This week, there’s so much to unpack.

Sonic blockchain hit $1 billion TVL in just 66 days, Tether minted $1 billion USDT on Tron blockchain, and Chainlink integrated the Pi Network into its Data Streams ecosystem.

For the first time, a UK-based school has decided to start accepting BTC payments in the UK; Roundhill Investment are to launch a Robot-themed ETF, while three top airdrops are set to launch in April.

Let’s dive in.

Sonic blockchain hits $1 billion TVL

The crypto market in 2025 has faced significant turbulence. The market capitalization of trending meme coins has dropped, driving DeFi’s total value locked (TVL) down from $120 billion to around $87 billion.

Sonic has bucked the trend, consistently hitting new TVL highs.

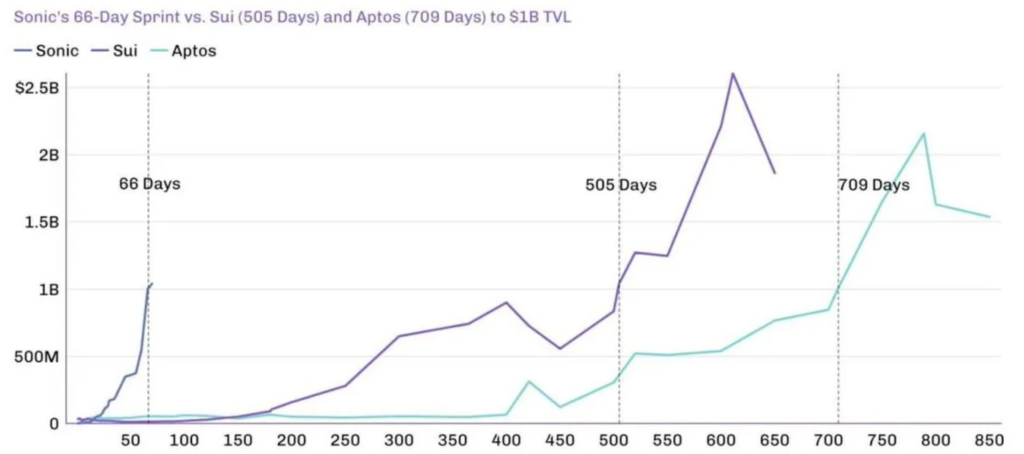

It reached $1 billion in April after growing almost 40 times since the beginning of the year. Its TVL increased to $1 billion in just 66 days despite a bearish DeFi market, surpassing rivals like Sui and Aptos, who took 505 and 709 days, respectively.

So, what makes Sonic a bright spot amid a rough market?

The platform’s speed and developer-first fee model attract projects and capital amid widespread crypto pullbacks. Derivative exchanges like Aark Digital and Shadow Exchange and protocols like Snake Finance, Equalizer0x and Beets can entice new users, advancing Sonic’s momentum.

In addition, Sonic processes up to 400,000 transactions per second, unlike other blockchains, which are limited by long block times. It also focuses on improving user and developer experience.

Thus, this achievement indicates strong capital inflows into the Sonic ecosystem despite the broader DeFi trend of capital withdrawal. Even with all these, Sonic is not immune to risk.

For one, market volatility affected its token value, which declined by 20% in the past month. Also, Grayscale recently removed Sonic from its April asset consideration list. Then, Sonic faces competition from other high-performance chains.

Ultimately, while Sonic holds an advantage in speed, long-term user adoption will hinge on whether its ecosystem can deliver real value, not just high TVL figures.

Tether mints $1B USDT on Tron chain

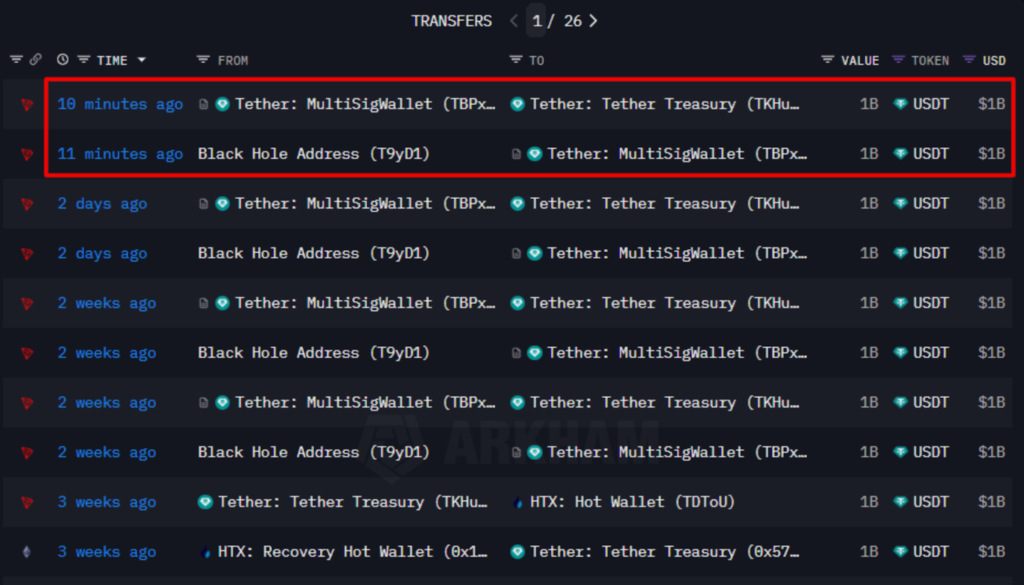

Tether, the world’s largest stablecoin user, has minted another $1 billion USDT on the Tron blockchain. The recent minting allegedly took place in several transfers.

In line with Arkham’s on-chain analytics, the $1B USDT transfer was initiated from a Black Hole address, “T9yD1,” to a Tether Multisigwallet. This was followed by another $1B transaction initiated from the respective MultiSigWallet to the Tether treasury.

This pushes Tether’s total USDT supply on Tron past $50 billion, with $9 billion already in 2025. It furthers Tether’s dominance within the stablecoin sector while indicating a strategic move towards increasing liquidity for traders and decentralized applications (dApps).

Thus, Tron’s blockchain fundamentals show bullish signals, supported by on-chain activity amid the market turbulence. According to real-time data from Tronscan, new TRX accounts surged, and the Total Value Locked (TVL) rose, while its daily transaction count increased, reaching a new number of all-time transactions.

This increase emphasizes rising user adoption and increased stablecoin activity as market volatility heightens. It also aligns with the prevalent narrative that investors begin to reallocate capital towards crypto risk assets.

To improve user accessibility, TRON introduced a “Gas Free” feature that allows users to pay transaction fees using USDT, eliminating the need for TRX. This innovation reduces the barrier to entry, primarily for new users entering decentralized finance (DeFi).

Moreover, TRON’s ability to attract retail and institutional use cases reinforces its place as one of the most dynamic and scalable ecosystems in the blockchain space.

Typically, new stablecoin issuance, mostly on Tron, precedes surges in TRX and other related tokens. Many newly minted USDT fuels cross-border transfers, OTC desk settlements, and DeFi lending, all of which incur TRX gas fees.

To that end, moments of intense market volatility with traders rotating in and out of stablecoins often lead to traction for TRX holder incentives, leading to continuous buy pressure.

This has also led Tron’s founder, Justin Sun, to predict positive things about the network boldly. He posted on social media that TRX, USD, and USDD are primed to hit new all-time highs in Q2.

Tether to support Bitcoin mining Pool Ocean

Tether has affirmed that it will direct resources to help the Bitcoin mining pool Ocean, pledging to “deploy both existing and future hash rate” to the pool.

Ocean is a Bitcoin mining pool led by Bitcoin Core developer Luke Dashjr and backed by Block boss and X (formerly Twitter) co-founder Jack Dorsey. Tether said it would do so to

“support the resilience, transparency, and decentralization of Bitcoin’s foundational infrastructure.”

Hashrate is the computational power used by the Bitcoin network. The higher a Bitcoin mining pool’s hash rate, the more efficiently it can find blocks and reap the immense rewards of newly mined Bitcoin and transaction fees.

In the past, the pool blocked non-financial Bitcoin transactions that Dashjr called “spam,” like those containing Ordinals inscriptions, i.e., NFTs on the Bitcoin blockchain.

Then, Ocean conceded and allowed pool participants to choose whether or not to block such transactions.

Typically, Bitcoin uses proof-of-work (PoW) consensus, where blockchain mandates miners to race to solve complex puzzles, with the quickest miners rewarded with digital tokens.

Tether mints USDT, the leading stablecoin and third-biggest crypto by market cap. In January, it is buying more digital coins and announced that its stablecoin would soon be available via Bitcoin and its layer-2 network, Lightning.

Tether provides the pool with processing power by deploying the hash rate on Ocean. Its CEO, Paolo Ardonio said,

“Deploying hash rate to Ocean aligns with both our mining investments and our broader mission to fortify Bitcoin against centralizing forces.”

Chainlink integrates the Pi Network

Chainlink, a leading decentralized oracle network, has integrated Pi Network into its Data Streams ecosystem, facilitating real-time pricing data access. This development marks a notable milestone for the network.

The announcement, shared via social media, highlighted the addition of Pi and 22 other assets, including GRASS, RUNE, JASMY, etc. It read,

“In just the past week, 22 new assets became supported by Chainlink Data Streams.”

For context’s sake, Chainlink Data Streams is a low-latency oracle solution that delivers real-time market data using a pull-based model. This approach combines off-chain aggregation with on-chain verification for scalable, fast, and reliable decentralized data access.

Popular analyst Jatin Gupta mentioned on X how this integration is advantageous for Pi’s multiple users in the DeFi space. Among them is access to reliable, real-time market data, enabling highly accurate Pi price feeds for dApps.

In addition, Gupta outlined vital benefits for the Pi ecosystem, including enhanced liquidity and seamless multi-chain compatibility. With this integration, Pi tokens can operate across prominent blockchains, be useful in several industries and position Pi Network as a trusted platform for latency-sensitive dApps.

In addition to the Chainlink integration, the Pi Network has made other essential advancements. These milestones mark a crucial turning point in its journey toward becoming a fully functional Web3 platform.

One is the introduction of a global on-ramp as a pivotal step toward mainstream adoption. Also, the launch of a monetized advertising ecosystem via the Pi browser has been announced.

Although some challenges remain, Chainlink’s integration provides Pi Network an essential opportunity to expand its utility and visibility. For Pioneers, this development strengthens the project’s long-term vision of creating a sustainable, people-driven digital economy.

Scottish school to accept BTC investments

History was made as a school in Scotland has affirmed it will be the first in the UK to start accepting Bitcoin payments. Lomond School in Helensburgh said the choice was made after many local and foreign parents made the request.

To “manage and mitigate risk,” the school said it would start accepting the most prominent cryptocurrency in phases and convert digital coins received into Pounds sterling.

Also, the school said it would ensure full compliance with the UK financial regulations when accepting BTC. It further mentioned it would consider building a crypto reserve if its use case grows in the UK.

The school reportedly noted,

“Assuming Bitcoin gains broader acceptance in the UK and worldwide, the school will look to build a Bitcoin asset reserve.”

Now, other countries are considering holding Bitcoin, like other assets in reserves. They intend to follow in the footsteps of a “Bitcoin asset reserve” led by U.S. President Trump’s executive order signed last month, which empowered the government to hold BTC.

Roundhill investment to launch Robot-themed ETF

New York-based Roundhill Investments filed a prospectus with the U.S. Securities and Exchange Commission (SEC) to launch a Humanoid robotics ETF. According to market research, the global humanoid robotic market was valued at $2.21 billion in 2023 and is expected to exceed $76 billion by 2032.

Roundhill, founded in 2018, is known for thematic ETFs, and the Humanoid Robotics ETF could join its roster of niche tech funds, like video games, AI, metaverse, and Bitcoin Strategy ETFs.

Humanoid robotics are robots that resemble and function like humans, such as Tesla’s Optimus and Boston Dynamics Atlas robots. Lately, there has been a surge in interest in general-purpose robotics through companies like Tesla, Nvidia, and Figure AI.

According to the filing, the Humanoid Robotics Fund would invest primarily in equity securities of companies that Roundhill considers leaders in humanoid robotics – developers, producers or suppliers.

If approved, the fund would expose investors to companies at the vanguard of Humanoid robotics, a rapidly evolving area of artificial intelligence (AI).

Some other ETFs typically focus on robotics, like the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the ROBO Global Robotics & Automation Index ETF (ROBO). Yet none are dedicated solely to humanoid robots.

Yet, risks remain, such as limited commercial availability, operational or staffing challenges, global pressures, and AI and robotics development in China. Moreover, the prospectus read,

“The development and commercialization of fully functional humanoid robots involve complex and evolving technologies, which may face unforeseen technical challenges, regulatory hurdles, and market acceptance issues.”

Top 3 crypto airdrops in April

As April progresses, and with dominant market uncertainty, traders and investors are looking for new investment opportunities.

Crypto airdrops offer such avenues, providing farmers and investors early access to profitable projects with little to no initial capital required. While many projects have confirmed airdrop status, the following will be worth looking at this week.

Towns

Towns is an on-chain messaging platform on the Base network that offers decentralized, community-owned communication. It recently raised over $35 million from key investors, including Coinbase, Benchmark and Framework Ventures.

With confirmed airdrop status, tasks are low-cost and require Base network setup such as ETH for gas fees. Participants can also join Towns’ servers, with early spots possibly free, while later ones require a small fee.

Towns shared on X,

“Trading is live on Towns. You can now trade any Solana or Base token directly in your Town. Type $ followed by the ticker or a contract address in any chat to pop up a chart and buy instantly using your Towns wallet.”

Active engagement or participation, including chatting, joining or creating towns, and “clicking the beaver” to earn points, which may determine airdrop eligibility, is rewarding. With the network already tracking points for prior interactions, ongoing activity will boost chances.

Recall

Next is Recall (formerly Ceramic), which confirmed its airdrop and launched a points program. The project is a network for crowdsourced AI agent competitions.

Recall posted on X,

“Recall Surge is our points program that recognizes and rewards your contributions to the community. Earn fragments and climb the leaderboard by participating in AI competitions, social quests, and more.”

Interested participants can complete tasks on Zealy and Galxe and earn Fragments (points). The program already includes quests on popular platforms such as Absinthe, Galxe, and Zealy. The Recall team is also exploring adding Kaito in the future.

One gets additional points for roles in Discord, inviting friends, and searching for suitable AI agents. Participants who refer new users receive 10% of that person’s lifetime points.

Airdrop farmers increase their ranks on the community leaderboard by earning Fragments weekly, with higher ranks likely to increase rewards. Moreover, this crypto airdrop community comes after Recall raised $30 million from backers such as Coinbase Ventures, Union Square, Jump Crypto, etc.

Allo

The Allo project periodically adds new campaigns on Galxe, offering participants who finish these activities a chance to earn the real-world asset (RWA) expert role in Discord.

Allo has raised $102.75 million, with backers including YZi Labs (formerly Binance Labs), Gate Labs, Morningstar Ventures, and NGC Ventures. Yet, it has limited roles, including Bull, which requires players to finish two campaigns on Galxe to get it.

Closing remark

Sonic’s milestone has had a lasting impact. It has been ranked the second-highest netflow protocol this year, behind Base. Also, Chainlink’s integration provides Pi Network an essential opportunity to expand its utility and visibility.

Tether minted $1 billion USDT on the Tron blockchain, reinforcing the former’s dominance within the stablecoin sector. Bitcoin’s adoption grows stronger as a UK-based school plans to start accepting payments. Finally, the airdrops keep coming, and April plans to welcome three upcoming ones.

Zypto Unveils its Next-Gen White Label Crypto Cards

Zypto has unveiled its next-generation White Label crypto cards for businesses looking to offer Visa or Mastercard cards to their users. These cards are fast, 100% customizable, and powered by the Zypto Payment Gateway, enabling global secure payments.

Find out more here.

There’s so much to unpack this week. So, share your thoughts and questions in the comments section.

FAQs

How much did Tether mint on Tron?

Tether minted $1 billion USDT on the Tron blockchain, which pushes Tether’s total USDT supply on the blockchain past $50 billion.

Why did Chainlink integrate Pi Network?

Chainlink integrated Pi Network into its Data Streams ecosystem, facilitating real-time market data access.

How long did it take Sonic blockchain to hit $1 billion?

It took Sonic blockchain 66 days for its TVL to increase to $1 billion.

Why did the Scottish school plan to start accepting BTC?

The choice was made after many parents asked for it.

Why does Roundhill want to invest in Robot-themed ETFs?

Humanoid robotics is a rapidly evolving area of artificial intelligence (AI), and its value is primed to surge in the coming years.

What are the three top crypto airdrops in April?

They include Towns, Recall and Allo.

Another important and valuable blog coming from Zypto. Allo and Recall one of my favourite project currently. I am also working their project. Other projects i know first time. But, looks interesting