This week, we saw Bitcoin finally break 100k, NFT sales reached a six-month high of $562M, as Ethereum ETF inflows surpassed Bitcoin ETFs for the first time in weekly and monthly performance.

In addition, altcoins like Shiba Inu (SHIB) and Ether (ETH) made strides against the backdrop of the increasing Altcoin Season Index. Unsurprisingly, this has led to speculation about whether an altcoin season is on the horizon.

Let’s go into in-depth details. Read on.

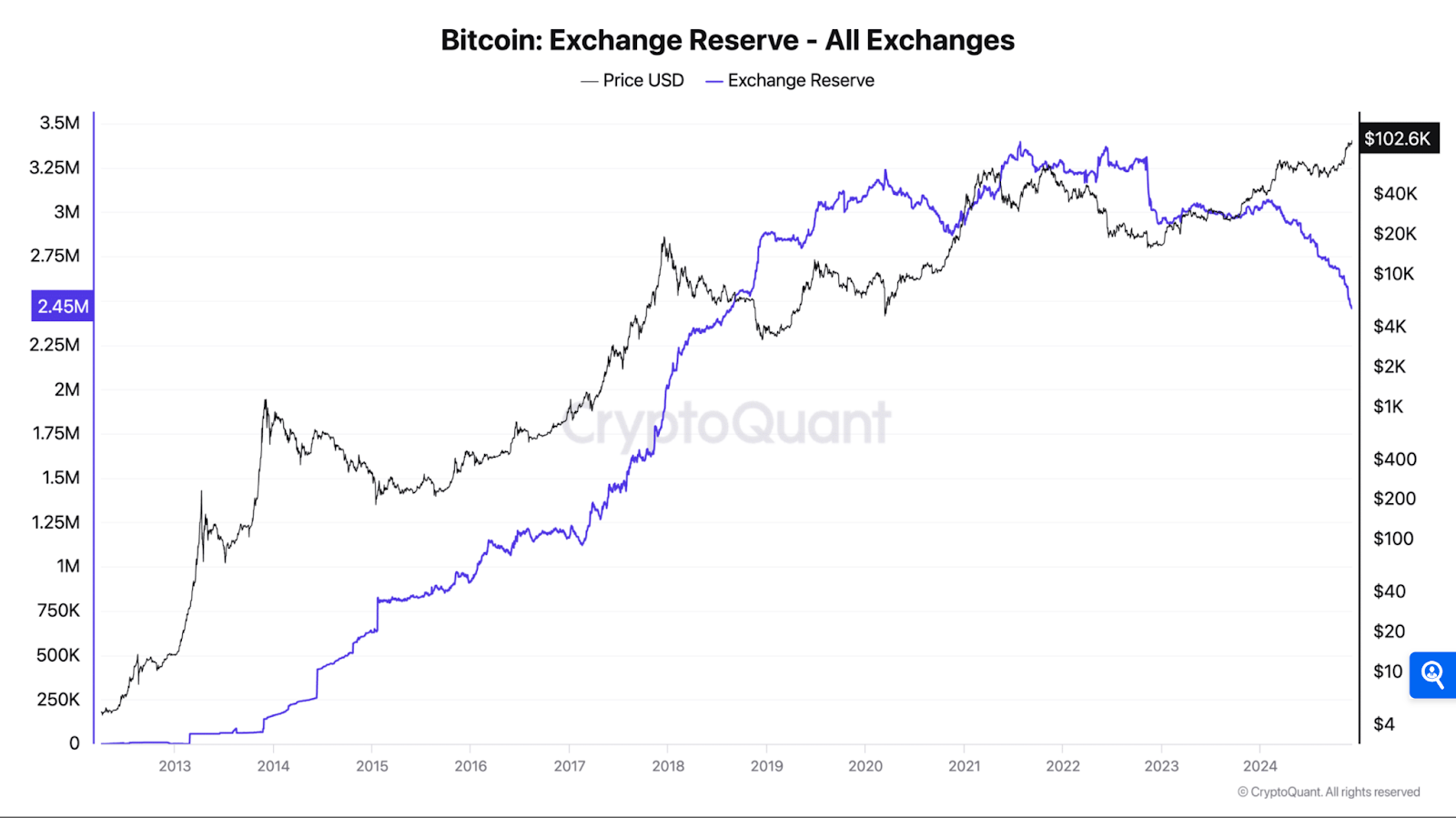

Bitcoin finally surges past $100K

At long last, Bitcoin (BTC) has finally surged past the $100K mark and hit a new all-time high (ATH) in the process. Per CoinMarketCap, at the time of this writing, Bitcoin was priced at $102,268, up by 6.14%.

Last week, we highlighted some predictions from some analysts about whether BTC could reach the $100K mark. But now that it has, many stakeholders have things to say.

Vishal Sacheendran, Head of Regional Markets at Binance, spoke about renewed “optimism” in the crypto market as governments globally began embracing and adopting investment in digital assets.

Dan Coatsworth, investment analyst at AJ Bell, defined it as a “magic moment” for the cryptocurrency and said it had a “clear link” to Donald Trump’s Presidential win.

Trump took to social media to commemorate the milestone, posting “Congratulations Bitcoiners” and “You’re welcome!” He has previously famously pledged to make the US the ‘crypto capital’ of the world.

Shoki Omori, the chief Japan desk strategist of Mizuho Securities, alluded to BTC’s rise to the new SEC chair. He noted, “Individual investors must be excited to see the BTC price top $100,000 following the news of Paul Atkins being nominated as SEC chair.”

By and large, the crypto market is strongly bullish, as positive sentiment has been rife since BTC achieved this huge milestone. For now, there’s no saying how far it can go from here.

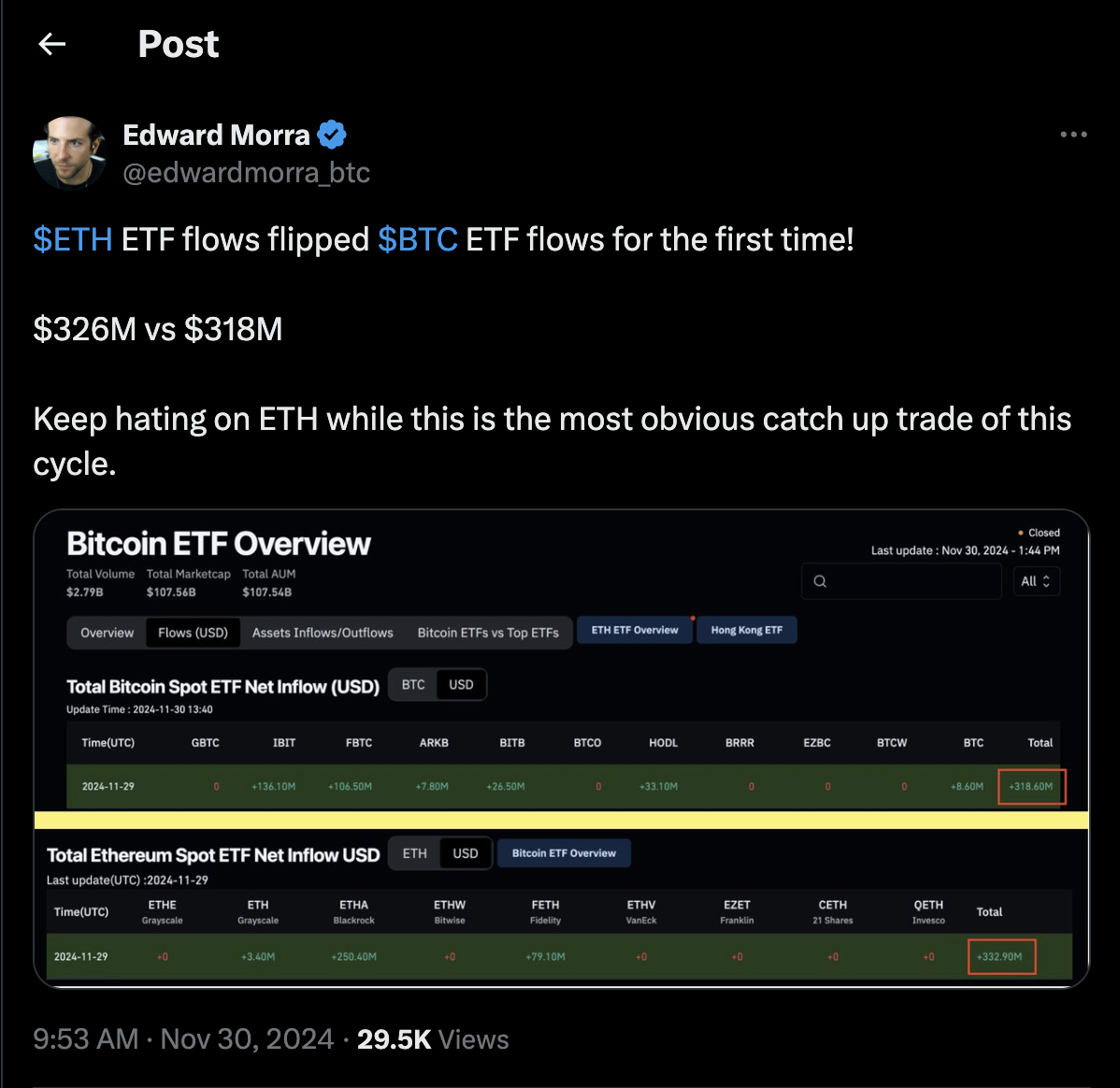

Ethereum ETF inflow surpasses Bitcoin ETFs

On November 29, Ethereum (ETH) exchange-traded funds (ETFs) in the U.S. experienced a surge in daily inflows during their latest trading day. Ethereum ETFs recorded $332.9 million in inflows, exceeding Bitcoin’s ETF performance.

Ether (ETH) reached a 5-month high, topping Bitcoin (BTC) in weekly and monthly performance. This uptrend indicates increasing interest in ETH, emphasizing its comeback after considerably lagging behind Bitcoin’s (BTC) performance.

Among the high-performing ETFs were BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH), which had $250 million and $79 million, respectively. Then there was Grayscale’s ETF, with modest inflows of $3.4 million.

This signaled the fifth consecutive day of positive inflows, concluding the second-strongest week for the group with $455 million in total inflows, compared to Bitcoin ETF’s $320 million in inflows (which later faced net outflows). Impressively, this occurred even with the shortened trading week (due to Thanksgiving).

Edward Morra, a crypto trader, shared his thoughts:

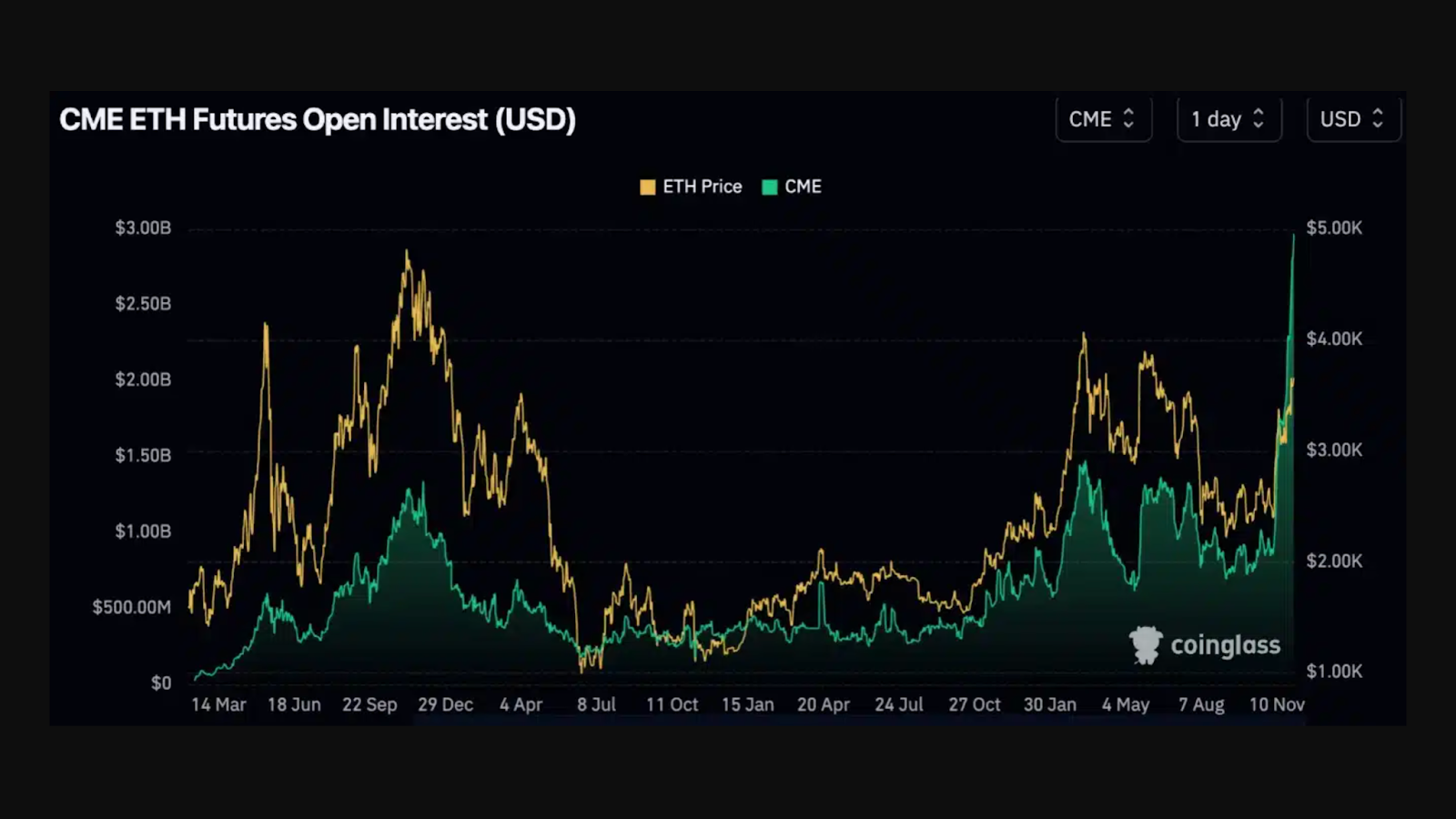

Furthermore, open interest in ETF futures on the Chicago Mercantile Exchange (CME), which targets institutional investors, has hit all-time highs of nearly $3 billion. This growth feeds into more positive sentiment toward Ethereum as a leading asset in the crypto ecosystem.

Yet, this wasn’t Ethereum’s only milestone.

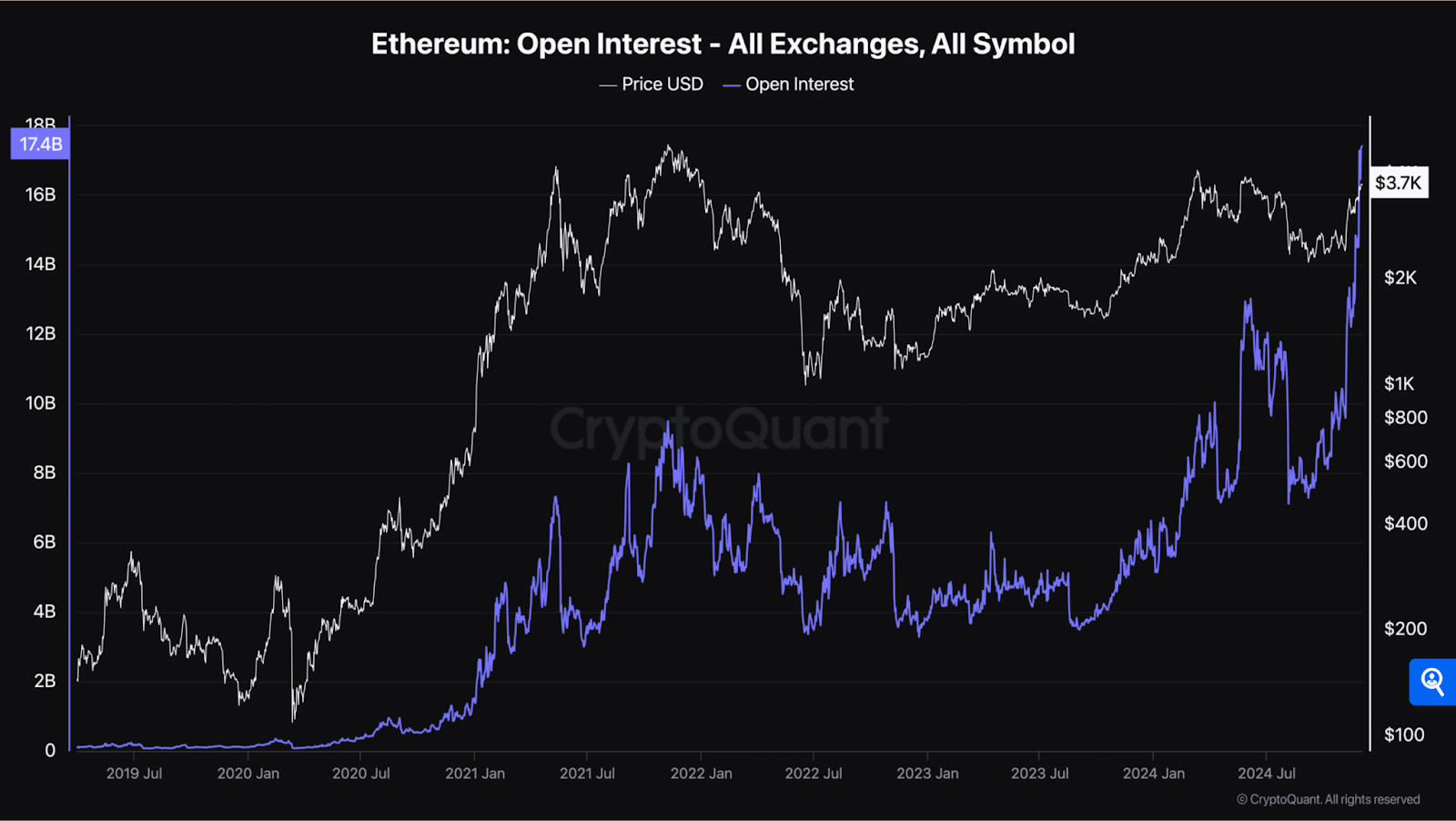

Ethereum open interest reaches record high

Ethereum has recorded a notable milestone, as one of its essential derivatives metrics has hit an all-time high. Ethereum’s Open Interest (OI) has recorded an all-time high of over $17 billion.

This means more traders are entering futures or options contracts positions, and extra funds are probably entering the market. This is happening against the backdrop of Ether (ETH) getting close to $3,700.

In addition, the funding rate also enjoyed a substantial rise over the last couple of days. An increase in the metric is bullish, as it often suggests a promising market where traders can pay higher to maintain their long positions.

While this might suggest continuous price growth, the truth may be different. As seen on the chart, whenever open interest increased, it was followed by price corrections. This happened in 2021 and 2024 when an increase in OI led to a market top.

Is that going to happen again?

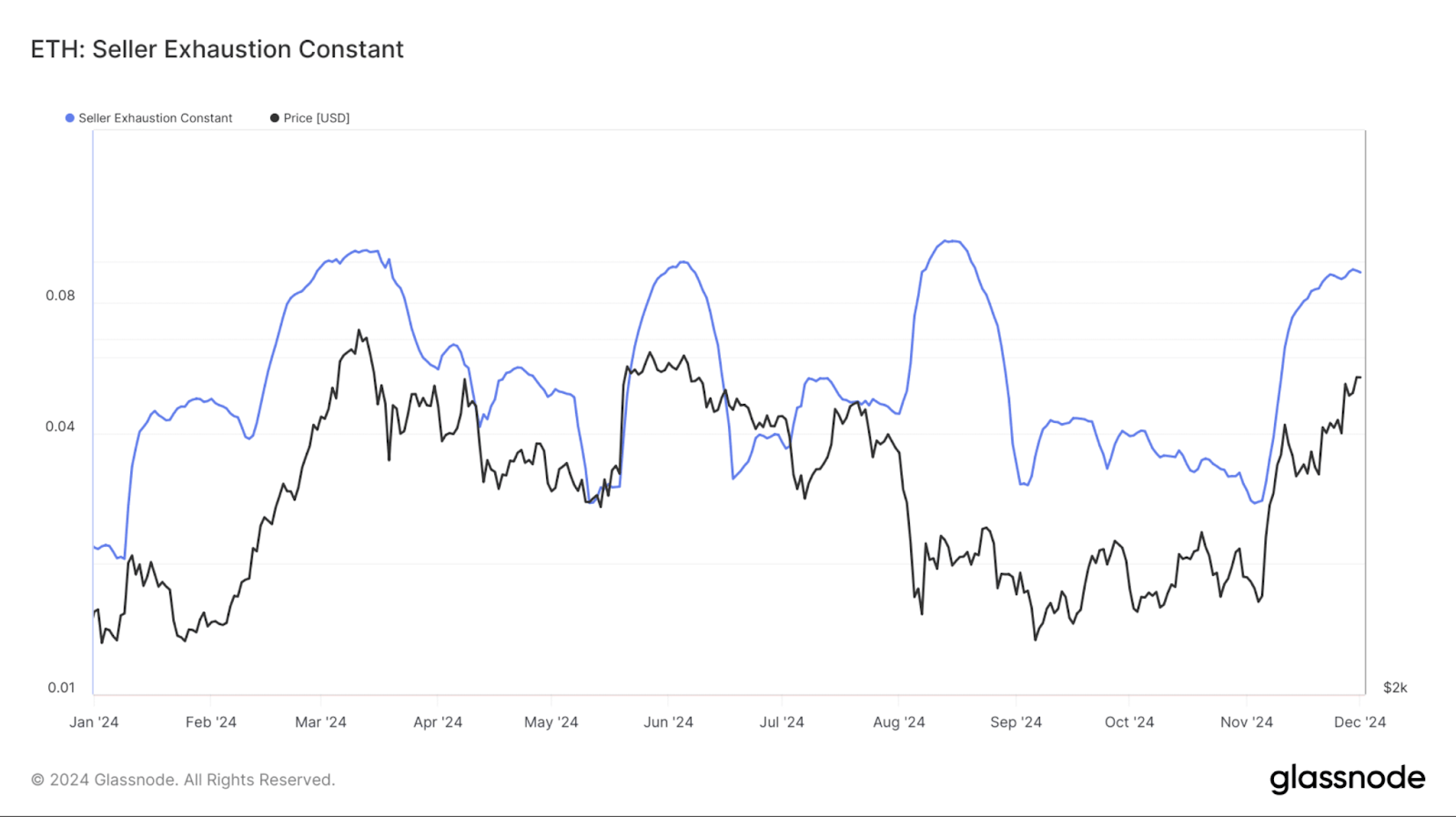

We analyzed the token’s on-chain data to determine whether ETH was at its highest level in the crypto market. The above chart shows that ETH’s exchange reserve is increasing, which indicates rising selling pressure.

In addition, we can see that ETH’s seller exhaustion constant peaked. The chart shows that whenever the metric peaked, ETH’s price declined massively in the subsequent days.

Is altcoin season on the horizon?

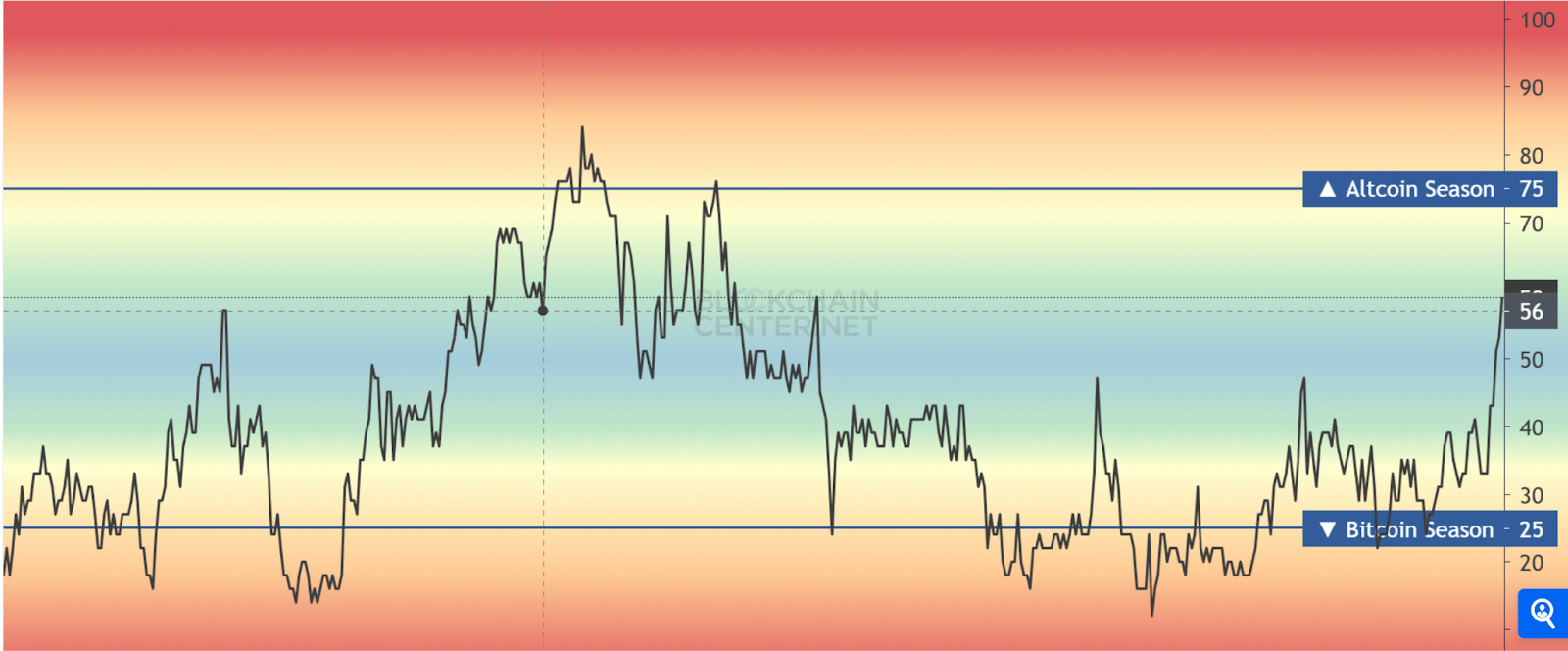

While still strong at 57.3%, Bitcoin’s (BTC) dominance has narrowly reduced. This signifies increased investor interest in alternative digital assets. The Altcoin Season Index witnessed a significant spike for the first time since April.

The Altcoin Season Index increases

The Index climbed to 59, indicating a possible transition towards an altcoin-dominated cycle. It recently jumped from 33 to 75, approaching the cusp 75, which suggests an altcoin season.

The gain implies increasing momentum among altcoins, backed by considerable price movements in tokens like Ether (ETH), Solana (SOL), and Binance Coin (BNB). Typically, such price actions have coincided with decreased Bitcoin (BTC) dominance, establishing the platform for altcoins to soar.

Moreover, the index’s trajectory indicates an evolution from Bitcoin-led dominance earlier this year toward a more varied market. Nonetheless, mentioning that the index has yet to break into altcoin territory is essential, suggesting a discreet optimism.

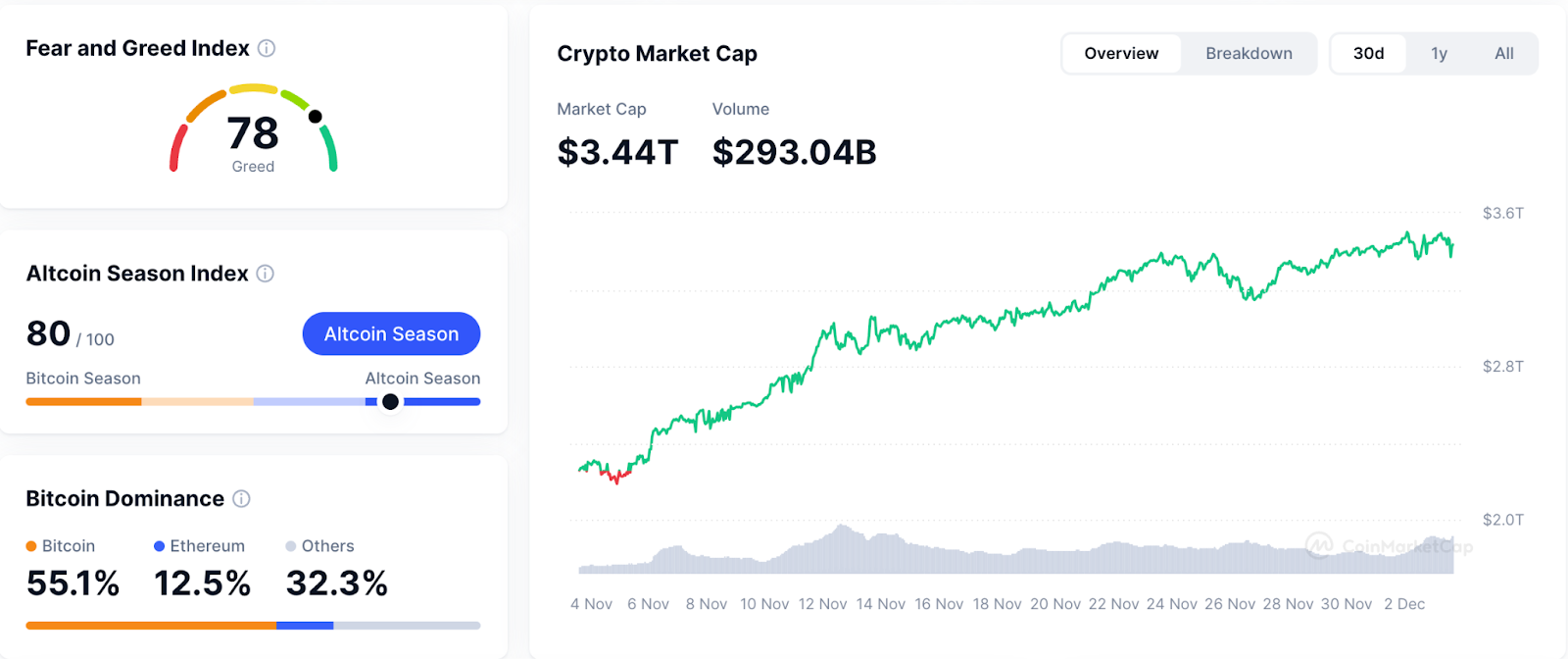

Also, note that Bitcoin’s dominance has reduced from its yearly high of 60.1% to 55.1%. This downtrend overlaps with altcoins obtaining a larger share of the market. Ethereum’s dominance has slightly increased to 12.5%, indicating a renewed interest in the second-largest cryptocurrency.

This highlights Bitcoin’s resilience during bearish markets, as it often acts as a sanctuary for investors. Still, the recent decline in dominance could suggest that the market is working towards a more expansive rally in other assets, primarily as investors continue to grow more optimistic.

The Altcoin market cap increases

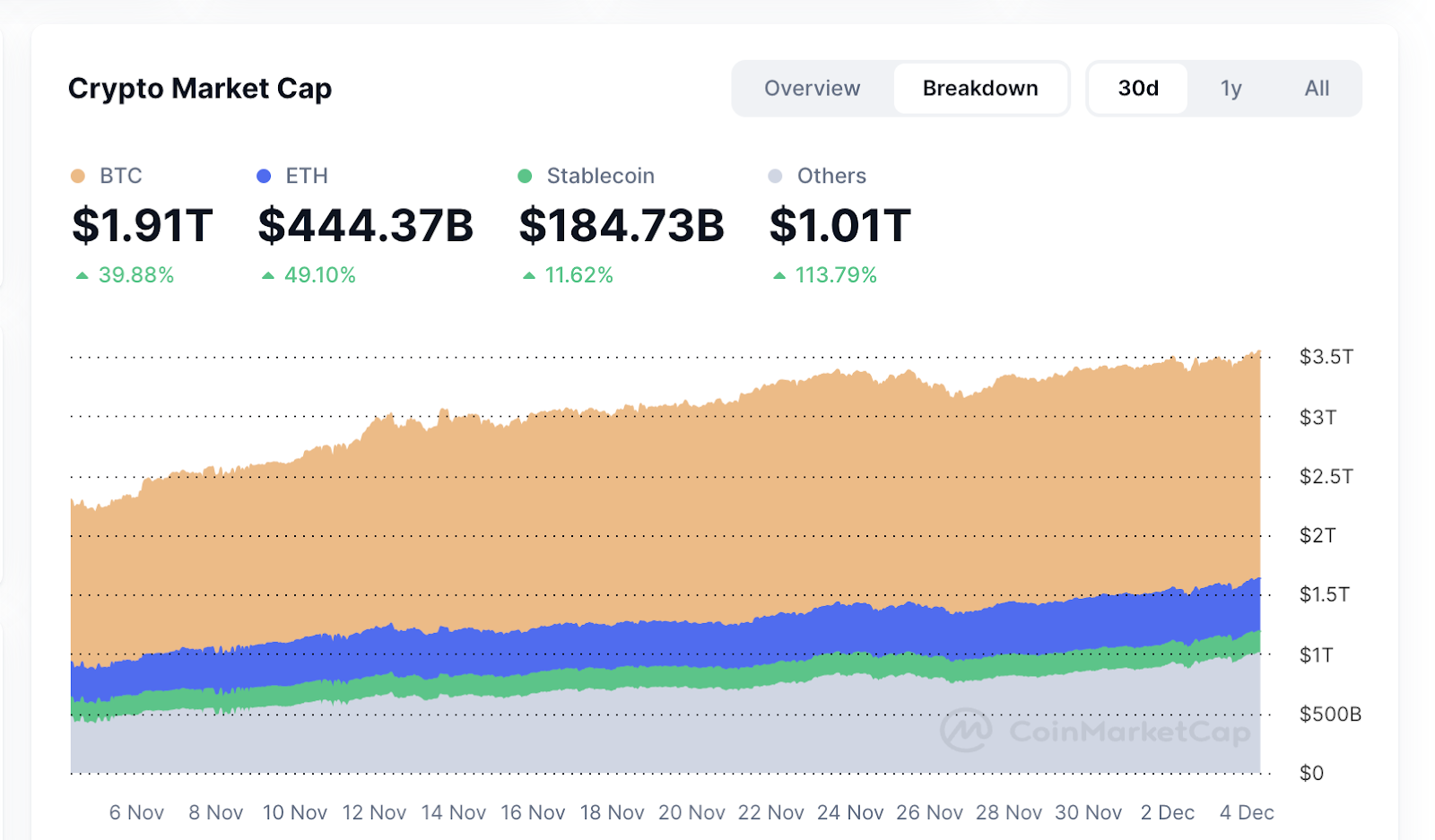

On the other hand, the overall crypto market capitalization, as seen in CoinMarketCap, has soared to $3.44 trillion. Unsurprisingly, Bitcoin leads the way with $1.91 trillion, while the stablecoin cap has risen to $184.73 billion. This signals increasing demand among investors for liquidity and risk mitigation.

Altcoins have enjoyed a massive surge of 113.79% to $1.01 trillion. Over the past month, altcoins have thrived, with market leaders like Ether (ETH) and Solana (SOL) posting double-digit percentage gains.

This increase in the altcoin market cap coincides with the Altcoin Season Index, further supporting the idea of a potential altcoin breakout. The coming weeks will be key as the market aims to clarify whether this is a sustained altcoin season or a momentary surge.

Yet, according to data, we must enter the altcoin season when altcoins cross the 70 threshold on the Altcoin Index. Undoubtedly, traders and investors will spend more time monitoring essential metrics like the Altcoin Season Index and Bitcoin dominance.

NFT sales reach a 6-month high of $562M

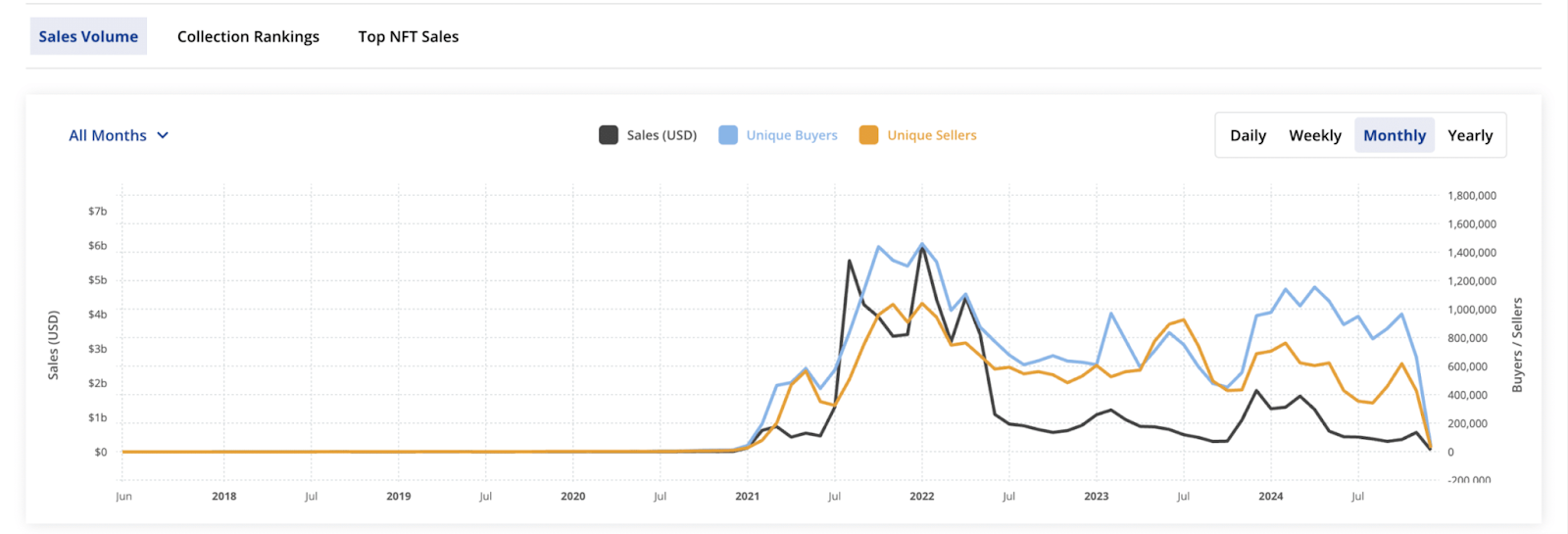

When was the last time you saw the once-popular ape-like assets (NFTs) everywhere on the internet? This is simply because there has been a noticeable decline in non-fungible token (NFT) volume in the past months.

There was a significant drop in NFT volume from the March peak of $1.6 billion recorded in April to less than $400 million in October. But now, the NFT space is starting to witness a rebound.

According to CryptoSlam data, the NFT sector’s sales volume increased by 57.8% in November to $562 million. This is the highest monthly sales volume since the market reached $599 million in May.

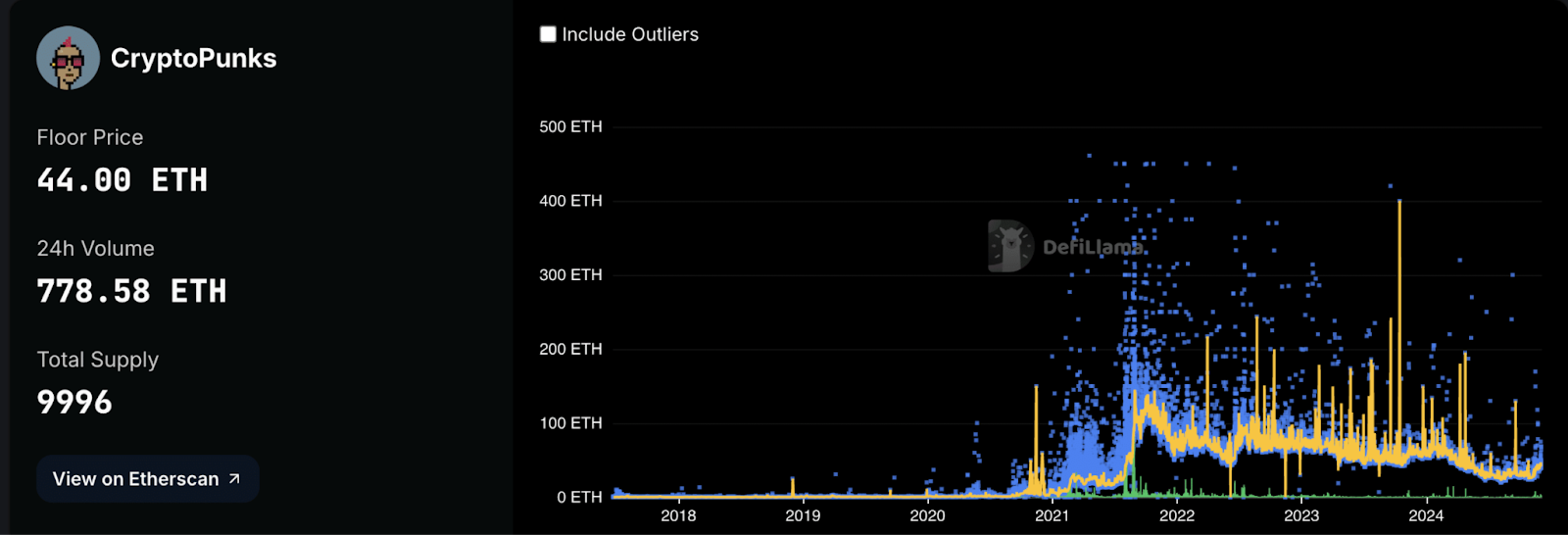

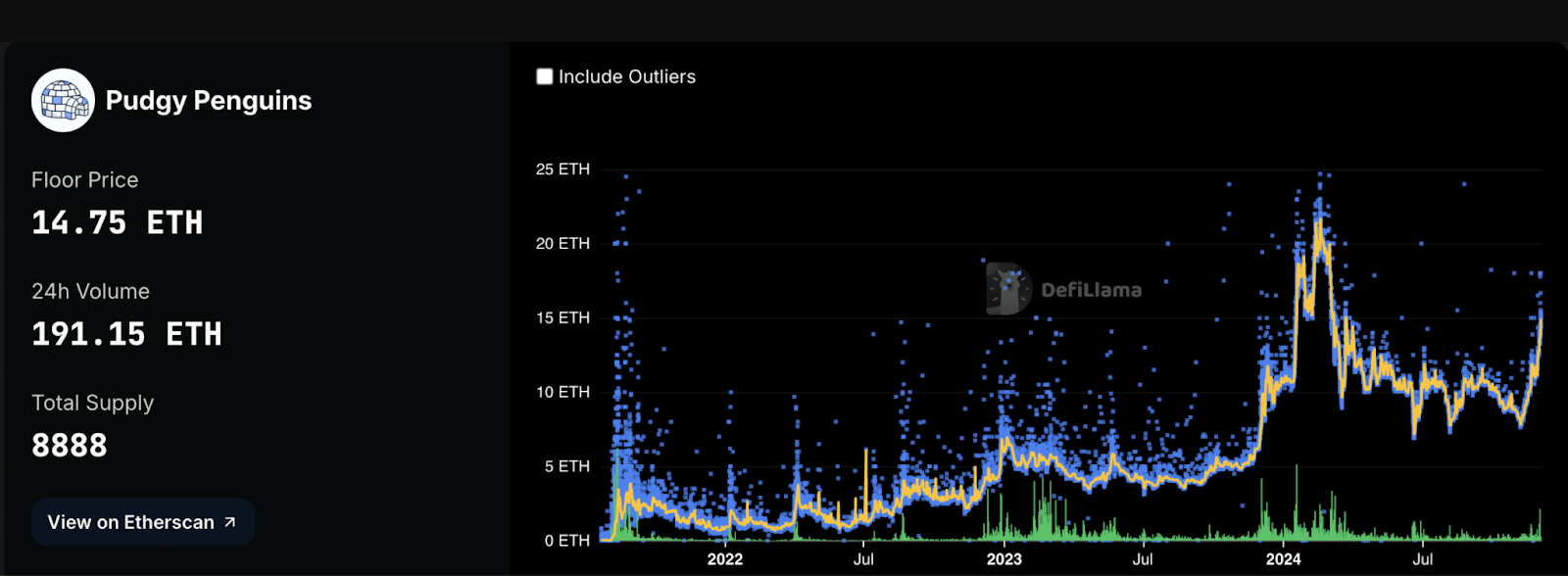

Furthermore, November’s momentum indicated a possible revival. This is primarily due to top performances from high-profile NFT collections like CryptoPunks and Pudgy Penguins and bullish sentiment in the crypto market.

CryptoPunks recorded a 392% surge in monthly sales volume, reaching over $49 million with 388 transactions, a 213% rise from October. Likewise, Pudgy Penguins posted major gains, as the collection saw its sales volume increase by more than 250% month over month, amassing $16 million in sales.

Per data from DefiLlama, CryptoPunks’ collection’s floor price rose from 26.3 ETH to 44 ETH at the time of writing. This indicates an increase of almost $159,148.

For Pudgy Penguins, the floor price increased from 8.7 ETH to 14.75 ETH. This translates to a 51% increase and approximately over $53,350.

Ethereum and Bitcoin lead other blockchains

Unsurprisingly, Ethereum and Bitcoin were the most dominant blockchains in the NFT space. The former recorded $216 million in NFT sales, a 12% rise, while the latter had a massive surge of 99.44%, totalling $186 million.

Then, other blockchains such as Solana, Polygon, and BNB Chain contributed to just more than $100 million in combined NFT sales for the month. This indicates increased investor belief and market activity as a bullish trend formed across the ecosystem.

Bitcoin (BTC) traded above $95,000 at press time, up 36.9% in the past month. Ether (ETH) traded above $3,700, seeing a bullish run up by 44.6% in the past month. Then, Solana (SOL) and Ripple (XRP) surged 36% and 34%, respectively.

Now that NFTs have posted such glowing numbers and signs of recovery amid broader market momentum, the NFT sector may be poised for sustained growth into 2025.

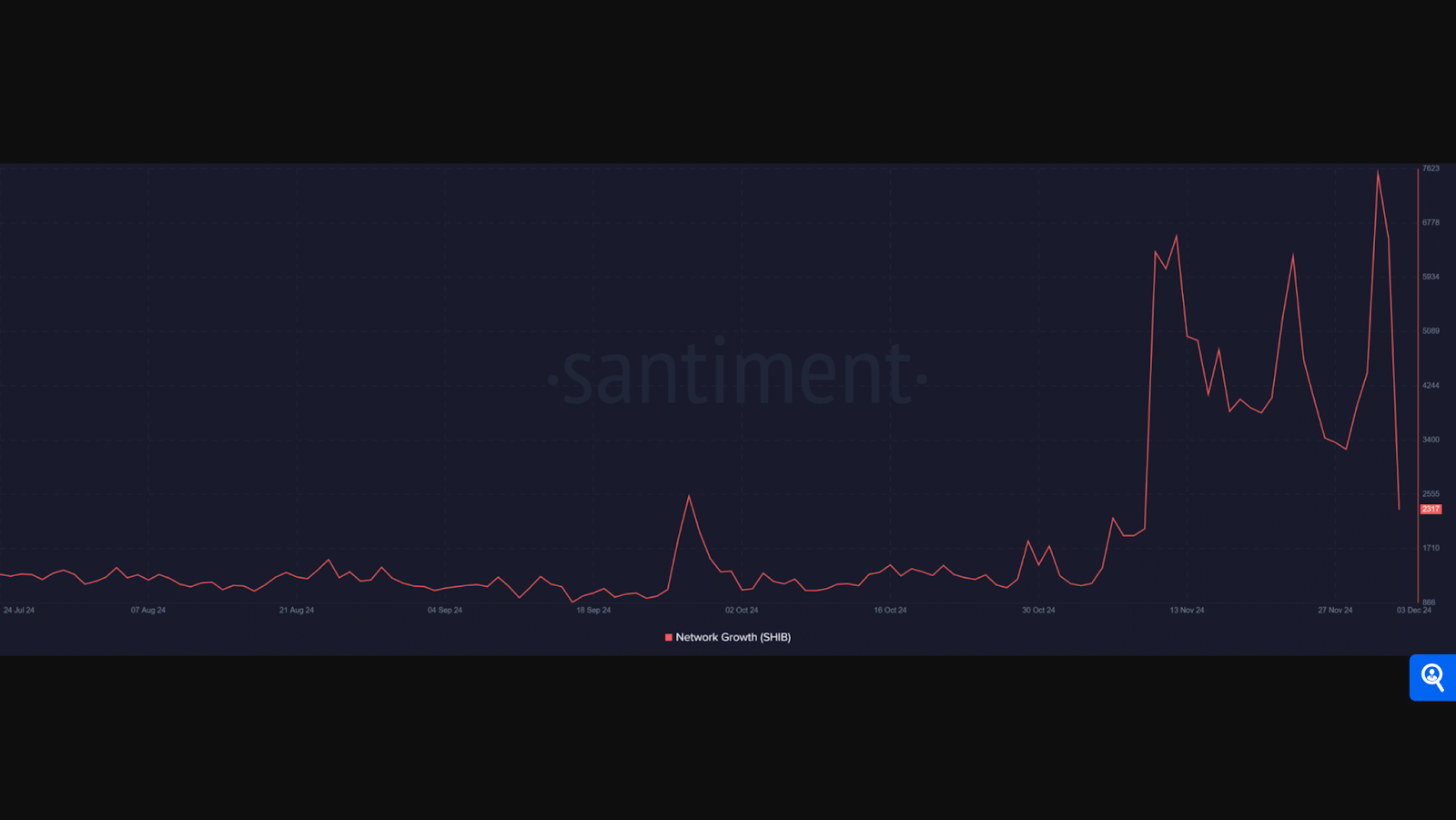

Shiba Inu’s network surges to new levels

Shiba Inu (SHIB) has considerably increased its network growth. Its price surged by over 6% to $0.000031 as the network recorded over 7,600 new wallet addresses – proof of a major influx of new users.

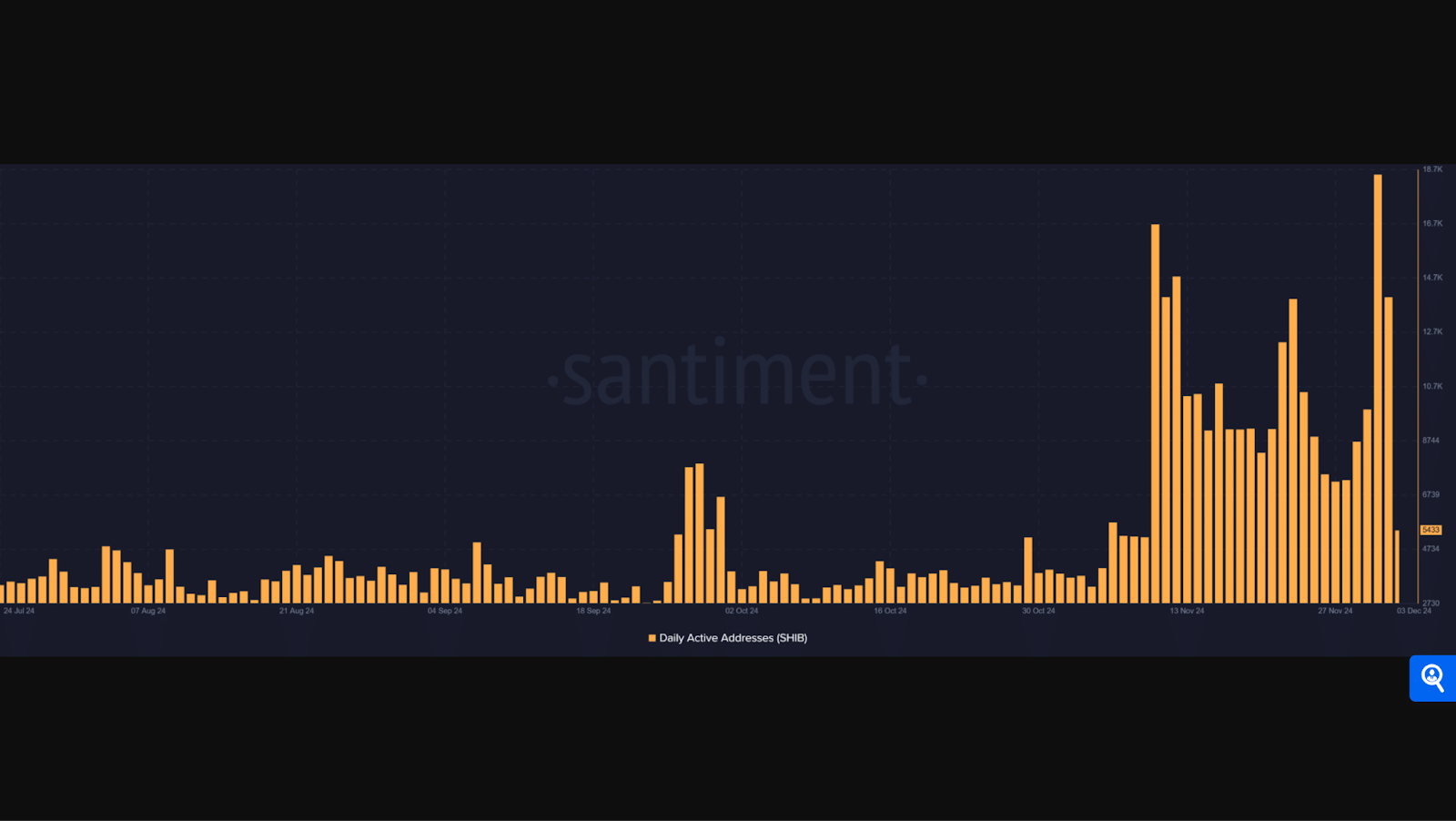

A comparable trend emerges when the daily active address charts are considered. During the same time frame, daily active addresses soared to over 18,000, among the highest activity for SHIB in 2024.

Typically, such growth is associated with heightened speculation or more expansive adoption. These factors could be catalysts for price gains as they indicate that new users join the ecosystem and existing holders engage in transactions.

The alignment between network growth and active addresses is essential. Typically, such chemistry foregoes strong price rallies, indicating growing utility and belief in the asset.

Yet, the sharp decline in network growth after the increase raises inquiries about whether the momentum is long-lasting or simply a temporary reaction to the crypto market.

So, what are the implications for Shiba Inu (SHIB) of increases in the daily active addresses, transaction volume, and price value?

What’s next for Shiba Inu?

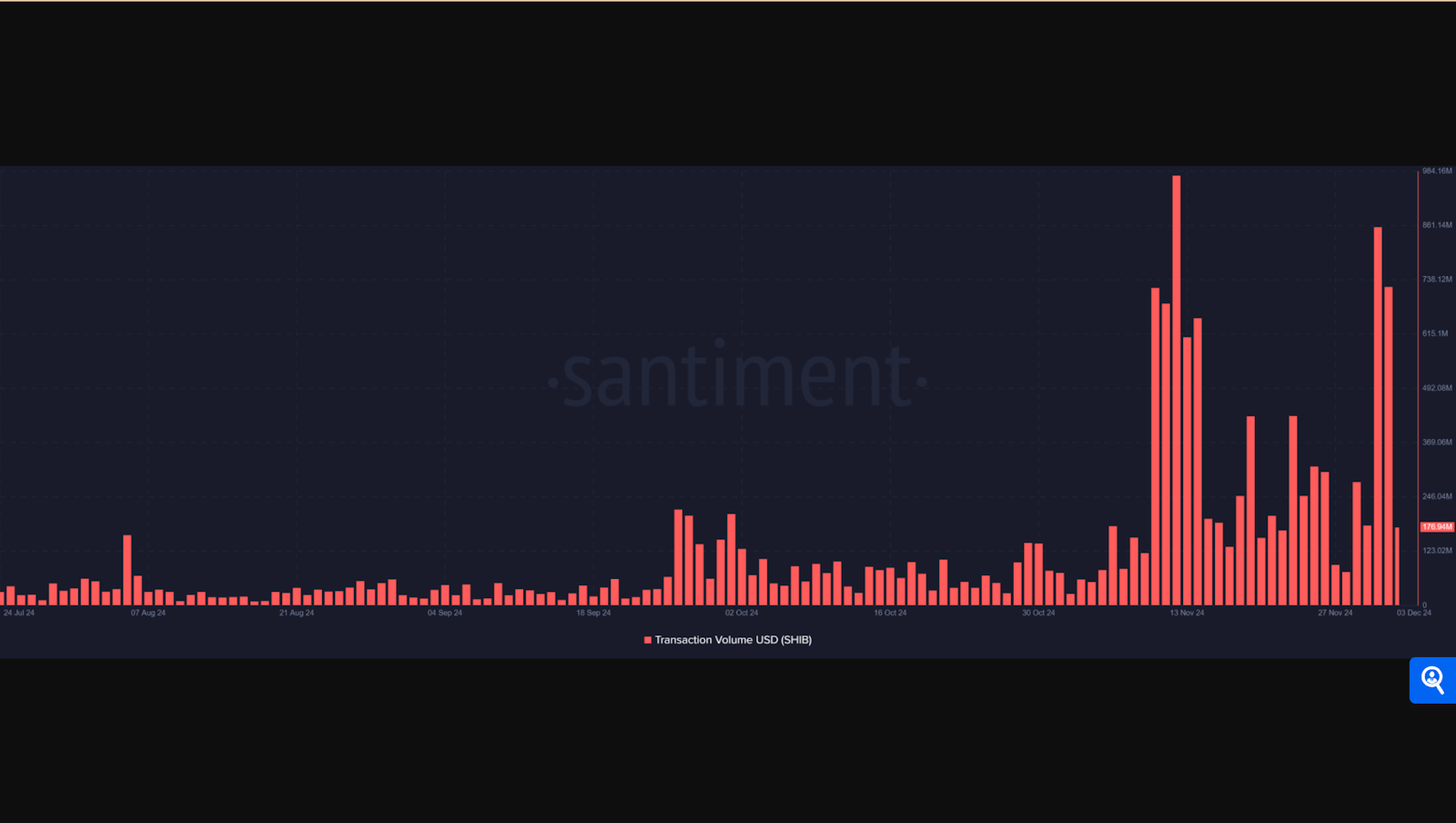

Although Shiba Inu’s network experienced immense growth, its transaction volume reveals mixed sentiment.

During the peak period of network growth and daily address activity, Shiba Inu’s (SHIB) transaction volume surpassed $857 million, highlighting significant trading interests.

Nonetheless, SHIB’s decline to $176.94 million reduced morale, which could insinuate profit-taking or market consolidation.

While high transaction volumes signal rising demand, the sustainability of these levels is vital. If transaction volumes continue to reduce alongside network growth, SHIB might struggle to maintain its recent bullish momentum.

Closing Remark

Ethereum’s milestones, such as its record-high Open Interest and the Ethereum ETFs surpassing Bitcoin ETFs for the first time, indicate that it is a leading asset in the crypto ecosystem.

With Bitcoin’s dominance slightly reducing, the Altcoin Season Index climbed to 59, indicating a possible transition towards an altcoin-dominated cycle. Yet, it must reach 70 before these speculations can become concrete.

The NFT sector witnessed massive growth for the first time in six months. Its surge by 57.8% in November to $562 million was mainly due to CryptoPunks and Pudgy Penguins, along with a bullish sentiment in the crypto market.

In addition, leading blockchains like Ethereum and Bitcoin gave it a new lease on life, with Solana, Polygon, and BNB Chain following closely behind.

Finally, Shiba Inu’s (SHIB) price increased by more than 6% to $0.000031 as the network recorded more than 7,600 new wallet addresses. This indicates a significant influx of new users.

However, although Shiba Inu’s network experienced immense growth, its transaction volume reveals mixed sentiment. Thus, if transaction volumes continue to reduce alongside network growth, SHIB might have to work harder to maintain its recent bullish momentum.

Zypto is committed to offering you the best and most secure crypto services. Our services are tailored to your needs, and we provide a smooth and fast onboarding process to get you started in the crypto space.

Zypto has partnered with MoneyGram to launch an upcoming, historic USDC-to-Cash and Cash-to-USDC global service. You can soon cash in or out of your Zypto App in USDC at participating MoneyGram locations. Keep your eyes on Zypto.com for upcoming announcements and find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What does Ethereum’s Open Interest (OI) record high mean

This means more traders are taking positions in futures or options contracts, and extra funds are probably entering the market.

Is an altcoin season on the horizon?

While there has been a massive surge in the altcoin market cap, we entered the altcoin Season Index when altcoins crossed the 70 thresholds on the Altcoin Season Index.

What does Ethereum ETFs surpassing Bitcoin ETFs mean?

Ethereum ETFs flipped Bitcoin ETFs with $332M to $320M, respectively. Thus, this positions Ethereum as a leading asset in the crypto ecosystem.

How did NFT sales reach a 6-month high of $562M?

This is due to top performances from high-profile NFT collections like CryptoPunks and Pudgy Penguins, alongside a bullish sentiment in the crypto market.

How did Shiba Inu increase its network growth?

Shiba Inu’s (SHIB) price surged by more than 6% to $0.000031, and its network recorded over 7,600 new wallet addresses—proof of a major influx of new users.

0 Comments