This week, the two leading cryptocurrencies – Bitcoin and Ethereum – surged through their ETFs, new addresses, and other policies. Also, stablecoins exceeded a monumental figure, further establishing them as revolutionary assets.

Find more as you read on.

Stablecoins surpass $200B in market supply

With stablecoins exceeding the $200 billion mark in total supply, there is more acclaim for their global reputation. These digital assets are no longer seen as merely niche products tied solely to cryptocurrencies.

Stablecoins have developed into prominent financial assets, thus bridging the divide between traditional and decentralized finance. They are primed to revolutionize global finance and reinforce the digital dollar’s dominance, and nothing has shown that more than their latest strides.

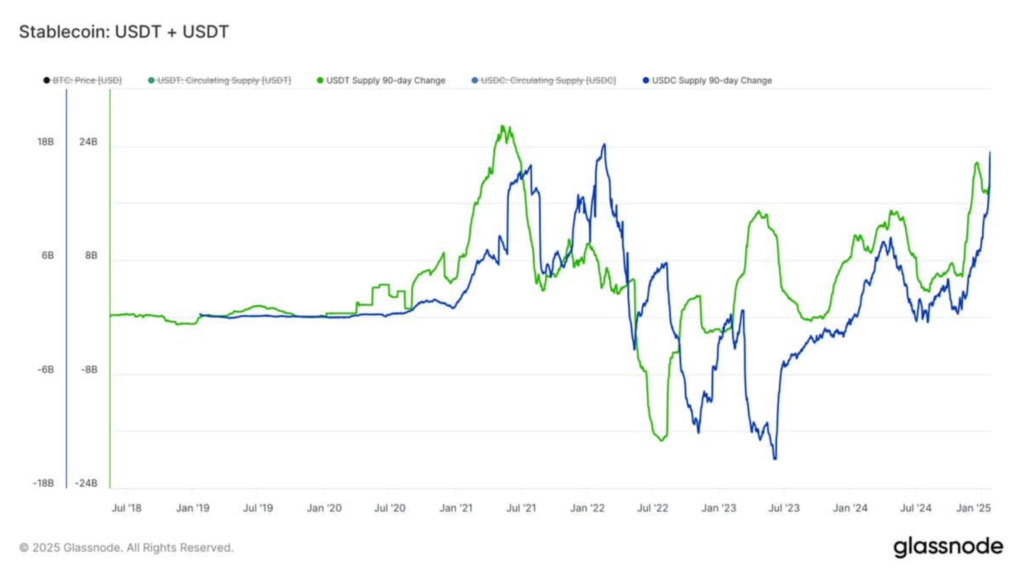

In the last 90 days, the stablecoin ecosystem has witnessed some surges. Tether (USDT) increased by $20 billion, and USD Coin (USDC) spiked by $17 billion. That’s how stablecoin’s total supply surpassed $200 billion.

In addition, recent data revealed stable upward growth for USDT, indicating robust demand across various ecosystems. Meanwhile, USDC, which declined in mid-2023, has sharply recovered. This reflects rekindled belief from both institutional and retail investors.

Thus, this surge in stablecoins emphasizes their advancing role as a liquidity source independent of central banks. It is well known that they provide efficient, borderless liquidity for various transactions. So, their exponential growth provides global liquidity without pressurizing the sovereign money supply.

Stablecoins’ impact on the US

Typically, Tether (USDT) has become the third-largest buyer of 3-month U.S. Treasuries, increasing its role in stabilizing the U.S. debt market. Likewise, USDT is also the 16th-largest buyer of U.S. Treasuries globally.

With $140 billion in circulation, USDT’s purchases contribute massively to the U.S. Treasury demand. By increasing in volume, stablecoins are adding liquidity to global markets and assisting the U.S. economy.

With the Asian behemoths China and Japan lowering their U.S. debt holdings, stablecoin issuers are stepping up. This evolution underscores the rising influence of stablecoins, as their utility can’t be overemphasized.

The inflow of capital from stablecoins (USDT and USDC) into U.S. Treasuries is helping to reduce Treasury yields. As the principal buyers of U.S. debt, stablecoins decrease treasury yields, pushing bond prices and increasing demand.

This lessens the U.S. government’s borrowing costs and helps keep interest rates down. Moreover, with stablecoins as essential buyers of Treasuries, the Fed may feel less pressure to increase rates, which can lead to a more prosperous economic environment.

A global shift to stablecoins

Generally, stablecoins in the US (USDT and USDC) are called ‘digital dollars’ as they represent the price stability of $1. The more stablecoins gain traction, the more cross-border transactions and enhanced global capital flow.

Stablecoins are projected to have a 5x increase and grow into a $1 Trillion industry in the following market cycle. This surge could further boost Bitcoin’s adoption, demand, price increase, and reputation, with an expected 5% of stablecoin capital inflow.

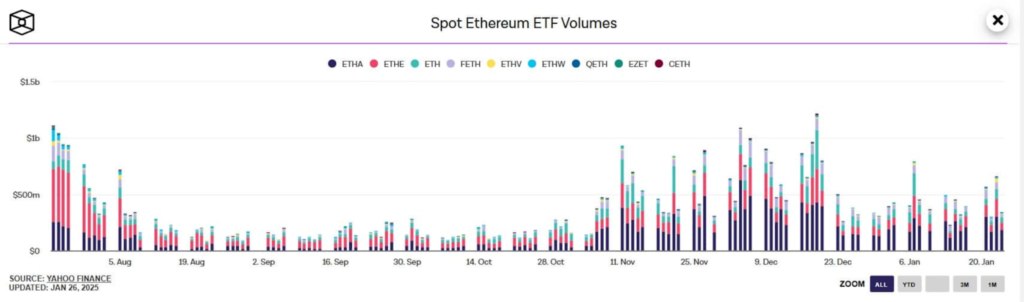

Ethereum ETFs attract $5 billion

Since November 2024 till now, Ethereum ETFs have experienced over $5 billion in inflows. This surge in institutional interest indicates growing confidence in Ethereum as a bedrock of DeFi development due to its scalability, expansive use case, and speed, amongst other features.

Interestingly, trading volumes peaked in December, constantly exceeding $1 billion on the highest-volume days. Ethereum ETFs like ETHE and ETHFW have quickly become favorites, emphasizing Ethereum’s capability as a diversified investment alternative.

What led to Ethereum ETFs’ appeal?

Ethereum’s institutional appeal continues to increase thanks to various factors. One such factor is the Shanghai upgrade, which unlocked staked ETH withdrawals without destabilizing the network.

Secondly, Ethereum’s stability, bolstered by layer-2 solutions like Arbitrum and Optimism, makes it a viable option for investors. Ethereum’s network is becoming a go-to platform for tokenizing real-world assets, as seen in JP Morgan’s $20 million tokenized bond.

This leads to the larger question of how Ethereum ETFs stack up against Bitcoin ETFs.

BTC ETFs vs ETH ETFs: Who wins?

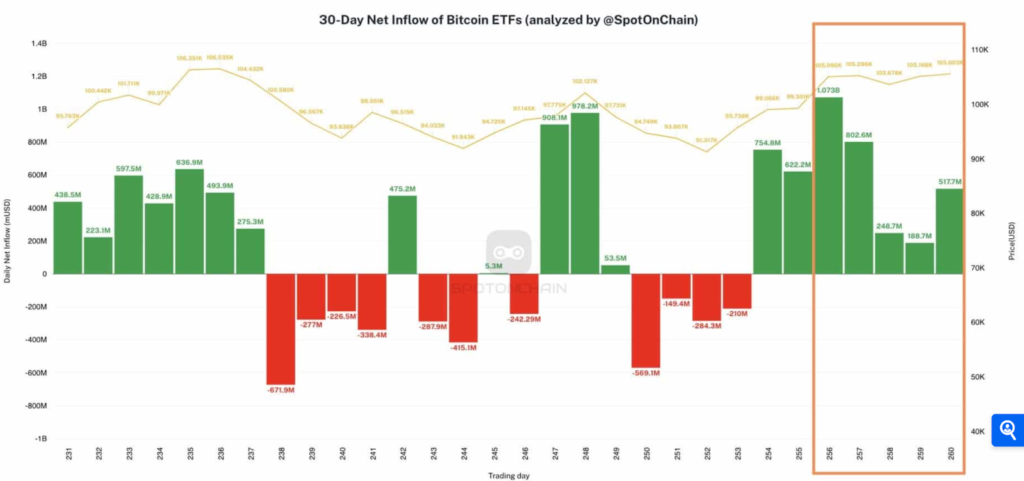

The first week of President Trump’s second term saw a massive influx of funds into Bitcoin (BTC) ETFs. There were inflows of $1.76 billion, which pushed Bitcoin past $109,000, with BlackRock’s Bitcoin ETF enjoying a daily inflow of $155.7 million in the last 24 hours as of press time.

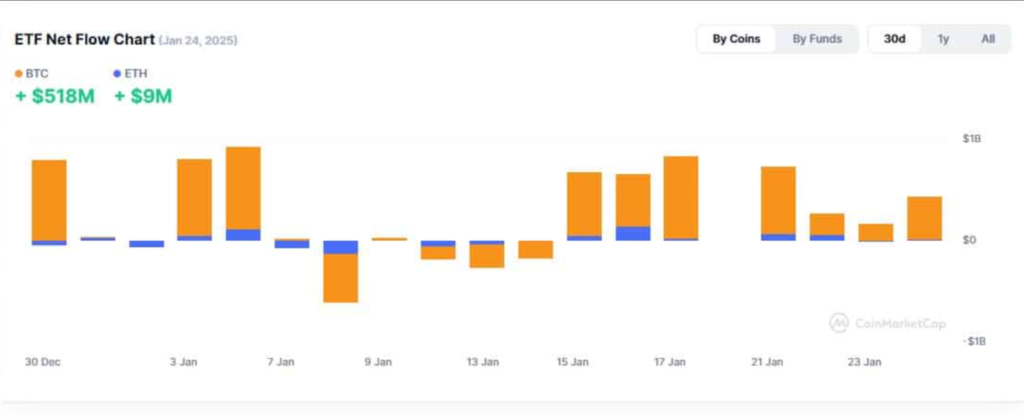

Moreover, with $518 million in net inflows in January, Bitcoin ETFs continue to increase their dominance as the preferred institutional investment.

Conversely, Ethereum ETFs gained a smaller amount, $139.4 million, showing a relative lack of momentum. According to SpotOnChain, ETH prices remain 27% below their all-time high.

This discrepancy implied that Bitcoin is a safer or more favorable investment compared to Ethereum under current market conditions. Thus, this trend could establish BTC as the prominent asset, mainly if identical patterns persist, overshadowing altcoins like Ethereum, which are undergoing stagnancy.

However, with Ethereum ETFs having drawn $5 billion since November 2024, there could be an upcoming transition in investor sentiment. For instance, Ethereum ETFs offer more manifold opportunities due to their use in DeFi, giving them an edge over Bitcoin’s more static use case.

With Ethereum ETFs poised to keep advancing, Bitcoin’s dominance could encounter mounting pressure as institutions adopt Ethereum’s more comprehensive applications.

The influx of funds into Ethereum ETFs signals a broader shift in institutional strategies, underscoring the importance of adaptable, future-proof assets. With improved blockchain regulatory clarity on the horizon, Ethereum’s dynamic ecosystem may set a new benchmark for financial innovation.

Thus, the rivalry between Bitcoin and Ethereum will probably stimulate innovation across the crypto ecosystem, pushing growth in multiple sectors. Still, given evolving marketing conditions and international rules, the ability of both assets to scale will decide their futures.

Bitcoin surges amid stock market stability

The premier cryptocurrency, Bitcoin, has grown significantly over the past year. It surged from the $30k mark past the $100k mark. This monumental development has enticed institutional investors in traditional markets to adopt Bitcoin as a beneficial asset.

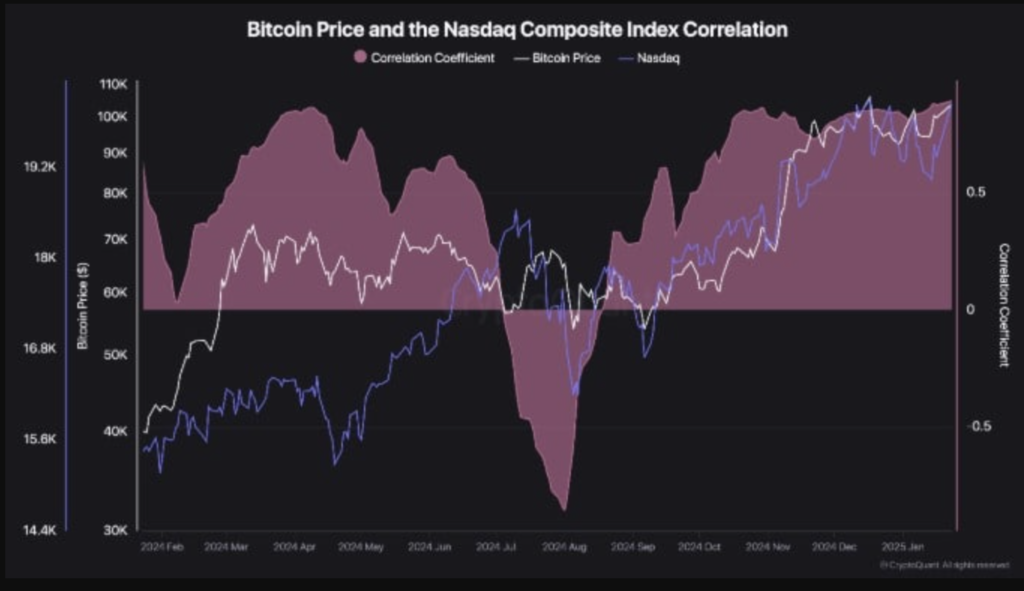

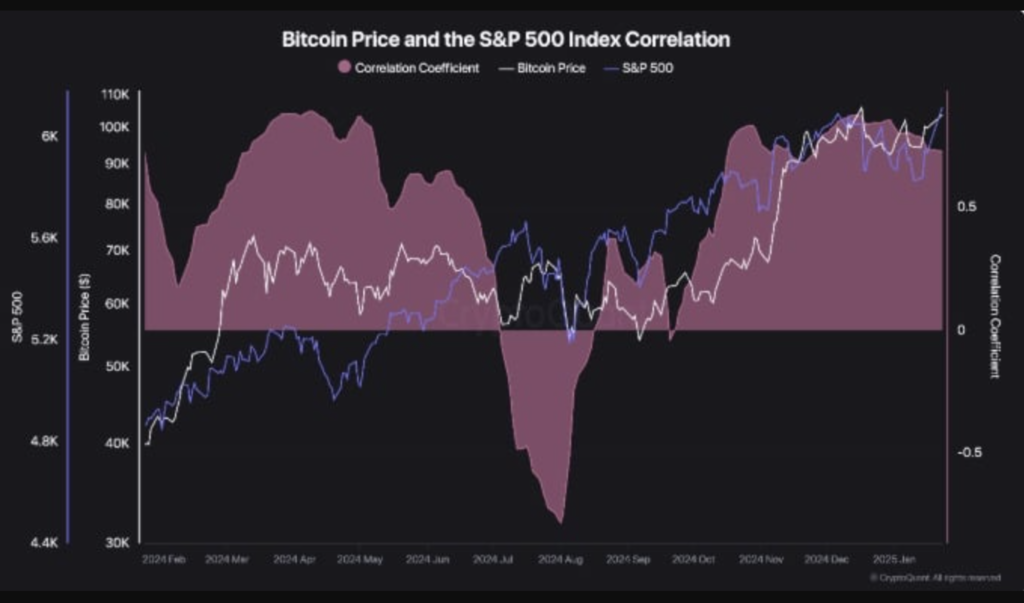

This has increased familiarity between BTC and the U.S. stock market, according to CryptoQuant.

For example, in 2024, BTC and Nasdaq indicated a historically strong correlation, reaching historic levels.

Similarly, on August 4th, 2024, when the U.S. stock market crashed, BTC dropped to $49k. In November, after the election, BTC and the stock market rallied strongly.

The increase in correlation signals that institutional investors now view Bitcoin as a traditional asset. Moreover, with Donald Trump in office and the crypto market anticipating relaxed regulations, BTC could now become widely accepted as an asset class among institutional players.

This recognition will then speed up BTC adoption and growth.

What is the implication for BTC?

Bitcoin’s sustained growth and boosted acceptance among institutional investors indicate it is well-positioned for further development. Thus, with the U.S. stock market still enjoying stability, BTC will continue to experience gains.

Beyond institutional investors, there is another group of investors whose trade activity has established BTC as the standout digital asset. They are long-term holders (LTHs).

Bitcoin’s latest HODLing trends?

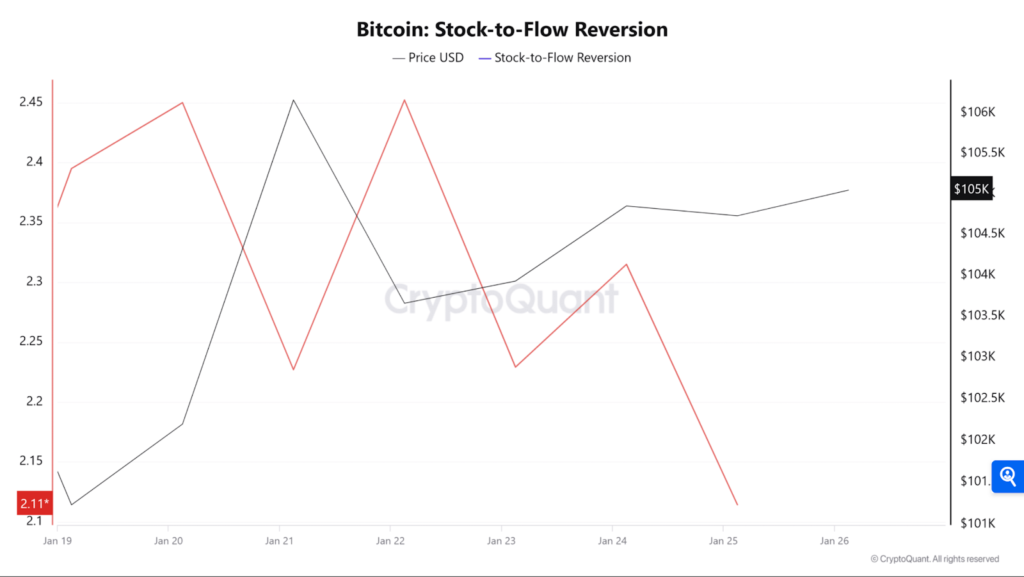

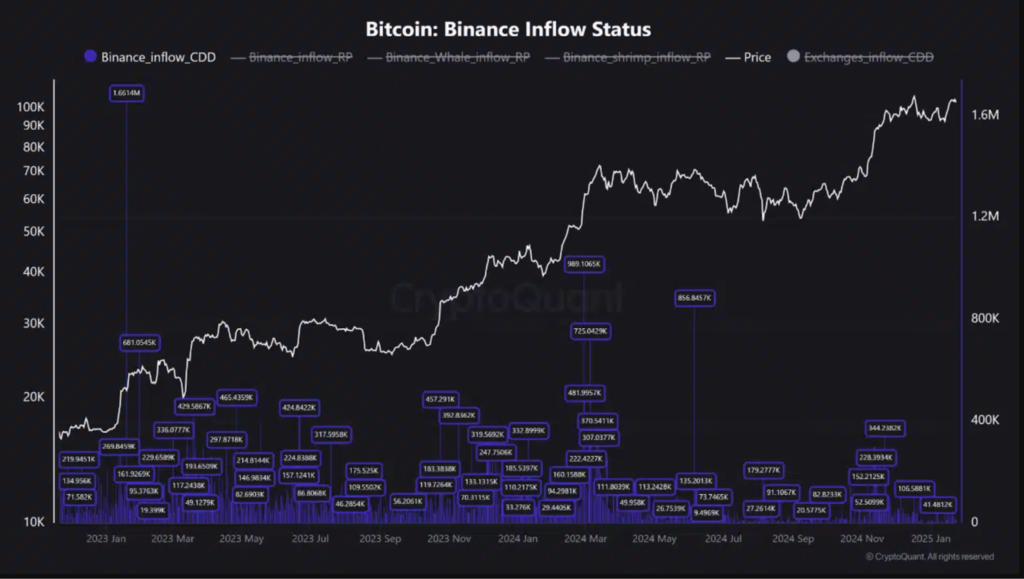

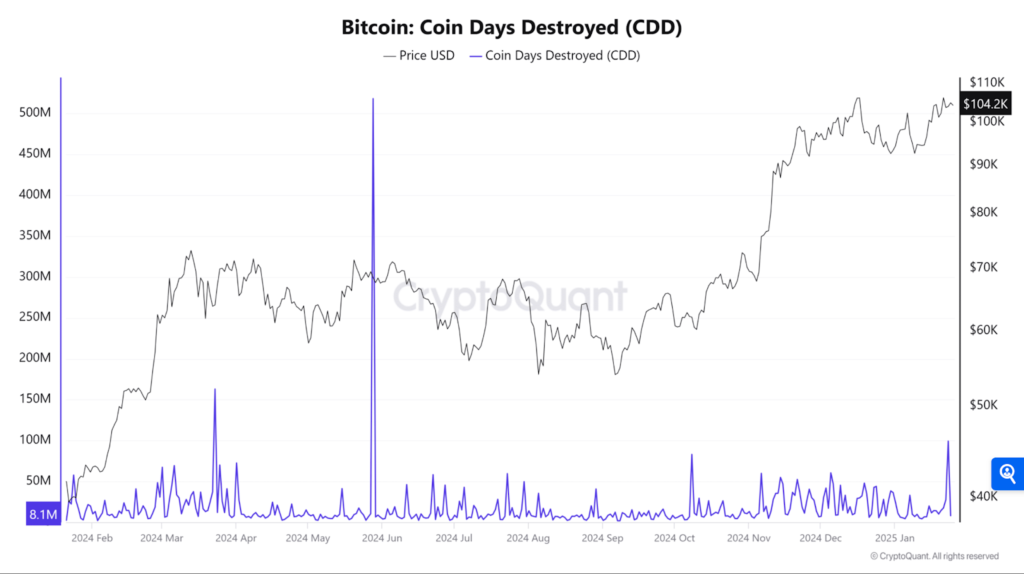

Data from CryptoQuant shows a robust HODLing sentiment across Bitcoin’s market, with minimal deposits to exchanges from long-term holders (LTHs). Long-term traders have owned their BTC for over 155 days, indicating their belief in Bitcoin’s value.

The chart reveals that only a tiny fraction of exchange deposits came from long-term holders. This suggests that experienced investors are not just retaining their holdings but actively avoiding short-term speculation.

Long-term Bitcoin holders have notably resisted selling, even during economic downturns. Their resilience is entrenched in a conviction that Bitcoin’s long-term future overshadows short-term price volatility. It is further influenced by financial nous, inspired by years of market cycles that reward persistence.

Unlike speculative traders, these LTHs prioritize accumulation and retention, aligning their actions with Bitcoin’s narrative as a scarce asset primed for future growth. Therefore, HODLers see BTC as a hedge against traditional financial instability and a path to decentralized financial platforms.

In addition, the low levels of Coin Days Destroyed (CCD), a metric for tracking the movement of older Bitcoin, emphasized the market’s stability and investors’ belief in its future. CCD levels showed that older coins have been primarily unmoved, signalling the inactivity of dormant BTC.

Together, these metrics underscored how long-term holders’ actions influence the market. They decrease sell-side pressure and contribute to Bitcoin’s stability, even during periods of volatility.

Overall, these trends suggest market confidence in BTC’s long-term potential. Moreover, as market conditions align with traditional market setups, BTC becomes more attractive to institutional investors.

Ethereum adoption increases with network activity

Ethereum recorded some notable milestones in January 2025, continuing from where it left off last year. This surge in network activity offers essential insights into probable market dynamics.

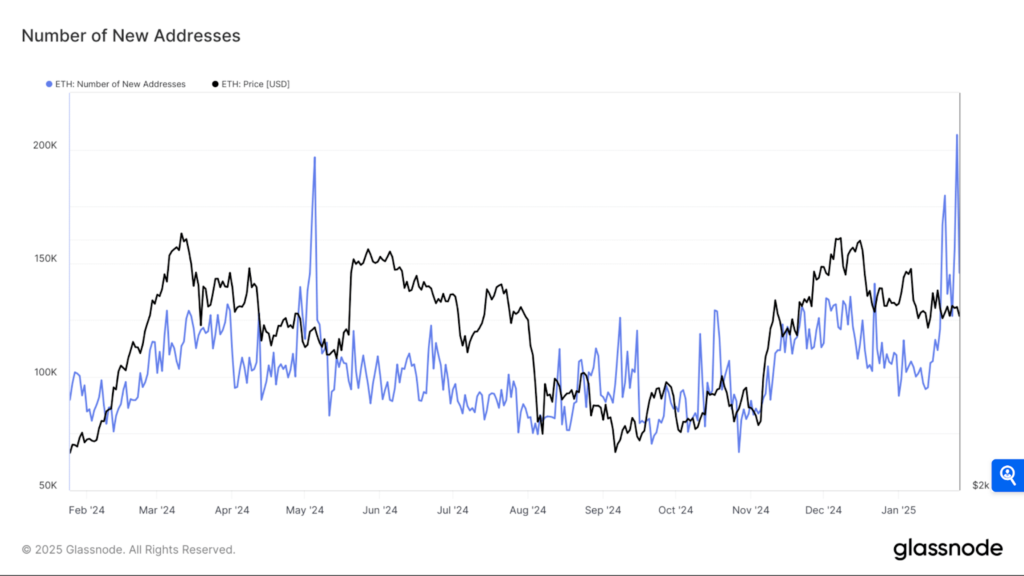

Glassnode data indicated a tremendous spike in new Ethereum addresses as they hit a 27-month peak. Between January 24th and 25th, approximately 200,000 addresses were added daily, a considerable increase from the average daily creation of 100,000-120,000 addresses recorded throughout 2024.

That said, the increase in new ETH addresses overlaps with increased market volatility, indicating that price action may attract new market users despite recent corrections.

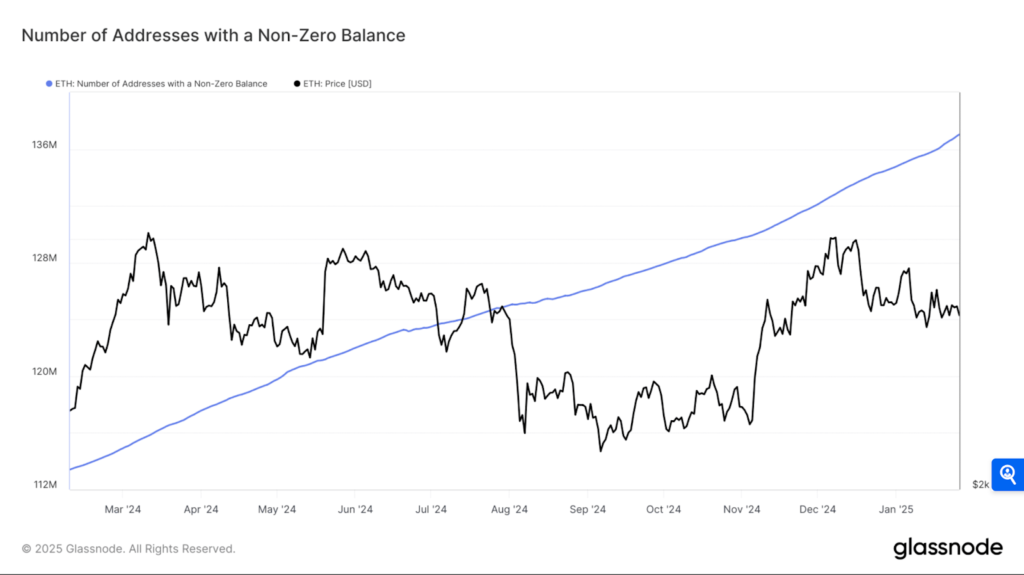

Likewise, non-zero ETH addresses reached 136 million on a continuous upward trajectory, indicating rising ecosystem adoption. This balance has shown incredible resilience, continuing to grow even during periods of price decrease.

The steady increase in non-zero ETH addresses contrasts with the more volatile price action, suggesting an increasing foundation of long-term holders and users actively engaging with the ETH ecosystem.

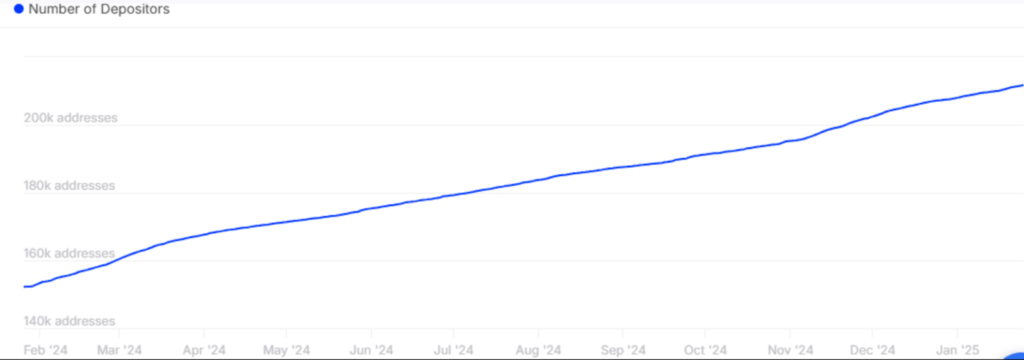

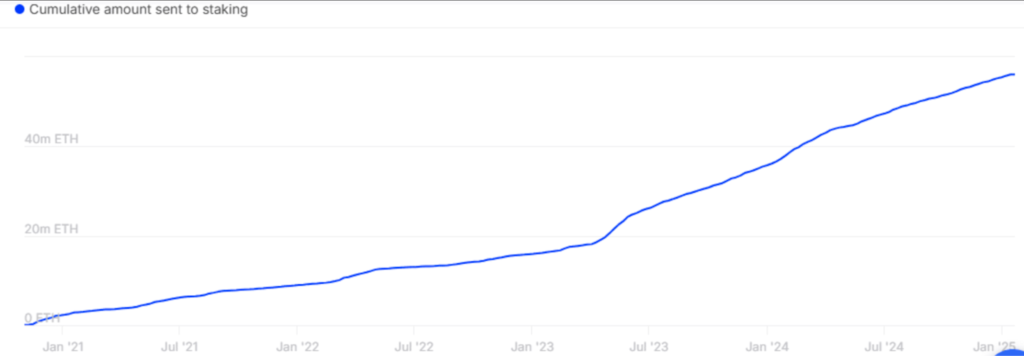

In addition, IntoTheBlock data divulged that the number of depositors into Ethereum staking contracts has been increasing.

The number of depositors into staking contracts recently peaked at 211,720 addresses on the 25th of January. About a year ago, roughly 152,230 addresses were deposited into smart contracts.

The number of ETH staked recently peaked at 56.38 million ETH recently, which marked a new ATH.

The observations above suggest that more ETH is being channelled into staking. This signals that investors are still confident about ETH’s long-term prospects, which contrasts with the recent short-term observations.

What does this mean for ETH?

For the Ethereum landscape, a surge in new addresses and consistent growth in non-zero balance holders presents an intriguing market dynamic. While ETH’s price action showed short-term weakness, the underlying network metrics indicated growing adoption and possible accumulation at the current levels.

Thus, the contrast between price action and network growth could suggest a probable variation that historically has preceded notable market movements. The sustained increase in network participation, mostly during price corrections, often indicates growing market maturity and possible institutional interest.

Even with Ethereum’s recent milestones, different analysts have varying views about the asset.

What do analysts think?

Michael van de Poppe said it is the “most hated rally”, inferring a surprising bullish run, one that market sentiment did not initially favor. Joao Wedson noted that altcoins have already dropped significantly, so it’s likely that many will recover and outperform Bitcoin.

This predicted rally could overlap with a growing interest in “real utility coins,” or cryptos that offer functional, real-world applications. As institutional interest in utility-focused tokens increases, their adoption could boost demand for Ethereum, given its prominent role in the blockchain ecosystem.

Closing Remark

With stablecoins hitting $200 billion, this underscores their increasing role as a liquidity source independent of central banks. Likewise, Bitcoin’s boosted acceptance among institutional investors indicates it is well-positioned for further development.

Ethereum ETFs’ surge in institutional interest indicates growing confidence in the token as a bedrock of DeFi development due to its features. For the Ethereum landscape, a surge in new addresses and consistent growth in non-zero balance holders presents an intriguing market dynamic.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

How did stablecoins surpass $200B in market supply?

In the last 90 days, Tether (USDT) has increased by $20 billion, and USD Coin (USDC) has spiked by $17 billion, leading to stablecoins exceeding $200 billion.

How high can stablecoins grow?

In future market cycles, stablecoins will increase fivefold and grow into a $1 trillion industry.

Who wins between BTC ETFs and ETH ETFs?

Bitcoin and Ethereum’s ability to scale will decide their forthcoming futures amidst evolving marketing conditions and international regulations.

What is the implication of BTC and the U.S. stock market familiarity?

The increase in the U.S. stock market correlation signals that institutional investors now view Bitcoin as a traditional asset.

What are the milestones that Ethereum recorded?

Ethereum added approximately 200,000 daily addresses, non-zero ETH addresses reached 136 million, and the number of depositors into staking contracts recently peaked at 211,720 addresses.

0 Comments