Donald Trump, the United States President, broke the internet by launching his memecoin, and his wife followed suit after. This directly impacted Solana as it hit a new ATH, XRP hit a 7-year high, and AAVE surged as well.

Read on.

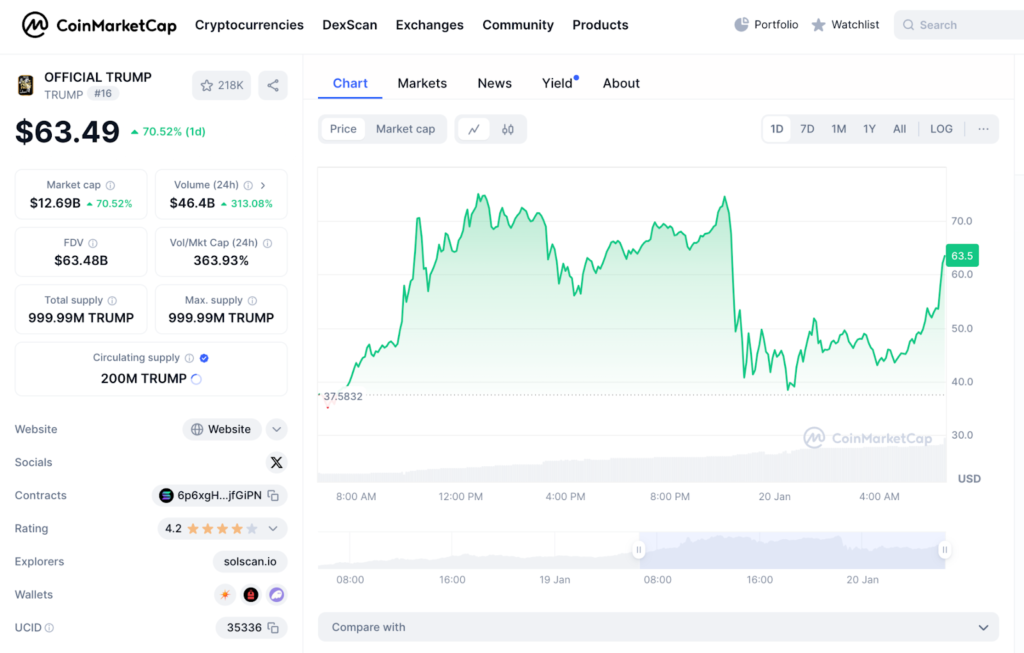

Trump’s memecoin surges to a peak of $15 billion

On January 18, Donald Trump, the President of the United States, stole headlines by launching his meme coin via this website. Named $TRUMP, the Solana-based asset symbolizes celebrating Trump’s victory in the presidential election ahead of his inauguration.

He wrote in a social media post on X,

“It’s time to celebrate everything we stand for: WINNING! Join my very special Trump community.”

The memecoin was advertised with a poster of Trump and his clenched fist superimposed over the caption “FIGHT FIGHT FIGHT,” referencing his response to his failed assassination at a political rally in Pennsylvania last summer.

A day later, on January 19, $TRUMP briefly surpassed $75, bringing the total market cap of all tokens in circulation to a peak of $15 billion. Afterward, it retraced to $63.49 at the time of this writing.

So, what has the impact of $TRUMP been like so far?

What has $TRUMP led to?

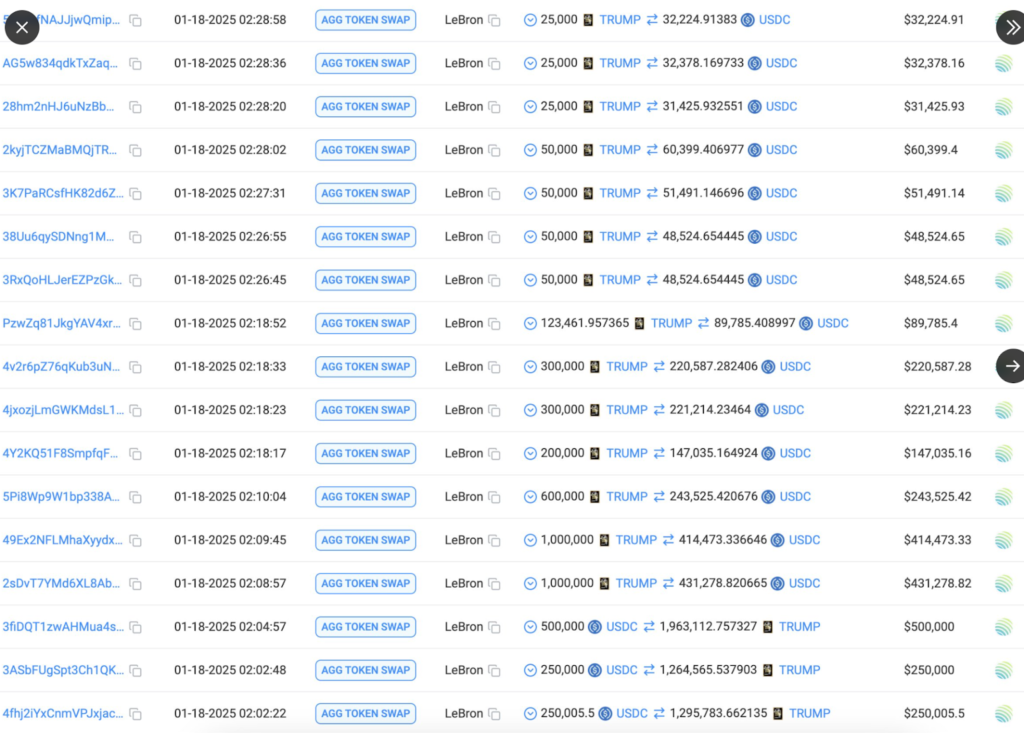

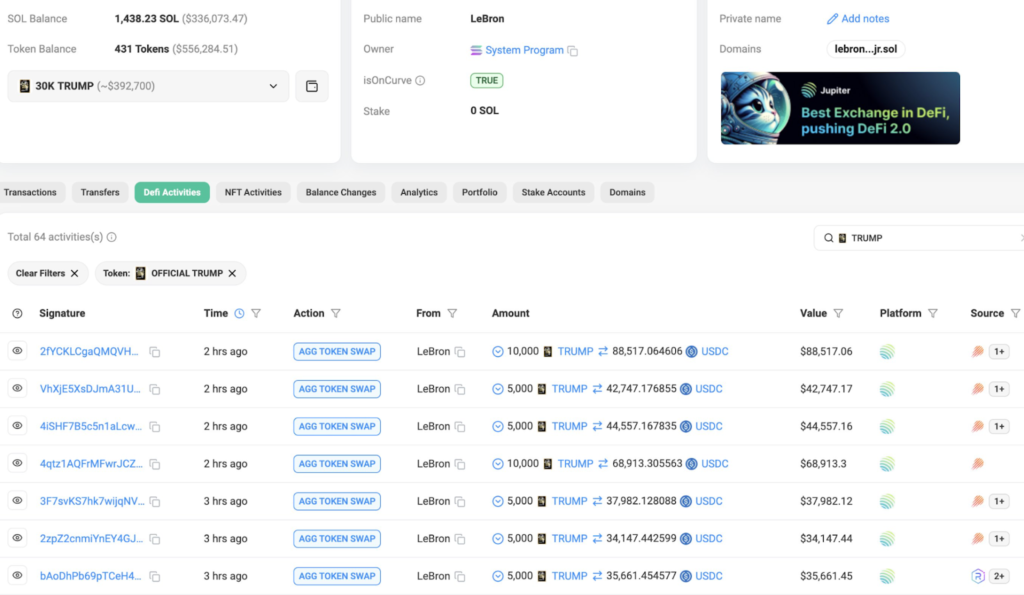

With his social media clout and governmental influence, Trump’s token launch led to massive wallet activity. On-chain analysis platform Lookonchain reported multiple whale trades.

Firstly, a wallet called “LeBron” earned over $2M on $TRUMP after quickly buying and selling the memecoin a mere 2 minutes after Trump’s official announcement.

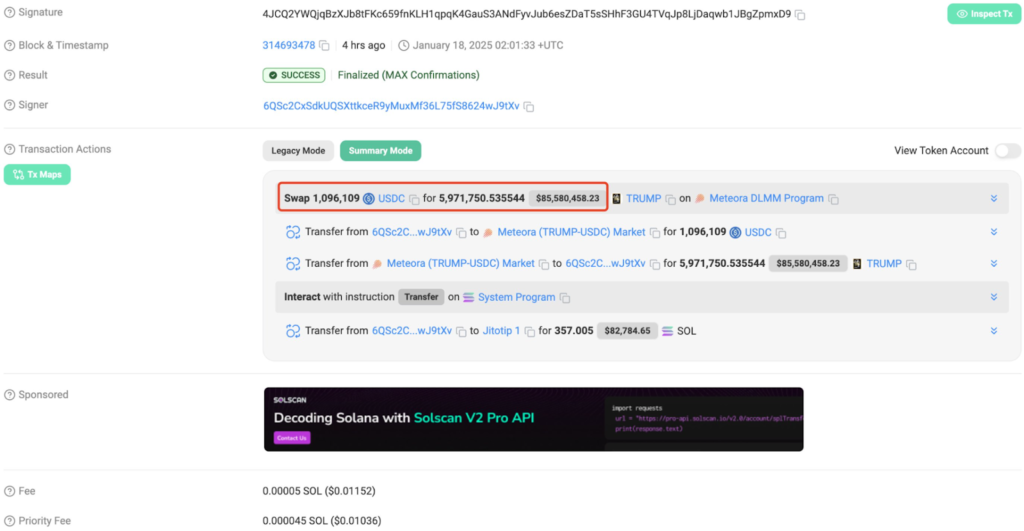

Secondly, another trader turned $1.1M into an astonishing $70M within four hours. After the official post, they bought a lot of TRUMP but decided to HODL. This helped them earn $20M after one hour before adding more profit as time went on.

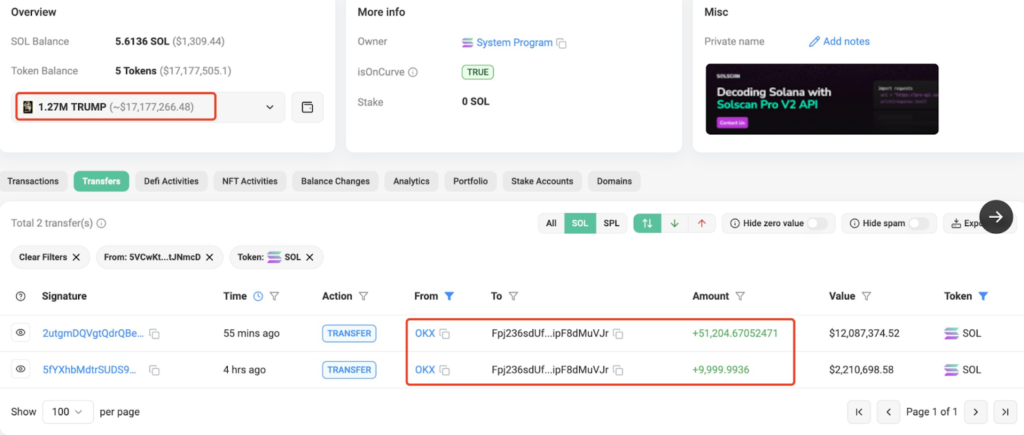

Then, a whale withdrew 61,205 $SOL to buy 1.27M $TRUMP at an average price of $11.25.

Similarly, another whale spent 8.5M $USDC to buy 1.03M $TRUMP at an average price of $8.28.

By and large, the whale activity of holding rather than selling was a sign of strong belief in the memecoin’s potential.

Conversely, a trader lost a massive $60M when they decided to sell their 4.49M TRUMP tokens, worth over $67M, and were left with just 30,000 TRUMP tokens, worth less than $3M.

What are people saying?

Beyond the monumental whale and trade activity after Trump launched his token, the crypto ecosystem also experienced intense speculation.

Investors, founders, and community members opine that the success of $TRUMP could influence tax reforms. Many stakeholders took to X to share their thoughts.

“Now that 80% of Trump’s wealth suddenly consists of crypto, you can expect an end to all federal income taxes on crypto sales within the year. This is how the game is played,”

noted Mike Alfred, a crypto investor and founder of Alpine Fox LP.

The pseudonymous trader Gammichan had similar thoughts,

“Trump is up around $20B on his token. That means an extra $5B in his pockets if he eliminates capital gains on crypto. The President of the United States now has a personal multi-billion dollar incentive to eliminate crypto gains tax.”

Custodia Bank’s CEO, Caitlin Long, also implied that Trump’s crypto endeavors could influence US tax policy. She said,

“Well, one of the side effects of meme-coining is that Trump now has a real incentive to change the taxation of crypto in the US.”

Finally, Daan Crypto, a pseudonymous trader on X, said,

“Because of the $TRUMP launch, which just hit $72 billion FDV, it siphoned away all the liquidity of the existing alts and into $TRUMP, SOL, and some others.”

He continued,

“This is simply because people sell their coins to buy $TRUMP. There’s not enough liquidity in such a short period, especially during a weekend.”

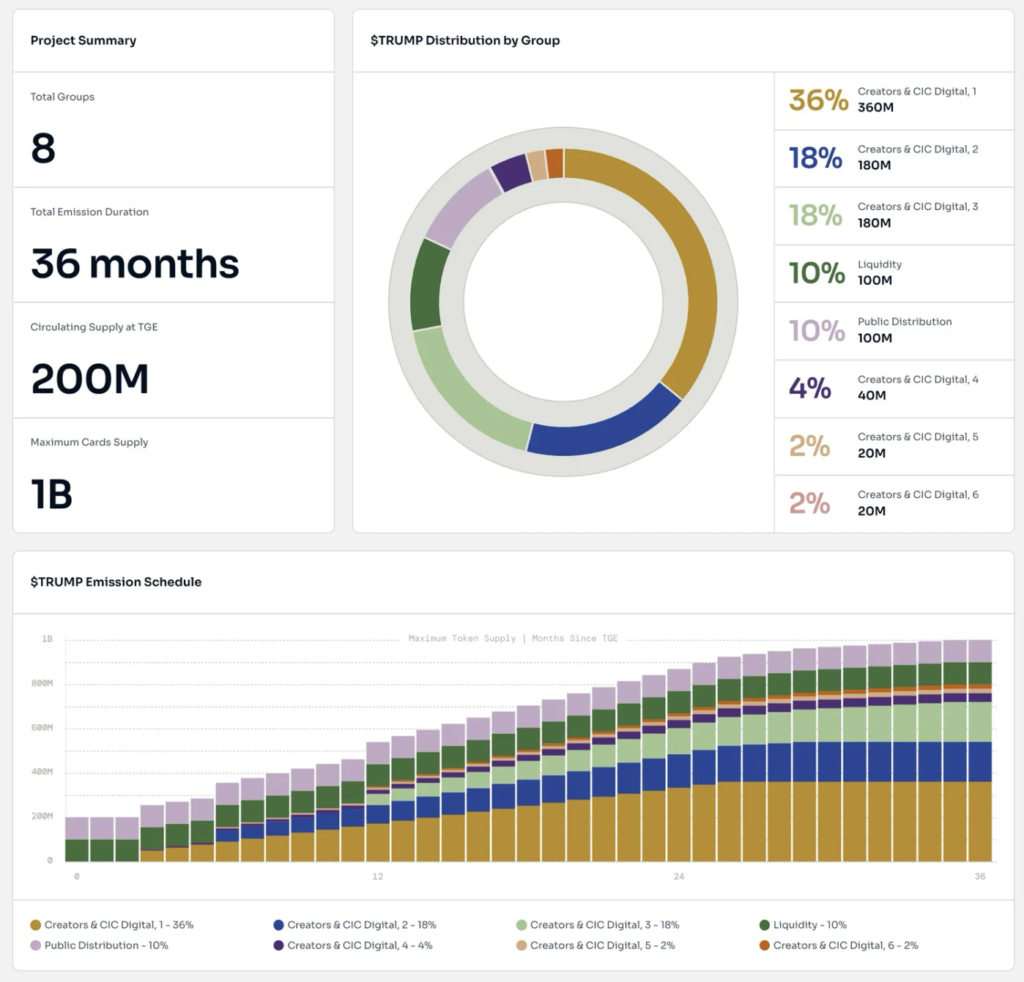

It is important to note that 200 million $TRUMP is available on day one and will grow to 1 billion $TRUMP over three years. Each group’s allocation is released on its schedule over three years.

Some other crypto advocates hailed the launch of $TRUMP as proof of Trump’s support for their industry. This is after his many promises to be crypto-friendly amid multiple regulatory crackdowns in the past.

Ripple CEO Brad Gillinghouse affirmed on X that the ‘Trump Effect’ is already taking shape. He said,

“2025 is here, and the Trump bull market is real. The optimism is obvious and very deserved.”

Yet, some naysayers didn’t share the enthusiasm.

Stephen Findeisen, a crypto-journalist, said in a video,

“The public’s gonna get wrecked, and obviously, the people that are going to make the most money are the insiders.”

He continued,

“They’re going to extract so much value from the Trump base; it’s insane. It’s gonna be the historic grift; I honestly can’t believe it.”

Solana soars a new all-time high

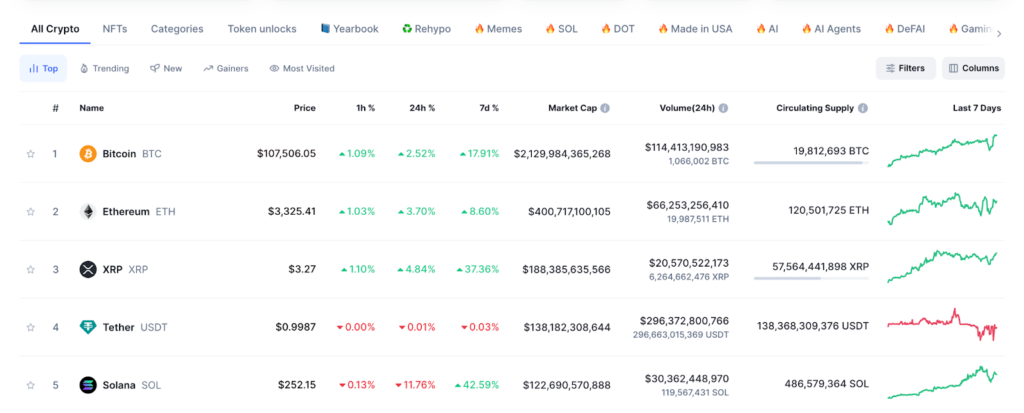

Solana has surged by 19% (its highest single-day rise) and hit a new all-time high (ATH) of $295.83. With a market cap of over $122B, it is now the fifth-largest crypto by market cap, behind Bitcoin, Ethereum, Ripple, and Tether.

While Solana’s price hits a new ATH of $295.83, its 24-hour DEX volume reached a record $23.7 billion, daily transactions reached 850,000, trading volume skyrocketed from $9 billion to $20 billion within 48 hours, and its Total Value Locked (TVL) reached $11.3 billion.

That begs the question: how did it get to this level?

Memecoin mania behind Solana’s growth

Without a doubt, Solana’s growth was directly tied to the launch of Trump-associated memecoins. Some reports affirm that these memecoins have led to considerable liquidity, increased trading volumes, and boosted investor interest.

Within 36 hours, $TRUMP increased by nearly 30,000%, hitting the top spot on Solana with a $12 billion market cap. Then first lady Melania Trump’s memecoin, $MELANIA, joined less than 48 hours later, soaring over 24,000% to hit $12.63 and a $5.2 billion market cap. Consequently, the total market cap of all Solana-based memecoins surged by 30%, reaching $30.8 billion.

While these assets are memecoins, their launch is significant as they debuted on the Solana blockchain. Moreover, they marked the Trump administration’s first official crypto venture – which was widely anticipated. It didn’t disappoint.

By and large, Solana is dominating the memecoin ecosystem with 50% of the top ten memecoins on its network. With all the stars aligning for Solana, will we finally see a Solana ETF?

Is Solana ETF on the horizon?

ETFs are a big part of the crypto ecosystem today. Last year’s $1.3 billion inflow into Bitcoin ETFs occurred due to increased investor interest amidst positive market sentiment. The same goes for Ethereum.

But Solana hasn’t been a beneficiary…until now.

The massive boost from the $TRUMP and $MELANIA memecoins has pushed Solana’s market cap to $140 billion. Solana needs to capitalize on this and get its ETF. This can encourage institutional capital, leading to a more significant boost for the altcoin.

Moreover, Solana’s 4,392 TPS (Transactions per second) compared to Ethereum’s 12-15 makes its speed vital to a volatile memecoin space where timing can’t be overemphasized.

While there’s no definite deadline, now seems like the most opportune time. With Trump back in the White House this year and institutionalized investment favoring the altcoin, Solana may be the most promising coin in 2025.

Yet, the sustainability of Solana’s growth depends on organic adoption beyond speculative memecoin trading. While $TRUMP and $MELANIA have led to momentous growth, long-term success will require broader ecosystem development, institutional investment, and network usage.

XRP hits $20 billion in trading volume

Ripple’s ecosystem has been showing strong signals of activity lately. The

XRP price spiked by 39% within the last seven days, so much so that its 24-hour trading volume hit $20 billion, and its market cap closed in on $190 billion.

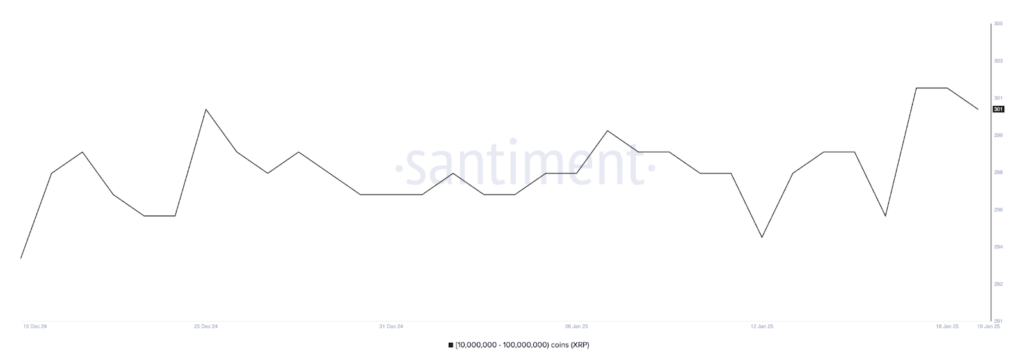

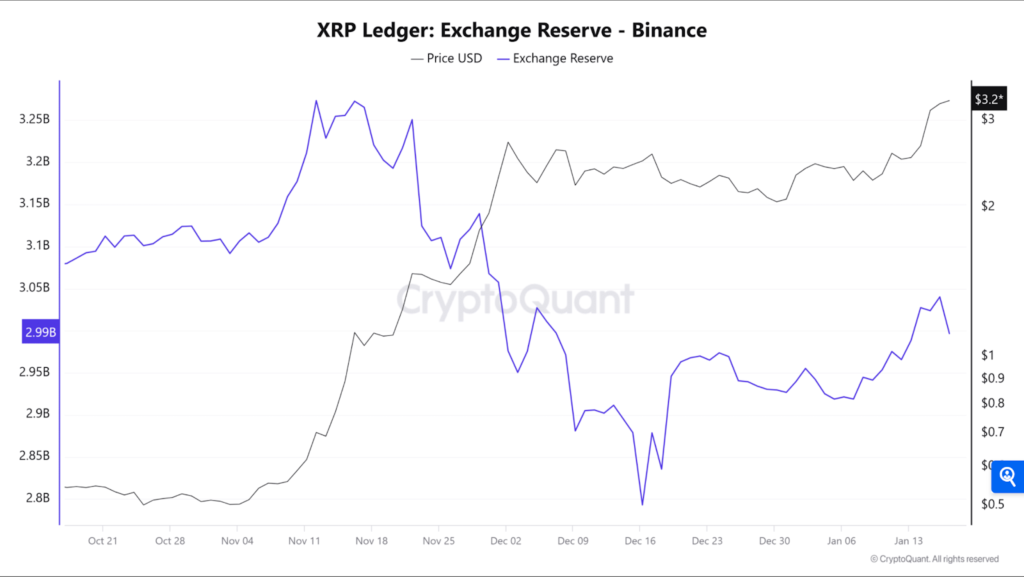

XRP hit a 7-year high and soared past the $3 mark on the charts. Since January, the altcoin has gained 52%, with substantial whale accumulation. Whales have bought over 1.4 billion XRP in the last two months, a massive 35% increase in demand.

What is behind the rise of XRP?

Firstly, the number of whale addresses holding between 10 million and 100 million XRP reached 302 – one of the highest levels in history. This indicates a high level of confidence among major holders.

This also means that the whales may be positioning themselves for possible price gains, which signals long-term optimism. If the whales continue accumulating further, they could stabilize and support XRP’s price, enabling sustained upward momentum.

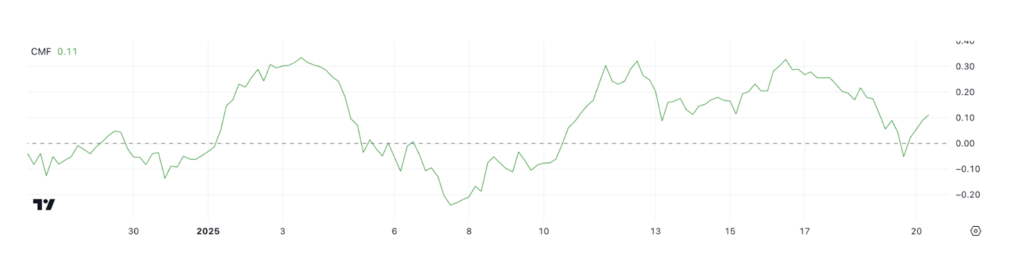

Secondly, at this writing, XRP Chaikin Money Flow (CMF) is currently at 0.11, rebounding from a recent dip to -0.05. This comes after a nine-day streak of positive CMF readings, which peaked at 0.33 when XRP hit a new all-time high.

For context, the CMF measures money flow into and out of an asset, with positive values showing accumulation and negative values indicating distribution.

Thus, at 0.11, the positive CMF signals that buyers still possess an edge, although momentum has lagged since its recent peak. This level indicates moderate accumulation, which could support XRP in the short term.

If the CMF remains positive or strengthens, it could indicate rekindled bullish activity, while a return to the negative domain might imply selling pressure and possible price declines.

Some extra signals for XRP

Typically, the higher the number of deposit transactions to exchanges, the higher the probability of a looming selling wave. Or it could also suggest more margin trading, with XRP as collateral.

During the consolidation phase in December, XRP deposits witnessed massive upward surges. Yet, the bulls were able to hold the $2 psychological support against the selling pressure. Its latest rally saw low deposits, meaning selling pressure was low.

Also, in early November, the price of XRP began to trend higher quickly. Likewise, the estimated leverage ratio (ELR) metric followed suit. The ELR offers insights into whether participants engage in more significant leverage trading, usually during a strong uptrend.

The ELR saw some respite in the second half of December due to the consolidation. However, the recent breakout past $3 pushed the ELR higher, flashing a warning to traders.

If XRP’s positive trend strengthens further, its price could rise to test levels above $3.40, possibly setting new all-time highs. However, XRP could have a price correction if the trend reverses, with its closest strong support at $2.60.

A break below this level could push the XRP price down to $2.32, and if further selling pressure occurs, the price might fall to $1.99, marking its lowest level since December 2024.

Since the beginning of January, XRP exchange reserves have increased. This can be viewed as a bearish sign contrary to the deposit count falling from XRP holders.

The conclusion can be that there may be some selling pressure from profit-taking, but not enough to top the bulls. This implies that traders probably used XRP as collateral in margin trading. Therefore, the rising ELR and exchange reserves suggest that volatility could affect traders in the short term.

AAVE rallies past $340, is $500 next?

Aave has enjoyed increasing momentum by moving decisively above the $340 resistance level, which previously capped its growth. At press time, AAVE was trading at $355.01; an impressive 15.69% surge over the past 24 hours.

Now, with favorable market conditions, analysts opine that AAVE could test the $500 level soon. Still, critical resistance levels must be cleared to sustain the upward momentum. With the next resistance near $380, it will determine whether AAVE continues this rally or faces temporary retracement.

What is behind AAVE’s growth?

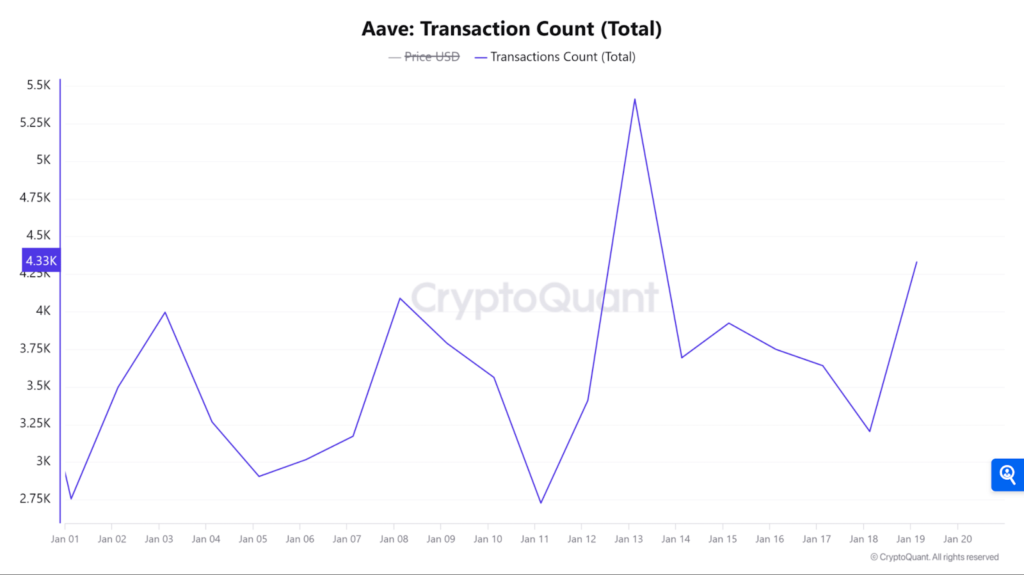

Firstly, daily active addresses on the network have risen massively, with a 36.70% surge over the past seven days. This growth indicated increased user activity and interest, which are necessary for sustaining price increment.

More so, the number of new addresses has spiked by 52.28%, signaling new adoption on the platform. Thus, these metrics indicated heightened confidence in the token’s ecosystem. However, maintaining this pace will be vital for long-term growth.

Secondly, the total transaction count increased by 1.55% to 4,329. Although modest, this increase aligns with rising trading activity and a recovering market. So, Aave was attracting both traders and long-term investors.

Thirdly, Open Interest (OI) has risen by 25.10%, reaching $414.61 million, which signaled speculative interest in AAVE. The surge aligns with the current bullish action and implies that traders were counting on the token’s ability to increase further.

By and large, AAVE is well-positioned to test the $500 level, led by bullish price action, key metrics aligning and increasing on-chain activity. Yet breaking through resistance at $380 will decide its trajectory in the short-term.

Closing Remark

The $TRUMP token launch led to massive wallet activity and proved that President Trump is as pro-crypto as he had previously advertised. AAVE can get to the $500 level provided there’s sustained growth, strong market support and consistent network activity. Ripple hit a 7-year high and time will tell how far it can get to.

For Solana, its growth and new ATH were directly tied to the launch of Trump-associated memecoins. This bodes well for the crypto ecosystem as his office will arguably push for crypto-friendly policies.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Why did Donald Trump launch $TRUMP?

Donald Trump’s memecoin and Solana-based asset, $TRUMP, was launched on January 18 to symbolize celebrating his victory in the presidential election ahead of his inauguration.

What led to $TRUMP’s peak of $15 billion?

$TRUMP briefly surpassed $75 and peaked at a $15 billion market cap on January 19, a day after its launch. This was due to intense whale activity and massive trades.

What is behind Solana’s new ATH?

The launch of $TRUMP and $MELANIA increased the total market cap of all Solana-based memecoins by 30%. This had a knock-on effect on

Solana as it surged by 19% and hit a new all-time high (ATH) of $295.83.

What is behind the rise of XRP?

XRP hit a 7-year high and soared past the $3 mark on the charts. Some major reasons include a massive increase in whale addresses and the Chaikin Money Flow (CMF) hitting 0.11.

What is behind the growth of AAVE?

The factors are an increase in the daily active addresses, total transaction count and Open Interest (OI).

0 Comments