This week, analysts predicted how the 2025 bull market could shape up, using the two leading cryptocurrencies, BTC and ETH, as case studies. Also, 460k Bitcoins were recovered, as Cardano whales purchased 40 million tokens, and Dogecoin surged by 18%.

Let’s dive in.

How 460k recovered Bitcoins could impact BTC’s price

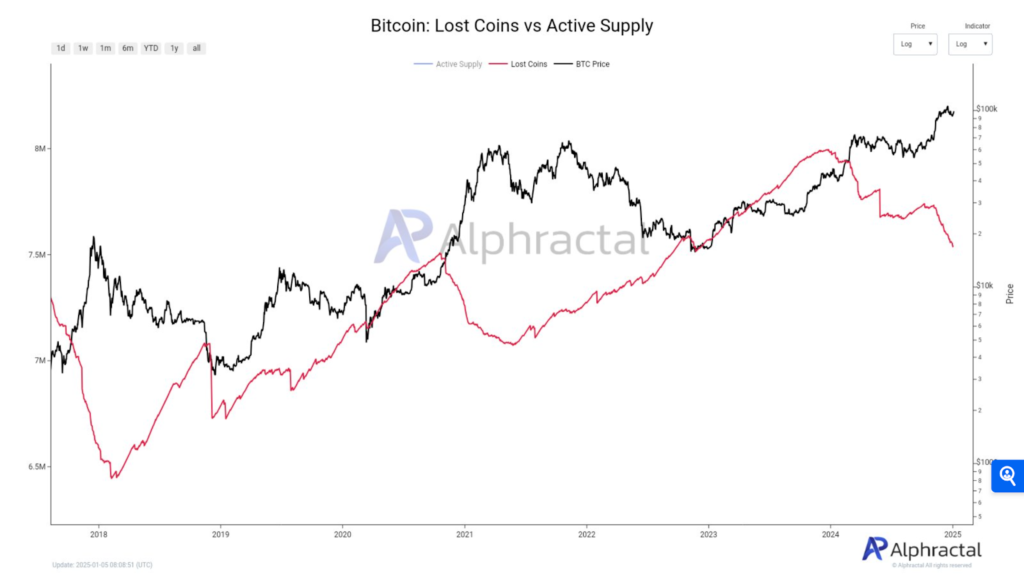

Remarkably, 460,000 previously inactive Bitcoin (BTC) have recently re-entered circulation. This impressive turn of events has unsurprisingly sent a shockwave through the market.

The reactivation of dormant BTCs, mainly since 2024, marks an evolution in Bitcoin’s market dynamics. This surge in long-held coins indicates rising confidence among long-term holders (LTHs), who capitalized on the launch of the Bitcoin ETF during the current bullish cycle.

As these dormant coins become active again, the available circulating supply of BTC will increase, which could massively affect its scarcity narrative.

Bitcoin’s scarcity and its influence on value

While BTC’s total supply is fixed, the availability of dormant coins re-entering the market contests the concept of scarcity. This influx could temporarily affect the asset’s perceived scarcity, primarily if they are sold quickly, possibly creating short-term volatility.

Typically, Bitcoin’s value is intrinsically tied to its scarcity. With a total supply capped at 21 million coins, BTC was created as a limited resource, and this finite supply has long been a major driver of its value.

The principle of demand and supply states that when an asset is scarce, its perceived value increases—mostly if demand remains steady or increases. This scarcity narrative has boosted Bitcoin’s reputation as “digital gold,” a store of immense value.

Thus, the return of inactive coins could disrupt the long-standing scarcity narrative that has described Bitcoin’s value. Although the total supply of Bitcoin remains limited, the reactivation of these coins improves the circulating supply, altering the balance between supply and demand.

This could damage BTC’s perceived scarcity, especially if massive amounts of BTC are moved onto exchanges and sold. This influx of supply might temporarily affect BTC’s value until the market absorbs the coins.

Bitcoin’s future in a more liquid ecosystem

Generally, this situation injects more liquidity into the Bitcoin market, with positive and negative implications. On the one hand, increased liquidity leads to easier trading and more market efficiency.

Conversely, a sudden surge in active supply could lead to price volatility, mainly if large amounts of Bitcoin are sold simultaneously. This increase in liquidity could impact BTC’s price stability, possibly reducing speculative surges and facilitating more sustainable growth.

Cardano whales purchase 40 million tokens

Cardano (ADA) witnessed a monumental 270% rally between early November and December before reversing from its long-term trendline resistance. After hitting a low of $0.878, Cardano (ADA) has undergone a strong uptrend to $1.119, surging by 23.80% on weekly charts.

Now, Cardano whales have purchased 40 million tokens.

As of this writing, ADA was trading at $1.106 – a 1.23% increase from the past day. The price pump has made analysts drop their two cents on the factors behind it.

According to the famous crypto analyst Ali Martinez, heightened buying pressure pushes ADA prices. In his analysis, he pointed out that Cardano whales have been binge-buying.

Typically, whales’ attempts to purchase an asset show bullish sentiment and confidence in the crypto market. This demand for ADA is not merely for whales but also retail traders. Consequently, other market participants have bought the altcoin since New Year’s Eve.

Also, Cardano’s founder, Charles Hoskinkson, hinted at grand plans for the Lace Wallet platform and significant upgrades that would bolster the company’s ecosystem throughout the year.

He remarked,

“Lace is going to go through its largest upgrades and enhancements this year from multiplatform to many new and exciting features.”

This comment was a response to an X user who praised the launch of Lace and said,

“Really happy with Lace. Clean UI, easy to use, consistent transactions, etc. I personally feel most comfortable using a native wallet as well.”

These remarks came as the platform announced that users were migrating from Nami to Lace in “full swing.” This transition indicates a strategic plan to position Lace Wallet as a prominent light wallet platform.

Hoskinson had previously expressed his confidence in Lace Wallet’s potential to become a “powerhouse” in 2024. But beyond Lace Wallet, Cardano actively promotes other innovative solutions within its ecosystem.

In November, Hoskinson dialogued with Ripple’s CTO, David Schwartz. They discussed the capabilities of Cardano’s privacy-centric blockchain project, Midnight, and Ripple’s XRP.

Midnight seeks to revolutionize secure data handling while adhering to regulatory compliance. Hoskinkson anticipates that it will reshape privacy-driven Decentralized Applications (dApps).

What do ADA charts suggest?

Advanced buying activity from whales and retailers indicates that ADA is well-positioned for additional profits. Thus, Cardano is enjoying strong upward momentum amid increased demand.

Cardano’s growing scarcity demonstrates the increased demand. This is evidenced by the rising Stock-to-Flow ratio (SFR), which has jumped to 133.7. When the SFR increases, it suggests that ADA is becoming scarce, with demand outpacing supply, which helps increase prices.

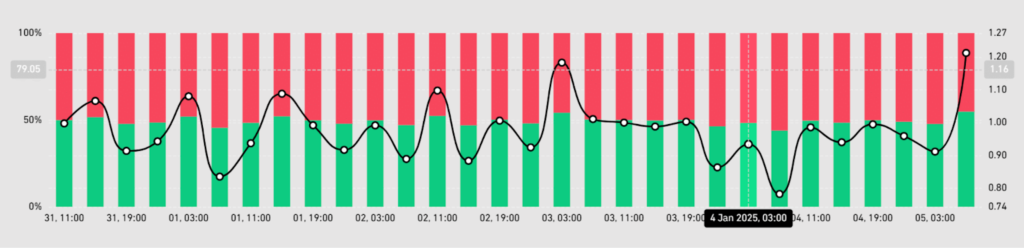

Furthermore, this demand for ADA is dominant for long positions, as per the long/short ratio, and 54% of traders take long positions. When longs dominate the market, it signifies bullishness among traders and an expectation that prices will increase.

Ultimately, Cardano’s MVRV Ratio has settled at 1.1, indicating low selling pressure. With MVRV at 1.1, it suggests that profit-taking pressure is relatively low.

The price can increase at this level before it becomes overbought. So, amidst increased activity from whales and retail traders, ADA’s momentum to the upside is growing. With positive sentiment, Cardano is well positioned for more gains.

If buyers continue to dominate the market, ADA could reclaim $1.2, which has faced multiple rejections. A breakout from here will push the altcoin to $1.5. Conversely, if a market correction occurs, the altcoin will dip to $0.89.

The 2025 bull market: Ethereum vs Bitcoin

In 2024, Ethereum lagged behind Bitcoin in terms of performance and demand. While Bitcoin (BTC) surged by 121.4%, Ether (ETH) struggled severely, with only 46.3% in returns.

The massive difference can be attributed to the January 2024 launch of Spot Bitcoin ETFs, which attracted $35.3 billion in inflows and pushed BTC to new heights—for Ethereum, ETFs, introduced in July, attracted a lowly $2.66 billion.

This contrast emphasized Ethereum’s struggle to keep pace with Bitcoin, primarily due to growing competition and a more bearish sentiment surrounding its ecosystem.

A year onward, the altcoin is under intense scrutiny as many have questioned its ability to reclaim its former dominance and deliver substantial gains. While Ethereum has always been a leader in the blockchain space, recent trends have led to concerns about its capacity to surpass in the next cycle.

Many experts and traders exhibit different thoughts regarding Ethereum’s future – from optimistic to cautious.

Analysts debate over ETH’s potential

First, Markus Thielen, Head of Research at 10X Research, expressed his doubts, inferring that ETH may lag behind BTC again this year. His cautious view makes ETH seem less attractive.

He pointed to a 1% decline in active validators over the past month and outlined risks such as greater unstacking and low demand outside Ethereum’s staking ecosystem.

“While the possibility of a new catalyst cannot be ruled out, we wouldn’t be surprised if Ethereum struggles to deliver meaningful rallies next year.”

Thielen also criticized Ethereum’s recent network upgrades, primarily the March Duncan and upcoming Pectra upgrades. He pointed out that of the 19 previous upgrades, only two significantly affected the cryptocurrency’s price.

On the other hand, Tim Lowe, Chief Business Officer at Attestant, is optimistic. He stressed that enhanced marketing strategies and a more explicit value proposition could increase demand for the asset. Lowe noted that Ethereum’s diversification appeal compared to BTC could attract more investors.

Traders have various opinions about ETH’s price trajectory. Cold Blooded Schiller’s pseudonymous trader identified two scenarios: a breakout with upward momentum or a drop toward the $3,000 range. Similarly, trader Dal forecasted a possible hike beyond $3,554 toward $4,000 or a dip to $3,102.

Finally, Michael Van de Poppe, CEO of MN Capital, mentioned his bullish outlook. He suggested that ETH may surpass BTC in the coming months and predicted that the ETH/BTC ratio would rise above 0.04 by January 2025, up from its current level of 0.03667.

Institutional demand for BTC grows

Bitcoin marked a historic milestone in the last month of 2024 as the premier cryptocurrency surged past the $100,000 mark. Consequently, institutional demand for the coin has grown, and many brands want to increase their BTC holdings in 2025.

Metaplanet has disclosed enterprising plans to expand its BTC holdings fivefold, targeting 10,000 BTC by 2025. The CEO Simon Gerovich stated on X,

“In 2025, we aim to expand our Bitcoin holdings to 10,000 BTC by utilizing the most accretive capital market tools available to us. Together, we’re building a company and driving a movement.”

He underscored grand plans for the firm’s future, focusing on transparency and improving shareholder engagement through inventive initiatives. Metaplanet seeks to harness collaborations to boost BTC adoption within Japan and globally, reinforcing its role in the crypto ecosystem.

Incidentally, Metaplanet’s strategy resembles MicroStrategy’s popular BTC investment approach.

According to a recent regulatory filing, MicroStrategy bought 1,070 Bitcoins for $101 million between December 30 and 31 last year, which increased its shares. The company now owns approximately 447,470 Bitcoins, worth nearly $45 billion.

Still, MicroStrategy publicized a plan to raise $2 billion in capital over the next three years. This aligns with its 21/21 strategy of raising $42 billion of capital by selling new shares and fixed-income securities to buy more Bitcoin.

In addition, MicroStrategy’s chairman, Michael Saylor, disclosed in an interview that he supports burning Bitcoin keys after death. This would ensure the loss or inaccessibility of the BTC involved.

Saylor’s statement recalls Satoshi Nakamoto’s, whose wallet contained 1 million BTC and has remained dormant since the anonymous figure (widely viewed as Bitcoin’s founder) went radio silent. Similarly, his view is rooted in Bitcoin’s absolute scarcity.

While the maximum supply of BTC is capped at $21 million, many Bitcoins are also lost, such as via lost addresses due to lost pass keys or the death of the wallet owner. These lost coins increase BTC’s value or floor price, making it more scarce and valuable as time passes.

Metaplanet and MicroStrategy’s ambitious BTC accumulation plans generally align with bullish predictions from many asset managers. Bitwise, Standard Chartered, and VanEck analysts have predicted that BTC can rise from $180,000 to $200,000 in 2025.

They are confident that flows into spot Bitcoin ETFs in 2025 could keep pace with the numbers from 2024. Moreover, Bitcoin’s prices could see a more considerable boost if the U.S. adopts a Bitcoin strategic reserve – of which BTC’s value could rise to $500,000.

Dogecoin surges by 18% in a week

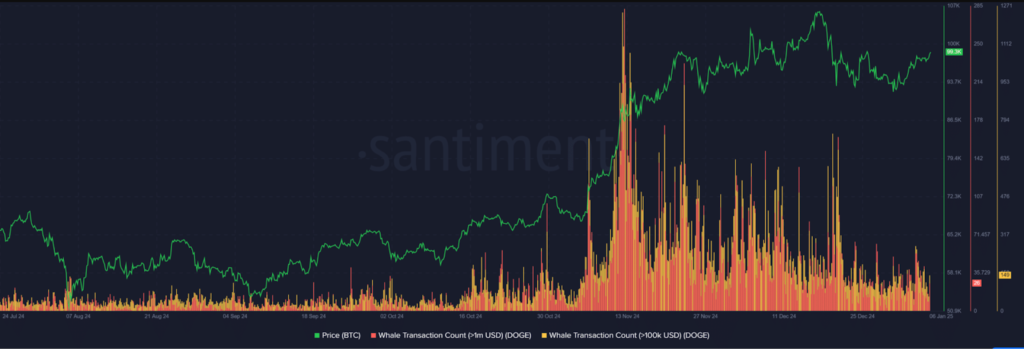

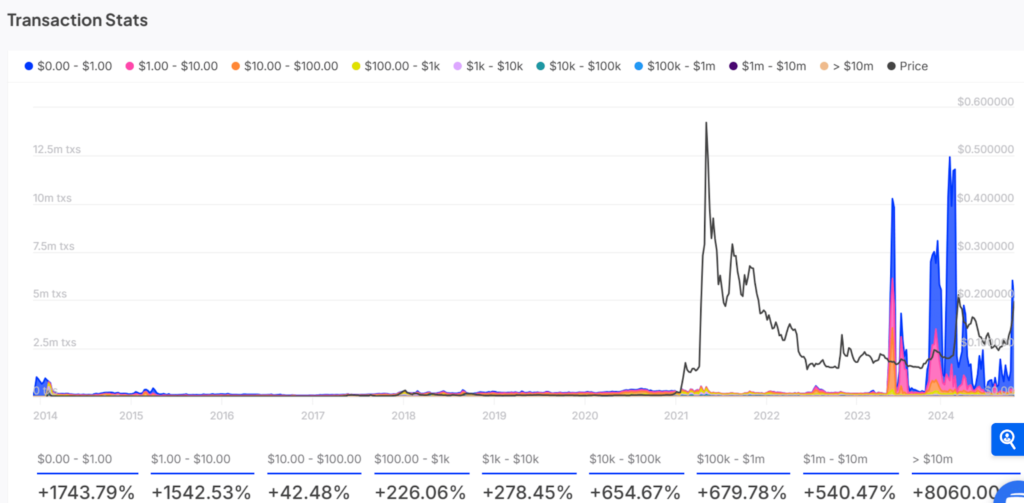

Dogecoin (DOGE) witnessed a massive 400% increase in whale transactions exceeding $100,000 within 24 hours, which coincides with a substantial 18% price increase over the past week.

This rise in whale activity has led to speculation about a possible bullish run for DOGE. As whales accumulate DOGE, many analysts envision the token reaching the $1 target.

Typically, an uptick in whale transactions precedes bullish trends. These larger trades usually reflect accumulation phases or strategic positioning for more upside.

Rising trading volumes and increasing market optimism indicate that whales depend on a sustained rally. With improving institutional interest, analysts speculate that Dogecoin could retest its all-time high (ATH).

It may reach the coveted $1 milestone in the coming months.

What is behind DOGE’s adoption?

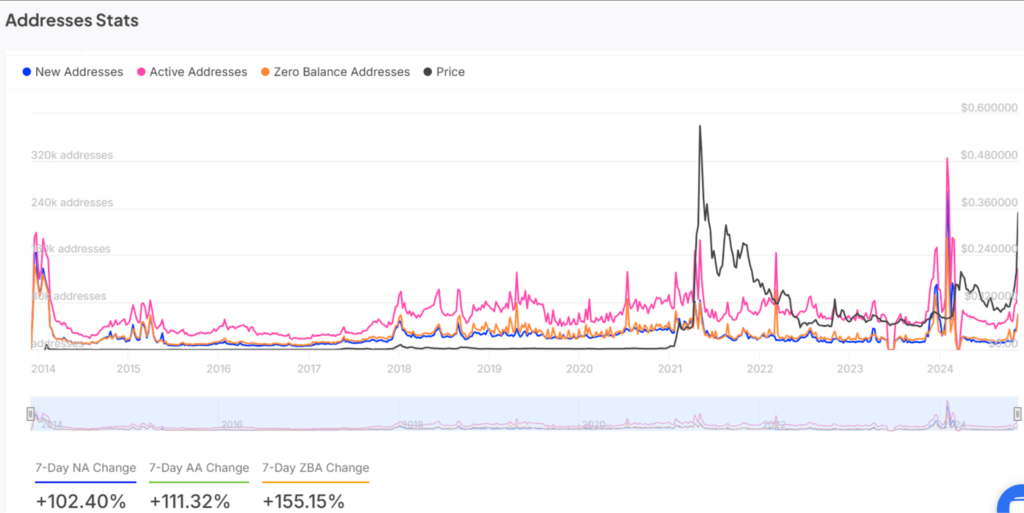

Firstly, Dogecoin’s (DOGE) considerable growth in adoption can be traced to its addresses. Over the last week, active addresses increased by 111.32%, while new addresses surged by 102.40%.

Secondly, transaction volume has increased. Transactions above $1 million have increased, alongside smaller transactions. This indicates a strong foundation for additional price growth in the near term.

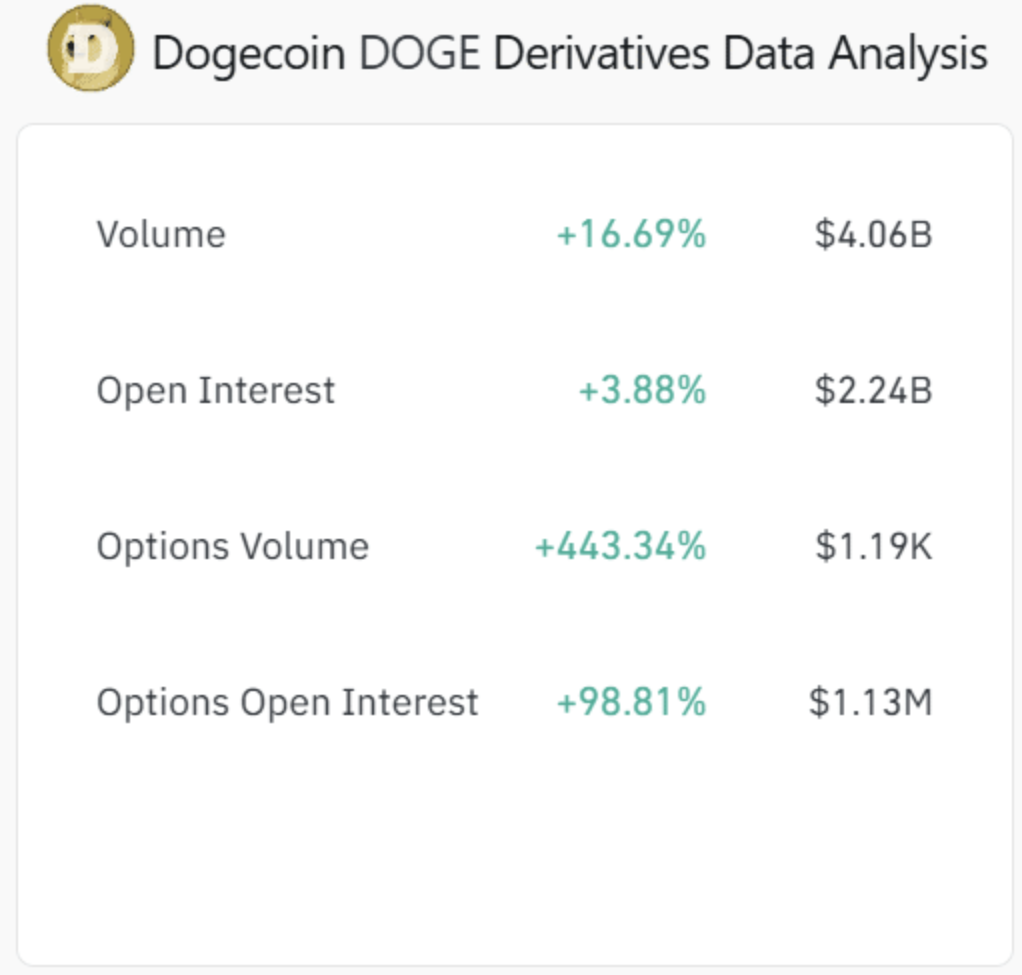

Thirdly, Dogecoin’s derivatives metrics also strengthen the bullish narrative. Open Interest (OI) has increased by 3.88%, while options OI has surged by an impressive 98.81%. In addition, trading volume has risen by 16.69% to $4.06 billion.

Closing Remark

Many experts and traders thought differently about the future of Ethereum and Bitcoin. For the former, the inference is that ETH may lag behind BTC again this year. Meanwhile, BTC keeps growing in institutional adoption, as it is buttressed again by the recovery of 460k dormant Bitcoins.

Cardano’s monumental 270% rally between early November and December has been further emphasized by its whales’ recent purchase of 40 million tokens.

For Dogecoin, the surge in whale activity, increased network adoption, and other favorable technical indicators indicate improved retail and institutional interest. This can lead to extra stability for DOGE’s price, indicating growing speculative interest.

What are your thoughts on this week’s cryptonews? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What does Cardano whales’ 40 million token purchase mean?

Advanced buying activity from whales and retailers indicates ADA is well positioned for additional profits.

What is the 2025 bull market outlook for Ethereum like?

Many analysts hold a cautious view, which makes ETH seem like a less attractive asset.

What is the 2025 bull market outlook for Bitcoin like?

After the vast milestones of 2924, institutional demand for BTC has grown, and as such, many brands want to increase their BTC holdings.

What effect does the recovered 460k Bitcoins have on the market?

This surge in dormant coins entering circulation indicates rising confidence among long-term holders (LTHs), capitalizing on the current bullish cycle.

If I could inspire others, I’d be grateful. As for the latest BuzzFeed News investigation into reactivating 460 of BTC 460,000 dormant blockchains again.

The flow of capital from Bitcoin hold addresses to purchasing new technology startups could potentially free up enormous amounts that would otherwise be spent at Amazon on non-liquid assets. The expansion also results from rechanneling (hopefully at a high level but not always) into other startups close by.

Between the boost to the confidence of long-term holders and the subsequent flooding of capital, the issue forces an interesting question: Can improved liquidity generate less harsh bull market cycles over time? Or will the needs instead be just as heavy?

Moreover, this causes me to think about miners under these circumstances. With rising liquidity that leads to locking in at a higher and reasonable price level, how will it affect profitability for miners? Miners are a critical part of the Bitcoin system and it is important to understand how changes in these circumstances may be affecting their behavior. Interpreting these new ideas is a new labor.