This week saw the crypto market massively affected by Trump’s policies, with various crypto assets reacting differently. Also, analysts predicted a surge for Ethereum as Shibarium’s listing led to some milestones.

Let’s dive in.

Bitcoin’s dominance level exceeds 60%

The overall cryptocurrency market has been hit with a massive price drop.

Furthermore, about $2.18 billion of liquidations were witnessed across the crypto market – the biggest ever.

Bitcoin (BTC) saw $409 million worth of liquidations, but the altcoin market suffered a much more considerable amount. This means more capital flowed into BTC than other cryptocurrencies, as investors sought safety in the most prominent crypto asset.

Thus, the Bitcoin Dominance (BTC.D) level increased beyond the 60% resistance zone, an area where BTC has historically faced rejection.

However, this time seems different as the dominance level appears firm. This could signal more increases for BTC in the short term in terms of price action and market sentiment. Conversely, this could lead to bad news for altcoins.

The crypto market is currently consolidating, with Bitcoin leading the charge. BTC.D could surge further, reaching 63.84% and 72.5% in the coming months. This change would be influenced by strong institutional interest and the steady flow of capital into Bitcoin.

Yet, it is vital to note that nothing is set in stone. There remains some hope for altcoins since BTC has yet to breach the $92,000 support level that marked the lows of its two-month range.

What led to Bitcoin’s fall?

Trump’s tariffs backfire

Behind the crypto market’s uncertainty and price decline is the trade war caused by U.S. President Donald Trump. On February 2, Trump posted on X (formerly Twitter), declaring that he had implemented tariffs on Mexico, Canada, and China, causing the overall market to turn red.

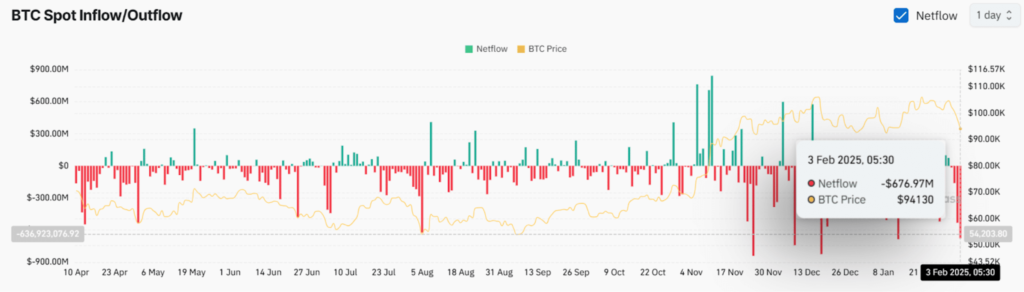

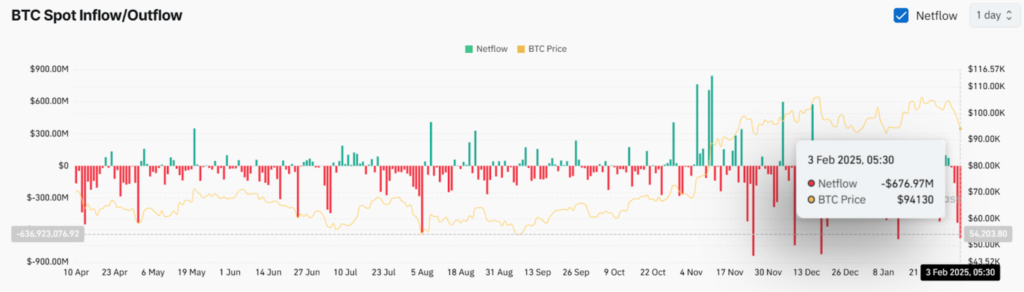

Nevertheless, traders and investors appeared bullish on BTC as it accumulated. Coinglass’ inflow/outflow data showed that since the beginning of the price drop, exchanges had witnessed a noteworthy outflow of $677 million worth of BTC.

This notable outflow in the current market indicates possible accumulation by whales, investors, and long-term holders, which could lead to buying pressure and force a further upside rally.

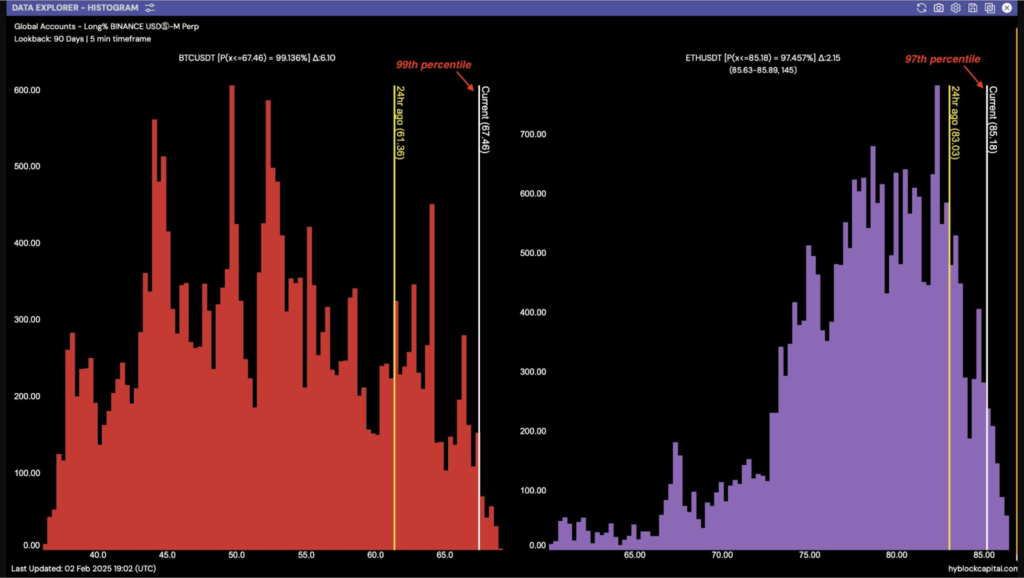

Also, Hyblock revealed that as BTC’s price trended downward over the past 24 hours, global traders have increased their long exposure. About 67% of accounts took long positions, signifying a bullish outlook for the premier coin.

When fusing these on-chain metrics, BTC presents a great buying opportunity.

Stablecoins have a say

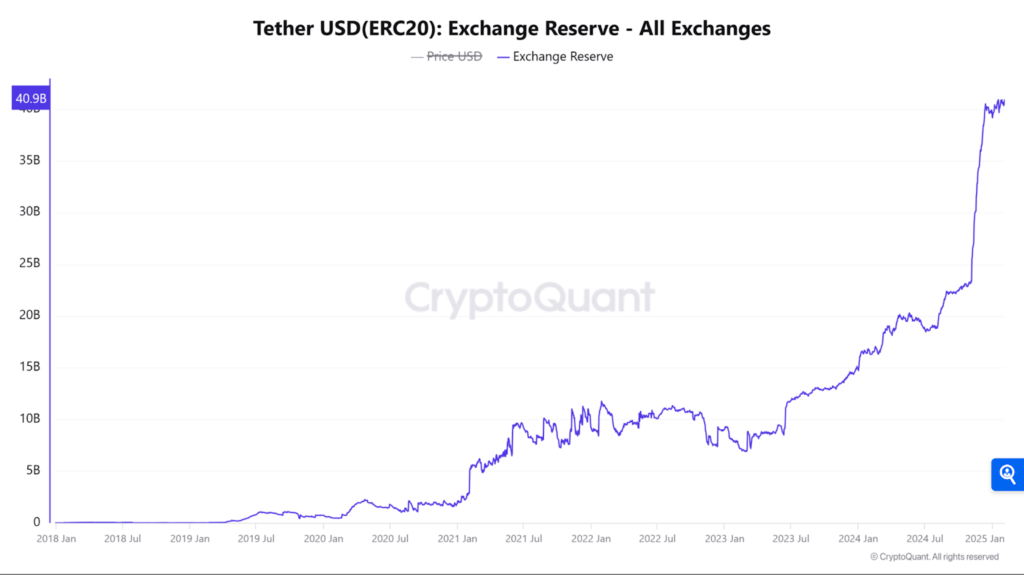

Stablecoins like Tether (USDT) have been steadily flowing into exchanges, indicating pressure waiting on the sidelines. Yet, no action has occurred, and liquidations have left the market volatile.

Thus, as the USDT Exchange Reserves show, increasing stablecoins could supply the buying power needed to support altcoins when market sentiment changes.

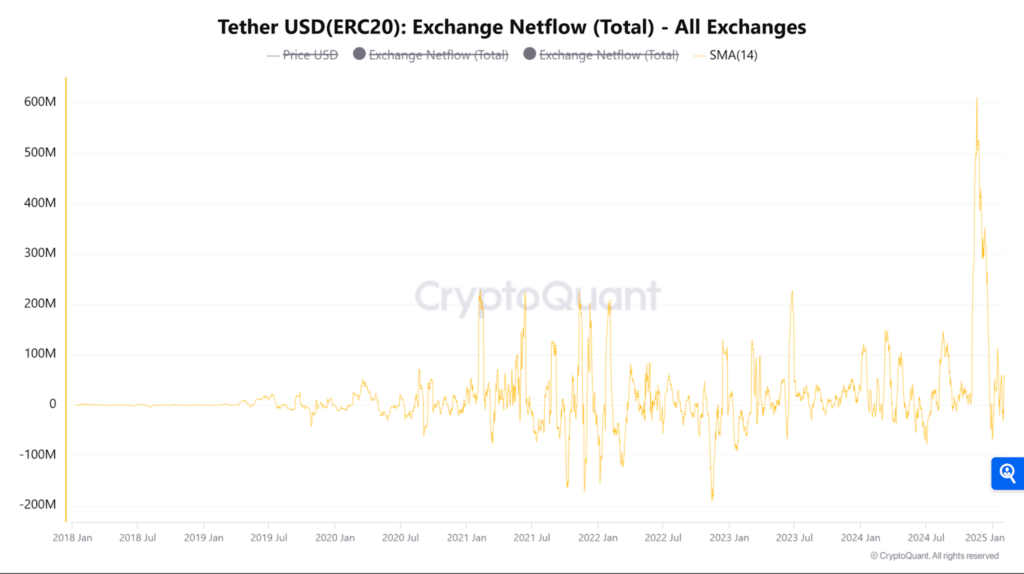

Still, the USDT netflows were positive in recent weeks, mainly in November. And while the transfer of stablecoins to exchanges was another means of buying, it has slowed since December.

Ethereum’s 4-year cycle signals a possible breakout

Although Ethereum has arguably been unspectacular recently, many analysts are backing an imminent significant price surge. They predict a potential 200% rise as historically successful technical indicators and market sentiments align.

Moreover, as we enter the thick of February, which is typically a productive month for ETH, many wonder if this signifies the beginning of the next big rally for the coin.

ETH’s recent chart patterns have sparked speculation among analysts about a possible rally. By observing the ETH/BTC pair, experts cite parallels with 2021’s fantastic run, which produced a 180% gain in just two months.

The data infers that Ethereum may be well-positioned for another comparable surge. The existing cycle consists of accumulation zones followed by breakout rallies. Thus, a possible 200% rally isn’t impossible, especially as ETH closes in on the four-year cycle pivot, which has historically indicated the start of notable upward trends.

What is the four-year cycle?

Ethereum has shown major cyclical patterns, particularly in 2017 and 2021, where it experienced substantial price surges. In 2017, ETH’s price rose by approximately 9,380%, reaching around $881.94 by year-end.

Likewise, in 2021, ETH’s market cap exceeded $250 billion for the first time, revealing considerable growth. These historical trends indicate a pattern of substantial growth roughly every four years.

As we approach the next cycle, analysts wonder whether ETH is poised for another tangible rally. This could validate predictions of a 200% increase.

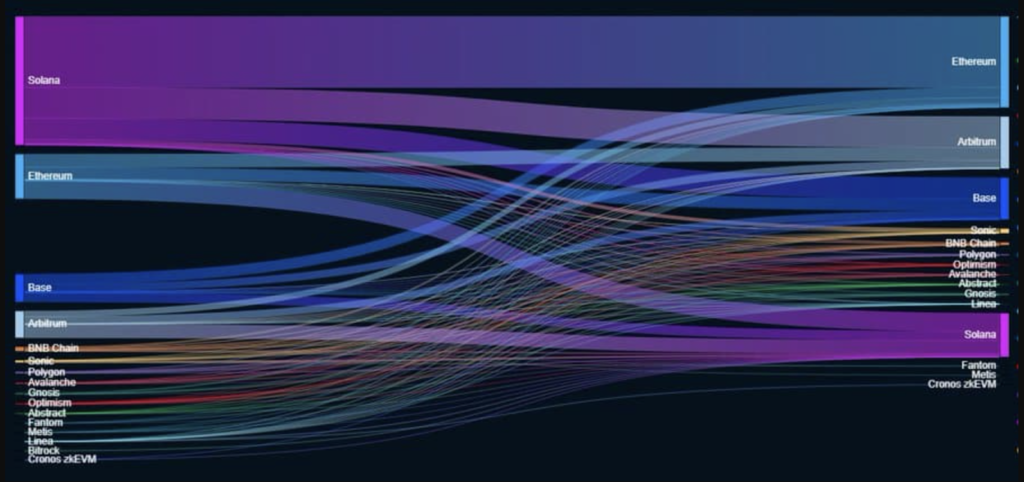

In the meantime, liquidity trends favor Ethereum as capital flows back from Solana. Over the past 24 hours, Solana has bridged four times more capital to Ethereum than vice versa.

This influx of liquidity could support Ethereum’s defence of current levels while positioning for a possible rebound. It could also signal renewed investor confidence in ETH.

But it’s not all rainbows and roses, as the Ethereum leadership has been hit with a barrage of criticism, particularly inefficiencies and a lack of direction.

In an informal poll, 97% of 335 voters holding 51,198 ETH chose Danny Ryan, a former researcher, to lead the Ethereum Foundation. Vitalik Buterin has affirmed that he is the sole decision-maker regarding the foundation’s changes.

Still, this wasn’t enough to forestall the steady decline of the most prominent altcoin.

ETH poised to go below $3k

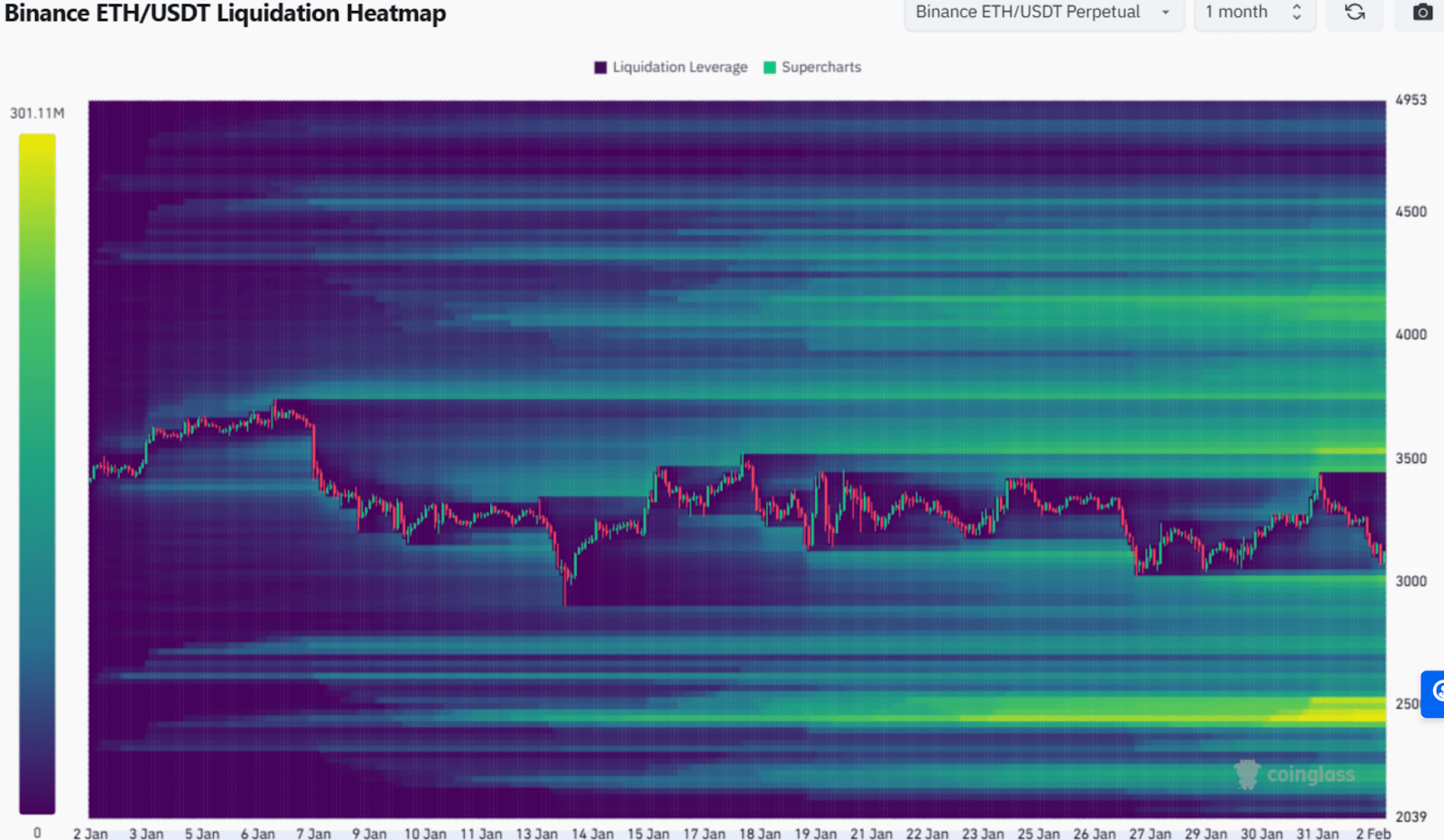

Between June and July 2024, the $3.4k-$3.5k acted as a support zone for ETH before it was flipped to resistance. The rally in November saw this area tested and a pullback occur.

Since then, this region has been incredibly essential. A rally beyond $3.5k in January was quickly reversed, and the price action has formed lower highs and lower lows.

The volume indicator was evidence of the weakness of the buyers.

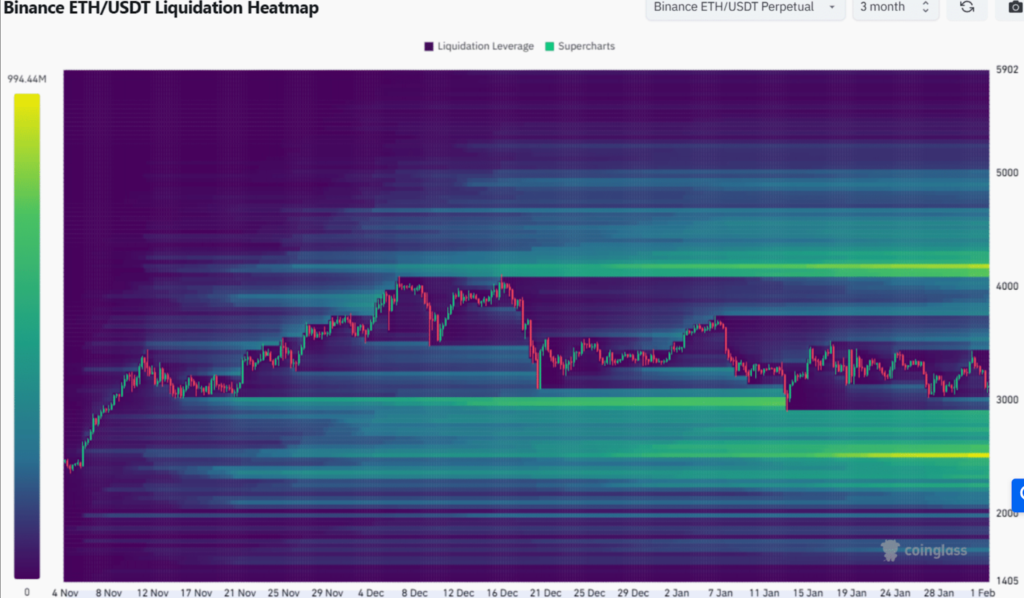

The 3-month liquidation heatmap showed that a move to $2,850 was feasible. To the north, liquidity pockets at $3,460 and $3,800 and a sizable cluster at $4.2k were visible.

The magnetic zone at and below $3k indicated that a move downward was the most likely outcome in the coming days, in tandem with the price action of the past month. Consequently, the liquidation heatmap showed that the following targets were $3k, $2.8k, and $2.7k.

Still, it is unclear if all these targets will be fulfilled in the coming weeks.

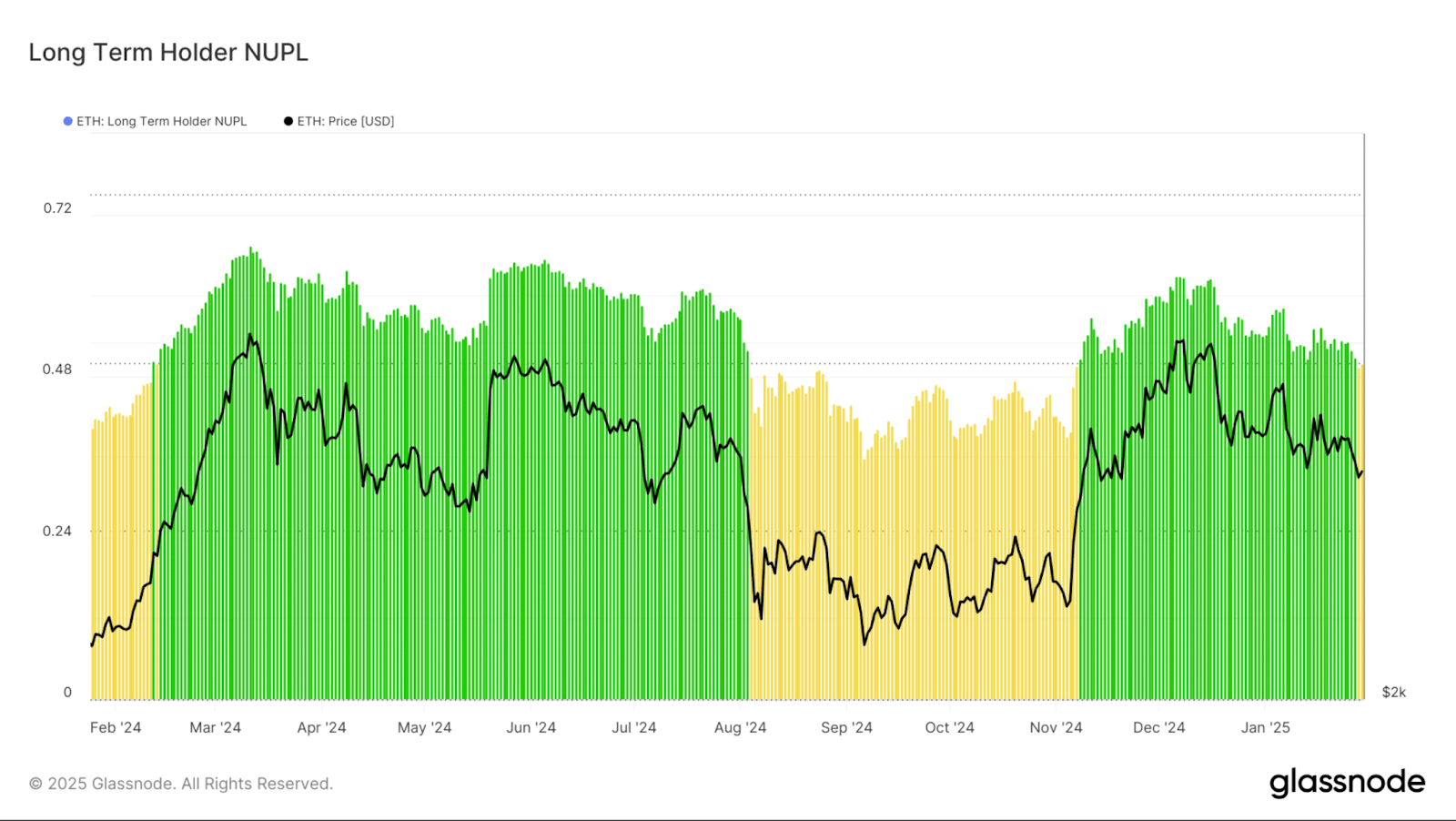

ETH Long-Term Holders (LTHs) grow anxious

As Ethereum hovered around the $3k mark, a subtle but meaningful shift occurred beneath the surface. Long-Term Holders (LTH) seem anxious and are showing the first signs of anxiety since November 2024.

The transition to yellow territory, with readings around 0.48, indicates that LTHs are entering a period of uncertainty, possibly due to Ethereum’s recent price action near the $3,200 level.

Recent data shows over 12 million addresses holding over 62.27 million Ethereum, with an average acquisition price of $2,425.31.

The concentration of holders who acquired ETH between $2,233.15 and $2,612.05 remains noteworthy, though the shift to the anxiety phase suggests these support zones might face advanced testing. Given the current sentiment shift, the overhead resistance above $3,205.97 seems more formidable.

Despite the sentiment change, the Accumulation/Distribution indicator retains its upward trajectory, reaching nearly 48M. This creates an interesting variation: while LTHs express anxiety, underlying accumulation patterns remain robust. Thus, the contradiction could lead to a critical juncture for Ethereum.

While technical structures remain bullish and accumulation continues, the emerging anxiety among LTHs could lead to increased volatility in the near term. Thus, the market faces a key test: whether the continued accumulation trend can neutralize possible selling pressure from anxious LTHs.

Ripple transfers 700 million XRP into escrow

On February 2, blockchain transaction tracker Whale Alert posted on X (formerly Twitter) that Ripple Labs had transferred 700 million XRP tokens into escrow. This action temporarily locked the tokens, which cannot be used for trading or any activity.

Moreover, this transaction by Ripple Labs comes when the overall cryptocurrency market is witnessing a significant price decline. Thus, it seems the move was made to avert a notable drop in XRP’s price amid bearish market sentiment.

That said, moving XRP into escrow has benefits. Historically, the price gains momentum in a bearish market when Ripple Labs locks tokens in escrow. On the contrary, when Ripple unlocks tokens from escrow, the tokens drop in value.

After the transaction, XRP was trading near $2.90 at press time, having dropped 3.60% in the past 24 hours. Despite the price decrease and bearish market sentiment, traders and investors have shown strong interest in the token, leading to a 65% increase in the asset’s trading volume.

Ripple’s on-chain metrics are bullish

Some long-term holders (LTHs) and investors took advantage of the recent price drop by stockpiling tokens per Coinglass. Data from spot inflows/outflows indicated that exchanges witnessed a major outflow of $70.50 million worth of XRP.

The substantial outflow further implied a perfect buying opportunity. At press time, the significant liquidations were at $2.791 on the lower side and $2.963 on the upper side, with traders being over-leveraged at these levels.

If the market sentiment doesn’t improve and the price falls to $2.791, almost $55.10 million worth of long positions will be liquidated. Yet, if the sentiment shifts and the price rises to $2.963, nearly $35 million worth of short positions will be liquidated.

As is typical in crypto, the bad news wasn’t far off. A day later, Ripple whales massively dumped XRP.

XRP whales dump 130 million tokens in a day

With the crypto market still volatile, XRP witnessed a significant 26.14% decline. This decrease was due to notable whale activity, where over 130 million XRP were dumped, signifying selling pressure.

Generally, large-scale sell-offs often have a knock-on effect. Investors’ confidence is affected, and smaller traders panic to minimize losses, leading to price drops.

Furthermore, a massive 100 million XRP (approximately $283 million) was unlocked from escrow into an unknown wallet, raising more concerns.

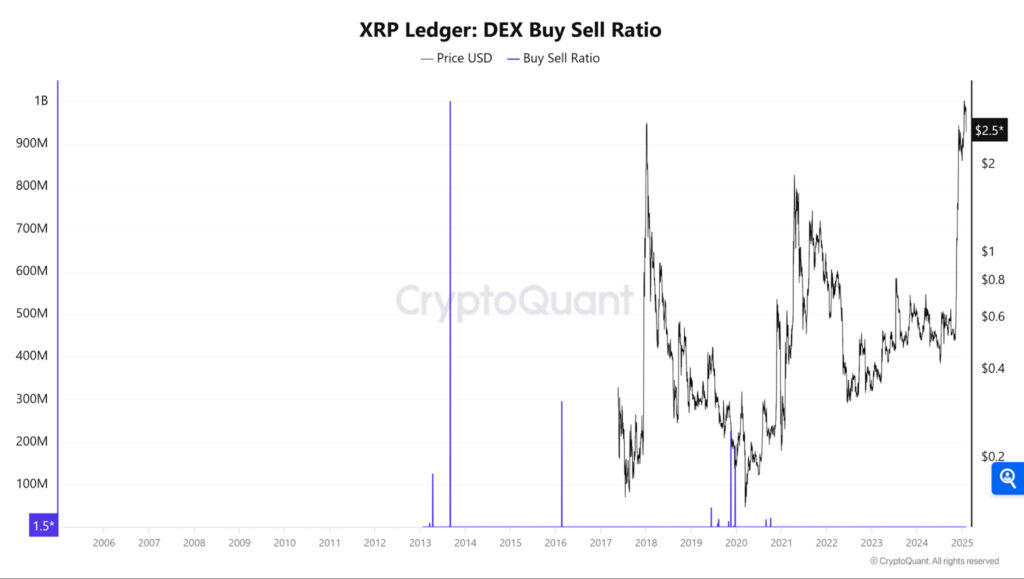

According to CryptoQuant, XRP’s buy-sell ratio has remained low over the past 16 hours, indicating selling pressure. The declining ratio points to a lack of buying interest, mirroring trends seen on centralized exchanges (CEXs).

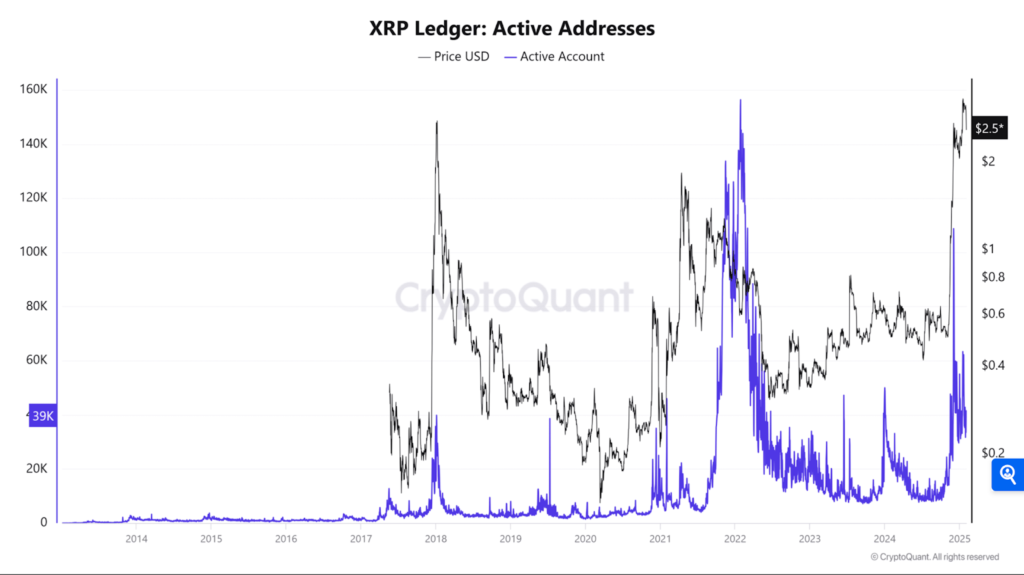

If this selling dominance continues, further price weakness could occur, making it crucial for buyers to re-enter the market to stabilize XRP’s trajectory. The number of active XRP addresses has decreased notably, indicating a slowdown in trading activity.

Fewer active addresses suggest lower liquidity, meaning price movements could become more volatile due to decreased transaction volume.

However, if this trend reverses and active addresses rise, it could signal renewed investor interest and potential price stablilzation. XRP faces heavy selling pressure as whale activity, escrow releases and bearish technical indicators dominate the market.

The MACD signals further downside potential, while the decline in active addresses and increased sell-offs reinforce the bearish outlook. Still, for long-term investors, such price corrections could present accumulation opportunities.

Thus, XRP’s next significant move will depend on whether buyers step in to nullify the selling pressure. If market confidence returns, stabilization or a rebound could occur.

What does Shibarium’s listing mean for the ecosystem?

The recent listing of Shibarium – Shiba Inu’s (SHIB) Layer 2 solution – has led to discussions in the crypto community. Recently listed by L2 Beat, the technology of Shibarium has been described by one of its pivotal developers.

Unlike conventional Layer 2 (L2) rollups, which often rely on centralized operators or have extended withdrawal periods, Shibarium works as a sidechain built on Ethereum (ETH). This enables it to operate with its validators while leveraging Ethereum’s security through periodic anchoring.

The developer explained its design, stating,

“Sidechains operate their validators and milestones while leveraging Ethereum’s security via periodic anchoring. In my view, this structure is more secure than optimistic rollups, which impose a seven-day challenge period for withdrawals.”

In addition, the ShibOS system integrates multiple security mechanisms, including a hybrid optimistic/ZK-based settlement model, to address the inefficiencies of optimistic rollups.

What is the impact so far?

Data from L2 Beat indicates that the total value succeeded by Shibarium has grown massively over the past year. As of the 2nd of December 2024, the L2 has secured over $6.4 million, displaying a steady uptrend.

The Shiba Inu L2 saw an early in mid-2024 as adoption increased, followed by a stablization phase where its value secured remained above $3.33 million for months. Plus, as of this writing, its value secured is around $3.5 million, declining by almost half from the peak it witnessed in December.

Alongside its rising value secured and increasing on-chain activity, Shiba Inu’s burn rate has increased by 786.90% in the last 24 hours. Over 31,010,900 SHIB tokens were burned the previous day, revealing intensified network activity and reduced circulating supply.

If sustained, such a rapid burn rate could support long-term price stability for SHIB. As more transactions are processed on Shibarium, Shiba Inu burning is expected to surge, further reducing supply and possibly increasing price pressure in the long term.

Closing Remark

Although Bitcoin’s dominance level (BTC.D) is high, an altcoin rally could still occur. Either way, investors have to be ready for both scenarios. For Ethereum, a possible 200% rally isn’t impossible based on the four-year cycle pivot, which has historically pointed to the start of notable upward trends.

Ripple locked many tokens in escrow to avert a notable drop in XRP’s price amid bearish market sentiment. Yet, that didn’t stop whales from massively dumping their tokens. Finally, with more Shibarium transactions primed to occur, SHIB is in a good position for long-term stability.

Zypto’s White Label Crypto Solutions

Zypto offers a White Label Crypto Solution that enables companies, organisations and projects to utilize their full range of products, such as crypto debit cards, crypto bill payment services, crypto wallets, etc., at a fraction of the cost and fast time to market. Find our more here.

Zypto’s Crypto Bill Payments Launch in Costa Rica

Zypto’s Crypto Bill Pay service is now available in Costa Rica. You can now pay your bills directly to 6 top billers using crypto like Bitcoin (BTC), Ether (ETH), or Solana (SOL). Find out more here.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

0 Comments