There’s so much to unpack this week. Come with me.

Grayscale plans to launch a Solana ETF, Ripple acquires prime broker Hidden Road for $1.25B, as Sui’s daily active address exceeds 2 million. Ethereum’s dApps generate $1B in fees and stablecoin supply hits $233 billion in April as Tether reportedly plans to launch a new stablecoin.

Let’s get into the thick of things:

Grayscale files for Solana ETF with SEC

On Friday, Grayscale filed a registration statement for its Grayscale Solana Trust (GSOL) with the U.S. Securities and Exchange Commission (SEC). It seeks to turn the product into an exchange-traded fund (ETF).

Crypto asset managers strive to offer extra products that enable investors to gain exposure to altcoins using a brokerage account. This is in line with their approach for Bitcoin and Ethereum ETFs, which were approved by the SEC last year.

Analysts are bullish that Solana will win a regulatory green light. They point to the SEC’s more crypto-friendly leadership and Solana’s developing futures market in the U.S.

Notably, the Grayscale Solana Trust, if converted into an ETF, would not partake in staking funds held in receipt, per the registration statement. The filing read,

“No action will be taken pursuant to which any portion of the Trust’s SOL becomes subject to the Solana proof-of-stake validation or is used to earn additional SOL.”

Grayscale’s filing came a day after the SEC acknowledged Fidelity’s application for a Solana ETF, one of many crypto applications awaiting review on the regulator’s desk.

Sui’s daily active address surpasses 2 million

In recent weeks, Sui network’s daily active addresses have surged from 1.38 million to a massive 2.46 million. As of this writing, it has overtaken TRON to become the third-largest blockchain by daily active addresses.

This is remarkable as TRON has traditionally been a big deal in daily activity, primarily due to its popularity in developing markets and usage in stablecoin transactions.

However, Sui’s rapid adoption indicates that users are increasingly moving to platforms that offer speed and developer flexibility.

What is behind Sui’s growth?

One of Sui’s major advantages lies in its technology. Built with the Move programming language, typically developed by Facebook for its Diem project, Sui offers developers a secure and performance-optimized foundation.

This has helped foster a range of decentralized applications (dApps) and services, contributing to the recent surge in activity.

Secondly, Sui features ultra-fast transaction speeds, with theoretical limits skyrocketing to 297,000 transactions per second (TPS). That refers to a seamless user experience in real-world scenarios. Thus, regardless of the use case—gaming, finance, NFTs—users find Sui’s infrastructure more enticing for high-volume, low-latency interactions.

Third is Sui’s growing support for cross-chain functionality. In the last three months, Sui has recorded nearly $1 billion in cross-chain funds flow into its ecosystem.

In addition, Sui’s DeFi ecosystem is also booming. The total value locked (TVL) across Sui DeFi protocols recently hit nearly $2.3 billion, up from under $400 million in August. That indicates over 5X growth in less than six months, setting Sui as a notable player in the DeFi ecosystem.

Most importantly, Sui has been averaging over 200,000 new wallet creations per day, with peaks of over 400,000. This influx of fresh users further cements Sui’s position as a rising star in the blockchain world.

Overall, Sui’s rise to the top three is not just a personal win for the network. It is a strong signal that the blockchain space is still highly dynamic. Newer platforms like Sui will keep innovating and attracting users due to their speed, developer support, and user trust.

To that end, older networks must adapt or risk falling behind.

Ripple acquires prime broker Hidden Road for $1.25B

Ripple has agreed to acquire prime brokerage firm Hidden Road for $1.25 billion, extending its reach into institutional finance and positioning itself at the centre of cross-market infrastructure.

The blockchain ventures into uncharted territory by combining classic finance practices with digital asset strategies, creating new paths for efficient financial services.

Ripple announced the acquisition on social media, making it the first crypto firm to own and operate a global, multi-asset prime broker.

Hidden Road provides over 300 institutional clients with services like prime brokerage, clearing, and financing across FX, digital assets, derivatives, swaps, and fixed income.

Ripple’s support is primed to help Hidden Road grow its operations and global presence. The former affirmed plans to invest capital to expand Hidden Road’s services and improve its prime brokerage offering.

Brad Garlinghouse, CEO of Ripple, said,

“We are at an inflection point for the next phase of digital asset adoption. With regulatory clarity in the U.S. emerging and maturing market infrastructure, we’re accelerating our push to reshape finance.”

In addition, Ripple plans to integrate its stablecoin RLUSD into Hidden Road’s collateral system. RLUSD will become the first stablecoin utilized for cross-margining between digital and traditional markets – which can strengthen its adoption as a USD-backed collateral asset for institutions.

Hidden Road will also migrate its post-trade operations to the XRP Ledger (XRPL) to improve efficiency.

Marc Asch, CEO of Hidden Road, noted,

“With new resources and risk capital, we’ll unlock massive growth—expanding capacity, products, and reach across asset classes. Ripple’s infrastructure and compliance-first approach align perfectly with our mission.”

Ethereum dApps generate $1B in fees

Ethereum’s dApps generated a massive $1.01 billion in application fees during Q1 2025, signalling the strength of the blockchain network’s ecosystem.

Also, Ethereum remains the stronghold network for stablecoin use.

It leads with 53.39%, followed by Tron (TRON) with 28.55%, while Solana (SOL), Binance Smart Chain (BSC), Base (B3), and Arbitrum (ARB) share the remaining fragments.

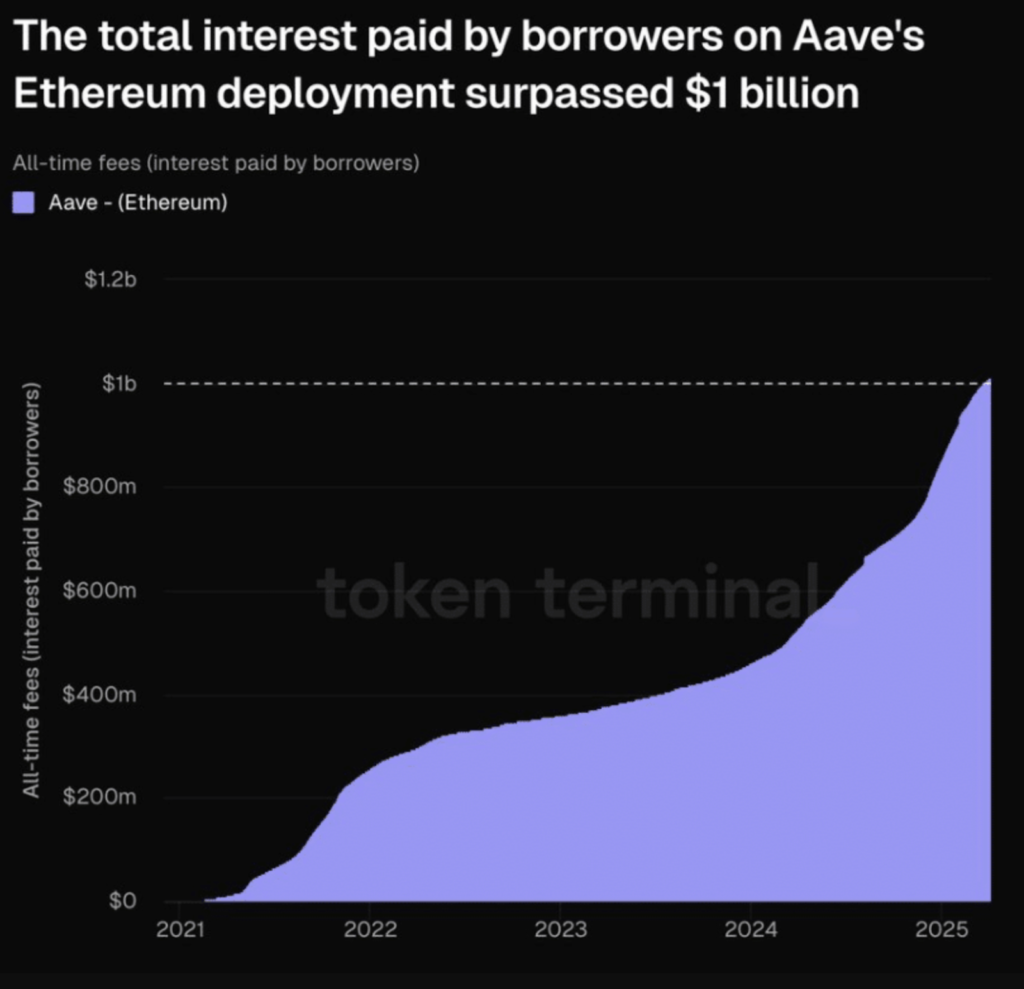

Aave’s lending interest surpasses $1 billion

A significant landmark for the AAVE network is the cumulative interest paid by borrowers, which recently hit a new record. Token Terminal’s data outlined that AAVE borrowers have spent over $1 billion in interest on Ethereum.

This increase in interest is a sign of increasing volume, user demand, protocol usage, and, most importantly, a hike in DeFi’s maturity.

What does this mean for the network?

First, the rise means AAVE has paramount confidence, mainly in the network’s smart contracts and liquidity. When interest hikes as it has, it implies that AAVE is seeing very high activity in its pools. This means AAVE’s liquidity providers earn notable yields and encourage more deposits.

Second, the increase in fees paid is vital for AAVE’s revenue and sustainability. AAVE earns a substantial share of interest revenue, meaning the network generates considerable revenue. This supports the protocol’s sustained development and adds value to the token.

Notably, growing confidence among users and liquidity providers offers them more room for growth, which makes the AAVE protocol more attractive to investors.

While the AAVE protocol has been seeing a surge in demand and usage, this has yet to be reflected in its price charts.

Stablecoin supply hits $233B in April

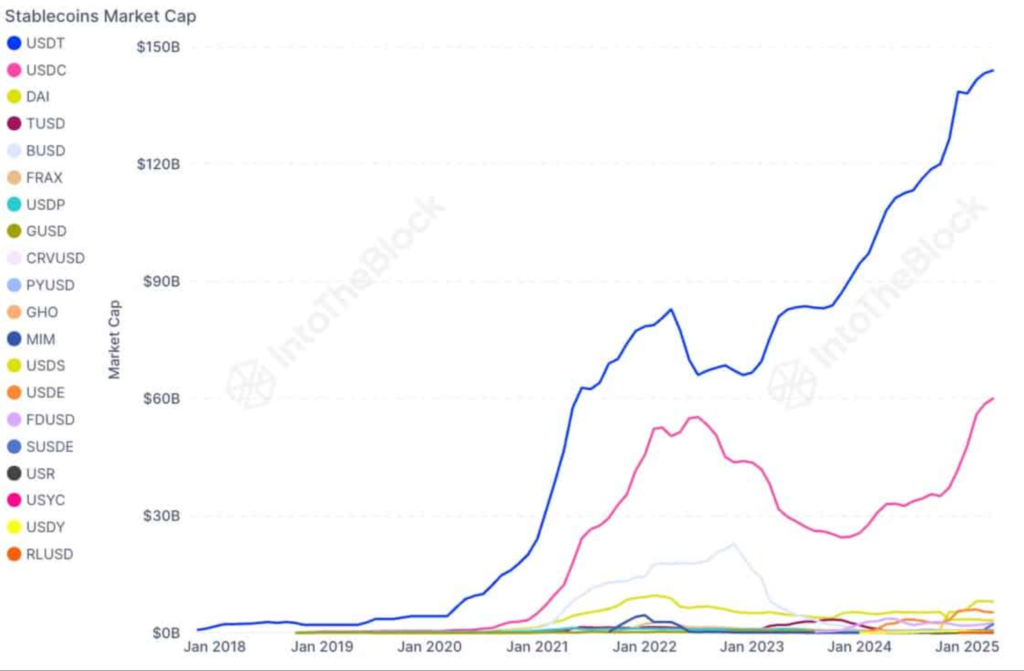

The stablecoin sector experienced record-breaking growth in Q1 of 2025. According to IntoTheBlock data, the total stablecoin supply hit $220 billion by April 2025 before increasing to $233.47 billion by the first week of April.

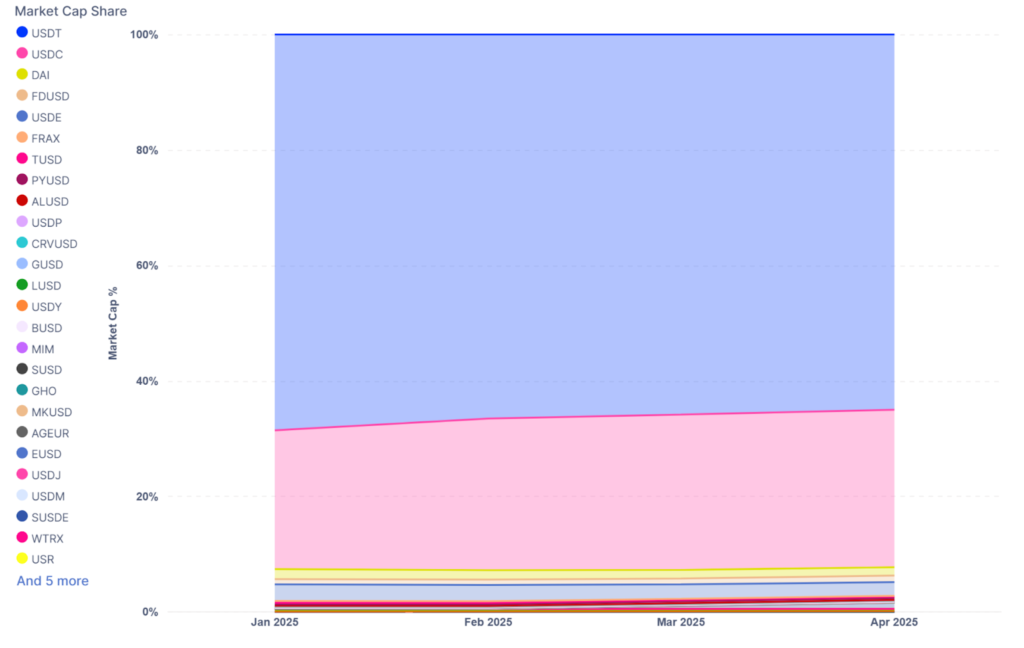

This signifies three things: rising institutional adoption, increased demand for on-chain liquidity, and the centralization of market power between two dominant issuers – Tether (USDT) and USD Coin (USDC).

USDT have a leading $144 billion market cap, which equates to 63% of the stablecoin supply. USDC, while trailing, has reclaimed momentum with a market cap of $59 billion and a 27% share.

These two control over 90% of the stablecoin market, leaving little room for competition and pointing to a centralized power dynamic.

Recently, Circle filed to go public under the ticker “CRCL” on the New York Stock Exchange. Thanks to backing from JPMorgan and Citigroup, Circle is eyeing a $5 billion IPO despite its net income reducing 42%, from $268 million to $156 million.

Even at that, it is no coincidence, as the stablecoin market provides a profitable backdrop for such a move, possibly revitalizing institutional interest at scale. The stablecoin market increased from $206 billion in January to $225.8 billion in April, marking a 9.61% increase in three months.

Still, this momentum isn’t universal.

DAI, FRAX, and TUSD saw sluggish growth, holding on to under 10% of market share, a clear signal of weak traction.

February 2025 recorded peak inflows and outflows at $106.57 billion and $106.01 billion, respectively. Yet by March, the tide turned: net outflows hit -$2.9 billion, the most significant quarterly drop.

April saw a sharp cool-off, with inflows and outflows plunging over 80% from March levels. In addition, March 31 witnessed the largest single-day outflow – a massive $1.54 billion, following a huge $1.39 billion inflow on February 3.

So, what is the implication?

On the one hand, stablecoin supply is rising, and USDC’s rebound – coupled with IPO news – is renewing institutional optimism. Conversely, failing exchange flows may indicate market fatigue, profit-taking, or a pivot to long-term holding strategies.

The following quarters will indicate whether a broader decentralization is feasible or stablecoins will continue operating under a tight two-player regime.

Tether reportedly plans new stablecoin

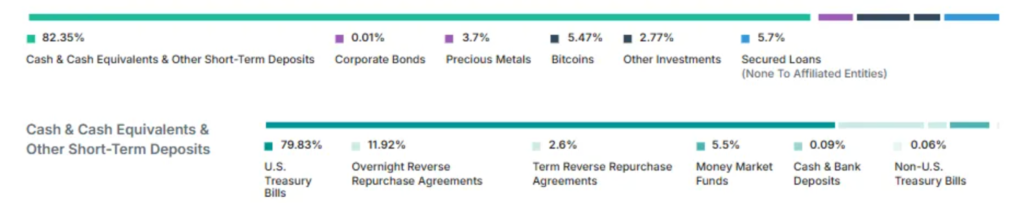

Crypto analyst Novacula Occami outlined that USDT’s reserves include Bitcoin and Gold, which are explicitly disqualified by the SEC’s criteria. As a result, USDT may fall within the scope of securities law and face potential restrictions in the US.

He added,

“USDC and the Paxos coins comply with the SEC’s guidance and are not securities. USDT, however, with its gold, BTC, and other reserves, are securities and cannot be legally offered in the US.”

Thus, Forbes journalist Nina Bambysheva reported that Tether plans to launch a new stablecoin to align with US regulations. This infers that the proposed asset would be fully backed by cash and US treasuries.

Such a pivot would mark a significant shift in strategy for the issuer as it navigates increasing scrutiny.

The US Securities and Exchange Commission (SEC) has issued a vivid statement on the regulatory treatment of stablecoins. The agency confirmed that certain stablecoins, under specific conditions, do not fall under the meaning of “securities.”

The SEC labelled these assets as “covered stablecoins” and ruled they must meet stringent restrictions to remain outside the regulator’s oversight. In a statement, they explained that a covered stablecoin must maintain a one-to-one peg with the US dollar and be backed by highly liquid, low-risk assets.

“Covered stablecoins are not marketed as investments; rather, they are marketed as a stable, quick, reliable and accessible means of transferring value, or storing value and not for potential profit or as investments.”

It must also be redeemable on demand at full value. Importantly, these tokens cannot offer profit, interest, governance rights, or ownership stakes. Their sole function must be payment, money transfer, or value storage.

The SEC clarified that these assets are not investment vehicles and are typically marketed as “digital dollars.” As such, the agency does not consider its offer or sale to involve securities under federal law. The regulator asserted,

“Accordingly, it is the Division’s view that covered stablecoins are not offered or sold as investment contracts,”

This clarity is another step in the right direction for the SEC, which is typically unclear in its approach to crypto regulation.

Yet, while the SEC’s guidance provides a path forward for stablecoins like USDC, it casts doubt on whether USDT qualifies. The guidance excludes reserves of crypto assets or precious metals, which are part of USDT’s current backing.

The news comes as stablecoins are gaining wider adoption despite market volatility. Daily usage keeps climbing even during a challenging first quarter for digital assets.

Data from IntoTheBlock shows that the sector grew by more than $30 billion during Q1 despite the broader market sell-off. Nonetheless, industry responses to the new guidelines have been mixed.

David Sacks, a White House advisor on crypto policy, celebrated the move. He affirmed that the statement provides long-overdue clarity and could ease regulatory burdens for compliant issuers.

He said,

“The SEC had determined that fully-reserved, liquid, dollar-backed stablecoins are not securities. Therefore, blockchain transactions to mint or redeem them do not need to be registered under the Securities Act.”

However, SEC Commissioner Caroline Crenshaw offered intense criticism. She warned that the guidance downplays risks in the stablecoin market and misrepresents essential legal issues.

According to her, the statement presents a simple view of the industry. She said,

“The (SEC’s) statement’s legal and factual errors paint a distorted picture of the USD-stablecoin market that drastically understates its risks.”

Closing remark

This latest move emphasizes Grayscale’s persistent motivation to broaden investors’ access to crypto on Wall Street following the submission of Form 19b-4 for its Solana trust in December.

Ripple is making waves in institutional finance with a $1.25B acquisition of Hidden Road, becoming the first crypto firm to own a global, multi-asset prime broker, blending traditional finance with digital innovation. Sui’s growth marks a significant milestone for the relatively young Layer-1 network and signals broader changes in user preferences and blockchain utility in 2025.

Stablecoins’ high supply record is proof of rising institutional adoption, with Tether at the forefront which is what makes Tether’s plans for a new stablecoin remarkable.

Zypto’s Vault Key Card – Order now in Zypto App Beta Program

Zypto has announced that you can now order for the Vault Key Card (VKC) through the Zypto App Beta Program. It is available on both Android and iOS devices.

Find out more here.

So much has gone down this week, so what’s your favorite news? Share your thoughts and questions in the comments section.

FAQs

Why did Grayscale file for Solana ETF with SEC?

Grayscale seeks to broaden investors’ access to crypto on Wall Street and sees Solana as a big part of it.

Which payment apps do Chainlink and Solana want to support?

Chainlink and Solana intend to support PayPal and Venmo.

How much did Ethereum dApps generate in fees?

Ethereum’s dApps generated a massive $1.01 billion in application fees during Q1 2025.

What are the two leading stablecoins?

The leading stablecoins include Tether (USDT) and USD Coin (USDC).

What high-profile plan does Tether have?

Tether allegedly plans to launch a new stablecoin to align with US regulations.

I keep checking the Zypto app like I’m gonna order VKC any second. Can’t decide if I should do it today or wait. Now, I am keee arranging my money, soon I order one card.