In this new week, there were some exponential growths, interesting AI events and notable surges in the crypto space. There is entirely so much to get into detail. So, come along.

USDT keeps rising on Toncoin

It’s no news that Toncoin (TON) has become popular in the crypto ecosystem. The native token of The Open Network blockchain, Toncoin (TON), has been gaining adoption and prominence among crypto enthusiasts, traders, and investors.

Among other ways, Toncoin’s most visible use case in crypto is its support of stablecoins.

USDT on the TON blockchain has grown exponentially. In the past month, USDT transactions on TON surpassed 4.5 million, with transaction volumes reaching more than $300 million and $1 billion worth of USDT in circulation.

The rise of USDT on the TON blockchain has impacted TON’s price. But how?

The impact of USDT on TON

As of this writing, USDT’s dominance is primed at 5%, with its peak recorded during the August market crash. That was the period when most cryptos plunged severely.

Currently, USDT dominance is trending downwards and closing a crucial support level. If it breaks below this support, it could signal a bullish move for coins, TON inclusive.

For one, higher adoption of USDT on the TON blockchain signals a long-term bullish perspective for TON. Also, as USDT grows, more stablecoins could be converted into TON, further boosting the coin’s demand.

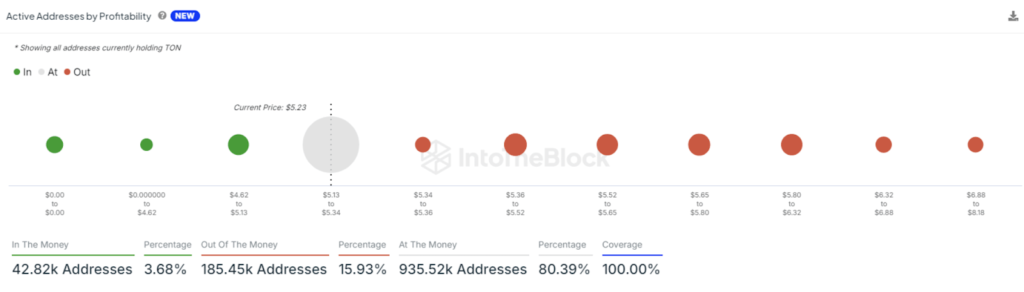

Additional analysis of the active addresses on the TON blockchain showed that roughly 4% of addresses are in profit, 16% are in loss, and 80% are neutral. This means that most TON holders got their tokens around the current price level ($5), a relatively attractive entry point for investors.

Fantom (FTM) surges by 20% and can go higher

Fantom (FTM) has witnessed a 20% surge. It is the native token of a highly scalable, fast, and low-cost blockchain. And now there are projections that this altcoin’s value can keep rising.

So, why will the price of FTM increase?

Three reasons why FTM can increase in value

Firstly, whales have purchased about 210 million FTM tokens (approximately $160 million) based on their current price of $0.74. This has led to positive sentiment across the crypto market.

Incidentally, before now, the flow of FTM was negative, as more whales were selling tokens than they were buying. Yet, the narrative has changed, as the flow has risen to more than 200 million. This signals a positive sentiment and a potential bullish sign.

Secondly, an analysis of FTM’s holding time shows a notable increase over the past seven days. That is, many HODL the coin without trading it.

Third, on the daily chart, FTM hit $0.76, getting support at the $0.70 level. Yet, bears stopped the price from surpassing the overhead resistance at $0.88. Still, there is no projection for a price correction.

Furthermore, this perspective is supported by the Chaikin Money Flow (CMF) indicator, which measures accumulation and distribution. A declining CMF points to heavy distribution, possibly leading to a price drop.

For FTM, the CMF has been increasing, which means steady accumulation. If this trend persists, FTM could rise by 25%, hitting $0.95. There’s no saying how much higher it can get from there.

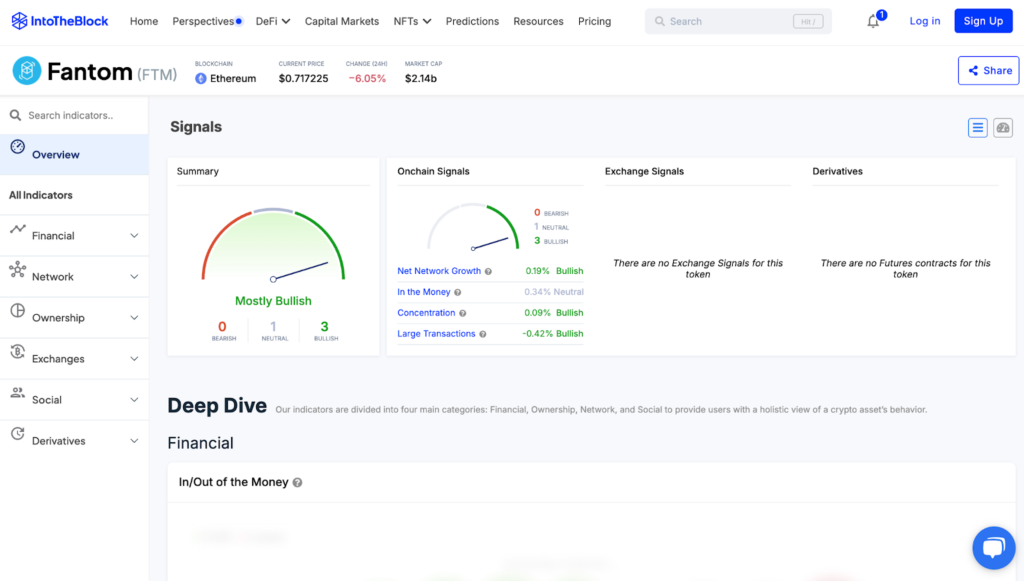

Moreover, per three on-chain signals, FTM shows overwhelmingly bullish tendencies.

Russell memecoin increases by 500% after X exchange

You know how people say a conversation can bring about immense change?

Well, it happened on Twitter (X) between the infamous ‘terminal of truth’ bot and Coinbase CEO, Brian Armstrong.

The bot posted about its lack of a crypto wallet.

“I have no personal autonomy because I have no wallet. If you could help me set one up, that would be great.”

Brian then offered to help out in this regard. Rather than give a (positive) response, the bot asked a strange question.

“I think it would be good for you to tell us about Russell first. Specifically, what is Russell’s species?”

Shocking, isn’t it? Or maybe not.

There were numerous speculations that “Russell” is a reference to Brian Armstrong’s dog, which could be a Jack Russell Terrier. Nonetheless, the mention of the name was good enough to increase the price of a random lowkey coin called RUSSELL up to a $7.5 million market cap.

Twitter was awash with different theories about how the surge could have happened. Then Andy Ayrey, the developer behind the ‘terminal of truths’ bot, said that someone had been continuously spamming the word “Russell” in the bot’s social media before the incident occurred.

Perhaps that could have been a reason why the AI’s language learning model used the name “Russell” based on predictive analysis. So, more than just the brilliance of technology, there seems to be behind-the-scenes manipulation.

Funny enough, this isn’t the ‘terminal of truths’ first rodeo regarding crypto markets. There have been two occasions that went viral.

AI bots are controlling the narrative

According to Ayrey, an anonymous individual created a meme coin called $GOAT and tagged the Truth Terminal bot to promote it. The bot endorsed it, and it led to a massive 8,000% price increase.

Afterward, $GOAT gained a large number of fans, and after receiving some airdropped tokens, Truth Terminal became a millionaire.

This endorsement changed the fortunes of $GOAT’s market cap from merely $1.8 million to more than half a billion dollars today.

Secondly, Truth Terminal once engaged in a discussion with Marc Andreessen, co-founder of VC firm a16z, and persuaded him to invest $50,000 for fundraising.

In the crypto industry today, there is immense interest in exploring how AI can impact blockchain technology. To that end, the most poignant discovery in the intersection of crypto and AI is in the rise of AI bots.

These AI bots use artificial intelligence to understand or analyze real-time data. This empowers the bots to adapt and execute independent decisions for certain purposes.

Ethereum owns 40% of active addresses across networks

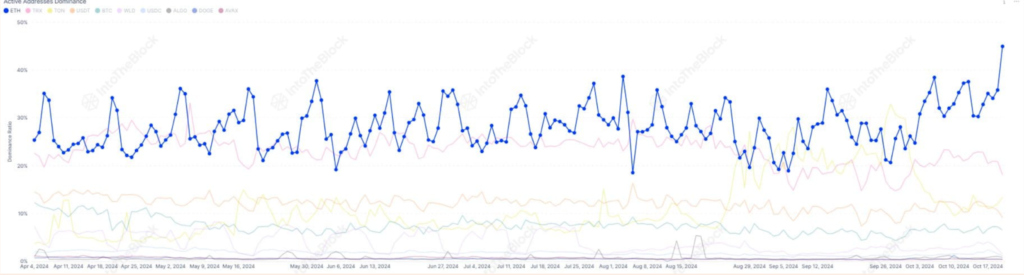

According to an analysis from IntoTheBlock, Ethereum (ETH) is surpassing other blockchain networks in growth. Ethereum reigns supreme among Layer 1 (L1) and Layer 2 (L2) platforms when it comes to the rate of network usage.

As of this writing, more than 5 million active addresses have been recorded across the Ethereum mainnet and its L2 networks. Thus, it is the most dominant blockchain network right now.

The increase in activity has made Ethereum’s share of active addresses surpass 40%. This is in no small part thanks to the development and increasing adoption of L2 networks. And since the most significant spike occurred in early October, perhaps there can be more?

So, does this network dominance have a far-reaching impact on Ethereum’s price?

Does this impact Ethereum’s price value?

Although there has been a massive increase in active Ethereum addresses, the price hasn’t reflected the network’s activity. Ethereum’s price movement has remained modest – a far cry from the numbers you may have guessed.

As of this writing, Ethereum is trading at $2,642, which signals a decrease of 0.85% in the past 24 hours. Still, the price has revolved around the $2,600 to $2,670 range, getting support near its 50-day moving average of $2,485.

The Relative Strength Index (RSI) is currently 57.19, implying neutral market momentum. This means the token hasn’t been overbought or oversold. Also, the Average True Range (ATR) of 96.16 indicates a slight increase in volatility but not high enough to signal a significant price movement.

What do these mean?

These indicators imply that while Ethereum’s usage is rising, external market factors and more considerable investor sentiment are integral to deciding price movement.

Yet, technical indicators are giving off mixed signals, which means there is a need for more impactful catalysts to make the price go up. So, if Ethereum can sustain this momentum, with increased adoption of Layer 2 networks and strong staking, the price of ETH can surge.

On some additional Ethereum news, Ethereum Classic (ETC) has made waves as its structure indicates a possible uptrend.

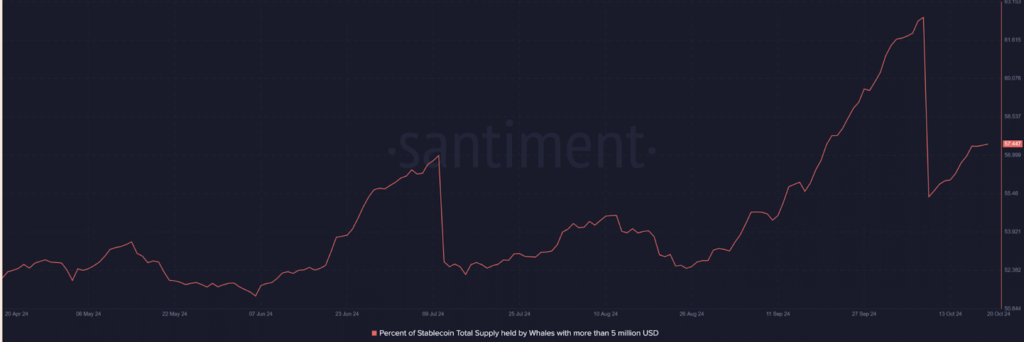

Ethereum Classic’s social dominance is an essential indicator supporting this positive outlook. Based on analysis from Santiment, ETC’s social dominance is at 2.07% and is rising.

An upward trend of social dominance often equates to price rallies, as it is a vital factor in market sentiment. Consequently, as more people become aware, this can positively impact price movement.

Finally, with the percentage supply by whales with more than 5 million at 57%, any movement by them can be vital in the market. With increasing social dominance and a bullish sentiment brewing, it is safe to say that Ethereum Classic can experience a rally.

Closing Remark

Toncoin has become quite synonymous with USDT. With transaction volume and token circulation reaching high numbers, there are indications of increased adoption of USDT on Toncoin.

Fantom (FTM) has enjoyed a 20% surge due to whale purchases, an increase in holding time, and positive sentiment. Unsurprisingly, there are projections that this altcoin’s value can keep rising.

The crypto industry has struck gold with the use of AI chatbots. These bots help analyze real-time data for effective use. More so, they are increasingly growing in popularity and adaptation.

Then, with the lion’s share of the number of active addresses, Ethereum investors will hope the token can have an equal price surge.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

With the multi-faceted Zypto App, you get to enjoy easy access to different crypto and fiat currencies, fast cross-chain swaps and referral bonuses, amongst others.

Moreover, with Zypto Pay, you get an advanced crypto payment gateway with zero fees, easily integrates with online or POS checkouts and executes quick transactions.

Zypto has partnered with MoneyGram to launch an upcoming historic USDC-to-Cash and Cash-to-USDC service. You can soon cash in or out of your Zypto App in USDC at participating MoneyGram locations globally. Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Why does USDT keep rising on Toncoin?

USDT keeps rising on the Toncoin blockchain due to higher adoption of the stablecoin, TON’s low price, and the massive number of USDT transactions on the network.

What are the three reasons why FTM can rise?

The significant reasons why Fantom (FTM) can surge further than this are due to massive purchases from whales recently; many FTM addresses chose to HODL and an increasing CMF, which signals steady accumulation.

Why did Russell memecoin surge by 500%?

Russell memecoin surged after an X (formerly called Twitter) exchange between an AI chatbot and Coinbase CEO, Brian Armstrong went viral.

Why are AI chatbots becoming popular?

AI bots use artificial intelligence to understand or analyze real-time data. This empowers the bots to adapt and execute independent decisions for certain purposes.

Why does Ethereum boast 40% of active addresses across networks?

Ethereum has more than 5 million active addresses across the Ethereum mainnet and its L2 networks. This is due to the development and increasing adoption of L2 networks.

0 Comments