This week has been full of rallies. Bitcoin surged to $64,000, and this has positively affected other altcoins. Now, the community watches with open eyes to see which altcoins will also rally. Then there’s the Solana Breakpoint, which saw a massive increase in attendance.

Let’s dive in.

Will BNB break the $600 barrier this time?

Binance Coin (BNB) is enjoying a bullish surge and could push past the $600 mark. There are indications and high expectations that the altcoin will make gains in Q4 2024.

This results from excitement garnered by the impending release of Binance co-founder and former CEO Changpeng Zhao (CZ). For context, CZ has been carrying out a four-month prison sentence for anti-money laundering violations since April 2024.

In CZ’s absence, the value of BNB dropped, reflecting market volatility and investor uncertainty. With less than a week till he returns home, BNB is primed to break through its long-standing horizontal resistance and lead to a possible rally.

Binance bulls are on the up!

BNB, ranked fourth by market cap, is, at the time of this writing, trading at $592. This marks an 8% increase over the past week.

What changed?

First, there is a positive sentiment caused by the Federal Open Market Committee (FOMC) rate cut. The Federal Reserve cut rates by 50 basis points – i.e., by 0.50% to a range of 4.75% to 5.0% – to support economic growth amidst inflation concerns.

Secondly, as word reached out regarding CZ’s release, BNB began trading near the $600 price. Since July, it has failed to break this key resistance…until now, maybe?

Then, with Bitcoin’s dominance nearly peaking, the altcoin season is upon us. The market cap of altcoins rose by 5.7% after the FOMC rate cut, performing better than Bitcoin’s 4.4%.

Moreover, the crypto market’s daily relative strength indicator (RSI) was 59 at press time, a positive sentiment.

With all these factors, BNB can keep rising as we head into Q4.

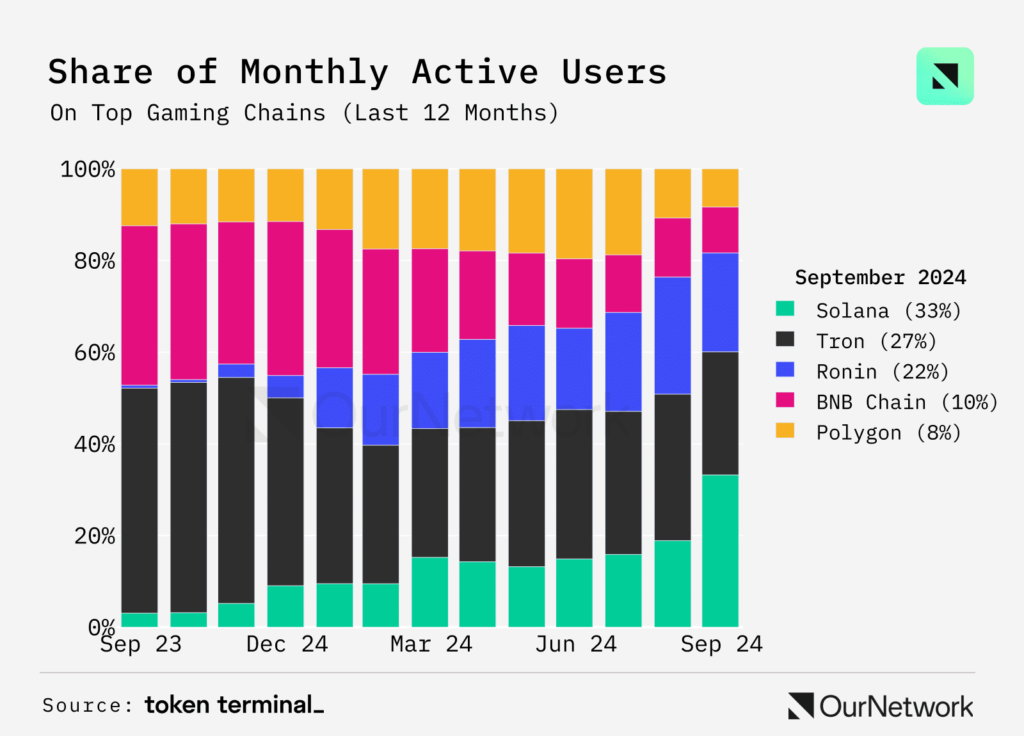

BNB gains traction in gaming

BNB Chain has been growing in leaps and bounds in the gaming sector.

It ranks fourth among the top five gaming blockchains based on monthly active users in September 2024. At 10%, BNB is ahead of Polygon at 8%, Ronin at 22%, Tron at 27% and Solana at 33%.

This increased usability and adoption further boosts the potential of BNB to break and maintain levels beyond the $600 resistance.

Is resilient Bitcoin set for a rally?

Bitcoin has been impressively resilient in September so far. That is no mean feat, as the month is historically bearish. Yet, it has surged by over 20% from its monthly low of about $52,500.

Although its market cap was marginally lesser than that of altcoins after the Federal Reserve’s rate cut, Bitcoin increased to more than $64,000. This displays bullish momentum.

There is palpable anticipation regarding the $65,200 mark as Bitcoin approaches a pivotal point in its trading channel. Remember that it has been trading in a prolonged downward channel since March’s record high.

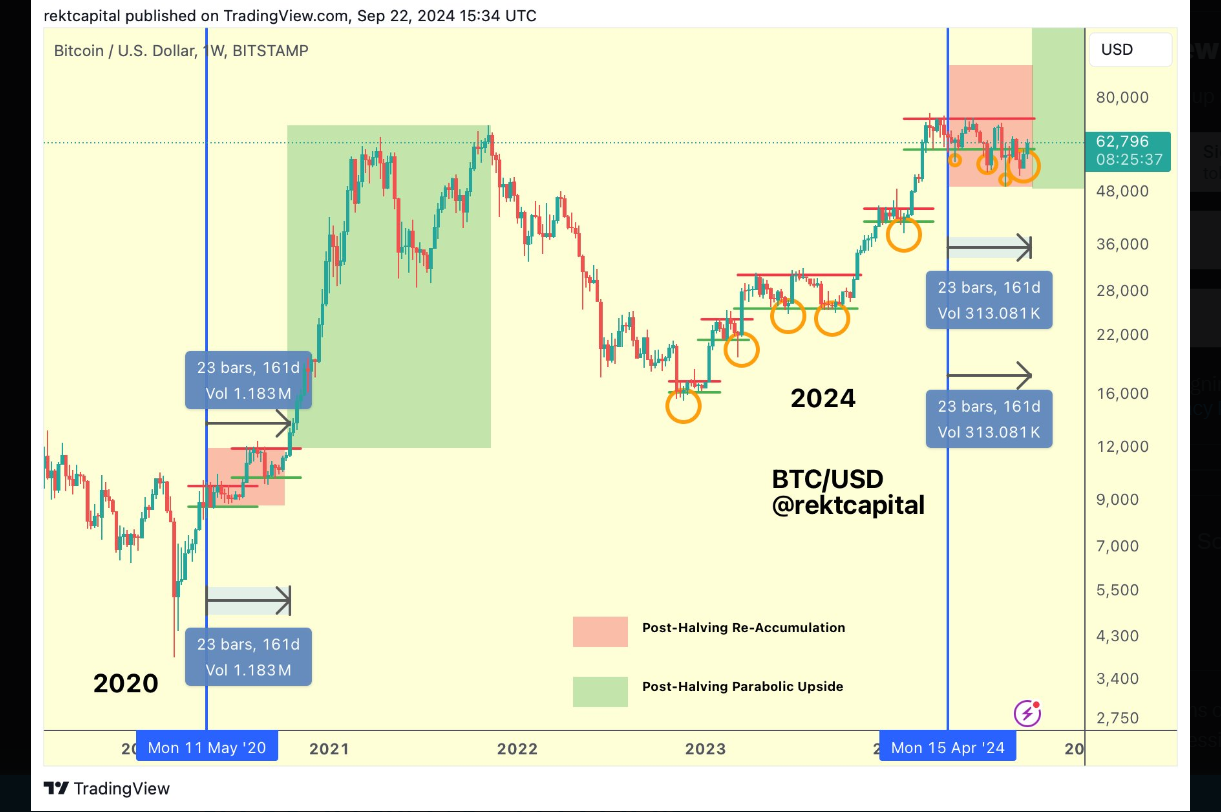

A déjà vu moment on the cards

Does lightning strike in the same place twice? Well, maybe. But in the crypto ecosystem? It’s pretty feasible. That said, Bitcoin is starting its post-halving behavior in 2020 today.

According to a highlight by crypto analyst Rekt Capital, Bitcoin’s price action in 2024 mirrors the market dynamics observed after the 2020 Halving. There are some similarities between both years.

The focus is on the 161-day post-halving period, which led to significant price changes.

Four years ago, Bitcoin’s price surged after breaking out of its Re-Accumulation range, which signified a significant rally. It was represented by advanced buying activity and a change in market sentiment, enabling prices to increase.

Today, Bitcoin is positioned just after the vital 161-day post-halving period, indicating a possible breakout. Bitcoin is trading at $64,382, with a 2.44% increase in the last 24 hours and a 7.1% gain over the past week.

This upward trend shows a similar pattern to 2020 and sustains the idea of a robust rally for Bitcoin ahead.

Analysts call for caution

Bitcoin’s resilient rally of $64,000 has brought it a bit shy of its August monthly high of $65,200. For many, most especially analysts, this could be the foreshadowing of new all-time highs.

Fairlead Strategies shared in their Cryptocurrency Compass report that Bitcoin has increased its relief rally and is now testing resistance from its 200-day Moving Average (approx. $64k), which aligns with its previous peak.

The company warned that “short-term overbought conditions are in place,” which indicated that a pullback could occur before any possible breakout occurs.

Valentin Fournier, an analyst at BRN, opined that Bitcoin’s volatility is decreasing, and the price has remained above the critical $62,500 level. To him, this could be the springboard for other gains.

Yet, he warned,

“We recommend maintaining medium-level exposure to capture potential gains while protecting against the possibility of a near-term dip.”

Six tokens that can rally in a possible altcoin season

With market sentiment high off the Federal Open Market Committee (FOMC) rate cut and Bitcoin’s surge to $64k, crypto enthusiasts and analysts are bullish on a possible altcoin season.

For starters, Ran Neuner, a popular YouTube channel’s founder of Crypto Banter, listed some tokens he thinks can fly if the altcoin season comes around.

Likewise, other altcoins surged during the week and were among the top gainers.

SUI

Currently trading at $1.38, Sui has been making waves in the crypto space for a while now. Buoyed by its integration of USDC on its blockchain, a partnership with Grayscale, and Bitcoin’s return to $64k, it has recorded an 81% surge within the past 30 days. Notably, there’s more to come for the network, which has made many confident that Sui can benefit in the short term if an altcoin season comes upon us.

FTM

Fantom (FTM) surged by 40% within 30 days and now trades at $0.67. It has garnered more attention since its upgrade to Sonic Labs in August. Taking the initiative, Sonic Labs is working on launching Sonic Gateway, a decentralized bridge for transferring ERC-20 tokens between Ethereum and Sonic. This has led to increased investor interest, which bodes well for Fantom.

TIA

Celestia’s TIA increased by more than 21% over the week. It was boosted by the announcement of over $100 million in funding led by Bain Capital Crypto, Syncracy Capital, Robot Ventures, 1kx, and Placeholder. This was done before its $1.12 billion token unlock in October, of which 16.4% of the total supply will be released into circulation. TIA is currently trading at $6.30 but still falls short of its February high of $20.85. Yet, as the token unlock approaches, news regarding TIA will be the talk of the town.

SOL

Not a stranger to lists, Solana (SOL) may be preparing for a strong rally. The fifth-largest cryptocurrency globally has a history of being dominant during altcoin market surges. It would be interesting to see that play out again. Currently trading at $150, SOL has had a 14% increase in the past seven days.

OM

Currently trading at $1.22, Mantra (OM) is up by more than 10% within the past seven days. It has enjoyed bullish momentum ahead of its main net launch in October, which should further propel its price to a new all-time high. The event aims to shed more light on the Real World Asset (RWA) focused blockchain. With more penetration into the market, the resultant effect will push OM upwards and perhaps form a new all-time high.

AERO

Currently trading at $0.97 with a 31% increase, Aerodome Finance (AERO) is one altcoin to look out for. Its total value locked (TVL) has hit a new all-time high of $869.73 million, but it is still primed to grow. Another is the Aerodrome MetaDEX model combines the best features of Curve, Convex, and Uniswap into one robust design. Based on AERO’s fundamentals, its price could grow, leading to increased token adoption.

What happened at Solana Breakpoint?

Solana Breakpoint, like Token2049, was a significant crypto event held in September in Singapore. It drew thousands of crypto enthusiasts, stakeholders, and investors, who collaborated to build for the present and future.

These are some highlights of what went down at Solana Breakpoint 2024:

Fast Forward from Frankendancer to Firedancer

Frankendancer is a new Solana validator in development that aims to improve the ecosystem’s robustness, performance, and safety. One of the most anticipated innovations in Solana, Firedancer, is expected to break new frontiers.

Solana is more future-proof than Ethereum

Jose Fernandez da Ponte, the head of crypto at PayPal, supported Solana over Ethereum in the eternal debate. He said Ethereum was “not the best solution for payments” as a retail payment network would need to facilitate “at least 1,000 transactions per second.” Da Ponte further explained that Solana’s enhanced token creation framework (Token Extensions) was a defining factor in PayPal deploying its stablecoin (PYUSD) on Solana.

TradFi giants to build on Solana

A couple of traditional finance (TradFi) giants pledged to build on Solana, highlighting its high speed, low cost, and other innovative features as compelling reasons. They include:

- Franklin Templeton: The highly-rated asset managing company announced plans to launch a money market fund on Solana.

- Securitize: The leading tokenization platform plans to add native support for Solana, enabling it to deploy its tokenized assets on the network.

- Societe General: The digital asset’s subsidiary, SG FORGE, plans to launch its EUR Convertible (EURCV) stablecoin on Solana.

- Citigroup: Fresh from launching the Citi Integrate Digital Assets Platform (CIDAP) for internal money transfers, Citi group’s head of digital assets, Mark Attard, affirmed that the company wants to explore opportunities to leverage it.

Beyond these, some Solana-based projects stole the show with product updates and other announcements. Jupiter, a DEX, announced the acquisition of a Solana blockchain explorer (Solana FM), while Seeker, a web3 mobile device, has surpassed 140,000 units in presales.

Closing Remark

The crypto community recorded many high points this week, from Bitcoin’s surge to BNB’s anticipated rally ahead of CZ’s release and other altcoins poised to join. Solana Breakpoint wasn’t left out, as the commitment of these TradFi companies to invest in the Solana network bodes well for the general crypto ecosystem.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

Zypto has partnered with MoneyGram to launch an upcoming historic USDC-to-Cash and Cash-to-USDC service. You can soon cash in or out of your Zypto App in USDC at participating MoneyGram locations globally. Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Will BNB reach $600?

With the current positive sentiment and the return of CZ, it is highly likely that BNB will reach $600.

Is Bitcoin bullish, and if so, why?

Bitcoin’s price has been resilient throughout September. Some reasons include the Federal Reserve’s rate cut and other market conditions.

What are the six tokens that can rally in an altcoin season?

The six tokens include Sui (SUI), Fantom (FTM), Celestia (TIA), Solana (SOL), Mantra (OM) and Aerodome Finance (AERO).

Is Bitcoin going to have a new all-time high (ATH)?

Although Bitcoin has rallied back to $64,000, it remains unseen if it can topple its current all-time high (ATH) of $73,000.

What is Solana’s Breakpoint?

Solana Breakpoint is a multi-day event where developers, creators, stakeholders, investors, and enthusiasts meet to discuss about advancing the Solana network.

0 Comments