This week has been ultra-positive for the crypto ecosystem. Bitcoin broke past the $60,000 resistance, and this resurgence impacted other altcoins. Also, Tether made some giant strides by announcing key collaborations with major players in the blockchain ecosystem.

Let’s get into it!

Are Altcoins going on a bull cycle?

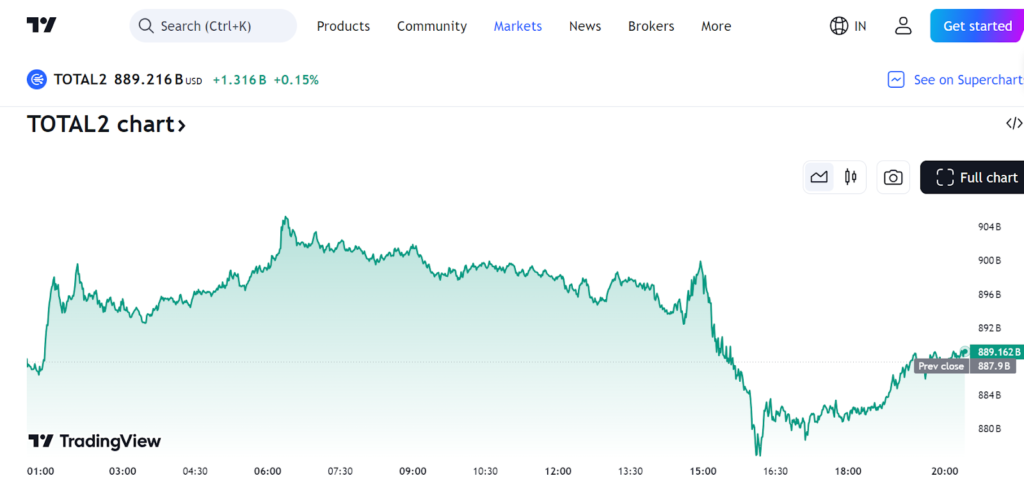

Volatility in recent months has rocked the crypto market massively. Altcoins have, without a doubt, been the biggest losers in the tumble. Since March 2024, altcoin market value has reduced from $1.27 trillion to around $880 billion.

Yet, it’s not all gloom and doom.

Analysts preach Altcoin optimism

Famous analyst Moustache asserts that this downturn might end soon. In a tweet, Moustache pointed out a vital action: USDT.D — which measures Tether’s market dominance — has recently broken its five-year uptrend. He posted this picture alongside his comments.

Typically, a drop in USDT.D foreshadows a rise in cryptocurrency prices. This is because investors gravitate towards altcoins. This could signify the beginning of a broader market.

Another crypto expert, Michael van de Poppe, advises using Dollar-Cost Averaging (DCA) with altcoins to prepare for the subsequent rise. He compared the current situation to previous bull runs in 2017 and 2021 and how things later ended up.

To him, altcoins can make a strong comeback despite their current struggles. One of his reasons is based on historical patterns from past bull markets. Secondly, Van de Poppe remarked that Bitcoin’s increase might lead to a rebound for altcoins.

Altcoins enjoy resurgence thanks to Bitcoin

The cryptocurrency market rallied as Bitcoin broke past the $60,000 resistance. This momentum spilled over into significant altcoins like Ripple (XRP), Binance Coin (BNB) and Tron (TRX).

XRP has risen by almost 6%, and its trading volume has surged by 57% to $2.23 billion. Likewise, BNB’s price has gained around 7%, with its trading volume appreciating by 127% and reaching $850 million, while TRX increased by 6.8%.

Other less popular altcoins have shown immense growth potential. In no short time, they will become attractive to investors.

The top 10 promising Altcoins

These are some of the top altcoins that seem promising due to their innovation and growing adoption.

- Helium (HNT): It has increased by 65.97% within the past 30 days.

- Zcash (ZEC): It has grown by 42.33% over the past 30 days.

- Aave (AAVE): It has witnessed a 31.29% increase in the last 30 days.

- Tron (TRX): It has grown 8.55% last month.

- Sui (SUI): Has increased 8.47% within the past 30 days.

- Tether Gold (XAUt): It has grown 5.48% in the last 30 days.

- Unus Sed Leo (LEO): It has risen 8.42% last month.

- Ripple (XRP): It has grown by 3.94% in the last 30 days.

- Klaytn (KLAY): It has risen 1.38% last month.

- 1000SATS (SATS) has shown steady growth, with a 0.02% increase in the last 30 days.

Bitcoin rises above $60k

Bitcoin has breached the $60,000 mark after a week of bearish consolidations. At this time, Bitcoin has been up by 4% in the past 24 hours and trading above $61k, with its market cap surpassing the $1.2 trillion mark for the first time in the past week.

This marks a significant action as the coin approaches the pivotal 200-day moving average, roughly $63k. If it can surpass this level, it could inspire confidence in investors.

According to reports, the net inflows into Bitcoin spot ETFs were more than $61 million, the most since the $192 million it recorded in August. Bitwise’s BITB had an outflow of $25 million, while BlackRock’s IBIT had the most inflows with $192 million.

This has sparked a flurry of increases in the cryptocurrency market.

Bitcoin’s increase causes market-wide surge

The global crypto market capitalization increased by 2.8% over the past 24 hours to $2.24 trillion. Its daily trading volume increased by 49%, reaching $29 billion. This has made old BTC holders react.

Per data from Santiment, Bitcoin’s one-year dormant circulation rose from 1,806 BTC to 6,759 BTC in the same timeframe. Also, the number of whale transactions comprising at least $100,000 worth of BTC increased from 5,041 to 7,565 unique transactions over the past 24 hours.

Yet, the Bitcoin Relative Strength Index remains below the 50 mark, which means it is not overbought despite the price surge.

Recent data indicates that the long-term holders (LTH) market cap gained a positive net value of $3 billion. Short-term holders (STH), however, sell at a worse price.

XRP price surges: Up to $1 soon?

As Bitcoin and other altcoins have started recovering on the charts, XRP has joined the team. It had a price surge of 3.5%, outperforming other coins. Still, the best may be yet to come.

Crypto analyst Dark Defender noted that XRP had reached the Fibonacci zone of 61.80% at $0.6044. He further remarked that it was trying to break at this point and go higher.

According to Dark Defender, XRP has indicated a bullish outlook. They include increasing trading volume, an upward channel breakout, a golden cross formation by its relative strength index (RSI), and green Heikin Ashi candles and Heikin Ashi candles.

Is $1 realistic?

Based on its current trajectory, XRP could be targeting different price levels. They include:

- $0.75: A near-term resistance level based on the upper boundary of the upward channel.

- $0.93: The expected price target provided that the positive momentum is sustained.

- $1.00: A critical level that could be hard to reach, but a breakout beyond this could lead to a considerable uptrend.

There is further cause for optimism regarding XRP due to some occurrences.

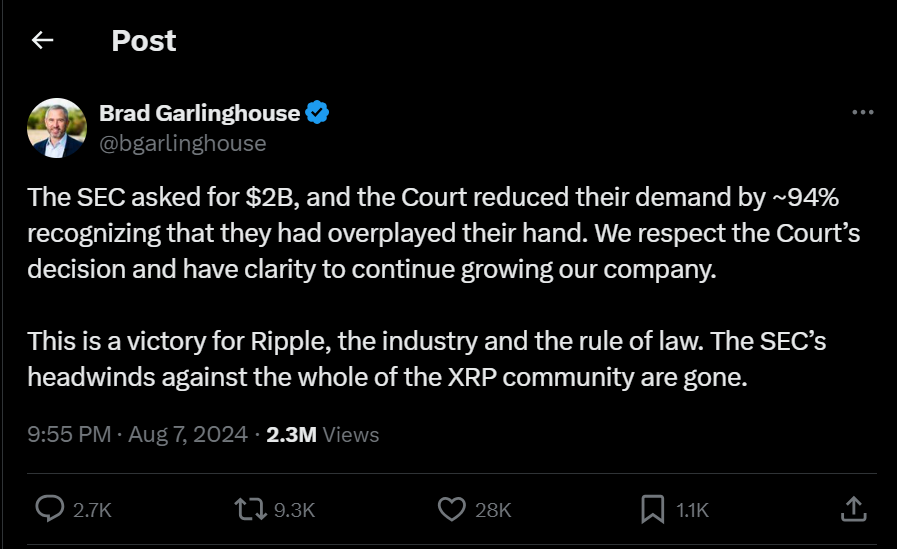

First is the recent conclusion of the SEC vs. Ripple Labs lawsuit. Ripple Labs was ordered to pay ‘just’ $125 million in penalties, touted as a victory for the company and the crypto community.

So far, Ripple’s on-demand liquidity (ODL) business has been smooth sailing. It continues with its operation outside the U.S.

Secondly, the anticipated XRP ETF launch and the RLUSD stablecoin have further led to XRP’s price surge. Ripple Labs has been actively pursuing these initiatives and remains convinced that they will take shape soon.

Tether makes big moves

Tether has made some strategic moves lately to improve digital currency accessibility and adoption. It has partnered with blockchain networks, investor firms, and the country!

Tether launches USDT on Aptos

Tether has launched USDT on the Aptos blockchain. The idea is to enable Tether to utilize Aptos blockchain’s scalability and speed to provide users with “extremely low gas fees, costing only a fraction of a penny.”

Paolo Ardoino, CEO of Tether, outlined the benefits of Aptos’ technology with USDT.

“The team at Tether is excited to integrate and collaborate with the Aptos ecosystem, enhancing our commitment to making digital currencies more accessible and functional.”

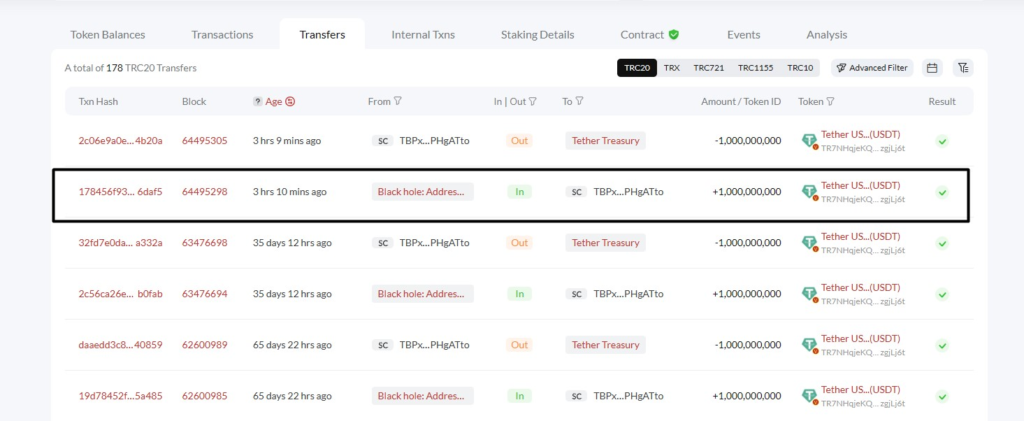

Tether mints $1 billion USDT on Tron

In addition, Tether has minted $1 billion USDT on the Tron network. Data showed that Tether minted many tokens and sent them to its treasury wallet.

Lookonchain said the ‘Tether Treasury’ wallet minted $33 billion in stablecoin tokens in the last year. So far, it has been reported that 19 billion USDT were minted on the Tron network, while the other 14 billion were minted on Ethereum.

Tether to develop a UAE-pegged stablecoin

Finally, Tether announced plans to develop a UAE Dirham-pegged stablecoin. Tether outlined plans to collaborate with Abu Dhabi-listed crypto conglomerate Phoenix Group (PHX) and Green Acorn Investments Ltd.

It marks Tether’s latest intended stablecoin addition alongside U.S. Dollar (USDT), Chinese Yuan (CNH), Mexican Peso (MXN), and Euro (EUR).

Tether aims to seek licensing for the stablecoin under the U.A.E central bank’s Payment Token Services Regulation. This could be a statement of intent, especially when considering Dubai and Abu Dhabi’s reputation as crypto hubs.

UAE has been a significant global crypto hub for the past two years. It has experienced a surge in crypto investment following the establishing of the Virtual Asset Regulatory Authority in Dubai. Coinbase CEO Brian Armstrong praised its “forward-thinking” approach to digital assets, while Binance identified the country as a “focal point” for the crypto ecosystem.

Paolo Ardonio further buttressed this point in a statement. He said the new stablecoin is aimed at “businesses and individuals looking for a secure and efficient means of transacting in the United Arab Emirates Dirham,” including cross-border payments, reducing transaction fees, trading, and diversification of assets.

Tether continues to lead the way with a $117 billion market cap valuation out of a $150 billion global stablecoin market capitalization. Still, projections show it could grow to $2.8 trillion by 2028.

Closing Remark

Ever the leader, Bitcoin’s resurgence this week came as a much-needed positive news for crypto enthusiasts. And as usual, its increase had far-reaching consequences.

First, it boosted the global market capitalization. Secondly, it increased the prices of altcoins — the biggest winners being XRP, BNB, and TRX. To that end, some other promising altcoins are now on the horizon.

Moreover, expert predictions on an XRP bull run may come to fruition, mostly as multiple chart patterns align to corroborate this. Still, is $1 realistic? Time will tell.

Tether is breaking boundaries and pushing new frontiers in the ecosystem. Launching USDT on Aptos is a masterstroke as it supports broader use cases due to the network’s speed and scalability.

Also, developing a UAE-pegged stablecoin is another no-brainer, considering Abu Dhabi’s progressive stance towards the blockchain space. At this rate, Tether might just go on to launch stablecoin for all currencies.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

Zypto has many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust payment gateway to give you a refreshing and safe experience.

You can also check our blog for more cryptocurrencies, NFTs, Web3, altcoins, and blockchain technology resources. Join the Zypto Crew, and let’s make your crypto journey easy and smooth.

Zypto has partnered with MoneyGram to launch an upcoming historic crypto-to-cash and cash-to-crypto service. You will soon be able to cash in or out of your Zypto App in USDC at participating MoneyGram locations globally.

Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Will altcoins go on a bull run soon?

According to some analysts, a bull run for altcoins may be on the horizon based on historical patterns from past bull markets.

Can XRP hit $1 soon?

Based on XRP’s current trajectory, there is cause for optimism, but it remains yet to be seen.

Why does Tether want to launch a UAE-based stablecoin?

Dubai and Abu Dhabi are reputable as some of crypto’s major economic hubs in recent years.

Is Tether’s partnership with Aptos a good thing for crypto?

Yes, it is, as Tether aims to utilize Aptos blockchain’s scalability and speed to provide users with extremely low gas fees.

Will Bitcoin surpass its current all-time high (ATH) soon?

Although Bitcoin breached the $60,000 mark, it remains to be seen.

0 Comments