Biden’s surprise resignation early in the week rocked the crypto ecosystem. Unsurprisingly, many are rooting for Trump, a popular advocate of the technology. Sentiments remain torn toward Kamala, who hasn’t played her ‘crypto hand’ yet.

Conversely, Biden’s news has thrown the SEC leadership into turmoil. Now, there are more questions than answers, coupled with some unfinished business in court. A positive news item, however, was undoubtedly the announcement of Ethereum ETFs. Its utility should further drive increased adoption of the coin.

How Biden’s Dropout Could Affect Crypto

On July 21, President Joe Biden announced, to the surprise of many, that he would not seek re-election for a second term. The Republican candidate was set to battle Donald Trump, the Democratic candidate, in the United States presidential election on November 5, 2024.

The news shocked many and impacted the crypto ecosystem. Also, after his resignation, he endorsed Kamala Harris, the Vice President of the United States, as his replacement in the upcoming election. This is sure to impact further how things develop in the space.

Biden Causes a Crypto Dip

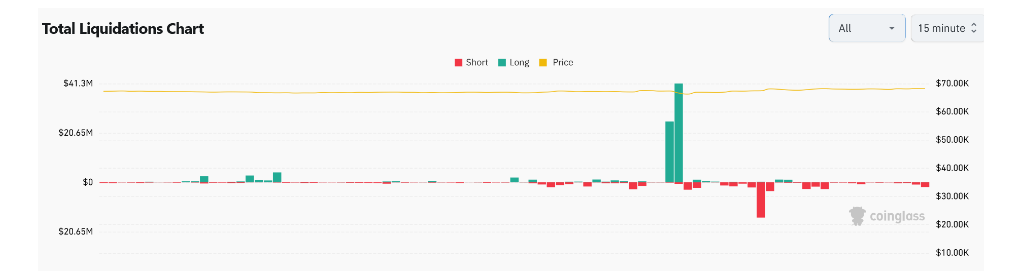

About 30 minutes after Joe Biden withdrew from the election, nearly $67 million of leveraged long positions were liquidated from the cryptocurrency market.

According to Coin Glass, the liquidations between 5:30 p.m. and 6:00 p.m. (UTC) on July 21 were triggered by a sharp 2.3% decline in the price of Bitcoin.

However, Bitcoin recovered speedily from the decline, reaching a 24-hour high of $68,480. This further occasioned mayhem for traders exposed to leveraged short positions, who lost a combined $34 million.

The combined liquidation totaled $134.5 million, the highest over a 12-hour time frame since July 8—more than $81.1 million owing to long positions and $53.4 million to short positions. About $43.8 million in BTC, $31.1 million in ETH, and $8.6 million worth of SOL were liquidated.

What Does a Kamala Harris Win Mean?

It didn’t take long to be public notice that Kamala Harris was the favorite to be the Democrat’s frontrunner. This has led to some new positive developments in her camp.

First, KAMA, her meme coin, surged by more than 400% to an all-time high market cap of $24 million and an all-time high price of $0.02. Also, it was alleged that her camp has raked in over $80 million worth of donations.

A Kamala win may mean the continuity of Biden’s stringent policies on crypto. Her predecessor was never crypto’s most prominent advocate. Moreover, Kamala once advocated more strict regulations in the tech space during her tenure as Attorney General.

Nonetheless, Polymarket, a crypto-based platform, has endorsed Kamala. According to Mark Cuban, a Bitcoin entrepreneur, her camp is already asking questions about crypto. It remains to be seen where her stance lies.

A Pro-Crypto Tenure with Trump

A win for Donald Trump will probably be a win for crypto, as evidenced by his many crypto-centric activities.

First, he recently announced his fourth NFT collection. Second, his presidential campaign has raised about $3 million in crypto, mostly Bitcoin and Ether. Similarly, he is set to speak at the upcoming Bitcoin Conference in Nashville, the first of its kind for a presidential aspirant.

The idea of a Trump win would enhance market confidence and investor sentiment. Last month, he claimed that Bitcoin would help the U.S. economy be ‘energy dominant’ and promised to end the ‘crypto hostility’ if elected.

A Donald Trump re-election would lead to massive growth in the crypto ecosystem.

SEC Chair Gensler To Retire By 2025?

There are rumors that Gary Gensler, the US Securities and Exchange Commission (SEC) chairman, will resign in the first quarter of 2025.

It is common for the SEC chair to resign after a change of administration. Gensler’s term ought to end on June 5, 2026, but he is expected to turn in his letter of resignation by January or February 2025.

Now, many are tipping SEC commissioner Hester Peirce to replace him.

This comes at a pivotal time for crypto regulation, based on the recent passage of the FIT21 bill in the House of Representatives. The bill grants the Commodity Futures Exchange Commission (CFTC) more regulatory authority over spot crypto markets.

No love has been lost between the two agencies, as both have dissenting views about crypto. Gensler believes crypto should be considered securities, while CFTC chair Behnam calls them commodities.

Uncertainty in leadership for the SEC would only help the case of the CFTC.

In related news, Coinbase has been hot on Gensler’s heels. The company filed a motion demanding his private emails since he began his tenure as the head of the SEC. This marks the latest chapter in their legal battle.

With Biden out of the race, Kamala can only influence the next SEC chair if she eventually emerges as the president. But, with pro-crypto Trump on the ballot this year, crypto voters may determine who heads the SEC in 2025.

BTC and SOL Gain as XRP and ETH Stabilize

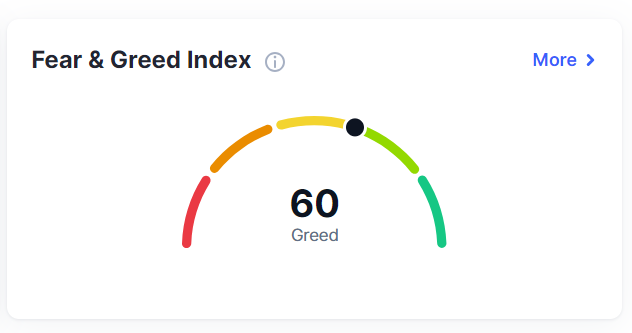

The cryptocurrency market has experienced a significant correction over the last 24 hours, even though the fear and greed index indicates a state of greed that reads 60.

Amidst this turmoil, Bitcoin (BTC) and Solana (SOL) have been shaken from their positions. However, XRP and ETH have maintained a commendable level of stability.

BTC and SOL Fluctuate

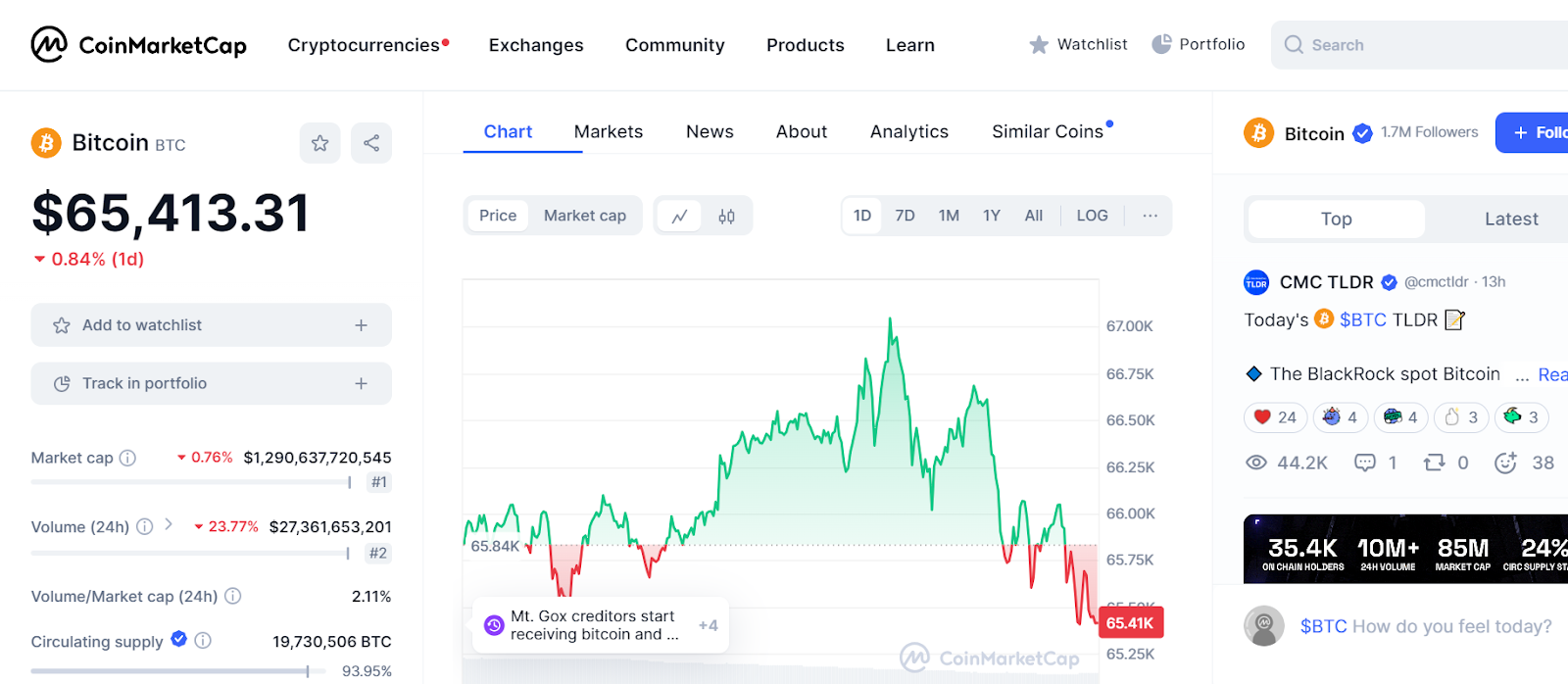

At the time of writing, BTC is trading at $65,830.37, a loss of 2.45% over the last 24 hours. BTC may be unstable due to immense selling pressure from Mt. Gox creditors or sentiment surrounding the U.S. presidential election.

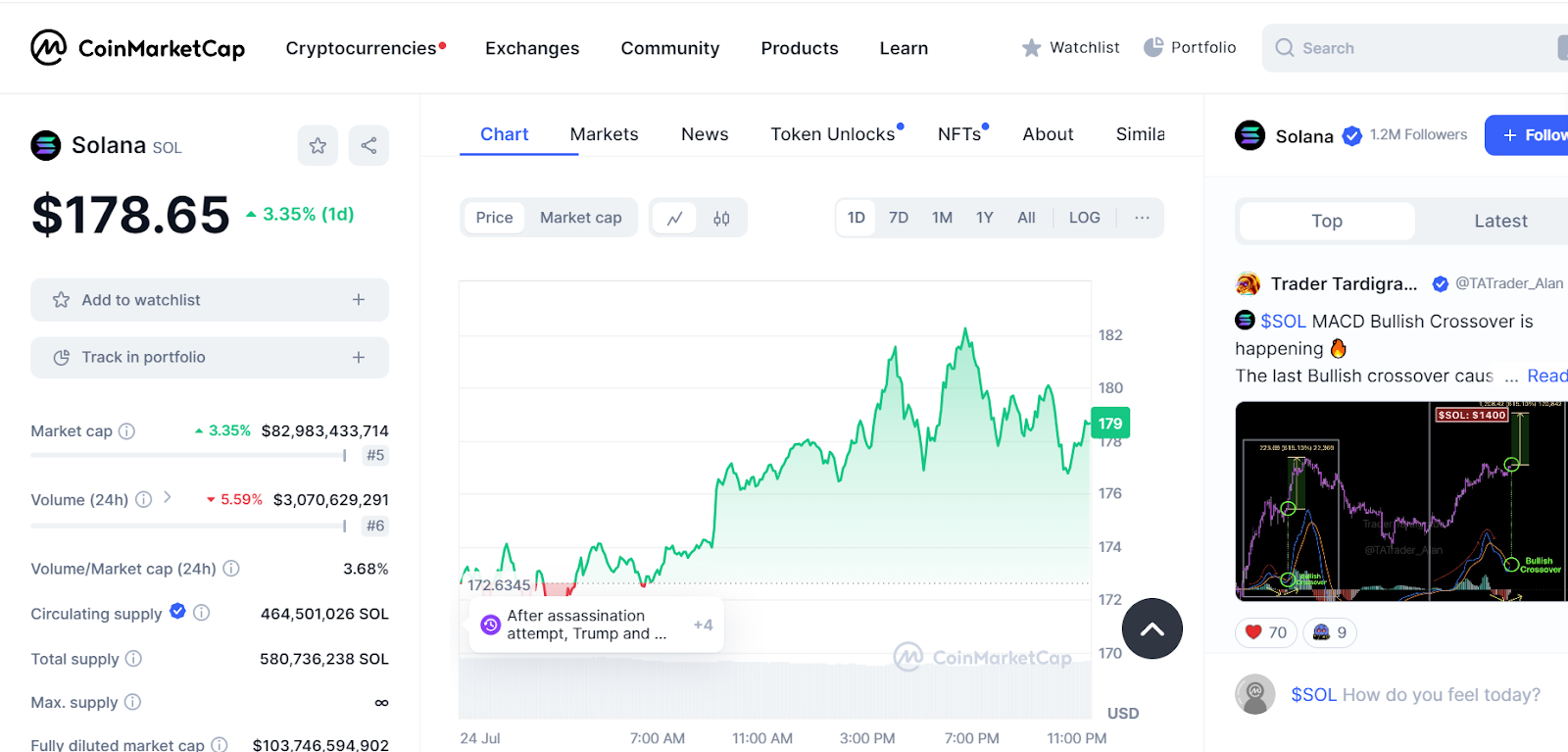

Similarly, SOL is trading at $178.65, signifying an increase of 3.98% over the last 24 hours. It has been bullish lately, and its market cap also increased marginally.

XRP and ETH Remain Formidable

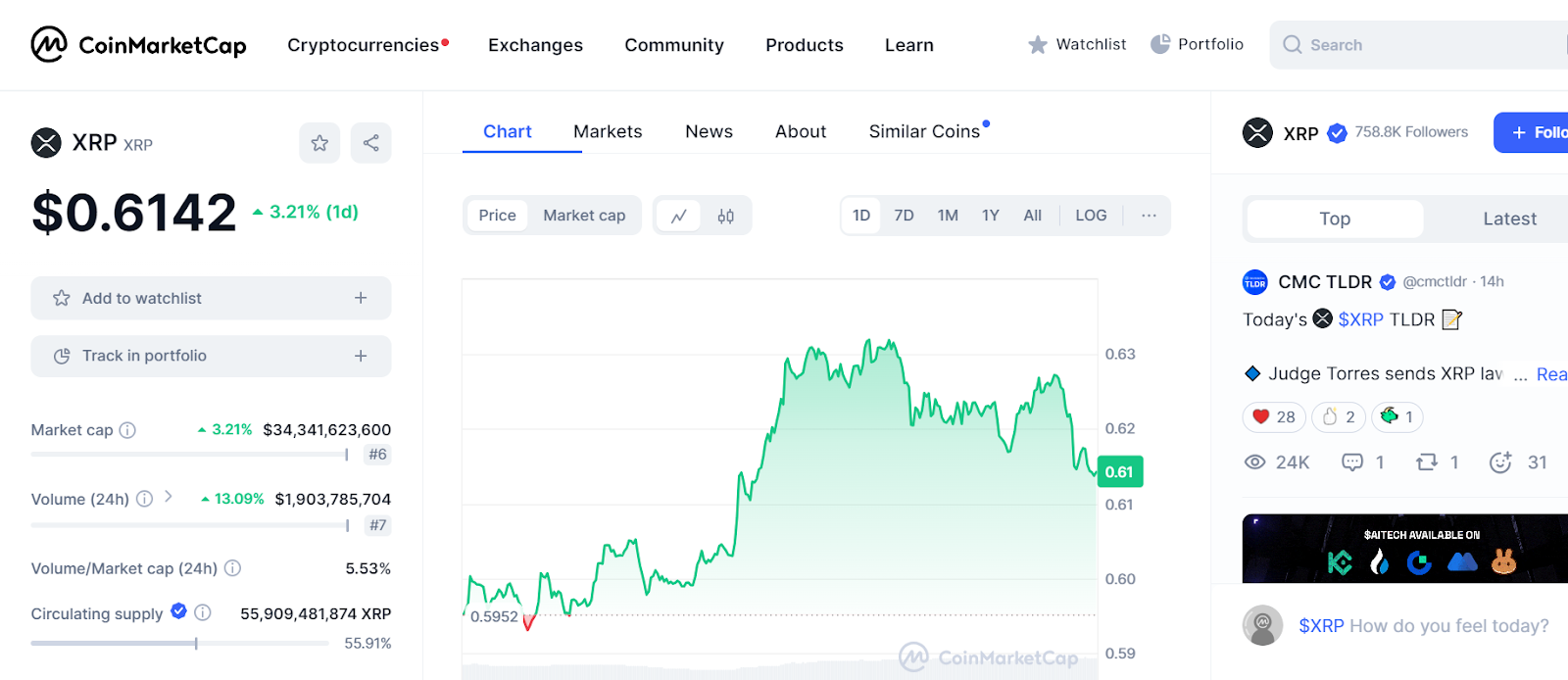

Amidst the fierce volatility in the market, XRP has been unshaken. Over the past 24 hours, XRP has maintained a stable price of $0.61, increasing by 3.21%. At $34.3B, its market cap further cements its place as one of the highly-ranked cryptos.

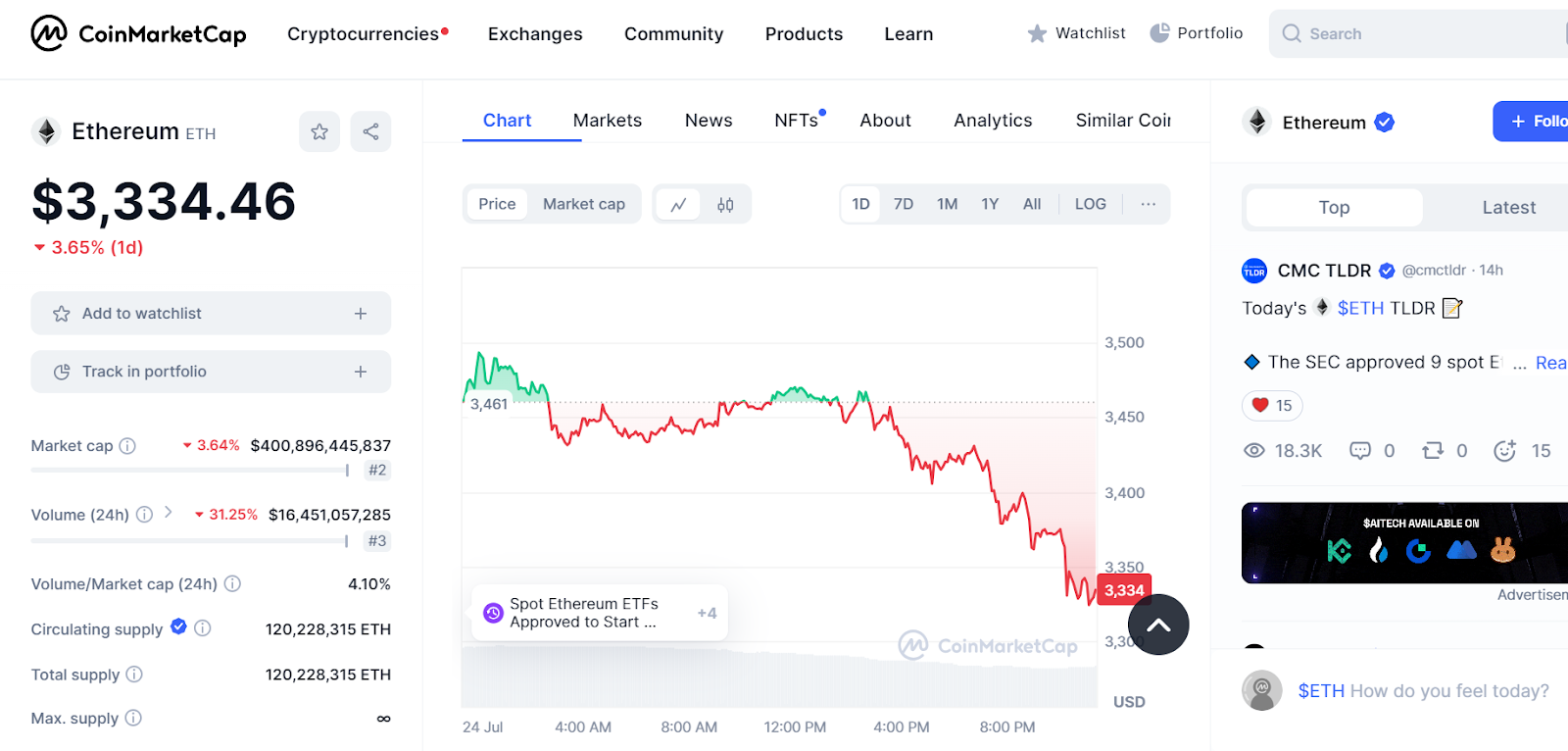

ETH has also experienced volatility within the past 24 hours. Although it has frequently tested the $3,430 support level, it is currently trading at $3,334.5, with a decline of 3.65%.

The energy exhibited by ETH may not be unconnected to the recent launch of Ethereum’s ETFs. Market analysts speculate that this move could catapult ETH to new heights, potentially pushing it beyond the $4,000 mark.

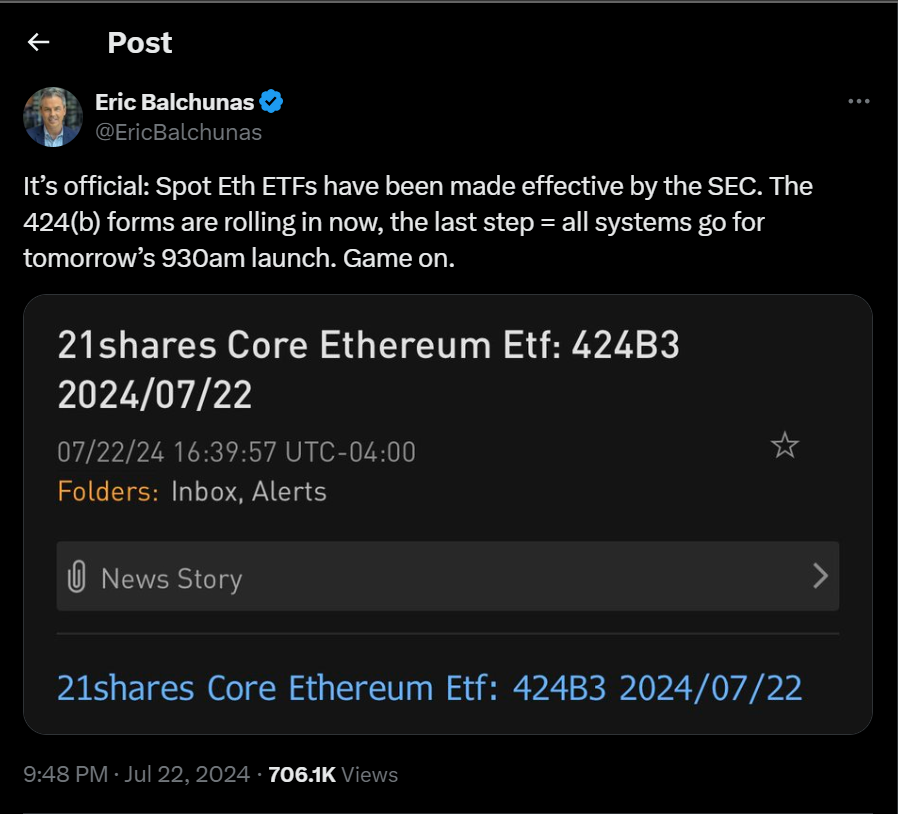

Ethereum ETFs to Start Trading

The Ethereum Exchange Traded Funds (ETFs) commenced trading on July 24, 2024, following approval from the SEC. Eric Balchunas, a senior ETF analyst at Bloomberg, announced the launch via his X account.

The Ethereum ETF is a financial asset that tracks the price of ETH, enabling investors to buy and sell the coin easily. The spot Ethereum ETFs that have commenced trading can be found on Nasdaq, NYSE Arca, and Cable BZX.

This development is a notable milestone for the crypto industry globally. Market analysts have predicted that it will spark a bull run and send the price of Ethereum to the moon.

Why is that so? Investors don’t need to buy ETH only on popular crypto exchanges or secure it in their wallets. Now, they can achieve both aims through the Stock Exchange ecosystem.

Top 3 AltCoins that Could Rise

The launch of the Ethereum ETF can catapult some altcoins to the moon. Here they are:

Blast (BLAST)

Based as an Ethereum Layer-2 token and a USP with native yield both for ETH and stablecoins, it has the potential to skyrocket following Ethereum’s ETF launch. This token is projected to jump to $1 when the full impact of the Ethereum ETF launch hits it.

Myria (MYRIA)

Myria, a layer 2 scaling solution for Ethereum, holds immense potential. The underlying idea behind the token is to scale NFTs, gaming, and more; hence, the token is hugely significant in the Layer-2 solution landscape. It is poised to hit a target of $0.013.

Metis (METIS)

The price of Metis slumped following the Bitcoin and Ethereum dip. However, as Ethereum recovers, Metis also shows significant recovery. With a market cap of $273 million, the METIS price trades at $43.16 and is projected to experience a potential surge above $100 if the bullish momentum orchestrated by the Ethereum ETF launch hits the market.

Closing Remark

The cryptocurrency market thrives on speculation, sentiments, and market news—for better or for worse. And there has been so much to deal with this week.

On the one hand, Biden’s withdrawal from the presidential race and the chances of Kamala Harris becoming the front-runner. In the same boat is Donald Trump, and all candidates have clashing crypto ideologies.

Next is the potential retirement of the SEC chair and what it could mean for the ecosystem in the future. Then, we had different coins fluctuating, but XRP and ETH stood out. This is in no small part thanks to the launch of Ethereum’s ETFs.

The Ethereum ETF is poised to increase the price of coins and other altcoins. Ultimately, the crypto community is all the better for it.

Zypto is committed to offering you the best and most secure crypto services. Our services are tailored to meet all your needs, and we offer a smooth and fast onboarding process to get you started in the crypto space.

The Zypto App comes with many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust payment gateway that provides a refreshing and safe experience.

You can also check the Zypto blog for more cryptocurrencies, NFTs, Web3, altcoins, and blockchain technology resources. Join the #ZyptoCrew, and let’s make your crypto journey easy and smooth.

What are your thoughts on this week’s cryptonews? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What cryptocurrency does Trump support?

Donald Trump, who was once skeptical of cryptocurrencies, has shifted his stance and is now supporting the use of digital currencies in his campaign.

His campaign accepts donations in various cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and others, through platforms like Coinbase Wallet and MetaMask.

What is the symbol for Ethereum ETF?

As of now, there is no Ethereum ETF (Exchange-Traded Fund) officially listed on major stock exchanges in the United States.

However, there are Ethereum trusts and funds, such as the Grayscale Ethereum Trust (ETHE). If an Ethereum ETF gets approved and listed, it would have its own unique ticker symbol, which would be announced at that time.

Is Gary Gensler resigning?

As of the latest information, there are no official reports or announcements indicating that Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), is resigning.

He continues to be actively involved in regulatory discussions and actions concerning cryptocurrencies and other financial markets.

0 Comments