Welcome to this week’s crypto roundup.

Uber may begin accepting crypto payments, as Circle marks a major milestone by going live on the NYSE. Tether’s $500 billion valuation lead to rumors, a Japanese brand invested massively in BTC, and Plasma’s ICO raised an impressive $500 million.

Let’s dive in.

Uber may accept crypto payments soon

In a recent interview, Uber CEO Dara Khosprowshahi claimed that his ride-sharing company is contemplating accepting stablecoins as a payment option.

He seemed exclusively interested in this sector, refusing claims of investing in Bitcoin (BTC). Yet, he was quite noncommittal in his statements, and there isn’t any official roadmap or timeline yet.

Previously, Uber has shown repeated interest in blockchain technology and the Web3 industry by partnering with Solve.Care. Still, this isn’t the first time that Khosrowshahi asserted that Uber may accept crypto payments in the future. He once made huge claims in 2022, but they didn’t stick.

However, the interview shows that Uber’s CEO is still interested in such a plan. He praised the benefits of stablecoins,

“We’re still in the study phase, but I think stablecoins are one of the more interesting instantiations of crypto that have a practical benefit other than crypto as a store of value.”

He also added,

“Stablecoins are quite promising, especially for global companies that are moving money around globally, to create a mechanism for us to reduce costs.”

To be clear, Khosrowshahi stated that Uber’s interest lies almost entirely in stablecoins. He referenced the recent trend of corporate bitcoin acquisitions but did not seem to approve of this strategy.

After all, the company has been doing well this year, and pivoting to Bitcoin can transform a firm’s entire business model. By contrast, stablecoins offer a concrete use scenario for Uber, as the company has a global client base.

Nonetheless, Uber’s stock valuation increased briefly after the stablecoin interview. The gains may largely be reduced in after-hours trading.

Circle goes live on the NYSE

After its major IPO launch, Circle has added another feather to its cap. It has become the first-ever major stablecoin company to go public in the US. Circle trades under the “CRCL” ticker on the New York State Exchange (NYSE).

The news was announced via a social media post by the CEO, Jeremy Allaire. In addition to showing his gratitude, Allaire underscored that going public could transform Circle.

He emphasized that Circle’s mission to reshape global finance digitally remains a decades-long journey. Yet, after 12 years, going public is a sign of real progress.

He said,

“I believe it’s a significant moment in the future development of our global economic system as it inexorably synthesizes with the internet.”

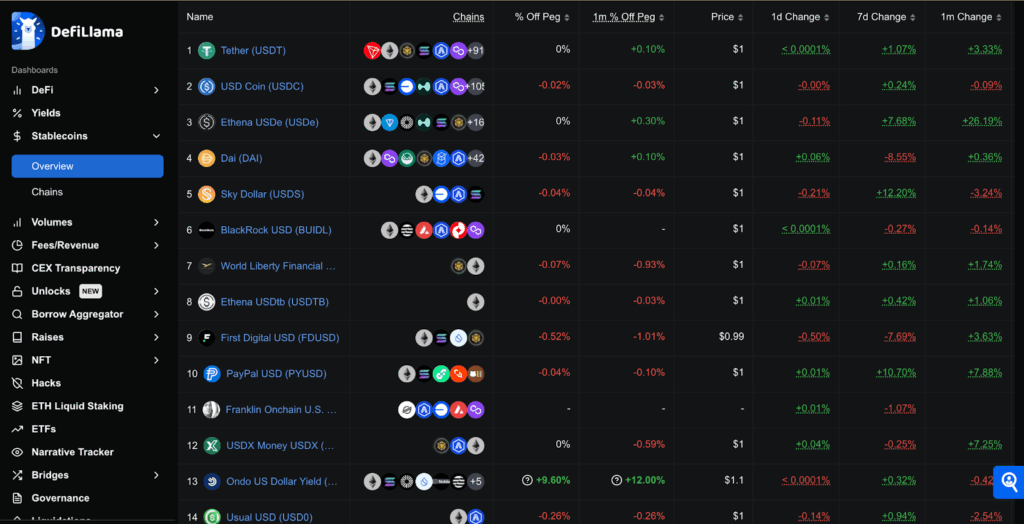

Circle’s USDC is the 7th largest cryptocurrency with a $61.4 billion market cap. It also recently increased its target goals, raising the per-share price and offering 8 million additional shares.

Although Circle is not the largest stablecoin issuer, it’s been making impressive progress in the last few weeks. Its trading volume recently hit an all-time high, and cross-chain bridging transactions also broke records.

Circle aimed to raise over $1 billion with its IPO, and going public indicates its rapid success at achieving this task.

Still, becoming a public company won’t necessarily change Circle’s day-to-day operations yet.

Allaire didn’t mention any changes in the firm’s leadership or commit to any bold new initiatives. He spoke of continuing to transform the global economic system but emphasized that this is a long-term vision.

A few possible options for Circle might be using its new resources to considerably upgrade its technological infrastructure or compete for Tether’s share of the stablecoin market.

Tether’s $500 billion valuation sparks IPO rumor

Tether CEO Paolo Ardonio has disregarded talks about the stablecoin issuer going public. These discussions come after Circle, Tether’s market rival, launched its IPO (Initial Public Offering) and went live on the NYSE.

His stance comes despite Tether’s $515 billion valuation by market analysis. According to Jon Ma, a builder on Artemis, this is enough to make Tether the 19th most valuable company globally.

Jon said on X,

“If Tether went public today, Tether would be the 19th largest company in the world at $515 billion. That’s ahead of Costco and Coca-Cola.”

The figure was inferred based on Tether’s $13 billion net profits in 2024 and projected EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $7.4 billion for 2025.

The figure was inferred based on Tether’s $13 billion net profits in 2024 and projected EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $7.4 billion for 2025.Ardonio responded to Jon’s post, saying,

“Tether valuation at $515 billion is a beautiful number. Maybe a bit bearish considering our current (and increasing) Bitcoin + Gold treasury, yet I’m very humbled. Also, truly excited for the next phase of growth of our company.”

Despite the bullish projection, Ardonio clarified that Tether has no intention of going public. This follows a previous post he made on X when he said, “Tether doesn’t need to go public.” This signals confidence in the company’s current private structure and trajectory.

Furthermore, other commentators gave their opinions about it.

Anthony Pompliano of Professional Capital Management pushed the envelope further. He predicted, “$1 trillion eventually.” Jack Mallers of Twenty One Capital echoed the sentiment with an even more optimistic “over $1 trillion” estimate.

However, alongside the hype, skepticism loomed.

One user pointed out that going public would open Tether to more scrutiny and audits. Against this backdrop, users remain skeptical that Tether could go public, referencing ongoing transparency concerns that have dogged Tether for years.

Ardonio’s stance reinforces this view. Despite potentially being worth more than many S&P 500 giants, Tether seems content to keep scaling privately without the added regulatory glare of Wall Street.

Tether’s core product, the USDT stablecoin, remains the most traded crypto asset by volume. Nonetheless, the company has also diversified its balance sheet.

Recent attestation reports show that Tether holds billions in US treasuries, Gold, and Bitcoin. These are assets that increasingly underscore its financial strength and credibility.

Ardonio is gambling that staying private is a strength, not a setback. Will such a strategy keep it ahead of rivals like Circle? Time will tell if this will be a good choice or not.

Japanese fashion brand invests over $76 million in BTC

ANAP Holdings, a Japanese clothing brand, is joining the trend of corporate Bitcoin (BTC) acquisitions.

It purchased over $76 million in Bitcoin and plans to invest over $55 million of it, while converting the rest after further capital increases. The firm is paying for this through a new sale of company shares. In the last month, ANAP’s stock price has increased by over 90%.

Multiple firms across the globe have been pivoting to this strategy as BTC keeps growing consistently. Others have been de-prioritizing or even halting their original core functions.

For ANAP, this will be less of a full pivot than a way to take advantage of long-term BTC gains. Generally, a full pivot to Bitcoin is an emergency measure, but ANAP’s fashion lines are reporting healthy growth.

For now, BTC is just a bonus. If it keeps performing well, ANAP will have a profitable Bitcoin investment on top of its regular business. In the event of a market downturn, the company will be less vulnerable to forced liquidations.

Still, ANAP Holdings isn’t the only company making strides with BTC investments today.

Michael Saylor announced that Strategy is doing the same. Pumping over $110 million into its own Bitcoin treasury, MicroStrategy is continuing the trend that made it a high-level whale.

As long as firms like MicroStrategy keep committing to Bitcoin, it’ll be easier for ANAP to enter the market. Moreover, with crypto increasing in popularity in Japan, more companies may be encouraged to follow.

Most importantly, a win for ANAP Holdings will be the most convincing signal.

Plasma ICO raises $500 million

Plasma’s highly anticipated ICO (Initial Coin Offering) for its XPL token raised $500 million from over 1,100 depositors. Although the token has not yet been launched, expectations are rife that the final unlock could bring in $1 billion to $2 billion.

The team posted a social media announcement,

“We have reached our deposit cap of $500 million. We are thrilled that 1,100+ wallets participated, with a median deposit amount of ~$35,000.”

Amid the headlines, a deeper story is emerging. Concerns extend from whale domination and insider access to a growing feeling that token launches are increasingly becoming gated events for the crypto elite.

The numbers show that only a handful of wallets accounted for outsized allocations. More specifically, the top three contributors deployed over $100 million collectively.

Probably more shocking, one user reportedly paid 39 ETH in gas fees, which secured them a $10 million USDC allocation. This was pointed out by a user on social media.

This illustrates the intensity of FOMO and the lengths participants were willing to go to for early access. Nonetheless, the frenzy has come at a reputational cost.

With whales taking the lion’s share, many are questioning how fair the launch has been.

This user complained before the raise closed on social media.

Despite offering just 10% of the total XPL token supply in the public sale at a $500 FDV (fully diluted valuation), retail users were effectively pushed to the sidelines. They will likely only get in later, at more than 10x the price.

This sharp discrepancy has some calling it a “whale sale,” rather than a launch accessible to the broader community. Furthermore, there may be more than just bad optics at play.

Crypto trader Hanzo raised serious red flags, indicating possible coordinated insider behavior. He calls out over 100 wallets, each receiving 48 million USDC, before the token even launched, indicating that some of these wallets approved token interactions before the token contract went public.

The nature of the raise led to inquiries. Hosted on Sonar/Echo, referred by some as “the CoinList of this cycle,” a time-weighted share of vault deposits determined plasma’s deposit period.

Participants had to lock stablecoins on Ethereum, with a minimum 40-day lockup. Yet, with the deposit cap suddenly raised to $500 million and filled almost instantly, many users were left wondering whether this was ever meant to be an open opportunity.

A user criticized Plasma’s architecture and found it lacking in some areas, hinting that it was shoved into the audience’s face by influencers. Another user praised its distribution and Plasma holders.

Plasma’s ICO acts as a mirror to today’s market mechanics where speed, size and sometimes, connections matter more than innovation or accessibility.

Societe Generale unveils US Dollar-pegged stablecoin

Societe Generale-FORGE, a regulated arm of France’s Societe Generale bank, has announced the launch of USD CoinVertible (USDCV). It is a US dollar-backed stablecoin designed for institutional clients and fully compliant with MiCA regulations.

USDCV offers fast settlement and enhanced interoperability for institutional markets. It will run on the Ethereum and Solana blockchains, and trading will commence in July 2025.

This approach ensures strict supervision and transparency, meeting the evolving needs of European and global markets. The French banking giant’s crypto arm will provide daily public updates detailing the composition and value of reserves.

These disclosures will be readily available via their collateral disclosure page, enabling stakeholders to verify collateralization in real time. The Bank of New York Mellon will serve as custodian for its reserves, supporting Societe Generale’s reputation for institutional-grade asset management.

This USD-backed launch follows the earlier success of EUR CoinVertible, Europe’s first institutional stablecoin on a public blockchain, introduced in April 2023. That initiative demonstrated Societe General-FORGE’s expertise in regulatory compliance and digital infrastructure.

The news comes as the US Department of the Treasury predicts that the stablecoin market could reach a market capitalization of $2 trillion by 2028. It was also reported that major US financial institutions, including JP Morgan Chase, Citigroup, Wells Fargo, and other commercial banks plan to launch a stablecoin jointly.

Zypto App v1.17 Features Optimism and 14 New Languages

The latest release of Zypto App, v1.17, integrates the Optimism blockchain, including fast, single-platform multichain and DEX swaps for over 150 coins and tokens on the Optimism network. Also launched is support for 14 new languages, improving accessibility for Zypto’s rapidly growing global community,

Find out more here.

Closing Remark

Uber hasn’t made any firm commitments regarding this stablecoin plan. Perhaps, it may join the Web3 trend and provide the stablecoin market with more utility. However, for now, there’s no clear reason to assume this will happen.

With Circle’s success in going public, the crypto industry might have a rising major player on its hands. As the stablecoin space enters a new phase of institutional scrutiny and public-market exposure, Tether appears committed to growing on its terms.

Societe Generale’s USD CoinVertible (USDCV) is another step in the right direction for the European financial market. Lastly, whether Plasma becomes a prominent chain or a cautionary tale will depend on its impact beyond the ICO hype.

What is your favorite story this week? Share your thoughts and questions with us in the comments section.

0 Comments