This week, the cryptocurrency landscape witnessed a mix of breakthroughs and setbacks. A $235 million hack of an Indian crypto exchange dealt a severe blow, highlighting ongoing security vulnerabilities. Meanwhile, Bitcoin’s price hit a critical bull market trendline, reminiscent of past surges that led to significant gains.

Saudi Arabia’s Riyadh emerged as a potential crypto hub, quietly building a robust infrastructure to support digital currencies. In Asia, Bitcoin Layer 2 solutions offer miners new income opportunities through staking. Amidst these developments, BlackRock’s announcement of a competitive fee for its upcoming spot Ether ETF amid a rush of S-1 filings signals a growing interest in cryptocurrency ETFs.

WazirX’s native token, WRX, drops 15% following a $235M hack, primarily involving PEPE, GALA and USDT

India’s leading cryptocurrency assets exchange, WazirX, suffered a malicious attack, resulting in a loss of about $234 million worth of digital assets. WazirX released an incident overview through a tweet that reads:

“A cyber attack occurred in one of our multisig wallets involving a loss of funds exceeding $230 million. This wallet was operated utilizing the services of Liminal’s digital asset custody and wallet infrastructure from February 2023.”

Details and impact of the cyber attack

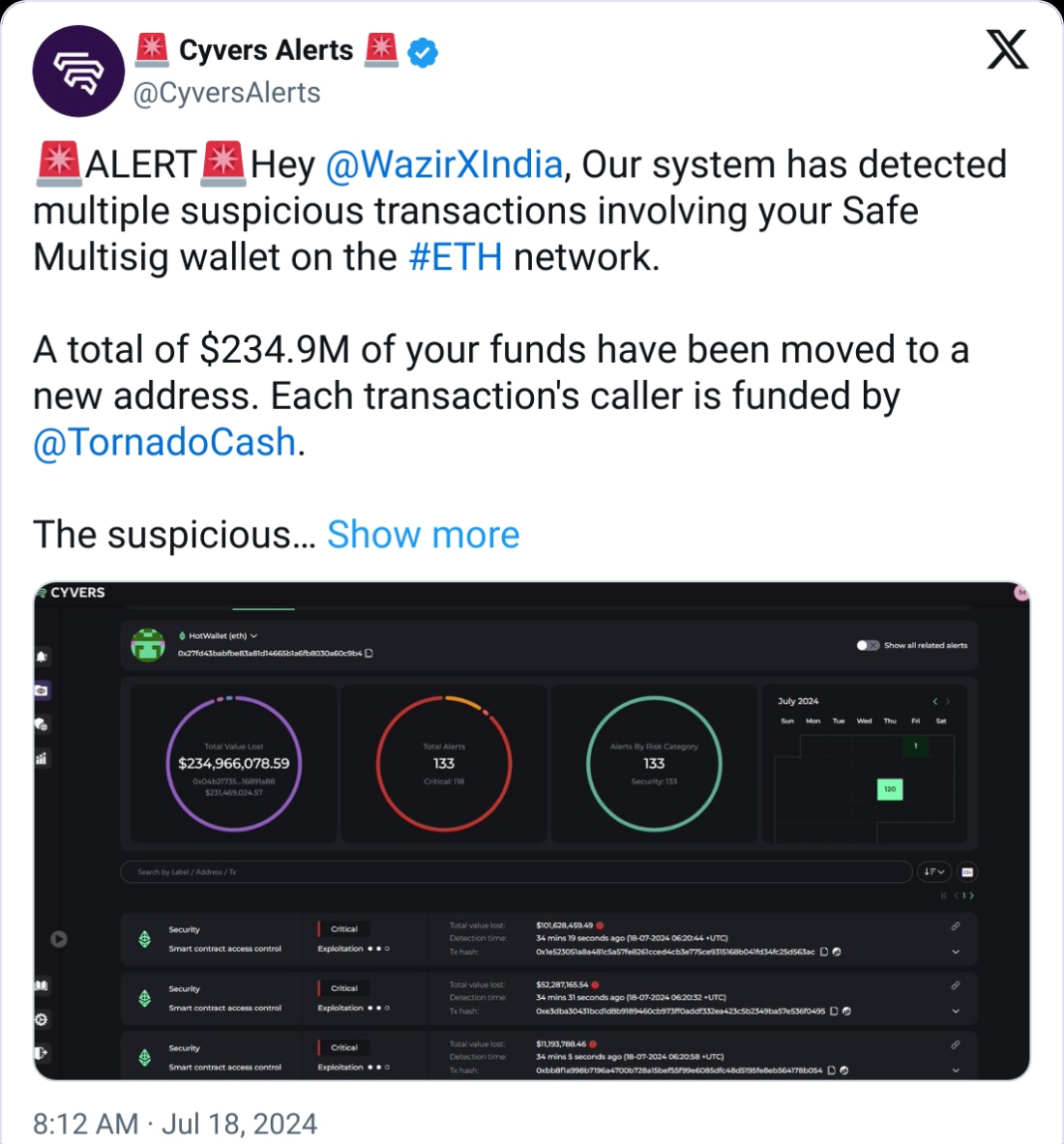

Cyvers, a blockchain security firm, revealed through a tweet that $234.9M of funds were moved from WasirX’s wallet to a new address, and the caller of each transaction is funded by the crypto mixer Tornado Cash.

Cyvers further stated that at the time of their announcement, the attackers had swapped the stolen USDT, PEPE, and GALA to ETH and continued to execute other swap transactions, including Polygon, Uniswap, Shiba Inu, Floki Inu,1Inch, and the FTX Token.

Data shared in the Telegram Channel Investigations by ZachXBT revealed that the largest tokens in the stolen stash include $87.5 million worth of SHIB, $4.6 million worth of MATIC, and $93.5 million worth of ETH.

Consequences for wazirx and its token

The security breach impacted the price of WazirX’s native token, WRX. CoinMarketCap shows that the token lost roughly 15% of its value when news of the attack emerged. WRX has fallen further from $0.168 to $0.1396 at the time of writing, which caps the devaluation at 17% within the past 24 hours.

Following the malicious attack, WazirX temporarily paused INR and crypto withdrawals on the platform.

Bitcoin reaches a significant bull market trendline, historically leading to a 30% price gain

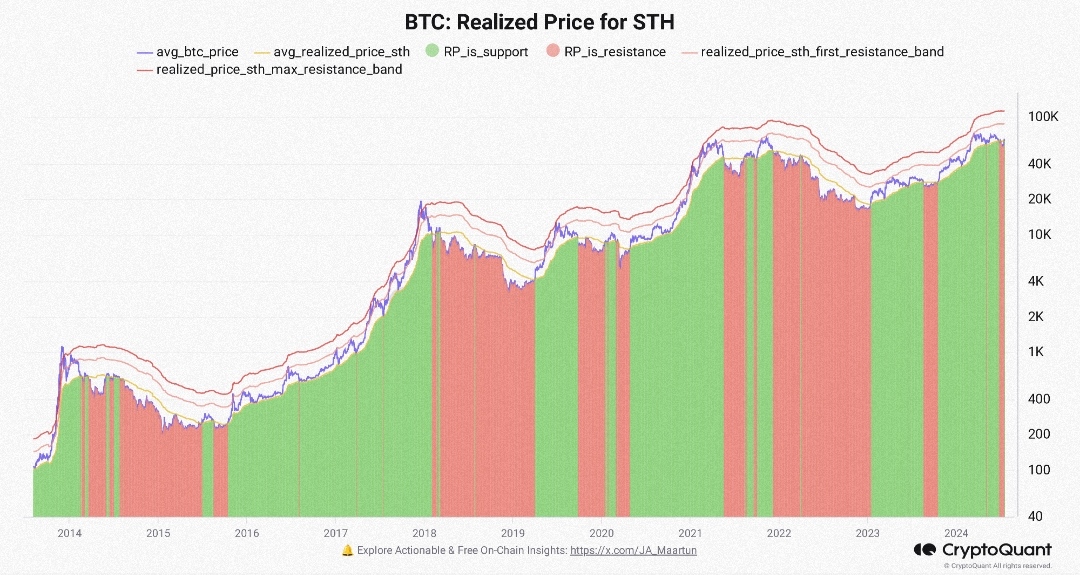

Bitcoin, the largest cryptocurrency in the world, is on the verge of a massive breakout as it nears a crucial bull market trendline that broke in June last year. According to CryptoQuant, the latest swing in Bitcoin price is again attempting to retest Short-Term Holder (holding Bitcoin for less than 155 days). This step is important for a significant upside in BTC’s price.

Historical significance of STH realized price

In the past, the STH realized price has served as a reliable support level to aid the prediction of possible bounce price levels during a bull market.

Potential for a significant price rally

Bitcoin has reclaimed the STH realized price twice since early 2023, each time followed by at least 30% gains. This suggests that as the asset has reclaimed the STH realized price again, a substantial rally to the upside might be on the horizon.

Saudi Arabia’s Riyadh emerges as a potential crypto powerhouse with robust infrastructure and favorable regulatory conditions

Saudi Arabia’s capital, Riyadh, has set plans to become a major disruptor in the crypto ecosystem by 2030. Saudi Arabia’s young, digitally-savvy population, high internet penetration, and robust infrastructure highlight a great potential for a thriving crypto ecosystem.

The 2030 vision aims to reduce Saudi Arabia’s dependence on oil and diversify the economy. Beyond the economic ambition, this vision represents Saudi Arabia’s bold leap into a digital future, which has drawn the partnership of leading crypto platform Binance into playing this pivotal role in this crypto revolution.

Binance’s role in Saudi’s crypto digital transformation

Binance stated that Saudi Arabia’s rapid growth in crypto transactions was the highest in 2023, highlighting its dynamic market and making it a priority for them. So, through their academy, Binance has committed to empowering Saudi citizens with the knowledge to navigate the crypto landscape and shape their digital future.

Saudi Arabia’s Investment in gaming and Web3 potential

Saudi Arabia has invested heavily in gaming, with initiatives like the National Gaming and Esports Strategy, the Saudi Esports Federation, and the launch of Savvy Games Group, positioning it uniquely in the competitive industry.

The upcoming Esports World Cup also highlights Saudi Arabia’s commitment to developing a robust gaming industry. This aligns with Web3’s potential for in-game ownership and innovative gameplay experiences. The success of the Esports World Cup could help position Saudi Arabia in the rapidly growing Web3 gaming sector.

Bitcoin L2 Solutions Aid Asian Miners

The recent crypto halving event reduced the reward for mining activities, leaving Asian miners looking for new avenues to sustain their revenue. Here, bitcoin L2s stride in, offering fresh income streams and keeping the miners’ spirits high.

New revenue streams through bitcoin L2s

Bitcoin L2s remain crucial to the Asian crypto ecosystem, offering miners new revenue streams after the most recent halving. These secondary protocols built on the main Bitcoin blockchain provide a lifeline and fresh income streams for Asian crypto miners, challenged by the reduced rewards caused by Bitcoin’s halving to diversify and secure new revenue streams.

Transforming bitcoin transactions

It’s clear that Bitcoin L2s are not just interim fixes but are paving the way for the future of cryptocurrency transactions. With the potential to transform the utility and efficiency of Bitcoin transactions, their role in shaping the next phase of digital currency is undeniable.

The miners’ adaptation to these new technologies will undoubtedly play a significant role in the sustainability and continued growth of the crypto economy, especially in regions heavily reliant on mining activities.

Expert insight on the necessity of bitcoin L2s

Robbie Liu, head of Asia at blockchain protocol Polyhedra Network, told Cointelegraph:

“Bitcoin L2s are not just an innovation; they’re a necessity for the evolving crypto ecosystem in Asia. With the recent halving, miners are looking for ways to maintain profitability, and L2 solutions offer just that.”

BlackRock Sets Spot Ether ETF At 0.25% Amid S-1 Filings

Asset management firm, BlackRock has announced its fee for its spot Ethereum exchange-traded fund at 0.25% ahead of a potential launch on the 23rd of July 2024. This move comes as the cryptocurrency market eagerly anticipates the introduction of more regulated investment vehicles for digital assets.

Details of BlackRock’s fee structure

BlackRock’s S-1 registration statement, filed on July 17, details that its fee will be accrued daily at an annualized rate equal to 0.25% of the fund’s net asset value and payable at least every quarter in US dollars, in-kind, or a combination of both.

It said it could “waive all or a portion” of the fee for certain periods and added that it plans to do this upon launch.

Initial trading fee and comparison with other ETFs

Similar to iShares Bitcoin Trust’s launch, BlackRock’s spot Ether ETF will start trading at a reduced fee of 0.12% until 12 months pass or after it amasses $2.5 billion in net assets, whichever comes first.

Other asset managers also disclosed their waiver periods and new proposed fees amid a surge of amended S-1 registration forms. Franklin Templeton’s spot Ether ETF will charge the lowest fee at 0.19%, while VanEck and Bitwise have set their fees at 0.20%. The 21Shares Core Ethereum ETF charges 0.21%, and Fidelity and Invesco Galaxy benchmarked theirs at 0.25%, like BlackRock.

Closing Remark

The cryptocurrency industry is a moving train, with meteoric changes occurring at the speed of light, from over $230 million worth of security breaches to rapid innovations and changes across the board.

As the crypto space evolves, one thing is certain: long-term players, developers, investors, exchanges, and stakeholders must invest in advanced security measures to mitigate digital asset theft.

Saudi Arabia’s Riyadh plans to become a significant disruptor in the crypto ecosystem by 2030 is a welcomed development. Saudi’s plan will catalyze cryptocurrency adoption in Asia and play a pivotal role in the emerging crypto revolution. Their young, digitally savvy population, high internet penetration, and robust infrastructure, combined with Binance’s educational partnership, are formidable combinations to catalyze the revolution within the next few years.

Did any particular development stand out to you? Leave a comment below and let us know your perspective!

Ditch banking bottlenecks and soaring fees. Unleash the power of borderless blockchain payments with Zypto. Easily accept crypto from customers worldwide, convert to local currency instantly, and spend using virtual and physical crypto cards – no more outdated cross-border hassles.

FAQs

Is cryptocurrency legal in Saudi Arabia?

Cryptocurrency is not fully legal in Saudi Arabia. The Saudi Arabian Monetary Authority (SAMA) and the Capital Market Authority have issued warnings about the risks of cryptocurrencies and have banned banks and financial institutions from dealing with them.

However, there is no explicit law prohibiting individuals from holding or trading cryptocurrencies, although the regulatory environment is restrictive and cautious.

Is WazirX hacked?

As of the latest information, WazirX has not reported any major hacks. However, like many exchanges, it has faced security challenges and has taken measures to improve its security protocols.

Users should always ensure their accounts are secure and follow best practices for protecting their assets.

Is WazirX going to close?

There is no official indication that WazirX is going to close. However, the exchange has faced regulatory scrutiny and operational challenges, including disputes over ownership and compliance issues in India. These factors have led to concerns about its future, but the platform continues to operate as of now.

0 Comments