As the crypto space continues to innovate and expand, this week brings exciting updates. Sonic SVM will launch a $12.8M sale of 50,000 HyperFuse nodes to support its gaming platform on the Solana blockchain, scheduled for the week of September 16, 2024.

In another development, U.S. Judge Brian Martinotti rejected Coinbase’s request to dismiss a proposed class action by the exchange’s shareholders. The ruling requires Coinbase to face lawsuits concerning SEC risks. Meanwhile, Bitcoin and crypto markets see volatility amid FED rate cut anticipation.

Sonic SVM Plans $12.8M Node Sale

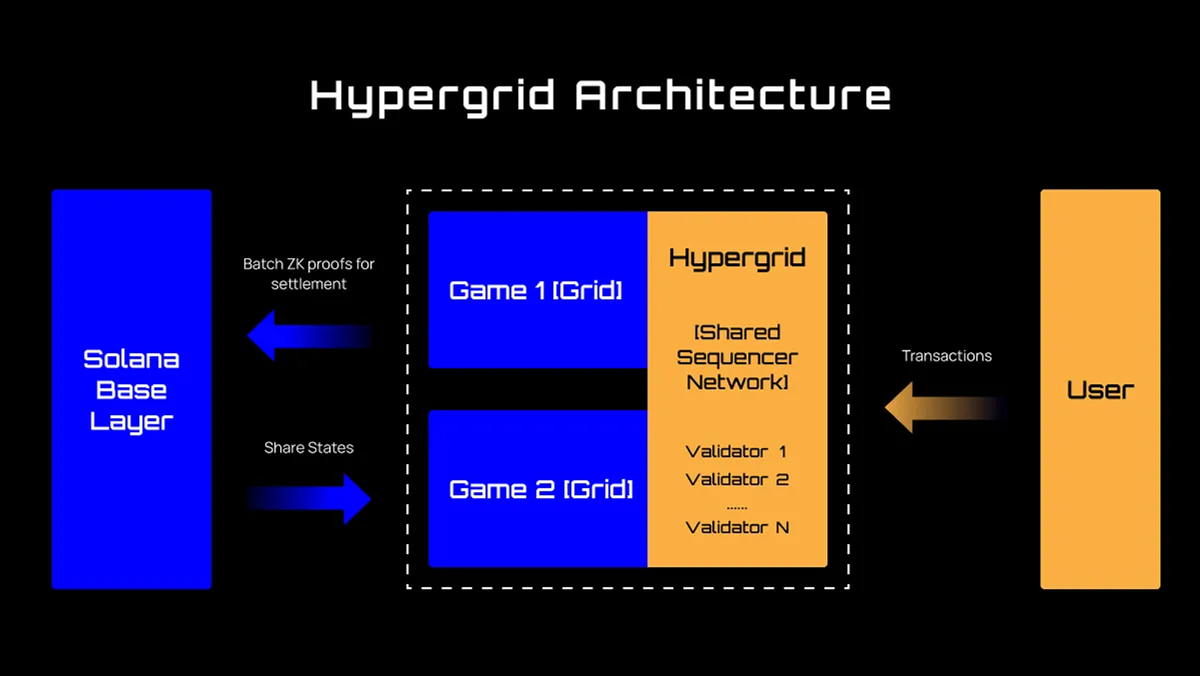

Sonic SVM, a gaming-focused blockchain project, is preparing to raise $12.8 million by selling 50,000 HyperFuse nodes to bolster its platform on the Solana blockchain. This sale, scheduled for the week of September 16, 2024, is the first of its kind on the Solana ecosystem. The nodes are part of the HyperGrid framework, which is designed to optimize blockchain networks for gaming applications.

This node sale comes on the heels of a $12 million Series A funding round led by Bitkraft, with additional investments from Galaxy Interactive and Big Brain Holdings. Sonic’s strategy to fundraise through node sales mirrors the approach taken by other blockchain projects such as Aethir and CARV, which have successfully raised substantial sums through similar models. For instance, Aethir raised $126 million by distributing 73,000 node licenses on Ethereum.

Sonic SVM’s co-founder and CEO, Chris Zhu, stated that the funds raised from the node sales would be used for development, platform security, and rewarding participants with tokens. Node holders will play a critical role in validating and securing the HyperGrid network, contributing to the ecosystem’s decentralized structure. These sales also offer investors the opportunity to acquire Sonic Tokens at a valuation lower than that of venture capitalists, potentially driving Sonic SVM’s growth in the blockchain gaming space.

What This Means for Solana and the Blockchain Space

Diagram of the HyperGrid Architecture

Solana is already one of the most scalable blockchain platforms, capable of processing up to 65,000 transactions per second (TPS). Sonic SVM’s HyperGrid framework aims to further amplify Solana’s scalability, particularly within the booming blockchain gaming sector. As gaming platforms continue to grow, having a network that can handle high transaction volumes is essential for long-term sustainability..

The proceeds from the node sale will be funneled into development efforts, grants for decentralized app (dApp) developers, and other strategic initiatives aimed at expanding the Solana ecosystem. With its decentralized architecture, HyperGrid will also enhance network security and resilience. This marks a pivotal moment for both Sonic SVM and Solana, solidifying their positions in the rapidly evolving blockchain gaming industry.

Bitcoin and Crypto Markets See Volatility Amid Fed Rate Cut Anticipation

The cryptocurrency market experienced a significant downturn this week, with Bitcoin (BTC) dropping 1.4% to $57,800. After a stable weekend above $60,000 fueled by encouraging U.S. economic indicators, the market’s attention has now shifted to the impending interest rate decision by the Federal Reserve.

This anticipated rate cut, the first in over four years, has led to declines across the broader crypto landscape. Ethereum (ETH) slipped by 0.83% to $2,270, while Binance Coin (BNB) experienced a steeper 3.4% loss, trading at $530.

Despite the market pullback, Bitcoin saw positive institutional sentiment as U.S.-listed Bitcoin ETFs recorded $436 million in net inflows, marking the strongest performance since July 22. In contrast, Ethereum ETFs saw $19 million in outflows, continuing a trend of weaker investor confidence.

Anticipating the Fed’s Next Move

The upcoming Federal Reserve decision on interest rates is being closely watched. Predictions from Polymarket bettors suggest a 51% likelihood of a 50 basis point cut, with a 48% chance of a more modest 25 basis point reduction, and a mere 2% chance of no change. Historically, a reduction in borrowing costs tends to foster bullish behavior in risk assets like cryptocurrencies.

Market participants believe that a rate cut could reignite optimism, which has been dampened by recent declines. However, if the rate cut exceeds expectations, it may signal more serious economic concerns, adding to market uncertainty.

Spotlight on Bitcoin and Altcoins

Bitcoin’s dip below $60,000 has sparked further analysis. Some suggest that short-term traders capitalized on profits after a streak of positive movement, reflected in the STH-SOPR index surpassing 1. Meanwhile, long-term holders have remained steady, eyeing a key support level at $58,100. If this level is breached, analysts suggest Bitcoin may test the $55,000 range.

The altcoin market saw mixed performances as well. Ethereum, Solana, and XRP posted slight gains of up to 1%, while Avalanche, Shiba Inu, Cardano, and BNB suffered losses of up to 5%. Nervos Network (CKB), however, bucked the trend with a 10.5% surge following its listing on Upbit, a major Korean exchange known for its active memecoin trading community.

Economic Uncertainty Heightens Market Tensions

The uncertainty surrounding the Federal Reserve’s decision has caused further disruption in the market. Traders are bracing for a potential 50 basis point rate cut, a sharp rise from the 14% probability just a week ago, according to CME data. As a result, Bitcoin dropped 3%, while Ethereum fell by 3.5%, with both trading around $58,000 and $2,300, respectively.

Adding to the tension, several Democratic senators, including Elizabeth Warren, have called for an even larger 75 basis point cut to prevent a potential recession. They argue that with inflation cooling and labor market conditions softening, a more aggressive rate reduction would mitigate economic risks. The demand for drastic action has prompted mixed reactions, with venture capitalist Marc Andreessen supporting the idea on social media.

Coinbase Must Face Shareholder Lawsuit Over SEC Risks, Judge Rules

In a significant development this week, Coinbase must face a shareholder lawsuit regarding potential risks with the U.S.

Securities and Exchange Commission (SEC). On September 6, U.S. District Judge Brian Martinotti, of the District of New Jersey, rejected Coinbase’s request to dismiss a proposed class action by shareholders accusing the company of misleading them about the probability of being sued by the SEC.

The lawsuit, filed in 2022, claims that Coinbase made “materially false and misleading statements” regarding its operations and downplayed the risk of regulatory action. Shareholders argue that the exchange portrayed an optimistic outlook on the likelihood of an SEC lawsuit, despite knowing that listing certain assets could lead to enforcement actions.

Judge Martinotti ruled that the plaintiffs’ allegations were valid, particularly regarding Coinbase’s negligence in communicating regulatory risks. He stated that the exchange and its executives provided a “favorable picture” of their compliance, stressing that the crypto assets listed were not securities, which contradicts the SEC’s stance. In June 2023, the SEC officially sued Coinbase for violating U.S. federal securities laws, escalating the tension between the exchange and regulators.

Although Martinotti dismissed some of the claims in the lawsuit, he allowed others to move forward. He highlighted that the remaining allegations were based on how the court interprets the shareholders’ claims rather than the actual events. As a result, the lawsuit will continue, allowing further examination of Coinbase’s conduct.

A Coinbase spokesperson responded to the ruling, stating: “The Court agreed that a significant portion of the plaintiff’s claims should be dismissed. We remain confident that we are right on the facts and the law and look forward to proving the rest of our case. We appreciate the Court’s careful consideration.”

This ruling adds pressure to Coinbase as it continues to battle regulatory scrutiny and litigation. The exchange’s legal challenges come at a critical time, as the SEC intensifies its enforcement efforts across the cryptocurrency industry.

Conclusion

Sonic SVM is poised to fuel its growth on the Solana blockchain with its upcoming node sales, a key step as the Web3 gaming space expands. With its HyperGrid architecture, Sonic SVM may become a game-changer for blockchain gaming, solidifying its role in Solana’s ecosystem.

Regardless of the outcome, the FED’s decision will undoubtedly influence the trajectory of the crypto market. A larger-than-expected cut may signal deeper economic issues, driving more volatility in both traditional and crypto markets. With Bitcoin already under pressure, traders are bracing for a critical week ahead, with key support levels being closely monitored.

The ongoing legal battle between the SEC and Coinbase highlights the complexities of regulatory compliance in the crypto world. As Coinbase navigates this landscape, it is hoped that they will continue to uphold their high standing while resolving issues with the SEC.

Did you find our crypto news this week interesting? Let’s hear from you!

Zypto is committed to offering unmatched and secure crypto services. Our services are tailored to meet your crypto needs, while offering a smooth and fast onboarding process to get you started in the crypto space. Zypto App comes with robust features to enhance your trading, including virtual and physical cards and an excellent payment gateway to give you a refreshingly simple experience.

Stay updated on the latest in the crypto space through our blog, where we cover hot topics, educational articles, and crypto for business and daily life.

FAQs

What is the SEC Vs. Coinbase Court Case?

The court held that the SEC’s allegations concerning Coinbase’s crypto transactions were sufficient to subject them to federal securities laws under the Howey test. The case proceeds as the court draws reasonable inferences in the SEC’s favor and assesses whether the claims are valid for relief.

What’s Next for the Crypto Market Given The Dip In Bitcoin?

As the financial world awaits the Federal Reserve’s final decision, experts are divided on the best course of action. A 50 basis point cut appears to be the preferred approach for some, who argue it would align interest rates with economic realities without causing confusion in the markets. Others fear that delaying further action may lead to harsher consequences down the line.

Could Sonic SVM’s Node Sales be a Game-Changer for Web3 Gaming?

While we aren’t sure yet, Sonic’s node sale on Solana looks promising, particularly with its innovative HyperGrid framework.

The HyperGrid framework has great potential for the future of Web3 Gaming. With its innovative ideas, Sonic SVM is positioned to transform interaction between blockchain technology and gaming on Solana.

0 Comments