Welcome to This Week In Crypto, where we go over some of the most essential news in the industry.

Of course, everyone knows Bitcoin has hit its all time high of $111,903 this week, but that’s not all that’s happened. There were new beginnings via Galaxy Digital’s listing, CoinMarketCap’s project, and Ripple’s expansion plans. Then, SUI surged to a massive stablecoin supply amid a positive crypto inflow.

Let’s get into it.

Galaxy Digital secures Nasdaq listing

Galaxy Digital, an American digital asset investment firm, has officially registered on the Nasdaq Global Select Market. The founder, Mike Novogratz, celebrated the milestone with a social media post.

In a distinct interview with CNBC, Novogratz decried the U.S. listing process, saying, “It felt un-American, unfair, infuriating.”

He also mentioned that what was expected to be a 90-day process dragged on for 1,320 days (over four years), required nine rounds of SEC feedback, and cost over $25 million.

He added,

“One of the things that people didn’t understand about the crypto tax is that you needed to be very well capitalized – and a pretty big, strong company – just to stay in the game.”

The crypto community was overjoyed at the news and responded through messages on social media.

After overcoming regulatory hurdles, Galaxy Digital officially began trading on the Nasdaq under the ticker symbol $GLXY. The stock debuted at $23.50 per share and rapidly gained traction, reflecting market optimism around the listing.

According to Google Finance, Galaxy Digital’s stock grew by 3.01% at the time of trading, reaching $31.49. This signals investor confidence following the firm’s long-awaited U.S. market entry.

Furthermore, Galaxy Digital’s Nasdaq debut is part of a more expansive trend, as several crypto-focused firms, such as Marathon Digital Holdings and Coinbase Global Inc., are already trading on the exchange.

This shift comes amid a rise in Bitcoin’s price, which has reignited interest in the asset and stocks. Therefore, as more institutional money enters the space, Bitcoin and traditional stocks become more connected, showing how the market is evolving and merging traditional finance with digital assets.

CoinMarketCap announces token launchpad

CoinMarketCap announced its new platform, ‘CMC Launch’, a pre-TGE (token generation event) launchpad, with Aster as its first project. Aster, a decentralized perpetual exchange, is airdropping its new AST token in this release.

After CoinMarketCap concludes the AST airdrop, it will continue checking out high-quality crypto projects that have yet to release a token. CMC Launch could prove quite popular with the platform’s monthly audience of 70 million.

A household name in blockchain data and analysis, CoinMarketCap is branching out with CMC Launch. This means that CoinMarketCap has entered an increasingly competitive and crowded market with popular players like Pump.fun, PancakeSwap’s SpringBoard, and more recently, Raydium’s LaunchLab.

Rush Lu, CEO of CoinMarketCap, claimed,

“The crypto space is packed with thousands of projects all competing for attention. CMC Launch helps new projects connect directly with users who are actively looking for the next big thing. As the ‘Home Of Crypto,’ we’re thrilled to welcome Aster as our first CMC Launch project and introduce them to our global community.”

Still, CoinMarketCap isn’t the first data analysis platform to branch out like this. Arkham Intelligence launched its perpetual futures exchange last year. Although Aster is a perpetual exchange, nothing suggests it’s entering a long-term partnership with CoinMarketCap.

According to CoinMarketCap’s press release, Aster was chosen as CMC Launch’s first project for specific reasons.

Backed by YZi Labs, an independent Binance spinoff, Aster aims to reimagine the perpetual exchange ecosystem with non-custodial trading, minting, staking, sturdy infrastructure, and more. It’s currently available on BNB Chain and Arbitrum, and plans are underway to expand to other blockchains.

After finishing the Aster airdrop, CoinMarketCap plans to scout out other promising pre-TGE crypto projects. It will employ stringent quality standards in this process. Aster has established a devoted following, ideally helping the AST launch gain traction.

CoinMarketCap estimates it has over 70 million monthly users, which could make a massive airdrop audience. Furthermore, the company could tap into potent new revenue streams while enriching the crypto ecosystem.

SUI reaches a stablecoin supply of $1B

Sui’s (SUI) stablecoin supply has surpassed the $1 billion mark. A rising stablecoin base typically precedes a ramp-up in DeFi activity, liquidity provisioning, and leverage deployment.

As the chart shows, USDC dominates the stablecoin ecosystem on SUI with a 70.55% share. Yet, these stablecoins aren’t just reserves. Instead, they’re capital in waiting.

SUI is flying high on utility-driven fundamentals and upside potential. Ecosystem developers are actively scaling real-world applications, while capital allocators are profiting.

The token ranks among the top 10 crypto assets by weekly returns, recording a 15.4% gain last week. That outpaced other established tokens like TRX, BRB, and BTC while closing the gap on SOL.

The weekly jump in SUI’s stablecoin market signals a risk-off pivot, but when the market environment shifts back to risk-on, that sidelined liquidity could become active. Thus, igniting swaps, LP inflows, and leveraged positioning.

With that kind of liquidity primed for activation, SUI looks poised to challenge the $4 resistance. This could lead to more price discovery and a new all-time high, especially if capital rotation and on-chain velocity heighten.

Sui’s impressive numbers across essential on-chain metrics and bullish ROI signals show its dominance in the L1 (Layer-1) space. From liquidity depth to user participation and DEX volumes, Sui aims to compete with legacy blockchains that once dominated core network fundamentals.

Now that its stablecoin supply has broken through the $1 billion barrier, SUI is intensifying the competition, which sets the stage for a heated showdown in the L1 space.

Ripple plans to improve payments in the UAE

According to the official press release, Ripple has partnered with two Dubai-based financial institutions to provide payment services. They include Zand Bank, which is driven by artificial intelligence (AI), and fintech firm Mamo.

Ripple offers access to over 90 payout markets globally and handles more than $70 billion in transaction volume annually. It also facilitates 24/7 cross-border transactions and streamlines settlement processes by utilizing the network’s efficiency, scalability, and speed.

Zand Bank, the UAE’s first digital-only bank, also revealed plans to launch a stablecoin pegged to the UAE dirham (AED). This initiative bolsters local digital payment capabilities, offering a stable and efficient transaction medium within the UAE’s growing digital economy.

Chirag Sampat, Head of Treasury and Markets at Zand Bank, said

“Our collaboration with Ripple highlights our commitment to empowering global payment solutions through blockchain technology.”

Mamo’s CEO, Imad Gharazeddine, said,

“The UAE is on an incredible growth path, with over a million businesses expected to call it home by 2030. At Mamo, we’re proud to be at the forefront of this journey, making global payments simpler and more accessible for everyone.”

Ripple’s partnership builds on its earlier strategic move to secure a license from the Dubai Financial Services Authority (DFSA). The March 2025 approval allows the company to offer crypto payment services within the Dubai International Finance Centre (DIFC).

This regulatory milestone complements Ripple’s footprint across key markets, including the United States, Brazil, Mexico, Australia, and Switzerland.

With over 60 regulatory licenses and registrations globally, Ripple continues to strengthen its position as a trusted partner for financial institutions.

Crypto inflows surge to $785 million

The latest CoinShares report shows that crypto inflows hit $785 million last week. Although slightly lower than the previous week’s $882 million, this marks a fifth week of consecutive positive flows.

This pushes the year-to-date (YTD) totals to $7.5 billion, surpassing the previous peak of $7.2 billion recorded in early February. This signifies a full recovery from the almost $7 billion in outflows between February and March.

Ethereum stood out amid the positive flows into digital asset investment products. Moreover, the Pectra upgrade and the network’s leadership changes drove the changing sentiment.

While investor sentiment was divided across regions, the US led the positive flows with $681 million inflows.

Countries like Germany and Hong Kong rounded up the top three with $86.3 million and $24.2 million, respectively. In contrast, Sweden, Canada, and Brazil saw outflows of $16.3m, $13.5m, and $3.9m, respectively.

An excerpt in the report read,

“Bitcoin attracted US$557m in inflows, a decrease from the prior week, likely due to continued hawkish signals from the US Federal Reserve. Short-bitcoin products saw a fourth consecutive week of inflows, totalling US$5.8m, reflecting investor positioning amid recent price gains.”

Furthermore, Ethereum was the standout performer, with $205m in inflows last week and $575m YTD, displaying renewed investor optimism after the successful Pectra upgrade and the appointment of new co-executive director Tomasz Stańczak.

While Ethereum and other altcoins recorded positive flows, Solana bucked the trend. It recorded $0.89 million in crypto outflows. This aligns with a recent trend of declining TVL (total value locked), plunging 64%.

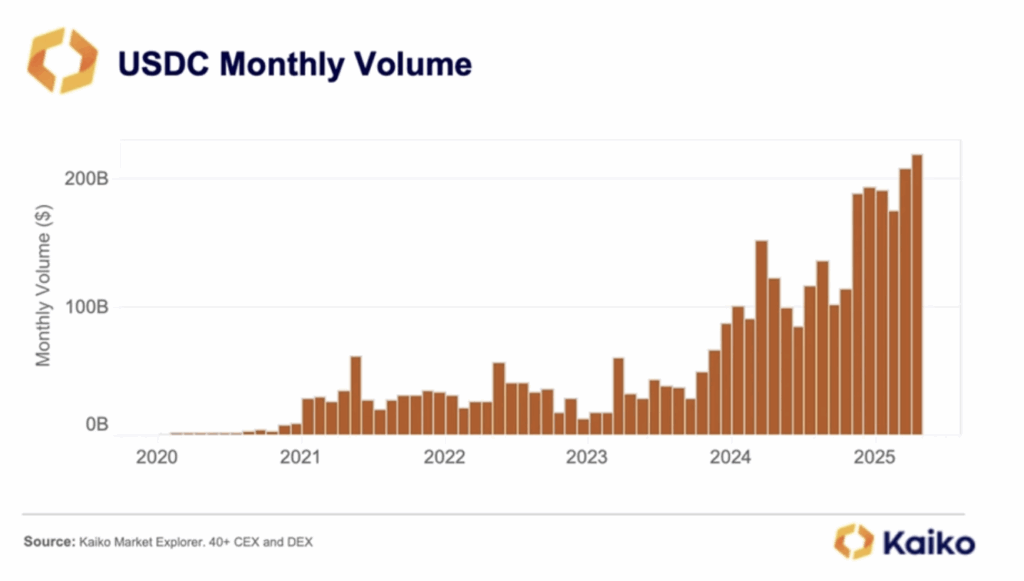

USDC volume hits a new high

While Circle’s USDC and Tether’s USDT remain the top two stablecoins, USDC shows signs of strong growth in volume and market share.

According to a report, USDC reached a new record in trading volume with $219 billion in April 2025, double the $106.5 billion recorded in January 2024.

Binance, the world’s largest crypto exchange, has played a vital role. Due to a strategic agreement signed with Circle in December 2024, it accounted for over 57% of USDC’s global trading volume.

Two main factors describe this remarkable growth in USDC’s volume and share.

First, the partnership with Binance gave USDC access to a large user base. Second, USDC benefited from the growing demand for regulatory-compliant stablecoins, especially in Europe, where the MiCA framework is now in effect.

Kaiko reported,

“The deal is also highly profitable for Binance, with Circle paying over $60 million upfront plus ongoing incentives, while aligning with Binance’s compliance push under Europe’s MiCA rules.”

Kaiko data indicates that USDC’s market share among stablecoins on Binance increased from 10% at the end of last year to nearly 20% today. Also, USDT’s monthly volume dropped by 49% while USDC’s increased by 16% since November 2024.

Kaiko also mentioned,

“While USDC is gaining momentum on centralized exchanges, Tether’s USDT is facing headwinds. USDT trading volumes on CEXs have dropped sharply…mirroring a broader contraction in USD-denominated trading activity. This decline reflects persistent risk-off sentiment, weaker retail engagement, and limited speculative appetite across crypto markets.”

Despite USDC’s growth, it still has a long way to go before it catches up with USDT. As of May 2025, USDT’s market capitalization is over $150 billion, more than twice its market capitalization in July 2022. Meanwhile, USDC’s market capitalization is $60 billion, only 12% higher than its July 2022 level.

Although USDT and USDC keep growing, the stablecoin space could change quickly as new competitors emerge. Major financial institutions like World Liberty Financial, Fidelity, Ripple, BlackRock, and Meta have entered the competition.

Closing remark

Galaxy Digital’s listing proves that Bitcoin and traditional stocks are becoming more connected. It shows how the market is evolving and merging traditional finance with digital assets.

With CoinMarketCap’s new pre-TGE project, Aster, more blockchain analysis platforms are expanding into new revenue streams while enriching the crypto ecosystem. Still, CoinMarketCap is entering into a competitive space with other players like Pump.fun, and SpringBoard.

Sui’s (SUI) stablecoin supply has surpassed the $1 billion mark, with USDC dominating with a 70.55% share. SUI’s value is now primed to increase due to some essential on-chain metrics.

Ripple has partnered with two Dubai-based financial institutions (Zand Bank and Mamo) to provide payment services. This will expand its presence globally, where its speed, efficiency, and scalability will be greatly admired.

A fifth consecutive weekly crypto inflow indicates positive sentiment for the industry. Although investor action was divided across regions, the US led the flows by country, while Ethereum led the flows by asset, with Bitcoin also positive.

Finally, USDC reached a new record in trading volume and has never been closer to USDT. Still, the latter is showing no signs of slowing down. Moreover, with new firms in the stablecoin sector, the USDT-USDC dominance may become challenged.

The Zypto Blog Just Got a Major Upgrade

It’s more than a fresh look – it’s a smarter, sharper experience built for both crypto newcomers and seasoned natives. Dive in and explore the latest insights, updates, and stories shaping the space.

Find out more here.

Are you satisfied, confused, or inquisitive? We would love your feedback. Please share in the comments.

FAQs

What notable thing did Galaxy Digital do?

Galaxy Digital has officially secured its listing on the Nasdaq Global Select Market.

What is CoinMarketCap’s new project?

CoinMarketCap launched its new pre-TGE platform, ‘CMC Launch,’ with Aster as its first project.

What notable thing did Sui do?

Sui’s (SUI) stablecoin supply surpassed the $1 billion mark.

What trading volume did USDC reach?

According to a report, USDC reached a new record in trading volume with $219 billion in April 2025.

Who did Ripple partner with in Dubai?

Ripple partnered with Zand Bank, which is driven by artificial intelligence (AI), and fintech firm Mamo in the UAE.

What was the crypto inflow level last week?

Crypto inflows hit $785 million last week compared to the previous week’s $882 million.

0 Comments