This week in the cryptosphere saw plenty of positive developments, inlcuing global crypto adotion projections and preditions for a possible $150k Bitcoin in this cycle. Netflix also released their investigation into the identity of Satoshi Nakamoto, however did they hit or did they miss? Let’s take a closer look into it all in this in this week’s crypto news roundup.

Global Crypto Adoption Projected to Reach 8% By 2025

Cryptocurrency adoption is on the brink of a significant milestone. According to a new report from MatrixPort, 8% of the global population will be using digital currencies by 2025. This indicates a 0.49% increase in the world’s population engaged with cryptocurrencies. Based on the report, the rise in adoption rates will result from institutional interest and economic uncertainty.

Institutional Influence: A Key Driver

The gradual establishment of clear regulatory frameworks, such as the SEC’s approval of Bitcoin and Ethereum ETFs, has attracted institutional investments. The involvement of institutional investors has attracted billions of dollars, which has been pivotal in the rising adoption of cryptocurrencies.

A significant reference is BlackRock, a company heavily invested in Bitcoin ETFs. Their investments foster trust and legitimacy within traditional financial systems. As more institutional investors get involved, the liquidity in the market is expected to increase. This makes digital assets more attractive for long-term investment, hence greater adoption.

Bitcoin: The Flagbearer of Crypto Growth

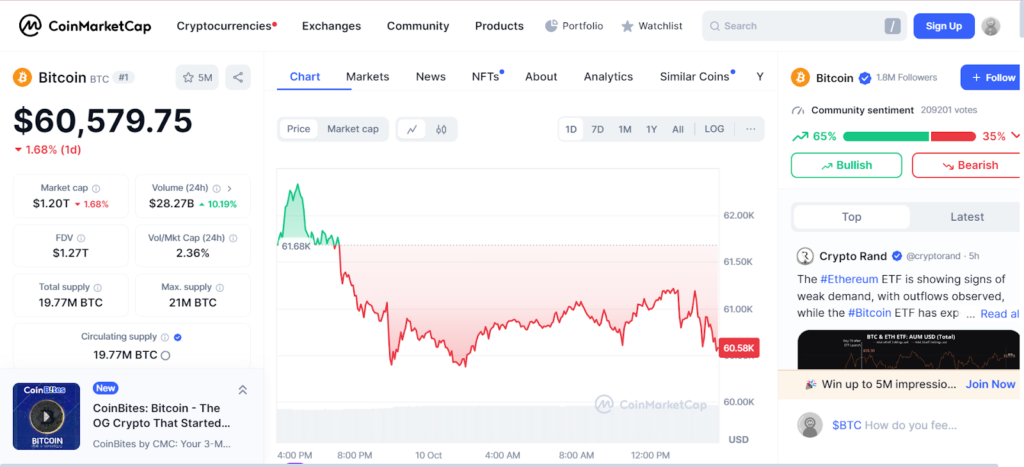

Bitcoin remains at the forefront of the cryptocurrency movement. The currency was hovering around $40,000 at the beginning of the year, but it has since experienced a 55% growth, reaching approximately $62,000 by early October.

This year’s rise in Bitcoin’s value reflects its growth within the financial ecosystem. This robust performance has boosted Bitcoin’s status as a hedge against inflation, solidifying its “digital gold” reputation. With investors finding BTC as a safe haven, adoption will increase.

Regulatory Challenges and Debates

Despite several indicators suggesting an 8% adoption rate in 2025, achieving this figure is not without hurdles. The crypto market is heavily regulated or banned in certain regions. In the U.S., the SEC is actively contesting the digital asset industry.

2024 has seen the continuation of legal battles, such as the ongoing dispute between the SEC and Ripple Labs. This highlights the regulatory uncertainties that still loom over the crypto space. Additionally, plans for crypto-related bills in Congress can slow the adoption rate.

The Road Ahead: Opportunities and Risks

An increase in the adoption rate shows that the industry is on the right path. There would be room for opportunities. However, we can’t overlook the risks, such as hacks. The public eye is on cryptocurrency, and crypto adoption will happen globally, especially in the United States.

Who is Peter Todd? HBO’s Documentary Supposedly Reveals Satoshi’s Identity

Popular movie streaming service Home Box Office (HBO) has premiered its long-awaited documentary that promised to solve crypto’s biggest mystery: The identity of Satoshi Nakamoto, Bitcoin’s pseudonymous creator.

For weeks, the HBO documentary titled “Money Electric: The Bitcoin Mystery” sent the crypto ecosystem into a frenzy, as there were many speculations. On October 8, they decided to put the speculations to an end by releasing the documentary.

According to HBO, Bitcoin core developer and cryptographer Peter Todd is Satoshi Nakamoto. However, there are inconsistencies and chronological discrepancies with their theory.

Did HBO Mistake Todd’s Sarcasm for Truth in Their Bitcoin Documentary?

HBO’s documentary claims that Todd used a pseudonym to boost Bitcoin’s credibility. However, the timeline of BTC’s launch and the events of Todd’s life does not connect. According to historical records, Bitcoin was launched in 2008, and around this time, Todd was pursuing a degree in fine arts. This was a time in which his interaction with cryptography was minimal.

According to Todd, he got involved with Bitcoin in 2014, five years after the token went live. This discrepancy between the timelines raises doubts about the documentary’s angle. However, the documentary highlights a moment where Todd claims to be Satoshi Nakamoto. The mannerism suggests that he was sarcastic, but HBO held on to it.

Considering these elements, the documentary crafts a narrative that exceeds the evidence. This has left several crypto users questioning the line between storytelling and factual reporting.

Todd’s Critique of HBO’s Bitcoin Documentary

Throughout HBO’s documentary, Todd criticizes the filmmakers’ approach. He labels their theories as “ludicrous” and dismisses them with sarcasm. “Of course, I’m Satoshi, and I’m Craig Wright,” Todd said, discrediting them for sensationalizing the story.

Todd anticipates that the documentary will be entertaining. In his words, “It’s going to be yet another example of journalists missing the point in a way that’s very funny.” He further argues that the distractions it creates could inadvertently keep the Bitcoin conversation going.

Previous Theories About Satoshi Nakamoto’s Identity

Several computing experts have been rumored to be the creators of cryptocurrency. Notable names include Dorian Nakamoto and Craig Wright. In 2015, Wright declared that he was indeed Satoshi, but a UK High Court judge disregarded his claims. For key Bitcoin figures, keeping Satoshi’s anonymity enhances the currency’s decentralized appeal.

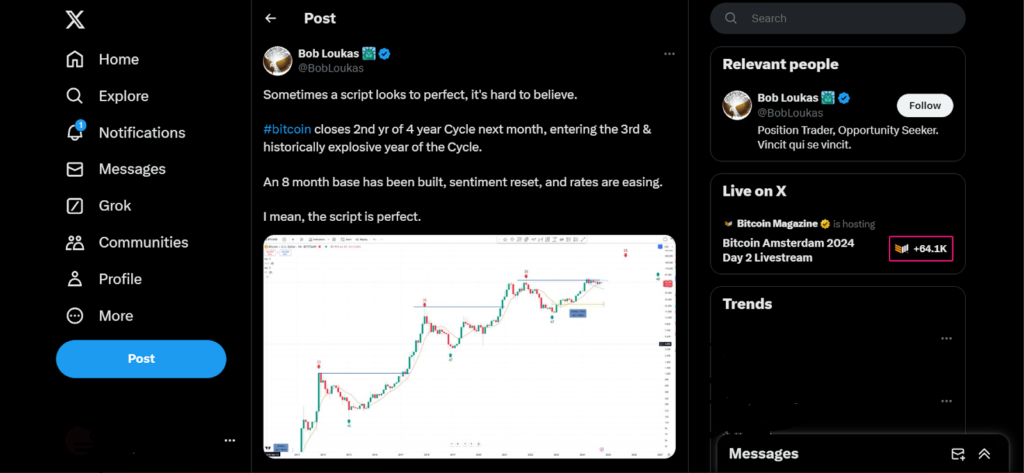

Bitcoin’s Chart Looks Bullish: $150k Possible in This Cycle

Bitcoin’s price is consolidating below its 2021 peak of $69,000. In a bold forecast, independent trader and crypto analyst Bob Loukas has projected that Bitcoin’s price could reach $150,000 with its historically bullish cycle.

According to Loukas, Bitcoin is entering an “explosive” period of a four-year cycle. “It is a perfect script,” he added via his October 8 post via X. He further suggested that BTC is en route to a bullish third year, which begins this November.

Historical Cycle Analysis

When this report was being put together, BTC’s price was hovering around $60k. The token has consolidated for eight months, forming a falling wedge pattern. Loukas views this formation as a signal for a significant breakout, potentially boosting Bitcoin’s price.

Loukas’ analysis is based on a four-year cycle framework, as he identified vital trends. He pointed out similarities with previous cycles that led to a surge in BTC’s price. Additionally, geopolitical tensions and institutional buy-ins are fuelling a bullish outlook.

Bitcoin’s Four-Year Cycle

Bitcoin’s reward system operates on a four-year cycle called the Bitcoin halving cycle. At this point, the rewards given to miners are reduced by 50%. The last halving event occurred in April 2024 and is expected to create upward pressure in November.

Loukas points out that BTC is consolidating, which occurs when the price stabilizes after a rally. Six months after the halving event, the cyclical dynamics signal future growth. According to Loukas, these patterns set the stage for a surge above $150k.

Technical Breakdown: Understanding the Falling Wedge Formation

Bob Loukas’s analysis is mainly structured on the falling wedge pattern that Bitcoin’s chart displays over the last eight months. In crypto technical analysis, a falling wedge indicates that bulls are or about to dominate the market.

Bitcoin’s price charts showcase several lower highs and lower lows within the falling wedge. An interpretation of these candlesticks is a subtle decrease in selling pressure. Decreased selling pressure leads to higher buying interest and significant upward movements.

In light of this optimistic outlook, traders and investors anticipate a bull run before the year ends.

Market Sentiment and Institutional Interest

Q4 sees renewed interest from institutional investors in Bitcoin. Spot ETFs are expected to increase in adoption as the price of BTC steadily grows. With growth, there would be FOMO, potentially leading to a significant bounce.

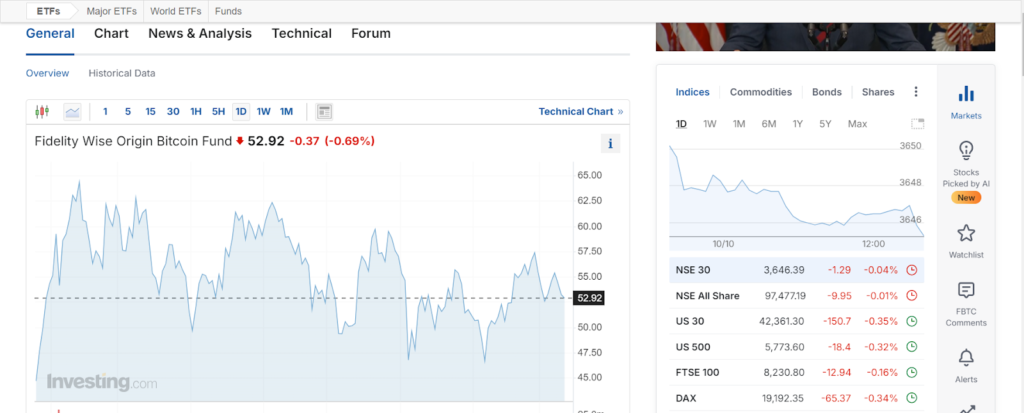

Spot Bitcoin ETFs See $18.6 Million Outflow

This week, U.S. spot ETFs enjoyed streaks of positive flows. However, that was slightly halted on October 8, when Bitcoin ETFs posted $18.66 million in net outflows.

Fidelity’s FBTC ETF took the biggest hit, with over $48.82 million in withdrawals. Next was Grayscale’s GBTC ETF, as they reported a smaller outflow of $9.41 million. BlackRock’s IBIT ETF, however, was the only fund to record inflows, adding $39.57 million.

The other nine major Bitcoin ETFs recorded no inflows. At the end of trading on October 8, the total trading recorded from the 12 U.S. spot BTC ETFs was $1.35 billion. This was a 10.65% increase from the previous day.

The Aftermath

October 9 was pretty much the same as outflows continued. This time, the prominent Bitcoin ETFs accumulated a net loss of $18.6 million. After having a quiet day on October 8, it was Ark’s ARKB ETF’s turn to lead the outflows, reporting $44.5 million in net loss.

BlackRock’s IBIT was the only ETF to record an inflow for the second day in a row. BlackRock had a modest inflow of $13.9 million. Other major funds, including Fidelity’s FBTC ETF, reported no inflows or outflows. This marked a quiet day for the broader market.

Ethereum ETFs See Limited Activity

Like BTC, Ethereum ETFs also reported outflows on October 8. A total outflow of $8.1 million was recorded, with Fidelity’s FETH and Bitwise’s ETHW ETFs leading. Fidelity posted an outflow worth approximately $3.6 million, while Bitwise lost $4.5 million.

Other notable ETFs based on Ethereum reported no inflows or outflows. This includes VanEck, BlackRock, and Grayscale.

The following day (October 9) was relatively quiet. The Ethereum ETFs market remained unchanged, as no movements of funds were recorded. The lack of inflows and outflows indicated a pause in investor interest after the previous day’s outflows.

How Is Market Consolidation Enhancing Investor Confidence?

The back-to-back outflows from Bitcoin ETFs might create a cautious sentiment among investors. However, this should not be the case. Before October 8, U.S. Spots Bitcoin ETFs experienced a streak of inflows. Analytics is in favor of positives coming next week.

For Ethereum, the limited activity suggests a period of market consolidation. Investors are most likely reassessing their positions on which exchange-traded funds assets to lay money on. This quiet period could indicate broader preparation for upcoming market shifts.

Closing Remark

As we reflect on the developments this week, it’s clear that the industry is at a pivotal stage.

Fluctuating ETF flows and strong Bitcoin price forecasts highlight a broader cautious optimism. The expected rise in global crypto adoption to 8% underscores the integration of digital currencies into everyday finances—this trend, along with expert insights, signals major shifts in market patterns.

As the year ends, the crypto community should stay aware of regulatory changes and market signals that shape adoption and investment.

Our Zypto App has many features to enhance your trading, including virtual cards tailored to suit your specific needs and a robust payment gateway to give you a refreshing and safe experience.

Zypto has partnered with MoneyGram to launch an upcoming historic USDC-to-Cash and Cash-to-USDC service. You will soon be able to cash in or out of your Zypto App in USDC at participating MoneyGram locations globally. Find out more here.

What are your thoughts on this week’s cryptonews? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What is the projected global crypto adoption rate by 2025?

By 2025, it’s expected that 8% of the global population will be using cryptocurrencies.

Has Satoshi’s identity been revealed?

HBO’s documentary “Money Electric: The Bitcoin Mystery” suggests that Peter Todd might be Satoshi. However, timeline inconsistencies cast doubt on this claim.

What are the predictions for Bitcoin’s price in this cycle?

According to analyst Bob Loukas, Bitcoin’s price could soar to $150,000 during its current four-year cycle.

How have Bitcoin ETFs performed recently?

Recently, Bitcoin ETFs experienced significant outflows—notably an $18.6 million net outflow on October 8.

How are Ethereum ETFs performing compared to Bitcoin ETFs?

Ethereum ETFs have seen limited activity. There has been little to no activity, indicating a consolidation.

Great technical analysis this week. Educational as always!

Agree. Excellent roundup and TA as always!

Great technical chart analysis. This post was educational as always. Great work!