Meme coins are mainly behind the current positive developments in the crypto market. They are behind Solana recording $100 million in revenue and TON surpassing 1 billion transactions.

Let’s see what else is there.

Solana’s Pump.fun earns $100 million in revenue

Pump.fun, a Solana-based meme coin and trading platform, has recorded a historic $100 million cumulative revenue. It also has a daily income of $344K.

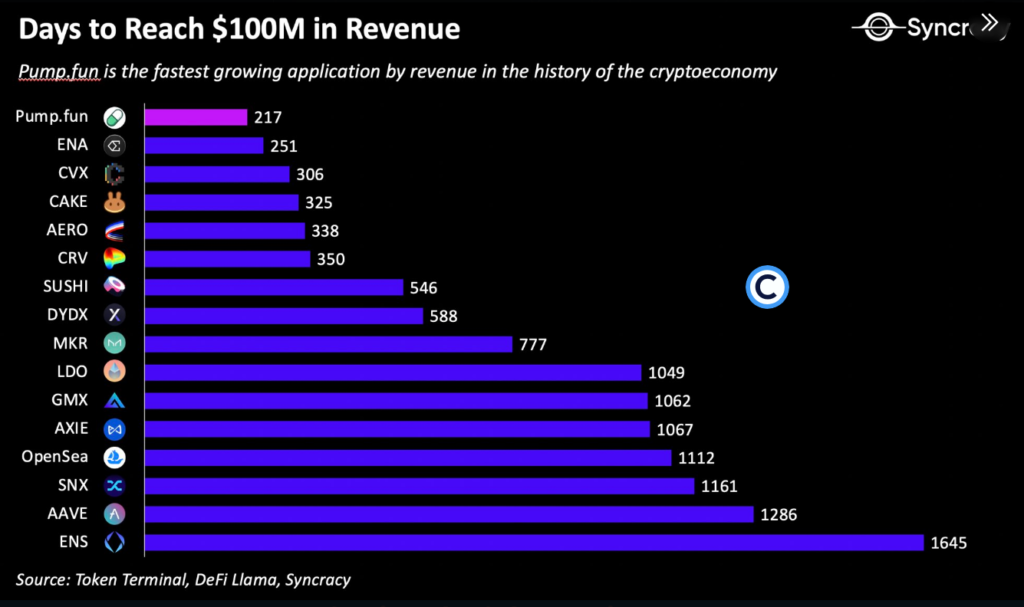

The meme coin factory surpassed the $100 million milestone in 217 days. Incredibly, it reached this number in just over seven months since its debut in January 2024.

That makes it the fastest meme coin to reach such numbers. Other similar fast-growing protocols, like CNA CVX, spent 251, 306, and 325 days to hit the $100 million mark.

Generally, DeFi protocols’ revenues comprise the total fees they charge their users minus the amount paid to their liquidity providers. According to Syncracy Capital’s co-founder Ryan Watkins, that is not the only metric for measuring that.

He noted that “active addresses interacting with Pump’s contracts” also matter.

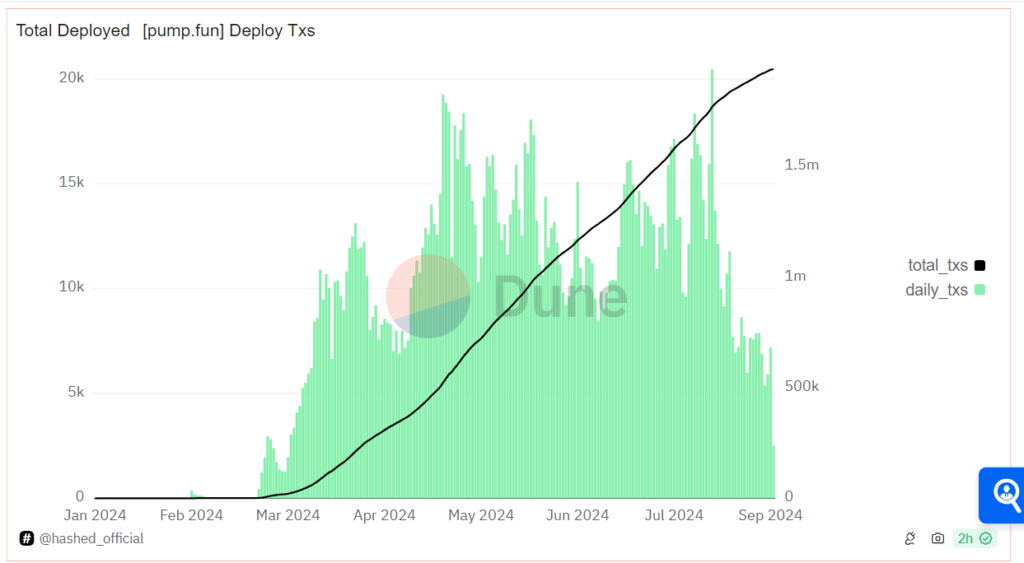

Degens have widely adopted pump.fun. The Solana-based protocol has launched over 1 million tokens since January, including over 500k tokens in one month. In early July, its daily revenue hit $1.99 million!

Watkins also said,

“Love it or hate it, Pump is a massive signal to builders to build on Solana and a trojan horse for consumer adoption of blockchains.”

Possible growing competition?

Typically, Pump.fun’s growth can be traced to the surge in meme coin activity within the crypto industry this year. As of this writing, the global market cap for meme coins is nearly $45 billion.

Pump.fun’s rise stems from its novel approach, enabling non-technical users to launch meme coins quickly, rapidly, and affordably. This has attracted many participants, enthusiasts, and influencers to join in.

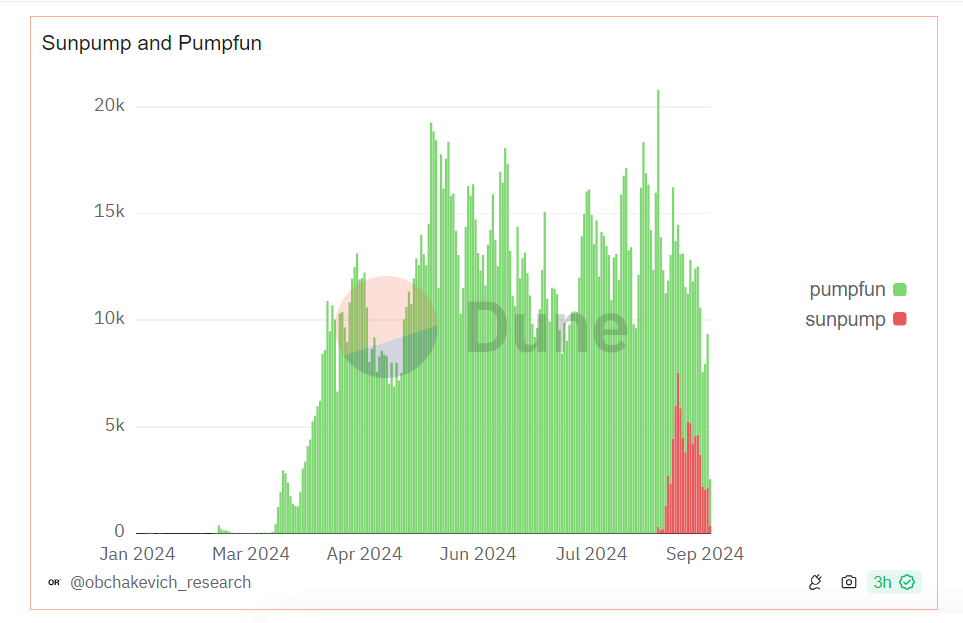

Yet, Pump.fun’s success has inspired some growing competition. Sunpump from the Tron blockchain has been making headlines due to founder Justin Sun’s marketing strategies.

Sunpump has been hot on the heels of Pump.fun. Within the past week, Sunpump was responsible for up to 40% of meme coin trading volumes on peak days. It also accounts for almost 50% of Pump’s revenue.fun’s token mints.

Pump.fun causes controversy in the crypto community

Pump.fun’s massive feat has sparked a debate within the crypto community. Some critics argue that many tokens are scams, while others are drawn to the platform’s seamless integration with other tools.

Last month, Pump.fun enabled free token launches and provided incentives for successful releases. However, it faced heavy backlash for its platform’s massive volume of tokens.

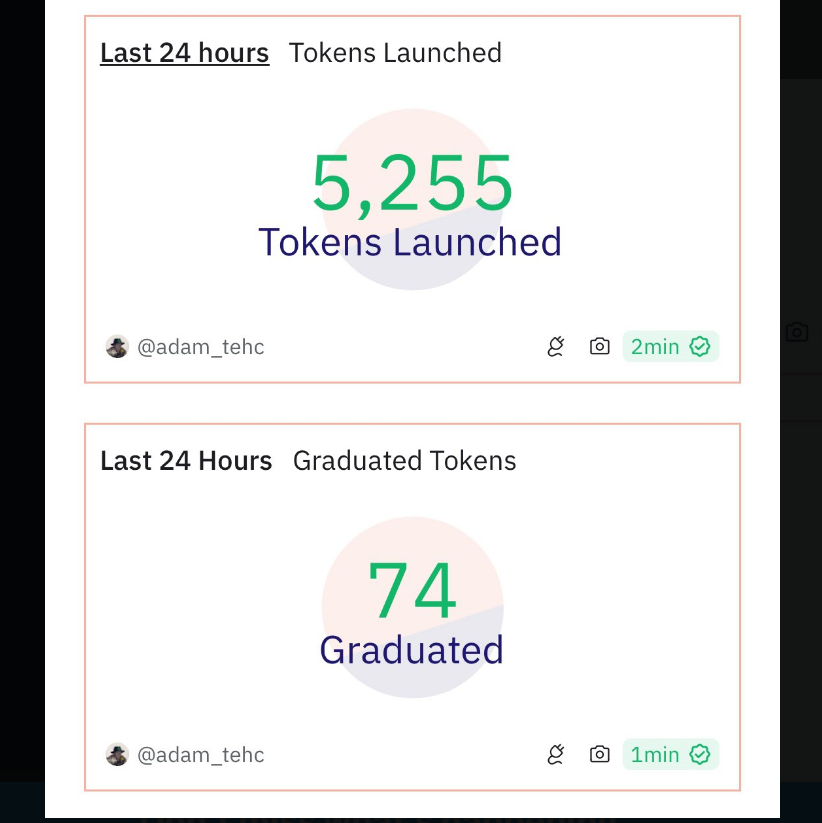

In the past 24 hours alone, it launched about 5,255 meme coins. However, only 74 tokens ‘graduated’ to raydium, and only one token reportedly surpassed $1 million in market cap.

Different people have voiced out their varying stances.

Rani, a crypto analyst, said,

“Pump.fun and the various derivatives obliterated any chance of bull run to maintain momentum in 2024. [They] sucked in all liquidity that should have gone to actual projects, 95% of users lost money to scams, and winners cashed out.”

Watkins said, “[Pump.fun] revenue growth was partially due to it appearing best to retail speculators, but also because it charges the highest fees of any DEX on chain.”

Andrei Grachev, managing partner at DWF Labs, had some advice. He outlined the need for Pump.fun and Sun.pump to focus on quality over quantity, which would encourage long-term adoption and commitment from the crypto community.

Solana tops blockchain activity in August

Solana (SOL) has been trending for a while now in the crypto community. More often than not, it has been because of the meme ecosystem. This time, it is due to a surge in the blockchain network’s activity.

Solana’s network stays busy

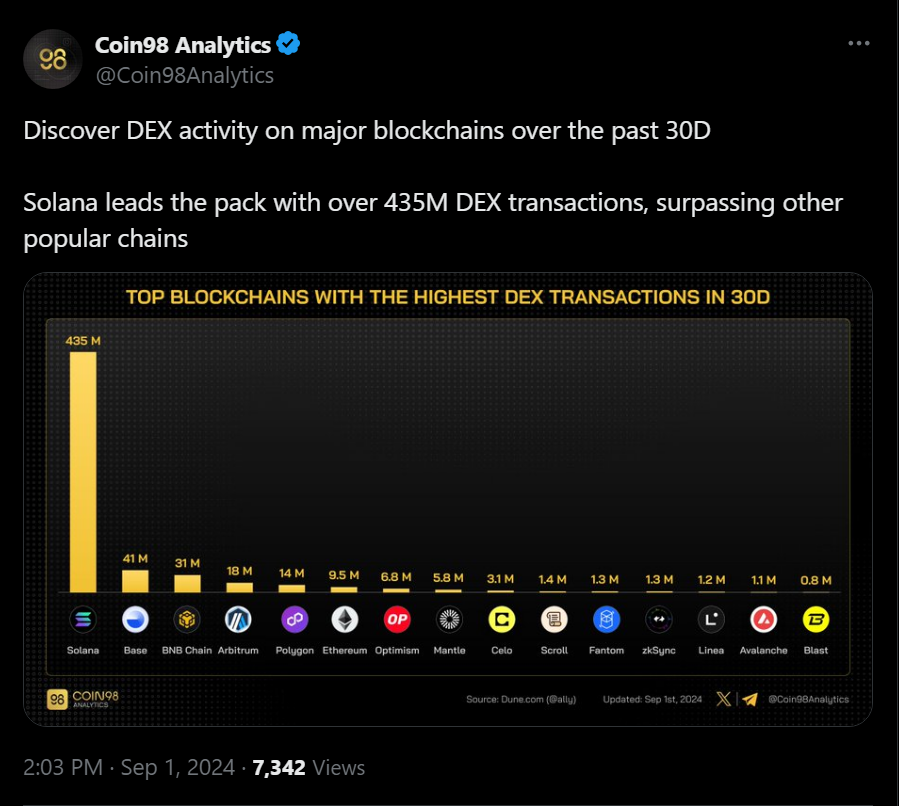

According to Coin98 Analytics, a data analytics platform, Solana topped the list of blockchains regarding DEX transactions in August. It led by a considerable margin, reaching 435 million. Behind Solana were Base and BNB Chain at 41 million and 31 million, respectively.

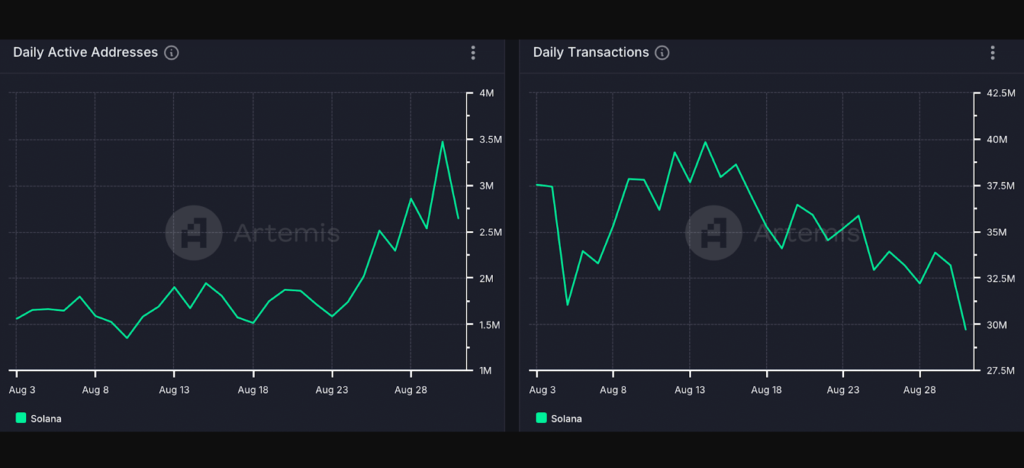

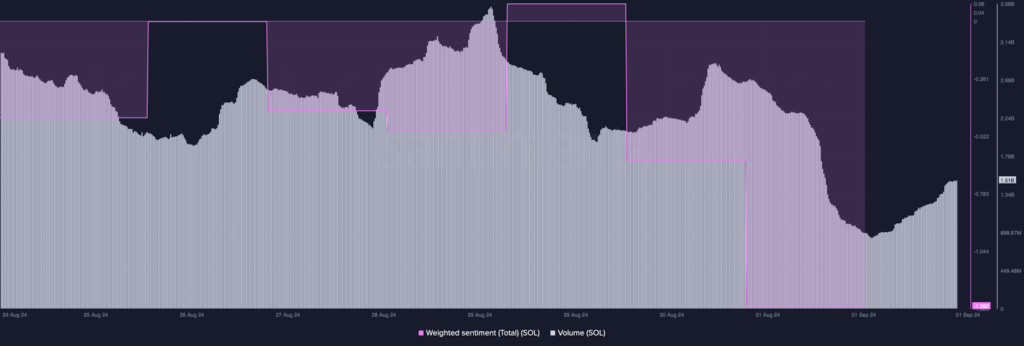

By analyzing data from Artemis, we can see that SOL’s daily active addresses reached 3.5 million by the end of August. Surprisingly, its daily transactions dropped within the same time frame.

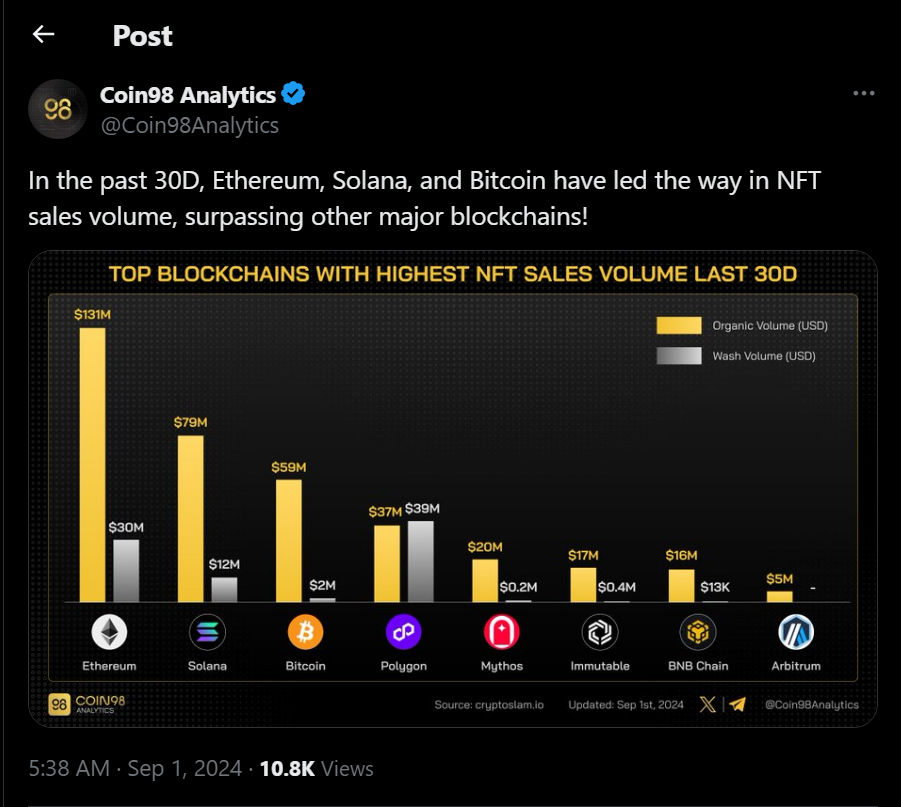

Also, Solana recorded a $79 million windfall from NFT sales in August. It recorded an impressive amount, only trailing Ethereum, which made $131 million. Others on the list include Bitcoin, Polygon, and Mythos.

According to data from Crypto Slam, the number of unique buyers and sellers on Solana dropped significantly by 34.39% and 24.96%, respectively. Likewise, total transactions on Solana fell by 48.48%, reaching just over 1.1 million.

Despite the downturn, the average sale price on Solana was relatively stable at $66.62, just a bit more than the overall market average.

So, what effect did all of these have on its price?

Solana’s price remains bearish

Despite the substantial gains and activities in the Solana network, SOL’s price still turned bearish.

Per CoinMarketCap, SOL’s price reduced by almost 20% in the last seven days. Likewise, in the past 24 hours, the token dropped by 2% also. It trades at $130.54 with a market capitalization of $60.9 billion at the time of this writing.

What could have led to this?

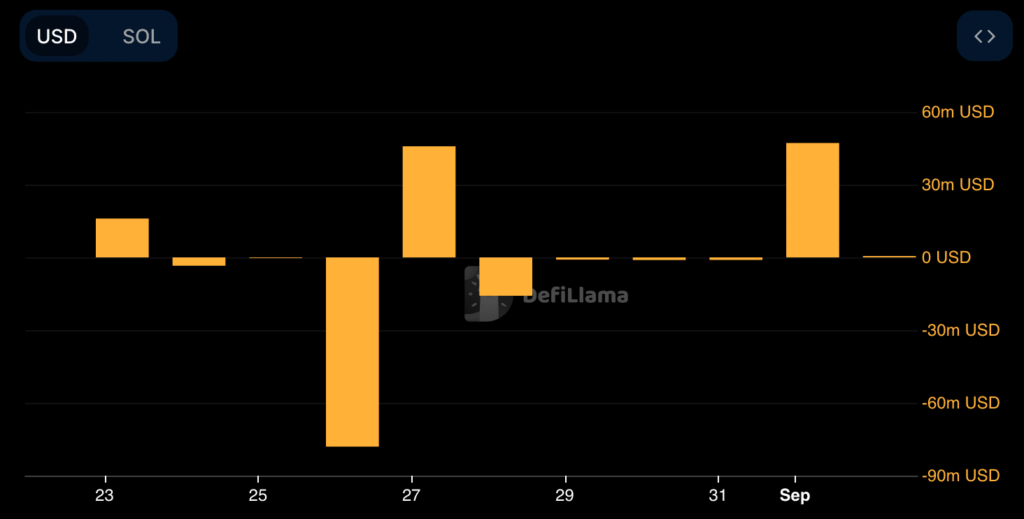

This could have come about due to an increase in selling pressure. Based on data from DeFiLlama, SOL’s inflows increased and reached $4.7 million on September 1.

Additionally, data from Coinglass showed that SOL’s Long/Short Ratio declined. This denoted more short positions in the market, which is a bearish sign. Similarly, Solana’s weighted sentiment reduced, which is also a bearish sign.

Yet, its trading volume reduced, highlighting chances of a possible trend reversal.

TON blockchain surpasses 1 billion transactions

The Open Network (TON) blockchain has surpassed more than 1 billion transactions in recent times, according to a TON scan. Also, the Telegram-affiliated network has successfully integrated USDT on over 100 platforms.

TON currently supports about 280,000 active users daily and processes around 800,000 transactions daily. It was reported that half of its transactions have occurred within the past three months.

Unsurprisingly, this historic milestone has been brought about due to the frenzy caused by the recent $DOGS meme coin airdrop event.

Furthermore, TON Core and Tonkeeper introduced the W5 smart wallet standard, which allows fee transactions in USDT. Pantera Capital invested in TON in May, leveraging Telegram’s user base to adopt more significant amounts of cryptocurrency.

Not content to stop anytime soon TON has another trick rolled up its sleeves.

TON Accelerator debuts new program

TON Accelerator has debuted a new incubation program called “TON: Acc.” It is for crypto startups with potential built on The Open Network (TON) blockchain.

The incubation program is primed to provide financial support and practical guidance to five promising crypto projects in the TON ecosystem. This should empower them to navigate the crypto market effectively.

According to Sophia Rusconi, Head of TON Accelerator,

“TON: Acc will help projects find a clear route to market, providing them with the funding, expertise, and support they need to become the next billion-dollar project on TON.”

This update is a welcome development as the TON has enjoyed unprecedented growth in 2024. Its total value locked (TVL) surged from $13.5 million in January to more than $350 million in September as its active addresses increased.

Nonetheless, its highs didn’t come without some lows.

It suffered two outages for 12 hours in August due to a massive spike in transaction volume during the launch of $DOGS. For context, between August 27 and 29, $DOGS transactions accounted for more than 30% of the 20 million transactions processed.

Also, Telegram’s founder, Pavel Durov, got arrested on numerous claims. However, the 39-year-old tech entrepreneur avoided jail time.

Is $MPEPE the next 100x token?

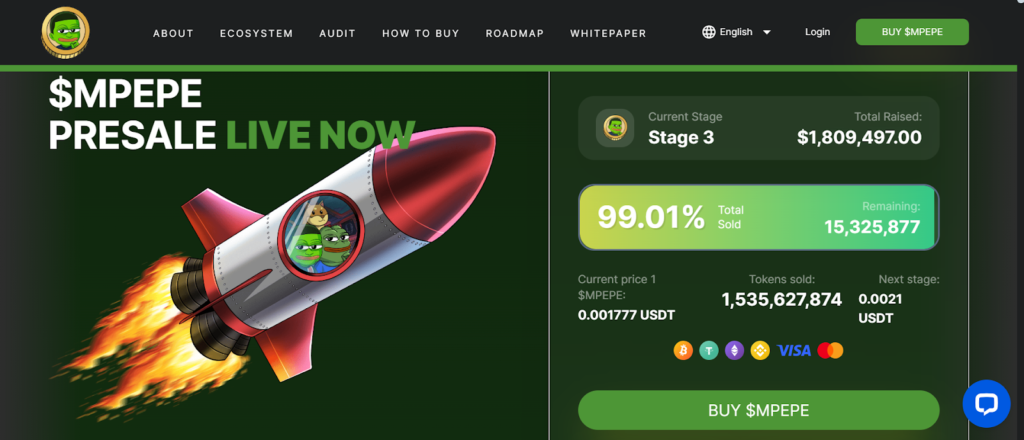

$MPEPE, the promising meme coin at the intersection of sports and blockchain, has been grabbing the attention of investors in the market. To some, it represents a potential opportunity amid its growing momentum.

At stage 3 of its presale, $MPEPE has sold over 1.5 billion tokens, 97.91% of its total supply. The price of 1 $MPEPE is set at 0.001777 USDT at the time of this writing.

Built on Arbitrum, Moon Pepe’s adoption of multiple DeFi mechanisms and gambling utility provides investors with different earning and engagement avenues. With its innovative approach, extensive features and robust community, $MPEPE has positioned itself as the next big thing in the crypto market.

Furthermore, there have been rumours that XRP and Tron whales are migrating to $MPEPE due to a potential 100x ROI (return on investment). The palpable excitement is probably due to the near completion of its stage 3 presale and imminent launch.

Yet, how far can $MPEPE really go? Time will tell.

Closing Remark

This week, meme coins were the biggest winners. These tokens have blazed the trail from Pump.fun to Sunpump, $DOGS and $MPEPE. Their gains have also had profound effects on their blockchains.

Solana’s network recorded a lot of activities, from DEX transactions to NFT sales. Yet, its price didn’t have a resultant surge. Still, with a reduction in its trading volume, we might witness a trend reversal.

The Open Network (TON) blockchain celebrated another milestone, surpassing over 1 billion transactions. This is further proof of the network’s fast-growing user base. And by launching its incubator program, TON signals an unwavering faith in the crypto community.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

The Zypto App has many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust payment gateway to give you a refreshing and safe experience.

You can also check our blog for more cryptocurrencies, NFTs, Web3, altcoins, and blockchain technology resources. Join the #ZyptoCrew, and let’s make your crypto journey easy and smooth.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

How did Pump.fun earn $100 million in revenue?

Typically, DeFi protocols’ revenues comprise the total fees they charge their users in addition to active addresses interacting with the protocol’s contracts.

Is Sunpump a rival of Pump.fun?

While Sunpump and Pump.fun are built on different blockchains, both are prominent meme coin launchpads.

Why did Solana have the highest DEX transactions?

This could be due to reasons such as an increase in daily active addresses or a high NFT sale.

How did TON record more than 1 billion cumulative transactions?

TON has many daily active users, integrated USDT on multiple platforms, launched the popular $DOGS token and debuted a new incubation program for crypto startups.

Will MPEPE be a 100x token?

$MPEPE is currently at stage 3 of its presale phase, so it is hard to say. However, it is a promising token.

0 Comments