This week in the crypto market was characterized by multiple whale activities across different blockchains. Different cryptocurrencies had whales either invest or withdraw a massive amount, which led to speculation of price movements. And there was Solana, who celebrated a yearly milestone.

Read on!

Solana’s TVL soars to yearly highs

Despite the recent market cooling, Solana still shows indications of intense network activity. The bears are responsible for suppressing the market excitement formerly witnessed in November and early December.

Regardless, all is going well for Solana, as evidenced by its latest spike in activity. Solana’s TVL just hit a new 2024 high at 55.37 million SOL. Still, the TVL performance is more precise in terms of SOL rather than in dollar value due to SOL price fluctuations.

TVL growth is typically associated with long-term optimism and positive network activity. Solana’s on-chain volume remained high despite the recent bearish sentiment in the crypto market. The network averaged over $3 billion in daily volume in the last two days.

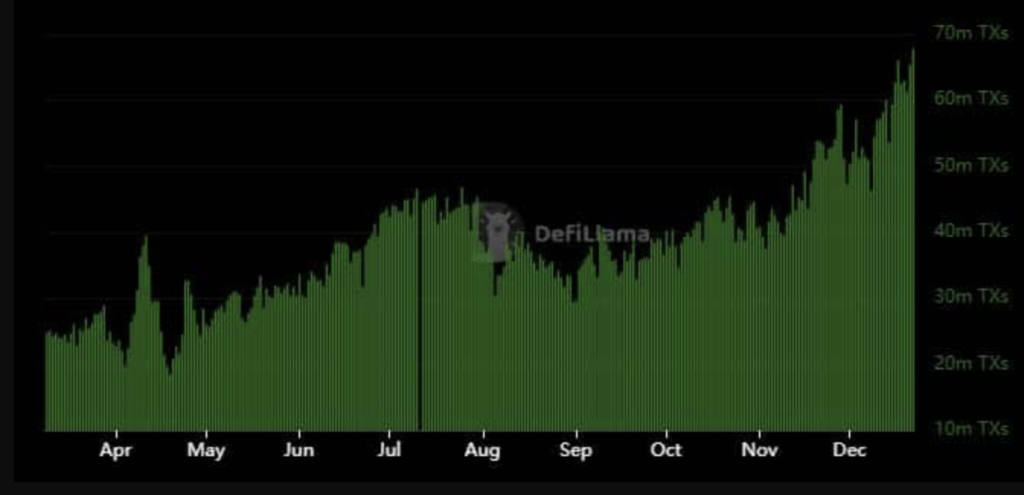

Solana transaction data also showed growing network activity. They have been on an uptrend for months and peaked at 67.77 million transactions in the last 24 hours, the highest recorded transaction count on the Solana network in the previous 11 months.

Will SOL become bullish soon?

The recent surge in Solana’s network activity could indicate a spike in organic demand for SOL. Nevertheless, the overall market performance has been primarily bearish this past week.

SOL reduced by 23% from its highest to lowest level last week. The declining spot outflows may enable a further recovery. Still, the derivatives market revealed that SOL may not be ready for a strong comeback.

Open interest-weighted funding rates were negative in the last two days. This was the first time SOL funding rates were negative in the previous six weeks.

Nonetheless, Solana funding rates started to show signs of going back on the positive side in the last 24 hours.

Dogecoin whales invest $80M worth of DOGE

Dogecoin (DOGE) whales have made a statement of intent by purchasing 250 million DOGE, approximately $80 million. This has signalled massive interest from investors.

Thus, this enormous accumulation indicates that whales are positioning themselves for possible price movements. But this begs the bigger question: Is an upcoming rally being anticipated, or is this just another phase in the market’s volatility?

Whales are market movers

For a long time, the Dogecoin market has been a habitat for whales’ investments. This recent activity further confirms their dominance in the crypto space.

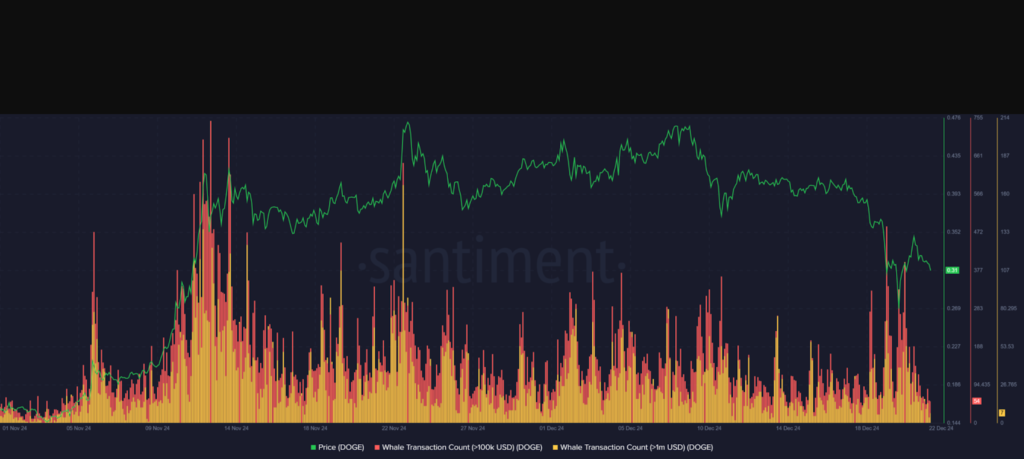

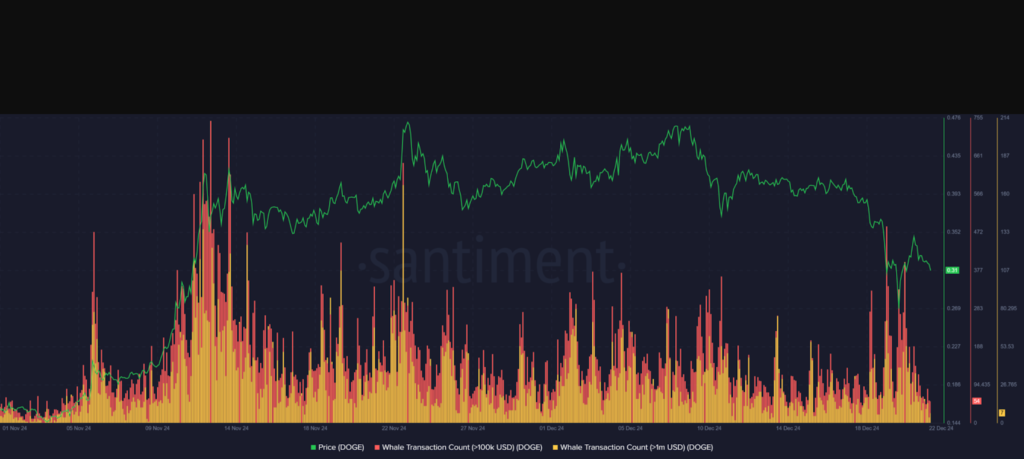

Within the past month, transactions exceeding $1 million surged massively during key price swings. The chart shows whales strategically entering or exiting the market at essential moments.

Impressively, whale activity spiked during DOGE’s rise toward $0.47, fueling speculation about their role in increasing price momentum.

Still, despite the recent decline to $0.31, whale transactions remain potent and show persistent interest. These enormous trades underscore the efficacy of whale movements in influencing market sentiment and liquidity.

With the DOGE holdings increasing by this much liquidity, the spotlight shifts to whether these investors envision a breakout rally or are simply amassing tokens in expectation of favorable market conditions.

So, what is next for Dogecoin?

What is DOGE saying?

Dogecoin (DOGE) has demonstrated a periodic trend of random price surges followed by corrections. In 2017, DOGE increased by 212%, retraced by 40%, and then was boosted by 5,000%.

Likewise, in 2021, DOGE increased by 476%, corrected by 56%, and later rose by 12,000%. This year, DOGE has followed a similar trajectory, surging by 440% from $0.065 to $0.39547 before retracing 46%.

According to crypto analyst Ali, this pattern indicates the possibility for another significant rally if the trend persists as it has in former cycles.

Dogecoin’s recent price movement tells a mixed story. DOGE rallied to a yearly high of $0.47 before sharply retracing and settling near $0.317. This shows a 1.43% descent over the last 24 hours and a 21.3% drop in the past week.

The price downtrend overlaps with broader market corrections, though whale activity exacerbates DOGE’s volatility. In addition, sentiment around Dogecoin emphasizes cautious optimism and high trading volumes suggest active market participation.

That being said, if DOGE can reclaim $0.35, bullish momentum might return.

Conversely, the inability to defend $0.30 could lead to more cons. Therefore, strong market catalysts need to maintain upward movement.

Price data shows DOGE’s support levels at $0.065 and $0.19-$0.20, while resistance is at $0.39547 and $0.73665. Analysts have projected a probable upper boundary of $17.94 if DOGE maintains its historical upward trend.

Dogecoin’s immediate trajectory depends on its ability to regain its old momentum. Its current price level, near $0.31, puts it in a make-or-break zone, with diminishing trading volumes indicating unease about reducing support.

Thus, if whales maintain accumulation, it could indicate confidence in a rebound. There are essential metrics to observe, such as changes in whale transaction counts and increased social engagement to restore speculative interest.

Without a powerful push past $0.35, DOGE risks protracted consolidation or additional downside. The next few weeks will probably test whether Dogecoin can switch from recent volatility into a prolonged recovery phase.

There is increased interest in Dogecoin

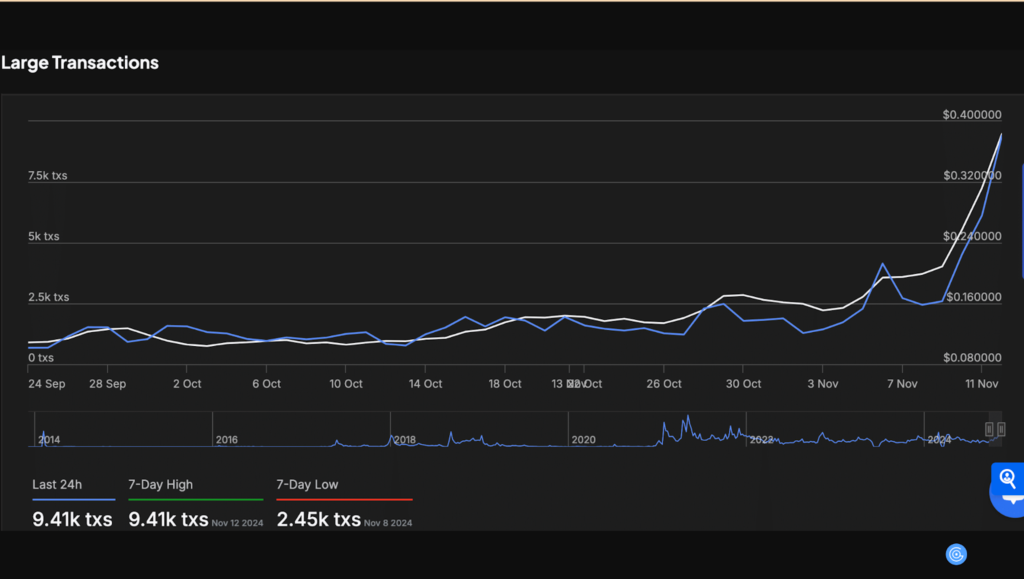

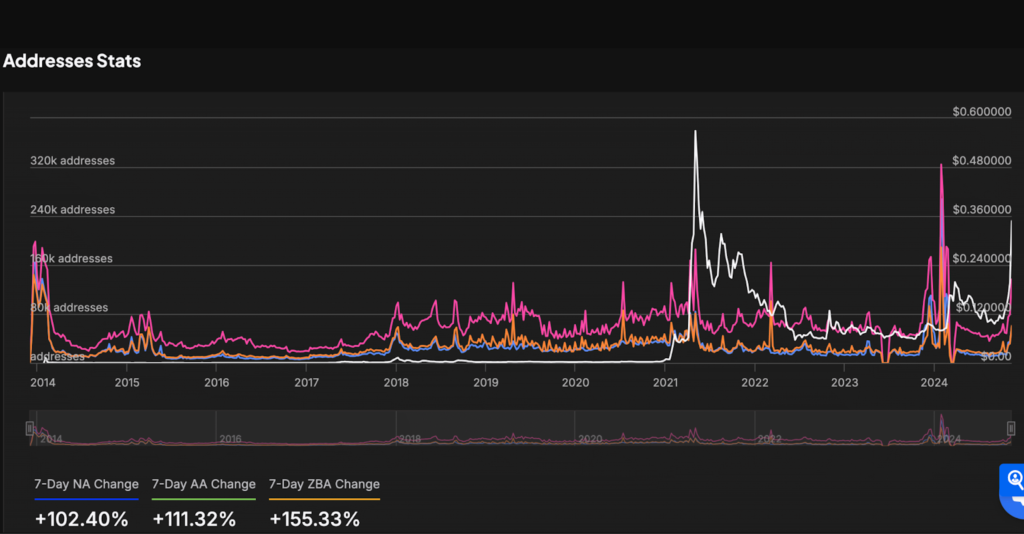

Data from IntoTheBlock suggests increased network activity. There were 136,850 active addresses and 58,990 new addresses created. Over the last week, new addresses increased by 102.40%, active addresses by 111.32%, and zero-balance addresses by 155.33%.

This address-activity growth overlapped with Dogecoin’s recent price move to $0.40. The advanced participation indicates a renewal in interest, probably from retail and institutional investors. Large DOGE transactions have also increased recently as whale transactions peaked at 9,410, aligning with the recent price surge.

The combination of historical trends, rising address activity and large transactions aligning implies that DOGE may be positioning itself for another massive price movement.

Ethereum whales buy $1B worth of ETH

Ethereum’s (ETH) whale bought 340,000 ETH, or approximately over $1 billion, in the last three days. This significant bulk purchase occurred despite price dips.

Consequently, this has led to speculation about a possible market rebound. The activity aligns with historical patterns, where considerable buys often preceded market recoveries.

This hints that Ether (ETH) might soon experience a price uptrend if this trend persists.

Will ETH have a price correction?

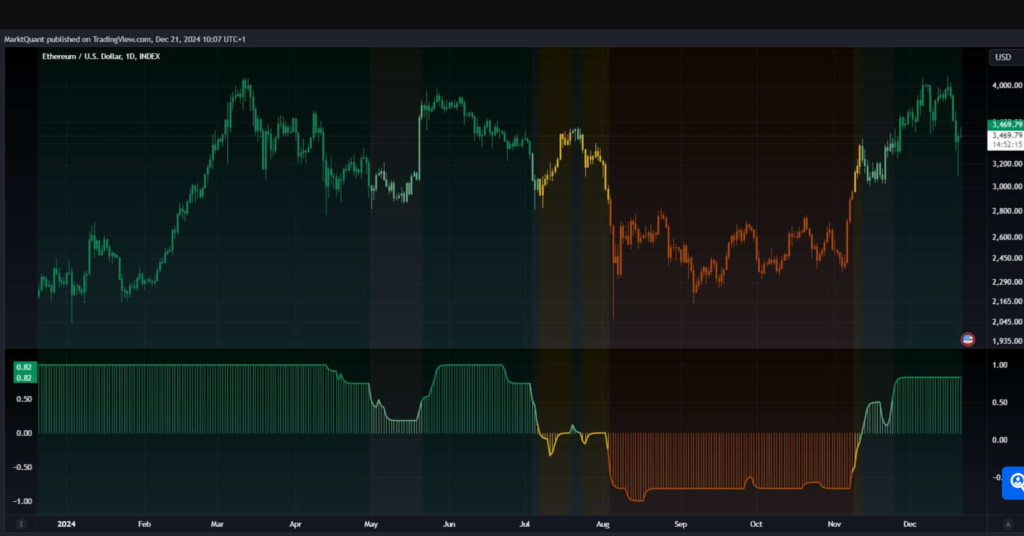

The Ethereum weekly chart indicated a possible completion of its correction. Ether’s price successively retested the Tenkan and Kijun lines of the Ichimoku Kinko Hyo indicator, inferring stabilization.

In addition, there were other signs of support as ETH interacted with the Kumo Cloud’s Senkou Span A, which was seen as a preliminary resistance turned support.

Furthermore, the lagging span retraced to its Tenkan line, reinforcing the resilience of current price levels. Even with these bullish signals, there was still caution regarding a possible retest of the Kumo Cloud’s Senkou Span B.

If Ether’s (ETH) price approaches this line, it would probably represent a critical market sentiment and strength test. Also, this year’s Long Term Trend Directions (LTTD) score could conclude at a strong bullish level of 0.82, indicating a positive long-term outlook.

Even with a momentary descent in mid-year, the LTTD returned to bullish territory. ETH began a consistent climb, overlapping with the LTTD score above 0.5, indicating sustained buyer interest.

The sharp plunge in the LTTD score in July corresponded with a price drop, displaying a short-term bearish phase. Yet, the quick recovery in LTTD by October and a complementary price rise implied that the correction phase had ended and that ETH was resuming its long-term upward trend.

Then, there’s the spot ETF ETH flow to consider.

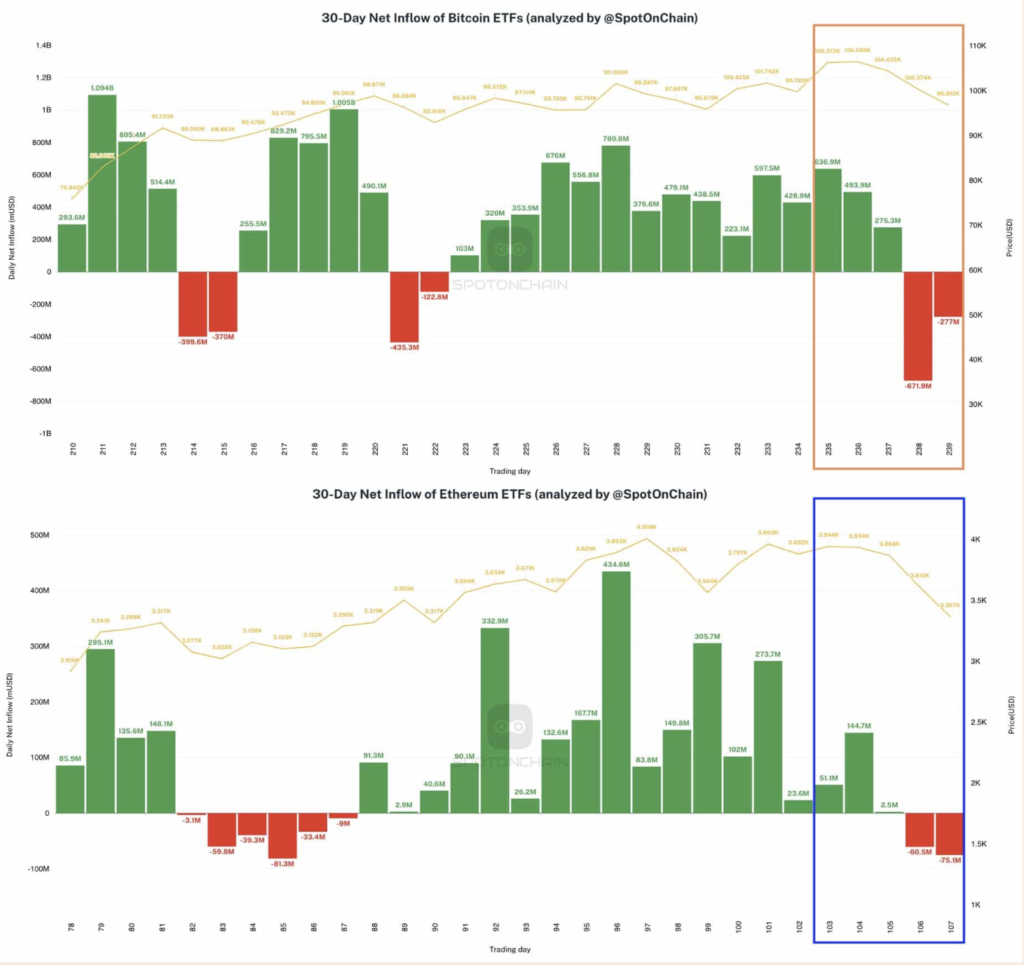

Ethereum ETFs experienced substantial outflows, with BlackRock’s ETHA experiencing its largest outflow ever, around $103.7 million, during a week marked by market downturns.

On the other hand, Bitcoin ETFs also enjoyed their most notable outflow since inception, totalling around $671.9 million. This reversal ended two consecutive weeks of inflows for Bitcoin (BTC) and Ethereum (ETH) ETFs.

Even with the outflows, BlackRock amassed considerable positions, adding 13.7K BTC valued at $1.45 billion and 33.9K ETH worth $143.7 million.

These price movements suggested massive shifts in ETF dynamics, mirroring more comprehensive market sentiments and setting the stage for future trends in cryptocurrency investments.

What do the charts say?

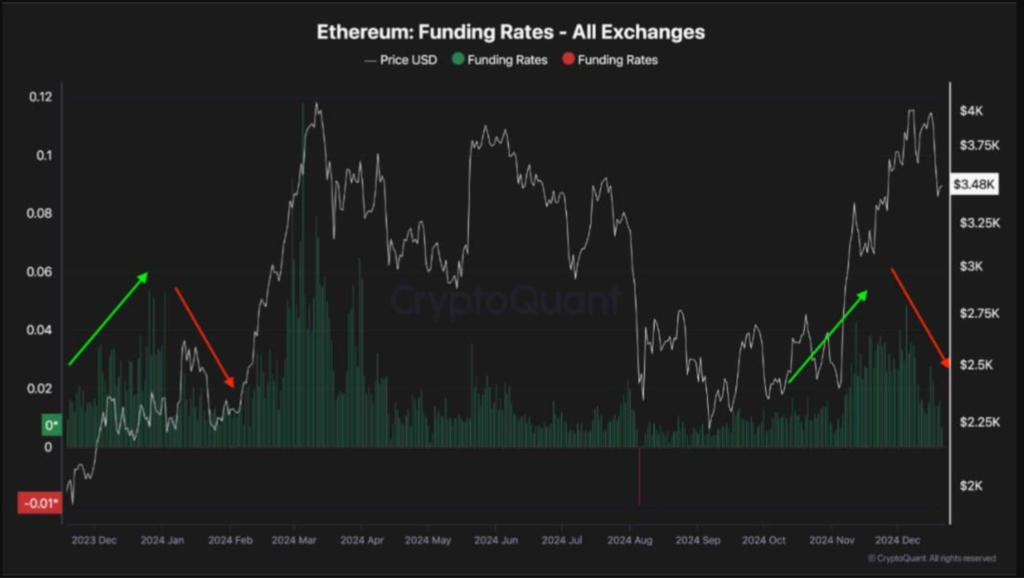

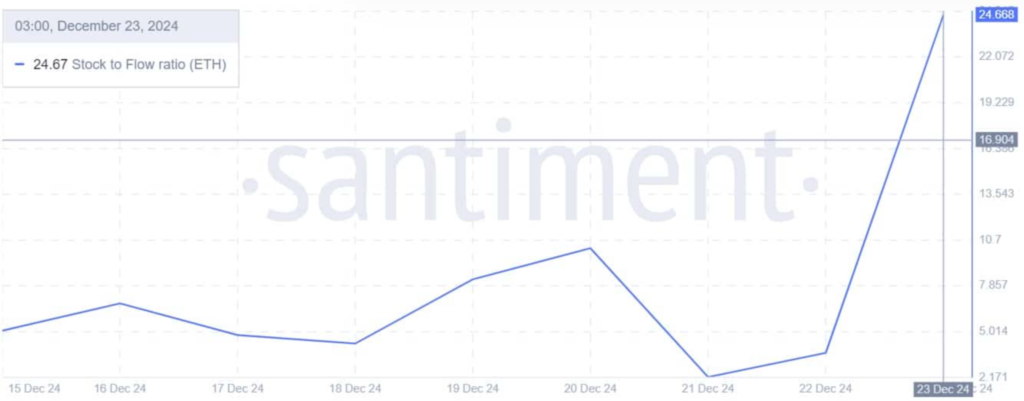

Over the past week, the altcoin plunged to a low of $3,095, reducing by 16.48%. This led to a massive market crash, with ETH hitting lows.

Although ETH’s funding rate increased last week, the altcoin’s failure to hold above $4k brought the funding rate back to healthy levels – appropriate for a bullish trend.

Consequently, this could lead to a more consistent rally in the upcoming weeks. Typically, such a pattern happened in January 2024 when the drop in funding rates cooled the future market, boosting ETH for a significant uptrend.

During this rally, ETH rallied from $2169 to $4091. This historical pattern suggests that the current market reset could lead to the start of another bullish phase.

With the crypto market optimistic, ETH could recover from the $3300 dip and reclaim higher resistance. If these conditions remain, ETH will regain the $3700 resistance and move towards $3900. Conversely, if the bulls cannot retake the market, ETH will drop to $3160.

Chainlink whales withdraw millions in 48 hours

Chainlink (LINK) has sent the crypto market into a frenzy. Nine new wallets withdrew 362,380 LINK worth $8.19 million from Binance in 48 hours. This notable whale activity outlines increasing interest in LINK, leading to claims about a possible price breakout.

At press time, Chainlink traded at $21.87, a 4.62% drop in the past 24 hours. Nonetheless, the whale’s activities suggest a forthcoming change in momentum that could determine its journey.

What’s next for LINK?

There is no gain in saying that Chainlink is facing a critical moment. After surging to $32 in November, LINK reduced to its current support level near $21. Still, this level could be a launchpad for another bullish attempt toward $32.

Yet, if it cannot sustain it, LINK could drop further, testing lower support levels. Thus, traders should closely monitor these price levels as they influence LINK’s immediate outlook.

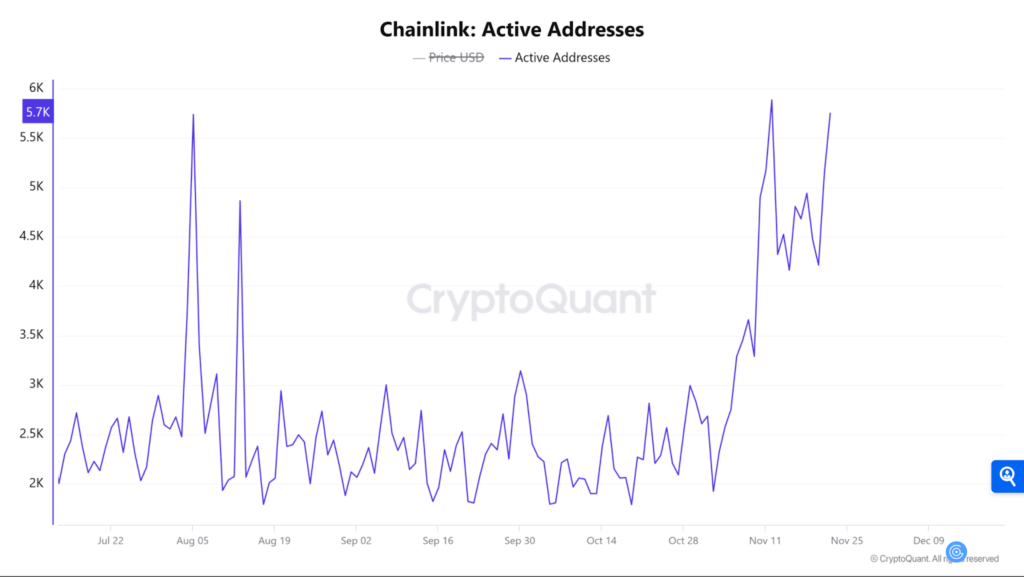

The transaction count for Chainlink increased by 0.76% in the last 24 hours, climbing to 10K. This increase in activity indicates amplified on-chain movement and revitalized interest among market participants.

Also, such an increase often correlates with price volatility, indicating that Chainlink might be gearing up for substantial movement. Thus, this metric outlines the market’s anticipation for LINK’s following price action.

In addition, active addresses also grew by 0.83% in the past day, reaching 5.7K. This rise aligns with whale accumulation, indicating more robust engagement within Chainlink’s network.

Then, increasing active addresses usually indicates increasing adoption, reinforcing bullish sentiment. Thus, this data supports the argument that LINK’s network is working towards further development.

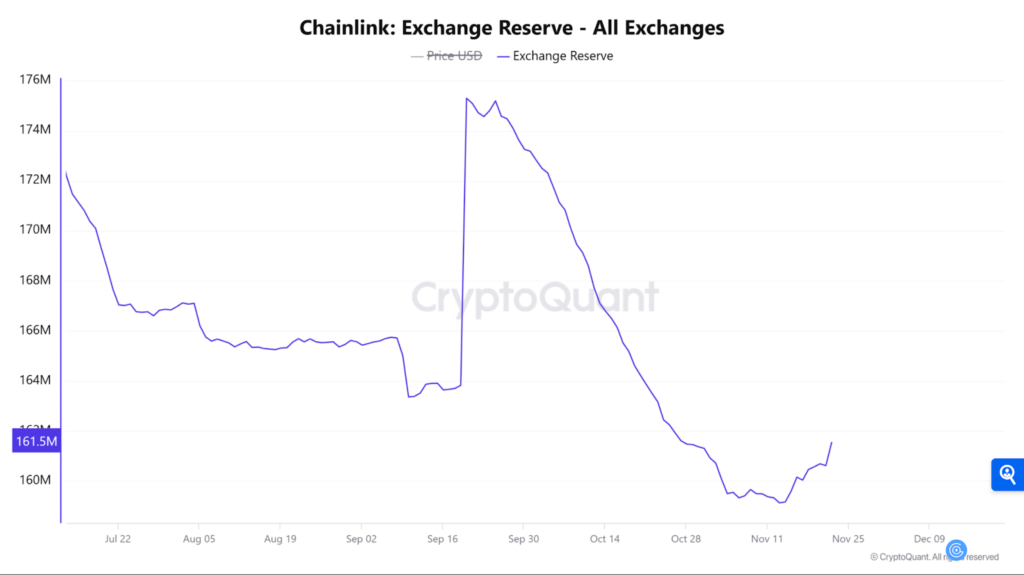

Conversely, Chainlink’s exchange reserves fell by 0.26% to 161.5 million over the last 24 hours. This decline indicates selling pressure as holders withdraw tokens from exchanges, possibly to hold them for the long term.

Furthermore, combining whale accumulation, rising transactions, active addresses, and shrinking exchange reserves strengthens the argument for a bullish breakout.

Thus, Chainlink appears well-positioned to reclaim its $32 resistance shortly if it maintains its critical support at $21.87.

Closing Remark

Solana still shows indications of intense network activity despite the recent cooling in the crypto market. Thus, this could indicate organic demand for SOL.

Whale activity could attract more investor interest and significantly impact market prices for Dogecoin, Ethereum, and Chainlink.

Zypto Launches The Vault Key Card

Zypto has just launched the Vault Key Card, an innovative tool combining the security of a hardware wallet with the ease of a mobile-first solution. Featuring NFC technology, multi-wallet support and durable design, your assets are kept super-safely in cold storage until you’re ready to tap and transact. Find out more here and here.

Zypto Expands Its ‘Pay Bills With Crypto’ Service

Zypto has also expanded its crypto bill payment service to eight new regions, including India, Pakistan, Malaysia, the Philippines and throughout Latin America. Residents in these countries can now use Bitcoin (BTC), Ether (ETH), and Ripple (XRP), among other currencies to pay utilities, credit cards, loans, universities, cable, internet, travel and much more. Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

Which yearly milestones did SOL reach?

Solana’s TVL hit a 2024 high of 55.37 million SOL, over $3 billion daily volume and 67.77 million transactions.

What effect did the Chainlink whale activity have?

The Chainlink whale withdrawal outlines increasing interest in LINK, leading to claims about a possible price breakout.

What does Dogecoin’s whale investment mean?

It means the whales anticipate a possible breakout rally or simply accumulate tokens ahead of favorable market conditions.

What is the impact of Ethereum whales’ purchase?

This has led to speculation about a possible market rebound, as the activity aligns with historical patterns, where considerable buys often preceded market recoveries.

What led to the increased interest in Dogecoin?

Dogecoin’s active address-activity growth was due to its recent price move to $0.40.

0 Comments