This has been one of the most productive weeks in the crypto market throughout 2024. Bitcoin (BTC) smashed its all-time high (ATH) to surge past the $80K mark for the first time.

Expectedly, that had a similar effect on altcoins in the market. Solana (SOL), Cardano (ADA), and other coins increased. Stablecoins weren’t left out of the massive wins as Tether (USDT) reached record-high netflows and had its exchange reserve rise to its all-time high (ATH).

Join in the conversation as we talk more about these.

Bitcoin surpasses $80K and reaches a new ATH.

Was Bitcoin’s (BTC) superiority ever in doubt? This has been a year where it has breached its former all-time high (ATH) price multiple times and always seemed likely to do it again.

At first, March saw BTC reach $69,210, $70,184, and $73,835, each time higher than the last. Then, after a few months of consolidations and price corrections, BTC surged to a new all-time high past $80,000 in early November.

The coin increased by more than 5% over 24 hours and over 18% in the past seven days, per CoinMarketCap data.

How did BTC get a new ATH?

On November 10, Bitcoin reached a new all-time high price of $80,152 and therefore smashed the $80k mark for the first time in history. To many analysts and stakeholders, this has been a long time coming and well deserved.

But what could be behind this astronomic surge?

First, it’s noteworthy that BTC hit its first new all-time high of $76,999 after Donald Trump’s re-election as the U.S. President on November 7. Then, three days later, on November 10, it crossed the $80,000 threshold.

Without a shadow of a doubt, BTC’s rise can be ascribed to the positive sentiment of global investors after Trump’s multiple campaign promises. Some of these include replacing the Securities and Exchange Commission (SEC) chairman Gary Gensler and making the U.S. the “crypto capital of the world”, among others.

Secondly, BTC’s increase results from general market bullishness, mainly after the SEC’s approval of spot Bitcoin exchange-traded funds (ETFs) early in the year. Since listing, nearly $26 billion worth of BTC has been pumped into these funds.

In addition, inflows have increased since massive outflows from the Grayscale Bitcoin Trust (GBTC). As of this writing, assets under management for Bitcoin spot ETFs are almost $79 billion, nearly 5.21% of BTC’s total supply.

Thirdly, inflation has reduced, making the job market better, too. This has made the U.S. Federal Reserve embrace an approach of leaving interest rates steady during last month’s FOMC meeting. Consequently, traders and investors have been encouraged to spend money on different assets.

Where does BTC go from here?

Now that BTC has hit a new ATH, what is next?

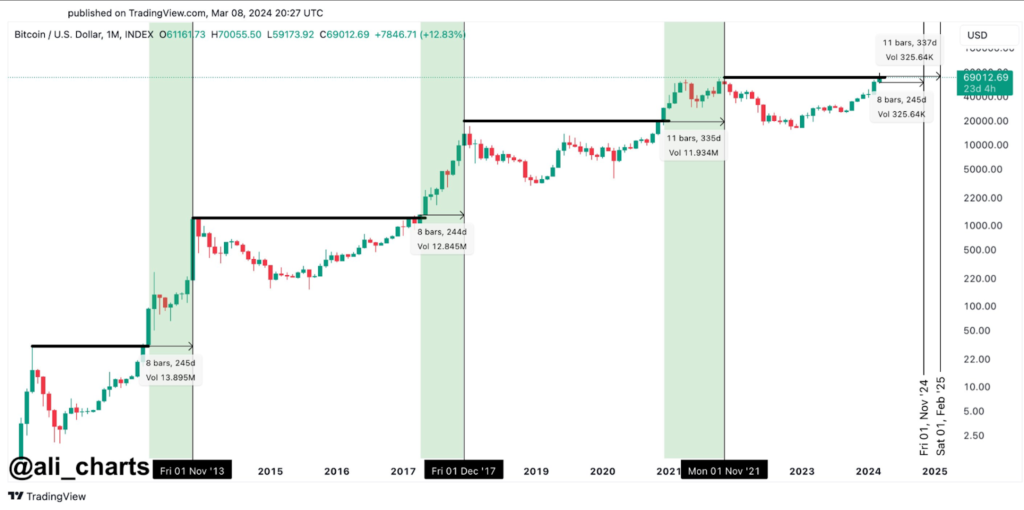

As pointed out earlier, some on-chain analysts had predicted BTC’s rise. One includes Ali Martinez, who previously posted on X that BTC’s market peak would be between November 2024 and February 2025.

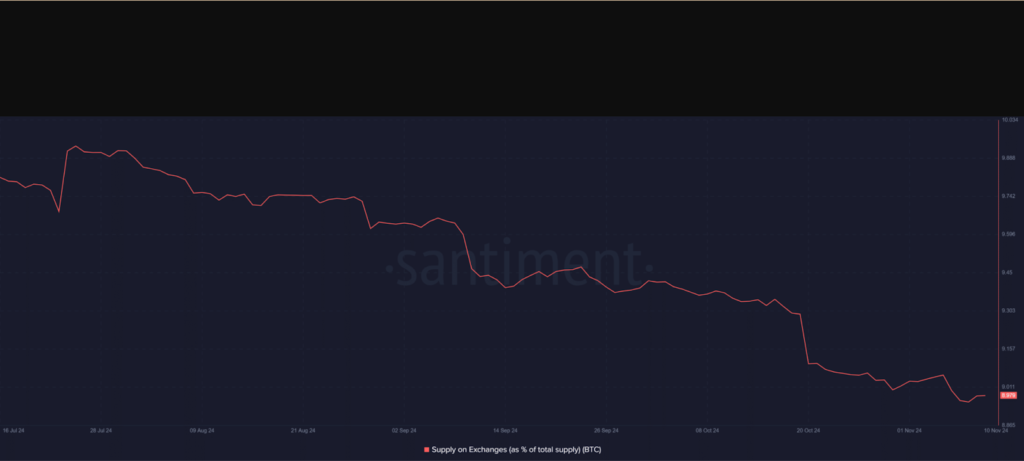

But now, the number of BTC getting locked into spot ETFs has led to a scarcity in the crypto market. About 9% of BTC’s total circulating supply was kept on crypto exchanges, which has dropped from almost 12% since the beginning of 2024.

However, the demand for BTC hasn’t let up one bit.

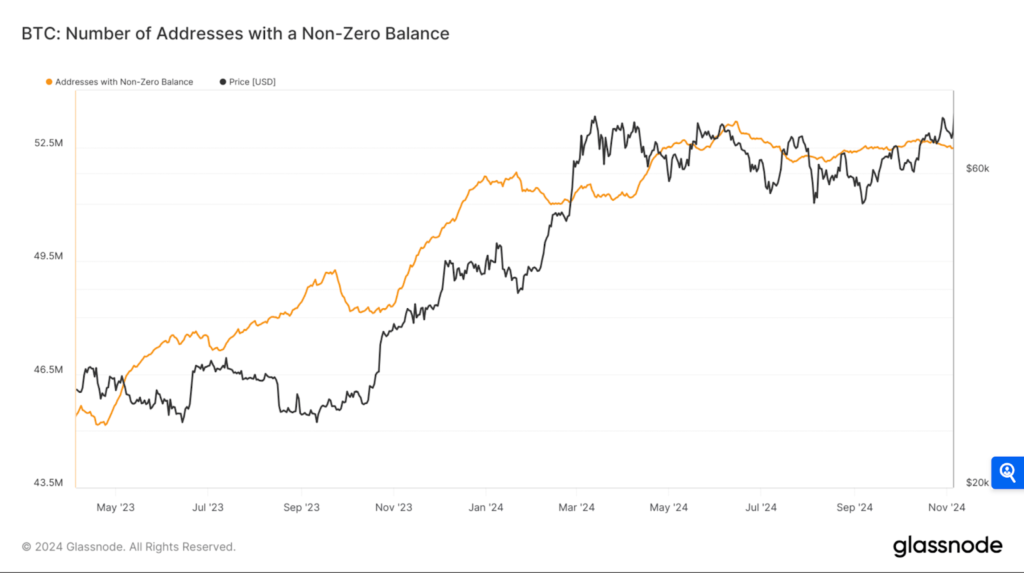

Before the bull cycle, 2024’s Bitcoin rally was powered by retail and institutional interest. Per Glassnode’s data, there has been an increase in whale entities holding 1K coins and addresses with non-zero balances.

Solana climbs to $200

As has become customary in the crypto ecosystem, Bitcoin’s (BTC) recent increase has had a knock-on effect on the market. Other altcoins have become bullish and enjoyed hikes on the price chart.

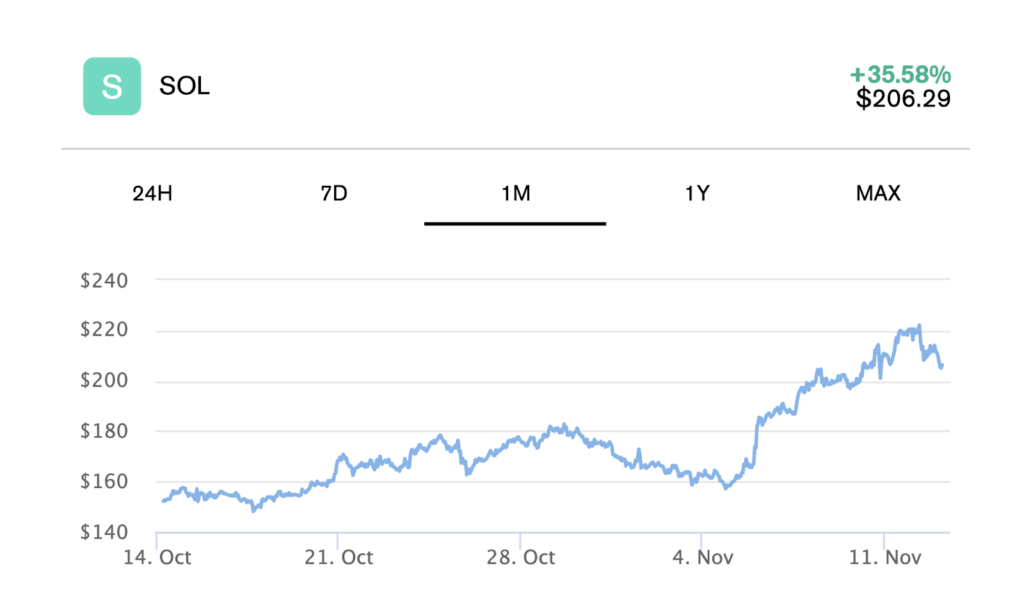

After enjoying a 20% price hike within the last seven days, Solana has risen above $200. At this writing, SOL was trading at $206 per market data.

SOL has hit a new seven-month high by reaching $200 and is one of the biggest beneficiaries out of the top 20 coins and tokens by market cap. Yet, the coin remains 23% down from its all-time high price of about $260 set in November 2021.

Also, this price increase has enabled Solana (SOL) to hit another new milestone. According to a post from SolanaFloor, a popular Solana-related analyst account on X, SOL’s market capitalization dominance attained 3.8% (an all-time high).

With SOL having surpassed $200 and reached a new ATH in its market dominance, can we expect a new altcoin season soon?

Is an altcoin season near?

Let us consider some metrics to see if Solana’s recent milestone and bull rally can spur an altcoin season.

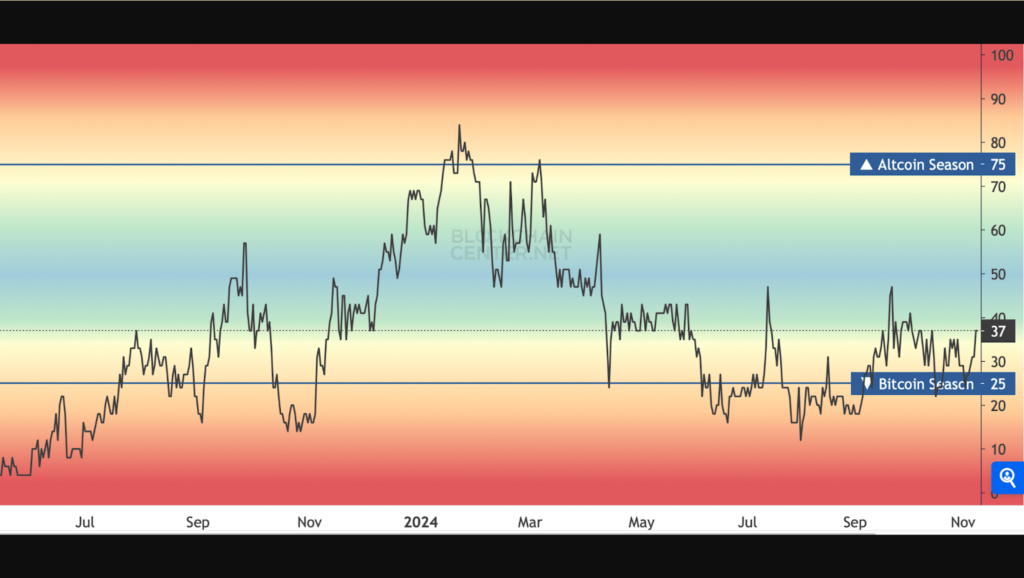

- Firstly, the altcoin season index reported an uptick, which implies an upcoming altcoin summer. Yet, it still recorded a value of 37. For context, a value close to 25 suggests a BTC season, while one near 75 suggests an altcoin season.

Based on the above, investors might have to wait a while for a significant altcoin rally. Can a ‘while’ mean 2025? Time will tell.

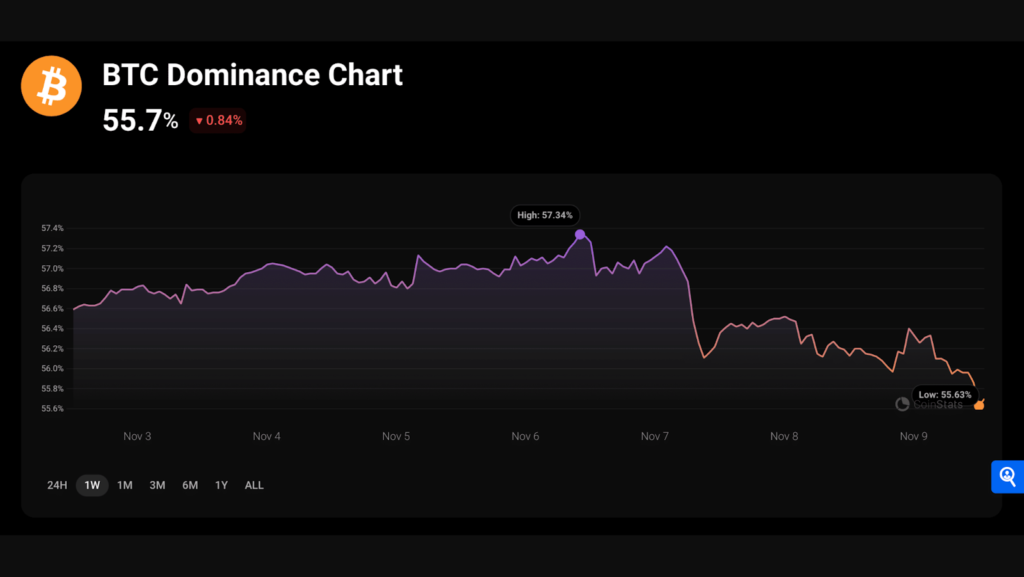

- Secondly, by looking at CoinStats’ data, we can see a positive development for altcoins. So, after the hurrah of smashing its previous ATH, Bitcoin’s dominance dropped sharply over the past week. At press time, BTC’s dominance was at 55.7%.

Invariably, a decline in this metric signals that the chances of altcoins dominating again are high.

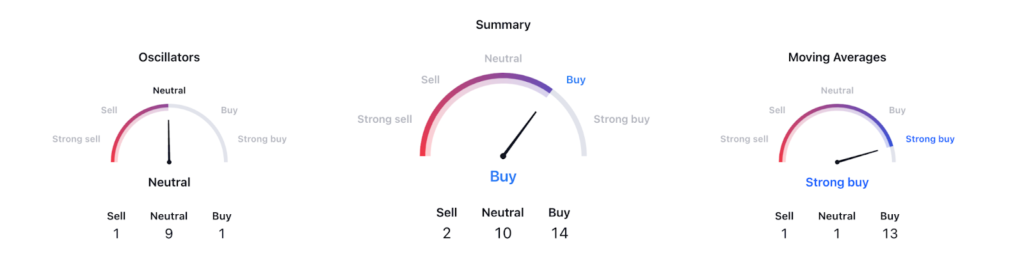

- Thirdly, most of Solana’s indicators are bullish, pointing to an optimistic rally for altcoins.

- Finally, analysts have gotten into the mix and have shared their thoughts on how far SOL can go on X.

CROW affirms that SOL could pump to $800 before the end of this year. Mihir predicts that SOL might rally to $900. To this analyst, the latest breakout above $200 is bullish and signals more uptrend. Then, Lochie2001 forecasts a price surge to $310-$340 before 2025.

Some weren’t as positive with their analysis.

There were some arguments that SOL’s recent price increase was due to a surge in memecoins. This is because of DeFi platforms like the Pump: fun token launch and Raydium, which saw massive benefits from the memecoin mania.

An X user called ‘CatfishFishy’ noted the possibility for ‘pump and dump’ schemes organized by ‘insiders.’ The post also alleges underage activity among the insiders’ audience.

- In addition, the speculation that memecoins are the primary reason behind SOL’s rise ignores an essential factor like Solana’s total value locked (TVL), which exceeded $7b.

As long as on-chain metrics remain positive and SOL derivatives do not waiver, Solana’s competitive advantage – speed, scalability, and efficiency – will keep paving the way for higher SOL prices.

Cardano surges by more than 60% in 7 days

Cardano (ADA) has been impressive recently, as data revealed that ADA bulls outshone the bears last week. The price of ADA surged by more than 60% over the past 7 days.

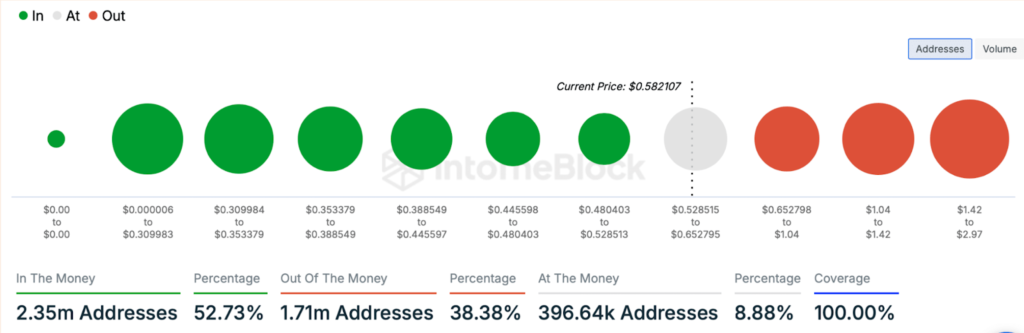

This has immensely benefitted Cardano investors, who enjoyed profits amidst previous losses due to this uptrend. Some 2.35 million ADA addresses gained profits, accounting for more than 52% of the total ADA addresses.

But this didn’t come out of nowhere.

A famous crypto analyst, World of Chats, recently posted on X, highlighting that after a bullish breakout occurred, ADA broke out and recorded more than 40% gains. Although the pattern emerged in December 2023, ADA has been consolidating inside it since then.

Now that ADA is in a good place, where does it go from here?

Will ADA’s uptrend last?

Let us consider some metrics for a holistic understanding of ADA’s current situation.

Firstly, per Coinglass data, Cardano’s Long/Short Ratio recorded a decrease in the last 24 hours. This means there are more short positions in the market than long ones. And this can be construed as a bearish development.

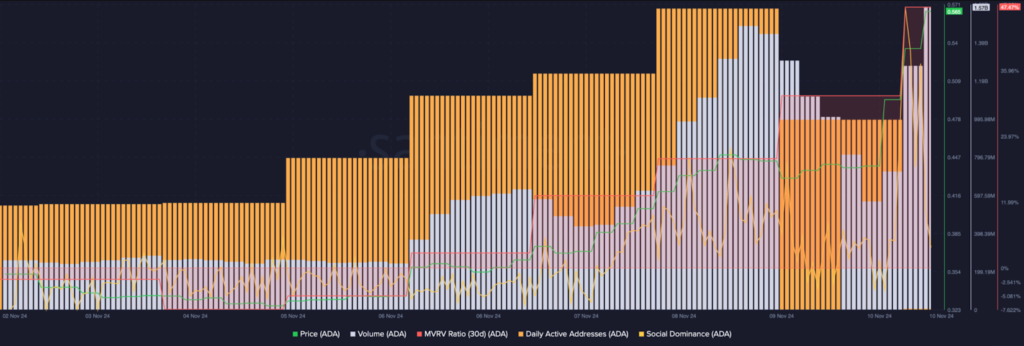

Secondly, by analysing Santiment’s data, we see that Cardano’s daily active addresses have reduced slightly over the last few days.

Yet, the rest of the metrics look bullish.

One is how the token’s trading increased alongside its price. Whenever the trading volume rises with price, it acts as a building block for a bull rally. Secondly, the token’s Market Value to Realized Value (MVRV) ratio spiked, plus its social dominance has increased markedly, as ADA’s popularity has increased recently.

USDT inflows reach record high

You know how it is often said that ‘good news comes in pairs?’ This is true, as BTC is not the only token that has experienced a massive increase. The stablecoin market has also hit a significant milestone.

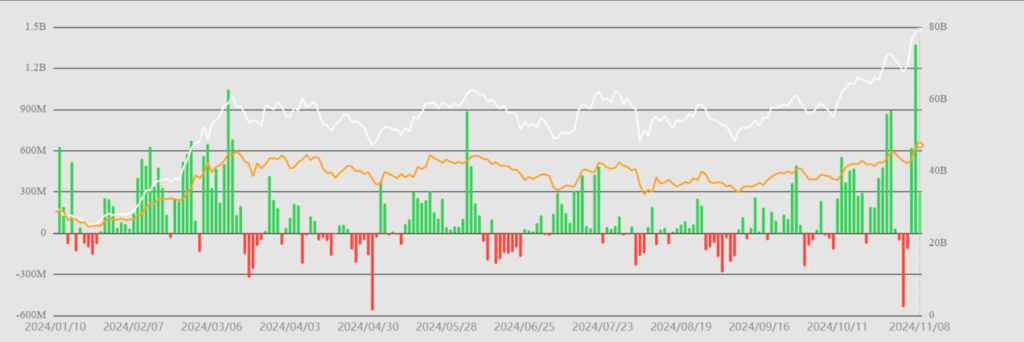

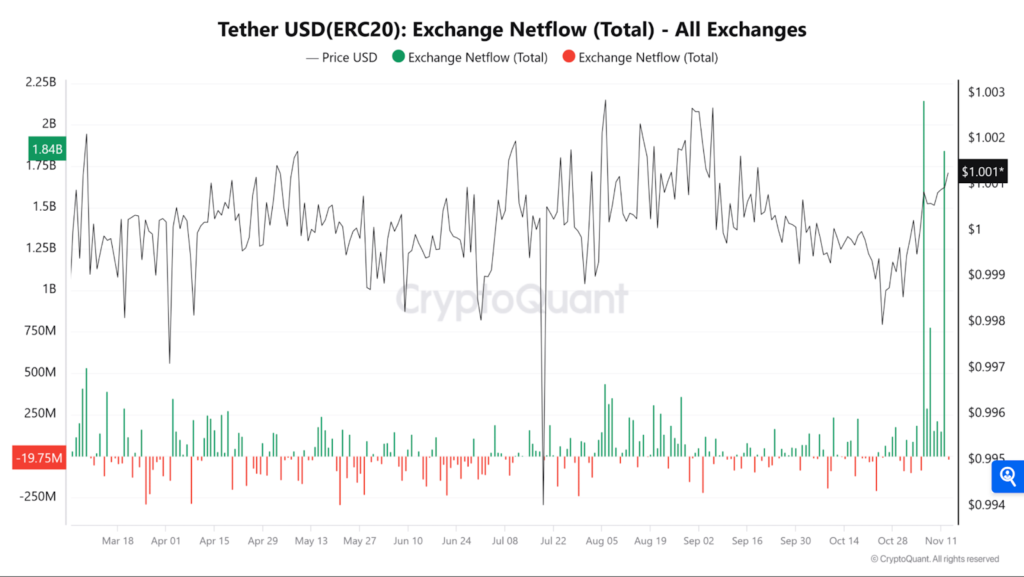

Tether (USDT) recorded over $1.5 billion in exchange netflow twice within seven days. This tremendous inflow has led to conversations on its implications for market liquidity, purchasing power, and the knock-on effect on BTC and other cryptocurrencies.

USDT records more than $1.5 billion in netflow

The historic level of over $1.5 billion in netflow that USDT has reached is proof of a substantial influx of liquidity into the crypto market.

According to CryptoQuant’s chart, the total netflow reached $1.84 billion on major exchanges. This indicates increased capital flowing into exchanges, possibly led by traders setting themselves up for probable market opportunities.

It is important to note that this was the second time USDT had witnessed a surge in inflows in the month. The first massive inflow was over $2 billion on November 6.

These massive inflows usually precede advanced market activity, as traders often deposit stablecoins (such as USDT) to prepare for purchase opportunities. Thus, this can wet the ground for increased demand for BTC and other digital assets, mainly if the bullish sentiment persists.

The market is changing

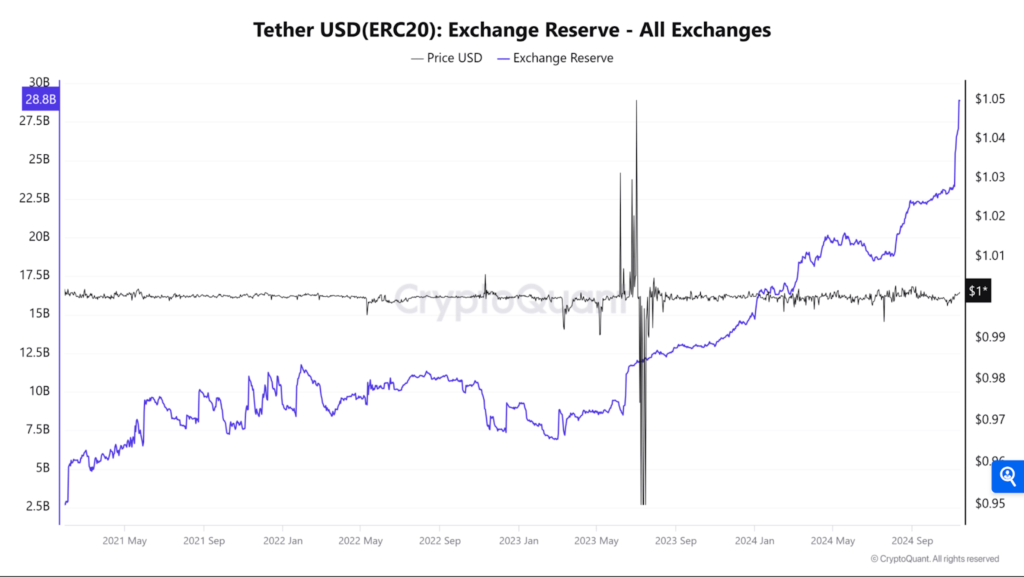

USDT’s record-high inflows aren’t just a win for the stablecoin community, as it points to a larger conversation. The exchange reserve chart showcases a gradual increase in USDT balances on crypto exchanges, hitting an all-time high of $28.8 billion.

This hike in reserves is in tandem with the vast netflows. It signals a growing pool of USDT liquidity ready to be deployed. Furthermore, it means that traders, investors and institutions are actively working towards capitalizing on market opportunities through spot buying or margin trading.

The recent netflow of USDT and its high exchange reserves point to a readiness for increased market activity—moreover, BTC’s momentous surge overlaps with the stablecoin’s milestones.

Closing Remark

Bitcoin’s (BTC) rise and subsequent new all-time high (ATH) has had an overarching effect on altcoins, stablecoins and the overall crypto market.

Solana (SOL) hit a new seven-month high of $200, and its market capitalization dominance attained 3.8% (an all-time high). Cardano (ADA) surged by over 60% over the past 7 days, and Tether (USDT) recorded over $1.5 billion in exchange netflow alongside a new all-time high (ATH) for its exchange reserve.

With positive on-chain metrics and optimistic analyst predictions, everyone bullishly asks how high BTC can get. And you can rest assured that altcoins won’t be far off as BTC keeps rising!

Zypto is committed to offering you the best and most secure crypto services.

Did you know you can pay bills, loans, or mortgages using your favorite cryptocurrencies with our Crypto Bill Pay service? It is now available in the U.S. and Mexico with more countries coming soon.

Zypto has also just launched the High Limit, 3DSecure Virtual Crypto card for the USA. It is non-reloadable, accepted globally on the VISA network, and issued within minutes. It’s also possible to buy it using your ZYP rewards earned from Zypto App. Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

When did BTC get its new ATH price?

On November 10, Bitcoin reached a new all-time high price of $80,152 and therefore smashed the $80k mark for the first time in history.

Which factors led to BTC surging past $80k?

There are many factors behind BTC’s new ATH. Some of them include investor sentiment due to Trump’s re-election, general market bullishness, lower inflation rate, and SEC and Federal Reserve policies.

Is an altcoin season on the horizon?

With Solana’s rise to $200, there are optimistic sentiments on why an altcoin season might happen. Some other factors include positive on-chain metrics, optimistic expert analysis, and booming SOL derivatives.

Can ADA’s bull run persist?

With ADA’s recent price surge of over 60%, there are more bullish metrics than bearish ones. Yet, you can never fully tell with the crypto market.

What is the importance of USDT’s significant milestones?

USDT’s significant milestones of a record exchange netflow and exchange reserve surging to its all-time high (ATH) signals advanced market activity as long as the bullish sentiment persists.

0 Comments