This week, optimism dominated the cryptocurrency market, starting with President Trump’s announcement about a crypto reserve and ending with the SEC dropping a lawsuit. Conversely, Binance decided to finally delist USDT in Europe while we analyze what’s going on with Solana.

Let’s get to the bottom of things.

Trump creates a strategic US crypto reserve

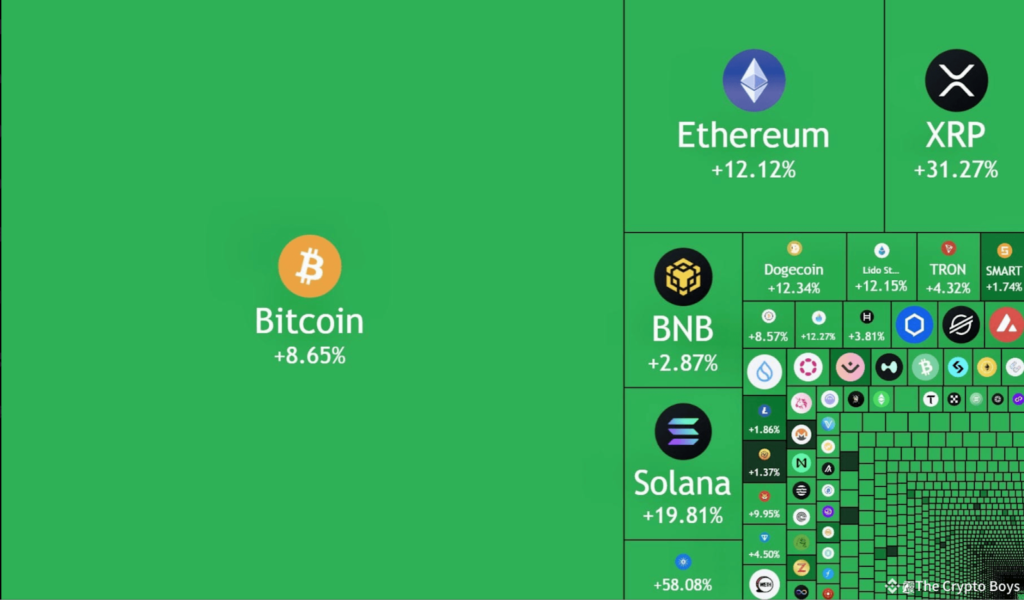

On March 3, President Donald Trump announced the creation of a strategic crypto reserve for the United States. As a result, the crypto market capitalization jumped by 7.43% to $3.05 trillion.

A U.S. strategic crypto reserve would act as a portfolio of digital assets to facilitate financial stability, hedge against market volatility, and support future investments. It could also be a digital counterpart to the country’s gold reserves.

He posted the announcement on his Truth Social account, detailing his plans to form a reserve of crypto coins, including Bitcoin (BTC), Ether (ETH), Ripple (XRP), Cardano (ADA), and Solana (SOL). Trump affirmed,

“I will make sure the U.S. is the crypto capital of the world.”

This positively impacted all coins as XRP surged 33%, SOL increased 25%, ADA soared more than 60%, and ETH and BTC increased 13% and 10%, respectively.

At the time of writing, an extra $1 billion worth of USDT had been minted. The issuance of stablecoins usually indicates an increasing demand for crypto assets, as they provide a pathway for purchasing tokens on the market.

Also, over $330 billion worth of crypto capital was added to the market.

Likewise, the Fear & Greed index reflects this bullish sentiment, moving from a state of fear (22) to neutral (40). This shift signals growing optimism among traders.

With Trump hosting the first White House crypto summit on March 7, investors will be keen to learn more about the reserve plans.

Crypto investors remain cautious

Despite general zeal, some industry leaders remain uncertain about the long-term impact of a strategic crypto reserve. Crypto stakeholder David Sacks hinted at further developments, mainly in the upcoming White House crypto summit.

This led two renowned industry figures to share their thoughts.

Brian Armstrong, CEO of Coinbase, argued that a Bitcoin-only reserve would be the most effective approach, stating,

“Just Bitcoin would probably be the best option – simplest and a clear successor to gold.”

He added that if demand for a broader crypto reserve persists, creating a market-cap-weighted crypto asset index would be the best approach to ensuring neutrality.

Arthur Hayes, co-founder of BitMEX, cautioned that the process could be lengthy and complex, requiring multiple stages of scrutiny. He said,

“Congressional approval would be needed to borrow money or revalue gold higher. Without that, they have no funds to buy these assets.”

Although optimism persists, crypto investors remain cautious, indicating that broad market acceptance isn’t fully confirmed.

US SEC to drop lawsuit against Kraken

The United States Securities and Exchanges Commission (SEC) has agreed to drop its lawsuit against prominent US-based crypto exchange Kraken. In a blog post titled “A win for fairness,” Kraken asserted,

“Today marks a pivotal moment for Kraken. In principle, the SEC staff has agreed to dismiss its lawsuit against Kraken with prejudice, with no admission of wrongdoing, no penalties, and no changes to our business.”

The SEC filed a lawsuit in November 2023 against the crypto exchange for violating securities law. Kraken was also alleged to have mingled $33 million worth of customer assets and failed to meet its record-keeping requirements or protect against conflicts of interest.

Interestingly, this is not the first recent crypto-related lawsuit the SEC has dropped. Last month, the SEC forewent its legal battle against prominent crypto players Coinbase, Gemini, and Consensys.

By and large, the move is in tandem with the broader change in approach towards the crypto markets from the US government. Kraken was quick to note this, adding,

“We appreciate the new leadership at the White House and the Commission that led to this change. Their bold and thoughtful leadership will lead to a new era of U.S. crypto innovation.”

What’s going on with Solana?

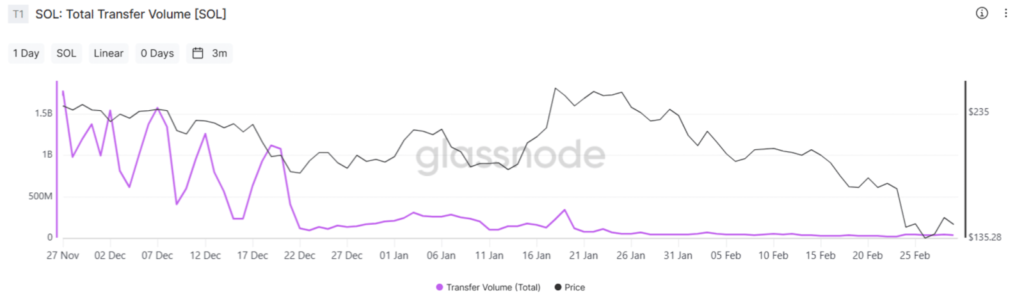

Over the past month, Solana (SOL) has struggled due to selling pressure, whale transactions, and reduced network activity. Its price has declined from February highs of $224 to slightly above $140.

Struggling to maintain momentum, Solana’s transfer volume has dropped from $1.99 billion to just $14.57 million. Its Total Value Locked (TVL) has also declined, dipping below $9 billion for the first time since November 2024.

This has fueled bearish sentiment as concerns over ecosystem engagement are rife. Over $500 million in liquidity has been transferred to competing blockchain networks, reducing Solana’s relative dominance.

FTX’s bankruptcy liquidation process recently impacted a substantial portion of Solana’s price action. As a result, millions of SOL were sold to institutional investors at massively discounted rates.

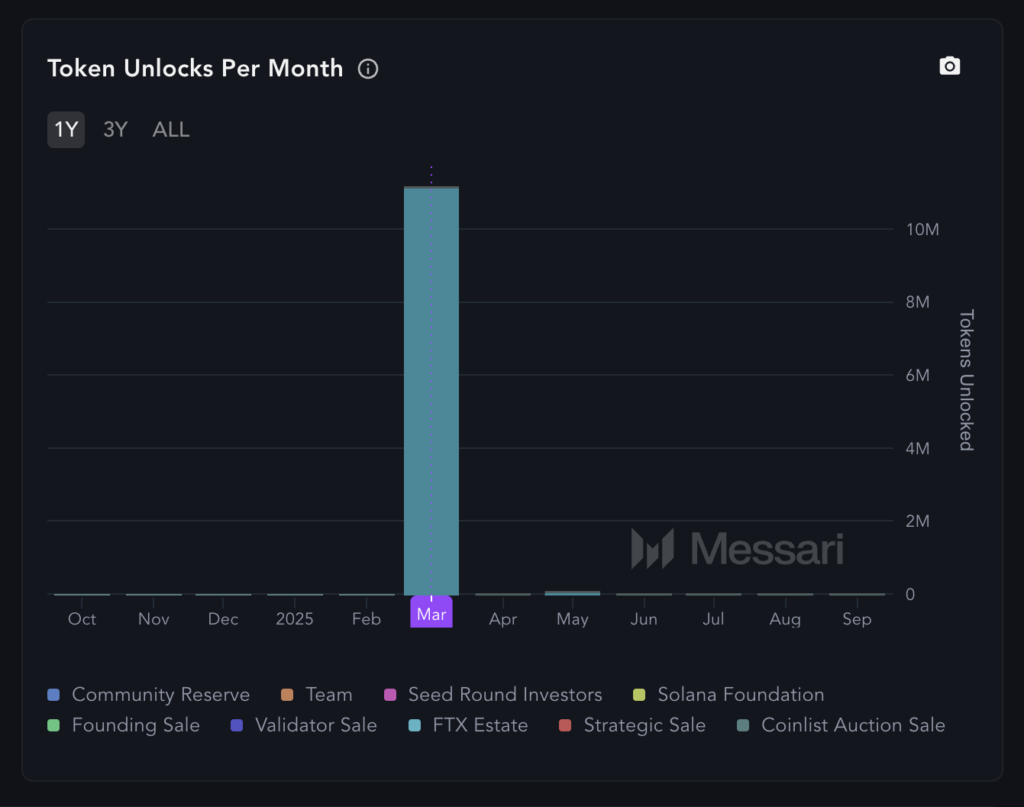

FTX liquidates over 11.2 million SOL

On March 1, the defunct crypto exchange FTX unlocked 11.2 million SOL, valued between $1.57 billion and $2.03 billion. This Solana unlock is part of its ongoing expensive bankruptcy process as legal expenses mount, surpassing $1 billion.

Liquidators are under pressure to retrieve funds for creditors, and the FTX estate still has two extra SOL unlocks in the subsequent month – about 12,700 SOL in April and 73,700 SOL in May.

Arthur Cheong, founder of DeFiance Capital, shared his two cents on social media,

“Participated in the SOL OTC deal at $64 via Galaxy and received the bullet unlock today. Not selling one of them. I think it will be substantially higher in 3 months.”

On-chain data revealed that the unlocked SOL represents about 2.2% of Solana’s circulating supply, which is currently 488 million tokens.

Despite this, analysts caution that persistent sell-offs from FTX’s estate or institutional investors could push SOL below $125-$130, levels specified as the next possible support zone.

Moving forward, Solana faces a critical inflection point. The market is now calmly watching SOL’s price action and institutional movements. Investors weigh the impact of FTX’s liquidation strategy, upcoming unlocks, and broader crypto market sentiment.

While some investors, including major institutional buyers, are holding their positions, the declines in transfer volume and capital outflows from Solana’s ecosystem outline ongoing challenges.

The next few weeks will determine whether Solana can stabilize or face additional downside pressure.

Solana whales get busy

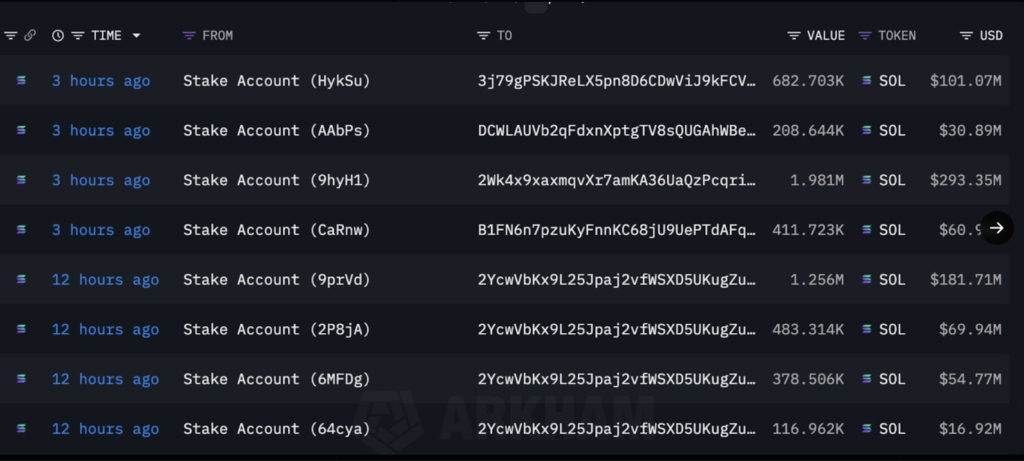

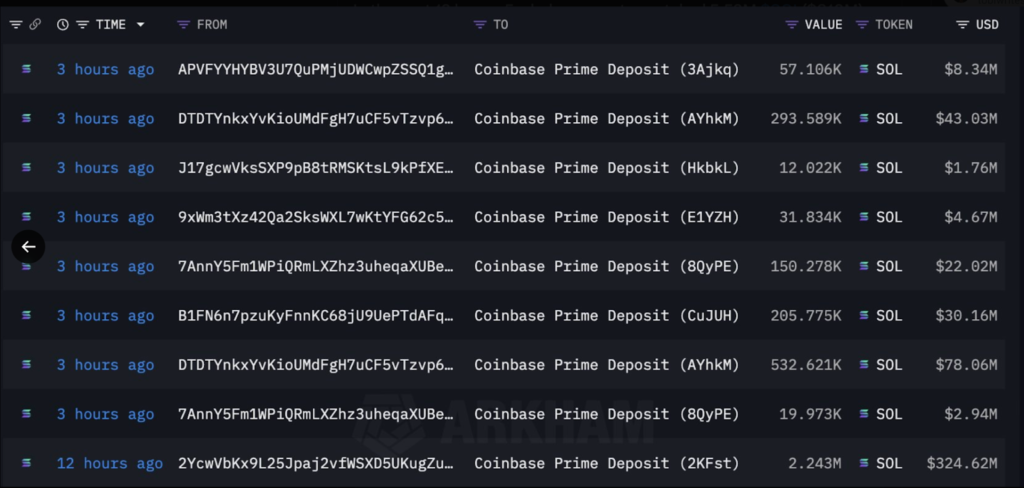

Solana underwent significant unstaking activity from whale accounts. Five major whale accounts unstaked 5.52 million SOL (worth $810 million), while 3.54 million SOL (worth $516 million) was deposited into Coinbase Prime.

Typically, such movements often indicate shifts in investor sentiment and liquidity trends. This has led to questions about its potential market impact, of which the Total Value locked (TVL) in Solana’s Liquid Staking Platforms (LSTs) provides vital insight into broader staking trends.

While the recent whale unstaking signifies major movement, the overall staking TVL has remained relatively stable. This implies that this is not part of a general exit but a targeted maneuver by a few large holders.

Despite short-term fluctuations, the TVL chart underscored a steady hike in staked SOL over the past year. This implied that while some whales may be repositioning, staking interest in the ecosystem has remained intact.

Previous patterns also showed that significant unstaking events do not lead to lengthy downward trends. If the deposited SOL remains inactive on exchanges or goes into other investment channels, its effect on price could be reduced. New staking inflows may offset the recent withdrawals, keeping the network’s security unchanged.

Generally, such large movements lead to selling pressure. Conversely, SOL stabilized this time, indicating strong market demand and confidence among traders. This suggests that while some reallocate their assets, overall market confidence remains intact.

If SOL maintains its price stability despite the large transfers, this could indicate strong underlying demand.

However, further significant unstaking events without sufficient offsetting demand could lead to short-term volatility. SOL remains in a crucial phase, balanced between strong support levels and potential market shifts driven by whale activity.

According to a press release from the CME Group, the leading derivatives marketplace has revealed plans to launch Solana Futures on March 17, pending regulatory review.

This will enable market participants to trade a micro-sized contract (25 SOL) and a larger one (500 SOL).

The Head of Crypto Products at CME Group added,

“With the launch of our new SOL futures contracts, we are responding to increasing client demand for a broader set of regulated products to manage cryptocurrency price risk.”

As expected, investors received this announcement well, and whales began accumulating the altcoin. To put it simply, whales are now actively accumulating SOL.

Per Lookonchain, Solana whales have accumulated 95,640 SOL tokens worth $14.42 million. When whales turn to accumulate, it reflects bullish sentiments or indicates they are taking the opportunity to buy the dip.

The recent drop in spot netflows can further confirm this buying activity. According to DefiLlama, this declined to -3.1 million from 1.29 million. When netflows turn positive, it implies the asset is seeing more accumulating addresses than selling ones. This also indicates strong positive sentiments among participants as they turn to buying.

Thus, the CME Group’s announcement has encouraged whales to return to the market. This shift in sentiment is not only an isolated case among whales but across other market participants.

Solana has been experiencing a short-term shift in market sentiments. Bulls have entered the market to displace bears, and if this shift can hold for an extended period, we could witness more recovery for SOL.

Binance to delist USDT in Europe

Binance plans to delist Tether’s USDT to European-based customers to comply with MiCA (Markets in Crypto-Assets) regulations. Yet, EU-based users can still withdraw assets until midnight on March 31.

The crypto exchange announced in a statement,

“We are making changes to the availability of non-MiCA compliant stablecoins in the EEA to comply with regulatory requirements. Impacted assets are USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC and PAXG. Binance will restrict the availability of spot trading pairs with non-MiCA compliant stablecoins for EEA users.”

MiCA took effect in December, and most major crypto exchanges delisted USDT afterward. This led to a $2 billion drop in USDT’s market cap. Binance, however, persevered and kept providing Tether to its European users—up until now, that is.

Although Tether’s USDT is the world’s largest stablecoin with a market cap of over $142.52B, the timing of this Binance news will be hard to swallow.

Coinbase announced it would delist USDT if the US government implemented MiCA-style stablecoin regulations. Also, Tether’s biggest rival, Circle, announced that its stablecoin could take some of Tether’s EU market share once the dust settles.

Moving forward, there’s no telling what further impact this could have on Tether’s fortunes.

Top 4 Made in America tokens to watch

President Trump’s formulation of a strategic crypto reserve sparked conversations in the cryptocurrency ecosystem. The upcoming White House crypto summit on March 7 will provide a forum for more meaningful discussions.

To that end, four key tokens – Hedera (HBAR), Chainlink (LINK), Official Trump (TRUMP), and Melania Meme (MELANIA) – are currently in the spotlight. Speculation is rife about their potential inclusion in the US crypto reserve.

Hedera (HBAR)

HBAR is among the top 6 biggest Made in America tokens by market cap, trailing only XRP, SOL, USDC, ADA, and DOGE. With the first two already included in the US crypto reserve and USDC being a stablecoin, speculation is increasing that HBAR could be next in line.

Such a move would boost bullish momentum as investors anticipate increased institutional adoption and government recognition.

Chainlink (LINK)

LINK remains a prominent player in the Oracle sector and has been expanding its influence in real-world assets (RWA). Its role in both industries reinforces its argument for inclusion in the US crypto strategic reserve.

With a market cap close to Hedera’s, LINK remains one of the most important Made in America cryptos since its launch in 2018.

OFFICIAL TRUMP (TRUMP)

The list can’t be complete without mentioning Trump’s meme coin, TRUMP. Although it has been struggling below $20 for over two weeks, the crypto summit could reignite interest in the coin.

This could reverse its recent downtrend and enable the token to regain some of its value. TRUMP remains one of the most hyped meme coins ever, briefly reaching a $15 billion market cap on its first day.

Melania Meme (MELANIA)

Like TRUMP, MELANIA (The First Lady’s memecoin) could also enjoy a boost from the Trump crypto summit. Launched on January 19, MELANIA quickly surged, reaching a $2 billion market cap within hours.

Yet, MELANIA has been trading below $1 for almost a week and is currently near its all-time lows. If hype returns, then the token could regain lost ground.

Closing Remark

Since he entered the White House, President Trump has been making his presence felt. Formulating a crypto reserve would benefit the ecosystem, with four other promising Made in USA tokens on the sidelines. Moreover, with the SEC set to drop another lawsuit like it has lately, the crypto space is on a good path.

Although Solana has struggled lately, its next move will be decided by monitoring exchange inflows, staking redeployment, and liquidity absorption. Meanwhile, for Tether, Binance’s delisting of USDT couldn’t come at a worse time, as Circle actively plans to corner the market share that its absence will create.

Zypto launches native Pi dApp

After the successful launch of Zypto’s Pi dApp, work is underway integrating Pi Network into Zypto App, the all-in-one crypto app. For now, Pioneers can access the dApp to help test the Pi Payment Gateway System, and earn Zyp reward points. Find out more here.

Will Trump’s policies do well or backfire? Can USDT maintain its leading position? Kindly share your thoughts or questions in the comments section below.

FAQs

Why did FTX liquidate 11.2 million SOL?

FTX’s SOL March liquidation is part of its ongoing expensive bankruptcy process as legal expenses mount, surpassing $1 billion.

What impact does Solana whales’ unstaking have?

While the recent whale unstaking signifies major movement, the overall staking TVL has remained relatively stable.

Why did the crypto market cap surpass $3 trillion?

After Trump announced the creation of a crypto reserve, the crypto market capitalization increased by 7.43%, reaching $3.05 trillion.

Why does Binance plan to delist USDT from its EU offerings?

Binance plans to delist Tether’s USDT to European-based customers to comply with MiCA (Markets in Crypto-Assets) regulations, which Tether struggled with.

What are the 4 Made in America tokens to watch out for?

Ahead of the Trump crypto summit on March 7, here are the four Made in America tokens to watch out for: HBAR, LINK, TRUMP, and MELANIA.

0 Comments