In another week filled with real-life events that impact cryptocurrency prices, there have been some surging and declines in different crypto values.

Solana has had a little bump on the road but still looks bullish; there are indications of why Ethereum can rise; Moo Deng is defying all odds in its steady ascent, and Grayscale has launched a Decentralized AI Fund for selected investors.

Let’s get to it.

Solana at $150, what happens next?

Some days after hitting $161, Solana (SOL) has returned to the $150 range. Its impressive rally weakened after the coin failed to break the $161 resistance level.

Nonetheless, Solana is trading at $156 per CoinMarketCap, showing a minute increase of 0.58% within 24 hours, an 8% increase in the last 7 days, and an even more impressive 30-day gain of 14%.

This price correction occurred against high activity and innovation on the blockchain network. So what are the activities?

What impacted SOL price?

First, a decline after a three-week surge led to intense activity in the Pump.fun account. Over the past five days, about 122,250 SOL (approximately $18.9 million) was liquidated.

While this reflects the hustle and bustle in the Solana ecosystem, it temporarily saturated the market and led to a price rebalancing. Ultimately,

this has caused a decrease in the price of SOL.

After almost a month of continuous rise, a consolidation phase was imminent. After making a profit, investors naturally held onto their positions, which also influenced the temporary price drop.

Activity in the network persists

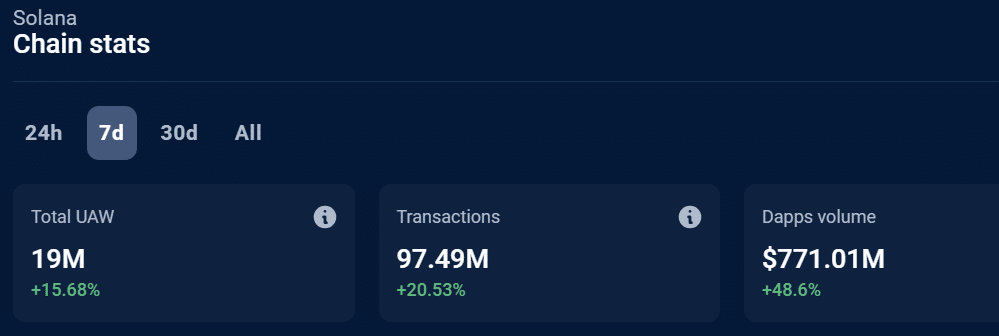

Despite Solana’s price drop, it continues to put up impressive numbers. Posting 3.04 million active addresses daily, the blockchain is one of the most active networks in the ecosystem.

In addition, the memecoin craze has further increased the number of users on the network. Pump.fun has immensely increased Solana’s meme coin trading capabilities. The account has generated 773,617 SOL (equivalent to $120.68) in revenue.

The launch of liquid staking SOL has also made more investors flock to the Solana blockchain. With an increase of 42.21% in trading volume, traders have had sustained interest and abundant liquidity from investors.’

Ryan Lee, chief analyst at Bitget Research, had some words,

“Based on the current market sentiment, the current Solana ecosystem’s development, and major partners’ involvement, SOL is expected to be more bullish than bearish in October. SOL may reach or exceed the price range of $160 or $180 in October.”

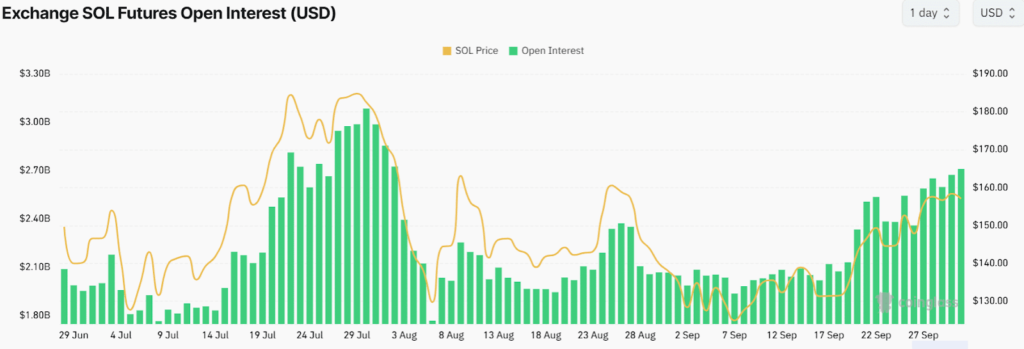

Solana’s Open Interest nears high

Traders are building up their positions on Solana as Open Interest increased to $2.71m per Coinglass. This means traders are opening margin positions on Solana while maintaining their current ones.

Positive metrics on Funding Rates show that these traders have probably opened long positions predicting further price surges. This indicates an overwhelming bullish sentiment around Solana.

Likewise, data from DappRadar has shown that the seven-day average for decentralized application (dApp) volumes on Solana has risen by 48% to $771 million. The dApp transactions have also increased by 20% to 97 million, while the Unique Active Wallets (UAWs) have increased by 15% to 19 million.

This is why Ethereum can rise

Ether (ETH) failed to break from the resistance at $2,968 for over six weeks. This has kept the largest altcoin in consolidation with no further price gain.

Yet, community players envision October to be the game changer for Ethereum. This could set the stage for a noteworthy rally toward $3,000.

Why?

Whales are making moves

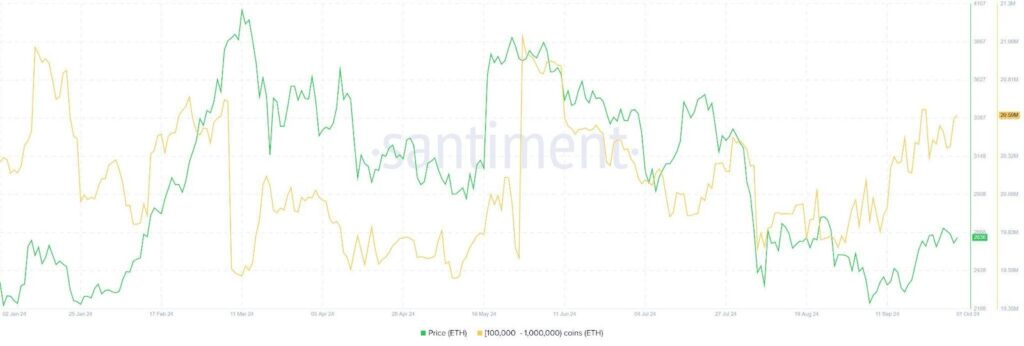

Currently, the sentiment around Ethereum is bullish, mostly among whales. In the previous month (September), addresses holding between 100,000 and 1 million ETH have amassed more than 600,000 ETH (approximately $1.57 billion).

These holdings – already at a three-month high – indicate high confidence in a possible price increase. That is, Ethereum can break out of its current consolidation. So, if this pattern holds, the investors’ influence would be a massive reason for this.

Funny enough, this has come against the backdrop of numerous ETH sell-offs.

Ethereum sell-offs reach $10m worth of ETH

The Ethereum Foundation has been on a selling spree throughout 2024. They liquidate ETH to fund the Ethereum ecosystem’s operations, research, and grants.

Since January, they have sold 3,766 ETH, valued at an estimated $10.46 million. They sold off 1,250 ETH in September alone, valued at $3.06 million. Those sell-offs have been consistent, as it was estimated that a sale happens every 11 days.

While this could fuel investor concern, it could also indicate strategic profit-taking.

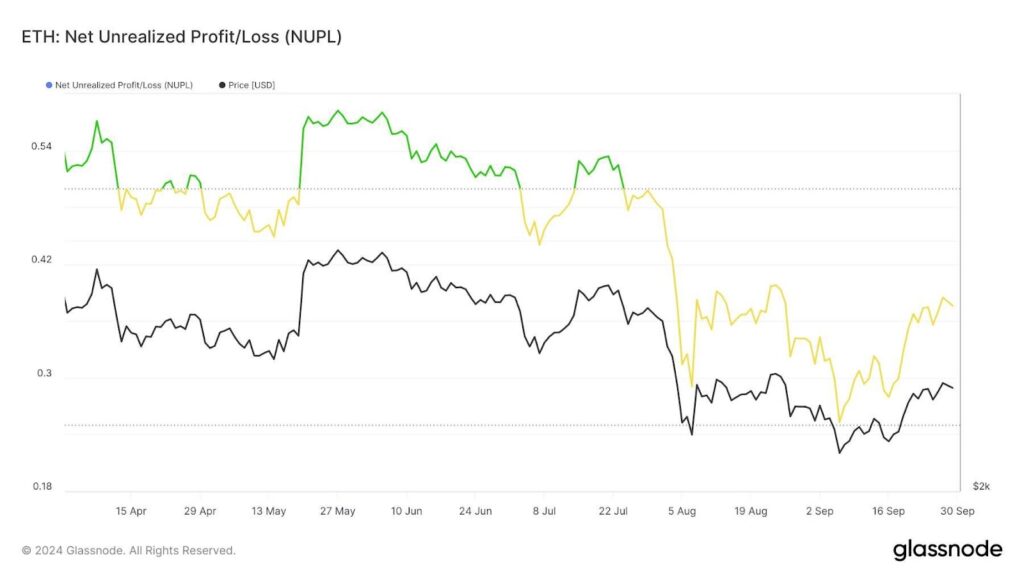

According to the Net Unrealized Profit/Loss (NUPL), ETH holders anticipate positive news. This perception ranges from capitulation (red), hope (orange), optimism (yellow), belief (green), and euphoria (blue).

By and large, Ethereum’s current range is a critical zone, as it has acted as both a support and resistance over the past weeks. Thus, breaking out of this range is essential for ETH to advance towards $3000.

On the positive side, the current market sentiment and macro momentum suggest that a breakout could be imminent.

Moo Deng keeps on rising

One of the most innovative qualities of the crypto ecosystem is how projects can come out of the blues and surge to the very top. That is the story of Moo Deng, the viral memecoin on Solana.

Since its launch on Pump.fun in September, the memecoin has grown from strength to strength. Like Dogecoin and Shiba Inu, Moo Deng has captured the attention of many, including investors. Beyond that, it is a community-driven and charitable investment.

Moo Deng defies all odds

In the aftermath of geopolitical tensions between Iran and Israel on October 1, Moo Deng’s price increased. This came as a surprise to many as there were considerable sell-offs in the market.

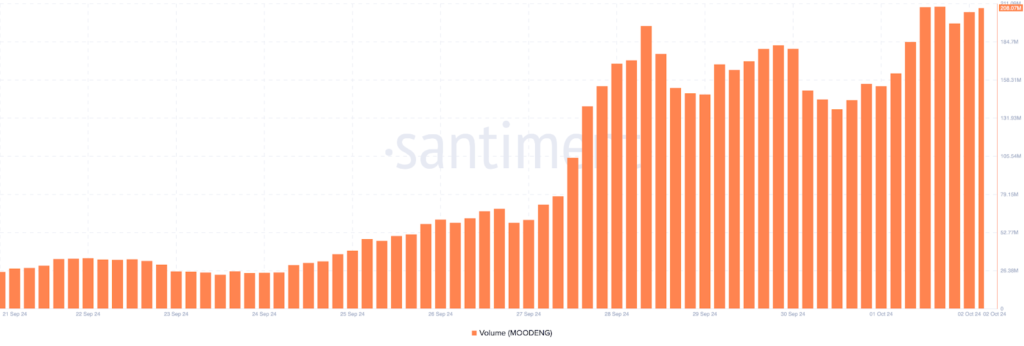

Indeed, liquidations exceeded $500 million as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) prices dropped, amongst others. However, Moo Deng surged by 30% and is currently $0.24, with a corresponding rise in its volume past $200 million.

An increase in the market cap and the price signifies that majority invested in the token. This indicates a possible bullish sentiment, and if the upward trend continues, it could lead to further momentum in Moo Deng’s volume.

Furthermore, Moo Deng’s social dominance is on the rise due to discussions surrounding it. Two different occurrences have shown the current pulling power the token has.

Moo Deng’s tale of two traders

In September, there were two occurrences involving Moo Deng with varying scenarios. One had a good ending, and the other not so.

The first was of an anonymous trader – whose Solana wallet address begins with “Db3P” – who bought 6 SOL worth of Moo Deng. At the time, it was worth just $800, as this was merely four hours after the token was launched.

After the price of Moo Deng surged, the trader’s holdings skyrocketed to around $7.5 million. At the time they transferred approximately 30.2 million Moo Deng tokens between that main wallet and three others.

There was no further news about what the trader did, whether they decided to HODL or swap the token. Rather, they were insider trading accusations levied on Twitter against them.

The other trader bought 26 SOL worth of Moo Deng tokens, which equaled 21 million tokens. At the time, the value was $3,537 and the meme coin’s market capitalization was $210,000.

When the token’s value and market cap declined for a while, the trader panicked and sold off their holdings for $2.19 SOL, at a worth of $297. Some days later, Moo Deng’s value skyrocketed and its market capitalization went up 5x.

Unfortunately for the trader, if they had held the token, its value would have been $6.3 million. So, they ended up with a paltry $297 instead of, well, so much more.

Now at $0.24, there is widespread anticipation that Moo Deng can get to $0.35 soon.

Grayscale opens its AI Fund to selected investors

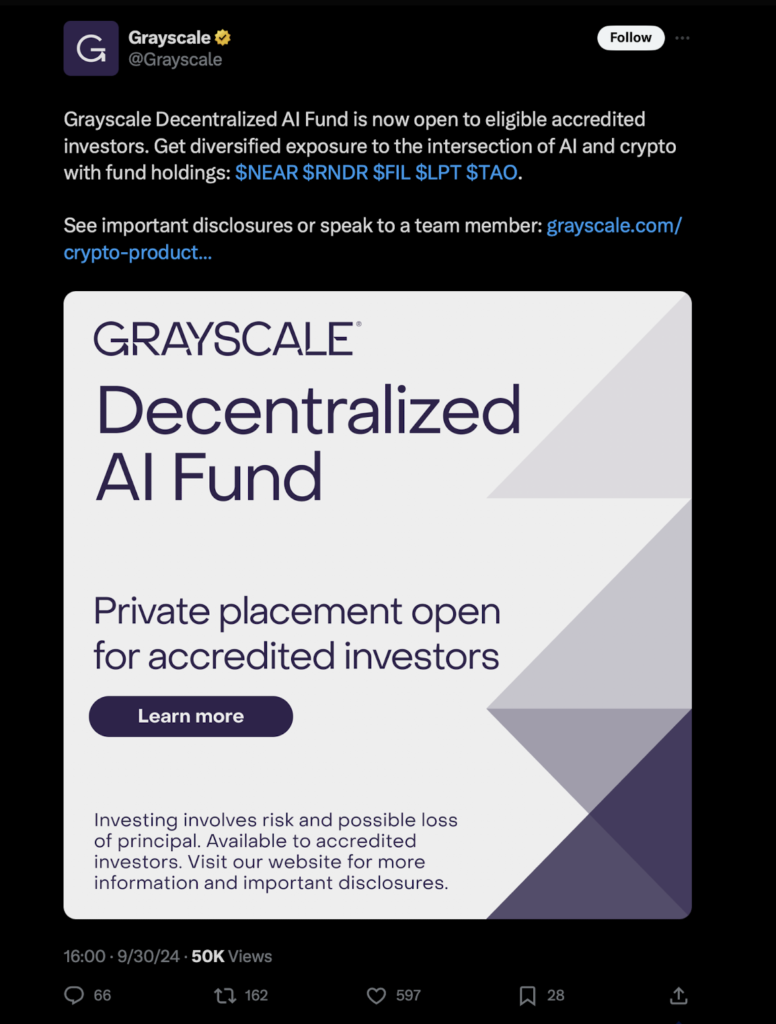

Crypto asset manager Grayscale has launched the Grayscale Decentralized AI Fund which offers exposure to decentralized AI and blockchain protocols to accredited investors.

The Decentralized AI Fund invests in and derives value from the price of native tokens of decentralized AI tokens. It provides access in the form of a security without the complexities of buying, storing and protecting digital currencies.

While it was previously only available through private placement, the fund now provides access to different tokens from prominent AI and blockchain projects. Now, the investors can hold shares akin to the value of the fund’s assets.

“Shares are intended to reflect the values of the Fund Components as determined by reference to their respective Digital Asset reference Rates and Weightings, less fees and expenses. The Fund Components consist of the digital assets selected using the Fund Methodology as implemented by the manager and the Fund is rebalanced from time to time,” the fund’s website says.

With more than 20 crypto-focused investment products, Grayscale aims to further provide exposure to promising protocols that are building solutions within the AI sector and will rebalance the fund on a quarterly basis to maintain its objectives.

The Fund focuses on three major areas: decentralized AI, solutions to AI-related challenges, and AI infrastructure. Thus, the holdings are distributed across five assets. They include:

- Near Protocol (NEAR) and Render (RNDR) — 30.5% and 25.6%, respectively. These protocols focus on infrastructure and resources vital to AI technology like 3D rendering and GPU computation.

- Filecoin (FIL) and Livepeer (LPT) — 25.5% and 8.2%, respectively. These protocols build solutions to centralized AI-related problems such as checks against bots and deep fakes.

- Bittensor (TAO) — 6.2%. This protocol builds decentralized AI services, such as chatbots and image generation services.

How is the Grayscale AI Fund Performing?

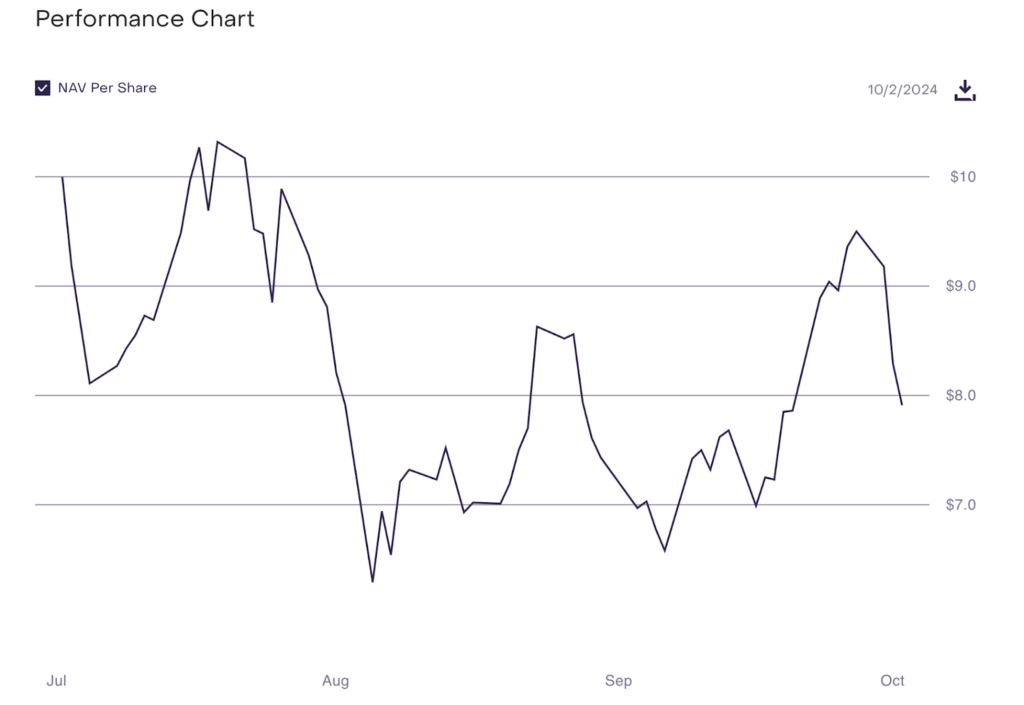

As of October 2, the Grayscale Decentralized AI Fund’s net asset value (NAV) per share was $7.91, reflecting a 4.6% decrease in one day. The fund manages $1,217,205 in assets (AUM).

Since the fund’s launch in July, its performance has steadily fluctuated. Between July and August, the NAV dropped by 20.9%; from August to September, it also reduced by 11.9%, while September to early October brought about a 13.5% increase so far.

While this indicates broad market volatility, the long-term objective of the Fund is primed to be a game changer.

Closing Remark

Even with investor uncertainty amid geopolitical tensions, Moo Deng has kept rising. This paints the larger picture of the crypto market this week.

Ethereum whales keep purchasing large amounts of ETH, even as the Ethereum Foundation continues its sell-offs, while Solana has an overwhelming bullish sentiment. The Grayscale AI Fund aims to support strategic AI and blockchain endeavors, and time will tell how that pans out.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

Our Zypto App has many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust payment gateway to give you a refreshing and safe experience.

You can also check our blog for more cryptocurrencies, NFTs, Web3, altcoins, and blockchain technology resources. Join Zypto, and let’s make your trading journey easy and smooth.

Zypto has partnered with MoneyGram to launch an upcoming historic USDC-to-Cash and Cash-to-USDC service. You can soon cash in or out of your Zypto app in USDC at participating MoneyGram locations globally. Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

How did Pump.fun impact Solana’s price?

The Solana meme coin protocol increased the number of meme coin traders on the network.

Can Solana reach $160?

An increase in trading volume and liquidity from investors indicates positive sentiments regarding Solana.

What can make Ether (ETH) rise?

There are indications that Ether’s (ETH) price can surge based on current market sentiments and macro momentum.

What is Moo Deng, and why does it keep rising?

Moo Deng is a Solana-based memecoin that offers a fun and community-driven investment for all.

What is the Grayscale Decentralized AI Fund?

Grayscale Decentralized AI Fund is a that provides placement to decentralized AI and blockchain protocols to accredited investors.

0 Comments