In this piece we cover how Pi Coin surged to a new all-time high (ATH) after the launch of the Pi Network Mainnet; Solana’s controversies affected its demand, while Bitcoin spot traders purchased $1 billion worth of BTC. Lastly, AVAX whale activity surged 80%, with good days ahead for the blockchain.

Let’s dive in.

Pi Coin surges to new all-time high of $2.9

After more than six years of speculation, Pi Network (Pi) finally launched on February 20, 2025. The project posted the announcement about its “Open Network” via X.

Yet, the price plummeted by 62.3% within a day and left many investors wondering how it would fare. However, within a week of its launch, Pi has stabilized to the point that it has surged to a new all-time high (ATH) of $2.9.

But what is the hype of Pi Coin all about?

Pi launches on the Mainnet blockchain

Pi Network is a Web3 blockchain project that enables users to mine crypto on their smart devices without needing expensive hardware. It utilizes an energy-light mining system and a large-scale KYC solution to guarantee security and verification.

This has attracted millions of users to its ecosystem who were eager to earn Pi Coins. Now, Pi Coin has over 60 million users and has surpassed 110 million app downloads, with an average of 110,000 new downloads per day.

According to the Pi Network’s website,

“Pi Network is a community of tens of millions of humans mining Pi cryptocurrency to use and build the Web3 app ecosystem.”

For core Pi users, the network’s launch was a watershed moment. After a two year delay, they could finally migrate their mined Pi Coins from the testnet to the mainnet. The transition would enable external connectivity on the Mainnet allowing Pi to interface with other networks.

Moreover, by being listed on major exchanges like Bitget or OKX, users can now trade Pi Coin. Furthermore, Binance asked their community to vote whether they wanted Pi to be listed – of which majority have voted in the affirmative.

Pi Coin hits new all-time high

Pi Coin recovered strongly after its initial post-launch crash. It regained its footing on February 21 and has not looked back since then. As at February 27, it has reached a new all-time high of $2.9.

Despite macroeconomic headwinds, investor sentiment around Pi Network has been largely bullish. With its launch, Pi Coin is expected to provide great accessibility and liquidity to traders.

While the token is yet to hit the $10 mark, some crypto analysts are optimistic about Pi Coin’s trajectory to increase its adoption and significant growth potential. To them, if Pi Network evolves into a widely accepted currency, then its price can exceed $500 by 2030.

Solana’s controversy drives down demand

Solana (SOL) has had a few tough weeks, and the recent bearishness in the market has impacted the token. Its price dropped from $256 to $173 in just under a month – a 32% drop.

The altcoin has been struggling with bearish pressure after hitting a local high of $195 three weeks ago. Amidst its struggle with low on-chain activity, Solana has declined to hit a three-month low of 3.5 million.

SOL daily active addresses reduce to 3.5M

When active users decrease, market interest and adoption substantially decline. Lower active users usually reduce on-chain activity, which could lead to price depreciation.

Historically, fewer users typically correlate with price decline as demand drops.

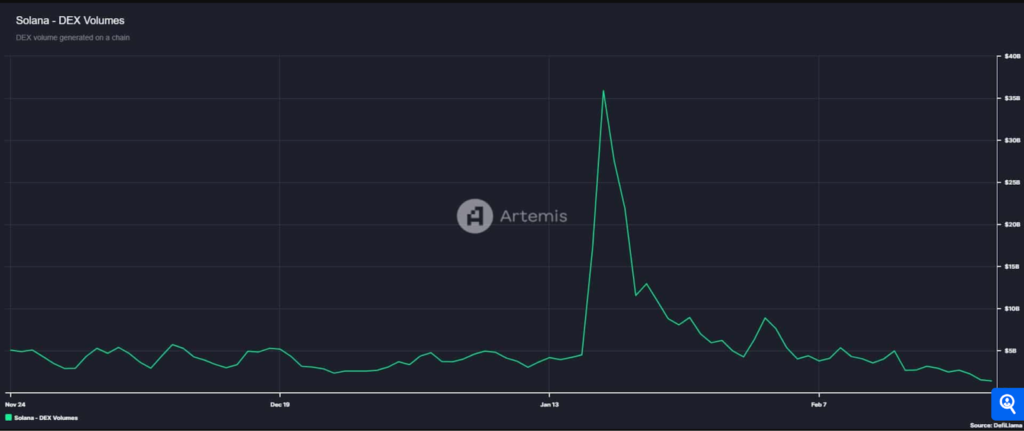

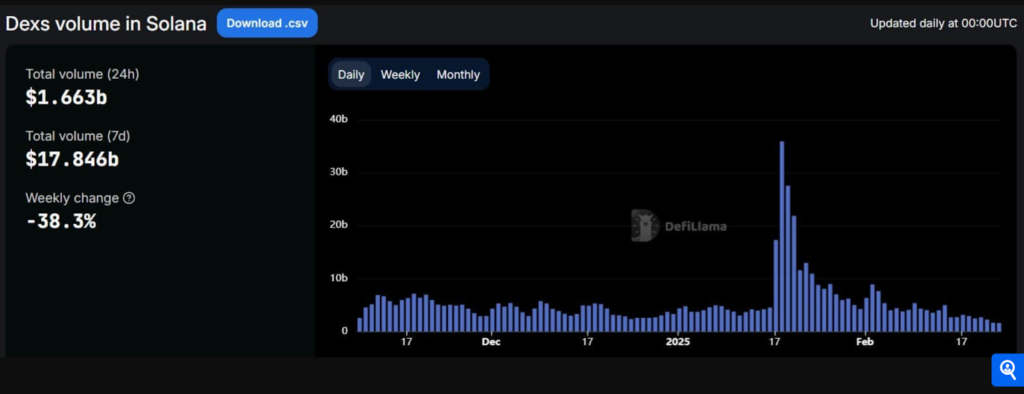

This reduced on-chain activity on Solana is further evidenced by the declining trading volume for the Decentralized Exchange (DEX). Artemis data shows that it has dropped to a four-month low of $1.5 billion, which indicates reduced trust in the network as investors prefer the Centralized Exchange (CEX) over security concerns.

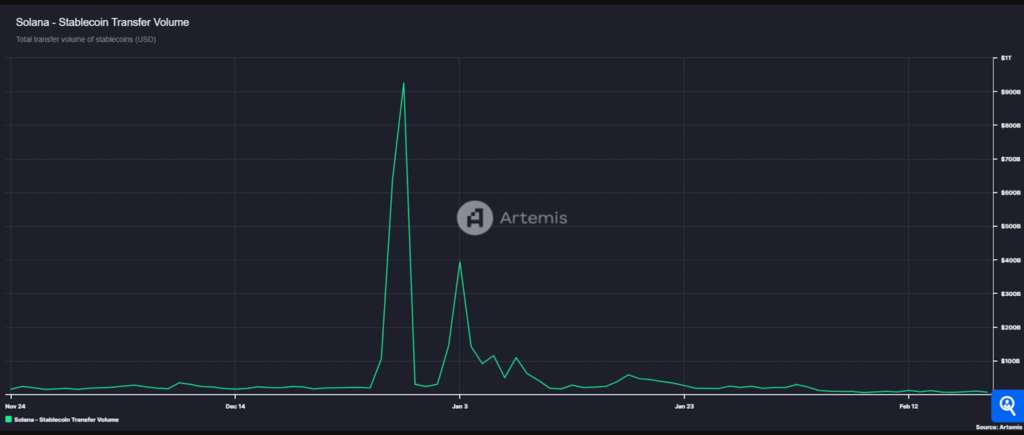

In addition, Solana’s stablecoin transfer volume has declined to $7.1 billion, a sustained decline from $394 billion a month ago. This significant drop suggests that large investors are considering other blockchains like Ethereum’s (ETH).

This also mirrors a risk-off sentiment among SOL investors.

Decline in SOL DEX volume

Solana’s DEX volume has significantly declined, with a 38% drop last week. This marks the fifth consecutive week of declining volumes, with top DEXs like Raydium (RAY) and Orca (ORCA) witnessing downturns of 54.34% and 20-30%, respectively.

Several factors contribute to the recent decline in Solana’s DEX volume.

First, the rise of memecoins, mainly the controversial LIBRA token promoted by Argentine President Javier Milei, has led to catastrophic losses for investors and tarnished Solana’s reputation.

This has reduced user engagement and trading activity on Solana-based DEXs, as many users have become more cautious in their trading behavior.

Secondly, the broader market-wide downturn is contributing to the decline. Solana’s on-chain volume decline mirrors similar reductions across other blockchain networks, such as BNB Chain, Ethereum, Sui, and Polygon.

This trend indicates a general cooling of DeFi activities across the sector, suggesting that Solana’s struggles may be part of a broader market showdown.

Additionally, Solana’s Total Value Locked (TVL) recently hit a new low of $9.90 billion. Although the TVL has since recovered somewhat past $10 billion, this still represents an almost 30% drop since mid-January.

Historically, significant TVL declines in Solana have overlapped with major sell-offs in SOL’s price, mostly as investor confidence reduced in response to ecosystem instability.

What is the impact on SOL?

Understandably, reduced on-chain activity has negatively affected SOL’s price movements and demand, leading to less buying pressure and downward price pressure.

How Solana battles these challenges can significantly impact SOL’s price and larger market sentiment.

Bitcoin spot traders purchase $1B BTC

The cryptocurrency market has been primarily bearish, with the market cap reducing to $3.15 trillion. Likewise, Bitcoin spot ETFs have seen a market outflow of -$552.5 million, as BTC lost 0.47% during this phase.

Such a significant outflow usually suggests bearish sentiment and leads to market turmoil. Yet, Bitcoin remained relatively stable because while the U.S. institutional investors kept selling, spot traders bought more, negating the effect.

According to Coinglass, about $1.07 billion worth of BTC was bought from the market and transferred into private wallets.

When a substantial purchase, almost twice the sale occurs, it implies spot traders are more bullish. If this buying trend from this cohort persists, a significant price surge is possible over time.

Surprisingly, this major purchase wasn’t driven by Koreans or U.S. investors, which is usually the case during significant spot market buying activity.

Korean retail investors have consistently reduced their BTC purchases since February. The Korean premium index has consistently reduced, reading 2.18, the lowest level since January 18.

Likewise, U.S. retail investors have also been selling. At press time, the Coinbase Premium Index was negative, below 0, with a reading of -0.9. This infers that retail investors have been selling and may continue.

Yet, this could be a positive for BTC because if Korean and U.S. retail investors keep buying BTC, the asset will likely experience a significant price swing, adding to the existing buying momentum in the spot market.

Divergence could lead to a price surge

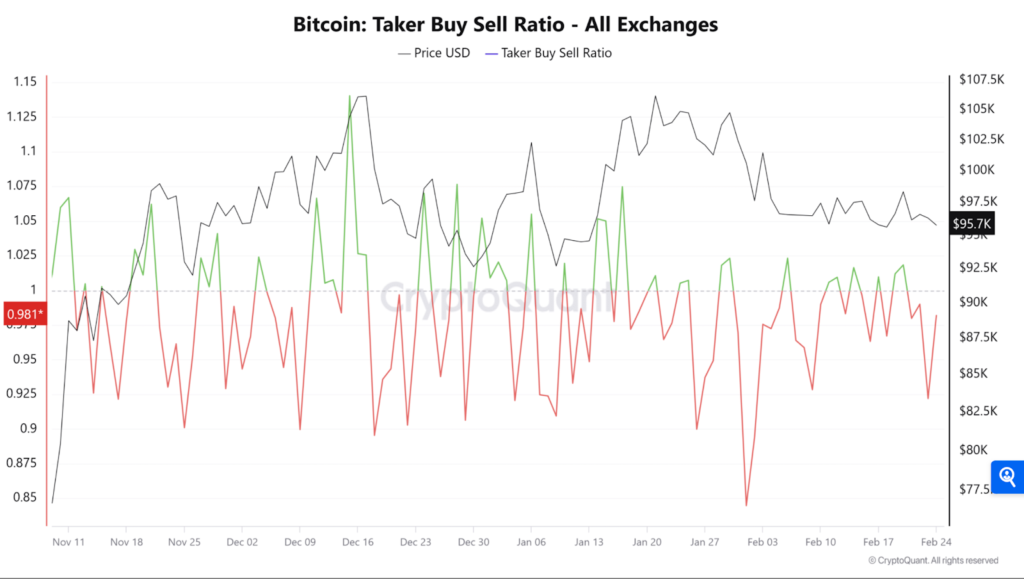

The derivatives market has experienced a divergence in essential market metrics, indicating a possible upcoming rally. At the time of writing, buying volume has increased despite a significant wave of long liquidations.

CryptoQuant data reveals that buying volume has risen substantially relative to selling volume, jumping from a low of 0.92 to 0.99. The instant the Taker Buy Sell Ratio crosses beyond one, it strengthens the current bullish sentiment pervading the market.

Even with the market turbulence and volatility over the previous month, BTC has enjoyed remarkable stability on the price charts. This can be seen in that every time BTC depreciated, its buyers have pushed it closer to $96k once again.

However, the recent state of the U.S. economy again affects crypto investors, especially retail traders, and could lead to further volatility. This is because traders are susceptible to news and other macroeconomic developments.

Conversely, whales tend to act differently and, at times, view the dip as a good chance for accumulation.

Bitcoin whales profit from retail’s fear

According to Santiment’s latest analysis, whales benefit from retail traders’ fear of collapse. The retail crowd assumes that history repeats itself by comparing recent news to former price performance under similar cases.

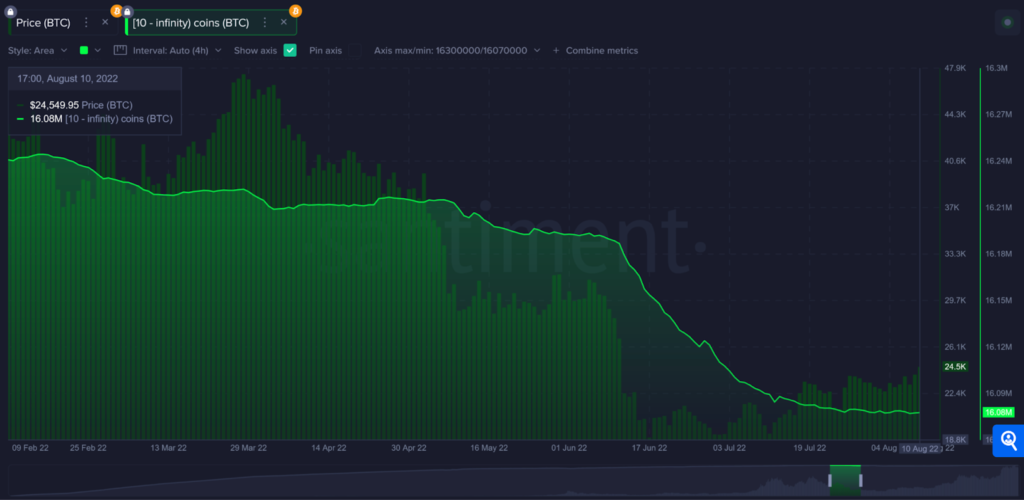

For instance, in 2022, Bitcoin’s decline of over 50% was attributed to the Fed fighting inflation and aggressively raising interest rates. Thus, retailers naturally fear a significant drop repeating itself due to recent inflation and the Fed’s failure to lower rates.

Retailers being oversensitive to inflation and interest rate hikes are enabling whales to accumulate coins with little market resistance.

Whales return to the market and buy the dip every time the price retraces on the charts, while retailers avoid it. During the 2022 bear market, for instance, wallets with over 10 BTC reduced their holdings as interest rates rose.

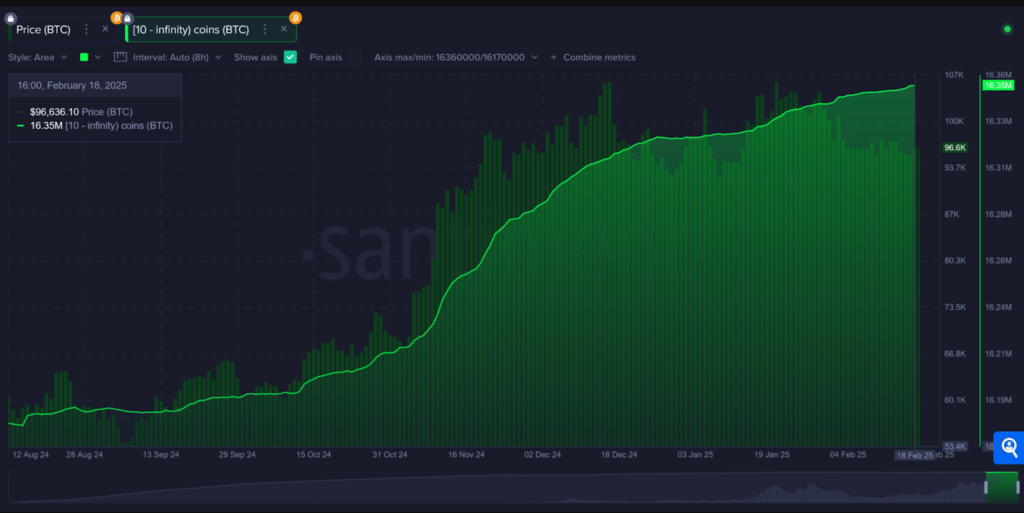

However, over the past six months, more than 10 BTC wallets have acted differently. They’ve witnessed massive growth, even with doubtful economic conditions. This means these holders are not sensitive to U.S. inflation data or Fed rate cuts. They expect Bitcoin markets to evolve independently due to their optimism regarding a market rebound.

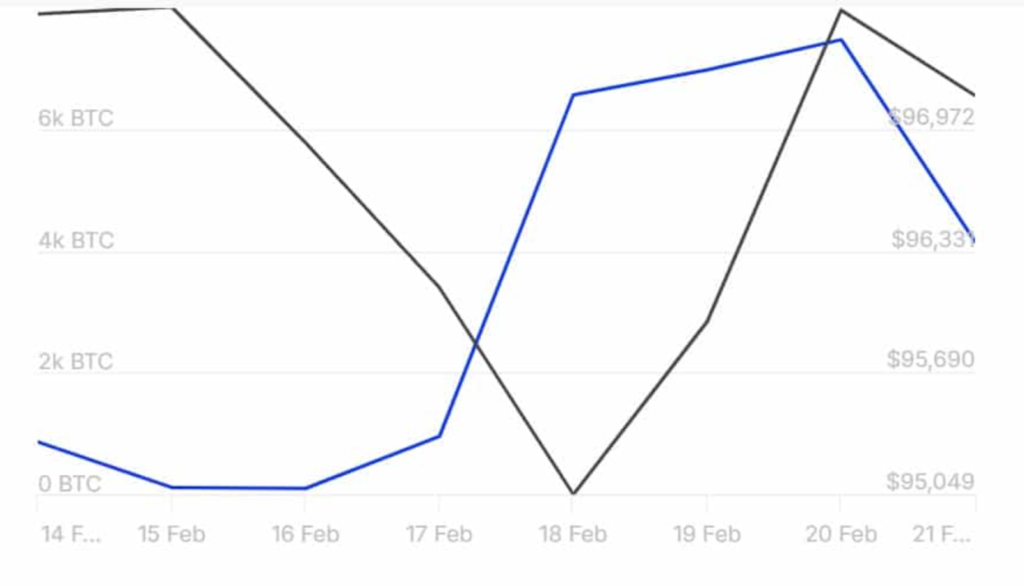

The optimism can be gauged by the fact that whale capital inflows have consistently surpassed outflows over the past week. To that end, large holders hit a high of 7.6k BTC and settled at 4.1k BTC, which means whales’ netflows have remained positive over the previous week.

This means that large holders are purchasing more BTC than they are selling.

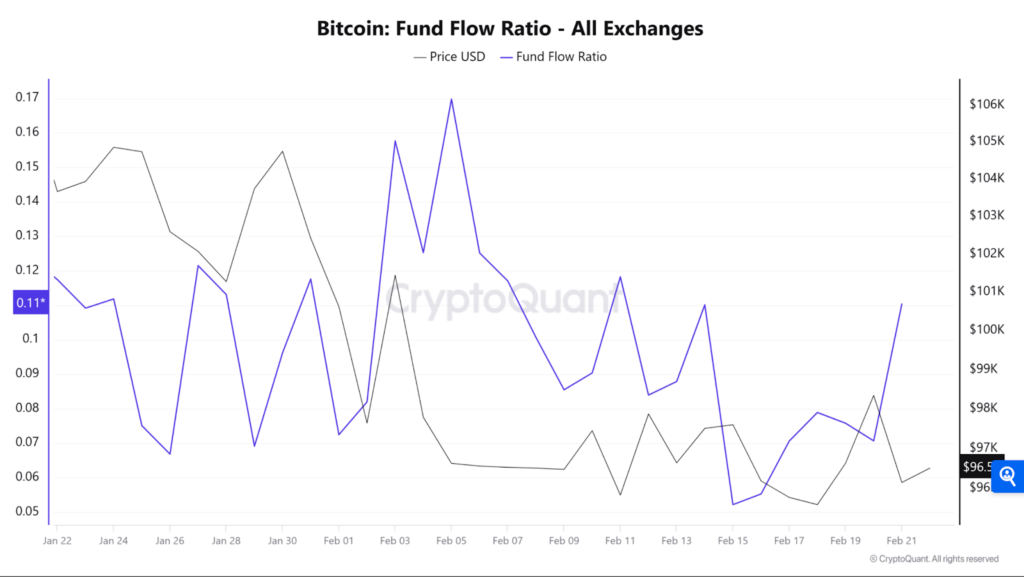

This capital inflow by large holders, including institutions, can be further validated by a declining fund flow ratio to exchanges. Over the past 18 days, the ratio dropped from 0.16 to 0.11. This implies that more coins have been moving to cold wallets as institutions accumulate constantly.

While retail traders retreat from the market, large holders are not. Whales are active and anticipate BTC’s price rebound soon. Thus, they’re simply scooping Bitcoin from other hands.

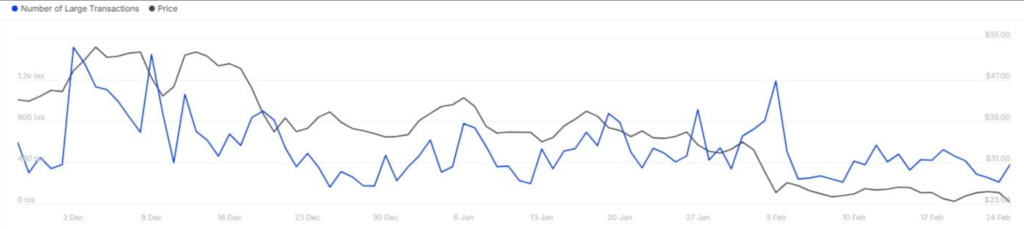

AVAX whale activity surges 80%

Avalanche (AVAX) has enjoyed bullish strides recently. The altcoin’s network activity has surged by over 80%, and the number of active addresses has increased.

These can be attributed to new on-chain developments, such as new partnerships or network improvements, which have boosted investor confidence in the blockchain.

Moreover, altcoins generally receive heightened interest. Thus, this perfectly aligns with the current developments in AVAX and a shift in sentiment.

The growing network activity and strong technical indicators have provided a bullish outlook for AVAX. If the chain can sustain its current momentum, it can attract more investors, pushing its growth further.

Closing Remark

Pi Coin surged to a new all-time high of $2.9 after its official launch on February 20, 2025, following an initial price drop. With over 60 million users and increasing adoption, Pi Network’s innovative mining system and growing market presence have fueled optimism about its long-term potential.

Solana’s on-chain volume decline mirrors similar reductions across other blockchains, raising questions about the network’s long-term health and growth.

Whales are active in BTC and anticipate a price rebound soon. Thus, they’re simply scooping Bitcoin from other hands. Lastly, the blockchain’s network activity suggests a bullish outlook for AVAX.

Zypto and Pi Network

Zypto has launched their native Pi Network dApp, and invites Pioneers to test the Pi dApp Payment Gateway by swapping a tiny amount of Pi for $1 worth of Zyp rewards points.

Keep a close eye on the news, as Pi Network users will, very soon, be able to use their Pi in exchange for Zypto’s products and services including crypto cards, bill payments and global on and off-ramp services, enabling the real-world use of Pi Coin on the Zypto Pi dApp.

Find out more here.

Are you pro-Bitcoin, pro-altcoin, or merely just a casual crypto observer? Do you have any thoughts or arguments about this week’s news? Please share them in the comment section.

FAQs

Is Pi Coin listed on major exchanges?

Yes, Pi Coin is listed on Bitget and OKX. Also, after a majority voted for Binance to list Pi coin via a community vote, it seems highly possible that the exchange will follow.

How high did Pi Coin get?

On February 27, Pi Coin surged to a new all-time high (ATH) of $2.9.

What is behind Solana’s struggles?

Amid its struggle with low on-chain activity, Solana’s daily active addresses have been reduced, its DEX trading volume has declined, and its TVL has hit a new low.

What does Bitcoin’s $1B whale purchase mean?

Such a substantial purchase implies that investors are bullish.

What is behind AVAX’s activity surge?

This can be attributed to new on-chain developments and network improvements.

0 Comments