Here’s what happened this week across crypto, culture, and capital.

A major exchange steps onto the world football stage, USDT leads a stablecoin surge, and Mr. Beast makes a $1.28M bet on-chain. Meanwhile, Asia’s crypto adoption accelerates fast, and the community rallies to fund cancer treatment using crypto donations.

Let’s get into it.

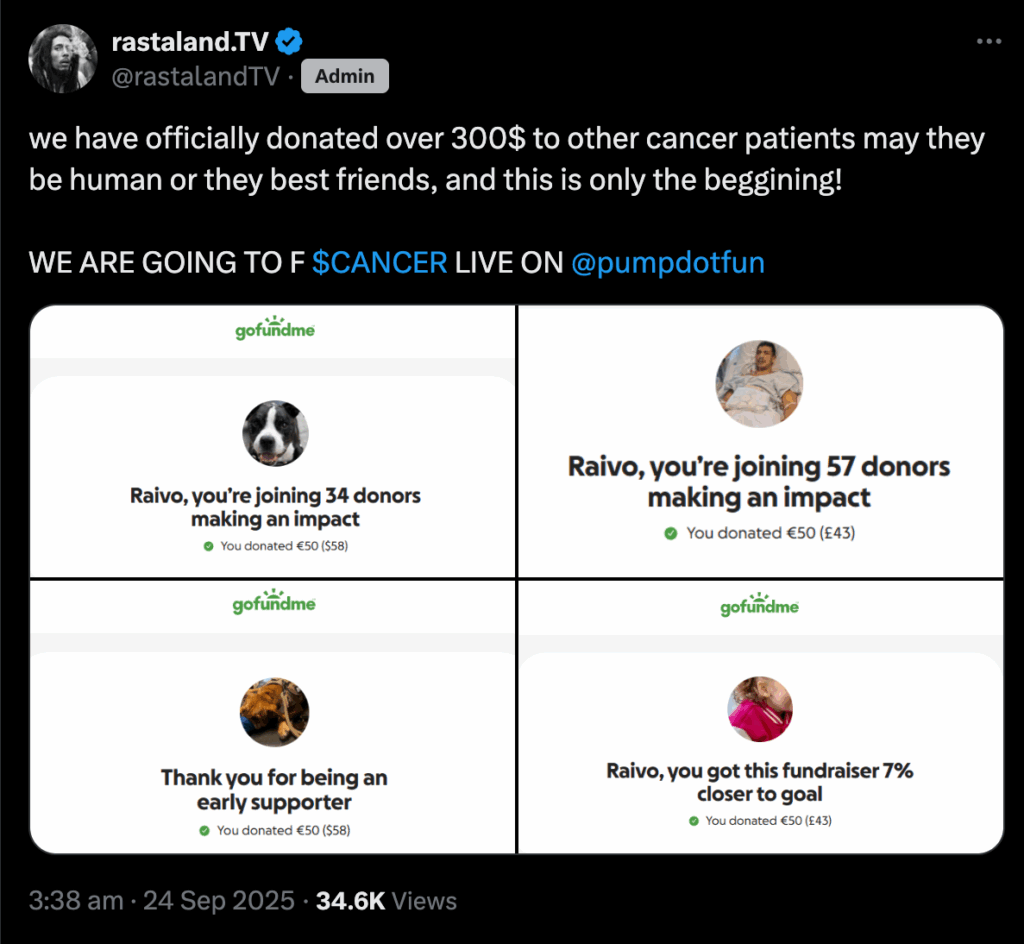

Crypto community raises funds for cancer patient

A stage 4 cancer patient recently gained huge support from the crypto community after a scammer initially stole $32,000 from his treatment fund. A thread was posted on X by the individual.

The victim, a 26-year-old Twitch streamer, “rastalandTV,” launched a $CANCER memcoin on Pump.fun and promoted it on his streams in a bid to raise funds for his treatment. This token gained a moderate amount of buzz, earning money from the community.

However, a hacker gave this user an on-stream donation, requesting that he play “Block Blasters,” claiming that it was a little-known indie favorite. In actuality, this game drained all of rastalandTV’s crypto wallets, consuming the creator fees earned from his $CANCER token.

The incident led the community to rally on his behalf in his fight against cancer. Sleuths unmasked the perpetrator and managed to compel Steam to remove Block Blasters and other crypto malware games.

Furthermore, the crypto community managed to pump $CANCER to new heights. Its market cap briefly reached a sum just under $8 million before rastalandTV announced that it had enough resources to continue paying for treatment.

Afterwards, he began donating the surplus proceeds to other charities like cancer research institutions. He has also been using his crypto in a mutual aid campaign, assisting other needy terminal patients.

Sui expands with new Asian partners

Layer-1 blockchain Sui is increasing its real-world user base in Asia. Last week, on Thursday, the company announced two new strategic partnerships with companies focused on real-world applications.

The global digital healthcare market is projected to grow from $309.9 billion in 2023 to $509 billion by 2027. Yet, several challenges remain unresolved. These include the lack of data ownership, poor system interoperability, and value monopolization by intermediaries.

First, Human Longevity Protocol CUDIS stated it will expand its platform to the Sui blockchain. CUDIS, built initially on Solana, explained that the Sui Stack will enhance the platform’s performance, functionality, security, and wider adoption.

The Sui Stack is a blockchain technology stack that integrates core blockchain ecosystem functions into a unified architecture. This includes execution, consensus, storage, networking, user experience (UX), developer tools (DX), and Maximal Extractable Value (MEV) handling.

CUDIS is an all-in-one platform integrating wearable technology, AI-based health analytics, and blockchain data management. Its concept is to reward users with crypto for healthy behaviors. An “AI smart ring” tracks actions like exercising and improving sleep to achieve this.

Secondly, South Korean table-ordering company T’order announced a strategic partnership with Sui. T’order plans to use the Sui blockchain and a decentralized data solution called “Walrus” for managing transactions and customer membership data.

It also plans to integrate with a Korean Won-backed stablecoin that will soon be launched on the Sui blockchain.

Moreover, Christian Thompson, Managing Director of the Sui Foundation, affirmed that the integration would create opportunities in Korea and significantly improve the experience for millions of Korean consumers.

He posted on social media,

“This is what mass adoption looks like! Korea is showing the world how Next-gen payments should work!”

Argentine Football Association lands sponsorship from crypto exchange

The crypto exchange LBank has entered the world of top-tier football with a landmark sponsorship agreement with the Argentine Football Association (AFA), the governing body behind the World Cup-winning national team.

This was announced on the social media platform X by its official account.

The deal gives the platform a prominent foothold in international sports marketing, while Argentina gains another major partner from the digital asset industry.

As part of its celebration, LBank introduced the “Bonus Pro” initiative, a $100 million program designed to highlight the exchange’s commitment to its users and reinforce its growing brand recognition.

For LBank, this represents more than a marketing move – it’s an attempt to merge the cultural power of football with the global rise of blockchain. Founded in 2015, LBank built its reputation as an early backer of emerging digital assets and has been spotlighted by outlets such as Forbes and The Wall Street Journal.

By associating with Argentina, one of football’s most decorated national teams and the 2022 FIFA World Cup champions, the exchange is placing itself on one of the sport’s most visible stages ahead of the 2026 World Cup in North America. Also, with global fans supporting superstars like Lionel Messi and Angel Di Maria, Argentina offers unparalleled exposure.

The agreement also highlights how deeply cryptocurrency has penetrated the sports industry. Football, in particular, has become a magnet for exchange sponsorships, accounting for the majority of new crypto sport deals in recent years.

Previous collaborations by the AFA include partnerships with Bybit in 2021 and Binance in 2022, signaling a steady embrace of digital finance within the sport.

The trend extends beyond football as well.

From OKX’s partnership with McLaren Racing to Gate.io’s involvement with Red Bull Racing, crypto platforms are investing heavily in global sporting events to connect with everyday fans. These efforts show how digital asset companies are using cultural touchpoints to move beyond niche communities and into mainstream visibility.

For LBank, the tie-up with the AFA is part of a larger strategy to blend innovation with passion. Executives at the company describe the partnership as a way to showcase blockchain’s potential while aligning with the universal language of football.

With the next World Cup barely one year away, platforms like LBank are positioning themselves not just as financial service providers but as cultural participants in one of the world’s most-watched spectacles.

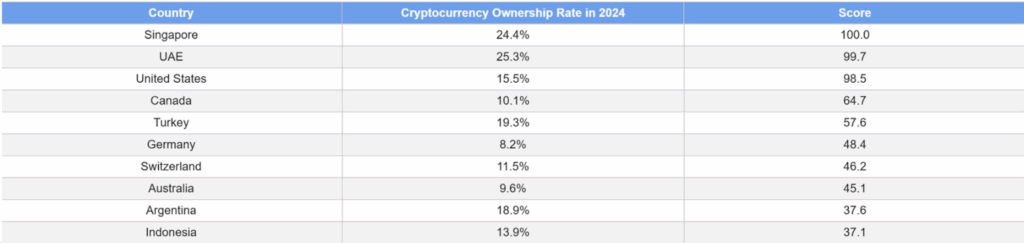

Singapore and UAE top global crypto adoption rankings

Singapore and the United Arab Emirates (UAE) now lead the world in cryptocurrency adoption, a new ApeX Protocol study shows. Singapore’s rapid increase in digital asset ownership and unmatched crypto-related search activity secured the top spot, while the UAE followed closely.

The findings highlight a global trend toward broader integration of digital assets, with the US, Canada, and Turkey also ranking among the most active markets.

Singapore achieved a perfect composite score of 100, driven by a sharp increase in cryptocurrency ownership and public interest. Search activity underscores this growth: the city-state logged around 2,000 crypto-related queries per 100,000 residents, the highest rate globally.

The rapid adoption reflects Singapore’s efforts to create a clear regulatory environment while supporting fintech innovation. The Monetary Authority of Singapore has introduced licensing frameworks for digital payment token services and tightened consumer protection rules for fostering trust and participation.

While volatility in global markets continues, Singapore’s steady regulatory approach and strong technology infrastructure have positioned it as a key hub for digital finance in Asia. This provides a foundation for sustained adoption and growth despite fluctuating economic conditions.

The United Arab Emirates ranked second with a composite score of 99.7, driven by 25.3% of its population owning cryptocurrencies. Crypto adoption in the UAE has grown by more than 210% in recent years, and it is supported by government initiatives to promote blockchain technology and attract global exchanges.

Dubai and Abu Dhabi have become focal points for crypto businesses, thanks to progressive regulatory frameworks such as Dubai’s Virtual Assets Regulatory Authority (VARA). These initiatives aim to provide clarity for firms offering trading, custody, and blockchain services, while maintaining compliance with international standards.

The UAE’s rising adoption reflects strong remittance flows and the region’s interest in diversified investments. As a major financial center with a significant expatriate population, the country offers a receptive environment for crypto as both an investment vehicle and a tool for cross-border payments.

The United States was ranked third with a score of 98.5, citing over 30,000 crypto ATMs and a 220% increase in adoption since 2019. Canada followed in fourth place, recording the fastest adoption growth of 225% and maintaining over 3,500 crypto ATMs. Turkey rounded out the top five with 19.3% of its population owning cryptocurrency, demonstrating strong grassroots interest despite economic volatility.

Other notable markets include Germany, Switzerland, Australia, Argentina, and Indonesia, all of which are seeing accelerating adoption supported by improving infrastructure and regulatory clarity.

Analysts point to a shift in global finance as digital assets move from niche investments to mainstream financial tools. This expansion suggests that crypto’s role in the global economy is evolving.

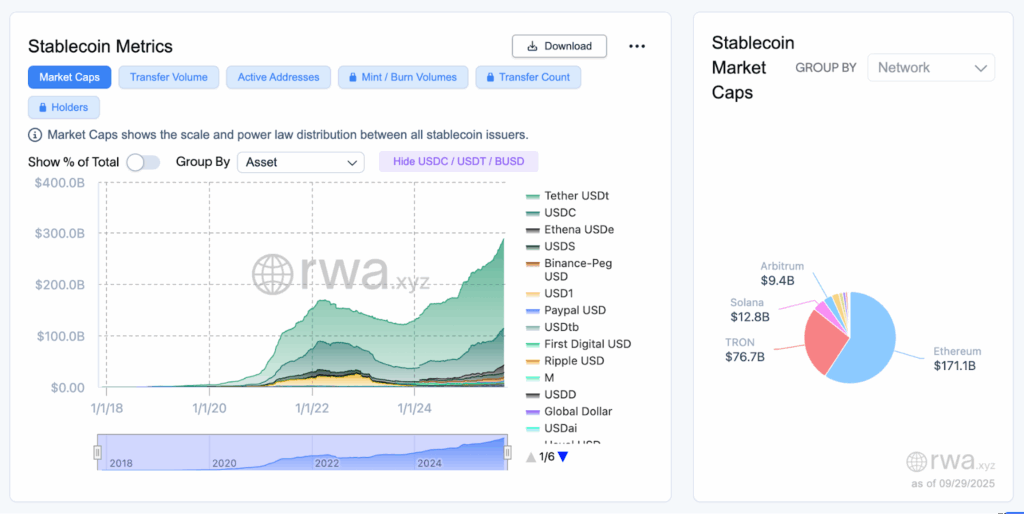

USDT still leads record stablecoin growth

The crypto industry’s appetite for dollar-pegged assets has exploded this year, with stablecoins adding tens of billions to circulation in just the past three months. Fresh figures suggest the sector is quietly driving one of the largest liquidity shifts in digital finance, even as broader market activity cools.

Over the last 90 days, net inflows across stablecoins topped $46 billion—a sharp acceleration compared to earlier this year. That surge pushed the total market capitalization near $290 billion, cementing stablecoins as the backbone of crypto trading and settlement.

Ethereum remains the dominant settlement layer, hosting $171 billion worth of stable assets, while Tron trails with $76 billion. Together, they account for the lion’s share of circulation, dwarfing newer ecosystems like Solana, Arbitrum, and BNB Chain.

Tether’s USDT kept its commanding lead with nearly $20 billion in new issuance this quarter, holding close to 59% market dominance. Circle’s USDC staged a remarkable comeback, jumping from just half a billion dollars in inflows in Q2 to $12.3 billion in Q3.

However, the real surprise came from Ethena’s synthetic USDe, which pulled in $9 billion after barely registering in previous quarters. That growth has already earned it almost 5% of the stablecoin market.

PayPal’s PYUSD and MakerDAO’s USDS also posted over $1 billion each in fresh inflows, while Ripple’s RLUSD showed early momentum.

For now, stablecoins are strengthening their position as crypto’s de facto dollar infrastructure—powering exchanges, DeFi protocols, and cross-border transfers.

MrBeast’s $1.28M bet on Aster

Aster (ASTER) has found itself in the spotlight again, this time thanks to YouTube superstar MrBeast, who appears to be doubling down on his bet.

Fresh on-chain data from Lookonchain showed that the creator snapped up another 167,436 ASTER tokens, worth about $320,000, adding to the 538,000 tokens he picked up just days earlier.

With his total investment now crossing $1.28 million at an average price of $1.87, the pattern pointed to a deliberate accumulation strategy rather than a casual buy. If looked from the performance front, Aster has been making a strong case for itself in the DeFi arena.

According to DeFiLlama, the DEX token raked in $14.3 million in trading fees within a single 24-hour period, placing it second only to Tether (USDT) on the global leaderboard, and ahead of heavyweights like Circle (USDC) and Uniswap (UNI). This revenue was nearly ten times higher than Hyperliquid’s $1.17 million during the same stretch.

That being said, it isn’t just a one-off spike either. A week earlier, Aster generated $10 million in daily revenue compared to Hyperliquid’s $3 million, showing repeated outperformance. The platform has also taken the top spot in DEX volume rankings, processing more than $42 billion in perpetual trading volume in a single day.

Furthermore, Aster’s rally has been fueled by heavy whale accumulation and high-profile endorsements, including Binance founder Changpeng Zhao. He highlighted the token’s growing presence as one of the largest holders of BSC-USDT outside Binance’s own wallets.

Zypto’s mobile top-ups with crypto highlight more real-world utility

Zypto App users continue to find practical use cases for their digital assets through the platform’s mobile top-ups with crypto feature. Available in more than 170 countries, the service allows users to purchase airtime, mobile data, and prepaid bundles using over 100 different cryptocurrencies.

The feature supports more than 800 mobile operators worldwide. Users can recharge their own phone or send credit to someone else by selecting the destination, choosing a plan, and confirming the transaction directly from their crypto wallet. In most cases, the mobile credit is delivered within seconds.

As crypto adoption grows, features like mobile top-ups are playing a key role in connecting digital assets to everyday needs.

Find out more here.

Closing remark

Decentralized finance has an amazing possibility to create positive change in the world. The wild story of the redemption of the cancer patient’s funds is proof of how crypto can be used innovatively, and how incredible the community is.

Sui expanding its reach into Asia is a smart play, considering its massive population. Similarly, with the digital healthcare space poised to grow, it only makes sense to incorporate cryptocurrency into its mechanism.

The fusion of sport and digital assets appears set to deepen. LBank partnering with the Argentine Football Association (AFA) is a strategic move and is set to usher in more collaborations.

While regulatory challenges remain, the continued rise in ownership and search interest underscores growing public confidence in digital currencies as part of a diversified financial strategy. Stablecoins keep dominating, but the next phase will depend on whether these tokens evolve beyond speculation and become deeply embedded in payments and finance.

Aster’s fee dominance and trading volumes provide a stronger narrative for sustained growth. The impressive numbers highlight the project’s rapid growth and its ability to capture meaningful liquidity and user activity in a highly competitive market.

And finally, as more users explore practical use cases for crypto, features like mobile top-ups from Zypto show how digital assets are quickly becoming part of everyday life.

There you have it for this week’s roundup. What’s your favorite in this week’s crypto news? Let us know in the comments below.

FAQs

How much was stolen from the cancer patient?

The scammer stole $32,000 from rastalandTV’s treatment fund ($CANCER memecoin).

Which two companies did the Sui blockchain partner with?

The two companies Sui partnered with are CUDIS and T’order.

Who did LBank partner with?

LBank entered a landmark sponsorship agreement with the Argentine Football Association (AFA).

What are the top two countries in the global crypto adoption rankings?

Singapore and the United Arab Emirates (UAE) lead the world in cryptocurrency adoption.

Which stablecoin is dominating the market?

Which stablecoin is dominating the market?

Tether’s USDT keeps dominating, holding close to 59% market dominance.

0 Comments