It has been a positive week in the crypto ecosystem. There have been some developments in partnership between crypto protocols. Also, some historic milestones have been recorded through transactions and active addresses.

Let’s dive in.

Is Toncoin ready to return to $8?

As has been the case for most of the year, Toncoin (TON) and the Open Network blockchain are back in the spotlight. This is time, though, for a good reason.

On September 15, the value of the USDT stablecoin issued by Tether on TON exceeded $1 billion. This surge signals heightened interest in Toncoin as the USDT was less than $800 million as of August 31.

This gain recorded in the TON blockchain could boost Toncoin’s fortune in many ways. Increased USDT volume could encourage more user activity, user fees, and demand for the coin, as well as a possible price increase.

But how high can the price get? Can it return to its all-time high of $8.24?

How high can Toncoin grow?

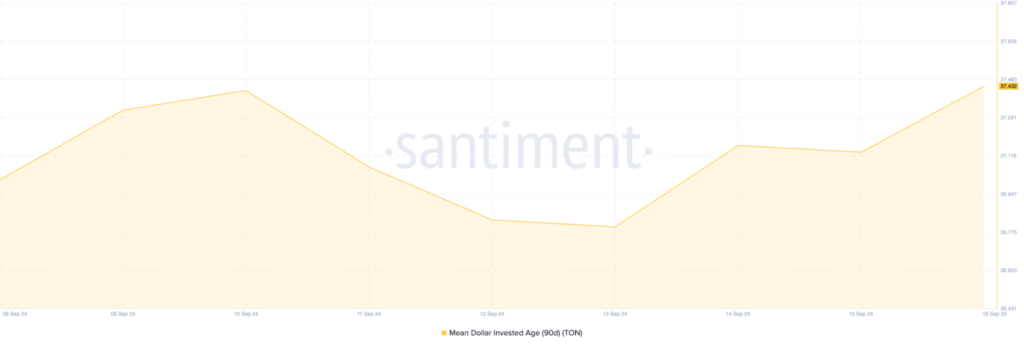

As of this writing, Toncoin is $5.54, a 32% decrease from its previous peak in June. Yet, on-chain data from Santiment reveals a rise in the Mean Dollar Invested Age (MDIA) – a metric measuring the average age of every dollar invested in a coin.

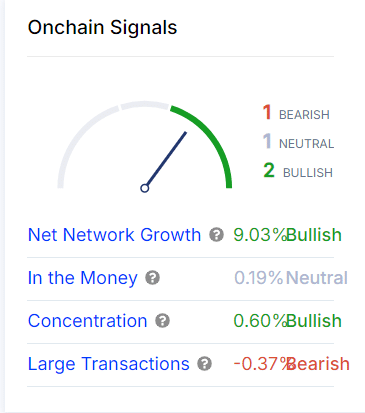

Furthermore, per data from IntoTheBlock, Toncoin’s net worth has risen by 9.03%. This signifies a steady influx of new users into the network, proof of increasing interest. Still, there has to be a corresponding buying pressure to prevent a reversal.

Similarly, concentration has grown by 0.60%, which shows that whales are accumulating. This signals confidence in Toncoin’s long-term potential and somewhat stabilizes the market.

However, there is also a 0.37% decline in large transactions, indicating traders’ hesitation to make big moves in the market until the emergence of more apparent trends.

Toncoin has strong support at $5.20, which helped push its price above the 20-day Exponential Moving Average (EMA). This has the markings of a bullish trend, and this setup had a significant role in Toncoin’s previous all-time high (ATH) of $8 in June.

The coin currently faces resistance at $6, a critical zone. Yet, if demand keeps accumulating, TON could surpass this level and reach $8.32 before the year ends.

TON Partners with Curve Finance

The TON Foundation has announced a collaboration with Curve Finance, a decentralized exchange (DEX). This partnership aims to “incubate a new TON-based stable swap project” to improve user experience and stablecoin trading on the blockchain.

Curve Finance will implement its Constant Function Marlet Maker (CFMM) technology. This tech is known for reducing the price impact on stablecoin and equivalent asset swaps, enabling more efficient asset exchanges.

Vlad Degen, the DeFi lead at TON Foundation, expanded on this.

“By integrating Curve’s CFMM technology, TON can make trading much more accessible to those who might not already be fully embedded into the ecosystem.”

An independent team will be selected to lead the project through a transparent process. The team will be empowered to utilize Curve Finance’s stable swap formula in their project. The new project’s tokens will also be airdropped to qualified participants.

The companies gave a press release,

“The collaboration with TON Foundation aims to improve the stablecoin trading experience on TON, making TON-based trading more accessible and accelerating the blockchain’s pace of adoption.”

Chainlink looks bullish

Trading at $10.65 with a market cap of $6.4 billion and ranked as the 14th largest cryptocurrency on Coinmarketcap, Chainlink is always one coin to look out for.

Some recent price movements in the LINK/USDT pair have begun indicating positive signs for traders on the prowl for both long-term and short-term gains. None is more critical than how Chainlink’s price formed crucial patterns.

The support zone around $9.5 has become a strong floor; Chainlink is trading under the $12.35 resistance level. There’s a low selling pressure indicating a possible breakout.

A breakout above the upper trendline could signal continued upward momentum if prices gravitate away from the $9.5 support level. This could help get LINK to $13.00, a 15% increase and a support floor.

The Chaikin Money Flow (CMF) indicator was positive, indicating buying pressure and a possible price rise.

Why else is Chainlink looking bullish?

LINK balance based on holdings

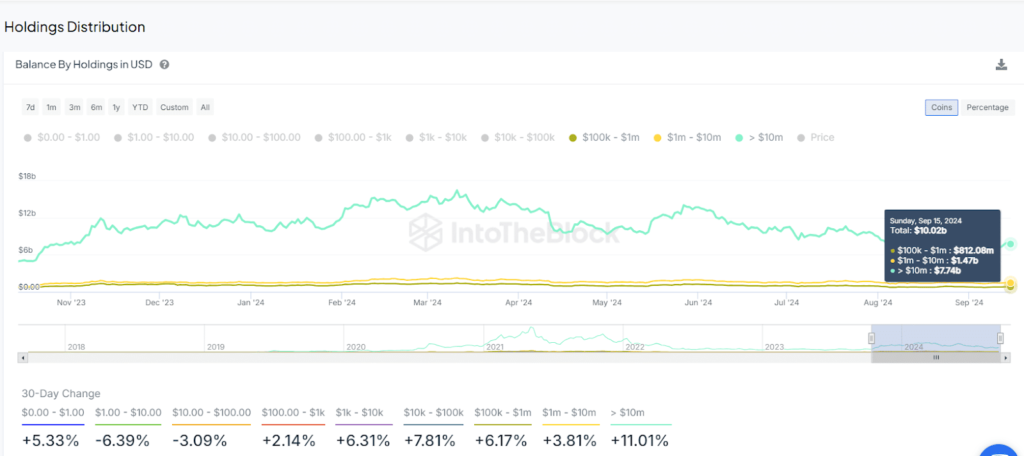

The distribution of Chainlink holdings also supports a bullish outlook.

The 30-day change in LINK balances indicated positive signs across several holding classes — from $100 LINK tokens to more than $10 million worth of LINK.

It is noteworthy that whales have increased their holdings by $10 million and $1 million. This is further proof of the rising interest and adoption of LINK.

The former have witnessed an increase in their balance by 11%. This has brought their total to $7.74 billion. The latter has also seen its balance reach $1.47 billion.

Market sentiment for LINK

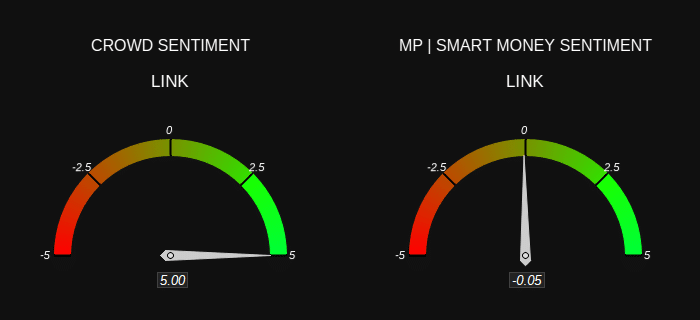

Market sentiment is a vital factor for gauging customer interest in the community. That can’t be overemphasized. So, what is the market sentiment for LINK?

The market sentiment for LINK shows a contrast between retail traders (CROWD) and institutional players (SmartMoney).

The crowd sentiment is noticeably bullish at 5. For Smart Money, it is slightly bearish at -0.05. Overall, the market sentiment is mainly bullish, although other dynamics will determine LINK’s movement.

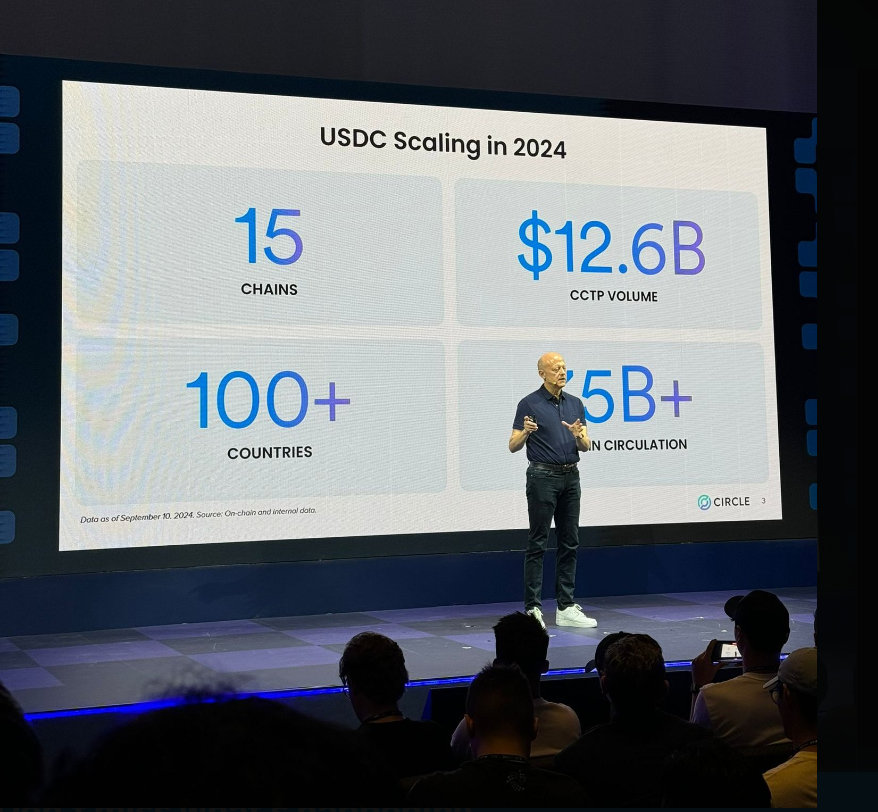

Circle’s USDC to launch on the Sui network

USD Coin (USDC), the second-largest stablecoin globally, will soon be natively supported on the Sui network. It is historic as Sui will be the first Move-based blockchain to support USDC.

Sui is a layer-1 (L1) blockchain that enhances digital asset ownership by offering fast, private, and secure transactions. Its focus on high-speed transactions makes it suitable for a wide range of real-time applications.

The news was announced by the co-founder and CEO of USDC issuer Circle, Jeremy Allaire, on his official X account (formerly known as Twitter).

This development expands the stablecoin’s (USDC) support beyond 15 blockchain networks. Some of the other networks include Algorand, Base, Ethereum, Polkadot, and Solana, amongst others.

So, what does this mean for USDC?

Sui to support USDC through CCTP

USDC will be supported on the Sui network through the Cross-Chain Transfer Protocol (CCTP).

Cross-Chain Transfer Protocol (CCTP) is a permissionless on-chain utility that facilitates USDC transfers securely between blockchains through native burning and minting.

The integration of USDC and CCTP is expected to boost Sui’s usability, security and interoperability for developers and users.

As a general-purpose blockchain, Sui typically enables developers to build apps for different cases. Now, with this partnership, developers can quickly build with USDC. In addition, CCTP will help design cross-chain experiences by connecting their Sui apps to the other blockchains USDC supports.

Adeniyi Abiodun, the co-founder and chief product officer of Mysten Labs – the developer of the Sui network – had some choice words.

“The availability of USDC as a native asset on Sui marks another important milestone in the maturation of the Sui ecosystem.”

He added,

“Combined with USDC’s world-class technology, the native USDC provides the Sui community with seamless access to one of the world’s most trusted digital currencies and solidifies Sui’s position as an industry leader.”

Circle still has some new developments in the works.

Circle makes other big moves

Circle plans to move its headquarters to New York City in some other development. Circle is set to move its legal headquarters from Ireland to the United States.

It will move into the city’s iconic One World Trade Center, occupying the top floor of the tall building.

“This is not going to be an ‘office,’ it’s going to be a powerful convening space that our industry and global leaders will benefit from,” Circle said.

Moving to the U.S. was a strategic move amid the complex regulatory environment for cryptocurrencies. It comes against the backdrop of a need to align with U.S. financial regulations as the company plans for an anticipated initial public offering (IPO).

It filed for the IPO in January, subject to the Securities and Exchange Commission (SEC) review and enduring market conditions.

Circle previously tried to go public through a $9 billion special-purpose acquisition company (SPAC) deal. But the plan never took off and was abandoned in December 2022.

Furthermore, Circle has also announced the expansion of its USDC stablecoin services to the Americas in Brazil and Mexico.

It now supports local bank transfers via PIX and SPEI, which are the payment systems for both countries. That way, there is a direct and instant conversion of Brazilian Reals and Mexican Pesos into USDC.

Circle’s integration with top banks enables 24/7 banking, and USDC conversion – using local currencies – facilitates access for more customers.

This is a part of the company’s global banking adoption plan for USDC.

Base reaches new milestones

Base, Coinbase’s Layer 2 solution, has announced an all-time high record of processing more than 4.5 million transactions in a single day. In the same vein, its number of active addresses has also hit a record of more than 1.9 million.

What is behind these Base milestones?

A vital reason can be attributed to the launch of cbBTC, a Bitcoin token on the Base network. cbBTC enables Bitcoin holders to access Ethereum’s decentralized finance (DeFi) ecosystem without the conversion of their assets.

This then helps to provide liquidity to DeFi protocols and trade on decentralized exchanges (DEXs), thus providing opportunities for Bitcoin holders.

Consequently, many Bitcoin holders have moved their assets into the Base network in a bid to capitalize on these new opportunities. This has increased the number of active addresses and the transaction volume.

What is next for Base?

These tremendous milestones reveal a growing interest in and adoption of Base by developers and users. The Layer 2 solution has high speed, low gas fees, and an overall ability to efficiently handle increased demand.

Furthermore, the successful launch of cbBTC outlines the need for interoperability and accessibility in facilitating blockchain adoption. With its utility well publicized, more users and developers will be onboarded on the Base network.

With over $1.6 billion in total locked volume (TVL), Base is the sixth-biggest blockchain globally, just behind the likes of Ethereum, Tron, and Solana, amongst others.

Considering its current trajectory, you won’t be wrong to bet on Base to keep capturing market share in the DeFi space.

Closing remark

Everything the Open Network (TON) touches turns to gold at this point. With the value of USDT on TON exceeding $1 billion, this is poised to encourage more user activity on the blockchain.

Could it lead to a price increase for Toncoin?

On the other hand, Chainlink seems bullish due to some signs, such as a massive increase in Chainlink holdings by whales, market sentiment, and price patterns.

Circle keeps making giant strides by launching on the Sui network, moving its headquarters to New York and expanding to Brazil and Mexico.

Finally, Base reaches new milestones in terms of number of single day transactions and number of active addresses. At this rate, it is poised to keep making history.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

Our Zypto App has many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust payment gateway to give you a refreshing and safe experience.

You can also check our blog for more cryptocurrencies, NFTs, Web3, altcoins, and blockchain technology resources. Join the Zypto Crew, and let’s make your trading journey easy and smooth.

Zypto has partnered with MoneyGram to launch an upcoming historic USDC-to-Cash and Cash-to-USDC global service. You can soon cash in or out of your Zypto App in USDC at participating MoneyGram locations globally.

Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Can Toncoin return to its former ATH of $8?

Until the emergence of more apparent trends, we can’t say for sure.

How is Chainlink looking bullish?

Chainlink looks bullish due to some price patterns and market sentiments.

Why does Circle want to launch on Sui network?

With Sui, users can conduct fast, private, and secure transactions using USDC.

0 Comments