It’s been another positive week in the crypto market. Although Bitcoin (BTC) hasn’t cracked the anticipated $100K mark, BTC ETFs have inspired massive crypto inflows. Solana’s (SOL) DEX volume surpassed $100B, Orchid’s crypto trading volume surged by 2500%, and Fantom (FTM) soared by 60% within a week.

Let’s look at the details.

Crypto inflows surge as Bitcoin ETFs dominate

It has already been a fortnight since Bitcoin (BTC) smashed the $80K mark and has continued pumping. This has continued to make waves in the market with sustained growth and activity.

Last week, demand for BTC increased as speculators and investors spent more money on cryptocurrency investment vehicles. The market hit an important milestone: global investment products saw net inflows of about $3.13 billion from Monday to Friday.

Crypto inflow hits milestone record

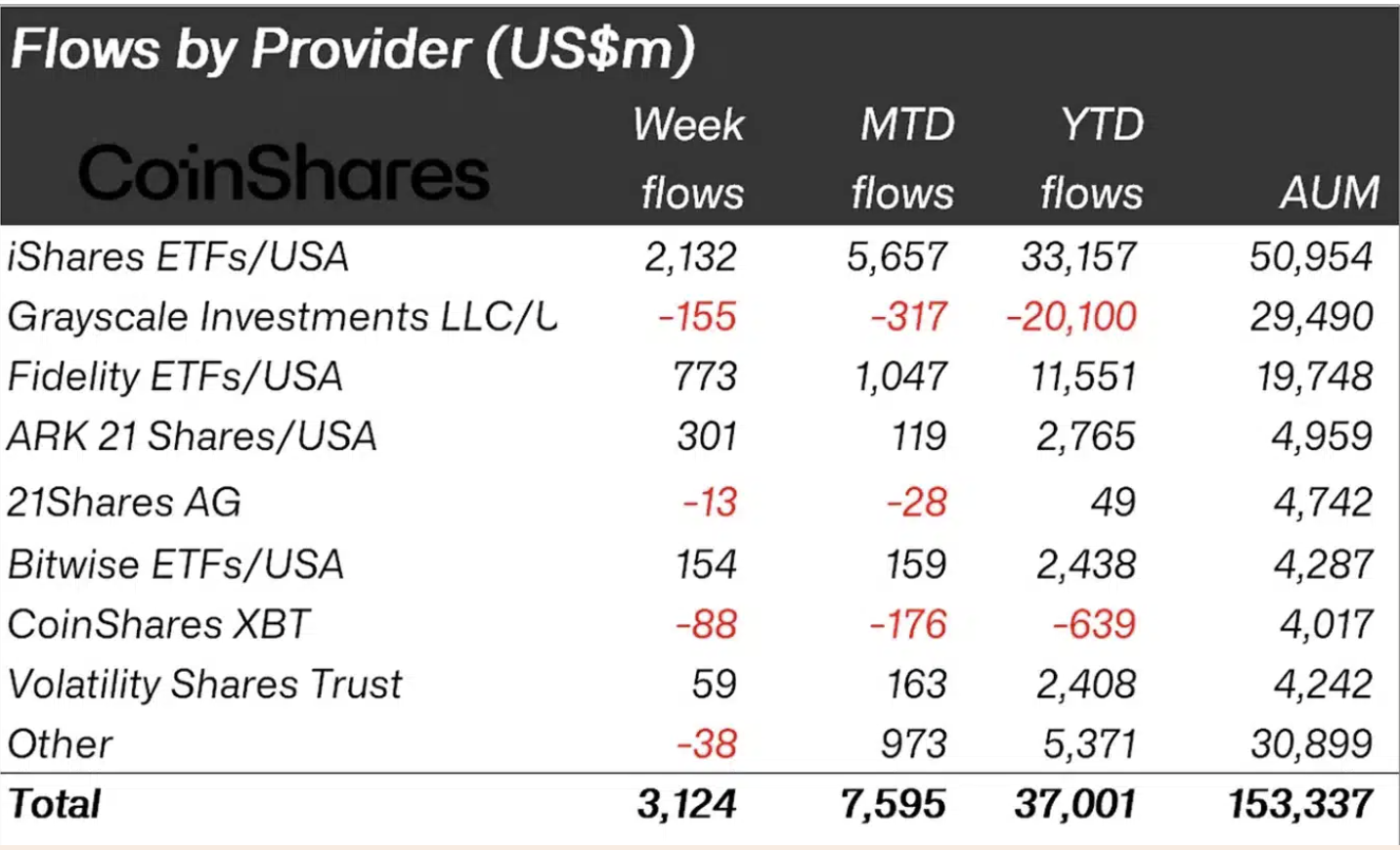

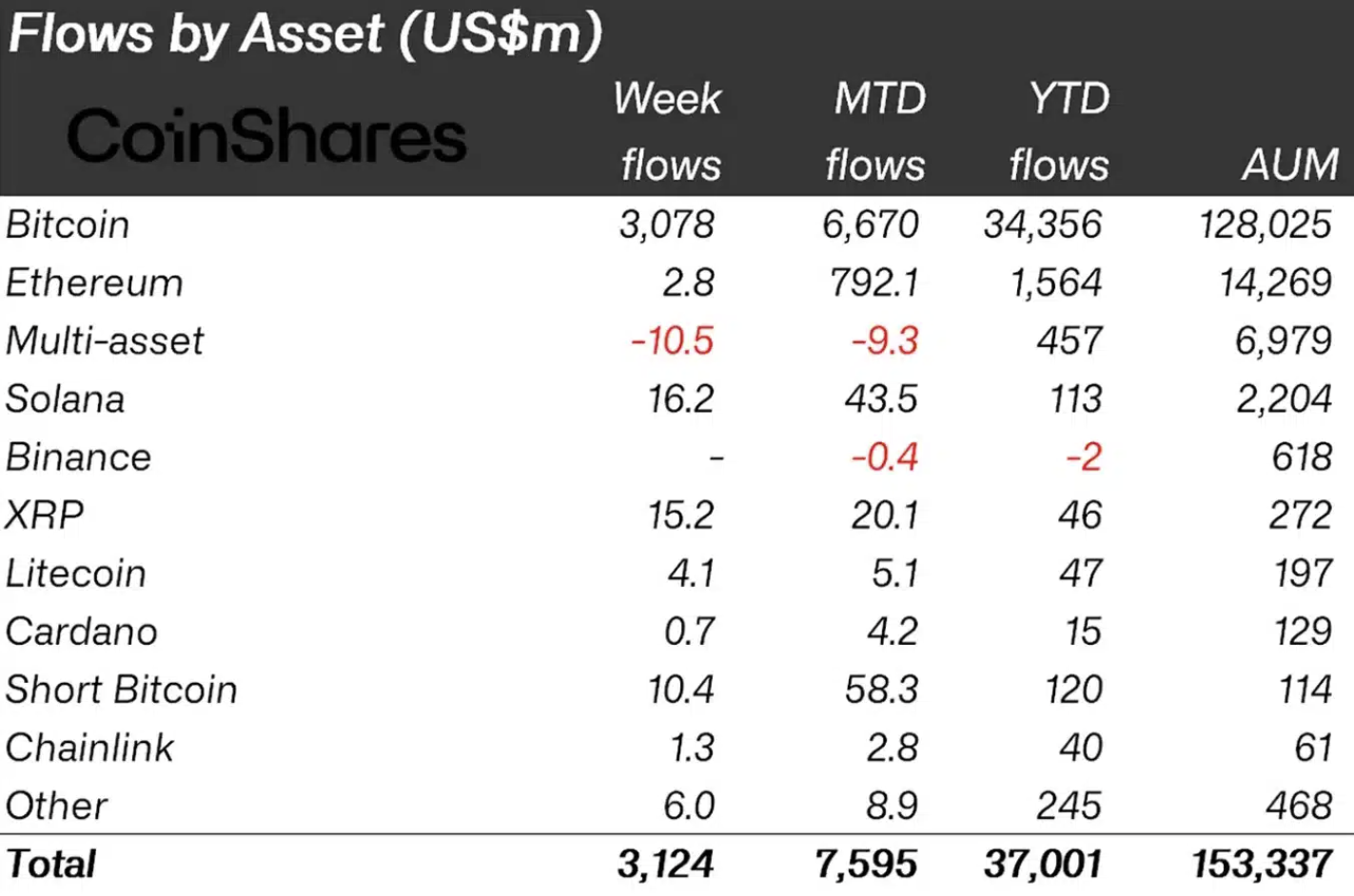

According to a digital asset manager Coinshares report, the surge was mainly due to increased interest in U.S. spot BTC ETFs. This development outlined the bubbling enthusiasm and the impact of political and economic changes in the space.

The report noted that due to the largest weekly inflows on record of $3.13B, the total year-to-date inflow of digital investment assets reached a milestone record of $37B. It detailed the week of the 18th – 22nd of November, where Bitcoin ETFs gained a massive 102% from the previous week’s $1.67 billion.

These gains also showed the seventh successive week of positive inflows, exhibiting sustained momentum and increasing investor sentiment. Also, the total assets under management (AUM) surged to an all-time high of $153 billion.

Even at that, BlackRock’s IBIT continued to lead the market. It recorded $48.95 billion in net assets as of the 22nd of November, with cumulative inflows reaching $31.33 billion. Likewise, it was responsible for a substantial portion of last week’s inflows (approximately $2.05 billion).

Conversely, Grayscale’s GBTC was responsible for $21.61 billion in net assets but has faced outflows exceeding $20 billion since its inception.

Bitcoin has company

Although Bitcoin dominated the inflow charts via BTC ETFs, altcoins also showed their growing appeal among institutional investors.

For one, Solana (SOL) led the altcoin pack with a massive $16 million net weekly inflows, surpassing Ethereum (ETH), which recorded $2.8 million. Other notable performers included Ripple (XRP), Litecoin (LTC), and Chainlink (LINK), which garnered $15 million, $4.1 million, and $1.3 million, respectively.

These impressive figures show increasing confidence in the altcoin sector. Interestingly, this confidence is fueled by solid price momentum and the extensive adoption of these digital assets across multiple uses and the political landscape.

These BTC funds led the charge, contributing about $3 billion to the weekly total, a far cry from the $309 million inflows for U.S. gold ETFs in the first year.

While BTC’s price rally continued to draw interest from institutional and retail investors alike, it also produced $10 million in inflows into short-Bitcoin products, bumping the monthly figure for these assets to a massive $58 million.

Can BTC rally to $100K?

Bitcoin (BTC) has been on an upward trajectory, enjoying a 46.59% monthly gain and expanding its market capitalization to $1.94 trillion. It has delivered impressive performances since it crossed the $90K mark.

However, its momentum has slowed recently, and a clear market direction needs to be established. Once market sentiment improves, fortunes will likely reverse.

So, can BTC rally to $100K?

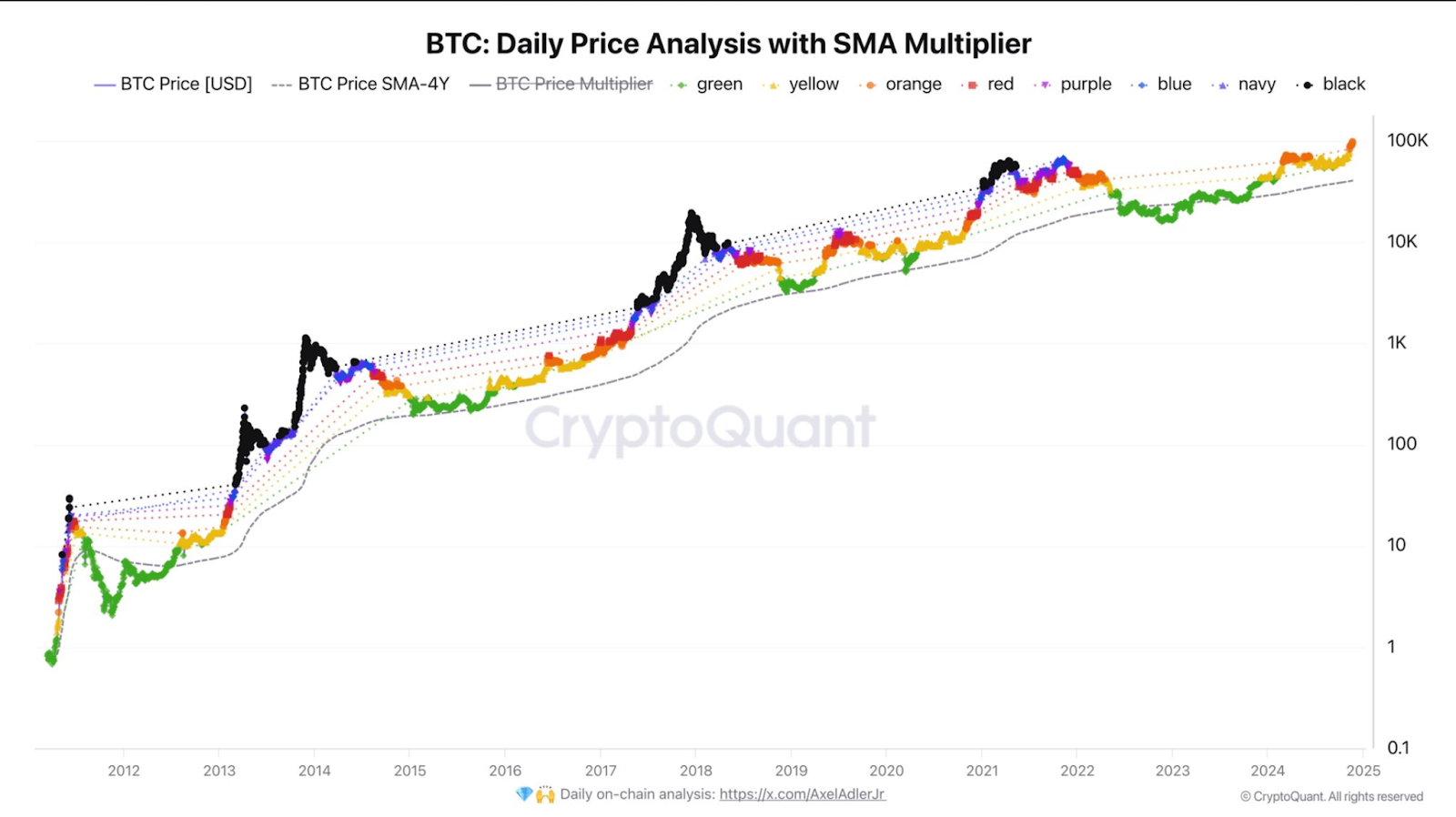

According to a chart by crypto analyst Alex Adler Jr., BTC has yet to reach its cyclical peak. The analysis utilizes color-coded zones—varying from green (beginning of cycle) to black (top of cycle)—to depict BTC’s market sentiment during diverse phases.

This means BTC is still far from the peak of its cycle, with five additional phases ahead. Typically, these phases follow a pattern; if maintained, BTC could exceed the highly expected $100,000 target.

If so, what has been preventing its increase?

What is affecting the BTC rally?

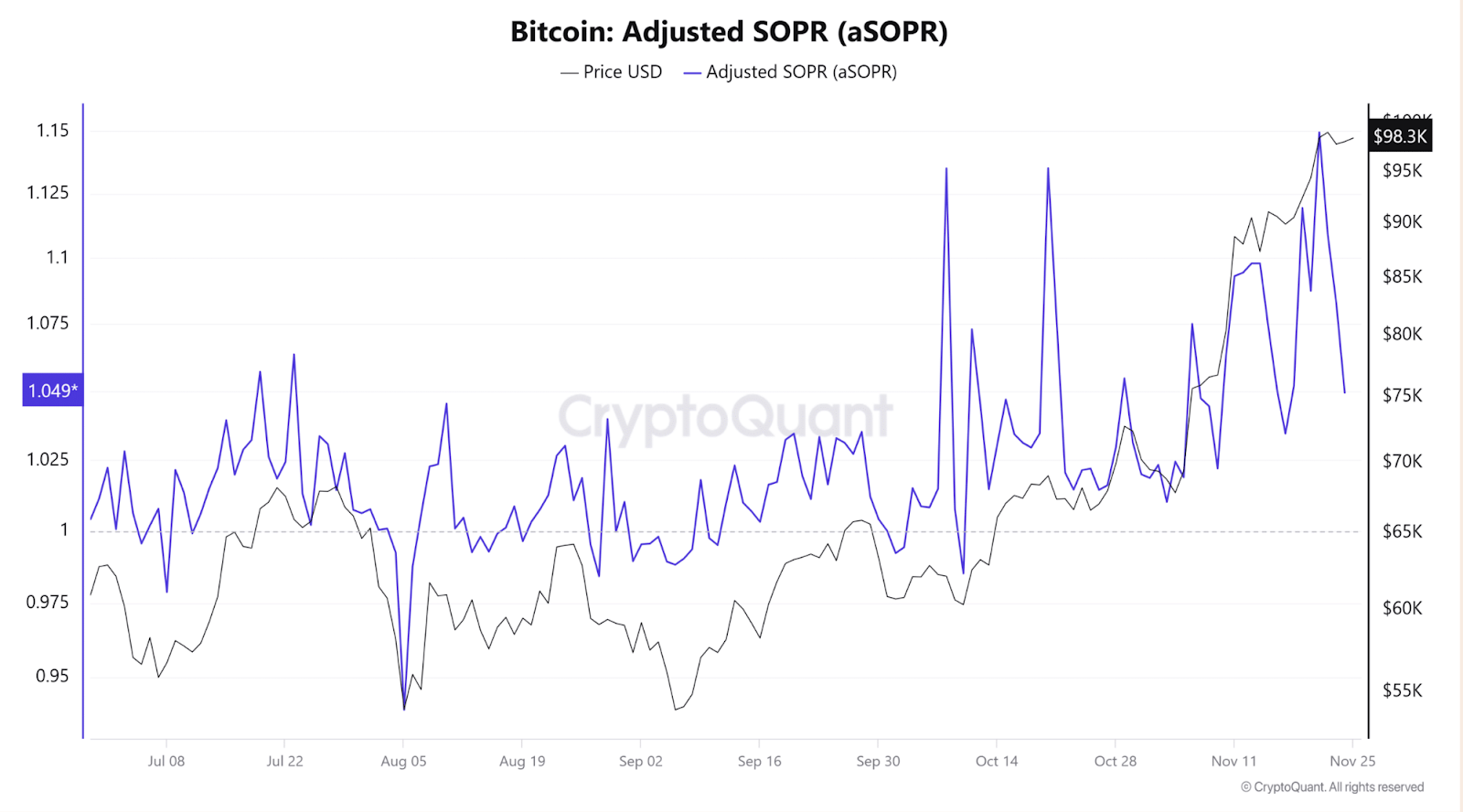

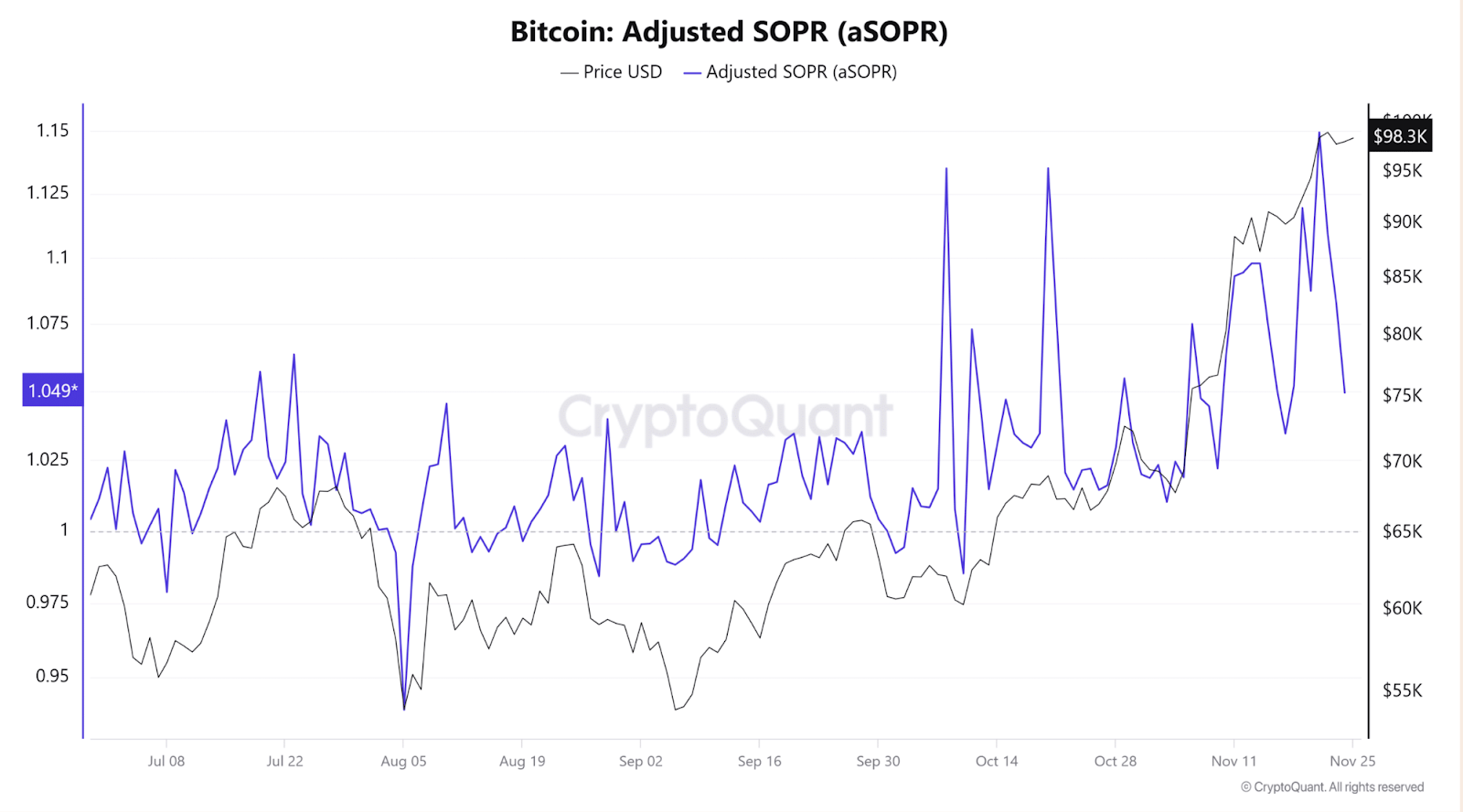

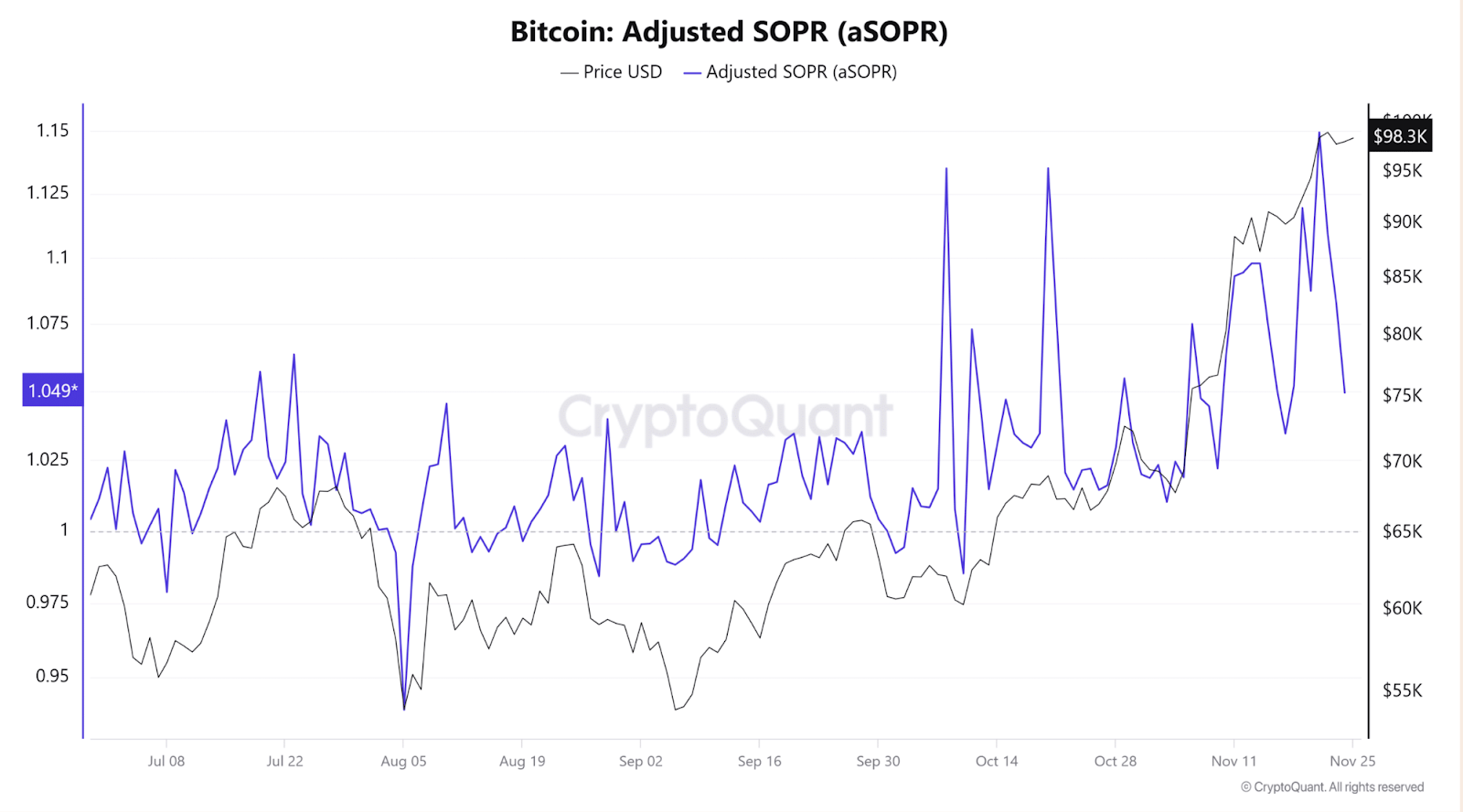

According to an insight from CryptoQuant, increased profit-taking affects BTC’s price momentum, stopping it from driving upwards significantly.

Also, the Adjusted Spent Output Profit Ratio (aSOPR) sat at 1.049 at press time. This means that investors were selling at a gain, which has heaped more pressure on BTC’s value, reducing its rally.

Then, there is the Take Buy/Sell Ratio, an indicator of whether buyers or sellers dominate the market. At the time of writing, it was 0.963. This implies that selling volume exceeds buying volume, giving bears the upper hand and preventing BTC’s uptrend.

What is holding BTC down?

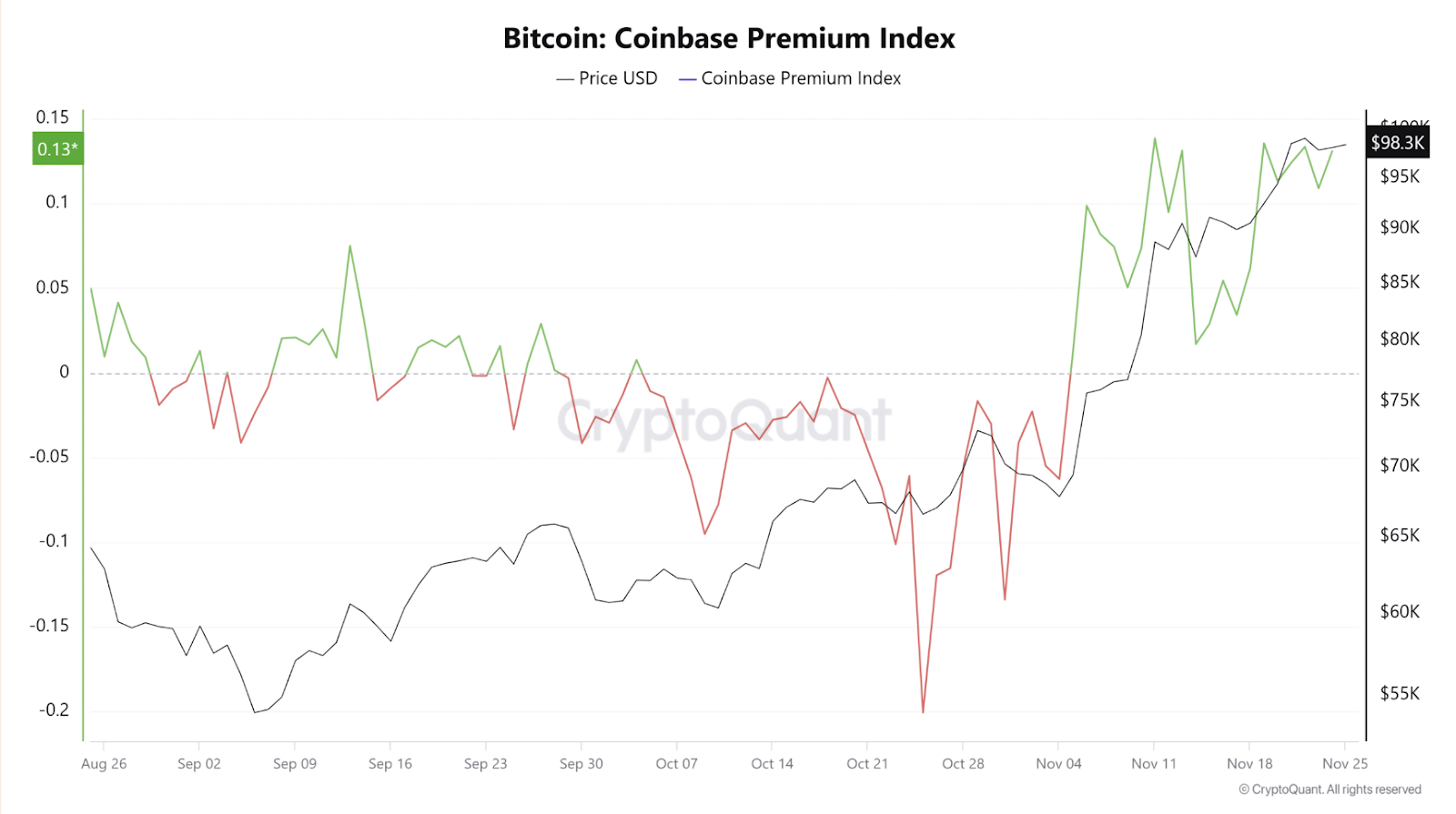

Another CryptoQuant report notes that U.S. investors have recently purchased Bitcoin (BTC).

The Coinbase Premium Index, which analyzes the price difference between BTC on Coinbase and Binance, has ticked higher, sitting at 0.1308. A number that is close to its November high of 0.1384.

A positive reading (above zero) on this chart signals more robust buying activity from U.S. investors than other markets. This heightened demand has, in no small way, helped sustain BTC’s price, stopping further declines.

Orchid crypto trading volume rises by 2500%

Orchid (OXT) has recently experienced a strong uptrend on its price chart and increased demand over the past 24 hours. As a result, trading volume and prices have surged massively.

Orchid crypto volume surges

Based on data from CoinMarketCap, OXT’s trading volume soared massively and hit a cumulative total of $547.74 million. The increase in trading volume points to two factors:

- It indicates that traders are actively buying and selling.

- It also signals a growing demand and adoption of the asset.

The surge in Open Interest also indicates this increase. According to Coinglass data, 24-hour Open Interest has spiked to $19 million, soaring 253.88%.

As OXT’s trading volume increased, so did its Open Interest surge to a new ATH (all-time high). Moreover, when the two happen concurrently, it suggests that investors are opening positions and these traders are mostly buying.

OXT charts are making a statement

Orchid (OXT) has enjoyed a strong uptrend during this increase, soaring from a low of $0.0768 to a high of $0.1598. As of this writing, OXT was trading at $0.1297 after a 30% uptick on daily charts.

The altcoin has made significant gains on weekly and monthly charts, increasing by 43.15% and 75.15%, respectively. This upswing, accompanied by high trading volume and open interest, signals investors are drawn to the altcoin.

Furthermore, the large holders’ inflow has risen to a year-high of 255.79 million OXT tokens, backed by a rising Relative Strength Index (RSI), which has surged from a low of 56 to 7. Likewise, the outflow of exchanges has also increased to a high of $7.1 million.

This indicates two things:

- Large holders are actively buying the altcoin.

- While the altcoin has surged, most investors are transferring their assets to store in cold storage or private wallets.

At this rate, OXT could witness more gains on its price charts. If this happens, the altcoin will see the next significant resistance around $0.17. Conversely, if short-term holders take their profits, the coin could decline to $0.09.

Solana DEX volume surpasses $100B

Solana has recorded another positive update alongside a long list of milestones this year. SOL has broken records, exceeding $100 billion in monthly DEX volume for November 2024 and facilitating an impressive 11 billion YTD transactions (Year-To-Date).

At press time, SOL was trading at $240.77, a 2.58% drop within the past 24 hours after reaching a yearly high of $267 earlier this month. Now, speculation is rife about whether this current momentum can lead to a sustained price rally or if additional price corrections are on the way.

What’s next for Solana?

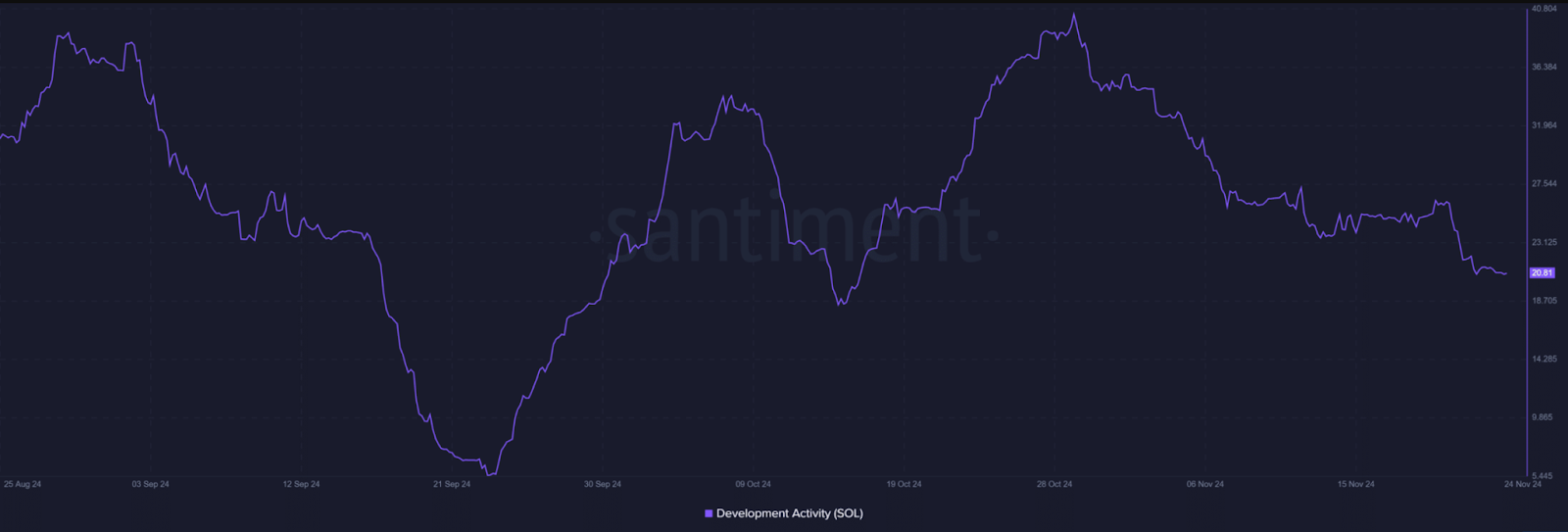

Solana has maintained continuous developmental activity alongside its fantastic market performance. As of November 24, the activity level was 20.81, slightly lower than in prior months.

Yet, this steady progress highlights SOL’s commitment to improving its ecosystem. This ongoing development offers a solid foundation for long-term adoption and price stability.

Solana’s liquidation data also indicates market optimism. On November 25, $19.67 million in long positions were liquidated compared to only $2.54 million in shorts, signaling bullish solid sentiment among traders.

Furthermore, this infers that even with recent price dips, most traders and investors expect Solana to continue its upward trajectory. It may then test previous highs soon.

Overall, Solana’s notable milestones in adoption and transaction volume, combined with its strong technical and market fundamentals, indicate that it is well-positioned for further growth.

Assuming SOL holds its $225 support level, a retest of $267 and beyond becomes highly possible. Nonetheless, failure to maintain this level could lead to a temporary correction.

The bullish sentiment and solid fundamentals are tilting toward an upward price breakout in the upcoming weeks.

Fantom (FTM) soars by 60% in 7 days

Fantom (FTM) has performed exceptionally this week in the crypto market. It has soared by 60% and has increased its market cap above $3 billion. This rally has attracted investors and analysts, mainly in the face of revitalized optimism in the market.

So, what is the cause of this surge in the FTM value?

What is behind FTM’s surge

One of the market’s top performers this week, Fantom’s (FTM) 60% rise has seen the token break past the $1.07 mark.

This rally was fueled by a sharp uptrend in trading volume and market participation and an increase in investor interest. Moreover, FTM’s on-chain metrics indicate positive sentiment.

In addition, FTM has stood out among other altcoins. Its rally of 130.91% surpasses those of AVAX, SOL, and ETH, which have rallied 55.48%, 27.18%, and 5.29%, respectively.

Fantom’s surge is underscored by remarkable ecosystem developments and expanding DeFi adoption. AVAX and SOL have exhibited persistence but lack the requisite momentum, while Ethereum focuses more on scalability than short-priced action.

Yet, consistent performance will depend on Fantom’s ability to sustain ecosystem growth and captivate long-term institutional interest. After all, it is primed as a high-risk, high-reward asset.

What’s next for FTM?

Although a significant rally proves strong market interest and ecosystem growth, its sustainability remains tentative.

The overbought RSI indicates potential for short-term corrections. Long-term adoption will be based on continuous ecosystem expansion and increased developer and user engagement.

Still, more significant market trends, such as Ethereum’s dominance and the recovery of competitors like AVAX and SOL, could challenge FTM’s uptrend.

Thus, to have a more ongoing trend, Fantom (FTM) must capitalize on its current gains by consolidating its position in the market and getting more institutional capital. Anything less, this rally may be a mere brief phase in the volatile market.

Closing Remark

This was quite an eventful week, with Bitcoin (BTC) ETFs leading a historic weekly and year-end crypto inflow. Other altcoins, like Fantom (FTM) and Orchid (OXT), also hit huge milestones.

Solana has maintained continuous developmental activity alongside its fantastic market performance, so its DEX volume surpassing $100B wasn’t surprising.

After declining from $95,000 during the week, several analysts have predicted their thoughts on BTC’s price trajectory. The general sentiment remains positive, so we must wait and see how things develop.

Zypto Launches The Global Visa Crypto Card

Zypto now has a global prepaid Visa crypto card. It enables easy off-ramping, instant transactions, and offers up to a $1,000 limit. With the Zypto App, you can get your Global Visa card at a 50% discount off the flat issuing fee. You can also use your ZYP Rewards earned from Zypto App, to load the card and spend your rewards as you like.

Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Why did crypto inflows surge with Bitcoin ETFs dominant?

The crypto market experienced net inflows of about $3.13 billion from Monday to Friday last week, with increased demand for BTC due to political and economic reasons.

Can BTC rally to $100K?

Bitcoin’s (BTC) momentum has slowed lately since crossing the $90K mark. Different analysts have posited several reasons, yet the overall sentiment is that BTC hasn’t reached the peak of its cycle.

What does Orchid’s (OXT) price uptrend mean?

Orchid (OXT) has experienced a massive surge in its trading volume and price, implying colossal trading action and growing demand and adoption of OXT.

Does Solana’s DEX volume surge affect its price?

Solana’s (SOL) notable milestones in adoption and transaction volume, combined with its strong technical and market fundamentals, indicate that it is well-positioned for further growth.

What is behind Fantom’s FTM surge of 60%?

There are multiple reasons behind Fantom’s (FTM) surge. They include remarkable ecosystem developments, expanding DeFi adoption, a sharp uptrend in trading volume and market participation, and increased investor interest.

0 Comments