In another typical crypto week, the market experienced volatility. Surprisingly, Bitcoin (BTC) and Ethereum (ETH) ETFs surged. Ripple signalled a big move with whale activity, and Solana (SOL) also has plans for an ETF.

On the domestic front, the U.S. presidential campaign benefits from donations from multiple crypto stakeholders.

Let’s get into it.

The Crypto Industry Grows Ultra-Political

Since President Biden stepped down from the presidential race and appointed his Vice President, Kamala Harris, as his successor, the crypto space has become embroiled in yet another political saga.

Democrats Receive Crypto-led Donations

According to a Bloomberg report, a group of pro-crypto super Political Action Committees (PACs) has raised over $150 million to support the Democratic party in the congressional primaries.

Among this cabal is Protect Progress, a pro-crypto PAC that has injected more than $13 million into the cause. Others include Fairshake, Defend American Jobs, Andreessen Horowitz (a VC firm), the Winklevoss brothers (Gemini exchange), and Coinbase.

Harris is currently winning the battle of fund-raising against Trump, as she has received more than $300 million. Interestingly, about 66 per cent of the donations have come from first-time contributors, which is a testament to the growing faith in her campaign.

The crypto industry is pumping funds through influential PACs to support the Democrats. With Harris at the head of their plans, they intend to advocate for improved regulatory clarity in the crypto space.

Trump has ridden the wave of promising to be the first ‘crypto president’ in the US to good effect. He has also received donations from executives of Ripple Labs, Coinbase, Kraken, etc., and has promised to fire the SEC chair, Gary Gensler—crypto’s arch nemesis.

Kamala to Change Her Crypto Stance?

With the crypto space gaining more traction in the U.S. presidential elections, pro-crypto Democrats have urged Kamala Harris to change her less-than-enthusiastic crypto stance.

Congressman Ro Khanna planned to host a meeting between Harris’ team and crypto industry stakeholders. Executives from Circle, Ripple, and Coinbase have reportedly reached out to them. Another congressman, Wiley Nickel, has been vocal in supporting Harris and criticizing Trump.

He said,

“The Biden administration didn’t do meetings with leaders in the space. We asked for those meetings already happening at the staff level.”

He remains optimistic that Harris will see the light soon.

“I don’t want to jump ahead of Vice President Harris, but I think we’re going to see some good policy positions that come out and let folks know that she’s looking for a reset on the issue.”

Nickel wasn’t as calm with Trump. At the Bitcoin Conference, he claimed that Trump was merely putting on a pro-crypto facade to get votes. He reminded the crowd when Trump called Bitcoin “a scam” in 2021.

“Donald Trump did nothing for four years as president; he doesn’t understand the issues. He’s someone who’s just trying to stay out of jail. I think he’ll say and do anything, but I don’t think that commitment is genuine.”

The CEO of Ripple Labs, Brad Garlinghouse, also chimed in.

Bitcoin and Ethereum ETFs Surge Amidst Crypto Slump

Bitcoin and Ethereum ETFs experienced surges in their trading volumes. The two assets nearly had a combined $6 billion increase in volume. This was a shock as both coins had price declines amidst a general crypto slump.

Bitcoin and Ethereum ETFs Rise

According to data from Coinglass, Bitcoin ETFs amassed a whopping $5.7 billion. BlackRock Bitcoin ETF (IBIT) was the highest ETF, witnessing a substantial increase in volume, at almost $3 billion.

While not as dominant as Bitcoin’s ETFs, Ethereum’s ETFs also enjoyed a volume increase to $715 million, according to Coinglass. Grayscale’s Ethereum Trust (ETHE) was the highest gainer, with over $261 million in trading volume.

Remarkably, this trading volume surge occurred against the backdrop of market volatility. This can mean either of two strategic moves from investors.

First, they saw a potential opportunity to buy more shares at a lower price in anticipation of profit later on. On the other hand, selling off their holdings could also minimize loss.

What Effect Did it Have on BTC and ETH Prices?

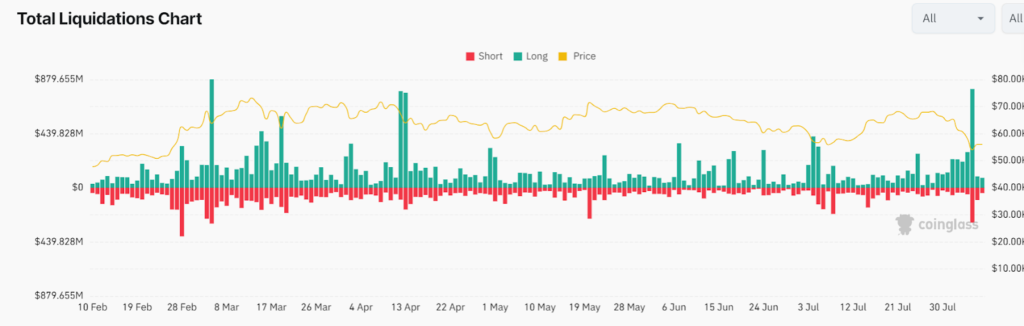

There was a massive spike in liquidation volumes amid a surge in Bitcoin and Ethereum ETFs. Analysis showed that the total market liquidation exceeded $1 billion on the day.

Data showed over $850 million in long liquidations compared to over $400 million in short liquidations. BTC and ETH liquidations comprised more than half of the total liquidation volume.

Bitcoin and Ethereum’s prices didn’t exactly make for good reading. The former was trading at approximately $56,100, a 0.52% decrease, while the latter traded at $2,415, a 4.49% decrease.

Ripple Signals a Big Move

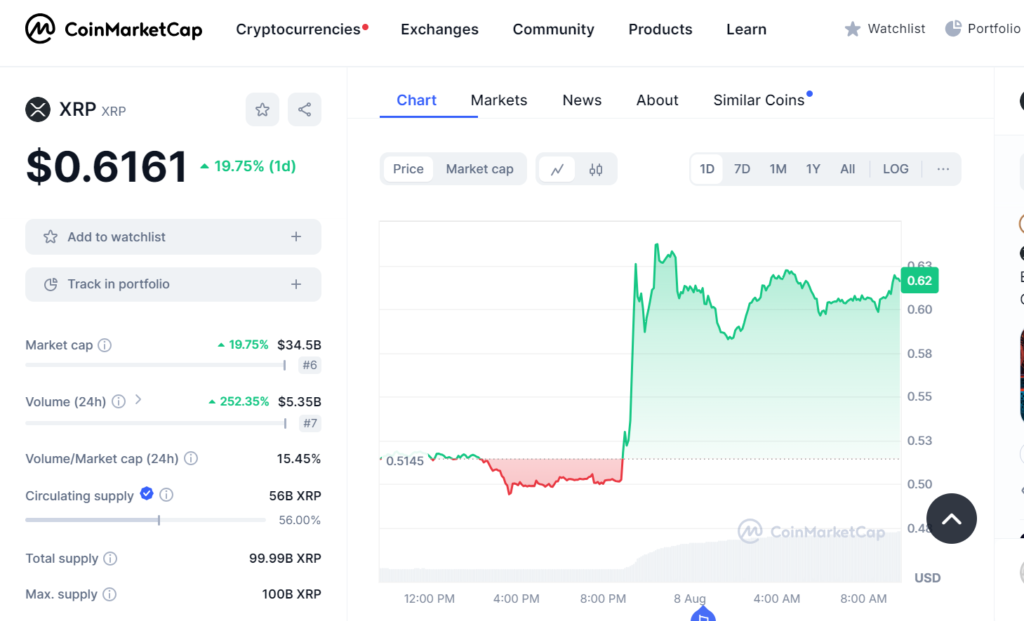

Despite the crypto ecosystem crash, Ripple has been steadying its ship. According to Whale Alert, crypto investors have transferred 157 million XRP tokens worth $75 million from centralized exchanges (CEXes), which could signal the beginning of something.

Also, Ripple has begun rolling out its upcoming dollar-pegged stablecoin via a new webpage. The stablecoin, Ripple USD (RLUSD), will be issued on the XRP Ledger and the Ethereum blockchain. However, for now, its availability “will be subject to regulatory approval.”

Next, the Ripple Bug Bounty program for security researchers was announced to the public. It has already awarded over $1 million in bounties, and its codebase includes Oracles, DID, Lenseing Protocol, etc.

Overall, Ripple (XRP) slipped to a $0.4300 low on August 5 but rallied 4% the day after. Yet, technical indicators infer that XRP could revisit the $0.4700 support level before it recovers. Afterwards, XRP could rally to its $0.6000 psychological level after the liquidity sweep.

Solana (SOL) Price Up by Nearly 40%

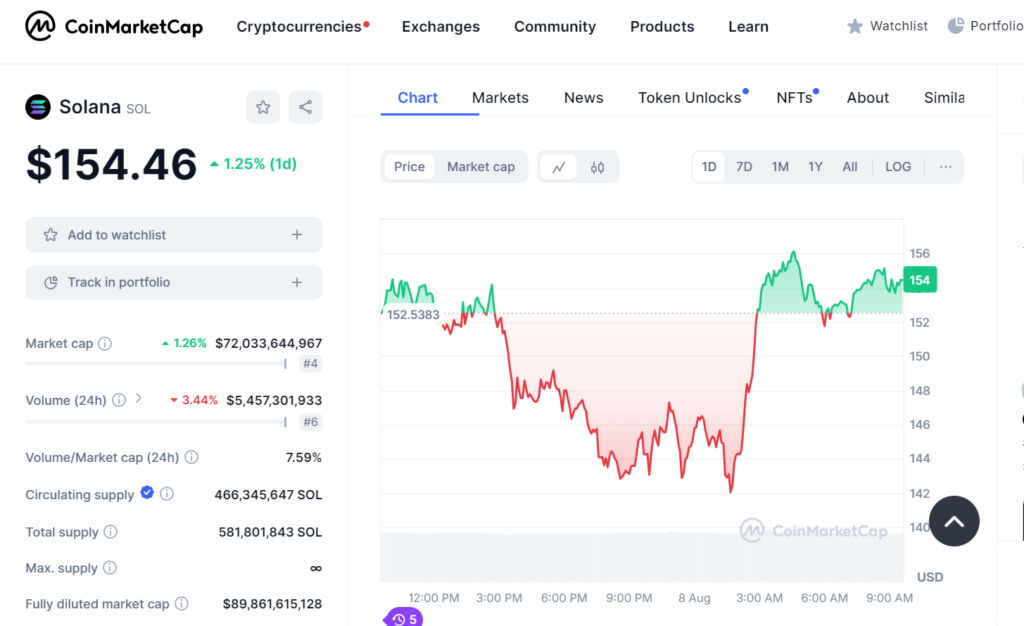

SOL has incredibly recovered from the week’s crypto crash and surged by nearly 40%. The coin dropped to as low as $110 at the beginning of the week but rebounded impressively, trading above the $150 mark. Its network volumes more than doubled to over $3.3 billion from $1.5 billion.

On the one hand, its rebound can be traced to an overnight surge in its meme coins. The Solana-based meme coins category increased by around 35%, as did the pump category fun ecosystem. Top gainers include Dogwifhat (WIF), BONK, and Popcat (POPCAT).

Secondly, Solana has also been strengthened by reports that crypto bank Anchorage aims to support SOL-based tokens that follow its Solana Program Library (SPL) token standard. These include Helium (HNT), Wormhole (W), Pyth (PYTH), Metaplex (MPLX) and USDC.

Transaction volume on the Solana blockchain increased as users engaged in more than 5 million transactions to acquire Ore. This cryptocurrency mimics Bitcoin’s proof-of-work algorithm but on Solana’s chain. The project gives each miner a personalized computational challenge and a chance to earn.

It mentioned on its website,

“As long as you provide a valid solution to your puzzle, Ore guarantees you will earn a piece of the supply.”

Furthermore, Optimism is rife around the Solana ecosystem ahead of an expected SOL exchange-traded fund (ETF). This could be the third spot token offered to investors behind Bitcoin (BTC) and Ether (ETH).

Lucy Hu, senior analyst at Metalpha, spoke highly about the quick rebound of SOL, its meme coins, and ETF adoption. She said it indicated renewed confidence in the crypto space and stabilization.

“The possibility of an SOL ETF shows promising signs to investors on SOL’s mainstream adoption.”

Closing Remark

Massive investor activity is a signal that should not be taken for granted in the crypto market. As the U.S. Presidential election looms in November, crypto stakeholders are placing their bets in different camps as the U.S. remains an essential hub for technology.

A pro-crypto Republican win for Trump would be good news for the community. The Democratic competition also shows signs of crypto adoption with strategic moves in place. Both of which are good for the market.

Amidst a week of volatility, Bitcoin and Ethereum ETFs have been the biggest winners. The two gained massively, but it was not enough to significantly impact the prices of BTC and ETH.

Ripple also made some big moves with whale activity, a stablecoin roll-out plan and a bounty program. Yet, its price dropped although it later rallied.

Solana, on the other hand, experienced a price pump of nearly 40%, a volume increase, and a surge in the price of its meme coins.

Zypto is committed to offering you the best and most secure crypto services. Our services are tailored to meet all your needs, and we offer a smooth and fast onboarding process to get you started in the crypto space.

Zypto App comes with many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust payment gateway to give you a refreshing and safe experience.

You can also check the Zypto blog for more cryptocurrencies, NFTs, Web3, altcoins, and blockchain technology resources. Join the #ZyptoCrew, and let’s make your trading journey easy and smooth.

What are your thoughts on this week’s cryptonews? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

0 Comments