This week’s news covers blockchain gaming, real-world assets, stablecoins, and the regulatory sentiments surrounding them. Then, we also examine the top five U.S. economic indicators for the crypto economy.

Let’s dive in.

Circle debuts new stablecoin-based network

Circle, the company behind the USDC stablecoin, has unveiled a platform designed to modernize global cross-border payments: the Circle Payments Network (CPN).

The CPN aims to enable banks and financial institutions to send money instantly, 24/7, using fully reserved digital dollars (USDC) and Euros (EURC). It is designed to support invoice payments, remittances, treasury services, payroll, and contractor payouts.

Over 20 design partners are already participating, including dLocal, WorldRemit, and Yellow Card, indicating a focus on institutions operating in emerging markets and high-volume remittance corridors.

Circle said in a post on social media,

“We are not just building stablecoins. We are building a modern infrastructure for global payments.”

The initiative targets the aging infrastructure of global finance, as international transactions are often slow, expensive, and hindered by legacy systems.

In addition, USD stablecoins have a combined market cap of over $230 billion, with USDT dominating at $144 billion and USDC at around $60 billion. So, the CPN represents a strategic expansion of Circle’s role from a stablecoin issuer to a provider of the infrastructure that moves assets at scale.

Also, Circle looks to deepen its foothold in the traditional finance world as it plans to seek U.S. licenses under the Trump administration.

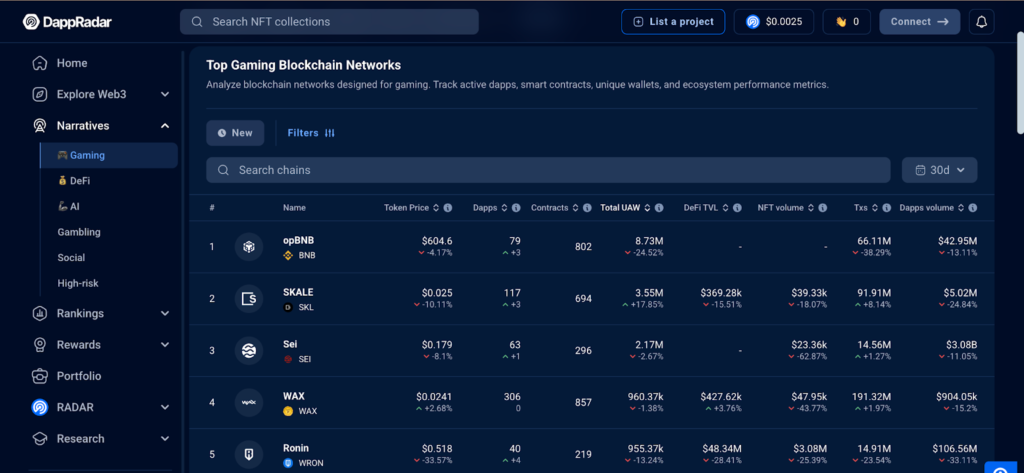

BNB Chain leads blockchain gaming

In recent years, the number of monthly Web3 games has increased exponentially. Over 1,400 games were played in March 2025, a 40% increase from the peak in volume and transactions in December 2021.

Although Axie Infinity was the industry’s breakout star, it has given way to a new leader in the GameFi space: BNB Chain. BNB Chain led this month with 245 games, with Polygon and Ethereum following behind.

Despite the high number of games, there is a significant decrease in yearly transactions and growth rate. While they declined in 2022 and 2023, they rebounded slightly in 2024, which is a positive sign for the future trend.

Over the past 30 days, BNB has generated a total of nearly 9 million unique wallet interactions (UWIs). It is also second in the number of smart contracts and third in the number of transactions.

The three biggest games on the BNB Chain are World of Dypians, SERAPH, and Egg Drop, based on the number of users and transactions. Still, all three games are present in multiple chains, which makes Karat Galaxy the biggest game exclusive to BNB.

Overall, the number of games has increased since 2021, with BNB Chain being the most prominent chain in various metrics. Yet, the sharp decline in GameFi token prices means that transaction value and volume are below their 2021 peak.

Similarly, some critics believe that BNB Chain’s lack of a flagship offering, like Axie Infinity, may diminish its ability to stand out. At the same time, others opine that its dominance in the essential metrics is enough.

Arbitrum to process $7B Real-World Assets (RWAs)

The Ethereum Layer 2 network, Arbitrum, has launched a new project called “Converge.” It is a blockchain for processing tokenized real-world assets (RWAs) and on-chain finance.

Ethena Labs and Securitize created Converge, aiming to bring billions of dollars’ worth of stable assets into the decentralized finance (DeFi) space.

For one, the latter and former are migrating over $7 billion in assets to Converge. Secondly, Ethena Labs is doing $5 billion in general stable synthetic dollar (USDe) transfers, while Securitize is doing $2 billion in tokenized exchanges.

In addition, Converge aims to transform blockchain speed, fees, and flexibility for next-gen DeFi and RWA growth. It settles transactions on Celestia (Layer 2 blockchain) and transfers stablecoins and NFTs across Layer 1.

Thus, instead of a native token like ETH exhibiting high volatility, Converge uses two stablecoins—USDe and USDtb—as the gas tokens. It helps keep transaction costs predictable and cheap, a huge win for businesses and users moving real assets.

How?

Block times will be 100 milliseconds at launch, but there are efforts to upgrade them to 50 milliseconds. Validators stake sENA, a staked version of Ethena’s token, to handle security, and developers building on Converge will have access to more tools.

In addition, the future Stylus upgrade will enable them to write smart contracts in various programming languages, including Solidity, Rust, C, and C++. Thus, making development significantly more scalable and flexible than in many existing blockchains.

Related: Learn About Real-World Asset (RWA) Tokenization

Arbitrum makes onward strides in the Layer 2 space

Converge launches as other Ethereum Layer 2 networks continue to explode with fierce competition. Now, the new network aims to attract many more app chains and DeFi protocols in the next few months.

Analysts also expect demand for ARB to increase gradually as the RWA market grows and more dApps join Converge. The Ethereum Pectra upgrade is also expected to launch on the mainnet before May 7.

New upgrades to Ethereum are expected to bolster not only ETH but also Layer 2 solutions, such as Arbitrum.

Related: Web3 and Blockchain: Layer 1 & Layer 2 Scaling Solutions

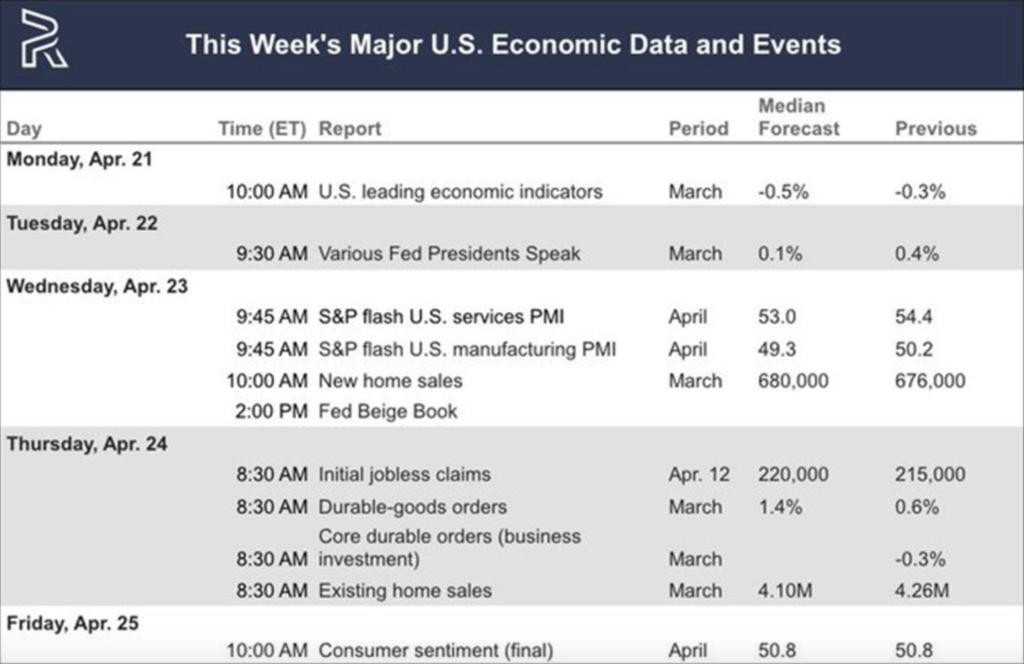

5 US Economic indicators this week

Several US economic indicators are scheduled for release this week, with possible implications for the crypto industry. The data has broadly influenced sentiment in the crypto market over the past several months.

To that end, traders and investors must adjust their portfolios and align their trading strategies to capitalize on vital economic events. The following indicators are bound to be relevant this week:

US Leading Economic Indicators

The first U.S. economic indicator is scheduled for Monday. The Conference Board’s Leading Economic Index (LEI) last reported a reading for February 2025, down 0.3% month-over-month (MoM) after a revised 0.1% increase in December 2024.

However, the six-month growth rate is improving, with stabilizing trends offering some optimism. For Bitcoin, a declining LEI may reduce risk appetite, prompting investors to shift toward safer assets, such as Bonds.

Services PMI

The S&P Global US Services PMI for March 2025 jumped to 54.4 from 51.0 in February, indicating expansion in the services sector. This rise, paired with a composite PMI of 53.5, reflects resilient consumer demand.

This strength supports the US dollar, reducing expectations for Federal Reserve (Fed) rate cuts, which could challenge Bitcoin’s appeal. A stronger dollar and higher yields typically weigh on Bitcoin, as seen in previous cycles.

For the April Services PMI, the median forecast is 53.0. Strong services activity may support broader risk-on sentiment, lifting bitcoin if equity markets rally, given its infrequent correlation with indices like the Nasdaq.

Manufacturing PMI

The S&P Global US Manufacturing PMI for March 2025 dropped to 50.2 from 52.7. Likewise, the ISM Manufacturing PMI reduced to 49.0 from 50.3. This weakness is due to high interest rates, weak global demand, and uncertainty related to tariffs.

Further data outline manufacturing’s struggles, warning of broader slowdown risks, mostly with trade policy volatility under the Trump administration. For Bitcoin, this signals a reduced risk appetite and may exert downward pressure due to its correlation with the equity market.

While a sharp manufacturing decline could provoke rate-cut expectations, persistent inflation and tariff-driven cost pressures make this unlikely.

Initial Jobless Claims

Initial Jobless Claims over the weekend recorded 215,000, down from 223,000 about seven days ago. It indicates a slight improvement but still reflects a labor market under pressure, suggesting ongoing challenges.

They include high interest rates, cautious business investment, and uncertainties surrounding tariff policies. All of these reduce employer confidence, which can lead to economic pressures.

Analysts note that lower claims could reduce concerns about inflation, policy uncertainties, and rapid deterioration. The modest drop in claims may signal economic weakness. If claims continue to decrease, Bitcoin could benefit from increased liquidity.

Customer Sentiment

Consumer sentiment was 50.8 in March 2025, which was a modest drop from February’s reading. This reflected tariff-related pessimism and concerns about inflation, despite solid economic conditions.

Typically, consumer sentiment is a measure of retail investor confidence, vital for Bitcoin’s retail-driven market. Lower sentiment could drain the zeal for speculative assets, pushing BTC lower, especially if risk-off sentiment dominates.

Contrarily, if sentiment stabilizes or tariff fears ease, Bitcoin could ride a risk-on wave. The possible effect is bearish, as declining confidence aligns with broader economic caution.

Coinbase launches XRP Futures Contracts

Coinbase, the biggest US-based crypto exchange, obtained regulatory approval from the CFTC (Commodity Futures Trading Commission) to launch XRP futures contracts through its derivatives arm.

This development marks a key moment for institutional access to XRP altcoin, amid a broader shakeup in the derivatives market. Earlier in the month, Coinbase announced its intention to bring regulated XRP futures to market, indicating that it had filed for the offering with the CFTC.

The announcement read on social media,

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures – bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets.”

This approval suggests an endorsement by the CFTC, opening the door to broader crypto derivatives activity in the US. It is unsurprising, given that the agency recently pivoted toward easing entry into the crypto derivatives sector by removing regulatory hurdles that had previously deterred traditional and crypto-native firms.

The CFTC explained,

“As stated in today’s withdrawal letter, DCR (Division of Clearing and Risk) determined to withdraw the advisory to ensure that it does not suggest that its regulatory treatment of digital asset derivatives will vary from its treatment of other products.”

The changes simplify registration requirements and lower operational barriers for launching crypto derivatives products.

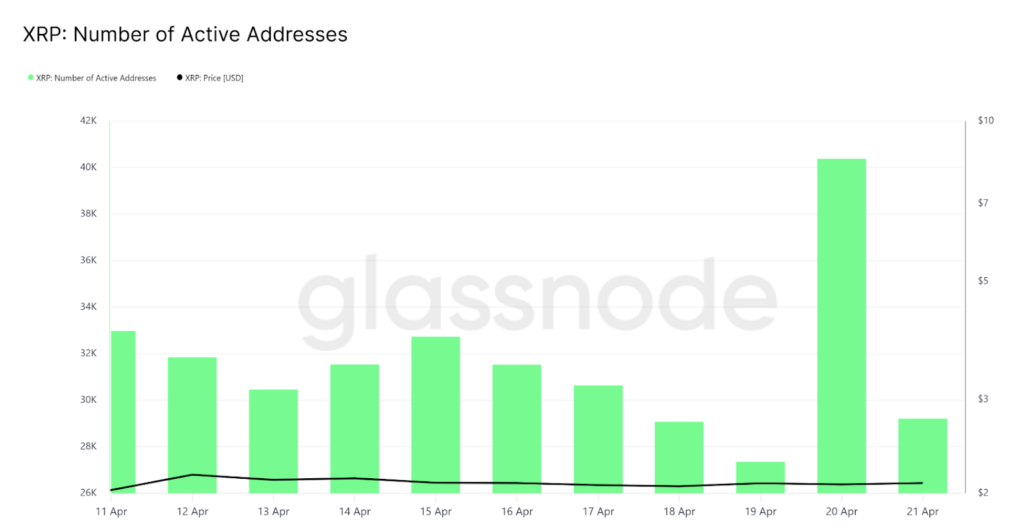

What impact has this had on XRP?

XRP Network Activity Soars 67.5%

With XRP historically maintaining high liquidity and a global user base, it represents a strong candidate for derivatives trading, especially in a newly liberalized environment.

Unlike more volatile mid-cap tokens, XRP benefits from a combination of legal clarity following the Ripple lawsuit outcome, broad exchange availability, and a sizable market cap.

These elements make it attractive to institutional traders seeking capital-efficient exposure. Recent on-chain data reveals a sharp uptick in network activity, further supporting the case for XRP futures.

Data shows XRP active addresses surged by 67.5% between April 19 and 20, ahead of Coinbase Derivatives’ XRP futures debut, spiking to 40,366 from 27,352. This suggests growing engagement from retail and institutional participants, probably in anticipation of expanded market access through derivatives.

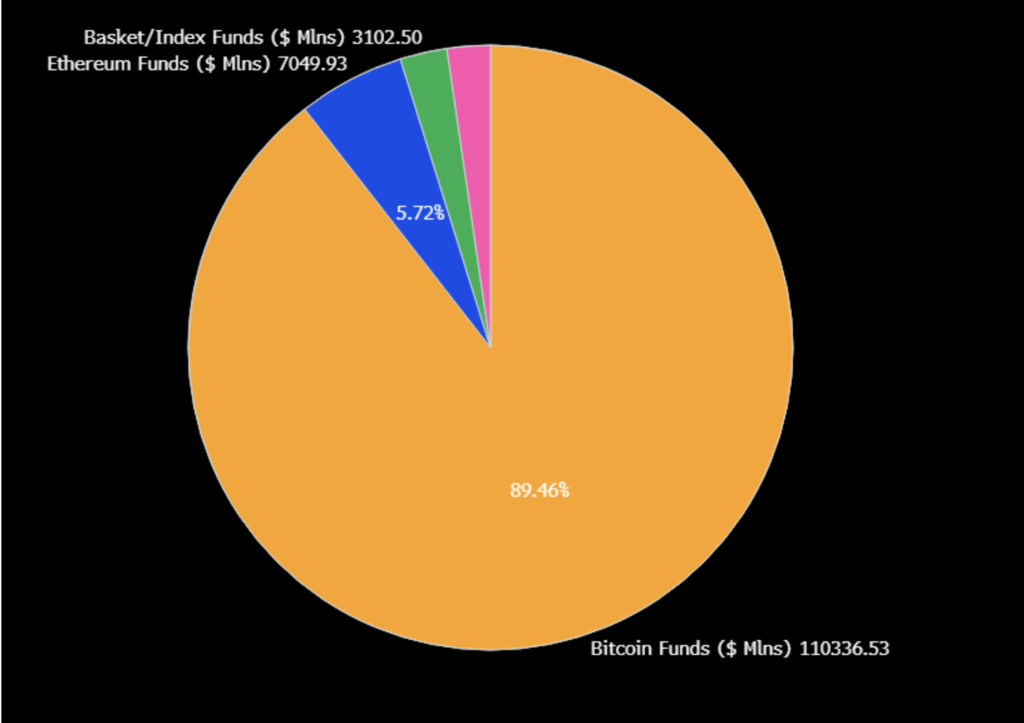

72 crypto ETFs are up for approval

With the SEC showing its willingness to approve new altcoin ETFs, 72 active proposals are in the works. Despite growing interest from asset managers in launching more altcoin-based products in the institutional market, Bitcoin ETFs currently command 90% of crypto fund assets worldwide.

New listings can attract inflows and liquidity in these tokens, as demonstrated by Ethereum’s approval of ETF options. Still, given the current market interest, it’s doubtful that any crypto found will replicate BTC’s massive success in the ETF market.

How so?

Bitcoin ETFs changed the global digital assets market over the past month. In the US, total net assets have reached $94.5 billion, despite continuous outflows in the past few months.

Bitcoin has a sizable head start with a dominant 90% market share. For context, BlackRock’s Bitcoin ETF was declared “the greatest launch in ETF history.” Any new altcoin product would need to offer a significant value-add to challenge Bitcoin’s position, which remains unchanged for now.

Their impressive early success opened a new market for crypto-related assets, with issuers flooding the SEC with new applications since. Now, many ETF issuers aim to seize this opportunity to create a product as successful as BTC.

ETF analyst Eric Balchunas also confirmed this via a social media post, where he name dropped SOL, LTC, and DOGE as coins awaiting approval. Other analysts claim that other products couldn’t displace more than 5-10% of Bitcoin’s ETF market dominance.

Still, that doesn’t mean that the altcoins ETFs are a fruitless endeavor. These products have consistently generated new inflows and interest in their underlying assets.

While XRP and SOL ETF approvals could drive new bullish cycles for the altcoin market, BTC is likely to dominate the ETF market by a large margin due to its widespread recognition as a “store of value.”

Closing remark

BNB Chain has become the most prominent blockchain gaming network in various metrics. Arbitrum’s Converge aims to revolutionize the processing of tokenized real-world assets (RWAs) via its innovative features.

Coinbase’s approval by the CFTC opens the door to broader crypto derivatives activity in the US. It also led to increased engagement from retail and institutional participants for Ripple (XRP).

The 72 crypto ETFs waiting for approval is a good sign as it shows the SEC is open to attracting inflows and liquidity. With CPN, Circle plots to position itself as a foundational layer in the global financial stack.

Zypto Launches $10K High Limit Crypto Card

Zypto is proud to introduce its new Mastercard Global Virtual Card – a powerful, flexible tool for every day spending and cross-border crypto users.

This high limit crypto card offers a generous $10,000 single-load limit, giving you the freedom to spend big wherever Mastercard is accepted. Connect it to your crypto wallet and choose from over 100 cryptocurrency options, add it to Google Pay or Apple Pay and, enjoy.

There’s so much to unpack this week. So, what’s your favorite news, question, or thought? Feel free to share in the comments section.

FAQs

How does BNB Chain lead blockchain gaming?

Over the past month, BNB Chain led in multiple key metrics, including the number of games, unique wallet interactions (UWIs), smart contracts, and transactions.

How does Arbitrum plan to process $7B worth of Real-World Assets?

Arbitrum launched Converge, which processes tokenized real-world assets (RWAs) with amazing features like blockchain speed, fees, and flexibility.

What are the top 5 US economic indicators this week?

They include Leading economic indicators, Services PMI, Manufacturing PMI, Initial Jobless Claims, and Customer Sentiment.

Who approved Coinbase’s launch of XRP Futures contracts?

Coinbase obtained regulatory approval from the CFTC (Commodity Futures Trading Commission) to launch XRP futures contracts through its derivatives arm.

How many crypto ETFs are awaiting approval from the SEC?

About 72 active proposals are in progress, awaiting approval from the SEC.

Zypto keeps deliver their best efforts in every blog. This blog posts are clear and packed with great information. I actually learned something new today. Appreciate the research behind it

Zypto analysis of yesterday’s market volatility actually helped me a lot to make a smart decision with my portfolio.

The way they explain technical concepts helps me easy to understand

Really liked how this one was written. Clear points, helpful context, and deatil analysis. Everything is simply clarify. That’s why I follow them.

ZYPTO consistently delivers the most relevant crypto updates. This kind of quality content helps the entire crypto users.

I have learned more from ZYPTO blogs than most other places. I also believe their information because they are delivering it solidly.

everything is clear and well-organized. Easy to read, easy to understand.

big news about MasterCard with $10k at a time deposit.