Without a shadow of a doubt, stablecoin supremacy has dominated this week.

On the one hand, Solana is pitching its tent with Solayer to launch sUSD. Next, crypto, fintech and venture capitalist firms partnered to launch a stablecoin network. Bitcoin ETF inflows increased to $2.22 billion, and Solana is now leading the NFT royalties race among blockchains.

Let’s get to it.

sUSD surpasses $10M deposits

Solana has joined the ranks of other blockchains like Ethereum, Bitcoin and BNB Chain in integrating stablecoins.

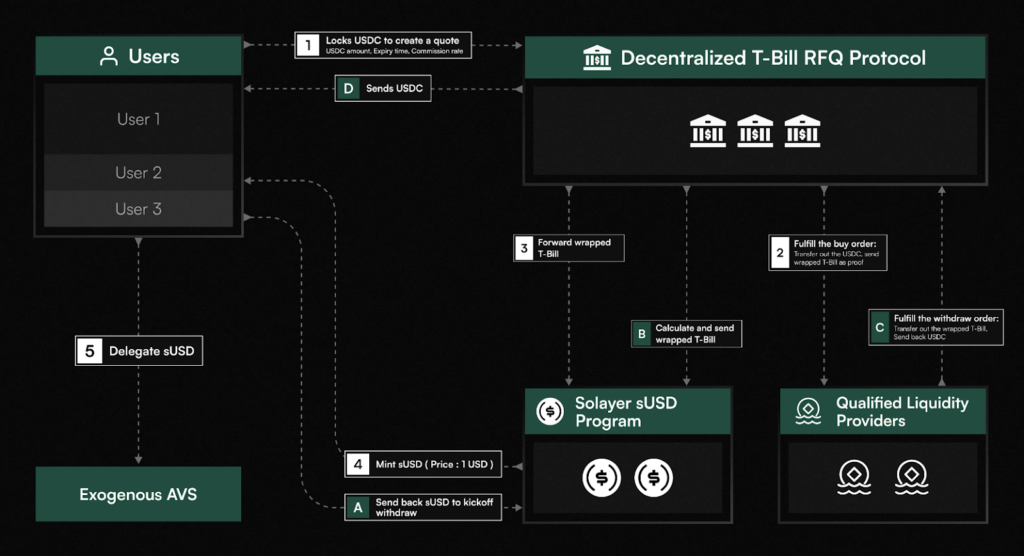

In a post on X, Solayer announced the launch of a stablecoin called “Solayer USD (sUSD) on Solana. sUSD is a synthetic stablecoin backed by real-world assets (RWA) that offers a decentralized alternative to the existing stablecoin.

Solayer USD (sUSD) surpassed 10 million USDC in deposits within its first hour.

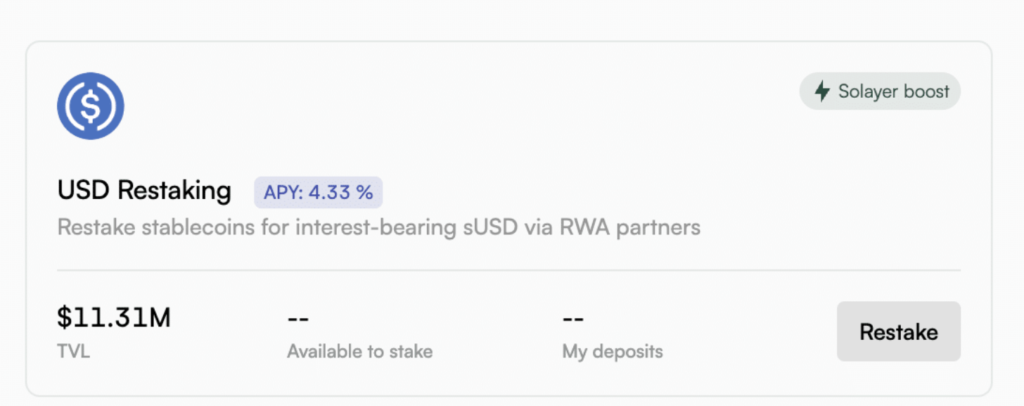

Moreover, based on data from Lookonchain, sUSD enjoyed almost 5,900 deposits, and at press time, its Total Value Locked (TVL) was $11.31 million.

Why did Solayer launch sUSD?

Solayer USD (sUSD) is the latest stablecoin, further providing stability and trust in the crypto space. It differs from most stablecoins in considerable ways, such as:

- Security: sUSD uses the tokenization platform OpenEden and its enhanced features for security.

- Yield-bearing: sUSD offers a 4-5% annual yield for its ecosystem.

- Stability: sUSD is backed by the U.S. Treasury bills (a ‘safe’ investment), which can attract conservative investors.

- Non-custodial Request-For-Quote (RFQ) marketplace: Only token holders can mint or burn sUSD.

Furthermore, Solayer maintains that its system is devoted to user ownership and total decentralization. The platform allows users to mint and obtain sUSD independently without an intermediary.

It affirmed here,

“The irony: most stablecoins are tethered completely to traditional banking infrastructure, drifting away from crypto’s core promise of individual freedom. sUSD is a fully decentralized stablecoin that brings the real world on-chain to create a true open internet.”

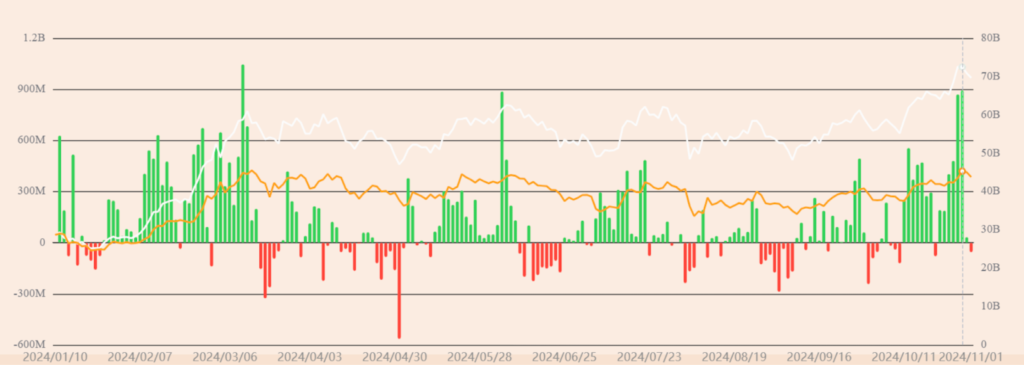

Stablecoins have been in a positive trajectory recently as data from Artemis shows that daily transfer volumes have exceeded $66.77 billion, up 73%. In the previous month, the total volume of transactions surpassed the $2 trillion mark.

Unsurprisingly, this number is dominated by prominent players like Tether (USDT) and USD Coin (USDC). In time, sUSD will be anticipating joining the ranks.

What is the impact of sUSD so far?

While SOL continues to bask in the sector-wide bull run inspired by BTC’s remarkable comeback, the launch of sUSD has also boosted the value of SOL.

SOL surged past the $180 mark for the first time in almost three months. And although it dropped to $175 at press time, it enjoyed weekly gains of 1.76% per Coinmarketcap.

Furthermore, the launch of sUSD has also highlighted growing investor interest in Solana as an alternative asset. This was proven by its inflows, as seen in the weekly CoinShares report.

Solana recorded $10.8 million in inflows, second only to Bitcoin’s remarkable $920 million inflows.

Bitcoin ETF inflows surge to $2.22 billion

Bitcoin (BTC) continues to hold firm at the $68,000 price level as anticipations for a bullish Q4 keep waxing stronger. In recent weeks, the influx of funds into Bitcoin ETFs has been at the heart of this.

For the week ending November 1, data from Sosovalue informed that Bitcoin ETF had a net inflow of $2.22 billion. This number is among the highest for 2024 and the third-largest weekly net inflow in history.

This influx is a positive sign that signals increasing optimism in Bitcoin ETFs as a choice option for gaining Bitcoin (BTC) more exposure. Likewise, it shows demand from institutional and retail investors regarding BTC.

How did BTC react to Bitcoin ETF inflows?

The recent price action of BTC outlines the influence of Bitcoin ETF inflows. Over the previous week, BTC peaked at $72,724 before slightly dropping to about $68,835.

This is proof that bullish sentiment from Bitcoin ETFs is impacting the price of BTC. What’s more? Bitcoin ETFs may continue to contribute to the current market uptrend.

The positive trend may continue as more capital flows into the market, mostly if regulations remain encouraging.

What is the prediction for BTC?

Top analysts predict that BTC will hit trend top prices between $100,000 and $150,000 by the end of 2024. Likewise, analysts also propose new all-time high (ATH) predictions as they study the Bitcoin charts.

They are increasingly confident that BTC will surpass its previous ATH at $73,700 to set a series of new ATHs in Q4 and continue outperforming itself in 2025. One such example is the CEO of the crypto analysis platform, Benjamin Cowen, who posted on X that altcoins are preparing for a grand finale.

However, alt season can only occur when Bitcoin sets new ATHs. According to Cowen, the altcoin reckoning stage should conclude by December 2024 or the second week of January.

Crypto and Fintech firms launch global stablecoin network

Some prominent crypto, venture capital and fintech firms like Robinhood, Paxos, and Galaxy Digital, amongst others, have collaborated to launch the “Global Dollar Network,” per this press release.

This partnership was done to advance the global adoption and application of stablecoins by making them easier to access and integrate, as announced in this X post.

What does this partnership mean?

The Global Dollar Network partnership plans to handle deficiencies in the stablecoin market, like high transaction costs and limited consumer safety.

This can further facilitate the stability of digital assets and promote interoperability among multiple platforms, enabling a seamless experience when transferring stablecoins across different exchanges and wallets.

The Global Dollar Network aims to become a unified platform encouraging individuals and companies to adopt stablecoin transactions. This can further bridge the TradFi (traditional finance) and DeFi (decentralized finance) economies.

The network supports a new stablecoin called USDG, issued by crypto platform Paxos. The token will be overseen by a committee of representatives from the network’s partners like Bullish, Anchorage Digital, Nuveri, etc.

USDG is set to launch into a highly competitive market, where USDT and USDC account for almost 90% of the total market capitalization. Still, it is currently only exclusive to Ethereum, although it plans to support additional blockchains.

It will also allow eligible custodians, payment processors, exchanges and firms to join by invitation, with a plan to develop new and better solutions using USD.

Each network partner’s CEO has been vocal in championing the benefit of USDG regarding attracting broader institutional and mainstream participation.

The co-CEO of Kraken, Arjun Sethi spoke out against a lack of competition in the regulated stablecoin market which has “prevented the industry from reaching its full potential.”

He said,

“USDG upends this dynamic with a more equitable model that will bring mainstream participants into the ecosystem and accelerate new stablecoin use cases.”

Paxos CEO Charles Cascarilla described the Global Dollar Network project as “replatforming the financial system” since leading stablecoins are “unregulated and retain all the reserve economics.”

He added,

“Global Dollar Network will return virtually all rewards to participants and is open for anyone to join.”

Johann Kerbrat, the vice president of Robinhood Crypto, affirmed,

“Stablecoins offer a bridge between traditional finance and cryptocurrencies, enabling faster, lower cost, and more efficient transactions.”

Anchorage Digital’s CEO Nathan McCauley explained that these early adopters will also enjoy “fast peer-to-peer and cross-border transactions and the ability to earn rewards on stablecoin deposits.”

What is its impact on the crypto market?

First and foremost, the Global Dollar stablecoin network is expected to boost stablecoin adoption in the crypto market by breaking down barriers for stablecoin transactions.

Secondly, the network can be attractive to both experienced crypto users and beginners through cross-platform compatibility, easy access to stablecoins and reduced transaction costs. This can further bridge the TradFi (traditional finance) and DeFi (decentralized finance) economies.

Typically, stablecoins provide liquidity in the crypto space. So, the Global Dollar stablecoin network can increase investor and institutional interest in enhancing stablecoin infrastructure.

With the likes of Robinhood, Anchorage Digital, Paxos and the likes supporting the endeavour, there is ample industry support. This may motivate other exchanges, stakeholders and financial institutions to participate.

By and large, the Global Dollar stablecoin network could foster more financial inclusivity in multiple regions via a stable, affordable and accessible digital solution. It also inspires equivalent initiatives in the crypto space.

In addition, with more stablecoin adoption, the crypto market may witness an increased influx of investors, users and capital. This naturally propels the crypto industry forward.

Solana now holds 51% of NFT royalties

Solana (SOL) has surged to capture a 51% share of the NFT royalties market, overtaking Ethereum (ETH).

This signifies a preference for Solana’s high speed, low cost and efficiency among NFT creators and collectors in the crypto industry. All of these foster a low barrier to entry for minting and trading NFTs – including high-profile collections.

Unsurprisingly, SOL’s price has undergone steady growth. Increased NFT activity has surpassed the $180 mark, can further push its price higher and its upward trend can continue.

But is it purely a logical projection?

Can Solana maintain its price gains?

Due to Solana’s growth in the NFT market, there is optimism for an increase in its price. Yet, some risks can prevent this.

Firstly, there is intense competition and saturation in the NFT space due to blockchains like Ethereum, Polygon, Avalanche and the like. In addition, some technical issues (network outages) may affect Solana’s performance.

For Solana to maintain its new spot at the top, there is an overwhelming need for ongoing network improvements, partnerships and innovation.

Closing Remark

Impressively, sUSD surpassed 10 million USDC in deposits within its first hour. It seems that Solayer’s new solution convinces users.

As for the Global Dollar Network, when many top firms collaborate on an initiative, it generates interest. Now, it’s left to see what they do with it.

Solana has stolen a march on its rivals like Ethereum and Polygon to hold the highest market share of NFT royalties. A lot must be done before it can hold onto this position.

Bitcoin ETF inflows keep increasing, this time to $2.22 billion. It shows strong demand from institutional and retail investors regarding Bitcoin (BTC). So, how high can BTC surge to?

Zypto is committed to offering you the best and most secure crypto services. Our Zypto App has many features to enhance your trading, including virtual and physical cards tailored to suit your specific needs and a robust cryptocurrency payment gateway enabling businsses of all sizes to accept crypto payments.

You can also check our blog for crypto education articles, and NFTs, Web3, altcoins, and blockchain technology resources. We make your trading journey easy and smooth.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What is sUSD?

Solayer USD (sUSD) is a synthetic stablecoin built on Solana and backed by real-world assets (RWA) that offers a decentralized alternative to the existing stablecoins.

What impact has sUSD had on the crypto ecosystem so far?

The launch of sUSD has highlighted growing investor interest in Solana as an alternative asset due to its weekly inflows. It also caused the price of SOL to surge past the $180 mark.

What impact does Bitcoin ETF inflow have on BTC?

The massive Bitcoin ETF inflow is a sign of solid demand of interest from institutional and retail investors regarding BTC. Also, it shows that Bitcoin ETFs are a choice option for providing BTC with more exposure.

What is the Global Dollar Network about?

The Global Dollar Network is a partnership formed by some crypto, venture capitalist, and fintech firms to further advance the global adoption and application of stablecoins.

Can Solana’s exploit in the NFT space impact its price?

Yes, however, Solana has to do a lot to sustain its spot as the highest blockchain with the NFT royalties market share.

0 Comments