Welcome to our third crypto news report of the month, and this one’s packed.

G7 banks prepare for a stablecoin showdown. Binance lines up a $600 million user payout. BNB and Sui hit new highs. Solana’s stablecoin supply breaks records. And Killer Whales makes a splash as Web3 goes primetime.

Plus, Zypto just added Hive, HBD, WLFI, and USD1 to the ecosystem, powering up even more multichain utility.

Let’s get into it.

10 banks explore G7 stablecoins

Ten of the world’s largest banks, including Citi, Deutsche Bank, UBS, Barclays, MUFG, Santander, and Bank of America, are exploring the launch of stablecoins pegged to major G7 currencies.

The initiative aims to create a network of interoperable digital tokens backed 1:1 by fiat reserves such as the US dollar, euro, pound, and yen. Although the project is still in its exploratory phase, it marks the first serious attempt by the global banking sector to enter the stablecoin market dominated by Tether and Circle.

Why is the plan good?

The proposed network could legitimize stablecoins as a trusted financial instrument. Unlike offshore issuers, G7 banks operate under strict capital and liquidity rules. Their involvement could bring credibility, transparency, and oversight to the market.

Supporters affirm that this could modernize global settlements through instant foreign exchange swaps. Also, banks view the project as a bridge between traditional finance and tokenized assets like digital bonds or securities.

What are the risks?

Despite its promise, the plan faces serious execution challenges. Each G7 stablecoin would be governed by separate national regulations, risking fragmentation and inconsistent standards.

Without harmonized legal and technical frameworks, interoperability between currencies could falter. Liquidity could also be affected. If each bank issues its own version of a currency token, markets could face overlapping or competing instruments.

How could things get ugly?

The biggest concern lies beyond G7 borders. Standard Chartered estimates such shifts could drain up to $1 trillion from developing economies by 2028. Moreover, a global network of bank-issued stablecoins could blur the line between public and private money.

If left unchecked, it risks creating a parallel monetary system faster than central banks can regulate, increasing systemic and cyber risks.

Binance to compensate users with over $600 million

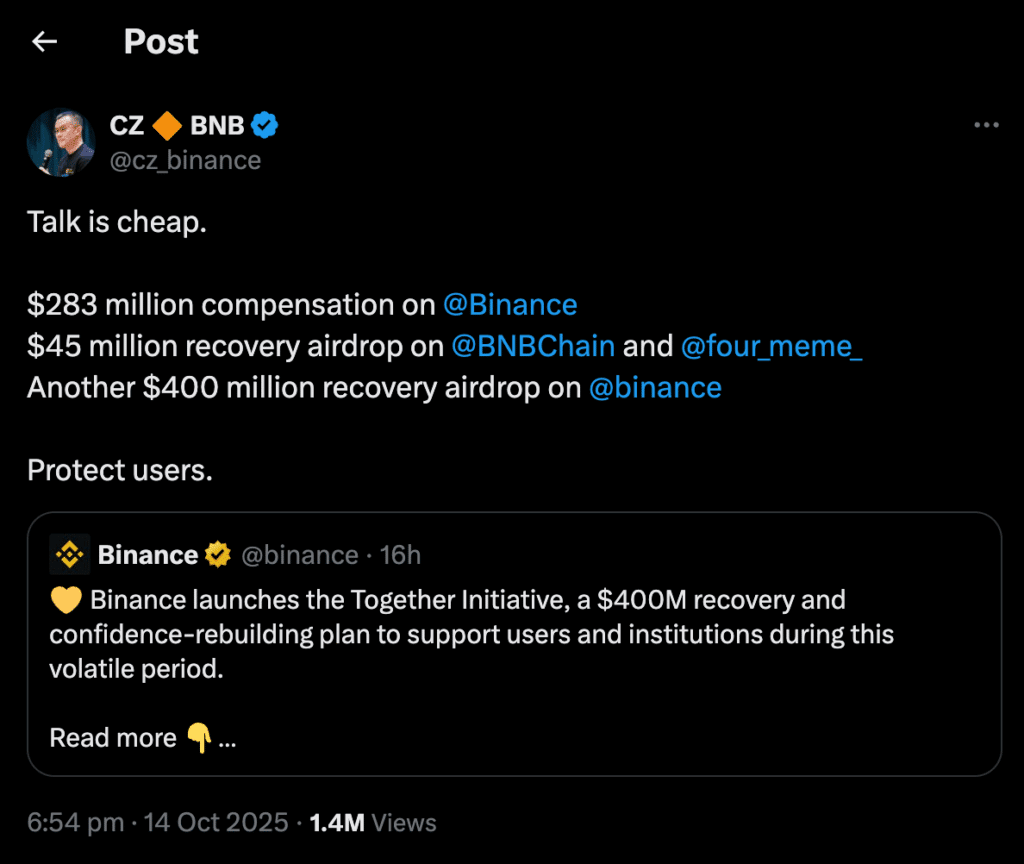

Binance and BNB Chain have announced a combined $728 million in recovery measures to compensate users following collateral asset depegging incidents during the October 10 market crash. This includes $45 million in airdrops, $283 million in immediate post-crash compensation, and the newly launched $400 million industry fund.

Crypto markets slumped last week, Friday, after US President Donald Trump threatened 100% tariffs on Chinese imports, with over $19 billion in leveraged positions liquidated in 24 hours. This marked the largest single liquidation event in crypto history!

In the aftermath, Binance has been criticized on several fronts. Some traders reported that technical glitches and discrepancies in stablecoin pricing prevented them from closing positions during the sell-off.

Yet, the exchange maintains it is not responsible for users’ losses. The exchange blamed a mix of thin liquidity, long-dormant limit orders dating back to 2019, and UI display errors.

In the official statement shared late Sunday, Binance articulated that the event was “macro-driven volatility,” not a platform failure. It acknowledged that global macroeconomic stress led to concentrated sell-offs by institutional and retail traders, triggering sharp price declines across crypto markets.

While users speculated that Binance’s systems might have malfunctioned, the exchange said its futures and spot matching engines, as well as API trading, remained fully operational throughout the event.

“Forced liquidation volume on Binance accounted for a relatively low proportion of total trading activity.”

Still, Binance confirmed that some assets, including USDe, BNSOL, and WBETH, briefly depegged due to the market shock. This situation liquidated some users’ positions that had used these tokens as collateral.

Further, in a detailed post-mortem, Binance revealed that part of the confusion stemmed from legacy limit orders still active on certain spot pairs, some of which had been open since 2019.

To complicate matters, UI display errors emerged after Binance adjusted tick size settings, which were the smallest allowable price movements on some trading pairs. This caused prices to display as zero in the interface, though the exchange clarified that actual executions and API data remained correct.

Binance said it has now resolved these display issues and will continue optimizing its systems to prevent similar confusion. The company reiterated its user-first principle, promising ongoing transparency and updates for those still submitting compensation claims.

Overall, Binance confirmed that the exchange does not “accept liability for users’ losses,” saying the compensation was designed to “rebuild industry confidence.”

Sui TVL hits an all-time high

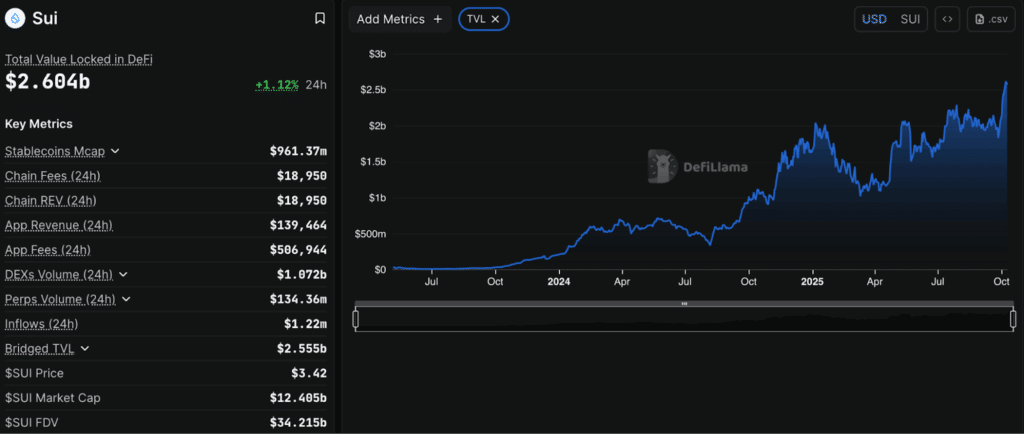

Sui’s total value locked (TVL) rose above $2.6 billion, setting a new record high, as decentralized finance (DeFi) activity surges in October. The development comes as the SUI token continues to face market challenges.

According to a blog from the Sui Foundation, the network’s total value locked (TVL) climbed from under $250 million at the start of 2024 to over $1.75 billion by year-end. Now, with TVL exceeding $2.6 billion, Sui has recorded more than a tenfold increase in less than two years.

Furthermore, the network has also surpassed its peers in stablecoin dominance. As of October 7, SUI’s stablecoin market cap reached $921 million, outpacing networks like TON, Mantle, and Optimism.

Besides network growth, institutional interest is rising as well. The new Altcoins ETF (DIME) by CoinShares gives US investors access to SUI and other layer 1 assets, suggesting greater confidence and capital inflow.

Analyst Michael van de Poppe also added that SUI could be on its way to reach a new record high. Thus, while the signals and fundamentals remain bullish, it remains to be seen whether the price can actually rise to record highs or whether more dips will follow.

Binance’s BNB reaches a new all-time high

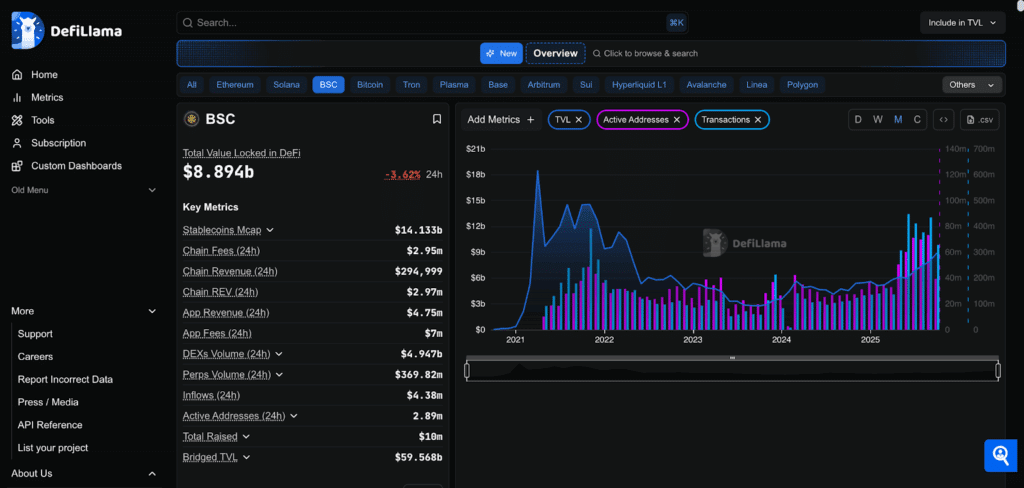

The cryptocurrency market seems to be quickly recovering from the recent crash. Binance’s BNB token is currently one of the hottest crypto assets in the market. It is currently outperforming major crypto assets, such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), etc.

The ongoing market recovery has pushed BNB to a new all-time high above $1300. According to data, BNB’s sender-only active addresses reached 3.46 million, and the successful transactions have surged 151% within the past 30 days.

BNB’s rally could be due to massive burns earlier this year. Binance undertook a $1 billion token burn in July through the BNB Foundation. The move led to a substantial dip in the coin’s supply, and, consequently, a price spike.

Also, BNB’s upswing could be influenced by increased corporate buying. Corporate treasuries have seen a massive rise in popularity over the last year. Corporate buys have played a major role in the market rallies this year.

On-chain metrics for Binance’s BNB have also been a bullish reversal over the last month. Data shows the total value locked (TVL) on the BSC chain has nearly hit the $9 billion mark.

Furthermore, BNB Chain has launched a $45 million “Reload Airdrop” in partnership with Four.Meme, PancakeSwap, Binance Wallet, and Trust Wallet to reignite trading activity across its meme coin ecosystem to more than 160,000 eligible addresses.

According to project details, recipients will be chosen through a randomized allocation system rather than based strictly on trading losses. Distribution will take place in multiple waves between mid-October and early November.

BNB Chain described the initiative as an effort to “reload” user confidence and liquidity in the meme coin sector. The Reload Airdrop marks one of BNB Chain’s largest coordinated relief efforts, signaling growing institutional and retail attention to its ecosystem.

Over the past few months, meme coins have been one of the most active yet volatile segments on the network. The move follows a wave of losses during the October 10 market crash, when several tokens built on Four.Meme, a no-code meme coin launchpad, suffered steep declines.

Since its launch, it has seen billions in cumulative trading volume, but also faced scrutiny following an exploit earlier this year. BNB Chain wrote,

“The meme coin community is one of the most active and creative communities in the ecosystem, who has been affected the most by recent events, especially during the past week,”

However, analysts warn that the randomized nature of the airdrop may create disputes over fairness and transparency. Such “recovery” airdrops risk promoting moral hazard by rewarding risky trading behavior.

Overall, the airdrop comes as BNB defies broader market pressure, recently hitting a new all-time high. The altcoin’s resilience and active user base have reinforced its position as one of the strongest performers in 2025’s volatile crypto markets.

Solana’s stablecoin supply hits record high

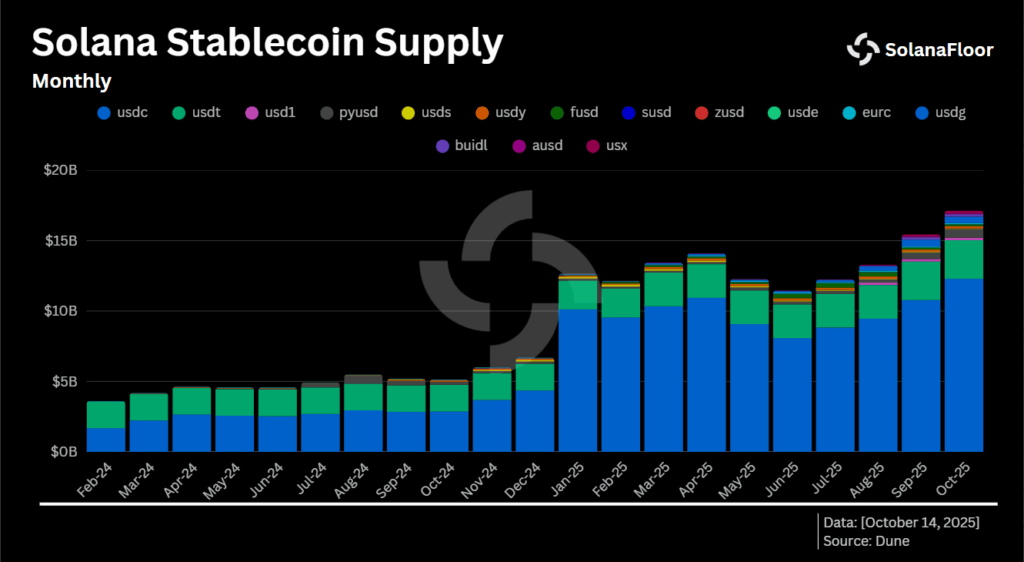

Solana’s stablecoin ecosystem has reached an unprecedented milestone. The total stablecoin supply on Solana now stands at $17.48 billion, marking a new all-time high for the network.

This achievement reinforced Solana’s growing importance as a hub for digital dollars within DeFi.

According to on-chain data, USDC continues to lead the charge with a commanding 72.3% share of the market, while USDT follows with 15.7%. The remaining portion is spread across smaller stablecoins such as PYSUD, USDS, and USDY.

September marked a defining moment for Solana’s stablecoin ecosystem. Circle, the issuer of $USDC, minted roughly 7.25 billion USDC on Solana during the month. This represents the largest monthly mint in Solana’s history and highlights the network’s growing appeal among stablecoin issuers.

Stablecoins have become integral to Solana’s ecosystem, facilitating smooth value transfer and providing essential liquidity for DeFi protocols. Solana’s low transaction costs and high throughput continue to attract capital inflows from both individual traders and institutional participants seeking efficiency and scalability.

At the time of writing, over the past 24 hours, Solana has outpaced all other Layer 1 and Layer 2 blockchains in terms of stablecoin inflows. This consistent momentum positions the network as one of the most active venues for stablecoin activity across the crypto landscape.

The network’s ability to handle large transaction volumes with minimal latency continues to distinguish it from its competitors.

Aiding the momentum, Jupiter Exchange recently announced a strategic partnership with Ethena Labs to launch a Solana-native stablecoin, JupUSD. Built on Ethena’s Stablecoin-as-a-Service stack, JupUSD is set to go live in Q4 2025. It aims to enhance liquidity management and provide a cohesive framework for Jupiter users.

The record stablecoin supply and new initiatives indicate a maturing market on Solana. Greater on-chain liquidity often precedes higher trading volumes and increased participation across DeFi protocols.

Killer Whales’ season 2 brings Web3 to the mainstream

Season 2 of “Killer Whales,” the highest-quality business reality show from the Web3 world, is now officially streaming on Amazon Prime and Apple TV, following its initial launch on X and YouTube.

This landmark placement on two of the world’s largest streaming platforms marks a pivotal moment for the entire Web3 ecosystem.

By delivering Hollywood-level production to a global audience online, Killer Whales does more than entertain. It demystifies Web3, showcases its real-world utility, and demonstrates the quality and potential of the entire ecosystem.

For the industry, this represents a new era of accessibility and legitimacy, proving that Web3 concepts can captivate a mainstream, Web2 audience. Killer Whales is streaming on X, Apple TV, Amazon Prime, etc., reaching 600M+ viewers in 65 countries, offering prizes, investor connections, and global exposure.

The show features a star-studded panel of crypto titans, such as CoinMarketCap, Lunar Strategy, UNCX Network, an incubator integration, next-generation projects, and a $1.5 million prize pool, which will be judged by industry heavyweights.

Zypto adds Hive, HBD, WLFI, and USD1 to ecosystem

Zypto App continues its ecosystem expansion, officially integrating Hive and Hive Backed Dollar (HBD), WLFI, and USD1 across its wallet, payments, and spending products.

These additions further strengthen Zypto’s mission to support the full spectrum of the crypto community, from decentralised content platforms to stable-value assets.

With each new chain, token, and feature added, Zypto builds a more powerful, more inclusive DeFi experience – one that keeps growing week by week.

Find out more about Zypto’s Hive integration, and its WLFI and USD1 payments integration.

Closing remark

The outcome of the G7 stablecoin initiative depends on whether the world’s top banks can innovate without repeating the same flaws they aim to replace. If realized, it could redefine how banks handle cross-border settlements and digital assets.

This episode marks one of Binance’s largest recent compensation efforts. It highlights the delicate balance exchanges must maintain between liquidity management and system resilience in a market that never sleeps.

Sui’s soaring TVL reflects more than just a bullish phase; it signals a lasting shift in DeFi market share. BNB will likely continue its rally over the coming days. The Federal Reserve is expected to roll out another interest rate cut after its next meeting. Another rate cut could trigger a market-wide upswing.

While USDC remains the cornerstone of Solana’s market, emerging players are introducing competition and diversification. These developments suggest that Solana’s stablecoin landscape is evolving into a more dynamic and resilient ecosystem.

Killer Whales stands as the only Web3-native production to break into this level of mainstream distribution, offering a bridge for millions of viewers to discover blockchain innovation.

Finally, as Zypto adds even more tokens and chains to its ever-growing ecosystem, one thing is clear, the future of crypto isn’t just multichain, it’s all-chain.

Enjoyed this week’s crypto news? Talk to us below in the comments section.

FAQs

Which 10 banks are exploring G7 currencies?

They include Citi, Goldman Sachs, BNB Paripas, TD Bank, Deutsche Bank, UBS, Barclays, MUFG, Santander, and Bank of America.

How much does Binance want to compensate its users with?

Binance plans to compensate its users a total of $283 million following collateral asset depegging incidents during the October 10 market crash.

What is SUI’s new all-time high TVL?

Sui’s total value locked (TVL) rose above $2.6 billion, setting a new record high.

What happened to Binance’s BNB?

The ongoing market recovery has pushed BNB to a new all-time high above $1300.

How high did Solana’s stablecoin supply get?

The total stablecoin supply on Solana now stands at $17.48 billion, marking a new all-time high for the network.

0 Comments