It’s the final crypto news roundup for October, and the industry is closing the month with momentum.

Citigroup moves toward crypto custody, and Rumble prepares Bitcoin tipping. Fidelity expands with Solana, while Ferrari announces its first digital token. Japan launches a yen-backed stablecoin, and global stablecoin payments hit record highs.

Plus, Zypto is now the official Electroneum wallet.

Let’s get into it.

Citi targets 2026 for crypto custody services

Citigroup (Citi), one of the world’s largest banks, plans to expand into the digital assets space with crypto custody services in 2026.

In an interview with CNBC, Biswarup Chatterjee, the global head of partnerships and innovation at Citi, said they’ve been developing the custody solution for over three years.

Custody means holding assets (including crypto) on behalf of customers for an exchange or a bank. Since banks are heavily regulated and relatively secure, it helps reduce cyberattack risks.

Chatterjee said that the firm was exploring various approaches, including an in-house crypto custody service or a third-party partnership. The update wasn’t surprising, though. In August, Citigroup indicated that it will prioritize the reserves used to back stablecoins.

Thanks to the GENIUS Act, stablecoin issuers in the U.S., including Circle, Tether, and Ripple, are now required to back their tokens with treasury bills and other cash-equivalent reserves.

Since the law was enacted, stablecoin supply has grown by over $50 billion, highlighting strong market momentum. With a $2 trillion market cap target by 2028, Citigroup’s move into the sector aligns with this accelerating growth.

Furthermore, the bank recently launched Citi Token Services, a blockchain for cross-border payments for its U.S. and UK clients. It also invested in a stablecoin payment platform, BVNK, further underscoring its interest in stablecoins and the crypto sector.

But it’s growing to be a crowded environment. Already, Circle and Ripple have applied for a state-chartered trust license to legally custody their own reserves without relying on third parties.

On the other hand, there’s little room for competition in the ETFs space. Although BNY Mellon has shown interest in crypto custody, Coinbase holds most of the current Bitcoin (BTC) and Ethereum (ETH) ETFs.

Rumble challenges YouTube with Bitcoin tipping

Rumble, the video-sharing platform, is set to launch Bitcoin tipping. The YouTube rival said the feature, supported by stablecoin issuer Tether, will be fully rolled out by December after ongoing pilot tests.

The integration highlights a shift in digital platforms embracing blockchain-based revenue tools. More online platforms are experimenting with crypto-based microtransactions to diversify income models.

Rumble, founded in 2013, gained early attention as a free-speech alternative to YouTube. The platform attracted conservative-leaning audiences and independent creators seeking fewer content restrictions.

The platform counted 51 million active users in Q2, and aims to empower creators with censorship-resistant payment options while diversifying its own crypto strategy after adding $25 million in Bitcoin reserves this year.

Speaking at the Plan B Forum in Lugano, Switzerland, CEO Chris Pavloski said the company is testing the feature with Tether before a phased launch, announced on October 24.

Tether CEO Paolo Ardoino highlighted the significance of the initiative. He added that crypto payments can protect creators from “debanking” risks while expanding financial access across emerging and developed markets.

The Rumble team posted a video on X showcasing its first tip sent to Rumble content creator and former Canadian political candidate, David Freiheit.

The update follows Tether’s $775 million investment in Rumble last year, reflecting the deepening ties between the two firms. Rumble positions itself as an anti-censorship video platform, popular among conservative creators seeking alternatives to YouTube’s ad-driven model.

The company is also developing a crypto wallet with MoonPay, enabling faster in-app transfers and custody for users. Pavloski said the wallet aims to make crypto transactions “as seamless as traditional payments.”

Analysts say Rumble’s integration could accelerate Bitcoin adoption among mainstream audiences. With tens of millions of active users, even partial uptake could meaningfully expand the crypto economy’s transaction base.

The initiative may also pressure rival platforms such as YouTube, Twitch, and TikTok to experiment with blockchain-based tipping systems. If successful, it could normalize peer-to-peer crypto payments across the digital creator landscape.

Rumble’s growing crypto presence aligns with its broader treasury diversification strategy. Earlier this year, it invested $17.1 million in Bitcoin, following a pledge to allocate up to $20 million.

Fidelity expands its platform with Solana

Fidelity Digital Assets has launched Solana (SOL) trading and custody across its retail, institutional, and wealth-management platforms. It confirmed that Solana trading is live on Fidelity Crypto for its users.

The platform offers commission-free transactions but applies up to a 1% spread per trade. New customers must open a Fidelity Brokerage account to access crypto features, though availability remains limited in some US states.

The move represents one of the largest traditional finance integrations of a non-Ethereum blockchain. It also broadens investor access to decentralized assets beyond Bitcoin and Ethereum.

Once dismissed after the FTX collapse, SOL has made a sharp recovery and now commands a market capitalization above $100 billion. The launch coincides with Solana’s renewed strength and extends Fidelity’s crypto offering, which already includes Bitcoin, Ethereum, and Litecoin.

With Solana’s inclusion, Fidelity continues to expand access to leading blockchain networks for both individual investors and large institutions.This announcement follows a series of regulatory developments and global initiatives to expand access to digital markets.

Notably, Hong Kong recently approved its first spot Solana ETF; a move that shows Solana’s growing appeal among regulators and institutional investors. Developers within the Solana ecosystem believe the network has significant room for growth and aim to position it as the home of internet capital markets.

To achieve this, Solana’s builders are focusing on hosting tokenized real-world assets (RWAs) such as stocks, money market funds, stablecoins, and collectibles. This effort seeks to democratize financial access and unlock liquidity traditionally trapped in illiquid asset classes.

Ferrari to launch digital token for fans bid

Ferrari is entering the cryptocurrency world with plans to launch a digital token that will allow its wealthiest fans to bid on one of its most iconic racing cars, the Ferrari 499P, a Le Mans-winning endurance model.

The Italian carmaker will issue the “Token Ferrari 499P” in partnership with fintech firm Conio, aimed exclusively at members of its Hyperclub, a private network of 100 elite clients with a passion for endurance racing, according to a Saturday report by Reuters. Enrico Galliera, Ferrari’s chief marketing and commercial officer, reportedly said,

“This is about strengthening the sense of belonging among our most loyal customers,”

Holders of the token will be able to trade among themselves and participate in exclusive auctions, including one for the 499P. The initiative is set to debut alongside the 2027 World Endurance Championship season.

Ferrari has already shown its openness to crypto. In 2023, it began accepting Bitcoin as payment for car purchases in the United States before expanding the service to Europe last year.

However, Ferrari’s crypto payment tools do not require dealers to manage cryptocurrencies directly. Instead, customers’ cryptocurrencies are automatically converted into fiat currencies and sent directly to bank accounts.

Ferrari’s move comes amid a growing number of crypto millionaires, which has increased by 40% over the past year to 241,700. This was driven by Bitcoin’s rally and a broader market boom that pushed the total crypto market capitalization past $3.3 trillion by mid-2022.

The number of individuals holding over $100 million in crypto rose 38% to 450, while the count of crypto billionaires increased 29% to 36 this year.

Japan’s first regulated yen stablecoin launches

JPYC Inc. has launched Japan’s first regulated yen-pegged stablecoin. The launch introduces regulatory-compliant stablecoin infrastructure in the world’s third-largest foreign exchange market.

The stablecoin market currently stands at $297 billion, with 99% denominated in US dollars. JPYC’s entry challenges this concentration, offering an alternative. The company targets $67 billion (10 trillion yen) in issuance within three years, rivaling USDC’s current $40 billion market capitalization.

Japan adopted strategies that prioritize consumer protection and financial stability. The Payment Services Act restricts issuance to banks, funds transfer operators, and trust companies, mandating 100% or greater reserve backing in yen deposits and Japanese government bonds.

JPYC’s business model centers on interest income from reserve assets rather than transaction fees. The company offers zero-fee issuance, redemption, and transfers, enabled by reserves held in interest-bearing deposits and government bonds. With a 1% average government bond yield, 1 trillion yen in issuance would generate approximately 10 billion yen in gross profit.

JPYC’s strategic significance extends beyond Japan’s domestic market. Though not huge, the yen already functions as a settlement currency in global payments, and a yen-dominated stablecoin could address demand distinct from dollar-based alternatives.

The stablecoin’s launch coincides with broader developments in Japan’s digital asset sector.

SBI VC Trade began facilitating USDC circulation in Japan in March 2025. Also, Progmat, backed by Mitsubishi UFJ Trust and Banking Corporation, is preparing a trust-based stablecoin offering. These established a precedent for domestic and cross-border stablecoin models.

The global stablecoin market recorded transaction volumes exceeding Visa’s payment volume in Q1 2025, indicating an evolution from speculative assets to functional payment infrastructure.

JPYC’s entry into this market tests whether regulatory-first frameworks can compete with established, less-regulated alternatives in attracting users and capital.

Stablecoin payments hit a new record

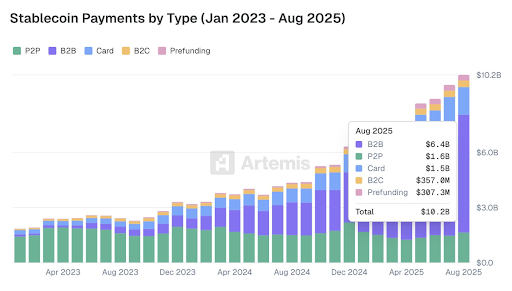

Stablecoin settlement volumes have expanded sharply this year, climbing 70% from $6 billion in February to more than $10 billion by August 2025.

According to a report from Artemis, the surge reflects how digital dollars are leaving the trading arena and entering mainstream commerce, with business-to-business transfers emerging as the dominant growth driver.

Artemis’ figures show that corporate usage of stablecoins now accounts for nearly two-thirds of total payments. Monthly B2B volume has more than doubled since February, rising 113%. Also, the cumulative value of stablecoin payment has grown to $136 billion since 2023.

Meanwhile, consumer channels are following the same trajectory of growth.

Card-based crypto payments have increased by about 36%, while business-to-consumer transactions are up 32%. Prefunding, often used by merchants to maintain instant liquidity, also jumped 61% during the reporting period.

This seamless flow effectively converts blockchain-based liquidity into usable cash, merging the yield opportunities of DeFi with the familiarity of traditional payment networks.

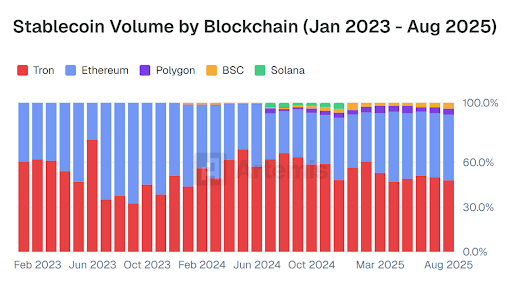

While the Tron network remains the largest blockchain for stablecoin settlement, its lead is narrowing. Tron’s share as newer, faster networks like Base, Codex, Plasma, and Solana began capturing liquidity.

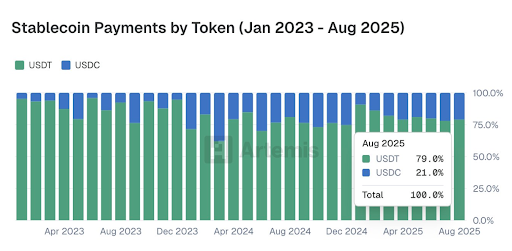

On the asset side, Tether’s USDT continues to dominate the stablecoin ecosystem with roughly 79% of all payment volume, driven by deep liquidity and unmatched accessibility across Africa and Latin America.

Yet, Circle’s USDC is quietly expanding its footprint as its ahre rose from 14% to 21% since February.

Data shows that USDT’s market capitalization stands at $183 billion, while USDC hovers near $76 billion. Together, they anchor the over $300 billion network of digital dollars that now move with the speed of code and the reach of global finance.

Electroneum chooses Zypto App as its official wallet

In a major update for Electroneum holders, the Electroneum blockchain has officially joined Zypto App as its new wallet home. The move marks a significant milestone for ETN users, offering a future-ready solution for storing and managing their assets.

Zypto App now stands as the official Electroneum wallet, giving ETN users full access to a multichain environment built for DeFi and real-world utility. Electroneum holders can securely store, receive, and manage their ETN inside Zypto alongside 20 other supported chains and over 24,000 tokens.

This new chapter opens up powerful features for ETN users, including cross-chain swaps, mobile top-ups, bill payments, crypto cards, and optional cold storage via the Vault Key Card.

The Zypto team has warmly welcomed the Electroneum community, with more integrations and ecosystem benefits already on the horizon.

Closing remark

Citigroup’s foray into the custody space is a net positive, but with crypto native firms also expanding, it remains to be seen how Citi will compete in the space. Rumble’s adoption of Bitcoin tipping signals that blockchain monetization is moving toward the mainstream creator economy.

The addition of Solana marks another step toward closing the gap between legacy finance and the digital asset economy. Ferrari’s proposed digital token launch also pushes the expansion of crypto further into the real world.

Japan’s first regulated yen stablecoin marks a significant development in Asia’s digital currency landscape. The new record for stablecoin payment depicts that on-chain money is no longer a niche settlement tool.

And finally, Zypto is now the official Electroneum wallet, opening the door for millions of ETN users to tap into a multichain DeFi future.

There you have it, our news for the week! What do you think? Let us know in the comments section.

FAQs

What is Citi’s plan for 2026?

Citi plans to expand into the digital assets space with crypto custody services in 2026.

How does Rumble want to challenge YouTube?

Rumble is set to launch Bitcoin tipping, supported by stablecoin issuer Tether.

How does Fidelity want to expand its platform?

Fidelity Digital Assets has launched Solana (SOL) trading and custody across its retail, institutional, and wealth-management platforms.

Why does Ferrari want to launch a digital token?

Ferrari plans to launch a digital token that will allow its wealthiest fans to bid on one of its most iconic racing cars, the Ferrari 499P.

Who facilitated Japan’s yen stablecoin launch?

JPYC Inc. has launched Japan’s first regulated yen-pegged stablecoin.

0 Comments