From primetime K-Dramas to billion-dollar blockchain moves, crypto is popping up in places you’d never expect. Whether you’re new to the space or just catching up, here’s what made waves this week.

K-Drama puts Crypto Mania on Prime-Time TV

A new Korean drama, “To The Moon,” will premiere on Friday. It will spotlight retail crypto investors chasing wealth through the 2017-2018 bull market.

At the press conference, a female cast member said she had purchased about $360 (KRW 500,000) worth of Ethereum years ago but still holds it because she never figured out how to withdraw it.

“Sometimes it rises to 600,000 won, sometimes drops to 400,000 won. I don’t know how to withdraw it, so I just leave it until the day it hits 500 million won.”

The drama airs on MBC, South Korea’s leading free-to-air public broadcaster known for producing nationwide hits such as “Coffee Prince” and “Dae Jang Geum.” The Friday-Saturday 10 pm slot is one of the network’s prime-time positions, guaranteeing broad exposure nationwide.

It will also be available via streaming in Taiwan, Indonesia and India.

The plot follows three low-income women working at a large confectionery company. Stressed out with stagnant office jobs, they turned to cryptocurrency during the nation’s first major bull run, when regulations were minimal and news outlets reported on students and retirees investing their savings in digital assets.

South Korea’s cryptocurrency market continues to expand, recording daily trading volumes of about $3.15 billion. It consistently ranks among the world’s largest markets, with Bitcoin and Ethereum proving especially popular among younger investors.

On Tuesday, Parataxis Korea, an institutional Bitcoin treasury platform, announced its first purchase of 50 BTC, signaling institutional participation in the domestic market. Meanwhile regulators are preparing to launch a won-based stablecoin market to balance rapid growth with better oversight.

Circle partners with Hyperliquid for USDC expansion

Native Markets has secured the USDH stablecoin ticker on Hyperliquid (HYPE), winning almost 70% of validator votes in Hyperliquid’s first major on-chain governance process.

Despite competition from established players like Paxos, BitGo, and Ethena, Native Markets emerged as the obvious frontrunner throughout the weeklong campaign.

Furthermore, Circle has announced a partnership with Hyperliquid, bringing USDC integration to the blockchain. The stablecoin issuer is bringing Native USDC and CCTP V2 on HyperEVM.

The company plans to make this a long-term collaboration, offering new tools for Hyperliquid developers. Also, Circle may become an ecosystem validator in the future, as it’s already a stakeholder.

Now, the important question is: will the USDH rule USDC?

With the launch of USDH, Circle’s USDC, the dominant dollar-backed asset on the network, is facing fresh competition. Still, a massive amount in USDC reserves remain on the platform, emphasizing its comfortable position.

Nonetheless, Hyperliquid has made it clear that USDC and other stablecoins will keep being supported as quote assets. However, they have to meet requirements like a 200,000 HYPE stake (about $10 million), a strong peg to $1, and sufficient liquidity depth against both USDC and HYPE.

Overall, this partnership can be mutually beneficial for both firms and the broader industry. Circle is the second-largest stablecoin company, but this Hyperliquid deal shows its commitment to being an industry leader.

Learn more: Explore: Zypto’s Stablecoin Wallet

Google unveils AI agent-to-agent crypto payments protocol

Google has unveiled its newest contribution to the AI sector, an agent-to-agent payments protocol. This open-source platform will allow AI agents to transact directly without human oversight.

The tech giant has created a new platform for AI agents to interact directly through financial transactions. Google’s new protocol focuses on agent-to-agent payments, aiming to make the firm a vital piece of the growing AI infrastructure.

James Tromans, the Head of Web3 at Google Cloud, claimed to reporters,

“The way we built it is from the ground up to factor in both heritage and existing payment rail capabilities as well as forthcoming capabilities such as stablecoins.”

The firm partnered with over 60 companies, aiming to maximally integrate payment options.Currently, the protocol allows payments in debit and credit cards alongside some USD-backed stablecoins. This could also expand to other cryptoassets in the future.

Google engaged in a huge level of collaboration for this AI development. Coinbase, which facilitated the first AI-to-AI crypto transaction, was named as a major contributor alongside firms like Salesforce, American Express, Etsy, and more.

With the degree of investment, optimism is high that things operate smoothly for all sorts of transactions. Google is quite committed to the AI sector, but this update shows real experimentation.

If Google’s efforts prove successful, it could ensure the tech giant’s position in a novel sector of an explosive market.

Solana TVL hit $13 billion ATH

The Solana network has experienced a surge in user demand and network inflows, resulting in its decentralized finance (DeFi) total value locked (TVL) reaching an all-time high of over $13 billion.

As buying activity grows, SOL’s price has also surged nearly 25% in the past week. What matters now is whether this wave of network growth will be sufficient to propel the altcoin back to record price levels.

According to DefiLlama, Solana’s DeFi TVL is at an all-time high of $13.38 billion, having skyrocketed by 18% in the past week. This surge is a clear marker of increased capital inflows into Solana’s DeFi protocols, a trend that can only be sustained when there is a rise in user demand and on-chain activity.

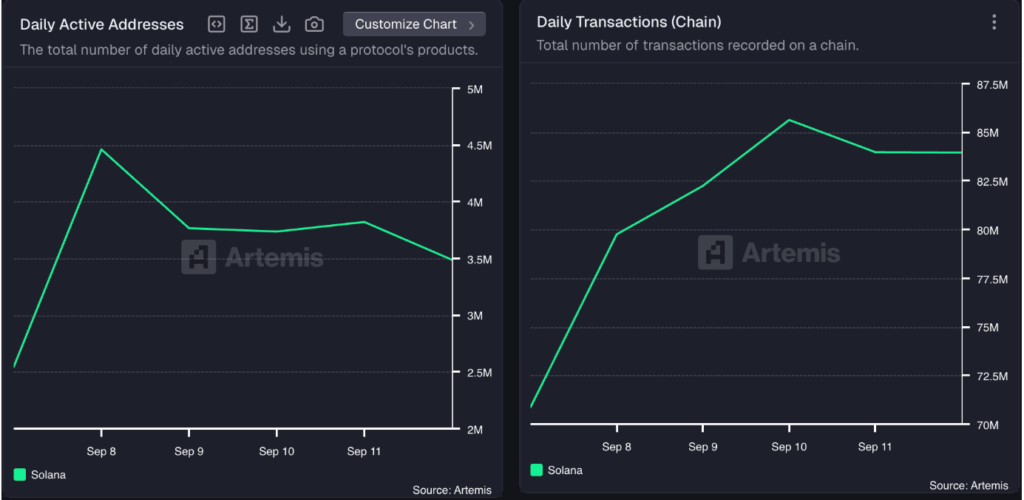

Data from Artemis confirms this trend, showing that Solana has experienced an uptick in daily active addresses and transactions. According to the on-chain data provider, in the past week, for example, the number of daily active addresses involved in at least one SOL transaction has increased by 37%.

The increase in users has directly translated to higher activity, as the daily transaction count on the network has climbed 17% over the same period.

When a network’s user demand increases this way, it signals stronger confidence in the ecosystem and deeper utility for its native asset. With the Solana network showing strength, attention now shifts to how these gains are reflected in SOL’s market performance.

Explore: Zypto’s Solana Wallet

Ethereum nears $5,000 as ETFs reshape market demand

Ethereum (ETH) has jumped by nearly 10% over the past week, driven by improving market sentiment and renewed investor demand.

The price surge comes as a broader risk appetite returns to the crypto market, raising hopes that ETH could be gearing up for a breakout toward the $5,000 mark.

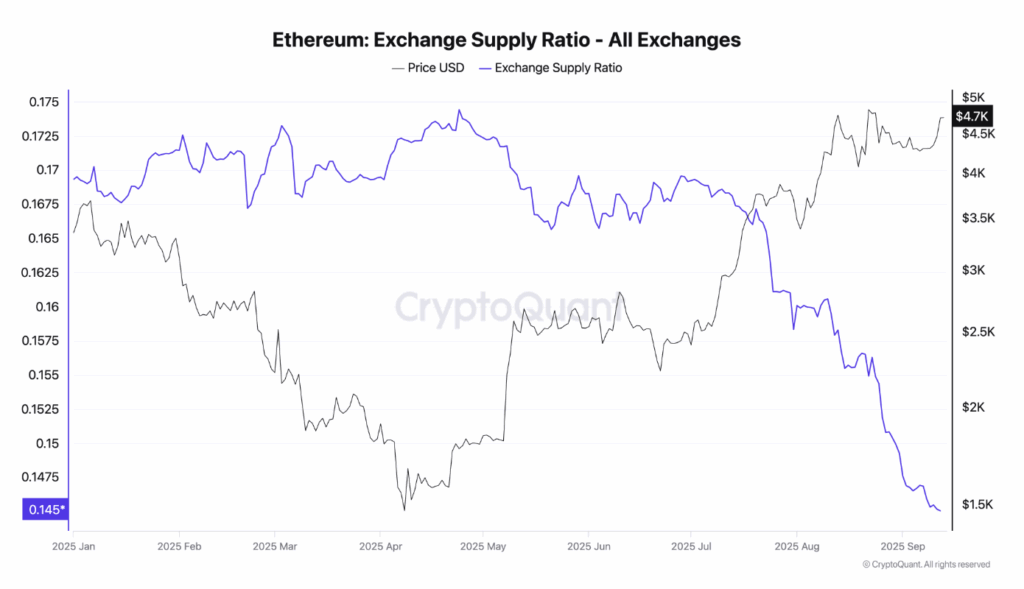

Ethereum’s Exchange Supply Ratio (ESR) has plunged to its lowest level this year, indicating that fewer coins are being held on centralized exchanges. As of this writing, the metric is at 0.14, falling steadily since July 20.

The ESR measures the share of ETH’s circulating supply on centralized exchanges. A higher ESR signals that more ETH is sitting on exchanges, increasing the risk of near-term selling pressure.

Conversely, when the ESR declines, as it has now, it indicates that holders are moving coins off exchanges, often into private wallets or custodial solutions. This reduces the immediate availability of ETH for sale.

Historically, such declines in exchange balances have often preceded extended rallies, raising the likelihood of a rally toward $5,000 in the near term.

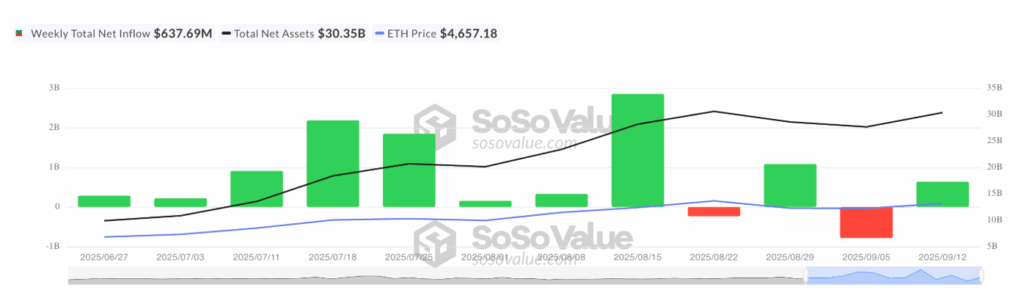

Furthermore, institutional confidence is showing signs of revival. Spot Ethereum exchange-traded funds (ETFs), which saw capital outflows last week, have recorded a rebound in inflows in the past few days.

According to SosoValue, between September 8 and 12, spot Ethereum investment funds recorded $638 million in capital inflows, a sharp reversal from the $788 million in outflows the previous week.

The turnaround reflects a decisive shift in sentiment, with key investors rotating back into ETH and strengthening the case for a sustained push toward the $5,000 level

Furthermore, Ethereum staking activity is locking up more ETH than ever before. Data from CryptoQuant showed that Ethereum investors have locked up an additional 2.5 million ETH since May, pushing the total amount of staked ETH to 36.2 million. Per Dune Analytics data, this represents nearly 30% of Ethereum’s total supply.

This steady increase reduces the top crypto’s circulating supply and reinforces its upward price pressure. It also signals that investors are committed to ETH for the long term and not short-term speculative plays.

Another strong piece of evidence showing that Ethereum’s market role has significantly changed is the acceleration of its on-chain utility. According to CryptoQuant, Ethereum’s daily transactions spiked to 1.7 million in mid-August, and the number of active addresses on the network reached a high of 800,000.

All the same time, smart contract calls broke past 12 million per day, which is an unprecedented level in prior cycles. The activity level underscores Ethereum’s growing role as the backbone for decentralized finance, stablecoins, and tokenized assets.

Explore: Ethereum Wallet Features in Zypto App

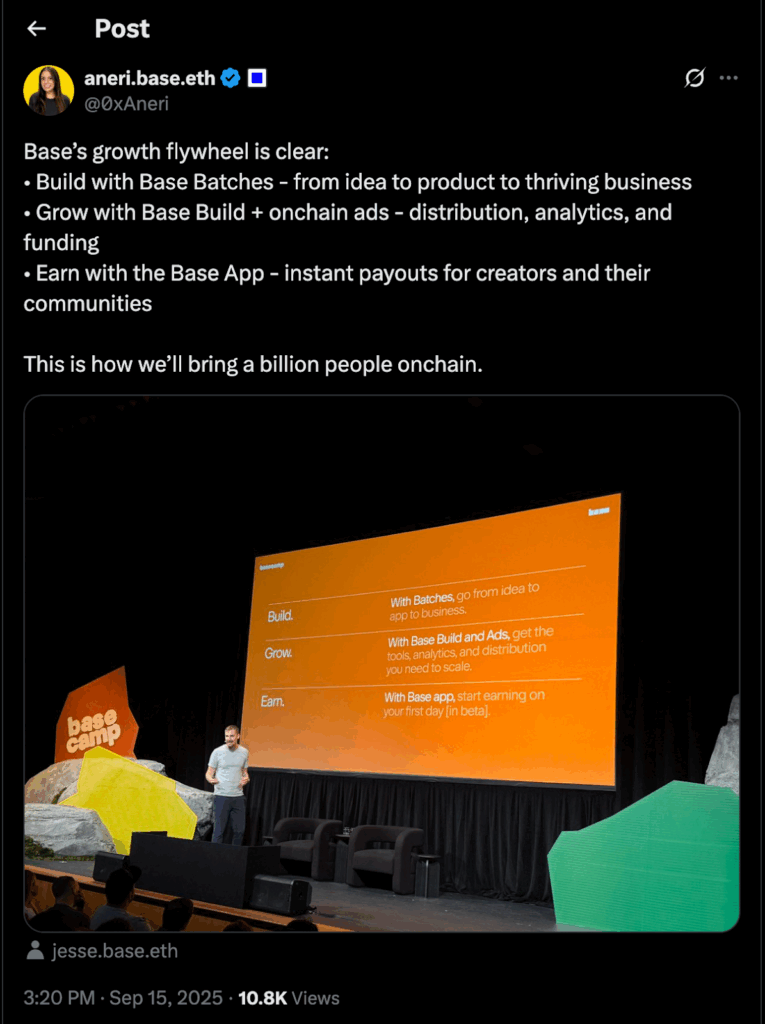

Base emerges as a major L2 contender

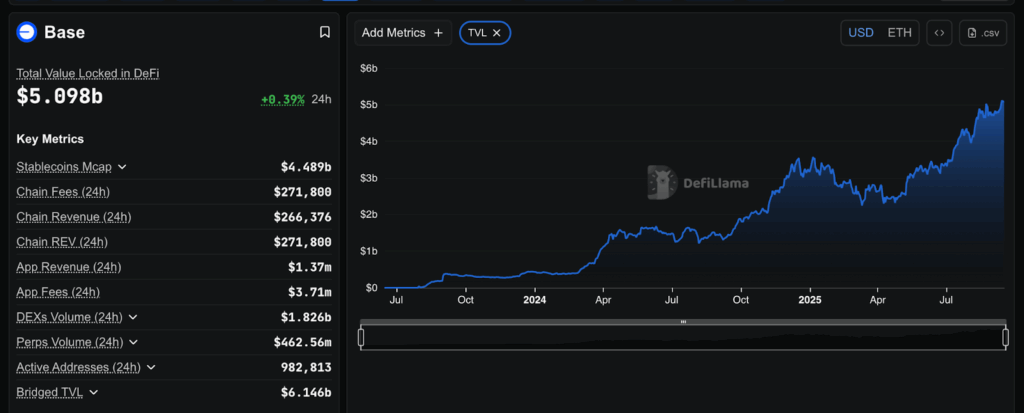

Coinbase-backed Layer 2 network Base is accelerating its ascent into the upper echelons of Ethereum scaling solutions. It continues to lead on multiple metrics, including weekly transaction counts and daily active addresses.

With a total value locked (TVL) of $5 billion, a stablecoin market cap of $4.5 billion, and daily revenues of $100,000, the project is now positioning itself as a serious contender in the increasingly competitive L2 ecosystem.

The activity reflects Base’s push to capture everyday on-chain behavior. From decentralized swaps to creator payments, the network is increasingly being used as a foundation for practical, user-facing applications rather than just liquidity mining or arbitrage.

Furthermore, Base’s team has emphasized its growth flywheel, designed to attract builders, creators, and users. This approach also advertises Base as a platform for growth and funding. This differentiates it from other Layer-2s focused primarily on transaction throughput.

The most eye-catching announcement from the BaseCamp event was the launch of a new bridge to Solana. Described as a way to move seamlessly across ecosystems, the bridge will enable users to trade assets across chains.

They could also deploy tokens in both ERC-20 and SPL-20 formats and tap into Solana’s liquidity within Base applications. Users can deposit and use SOL in Base apps, import any Solana token, and export Base-native tokens back to Solana.

Alongside the Solana bridge, Base also confirmed it is exploring the launch of a network token. In an update, the project said it is still in the early phases of exploration and has not yet provided specifics on timing, governance, or design.

Explore: Base Wallet Features in Zypto App

Zypto Integrates Hive for Gas-Free Global Payments

Hive users now have a new way to manage their crypto and spend globally, thanks to Zypto’s latest integration. The v1.21 app update introduces full support for HIVE and HBD, enabling gas-free transfers, full wallet functionality, and access to Zypto’s real-world payment ecosystem.

Users can now:

- Create or link a Hive account directly inside the Zypto App

- Send, receive and pay with HIVE and HBD without network fees

- Use their balances to pay bills, top up mobile phones, or fund crypto cards, all in-app

The Hive blockchain, known for its speed and fee-less design, powers a growing ecosystem of creators, apps, and communities. By adding Hive, Zypto expands its mission toward a more open and decentralised economic system – one where networks like Hive, decentralised to the core, are fully supported.

The integration includes full support for:

- Hive account linking and management

- Fee-free P2P transfers

- Payments in HIVE/HBD across Zypto features

- Swap access between HIVE, HBD and 24,000+ assets

Zypto’s community-led approach continues to attract diverse chains and user bases. Hive joins a growing list of supported networks inside the Zypto App, including Ethereum, Solana, Base, XRP, Tron, and more.

Find out more here.

Closing remark

The current buildup of stablecoins on exchanges has been noted as an “extremely strong bullish signal.” Analysts remark that this capital is poised to be deployed into assets such as Bitcoin and altcoins, signaling that a powerful rally may be on the horizon.

Retail participation and spot market volumes will still play a role in sustaining Solana’s momentum. If buying activity from smaller players still stalls, even whales might hesitate to drive the price higher.

Overall, it seems likely that the exchange reserves jumped, not due to panicked investors selling, but exchanges buying more XRP. In fact, this could be a sign of institutional coordination for an upcoming event.

Ethereum’s rally toward the $5,000 mark is reframing its role in global markets. The asset is transitioning from a speculative token into a reserve choice for institutions and large-scale investors.

With billions flowing through its ecosystem, real user adoption, and now a cross-chain bridge that expands its reach, Base is positioning itself as a central player in Ethereum’s scaling wars.

And with fee-free HIVE and HBD transfers now live in Zypto, Hive’s role as a decentralised, user-driven network is stepping into the spotlight, not just as a blockchain for creators, but as a solid infrastructure player in a more open financial future.

FAQs

Who did Circle partner with for expansion?

Circle has announced a partnership with Hyperliquid, bringing USDC integration to the blockchain.

How is Ethereum nearing $5,000?

Ethereum (ETH) jumped by nearly 10% over the past week, driven by improving market sentiment and renewed investor demand.

What did Solana TVL surge to?

Solana’s decentralized finance (DeFi) total value locked (TVL) surged, reaching an all-time high of over $13 billion.

What is the name of the K-Drama?

The Korean drama is called “To The Moon.”

How is Base becoming a major L2 contender?

Base continues to lead on multiple metrics, including weekly transaction counts and daily active addresses.

0 Comments