This week’s crypto news was all about new projects being launched on different platforms.

Polygon and Shiba Inu announced new projects, alongside ProShares Trust, their upcoming XRP exchange-traded fund (ETF). Interesting predictions were also made by industry experts, and we look into a few promising crypto airdrops.

Let’s dive in.

Polygon establishes the Agglayer Breakout program

Polygon plans for a major ecosystem expansion with the launch of the Agglayer Breakout program, as announced on social media.

The Agglayer Breakout program, backed by the Polygon Foundation and Polygon Labs, is designed to launch new on-chain projects on the Polygon network.

Also, POL stakers will be rewarded with token airdrops (usually between 5% and 15%) of the successful incubated projects.

These projects, once developed, will operate independently while contributing to Agglayer’s network effects, increasing overall utility and ecosystem growth. Agglayer is Polygon’s interoperability and scaling layer connecting multiple chains into a unified ecosystem.

How does the Agglayer program work?

The Agglayer Breakout program will operate as a separate network from Polygon while using the POL token as its native utility token. It uses Zero-Knowledge (ZK) technology, a privacy-first style of cryptography that allows one party to prove a piece of information to another without sharing sensitive information.

Its model involves four stages – incubation, growth, airdrop to stakers, and network effect contributions. Graduated projects will reward the POL community, connect to Agglayer, and expand the broader Polygon ecosystem.

Several standout projects are already involved. They include Privado ID, a Web3 identity verification project, and Miden, a Layer 2 Ethereum chain, among other unnamed projects.

The Agglayer Breakout program is also designed to solve the “cold start” problem for new projects by providing instant access to Polygon’s liquidity, stakers, and resources, helping them get off to a strong start.

XRP ETFs to launch soon

The U.S. Securities and Exchange Commission (SEC) has granted the go-ahead for ProShares Trust to proceed with its XRP ETF offerings. It could launch within this week, with April 30, 2025, set as the effective date.

According to a newly filed Form N-1A, ProShares will launch three futures-based ETFs: the Ultra XRP ETF, the Short XRP ETF, and the Ultra Short XRP ETF. This development follows the launch of Teucrium’s 2x Long Daily XRP ETF in early April.

It is essential to note that ETFs do not receive the same level of approval from the SEC as spot products do. Instead, they can only take effect if the agency doesn’t object within a specific period after filing. The filing shows that no immediate persuasion was selected upon filing, with April 30 later chosen.

The ProShares XRP ETFs offer 2x leverage, providing leveraged and inverse exposure to the price movements of XRP. In addition, it gives investors more options to access the popular altcoin through regulated financial products.

ProShares’ primary executive offices are located in Bethesda, Maryland, with ProShares Advisors LLC serving as the investment advisor. This launch is a strategic move for ProShares Trust into the digital assets sector, aligning with the firm’s efforts to offer investment products related to cryptocurrencies.

The funds are structured under a mutual fund framework and are registered in compliance with both the Securities Act and the Investment Company Act.

Expert projects $100 billion capital inflow

The approval of ProShares’ XRP futures ETF has sparked optimism among XRP investors. To that end, industry expert Armando Pantoja forecasts the move could lead to considerable capital inflow into the altcoin.

He wrote on social media,

“A spot XRP ETF could be next, unlocking real demand and sending prices soaring. $100 billion+ could soon flood into XRP.”

Firstly, Pantoja stressed that the approval marks a significant turning point for cryptocurrency, as it now attracts substantial attention from Wall Street and institutional investors. With this move, XRP gains a regulated and accessible avenue for major financial players to engage with the asset.

This development increases XRP’s investor base. Similarly, it affirms its mainstream legitimacy, positioning it within what he called the “elite league” of financial assets.

Secondly, Pantoja drew parallels between Ripple (XRP) and the trajectories of Bitcoin (BTC) and Ethereum (ETH). He noted that futures ETFs were approved first for both cryptocurrencies, followed by spot ETFs.

For instance, Bitcoin’s spot ETF was approved in 2024, three years after ProShares launched the first Bitcoin futures ETF in 2021. Now, in 2025, XRP appears to be following a similar path.

Thirdly, Pantoja predicted that the approval of a spot XRP ETF could have a significant impact on the market. As institutional investors gain greater access to the asset, it will likely trigger central buying pressure. In addition, a surge in demand and supply could set the stage for a dramatic rise in XRP’s price.

However, another analyst has tempered expectations. He affirmed that while the futures ETF approval is noteworthy, it is not the game-changer many might expect.

John Squire posted,

“It’s not the silver bullet that will trigger mass adoption or massive price action. The real catalyst will come when a Spot XRP ETF gets approved.”

Unlike a spot ETF, which buys and holds the actual token, creating real demand in the market, a futures ETF only allows investors to speculate on the price without purchasing the underlying asset.

This disparity means that while the futures ETF can increase recognition within traditional finance (TradFi), it does not directly impact the supply of XRP or create immediate buying pressure. Furthermore, futures ETFs often incur hidden costs, such as management fees, rollovers, and slippage, which can reduce investors’ overall returns.

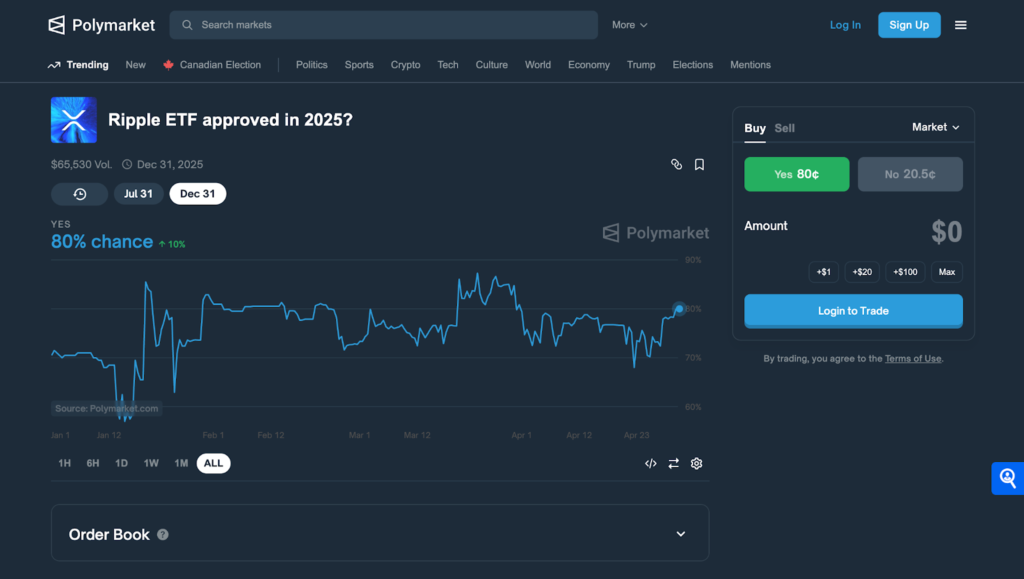

Nonetheless, on Polymarket, a prediction platform, the odds of an XRP ETF approval stand at 80%.

Shiba Inu unveils the Shibarium DappStore

Shiba Inu has unveiled the Shibarium DappStore, a curated portal that highlights decentralized applications (dApps) developed within its ecosystem. This was posted on their X social media page.

It is a development aimed at redefining user engagement on its Layer 2 network, to simplify access for users and developers in the fragmented Web3 world.

The Shibarium DappStore is a digital portal that provides users with verified, high-utility dApps that are also evaluated for usability. With this move, the team tackles one of the most significant challenges in decentralized environments – discoverability.

Furthermore, by curating dApps without constraining open development, the DappStore provides a framework to guide users through the increasing complexity of decentralized ecosystems.

Similarly, Zypto has become the first DeFi wallet to integrate Shibarium and ShibaSwap. This enables the platform to offer convenience, control and cold storage asset security for users in the Shiba ecosystem.

Developer Hub streamlines onboarding for builders

With the Shiba Inu DappStore release, Shiba Inu also released a rich Developer Hub, a single entry point for developing on Shibarium.

The hub provides centralized development resources, including SDKs for interacting with and deploying smart contracts, RDC endpoints, official documentation, and step-by-step tutorials.

More than just infrastructure, the hub provides developers with educational and technical resources to make onboarding easier, whether they’re deploying a social dApp or a decentralized exchange (DEX).

In addition, its Ethereum compatibility, high throughput, and reduced costs appeal to developers who require scalability and affordability. Finally, future features like Fully Homomorphic Encryption, in collaboration with ZAMA, promise that privacy-centric applications will have a natural fit shortly.

The growth indicators of Shibarium mark it ready to take off in mainstream Web3 development. With over 1,200 dApps, 24,000 active contracts, and 175 million wallet addresses, the ecosystem boasts activity levels that many older blockchain networks strive to achieve.

Industry expert reveals key VC interests for 2025

Andy, the host of The Rollup Co., outlined vital highlights from his conversations with top venture capitalists (VCs) on social media. These insights reveal the sectors that are attracting strong interest.

First, according to Andy, the first area of focus is stablecoins,

“Stablecoin issuers are very investable & will likely 10x in quantity.”

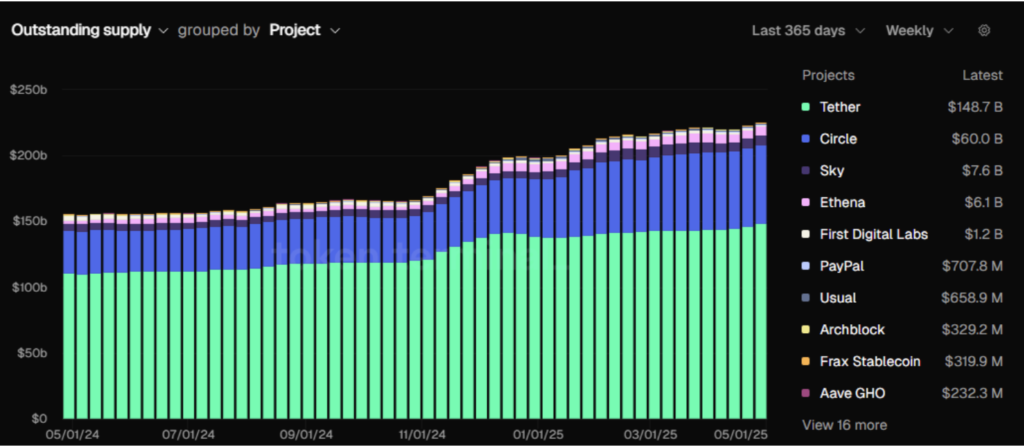

Multiple platforms, such as CoinMarketCap and CoinGecko, currently list over 200 stablecoins. Token Terminal has also shown that the stablecoin market cap has exceeded $225 billion; however, Tether and Circle still dominate most of it.

If this prediction holds, the number of stablecoin issuers could increase by hundreds. This would open new investment opportunities for individuals through airdrops, stablecoin yields, and DeFi protocols.

Secondly, VCs also find the AI sector interesting. However, they recognize a gap in how AI applications are developed between Web2 and Web3. Andy added,

“The AI sector is interesting, but better builders in Web2, for now.”

Recent reports have shown that the number of AI agents is growing at an average monthly rate of 33%. Yet, Web3-based AI solutions account for just 3% of the total AI agent ecosystem. These figures align with VC’s observations. Web3 AI may need more time to prove itself with practical and efficient use cases.

Another industry stakeholder, Anthony, founder of blockchain121, also commented on a trend where decentralized AI projects now attract top-tier talent from the Web2 AI space.

Anthony affirmed,

“Legit DeAI projects really are, for the first time, attracting legit world-class engineers and researchers from Web2 AI.”

Third, Andy revealed that VCs have a strong focus on real-world assets (RWAs):

“RWAs, RWAs, RWAs are all that matter.”

At the time of writing, the RWA.xyz platform indicates a current market cap of $18.9 billion. The involvement of major financial institutions, such as BlackRock and Fidelity, has boosted investor confidence in the sector’s long-term potential.

Finally, Andy mentioned that Bitcoin liquidity markets are also of interest to VCs.

Justin Sun calls JST a ‘next 100x token’

Industry figure and TRON founder Justin Sun has boldly made a declaration about the future of JST, the governance token of the Just ecosystem.

In a recent social media post, Sun claimed that JST has undergone a “complete and fundamental reversal” and suggested it could become the “next 100x token” as the TRON-based DeFi landscape matures.

Paramount to Sun’s argument is the performance of JustLend, a permissionless lending platform built on the TRON blockchain and incubated by JST. Since its launch, JustLend has grown into one of the largest lending protocols in the TRON ecosystem, allowing users to lend and borrow native assets through decentralized liquidity pools.

It operates similarly to Compound or AAVE on Ethereum, but with the added advantage of TRON’s high throughput and low transaction fees. According to Sun, JustLend’s growth has translated into tens of millions of dollars in net profit, with interest rates for lenders sometimes reaching up to 30%.

Another platform is USDD, a decentralized stablecoin incubated by the Just platform and TRON DAO Reserve. According to Sun, USDD has seen “explosive growth,” quickly becoming a widely used stablecoin within the TRON network and beyond.

Integration with lending and DeFi platforms has accelerated its adoption, further boosting the utility and demand for JST.

Justin Sun equates JST’s evolving role to a combination of AAVE and MakerDAO’s MKR. JST is used for governance decisions within the Just ecosystem and plays a vital role in the issuance and management of stablecoins and lending pools.

Also, he has committed to using all profits to buy back and burn JST tokens “at the appropriate time.” This mechanism is designed to reduce the circulating supply and potentially increase the value of remaining tokens, a strategy that has been successful for other DeFi projects.

The success of JustLend and USDD is proof that TRON is ambitious in its effort to rival Ethereum’s DeFi dominance, offering attractive yields and a user-friendly experience.

If they continue their upward trajectory and the promised buyback and burn program is implemented, JST could probably increase.

Top 3 crypto airdrops left in April

As April comes to a close, consider the following crypto airdrops. They have the potential to be lucrative for investors seeking promising projects. They include:

Parfin

Parfin is first in line among the other airdrops after the project raised over $32 million in funding. Key backers include Framework Ventures, ParaFi Capital, Valor Capital, and Mastercard.

Also, Parfin is the developer of Rayls, an Ethereum-compatible Layer 2 blockchain. Rayls bridges TradFi with DeFi, and based on this, Parfin is making headlines over the potential Rayls airdrop.

The project focuses on privacy, scalability, and interoperability for institutional use. It tracks airdrop farming tasks on bounty platforms, with users expected to monitor updates for maximum eligibility.

Airdrop farmers interested in Parfin’s Rayls token airdrop must join Parfin’s Discord, complete tasks, claim an NFT for a gas fee, and submit a form.

Nous Research

Nous Research is a blockchain service backed by key supporters, including Paradigm, Distributed Global, Delphi Labs, and North Island Ventures. Together, these firms, alongside others, accumulated up to $70 million for the confirmed status of the NOUS airdrop.

Nous Research has a waitlist form on the project website, so users who complete this form can gain early access to future products. The airdrop could drive adoption for the token, given Nous’ focus on censorship-resistant AI and partnerships like Bittensor (TAO).

Movement

The last crypto airdrop is Movement (MOVE), which recently launched the beta test of its Parthenon ecosystem. The project has raised over $41 million from backers such as Polychain Capital, YZi Labs, OKX Ventures, and Hack VC.

Airdrop farmers or investors interested in the MOVE airdrop can complete tasks and get beta EXP in return. For this activity, participants can only get a boost of farming future points in the main version of the ecosystem.

Closing remark

Polygon Labs is deeply involved in all decision-making for the Agglayer Breakout platform. This bodes well for the Polygon community as the Agglayer program’s innovative features can expand the former’s ecosystem.

Also, the approval of ProShares’ XRP futures ETF has sparked optimism among XRP investors. Beyond positive industry analysis, the optimistic sentiment from Polymarket makes for good reading, as well.

The DappStore provides a native spotlight to help achieve adoption in an active SHIB base, which has previously shown high interest in and adoption of new initiatives.

Finally, Justin Sun has boldly made a declaration about the future of JST. This comes as the TRON-based DeFi landscape matures, with the JustLend platform at the forefront.

Zypto App integrates ShibaSwap on Shibarium

Zypto has released version 1.15 of its app, becoming the first DeFi wallet to natively support both ShibaSwap and the Shibarium blockchain. Users can now trade $SHIB, $BONE, $LEASH, and $TREAT directly within the app, enjoy self-custody of Shibarium tokens, and access features like the Zypto VISA Card and Vault Key Card for cold storage wallet security.

This integration streamlines DeFi access for the Shiba Inu community. Find out more here.

With new launches on the way, as well as other bold claims, what is your favorite news this week? Let us know in the comments section.

FAQs

Which program did Polygon launch?

Polygon announced the launch of the Agglayer Breakout program on social media.

When does ProShares Trust plan to launch its XRP ETF?

April 30, 2025, has been set as the launch date.

What is the Shibarium Dappstore about?

It is a curated portal that highlights dApps developed within the Shibarium ecosystem.

What are the highlights of the VCs’ interests?

The VCs seem to be interested in stablecoins, AI, RWAs and BTC.

What are the three main crypto airdrops left in April?

They include Rayls, NOUS, and MOVE.

0 Comments