In the final week of 2024, we analyzed how 2025 could look for Solana and TRON. Ethereum stablecoins’ hit a new high, Dogecoin whales purchased 90 million DOGE tokens, and FTX confirmed the repayment date of customers’ funds.

Let’s dive in.

Ethereum stablecoins’ market cap hit a new high

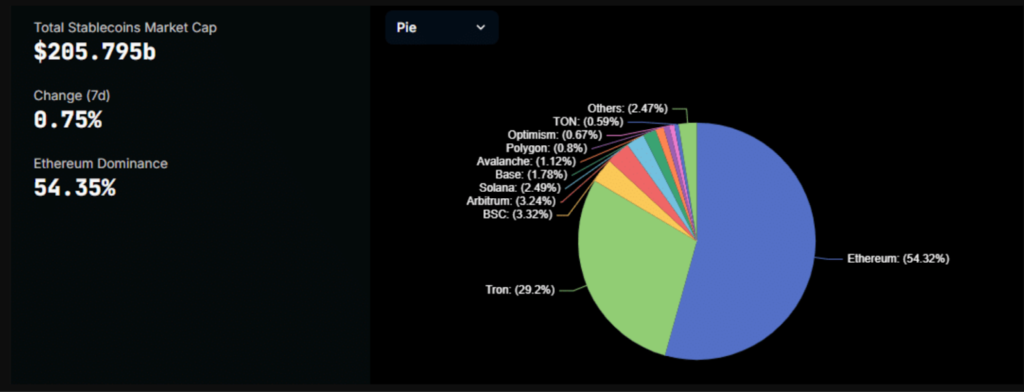

Crypto is in a good space as the global stablecoin market cap has hit a new all-time high (ATH). Ethereum has enjoyed the lion’s share of said growth, so the network’s stablecoin also hit a new ATH.

The total stablecoin market cap hit $205.79 billion, with Ethereum amounting to $117.39 billion. This formed an equivalent of 54.32% of the total market cap of the stablecoin value.

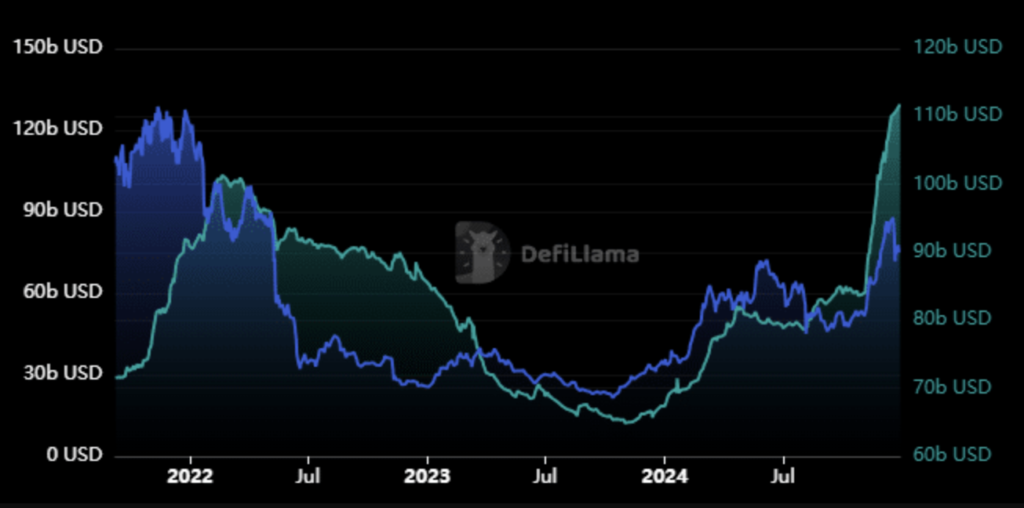

Ethereum’s stablecoin market cap has gained a new ATH due to significant inflows over the past two months. While this performance has helped increase its stablecoin dominance, it also emphasizes its improved liquidity. Typically, this should mean improved investor sentiment and network growth.

Yet, Ethereum’s total value locked (TVL) hasn’t had the requisite improvement.

Can Ethereum maintain its growth?

While Ethereum’s stablecoin market cap is favorable, its TVL has been diminishing. This is mainly due to Ether’s price instability (ETH). Still, a recent IRS update could have worsened this trend.

According to the U.S. Revenue Authority IRS, tax on staking rewards will depend on unrealized gains. The possible effect is that this could dissuade investors from staking their cryptocurrencies. Undoubtedly, this could initiate TVL outflows.

A lawsuit challenging the IRS’s stance on the issue has already been filed. Prospects of TVL outflows were not the only concern arising from these regulatory hindrances. Within the past 24 hours, USDT-related FUD has increased due to fears of USDT being possibly delisted in the U.K. because of non-compliance.

This development could initiate immense USDT outflows, primarily due to the UK’s standing as one of the largest global markets. In the meantime, USDT is the most dominant stablecoin on the Ethereum network at 64.3%.

USDT delisting on European exchanges could tremendously impact Ethereum’s stablecoin growth. Yet, the possible effect on ETH remains unknown, probably because stablecoin outflows will reduce organic activity and because stablecoin holders could potentially use ETH as a safety net.

The current stablecoin concerns in the UK are likely only short-term headwinds. Regulatory clarity should improve things and set the market up for long-term recovery.

4 reasons why Ethereum has struggled

Ethereum has struggled to persist with an upward trend over the last two weeks. During this time, ETH has traded within a consolidation range of between $3300 and $3500.

This has left important stakeholders questioning what could push ETH towards recovery. Analyst Burak Kesmeci, in this analysis, cites four essential Futures market metrics and their implications for Ethereum’s trajectory.

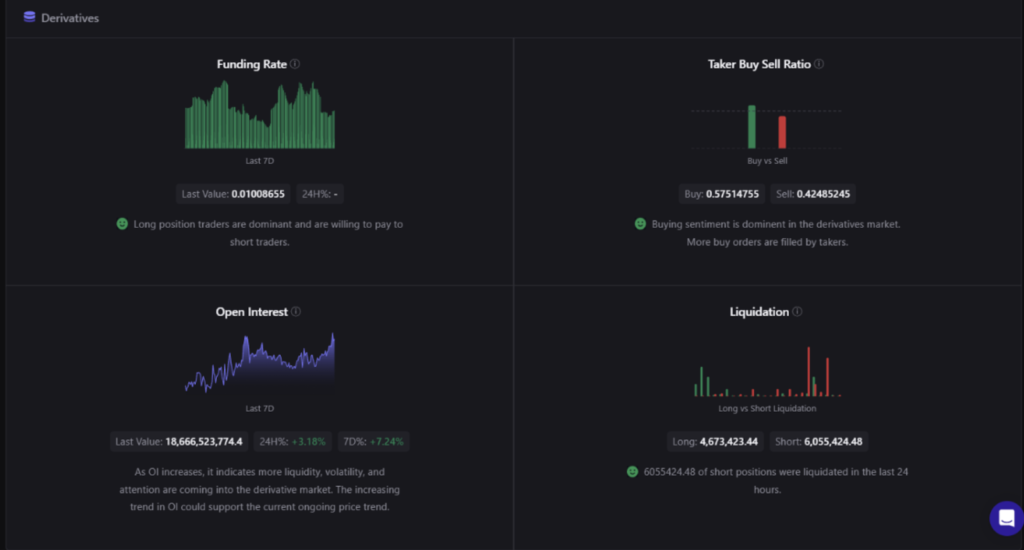

These metrics include Funding Rate, Taker Buy-Sell Ratio, Open Interest, and liquidation.

- At press time, Ethereum’s Funding Rate was 0.01, which implied that the market was healthy, with longs able to support ETH’s spot market.

- Ethereum’s Taker Buy-Sell ratio was 0.57, suggesting buying sentiment dominated the derivatives market. Typically, when buyers are active, this causes higher buying pressure, vital for higher prices through demand.

- Ethereum’s Open Interest has increased by 3.18% in 24 hours, indicating a slight heating up in the derivatives, although for a short term.

- Ethereum’s liquidation showed that many short positions were actively liquidated, totalling $6 million from the previous day until press time. This diminishes selling pressure in derivatives markets, thus negating the impact of rising Open Interest.

To that end, selling pressure in the ETH Futures markets has reduced. Although Open Interest may show that the market is heating up, the bulls have entered and seem to be stepping up.

What is Solana’s outlook in 2025?

Between 2023 and 2024, Solana (SOL) bounced back in style, surging from $8 to a high of $264. Still, analysts have an ambivalent projection for the altcoin in 2025.

Mert Mumtaz of Solana-based dev platform Helius opines that the new validator client Firedancer and ETF approval could be significant catalysts. Under the best conditions, the Firedancer client can process 1 million transactions per second (tps).

Also, it will increase network reliability by having another validator client in case one develops issues. Since December 25, the market has become bullish on SOL ETF approval by 2025, as shown in Polymarket odds increasing from 58% to 71%.

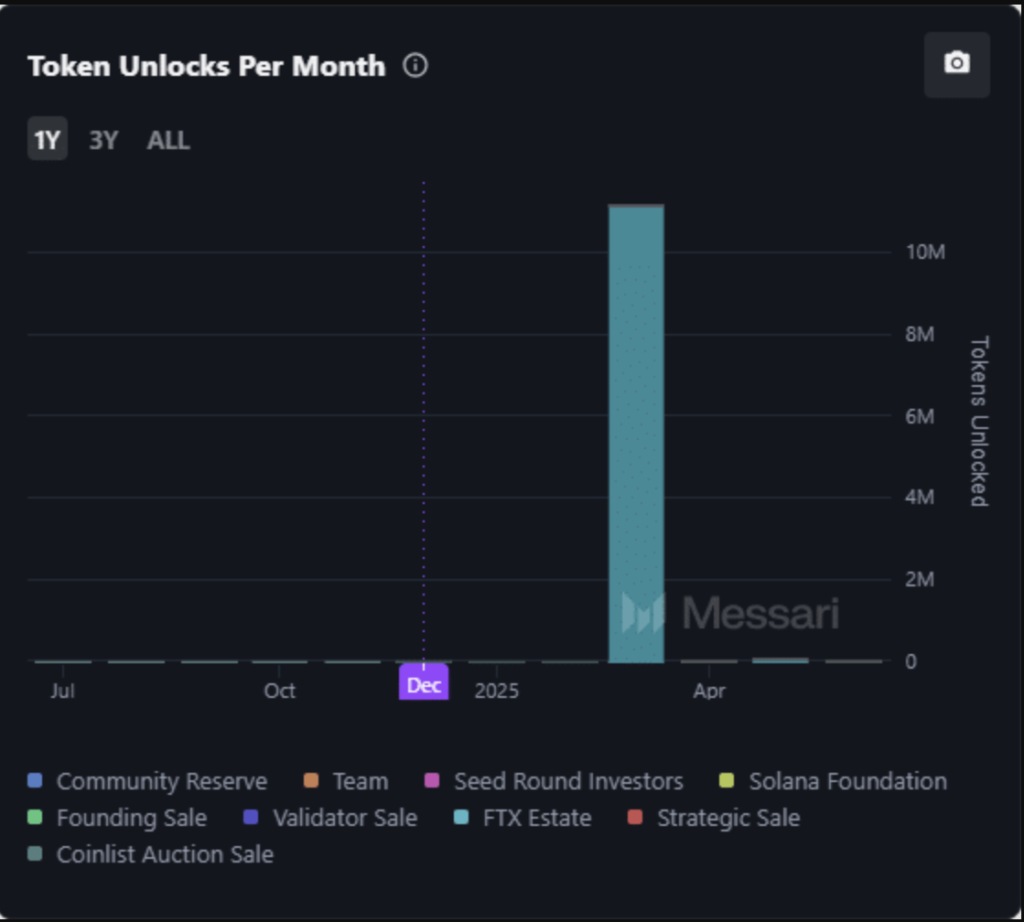

That being said, the ETF prospect and Firedancer could increase SOL’s value. Yet, an over $2B token unlock in March 2025 should also be considered.

A $2B SOL unlock

As one of the primary backers of the Solana chain, FTX’s bankruptcy was one of the major reasons why SOL crashed to $8. Galaxy Digital and other investors then bagged the defunct FTX estate SOL holdings at a discount.

The above data revealed that 11.2 million SOL tokens, worth over $2B, will be unlocked in 2025. This act could lead to market-sell pressure. Moreover, SOL underperformed ETH in December, a trend some analysts envisioned could continue into Q1 2025.

One analyst noted that ETH could offer better gains than SOL, mentioning the weakening SOL/ETH ratio, which follows SOL’s relative price performance against ETH.

He said,

“Solana is superb, there’s no denying, but the risk to reward just isn’t there in 2025 compared to ETH.”

That being said, SOL’s 2025 outlook looks at a crossroads, with essential bullish catalysts and headwinds.

In the meantime, there are some other positive updates in the Solana ecosystem.

Solana leads weekly stablecoin growth

Solana was the highest blockchain regarding stablecoin (mostly USDT and USDC) growth in the past week. The network added nearly $424.87 million in the last week of 2024, which made it the top gainer.

This recent milestone emphasized Solana’s exceptional growth in 2024. Its stablecoin market cap was $1.83 billion at the beginning of the year. By the end of the year, it had increased beyond $5 billion, its highest level in 2024.

Furthermore, Solana was among the best-performing blockchains in 2024 in terms of user growth, transactions, and stablecoin count. These factors have been vital to boosting liquidity as demand grows.

This development comes amid the recent increase in the global stablecoin market cap, which is above $200 million for the first time. Solana’s performance aligned with its TVL (total value locked), indicating more liquidity and accessibility in the Web3 space.

This could indicate that Solana has reason to be optimistic ahead of 2025, mainly because it has enjoyed more liquidity and positive investor sentiment as the year ends.

TRON’s price outlook for 2025

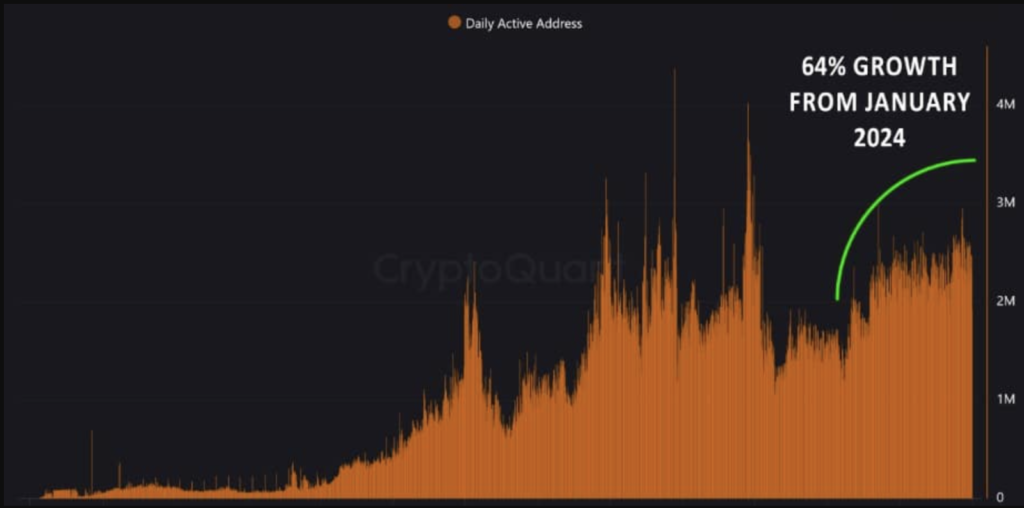

In 2024, TRON grew exponentially as the network’s active addresses surged by 64%. Likewise, its token TRX increased by 328.75%, from a low of $0.105 to an all-time high (ATH) of $0.450.

Like its address growth, TRON has also enjoyed a thriving DeFi and NFT ecosystem. TRON’s scalability and efficiency have increased its popularity and adoption among DApps.

Consequently, these factors set TRON apart as a major contender in the blockchain ecosystem. This bodes well for stakeholders, investors, and network users in the future.

Is there an impact on TRX?

Typically, sustained growth in network adoption positively impacts a token’s price. This trend has been seen throughout the year, as the price has usually mirrored network growth.

Still, in the short term, TRX has labored to keep pace. Since the November rally, led by the U.S. Presidential elections, TRX has been unable to reclaim higher resistance levels on the charts. Unsurprisingly, bearish sentiments have endured as investors became intolerant of the protracted consolidation.

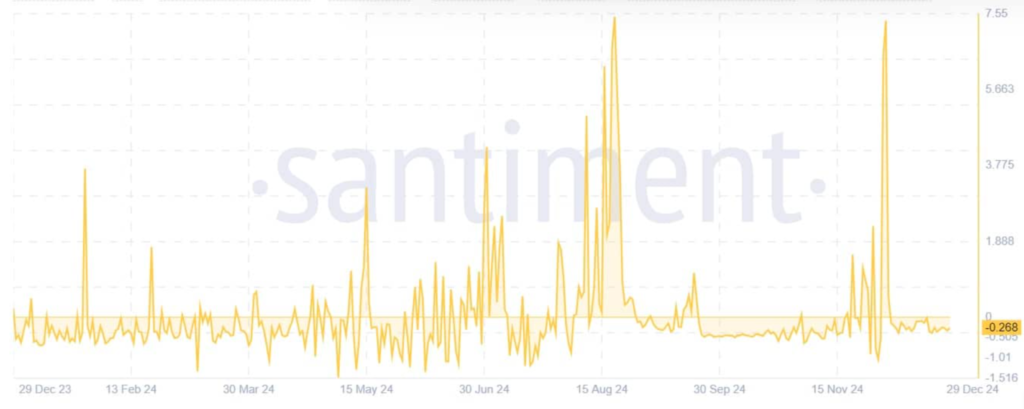

TRON’s weighted sentiment remained negative over the previous week. According to Santiment, investor sentiment has remained negative since early December, when the altcoin began to drop and later consolidated.

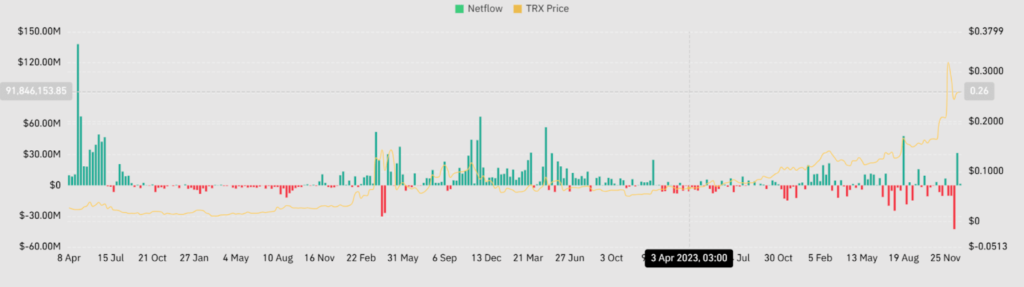

Furthermore, TRX netflows have turned positive on the weekly charts for two consecutive periods – a sign of increased exchange inflows. Usually, when inflows outweigh outflows, it indicates that the altcoin is facing increased selling pressure.

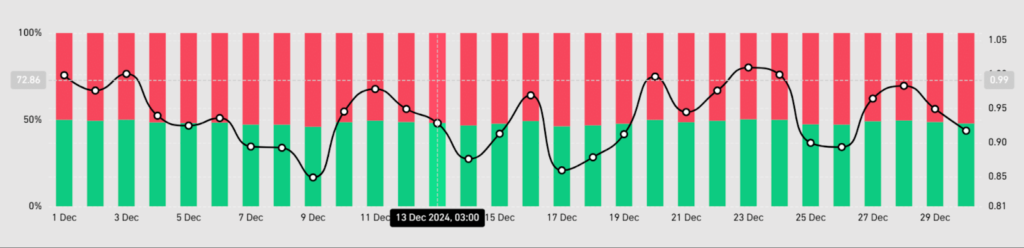

Moreover, this bearishness seemed even more robust in the short term. Most traders have taken short positions according to the long/short ratio. And with shorts dominating the market, it indicated that most investors expect the price to reduce.

However, TRX has struggled to gain more in the short term. To recover through 2025, the altcoin must break out from the consolidation range and reclaim $0.3. Yet, if market bears keep holding the market, TRX risks dropping below $0.2.

Overall, 2024 has been a remarkable year for the TRON ecosystem. Prices have increased, and so have the active addresses. Ahead of 2025, stakeholders, investors, and participants in the TRON community have high hopes.

FTX affirms the January repayment date

FTX, the crypto exchange that went bankrupt in 2022, has affirmed that it will begin repaying customers’ funds on January 3. Fellow exchanges Bitgo and Kraken will also help with the disbursed funds.

For context, the bankruptcy process started in 2022 after FTX’s liquidity crisis revealed financial misconduct by founder Sam Bankman-Fried (SBF) and major executives. SBF was convicted for 25 years, while the other officials got lesser sentences for cooperating with the prosecution.

The reimbursement could be completed in 60 days or less, and most could be finished by Q1 2025. About $16B is reportedly said to have been disbursed. Still, based on its reorganization plan, the first phase of the repayment will cover the ‘Convenience Class’ for those with $50K claims or less.

Part of the FTX statement noted,

“The Initial Distribution is limited to the Plan’s Convenience Classes. Separate record and payment dates for other classes of claims will be announced in due course.”

What is the next step?

After FTX’s announcement, some stakeholders gave their opinions.

John Ray III, the CEO of FTX Debtors, mentioned that their January timeline showed how successful their recovery efforts were. He said,

“We are well positioned to begin executing the distribution of recoveries back to all customers and creditors. We encourage customers to complete the necessary steps to begin receiving distributions in a timely manner.”

People eligible for refunds must file tax reforms and finish credential verification. Then, users will be onboarded for settlement through BitGo or Kraken via USD or stablecoins.

Simon Dedic of Moonrock Capital suggested that capital be funnelled into the markets.

“What do you think will happen to alts when a bunch of degens suddenly get billions of dollars in the middle of a bull?”

The native token FTT surged 10% on Sunday after increased market interest ahead of the repayments. However, at the time of this writing, the altcoin had retraced part of the weekend profits.

Dogecoin whales acquire over 90 million DOGE

Dogecoin whales have purchased over 90 million DOGE within the past 48 hours. This development has caught the attention of many in the crypto ecosystem and is proof of confidence among investors amid a major price breakout.

At press time, DOGE traded at $0.3155 after a minimal 0.19% dip over the past 24 hours. Yet, the main question remains whether this momentum can lead to the next bullish phase or further consolidation.

How is DOGE faring?

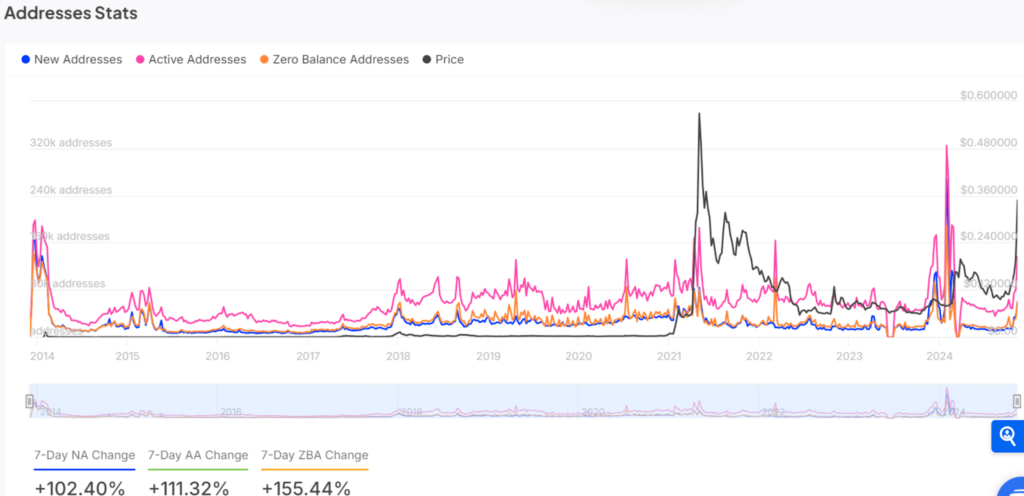

Dogecoin’s address statistics revealed a promising trend in network activity. The previous week has witnessed a 102.4% spike in new addresses, while active addresses have risen by 111.32%.

These indicate a surge in user engagement and price growth. Moreover, zero-balance addresses have increased by 155.44%, signifying an inflow of new participants testing the ecosystem.

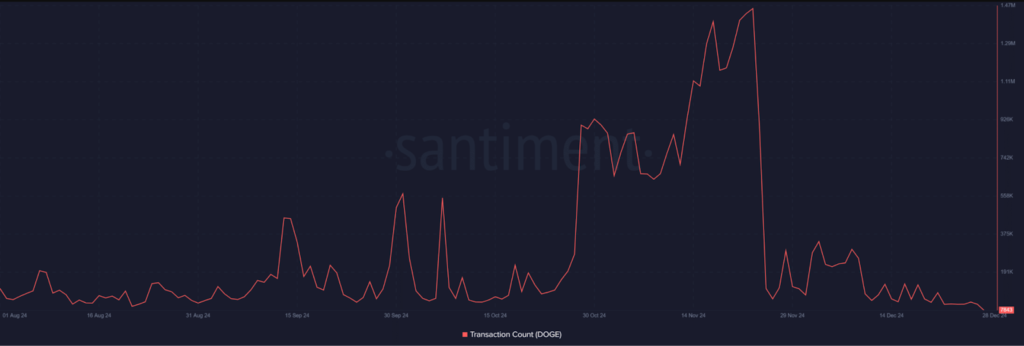

Even with the expanding whale interest, Dogecoin’s transaction count reduced significantly, with only 7,843 transactions documented at press time. This drop emphasized muted on-chain activity, which could be a headwind against bullish momentum.

Nevertheless, such quiet timeframes have usually preceded sharp price moves, which makes this worth observing.

The liquidation figures showed a nuanced perspective: $257,420 in short positions were liquidated, compared to $133,630 in longs.

This inequality implied that short sellers were beginning to lose control, probably paving the way for a bullish reversal. Still, this shift must maintain buying interest to change the narrative completely.

By and large, Dogecoin’s whale accumulation and rising address activity outline its potential for a breakout. Yet, the current market remains uncertain, with low transaction counts and mixed technical signals.

Closing Remark

For Solana and TRON, ending 2024 in a comfortable position provides a favorable launch pad for exploits next year. Ethereum ends the year with a dominant stablecoin market cap performance, which points to optimistic investor sentiment and network growth.

Two years after its controversial bankruptcy due to financial mismanagement by its top executives, FTX has confirmed its plans to begin repaying customers’ funds. This could go a long way in repairing the exchange’s reputation.

Finally, Dogecoin whales have acquired a massive 90 million DOGE, strengthening investors’ confidence amid a significant price breakout.

Yet, it remains uncertain if this momentum can lead to the next bullish phase or further consolidation.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What level did the global stablecoin market cap grow to?

The total stablecoin market cap hit $205.79 billion.

How high did Ethereum’s stablecoin market cap get?

Ethereum’s stablecoin market cap grew to $117.39 billion. This formed an equivalent of 54.32% of the total market cap of the global stablecoin value.

What is Solana’s outlook for 2025?

According to some analysts, Solana has room for improvement in 2025, mainly because it has enjoyed more liquidity and positive investor sentiment as 2024 ends.

What is TRON’s outlook for 2025?

Having enjoyed price surges and increased active addresses, stakeholders, investors, and members of the TRON community have high hopes ahead of 2025.

What does Dogecoin’s whale acquisition mean?

Dogecoin’s whale accumulation and rising address activity outline its potential for a breakout. Yet, cautious optimism prevails.

0 Comments