Welcome to another week in the crypto industry. The Ethereum Pectra Upgrade finally went live!

In today’s piece, we look at how Solana offered crypto influencers airdrops to launch meme coins and a surge in its transactions last month. Then, we consider how Stellar expanded its ecosystem, Binance’s listing impact, Apple’s timely updates, and the SEC’s plans to meet for discussions.

Let’s get into it.

Ethereum Pectra Upgrade goes live

Ethereum’s long anticipated Pectra upgrade, combining the Prague and Electra upgrade, went live at epoch 364032, activating 11 Ethereum Improvement Proposals on the mainnet.

The network crossed the upgrade at 10:15 UTC and was completed roughly 12 minutes later.

Tim Beiko, the Ethereum Foundation’s Protocol Support Lead, confirmed the news. He noted that ongoing testing of the new Ethereum Improvement Proposals (EIPs) would continue in the coming days.

Ethereum co-founder Joseph Lubin also commented, highlighting the network’s progress over the years. He described the Pectra upgrade as a major step forward in building the foundation for a decentralized global system.

Merging two main update layers: Prague for execution and Electra for consensus, the Pectra upgrade introduces additions that reshape how users, validators and developers interact with the Ethereum network.

Validators and staking providers benefit from reduced operational overhead, while developers gain tools for more efficient rollups and users will see improvements as dApps adopt new features.

Pectra Upgrade actives with 11 Enhancements

The key changes include EIP-7251, which increases validator capacity from 32 ETH to 2,048 ETH to streamline staking, EIP-6110 for reducing deposit delays from hours to minutes, and EIP-7002 which improves exit security for validators by enabling execution-layer triggers.

Then, scalability gains center on EIP-7691, doubling blob throughput to lower Layer 2 fees and EIP-7623 incentivizing blob adoption over costlier call data. Wallet usability improves via EIP-7702 allowing externally owned accounts (EOAs) to temporarily act as smart contracts for batch transactions and gas sponsorship.

Furthermore, security upgrades include EIP-2537 reducing gas costs for cryptographic operations and EIP-2935 enhancing historical data access for cross-chain applications. The upgrade also simplifies inter-layer communication with EIP-7685.

Despite testnet challenges, the mainnest transition appears stable, although network impacts such as validator storage demands will be monitored. Pectra positions Ethereum competitively ahead of its next planned upgrade, Fulu-Osaka, which aims to advance decentralization through Verkle trees.

Influencers offered airdrops to launch SOL meme coins

Boop.fun, a new token launchpad on Solana, announced an airdrop of 150,000,000 BOOP to prominent crypto influencers on X to motivate users to launch and buy tokens.

By working with data platform Kaito, Boop.fun divided active crypto influencers into tiers based on their followers, engagement, and “meme stuff” on X.

Each one gets a different allocation, but with limited amounts per tier. Still, only a certain number of users from each tier can then claim the airdrop, which requires users to perform some activities.

Still, the token claim isn’t immediately available. Instead, users must wait 30 days to unlock their respective BOOP allocations unless the token they create grows to meet select market cap criteria, bumping down their wait.

For example, if a creator gets their token to a $5 million market cap, it reduces the wait by five days.

This has generated considerable attention among crypto participants, as well as

ethical and moral dilemmas for some users. In addition, users also said that they ran into issues with claims and token migrations on the platform, due to demand.

How have the influencers reacted?

One questioned whether or not six figures worth of crypto tokens was worth the potential trade-offs, with pseudonymous artist Bold Leonidas saying “pass” at the idea at first because of the token launch mechanic.

Then, pseudonymous influencer Dingaling complained,

“migrations and airdrop experience on [Boop.fun] has been pretty horrible.”

Similarly, pseudonymous personality Cobie advised those debating a launch. They shared a disclaimer that included potential phrases like,

“I am launching this token solely to unlock my airdrop,” and “Do not buy it, as complete loss of investment is guaranteed.”

Solana’s 62.7% transaction surge in April

After quietly building momentum in April, Solana has seen increased user activity and strong network engagement.

Firstly, it experienced a surge in daily transactions, from 84 million to almost 99 million.

This uptrend suggests that Solana’s rally is driven by organic usage rather than mere speculation. Notably, transaction surges preceded different price jumps, indicating demand-pushing momentum.

Overall, the consistency of these patterns strengthens the bullish case for SOL, especially if user activity continues to accelerate.

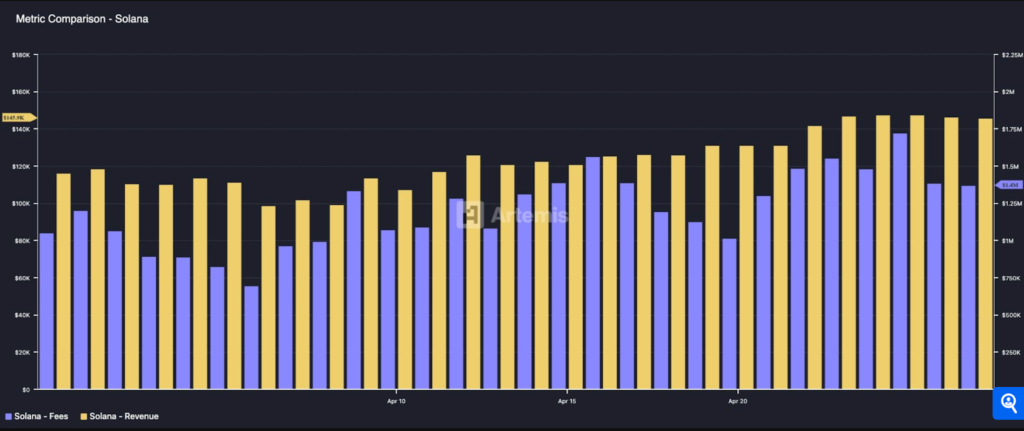

Secondly, daily fees rose from under $90K to $1.4M, while revenue trended upward in parallel, hitting almost $2M.

This reflects deeper network usage and enhanced monetization. Thus, the close alignment between fee generation and protocol revenue suggests sustainable economic activity.

This indicates high user demand and that Solana’s value capture mechanisms function effectively, positioning it competitively against peers as on-chain activity keeps scaling.

Thirdly, Open Interest surged alongside price, rising from approximately $1.6B to $2.3B. The chart below shows a substantial correlation between SOL’s price (green) and Open Interest (red).

This movement implies that market participants are confident in SOL’s trajectory, reinforcing that the rally is backed by strong capital inflows, not just spot buying.

Templeton to transfer $1.7T using Stellar

A major finance firm, Franklin Templeton, plans to transfer $1.7 trillion in assets through the Stellar platform. It selected Stellar because its transaction model offers low costs, streamlined transactions, and high efficiency.

Stellar’s transaction costs are around $120 for processing 50,000 transactions, whereas traditional financial systems typically charge $50,000. Thus, Franklin Templeton foresees saving over $200 million annually by integrating the Stellar network.

Daily activity has increased 35%, exceeding 20 million. This reflects strong usage, particularly in token transfers and decentralized exchange (DEX) operations.

Its price strengthens as institutional and retail interest increases. Robust network activity and key technical indicators signal further growth, reinforcing momentum.

Binance listing leads to rallies for two altcoins

Two altcoins, Maple’s SYRUP and Kamino’s KMNO, surged over 30% after receiving a Binance listing. Both projects have been active in DeFi, but their native tokens are recent.

Maple Finance is a DeFi institutional lender that launched in 2019. Its SYRUP token went live last November. Its lending platform took off on Solana and Ethereum in 2021, but it’s been arguably quiet since.

Yet, recognition has been growing for it, which led to the Binance listing.

Kamino Finance shares a few similarities with the former. The Solana-based DeFi liquidity protocol launched years ago, but KMNO first hit the market in April 2024.

Kamino has also gained notoriety in 2025 and is currently considered a major protocol in Solana’s ecosystem.

Overall, Binance’s listing can massively boost tokens even with a few isolated setbacks.

Apple to allow crypto payments in apps

A US federal judge, Yvonne Gonzalez Rogers, has ordered Apple to discard policies that limit application developers from directing users to external payment options.

According to court filings, the ruling arises from Apple’s long-running legal battle with Epic Games. The latter had challenged the former’s App Store practices as anti-competitive, to which Apple responded by adding further restrictive features such as warning screens and complicated redirects.

In 2021, the court issued an injunction mandating Apple to allow developers to offer alternative payment methods for their app users. Four years later, the court ruled that Apple cannot add new barriers or charge fees for off-app payments.

The judge wrote,

“Apple, despite knowing its obligations thereunder, thwarted the injunction’s goals, and continued its anticompetitive conduct solely to maintain its revenue stream.”

Under the new directive, Apple cannot charge fees or place additional hurdles for off-app transactions. The company has since updated its App Store guidelines to allow developers to include external payment links, provided certain conditions are met.

This change opens new possibilities for crypto-based apps that previously struggled under Apple’s tight ecosystem.

First, crypto community members pointed out that apps can now support direct payments using digital assets like USDC, ETH, and SOL. Also, iOS apps can finally enable in-app NFT purchases.

This removes the friction of redirecting users to external web browsers and could significantly improve the mobile user experience. Moreover, the decision makes it easier for developers to utilize app features using NFTs.

Yet, fiat-to-crypto onboarding remains a challenge. While Apple’s new policy makes crypto use easier once assets are acquired, users still need to complete KYC procedures to purchase tokens.

SEC to discuss RWA tokenization at crypto roundtable meeting

According to a press release, the SEC’s Crypto Task Force proclaimed its subsequent Roundtable discussion, focusing on tokenization. The agenda will span two halves, probably focusing on Real-World Asset (RWA) tokenization and generalized financial instruments.

The Commission announced that this discussion would include a complete list of participants, including many top firms, such as BlackRock, Fidelity, and Robinhood.

Hester Peirce, an SEC commissioner, affirmed,

“Tokenization is a technological development that could substantially change many aspects of our financial markets. I look forward to hearing ideas from our panelists on how the SEC should approach this area.”

Over the last few weeks, the SEC has shown an interest in tokenization. In late April, it planned to launch a ‘regulatory sandbox’ concerning real estate tokenization with counterparts in El Salvador and private firms.

Although the results seemed inconclusive, none of its non-SEC participants are scheduled to appear at the Roundtable. Yet, it shows interest.

The discussion is split between two main panels: “Evolution of Finance: Capital Markets 2.0” and “The Future of Tokenization.” Both feature participation from some of the major firms involved, with the US ETF issuers primarily speaking on the first panel.

This could suggest a focus on tokenization as a financial instrument for institutional investors. The latter panel involves RWA advocates like Securitize and Robinhood, indicating that it focuses on RWAs. Yet, that’s only speculation.

Other than these general outlines, the SEC hasn’t identified which areas of tokenization are its highest priorities.

A recent study from Binance Research claimed that RWA tokens are the most recession-proof sector of the crypto industry. Its market also grew despite broader downturns, further signifying its long-term potential.

This data might give the SEC extra incentive to study tokenization. Its conclusions will likely contribute to productive regulatory policy.

Closing Remark

Boop.fun attempts to distinguish itself from other token launchpads on Solana, offering daily BOOP token rewards to its users. This, alongside its increased user activity and strong network engagement, has generated huge attention in the crypto community, and rightly so.

Binance’s listing is further proof of its impact in the crypto industry. Then, Apple’s updated guidelines provide new possibilities for crypto-based apps through cryptocurrencies and NFTs.

Ethereum’s Pectra update comes as a major step forward in building the foundation for a decentralized global system. This positions the network as a leading blockchain.

Finally, the outcome of the SEC meeting may shape how the community interacts with Real-World Assets (RWA) tokenization. With the SEC ruling in favor of the crypto industry lately, optimism is rife.

Zypto Slashes Fees on the VISA Crypto Card

Zypto has upgraded their VISA Crypto Card, slashing fees by 33%. Arguably the best crypto card in 2025, it combines high limits and low fees with a full suite of powerful features such as global acceptance, 3DS and integration with Apple Pay and Google Pay.

Find out more here.

What’s your favorite story this week? Do you have some extra insight to share? Let us know in the comments section.

FAQs

How much airdrop was offered to Solana crypto influencers?

Boop.fun, a new token launchpad on Solana, announced an airdrop of 150,000,000 BOOP for crypto influencers.

What are the two altcoins that Binance recently listed?

The two altcoins are Maple’s SYRUP and Kamino’s KMNO.

What impact does Apple’s updated guideline have on crypto?

iOS apps can now support direct payments using digital assets like USDC, ETH, and SOL, and enable in-app NFT purchases.

Which Ethereum upgrade went live?

Ethereum’s long anticipated Pectra upgrade went live on May 7 2025.

What does the SEC plan to discuss in its Roundtable meeting?

The SEC’s Crypto Task Force plans to discuss Real-World Asset (RWA) tokenization at its Roundtable meeting.

Have been following their reports for over a year, avoiding many dangerous points in the market because of them. The fee reduction for the VISA card couldn’t have come at a better time for an average user.

Each Sunday, I read Zypto weekly updates as an input to my trading decision-making process. Since that fee-reduction announcement, I’m seriously thinking about switching my primary spending card to Zypto Virtual Visa Card

Zypto isn’t just releasing features ; they’re properly explaining that better than anyone. Every topic I clearly known from this blog post. Their blog is consistently one of the most valuable resources I’ve found. Smart, honest, and genuinely helpful content.