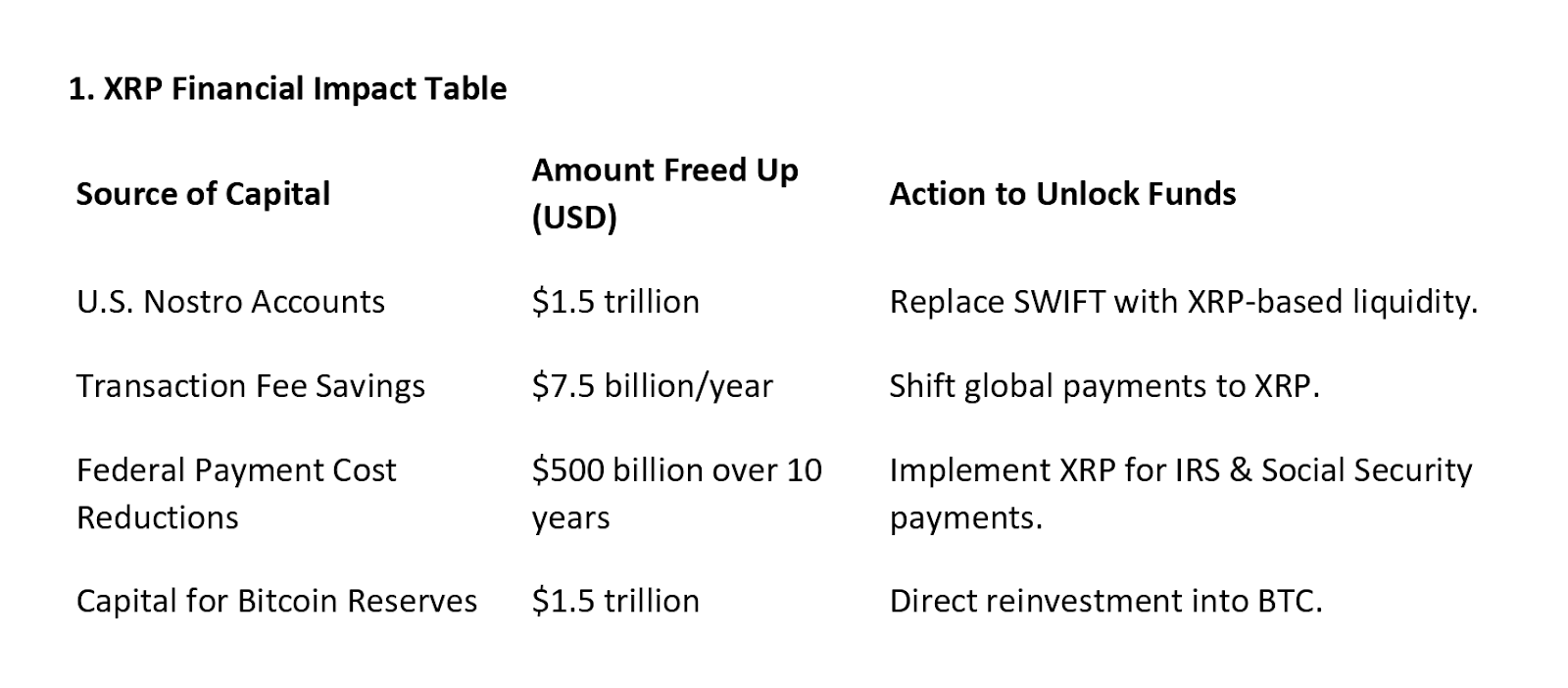

A proposal to make XRP a significant financial asset has been submitted to the US Securities and Exchange Commission (SEC). The document summarizes how the US could use XRP to unlock liquidity and secure a substantial Bitcoin reserve.

Typically, the SEC receives unrequested proposals from individuals or entities, but these do not always lead to action.

The proposal’s author, Maximilian Staudinger, supports a structured approach to President Donald Trump’s crypto reserve initiative. His strategy puts Bitcoin at the core of the US reserve while positioning Solana and Cardano within government applications.

Staudinger argues that while these blockchains enhance security and efficiency in state operations, XRP remains a vital asset for financial transactions.

“Solana and Cardano should be integrated into US digital infrastructure but not included in the reserve strategy. Instead, they enhance efficiency and security for state applications, while XRP remains the key asset for financial transactions.”

Considering this, Staudinger maintains that integrating XRP into the traditional financial system would release capital tied up in Nostro accounts. These accounts facilitate cross-border transactions and collectively hold $27 trillion worldwide.

He estimates that the US owns $5 trillion, with XRP possibly freeing up $1.5 trillion. He claims this liquidity could be used to acquire Bitcoin. However, his suggestion that the US could secure 25 million BTC at $60,000 per coin contradicts Bitcoin’s fixed 21 million supply cap.

Beyond liquidity, the proposal claims that shifting financial transactions to XRP could generate up to $7.5 billion in annual savings on transaction fees. It also implies that XRP could streamline government payments, including IRS tax refunds and Social Security distributions.

XRP’s regulatory uncertainty poses a problem

Despite its ambitious vision, the proposal recognizes that XRP’s regulatory status remains a critical barrier.

Staudinger calls for the SEC to classify XRP as a payment asset rather than a security and a resolution to its ongoing legal battle with Ripple. He also suggests that the Department of Justice (DOJ) lift restrictions preventing banks from utilizing XRP-based solutions.

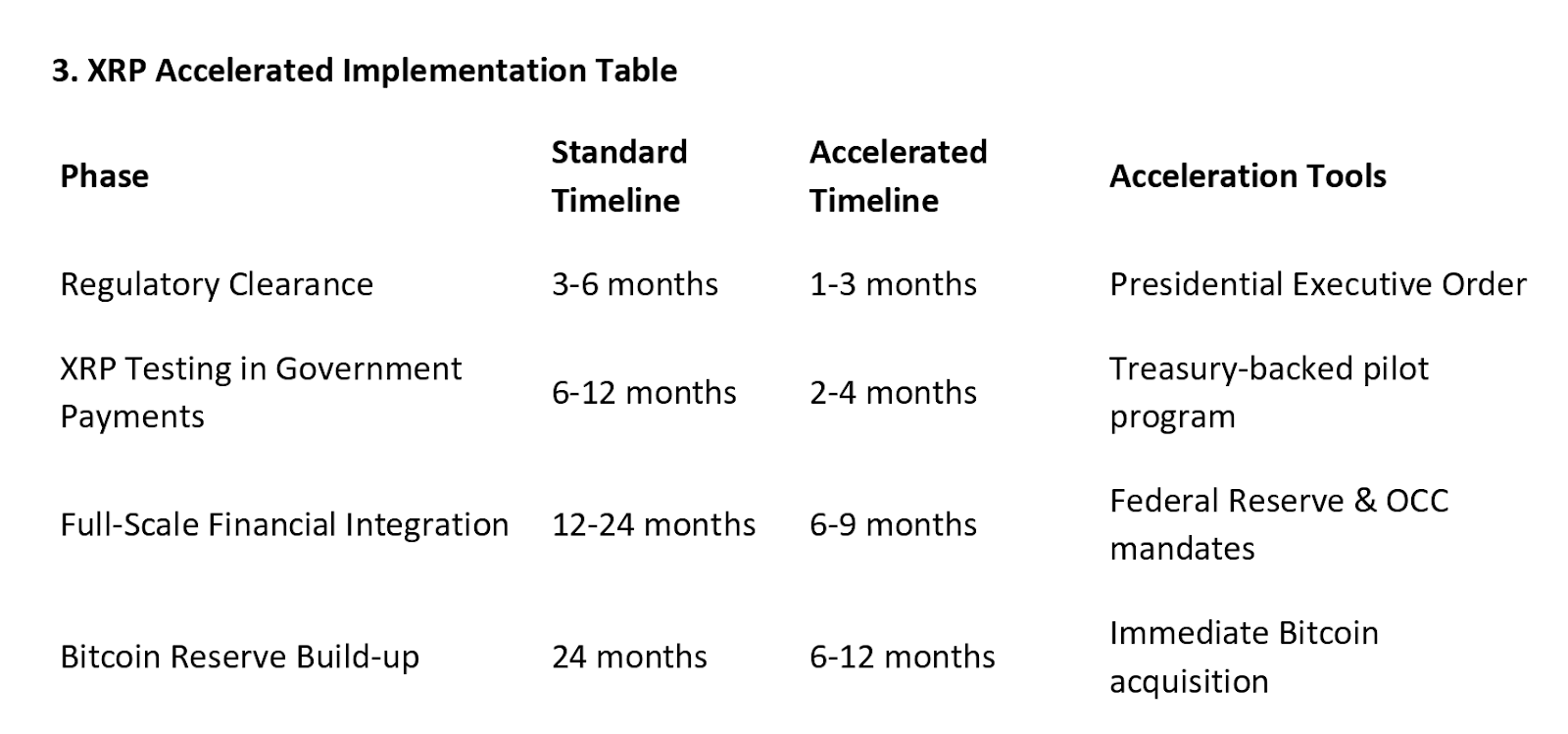

He proposed a presidential executive order to override regulatory barriers. Meanwhile, the document drafts two possible outlines: a standard two-year implementation period and an expedited six-to-twelve-month plan.

The latter would demand immediate regulatory approvals, fast-tracked government XRP trials, and mandates for banks to integrate XRP as a liquidity tool.

It’s vital to note that independent proposals, like Staudinger’s, generally have little weight unless backed by strong industry support or policy interest. A significant financial institution, regulatory body, or industry group proposal will likely be reviewed in-depth.

Is XRP’s rally at risk?

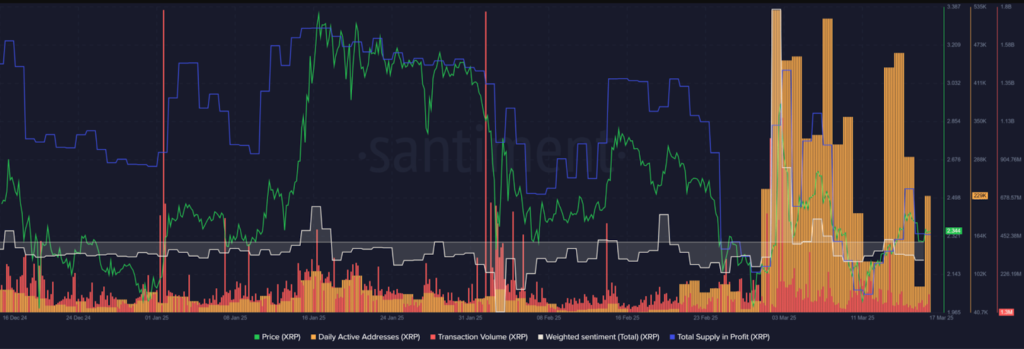

The on-chain signals behind the substantial XRP gains in the past six months have been mixed. As expected, the supply in profit was high, but the sentiment behind the token was negative.

The long-term holder’s unrealized profit/loss metric resembled the 2021 cycle top. Thus, even though XRP has been up 370% since the U.S. Presidential Elections, sellers have had the upper hand.

Data from Santiment underscored some positivity for investors. Although the total profit supply has been falling alongside the price since January, it was still significantly higher than in October and November 2024.

The weighted sentiment – which tracks social media engagement related to XRP – has been negative over the past three months, with only a few spikes of positive engagement.

The number of daily active addresses increased in March, and although the number has reduced, it is much higher than in recent months. The transaction volume trends remained comparable to the previous three months.

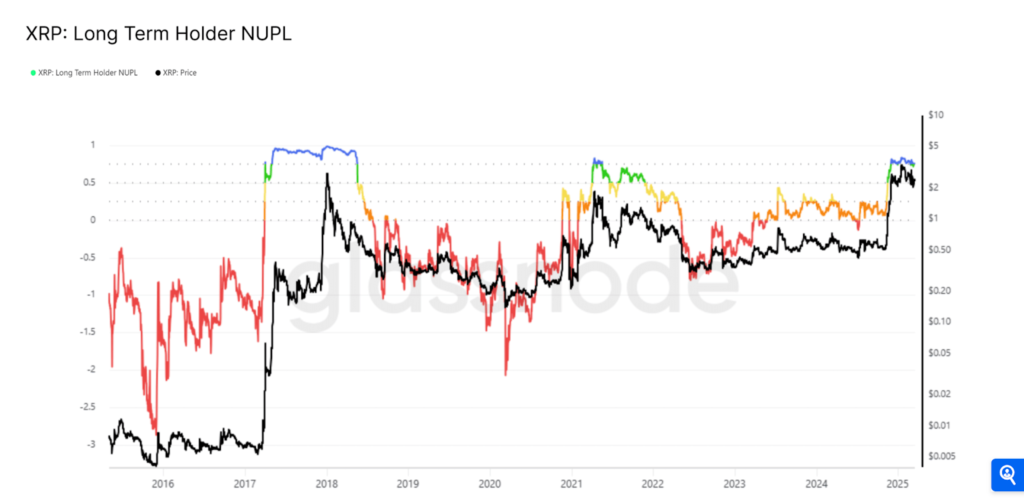

While Santiment’s metrics showed increased on-chain activity and possible demand, the long-term holder net unrealized profit-loss (LTH NUPL) outlined market euphoria and greed.

Over the past few months, the metric has hovered just above 0.75. The NUPL measures the difference between unrealized profits and losses among holders whose tokens are at least 155 days old.

Positive values imply that investors are, on average, profitable. A value of 0.75 meant that 75% of the market capitalization was in profit.

In the summer of 2021, the metric rose above 0.75, marking the cycle top for XRP. In 2017, the metric increased beyond 0.9 and stayed there for weeks. Yet, back then, it was also a much younger asset.

XRP made its cycle top already. Investors should be looking to partially cash out their holdings in case the market begins to turn and sustains a downtrend for the next two years.

5 economic events with crypto implications

This week, the crypto market will monitor global macroeconomic events. Each one has significant implications for traditional and decentralized finance markets.

The following developments will determine narratives and impact crypto investor sentiment:

US Retail Sales

The first one is US retail sales data, as they provide an essential summary of consumer spending trends in the US. Economists are keen to see if January’s surprising drop – linked to anxieties over Trump’s tariffs and cautious consumer behavior – persists.

Strong retail figures signal economic resilience, possibly boosting the US dollar. However, this outcome could pressure crypto prices downward as investors prefer traditional assets.

On the other hand, weaker-than-expected numbers might fuel speculation of Federal Reserve (Fed) rate cuts, often a benefit for Bitcoin (BTC) and crypto generally.

FOMC meeting and Powell’s speech

The Federal Open Market Committee (FOMC) will meet on March 18-19, and Fed Chair Jerome Powell’s post-meeting speech is attracting severe criticism.

After holding rates steady at 4.25%-4.5% in January, the Fed’s cautious stance on inflation and labor market strength has markets scrambling.

Although Powell’s recent remarks suggest no rush to cut rates, softening consumer spending and tariff uncertainties could change the tone. Crypto traders are unsure, as a hawkish outlook might strengthen the dollar, pressuring digital assets, while other hints could lead to a rally.

Bank of Japan Interest Rate decision

Away from the US, the Bank of Japan (BOJ) is set to declare its interest rate decision on Wednesday. It marks a key moment after years of ultra-loose policy. Speculation is rampant that the BOJ might raise rates, supported by Japan’s third consecutive quarter of GDP growth.

A stronger yen could reduce crypto enthusiasm in Asia, an important market, as investors tilt toward safer assets. Still, if the BOJ holds steady, it might signal prolonged liquidity, lifting crypto valuations.

Global Markets Investor, a popular account on X, noted how more Bank of Japan rate hikes were imminent.

“Average monthly wages in Japan rose by 3.1% year-over-year, the fastest rate in 32 years. In line with surging inflation, this gives a green light for BoJ to hike in May.”

Initial Jobless Claims

On Thursday, US Initial Jobless Claims will deliver a real-time gauge of labor market health. After reaching expectations at 220,000 in the week ending March 8, any uptick, probably toward the median forecast of 222,000, could reignite concerns about an economic slowdown.

This could prompt the Fed toward easing measures, one that crypto bulls often cheer. However, stable or decreasing claims might strengthen the Fed’s patience, putting pressure on risk assets like Bitcoin.

Bank of England Interest Rate decision

The Bank of England (BOE) will disclose its rate decision on Thursday, rounding out the week for macroeconomic events with crypto implications. With UK inflation above target, expectations tilt toward upholding current rates.

It is vital to note that a surprise cut is not off the table amid tariff-related growth worries. A steady pound could stabilize crypto markets in Europe, while a weaker sterling might encourage speculative buying.

These events mirror the relationship between macroeconomic data, Bitcoin, and crypto markets. Bitcoin, hovering below the $84,000 range, and altcoins like Ethereum are extremely sensitive to dollar strength and risk sentiment.

3 token unlocks in March

This week, three significant projects, ZKJ, MANTA, and BMT, are unlocking more tokens into the public domain. These tokens will release over $34 million worth of coins to support liquidity, price action, and overall investor sentiment.

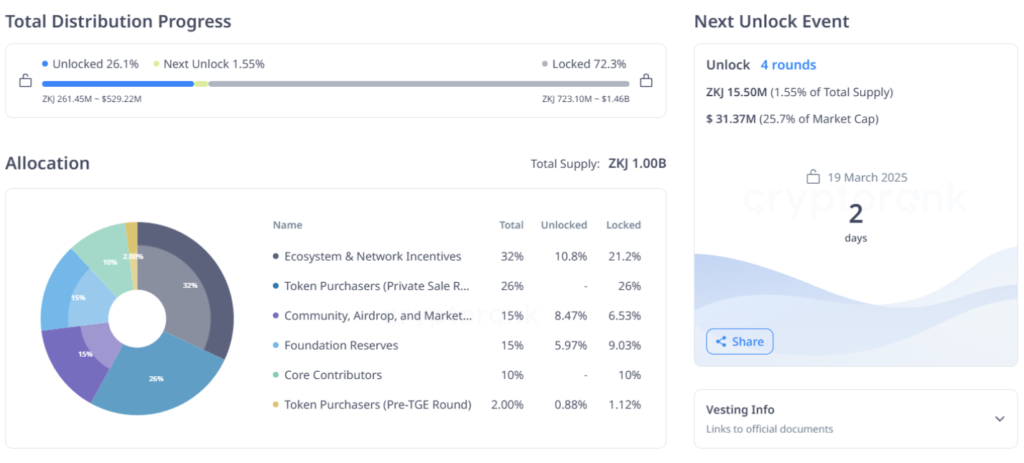

Polyhedra Network (ZKJ)

Polyhedra network is a blockchain focused on Web3 interoperability and scalability. Its zkBridge technology facilitates secure cross-chain transactions, messaging, and NFT transfers.

On March 19, 15.50 million ZKJ tokens worth $31.38 million will be unlocked. It includes 8.47 million tokens (2.65%) for network incentives, 2.61 million tokens (1.74%) for airdrops, 3.61 million tokens (2.41%) for foundation reserves, and 800k tokens (4.0%) for pre-TGE round holders.

The unlock equals 25.7% of ZKJ’s market cap, which may increase liquidity.

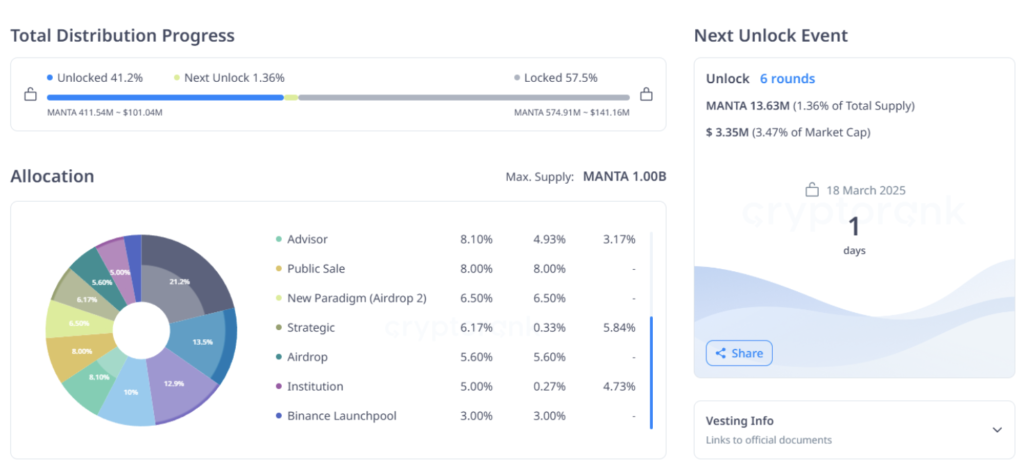

Manta Network (MANTA)

Manta network is a modular blockchain that boosts privacy and scalability with zero-knowledge (ZK) technology. MANTA tokens support transactions, governance, and ecosystem development.

On March 18, 13.63 million tokens, worth $3.34 million, will be unlocked. The distribution includes 3.37 million tokens (1.59%) for the community, 1.88 million tokens (1.39%), 3.50 million tokens (2.70%) for private investors, 1.87 million tokens (2.31%) for advisors, 1.67 million tokens (2.70%) for strategic allocations and 1.35 million tokens (2.70%) for institutional investors.

This unlock may impact sentiment as 42.5% of the supply remains locked.

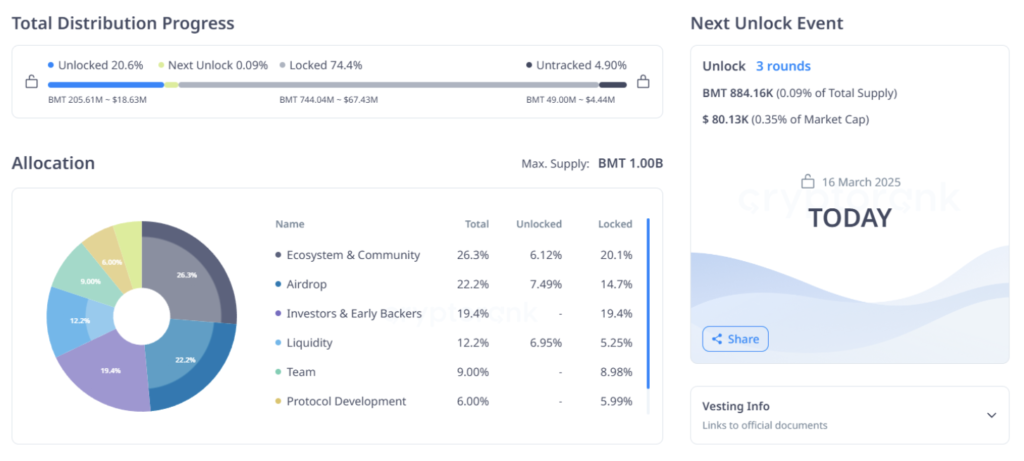

Bubblemaps (BMT)

Bubblemaps is a blockchain analytics platform that completed its TGE on the Binance wallet. Its initial sale, which aimed to raise 40 million BMT tokens at $0.02 each, attracted 202,990 BNB, over 13,500% more than expected.

The project is unlocking 884.16k BMT tokens daily, with 184.10l tokens (0.07%) for the community, 408.48k tokens (0.18%) for airdrops, and 291.58k tokens (0.24%) for liquidity provisions.

Although the staggered unlock schedule reduces sudden supply shocks, the market impact remains uncertain.

Dogecoin’s active addresses reach 395k

Although DOGE’s value has declined lately, its address activity increased to 395k from late February through early March. Combining rising active addresses with falling prices indicated unique market behaviors in motion.

It demonstrated that investors were assembling their low-priced positions to anticipate its upcoming recovery. Network activity skyrocketed when active addresses reached 395k while beginning at 97k. Also, social connections within communities played a role in the increase.

Regular social media buzz and events have pushed transaction activity within the Dogecoin network. In addition, large-holders’ fund movements possibly boosted address activity levels but did not influence DOGE’s price.

The disconnect between network activity and price suggests that network usage is not always linked to market value. For instance, on March 14, active addresses dropped to 55k, while the price stood at $0.171.

Overall, cumulative activity, community support, and whale fund movements are the major factors behind the increased activity, even as prices declined.

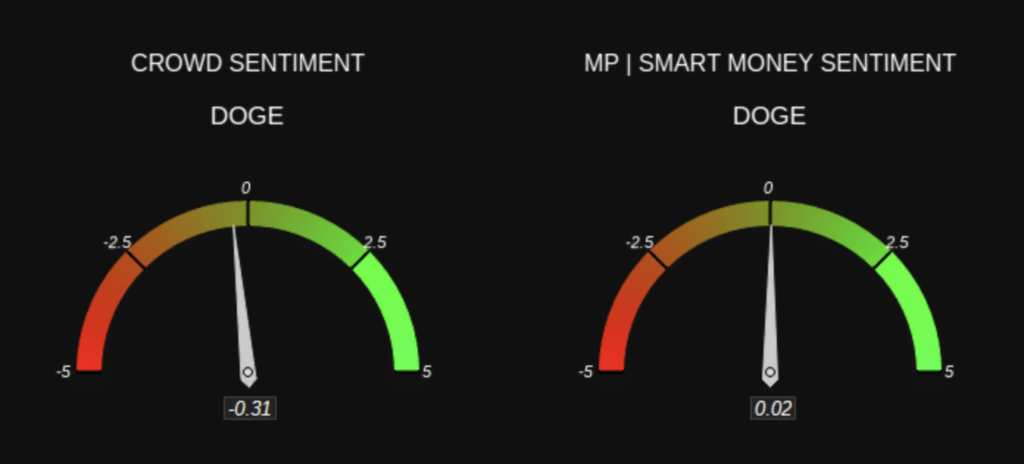

Moreover, the current DOGE crowd sentiment stood at -0.31, indicating a slightly bearish mood close to neutral. The Smart Money had a narrow positive reading of 0.02, suggesting mixed feelings.

Furthermore, negative sentiment from the crowd base indicated current market undervaluation and pointed toward a potential market shift.

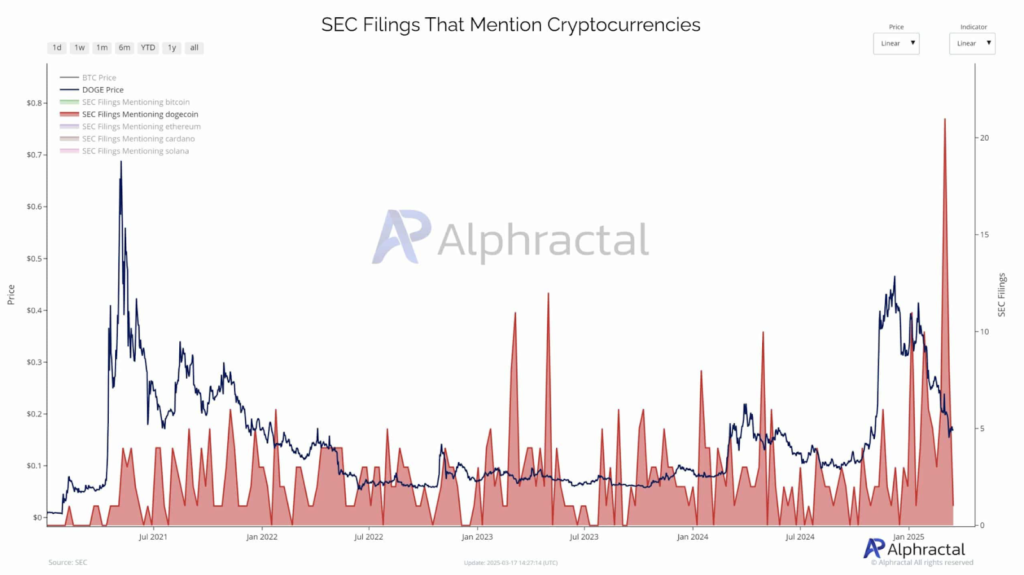

Dogecoin tops SEC mentions

Once seen as a mere memecoin, Dogecoin now rubs shoulders with Wall Street’s finest. Institutional giants like Graysacle, Goldman Sachs, and Webull referenced the token in SEC filings.

According to data from Alphractal, Dogecoin has hit an all-time high in SEC filing mentions, surpassing some well-known altcoins.

The data suggests an increase in mentions during a broader memecoin rally. Institutions view Dogecoin as more than a joke, indicating that DOGE is gaining acceptance as a legitimate part of their crypto exposure.

This trend reflects the growing acceptance of volatility, branding power, and community-driven assets.

More so, with rising volumes in DOGE, BONK, and PEPE, market watchers anticipate the launch of meme coin-themed ETFs. Traders view these tokens as high-risk, high-reward assets that enhance portfolios during bullish cycles.

The SEC recently classified memecoins as digital collectibles rather than securities, easing regulatory concerns. However, there is still scrutiny over influencer promotions and liquidity manipulation.

As institutional investment grows and retail enthusiasm increases, memecoins may need to evolve into transparent, community-focused assets. The coming months will reveal if they can combine popularity with credibility.

Bitcoin accumulation increases amidst price correction

Bitcoin’s accumulation trend score has ticked above 0.1 for the first time since March 11. While distribution remains firmly in control, this uptick hints at buying interest that could signal the early stages of renewed demand or a temporary pause in the prevalent downtrend.

Following a heavy wave of accumulation during the late Q4 rally, sentiment turned decisively risk-off as Bitcoin entered a distribution-dominant phase in early 2025.

This transition is evident in the increasing frequency of yellow and orange markers, indicating widespread selling or hesitation to buy.

Yet March 2025 reveals a subtle but notable shift: accumulation scores are increasing, and colors are returning to purple.

While still modest, this change indicates renewed interest from longer-term holders or entities slowly rebuilding positions. It may represent early positioning ahead of a trend reversal or a short-lived deviation in an ongoing bearish cycle.

Trump’s BTC reserve under fire

Despite the initial excitement over President Trump’s plan to assemble a strategic Bitcoin (BTC) reserve, Polymarket data shows a <30% chance that it will materialize within his first 100 days.

Furthermore, some European financial leaders have been voicing caution.

First, Francois Villeroy de Galhau of the European Central Bank (ECB) warned in an interview with La Tribune Dimanche that financial crises often originate in the U.S. and then ripple globally.

Secondly, the Bank of Korea (BOK) was also reluctant, citing Bitcoin’s extreme volatility in this article.

Likewise, in the U.S., similar opposition exists.

Representative Gerald Connolly has called on Treasury Secretary Scott Bessent to halt the initiative, highlighting potential conflicts of interest tied to President Trump and his close allies.

Yet, not everyone shares this skepticism.

Crypto analyst Christopher Perkins argues that digital assets could strengthen financial stability by enabling real-time transactions and reducing settlement delays.

In addition, Coinbase CEO Brian Armstrong noted increased government involvement in blockchain adoption. Also, Deutsche Bank has acknowledged Bitcoin’s potential role in shaping global financial standards.

Closing remark

While Staudinger’s XRP proposal seems ambitious, its regulatory uncertainty may be a considerable barrier. Thus, it must be backed by strong industry support. Then, the imminent macroeconomic events should also be taken seriously, as they can have noteworthy implications for the DeFi market.

With three major token unlocks happening soon, it can usher in a much-needed wave of positive investor sentiment. Furthermore, DOGE’s increase shows that memecoins can evolve into more tangible assets.

Finally, the BTC accumulation trend hints at either renewed demand or a brief pause in its downtrend. Time will tell which of the two it is.

Zypto App integrates Raydium

Zypto has integrated Raydium, Solana’s liquidity provider, on the Zypto App. You can now easily trade Solana-based tokens with deep liquidity, ultra-fast transactions and low fees. Find out more here.

There’s much to unpack this week amid events, unlocks, proposals, and surges. If you have any thoughts or questions, let us know below.

FAQs

What are the five economic events that can impact crypto?

They are US retail sales, the FOMC meeting, the Bank of Japan’s Interest rate decision, Initial jobless claims, and the Bank of England’s Interest rate decision.

What are the three token unlocks in March?

These tokens include the Polyhedra network (ZKJ), Manta network (MANTA), and Bubblemaps (BMT).

What is behind Dogecoin’s network address increase?

Some reasons include social media buzz, regular events, and large holders’ fund movements.

Why is XRP seen as vital to the crypto reserve initiative?

Maximilian Staudinger argues that XRP could increase liquidity and streamline government payments.

What does the increased Bitcoin accumulation mean?

This signals renewed demand or a temporary pause in the prevalent downtrend.

Solana blockchain one of the top blockchain in crypto market. So, A lots of people daily use Raydium for swapping their solana chain tokens. Everyone wants a low fee, secure and fast transactions app. But, phantom app most of time very low working. Zypto keeps adding exactly what we need. Thanks team for adding Raydium for all sol chain tokens swap in Zypto App

Zypto Raydium integration simplified my entire trading routine in Phantom wallet. Now, I can access deep liquidity for all my Solana tokens without switching apps in Zypto App.

Just tested the Raydium on Zypto app for swapping my TRUMP token to SOL token. I’m genuinely impressed! Very fast transactions, low fees cut from my profits. Zypto is now the only crypto app on my home screen.