Welcome to the first news story of June!

Stablecoins, including USDT and USDC, achieved record-high numbers via TRON and Circle, respectively. There were also several other notable updates, including the launch of a DAO by Shiba Inu and a USD1 airdrop by World Liberty Financial.

Let’s dive in.

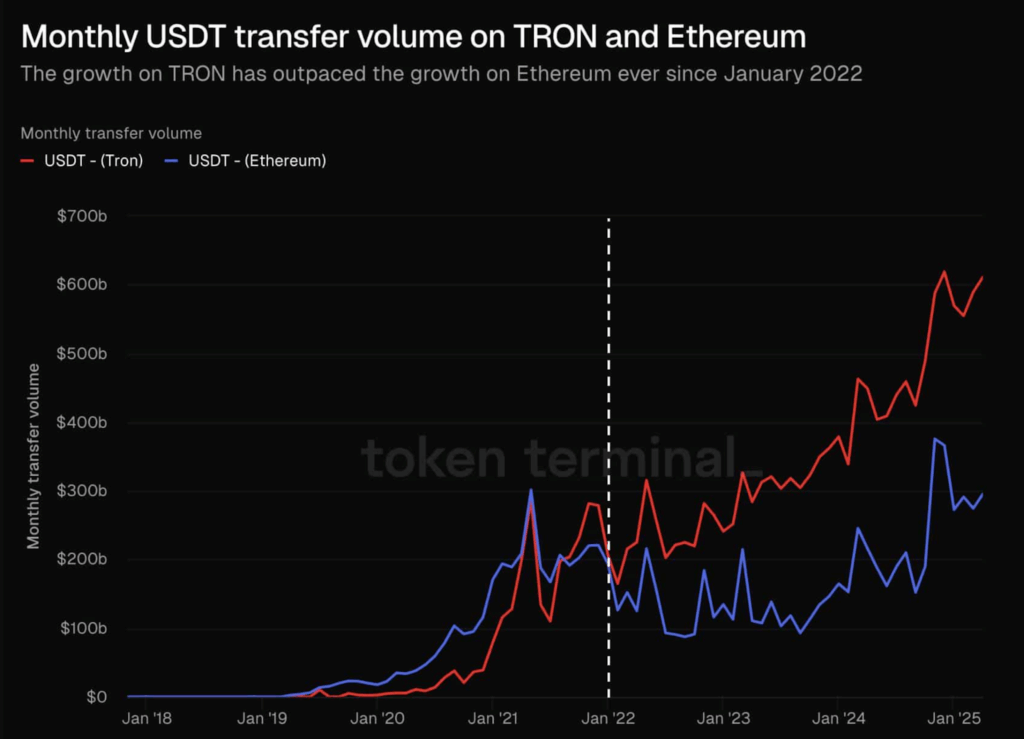

TRON’s USDT transactions hit $600B

Tether (USDT) transactions on the TRON network have accumulated a record high of $600 billion. This milestone reinforces its growing popularity as a low-cost, fast, and efficient platform for USDT transfers.

TRON has consistently outperformed Ethereum in terms of USDT transaction volumes since January 2022. While Ethereum remains the leading network for NFT and DeFi activity, TRON’s position as a stablecoin settlement leader cannot be ignored.

The shift to TRON for USDT transfers has been driven by its lower gas fees and faster confirmation rates. Higher fees than those of Ethereum have motivated users, mainly those in emerging economies, to switch.

The trend has created an evident divergence. TRON’s stablecoin base is now processing radically more volume on a day-to-day basis than Ethereum’s, with the gap increasing as well.

Though viewed as a fading giant when compared to newer Layer-1s, network activity on the TRON network has been painting a different picture. For example, the surge in USDT volumes is a sign of high underlying demand. This on-chain activity has the potential to breathe new life into TRON’s price action.

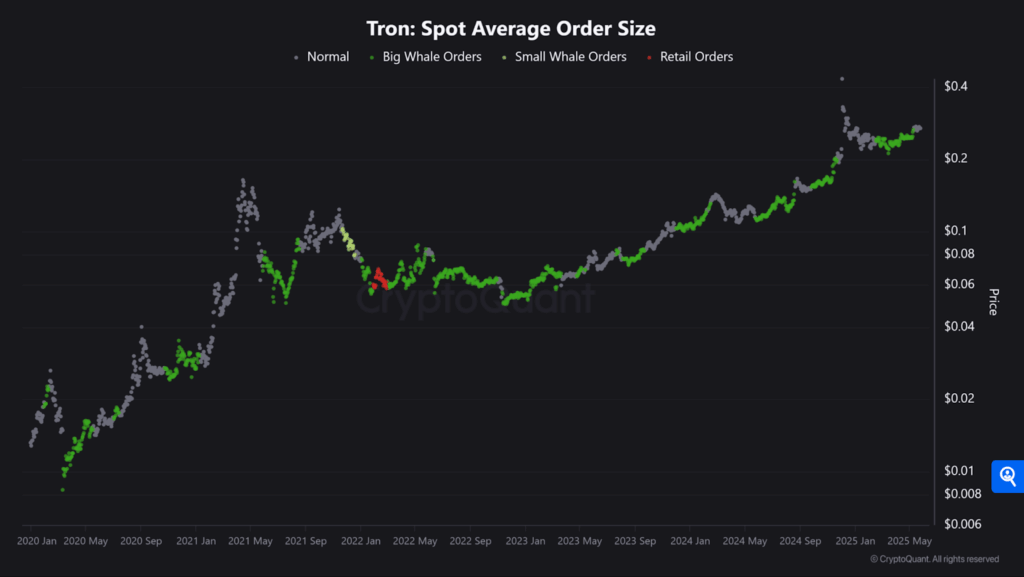

In the view of top analysts, network momentum is more likely to be reflected in renewed investor sentiment, mainly when driven by real usage. A noticeable surge in large whale orders has contributed to the increase in transaction volumes.

Similarly, whales have been steadily buying TRX at or close to its press time price levels. Whale accumulation during network expansion typically refers to long-term positioning, rather than short-term speculation.

If the trend continues, TRX could regain attention slowly, not through hype cycles, but through constant network utility.

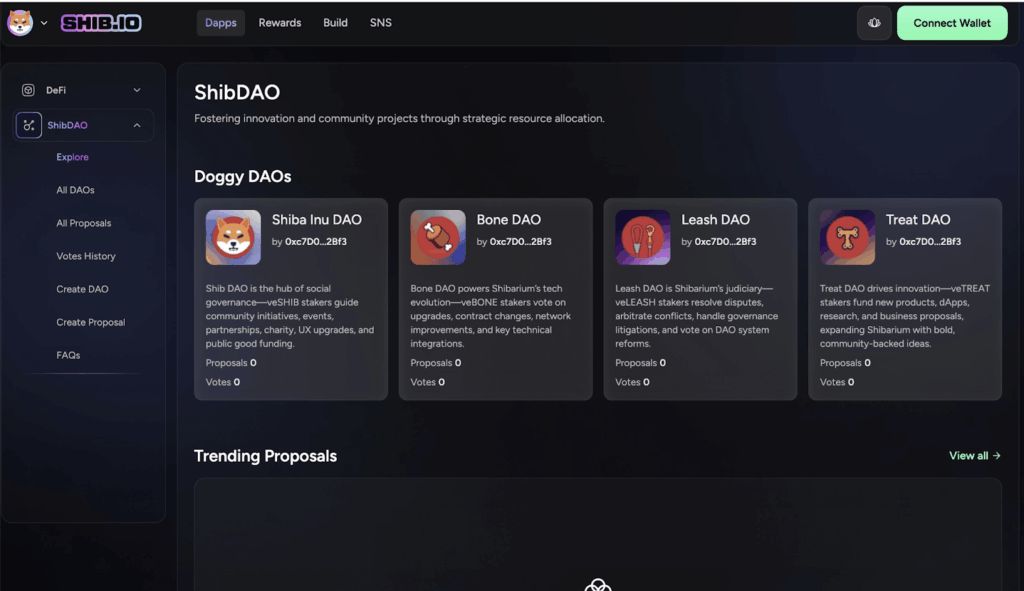

Shiba Inu launches the ShibDAO

Shiba Inu has officially launched ShibDAO, a community-driven governance framework that empowers users to vote on critical upgrades and proposals. This was announced via a social media post.

ShibDAO introduces a tiered governance model that distributes responsibilities across four key DAOs. These include:

- ShibDAO to oversee the community initiatives.

- BoneDAO will guide protocol development.

- LeashDAO will mediate internal disputes.

- TreatDAO will fund dApp innovation and ecosystem growth.

The DAO also enables the formation of smaller sub-DAOs, enabling community members to claim a Shib Name (SNS) and establish self-governing groups. These can focus on niche areas such as art, DeFi, or public goods.

Meanwhile, this launch coincided with Bury 2.0, a revamped staking system that enables users to lock SHIB, BONE, LEASH, and TREAT tokens to earn voting power. The longer and larger the stake, the more influence a holder gains within the ecosystem.

Shibarium update stated,

“Stake SHIB, BONE, LEASH, or TREAT to gain influence. The more and longer you stake, the more voting power you earn.”

The combined launch of ShibDAO and Bury 2.0 signals Shiba Inu’s evolving ambition – shifting from a meme token to a structured, utility-rich Web3 platform, governed by its community and built for long-term sustainability.

REX Shares files for Ethereum and Solana staking ETF

REX Shares has filed with the US Securities and Exchange Commission (SEC) to introduce two new exchange-traded funds (ETFs) centred on Ethereum and Solana.

According to the SEC filing, these ETFs will hold the underlying crypto assets and stake a portion of them. The filing, submitted on May 30, was marked “immediately effective,” signaling that the launch could happen soon.

Each fund plans to invest at least 80% of its assets in either Ethereum or Solana. Then, at least 50% of those holdings will be staked to earn on-chain rewards, which investors will receive as dividend income.

Bloomberg ETF analyst Eric Balchunas highlighted the filing’s significance, noting that it could lead to the launch of the first spot Solana ETF, as current offerings only track Solana futures.

He added that REX leveraged the Investment Company Act of 1940 (40 Act) to expedite the listing. This allows the firm to bypass the longer and more cumbersome process tied to the Securities Act of 1933 (33 Act).

Moreover, these funds will operate as C corporations rather than follow the traditional structure of regulated investment companies (RICs). This structure provides specific tax advantages, particularly for staking-related activities.

The fund will gain exposure to ETH and SOL through wholly owned subsidiaries in the Cayman Islands, which will acquire and stake the cryptocurrencies. The launch date is uncertain, but specific reports indicate the ETFs could be added within the next few weeks.

James Seyffart, another Bloomberg ETF analyst, called the move a “clever legal and regulatory workaround” to bring staking-based ETFs to market. He stated on X,

“These ETFs are structured as C-corporations, which is very rare in the ETF world. Only really used it for some MLP ETFs that I can think of off the top of my head. There are pros and cons to the structure, but it looks like one pro is that this was one way to get some level of signoff from the SEC.”

However, he cautioned that the long-term viability of this approach remains uncertain. This is because more efficient structures, such as grantor trusts, could eventually replace C-corp ETFs.

Meanwhile, market observers noted that the filing comes shortly after the SEC issued updated guidance on crypto staking.

Last week, the financial regulator clarified that staking models do not automatically qualify as securities. It also noted that additional features, such as early withdrawal options or bundled services, don’t change the regulatory status.

SEC Commissioner Hester Peirce said,

“The Division of Corporation Finance clarified its view that certain proof-of-stake blockchain protocol ‘staking’ activities are not securities transactions within the scope of the federal securities laws.”

Industry experts, such as Nate Geraci of the ETF Store, believe that this regulatory clarity could open the door for new crypto investment products. ETF issuers may now offer direct exposure to yield-generating digital assets through a familiar financial wrapper.

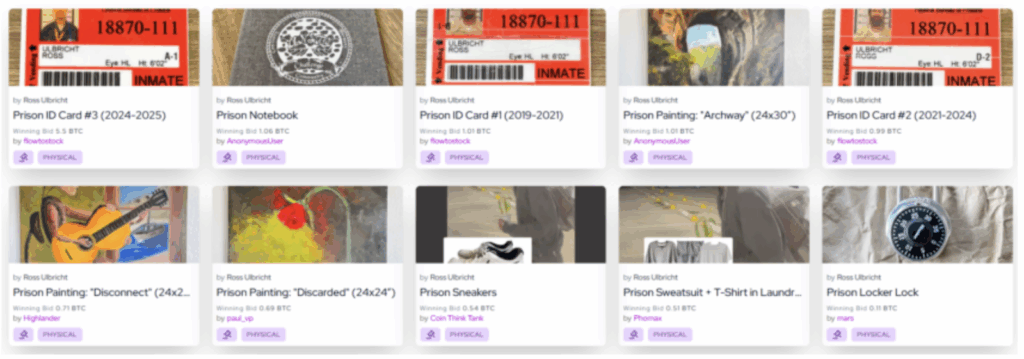

Silk Road’s Ross Ulbricht raises $1.3 million in BTC through auction

Ross Ulbricht, founder of the defunct Silk Road darknet marketplace, has raised over $1.3 million worth of Bitcoin through the sale of personal and prison-related items.

The auction, held via Scarce City, overlapped with his appearance at the Bitcoin 2025 conference – his first public event since being released from prison earlier this year following Donald Trump’s presidential pardon.

The items up for sale included his prison-issued ID cards, clothing, paintings, and handwritten notes. His 2024-2025 prison ID fetched the highest bid at 5.5 BTC, while the complete set of three IDs sold for a combined 7.5 BTC, valued at over $780,000 at the time.

Other memorabilia included a notebook sold for 1.06 BTC, three prison paintings that brought in a total of 2.41 BTC, and clothing such as his prison sneakers and sweatsuit, which sold for 0.54 and 0.51 BTC, respectively.

Ulbricht also parted with personal belongings from before his arrest, including a djembe drum, a backpack, and a sleeping bag. In a statement shared on the Scarce City auction platform, he explained that these items represent a chapter he is now ready to leave behind.

Ulbricht said,

“I’ve left Arizona, the state where I was in prison. It’s time to travel. That means downsizing and turning the page. I’ve decided to auction some personal items from before my arrest and during my time in prison. I don’t need the reminders, and I’m sure some of you will love to have them.”

Shortly after the auction, blockchain analytics platform Lookonchain detected a significant donation of 300 BTC, worth approximately $31.4 million, sent to Ulbricht. This transaction is one of the most essential single donations recorded this year.

The donation came a few days after Ulbricht’s emotional speech at the Bitcoin 2025 conference. On stage, he expressed gratitude to the Bitcoin community for their support during his time in prison.

The Silk Road founder also highlighted the values he believes should shape the next phase of crypto development, including freedom, decentralization, and unity.

He stated,

“When it comes to freedom, we’re not there yet. There’s still more freedom to be won.”

While Ulbricht’s past remains controversial, his message resonated with many attendees who continue to see Bitcoin as a tool for individual empowerment.

World Liberty Financial airdrops 47 USD1 stablecoins

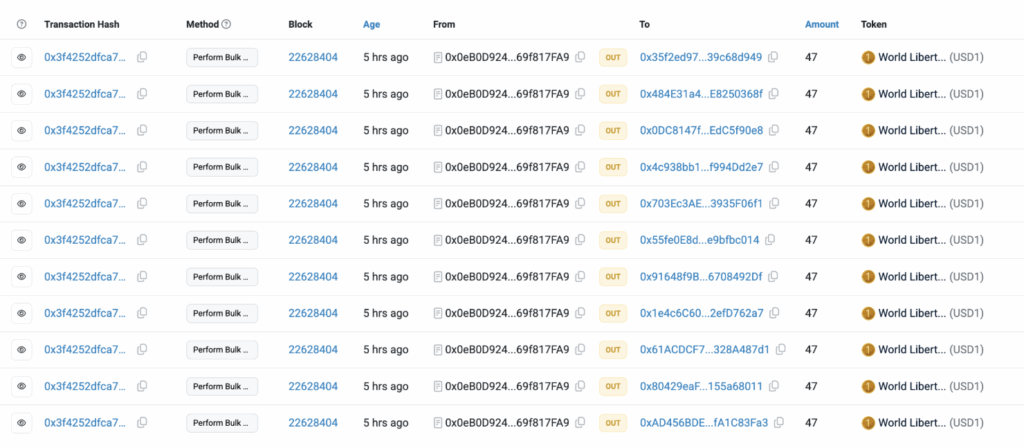

World Liberty Financial distributed 47 USD1 stablecoins to every wallet holding WLFI tokens. This distribution indicated the project’s recent governance decisions and its commitment to transparency.

This was verified by Etherscan on-chain data, providing instant evidence of the transfers. The airdrop, initiated by community governance, spurred immediate discussion as analysts observed mass transfers occur in real-time.

Lookonchain stated,

“Looks like Trump’s World Liberty [@worldlibertyfi] is airdropping 47 $USD1 to every wallet that participated in the $WLFI sale.”

This quick community verification reinforced trust in the process and affirmed the authenticity of the airdrop event.

The airdrop ignited other discussions within the community, as users tracked wallet balances and debated WLFI’s next steps. Moreover, publicly accessible transaction records on Etherscan increased confidence in the airdrop’s legitimacy.

Consequently, USD1 stablecoin has rapidly captured a major market share. Its circulation has surpassed $2 billion, a sign of both booming adoption and growing trust in the ecosystem.

Yet, most of its supply remains concentrated in just three wallets, which raises questions about decentralization and poses possible risks around liquidity and control.

To that end, industry analysts underscore that, while this transparent approach to distribution and tracking sets a standard for on-chain projects, ongoing monitoring of wallet concentration will be important. At least, while World Liberty Financial and USD1 seek broader acceptance.

Related: Zypto Launches Full USD1 Support Across the Platform

Circle’s USDC trading hits ATH of $7.7 billion

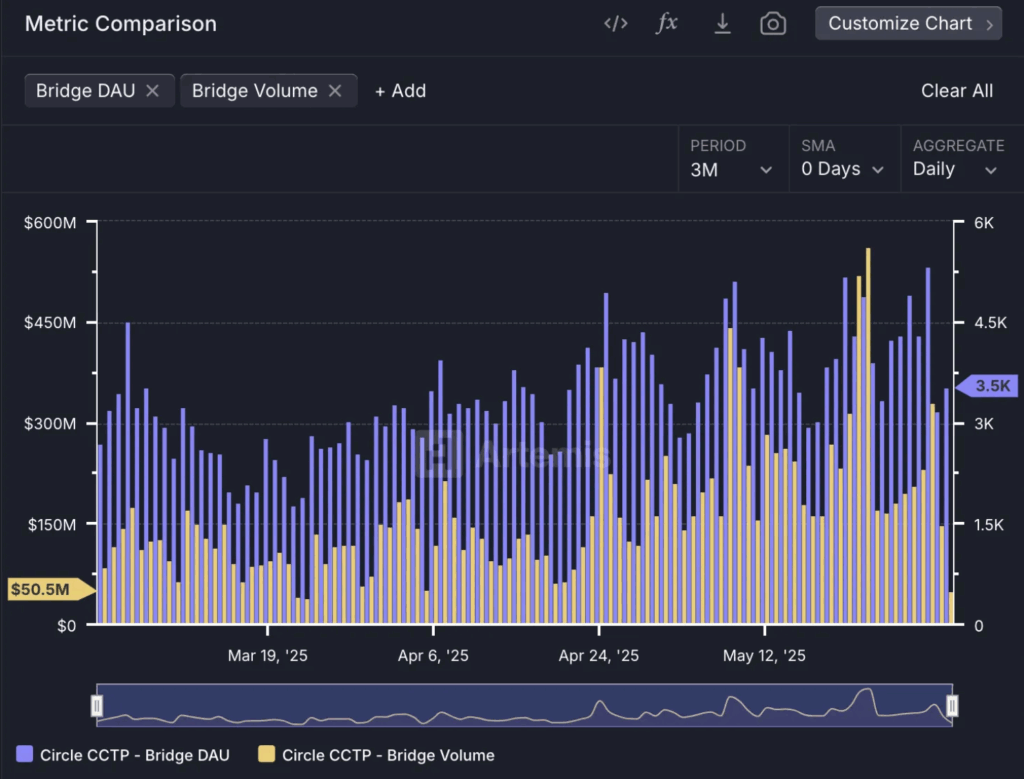

Circle’s Cross-Chain Transfer Protocol (CCTP) facilitated $7.7 billion in stablecoin bridging volume in May, an all-time high and an 83.3% increase from April.

The firm launched its IPO last week, rejecting outright buyout actions to remain active in the stablecoin market. This remarkable growth exemplifies Circle’s progress and solid foundations.

Circle, one of the largest stablecoin issuers, first launched CCTP in 2023 to enable seamless bridging of USDC across blockchains. Since then, it has integrated the protocol with several prominent blockchain networks, thereby increasing USDC’s interoperability.

Today, blockchain data analysis shows that CCTP hit a new all-time high for bridging volume last month.

This CCTP volume is especially relevant for Circle for another reason. This is because the total number of active stablecoin addresses also reached a new record last month: 33.1 million.

In a time when the total demand for stablecoins and utility solutions is only growing, Circle is working to present its payment ecosystem as an attractive option.

The company has been planning an Initial Public Offering (IPO) for the last few months, but it rejected a $5 billion offer from Ripple to acquire it outright. Instead, the firm opened its stock sale last week, aiming to raise $624 million while preserving its independence.

CCTP’s record growth could indicate Circle’s long-term market potential, perfect for enticing new capital. The stablecoin issuer already increased its IPO size today, setting a more ambitious target of $896 million.

Yet, Circle isn’t the only issuer developing new cross-chain transaction solutions.

While the number of active stablecoin addresses is rising, other prominent investment banks are planning to increase their presence in the industry.

Zypto launches USD1 across the platform

The USD1 stablecoin has officially launched on the Zypto platform. Users can now receive, store, swap, and spend both ERC-20 and BEP-20 versions directly.

USD1 holders can also load and top up using Zypto’s full suite of single-load and reloadable Virtual Crypto Cards, as well as the Physical Zypto Card. USD1 can also be used to pay bills or purchase our secure cold wallet solution, the Vault Key Card (VKC).

Find out more here.

Closing remark

While TRON has not garnered headlines like Solana or Ethereum lately, its fundamentals have remained strong behind the scenes. Its all-time USDT volume and strategic whale involvements might hint at a turning point.

Shiba Inu’s ShibDAO signals the network’s evolution into increasingly empowering its community. Then, Ross Ulbricht’s presence at the Bitcoin conference indicates a renewed call to participate in the crypto space, albeit from a different vantage point.

Finally, Circle’s record CCTP growth comes at a helpful time. USDC’s trading volume broke records in April, and now its utility protocols are also experiencing a surge in activity.

What’s your favorite news story this week? If you have any further thoughts, please share them in the comments section.

FAQs

Which milestone did TRON recently hit?

Tether (USDT) transactions on the TRON network have accumulated a record high of $600 billion.

Which new update does Shiba Inu have?

Shiba Inu has officially launched a tiered governance model called “ShibDAO.”

What business does REX Shares have with the SEC?

REX Shares filed a petition to introduce two new ETFs centred on Ethereum and Solana.

How much did Silk Road’s founder raise?

Ross Ulbricht, founder of the defunct Silk Road, has raised over $1.3 million worth of BTC through the sale of personal and prison-related items.

How many tokens did the World Liberty Financial airdrop to users?

World Liberty Financial distributed 47 USD1 stablecoins to every wallet holding WLFI tokens.

0 Comments