Welcome to the last crypto news report for June!

Solana crossed the $1 billion mark for revenue for two consecutive quarters, analysts have positive predictions for eight altcoin ETFs, Coinbase received a MiCA license for the EU Market and Bitcoin Dominance hit a new high. Stablecoins kept flying high through Circle and Nano Labs made a huge commitment.

Let’s go.

Solana reaches $1 billion revenue

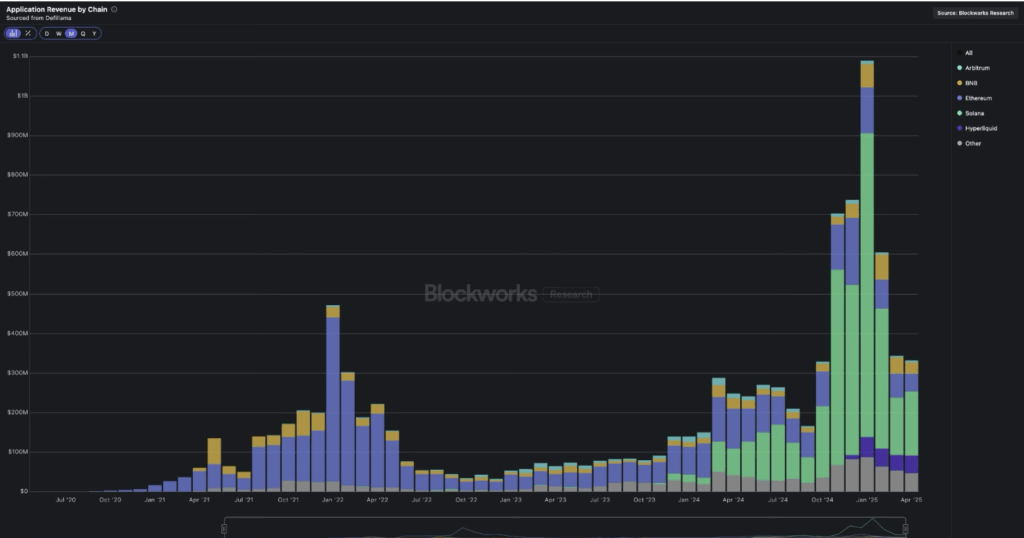

Solana’s current momentum keeps rising as it has recorded over $1 billion in revenue for two consecutive quarters. The Solana Foundation’s latest report highlights the blockchain’s accelerating economic performance.

It shows that the Solana app revenue reached its highest point in January 2025, generating over $806 million in a single month. This was followed by $376 million in February, pushing the network’s total app revenue for that quarter past the billion-dollar mark.

According to the report, improvements in protocol efficiency, developer engagement, and validator incentives support this growth.

An essential factor behind this surge is that the blockchain network has evolved into a hub for meme coin trading. Meme coin launchpad platforms like Pump.fun have become dominant forces within the ecosystem, with viral memecoins like POPCAT, BONK, and TRUMP increasing user activity and fees across the network.

Considering this, the fees from decentralized exchanges and other on-chain services have become a core indicator of Solana’s economic activity. It enables the network to reinvest in critical infrastructure, allowing the ecosystem to evolve with user needs.

This growing revenue incentivizes developers to stay on Solana. In 2024, it was the top blockchain for new developers, maintaining over 3,200 monthly active contributors and posting an 83% year-over-year growth in developer engagement.

It has also maintained 100% uptime for over 16 consecutive months. This includes the period of record-setting daily trading volume, which reached $39 billion in January 2025. Its key technical enhancements have reduced average relay times to under 400 milliseconds, a major leap from previous years.

Transaction throughput remains a standout metric, with Solana processing around 1,100 transactions per second (TPS), surpassing Ethereum’s average of 14 TPS.

This has led to validator rewards with real economic value (REV) hitting a record $56.9 million in January.

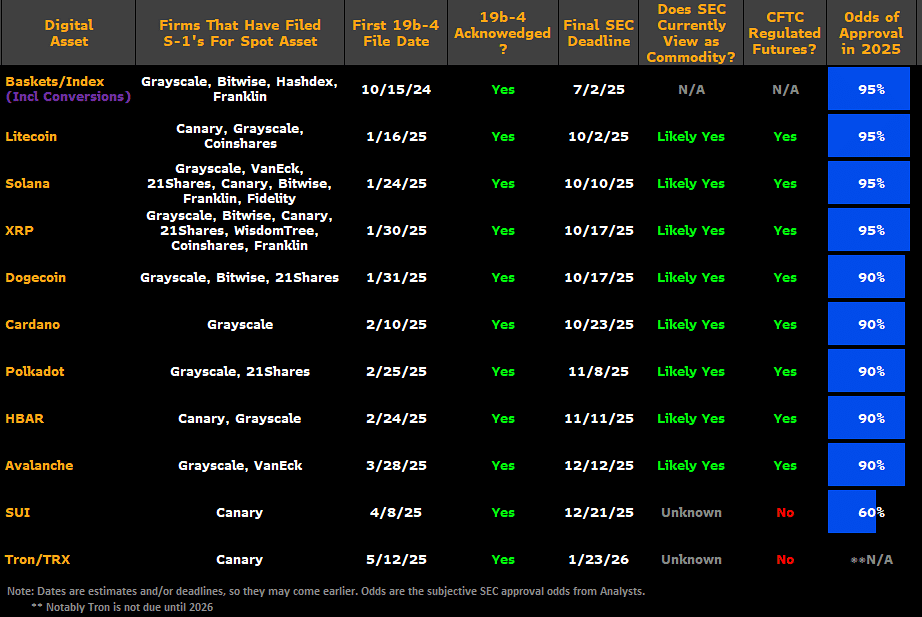

Analysts predict a 90% approval for these Altcoin ETFs

Despite months of speculation and ongoing regulatory back-and-forth, altcoin crypto exchange-traded funds (ETFs) in the U.S. have yet to receive the green light. Delays, revisions, and continuous debates have left the crypto community waiting in anticipation.

Yet, the outlook seems to be turning a corner.

According to Bloomberg analysts Eric Balchunas and James Seffyart, the approval of multiple ETFs is now viewed as almost inevitable.

It could also be a sign that the SEC may be gradually pivoting toward a more crypto-friendly stance.

James Seffyart posted on X,

“Eric Balchunas and I are raising our odds for the vast majority of the spot crypto ETF filings to 90% or higher. Engagement from the SEC is a very positive sign in our opinion.”

The analysts believe the SEC now likely classifies major altcoins like Solana (SOL), Ripple (XRP), Litecoin (LTC), and Dogecoin (DOGE) as commodities, possibly removing a major regulatory hurdle.

Polymarket data reflects this positive sentiment, with approval odds for altcoin ETFs soaring – Solana at 90%, Ripple at 88%, Litecoin at 85%, Dogecoin at 82%, and Cardano at 80%.

Interestingly, while regulatory optimism around altcoin ETFs is reaching new highs, market prices tell a different story. Altcoins continue trading in the red, mostly due to the broader market slump. Also, Altcoin Season Index confirms that we are in a “Bitcoin season,” explaining the drab altcoin performance despite ETF hype.

However, despite lingering uncertainty over whether the SEC will approve ETFs or delay them indefinitely, hope remains strong among market participants. It’s worth noting that even Bitcoin ETFs faced almost a decade-long wait before approval.

To speed up the regulatory process, asset managers such as VanEck, 21Shares, and Canary Capital have already petitioned the SEC to adopt a “first-to-file” system when reviewing ETF applications.

Amidst these ongoing delays in altcoin ETF approvals, institutional enthusiasm for altcoins keeps growing.

Recent research conducted by Coinbase in collaboration with EY-Parthenon revealed that 73% of institutional investors are now allocating funds to digital assets beyond BTC and ETH, with XRP and SOL emerging as the most preferred choices.

Furthermore, 68% of respondents showed interest in altcoin-based ETFs, particularly single-asset vehicles, indicating that institutional appetite for diversified crypto exposure is only growing stronger, even amid delays and ongoing Bitcoin dominance.

Coinbase receives MiCA license for the EU market

Coinbase has acquired a MiCA license in Luxembourg, enabling the crypto exchange to operate fully across the European Union. This was announced via a social media post on X.

In the press release, Coinbase described how monumental the licensing is. MiCA registration will enable the exchange to access 450 million customers across 27 EU member states – something its biggest competitor, Binance, can’t do.

Markets in Crypto Assets (MiCA) is a milestone piece of crypto regulation in the European Union (EU), bringing major changes to the regional industry. Major crypto firms have already left the market block, leading to setbacks and opportunities.

By acquiring a MiCA license, this has freed Coinbase to “offer a full suite of products and services.” Also, it is also opening a regional office in the country to further coordinate expansion plans.

Some EU member states have developed reputations for quick and easy license approval, but Luxembourg is not one of them. Unsurprisingly, Coinbase has been trying to meet MiCA compliance for several months now.

Coinbase is setting up operations in a nation bordering the EU’s biggest financial powerhouses, preparing for real integration with the market. The firm stated,

“By choosing Luxembourg, we’re positioning ourselves in a jurisdiction that understands the needs of the crypto industry and excels in regulatory clarity. This new hub represents a landmark step forward.”

Over the past few months, Coinbase has been increasingly expanding outside of the US crypto market. Earlier this year, it achieved a regulatory license in Argentina. However, with MiCA, Europe would likely be Coinbase’s biggest expansion outside the American market.

Overall, the exchange has a significant opportunity to dominate the centralized exchange (CEX) market across an entire continent. With a clear vision and precise skill, Coinbase could produce a considerable achievement.

Bitcoin Dominance hit a new high

At the time of writing, Bitcoin Dominance (BTC.D), which measures Bitcoin’s market capitalization as a percentage of the total crypto market, has hit a new high for 2025. It now surpasses 65%, marking the highest point since February 2021.

Also, retail and institutional investors have shown long-term confidence in Bitcoin.

Crypto analyst Rekt Capital made a bold prediction that Bitcoin Dominance could rise to 71% soon. Nic Pukrin of CoinBureau suggested a similar amount, while Raoul Pal of RealVision believes altcoins will bleed more than BTC during any correction.

Conversely, with the Altcoin Season Index showing negative trends in June, the prospect of an altcoin rally seems increasingly unlikely.

On June 23, the Altcoin Season Index dropped to 12 points—its lowest level in two years. Nic said,

“It’s now the furthest we have been from Altcoin season in almost a year. That’s if you believe the ‘Altcoin Season Index.”

However, renowned crypto analyst Michaël van de Poppe highlighted an interesting pattern. In recent years, the Altcoin Season Index has tended to bottom out in June or July.

This suggests a seasonal trend: investors tend to shift capital into bitcoin at the start of summer, and then possibly rotate back into altcoins in July or August. Analyst 0xNobler also believes altcoin seasons typically begin in the summer, which aligns with the previous predictions about Bitcoin Dominance.

Hence, these analysts infer that patience is vital for altcoin investors.

Circle’s market cap exceeds USDC supply

As of this writing, USDC supply has surged by 40% from $43.67 billion in January to $61.32 billion. Still, its market cap of $63.89 billion exceeds the total circulating supply.

Also, Circle’s stock has increased by over 800% in 18 trading days since its launch on the NYSE (New York Stock Exchange). During Tuesday’s trading session, Circle’s stock briefly approached the $300 mark before closing $263.45.

The meteoric rise shows increased investor confidence in Circle’s broader fintech potential beyond stablecoin insurance issuance. Now, traders view Circle as a full-stack digital finance operator – its CRCL stock flipping the circulating value of its USDC stablecoin a reflection.

The firm seems to be gaining attention as stablecoins power real-world assets (RWAs), DeFi yield farming, and cross-border payments. Unsurprisingly, Circle recently launched USDC on the XRP Ledger.

Meanwhile, BitMEX co-founder Arthur Hayes recently argued that Circle’s deep integration with Coinbase could become a strategic limitation. He inferred that this could limit USDC’s market reach, suggesting that the company’s future may depend on greater independence and diversification.

For now, the market appears to be invested in the Circle vision wholesale. The firm’s dual momentum in traditional finance (TradFi) and Web3 translates into capital inflows and cultural clout.

Surpassing its stablecoin in market cap goes beyond a financial milestone, reflecting a psychological paradigm shift. It points to investors seeing Circle as vital to the next phase of digital money infrastructure, not merely a product of it.

Nano Labs to build $1 billion BNB reserve

Nano Labs is issuing $500 million in private convertible notes to form a $1 billion BNB reserve, aiming for up to 10% of BNB’s supply. The news was communicated via an official announcement.

This substantial initiative indicates a new milestone in institutional involvement with public blockchain assets. The notes mature in 360 days, earn no interest before maturity, and are convertible to Class A common stock at $20 per share. Proceeds will fund the purchase of $1 billion in BNB, the native coin of its namesake blockchain.

This action reflects a growing institutional appetite for significant exposure to public blockchain assets. If the above is fully realized, this would mark one of the largest direct institutional purchases of a public blockchain’s native coin.

The notes’ flexible structure – no interest before maturity and an equity conversion feature – offers investors options. Depending on market developments, they can convert to equity later or redeem principal.

Meanwhile, Changpeng Zhao (CZ), the co-founder of Binance, highlighted BNB’s status as an asset separate from Binance Holdings or its exchange. This distinction is increasingly vital as institutions move to secure significant BNB positions, indicating a deeper market understanding.

Therefore, any institution – including Nano Labs – may freely purchase and use BNB, independent of Binance, the exchange.

CZ said,

“I heard about a few different companies doing this. So far, none are driven by me/us. But we are extremely supportive.”

For both investors and the industry, BNB’s public chain status builds credibility among institutions seeking diversified blockchain exposure. It also shows that major asset acquisitions are made by external parties, rather than platform founders.

This independence contributes to regulatory clarity and market trust, encouraging other entities to pursue similar moves.

Nano Labs’ initiative sets a new standard for institutional activity in blockchain assets. If the company acquires its target, market liquidity and valuation could shift considerably. Single-institution accumulations often impact market dynamics, and analysts will closely watch BNB’s supply concentration.

The convertible notes offer another way for investors to gain indirect BNB exposure, bridging traditional finance and blockchain markets. This could lead to more conventional capital into digital assets.

Market watchers will monitor Nano Labs’ progress in acquiring BNB and any market changes that result. Still, Nano Labs is establishing itself as a leader in institutional investment within the public blockchain asset space.

Zypto Launches ‘The Million Dollar Crypto Card’

Zypto has officially launched its new high-limit Physical VISA Card, designed for serious crypto users. With up to $175,000 per transaction and over $1 million in monthly spend capacity, the card aims to set a new benchmark for performance in the crypto card space.

With no monthly fees, it’s a powerful option not just for high-volume spenders, but also for those who prefer to hold the card for moments that matter – ready when needed, without ongoing costs. It’s a bold move, positioning Zypto among the top players in the crypto card market. Find out more here.

Closing Remark

Solana’s steady gains in performance, developer retention, and revenue generation point to a network on the rise. If the analysts’ predictions regarding the altcoin ETFs come through, it could be positive news amid the ‘Bitcoin Season.’

Coinbase has an excellent opportunity to dominate the CEX space in not just a continent, but globally. Institutional investors are showing long-term confidence in Bitcoin, as seen in the high Bitcoin Dominance (BTC.D).

Similarly, Circle’s latest milestone is beyond just capital gains, it also points to high network activity and institutional confidence. Lastly, Nano Labs’ upcoming BNB reserve establishes it as a leader in institutional investment.

Finally, Zypto’s new Physical VISA Card signals rising demand for high-limit crypto spending – and a shift toward serious real-world utility.

What’s your favorite news this week? Let us know in the comments section below.

FAQs

Which milestone did Solana cross?

Solana recorded over $1 billion in revenue for two consecutive quarters.

What are the major altcoin ETFs that analysts are bullish on?

The major altcoin ETFs include Solana (SOL), Ripple (XRP), Litecoin (LTC), Dogecoin (DOGE), Polkadot (DOT), Hedera (HBAR), and Avalanche (AVAX).

Which landmark did Coinbase record?

Coinbase has acquired a MiCA license in Luxembourg to operate fully across the European Union.

What record level did Bitcoin Dominance reach?

Bitcoin Dominance (BTC.D) hit a new 2025 high of 65%.

How did USDC’s market cap exceed its supply?

USDC supply surged from $43.67 billion in January to $61.32 billion. Still, its market cap of $63.89 billion exceeds the total circulating supply.

0 Comments