This week saw massive whale activity in terms of purchases and withdrawals, as well as a huge surge by a memecoin. Most of all, we analyzed the prospects of Bitcoin and Altcoins in 2025.

Let’s dive in.

Bitcoin vs Altcoins- who wins in 2025?

Recently, the crypto market has witnessed a prominent shift in focus, with Altcoins taking center stage amid growing optimism. With traders positioning themselves for possible profits, many are increasingly looking for long altcoin positions, predicting substantial price movements.

Conversely, Bitcoin (BTC) has adopted a guarded approach, with investors assuming a more conventional position. This difference in sentiment between Bitcoin and altcoins signals evolving dynamics, leading to a debate about the future of both asset classes.

Altcoins are on the rise

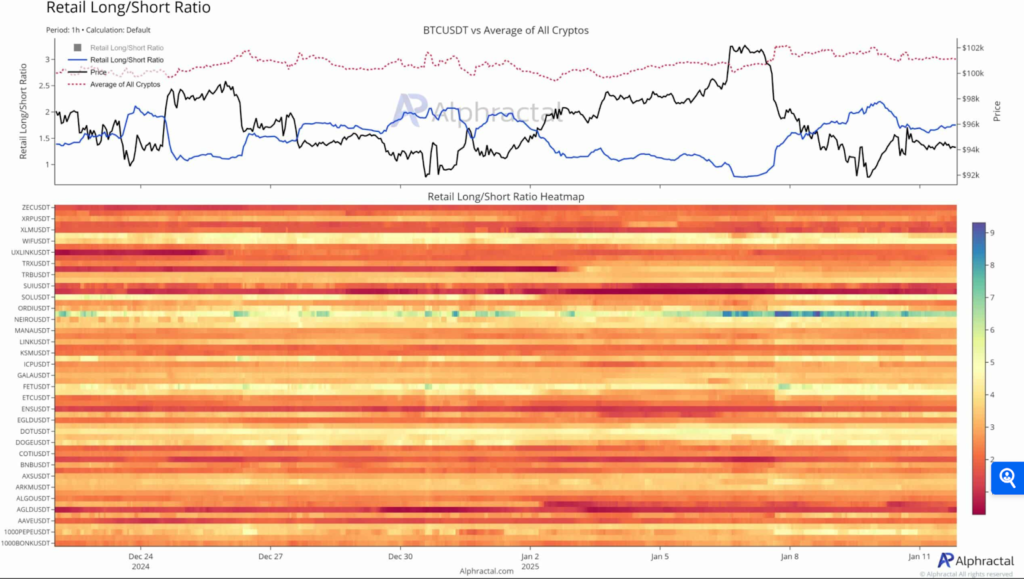

The retail long/short ratio heatmap displayed apparent trends in altcoin positioning. Assets such as SUI and SOL lead the charge in long positions, and sustained green zones reveal increased retail bullishness.

Then, coins like TRX and XRP have exhibited higher levels of short interest, indicating that traders anticipate downside movements.

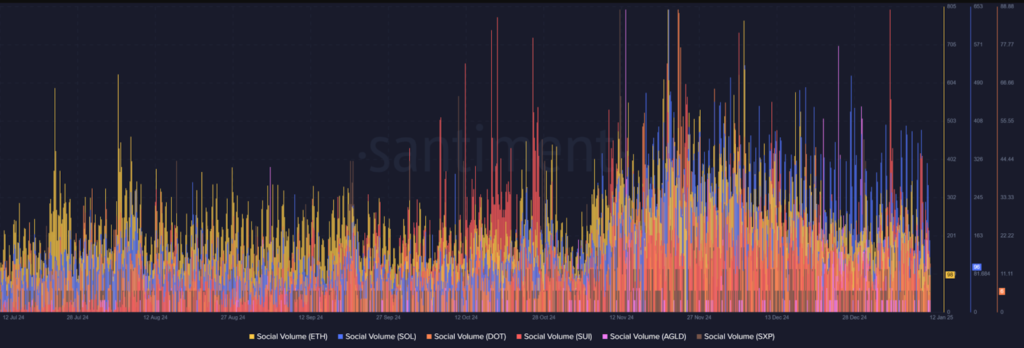

Social volume data supported this sentiment. As the chart shows, while Ethereum (ETH) maintained high engagement levels, Sui and Solana have increasingly closed the gap, led by network developments and community-driven hype. Altcoins like DOT and AGLD also witnessed surges in social volume owing to their heightened popularity in trading environments.

Despite the optimism around altcoins, Bitcoin seemed neutral to slightly bearish. The average retail long/short ratio for BTC was close to equality, indicating caution among traders amid slower price momentum.

This deviation is proof of evolving market dynamics. Traders seek higher risk-to-reward setups in altcoins while Bitcoin’s dominance weakens with speculation. For now, the altcoin rally seems to be pushed by retail interest and improving social sentiment.

Also, prominent financial analyst and Real Vision founder Raoul Pal introduced the concept of the “Banana Zone” via a post on X. For context, the “Banana Zone” represents a rapid surge in the cryptocurrency’s price, with the price trajectory taking the shape of a banana on a chart.

He affirms that this consolidation stage won’t last much longer as he expects the market to soon transition into “Banana Zone Phase 2,” which he depicts as “Banana Singularity” – a phase he predicts will trigger an altcoin season.

Furthermore, according to the latest update from BlockchainCenter.net, the altseason is still far, as the current index stands at 51. This is an indication that it is not yet the altseason. Therefore, the general sentiment regarding altcoins indicates that the market is at a crossroads.

While some coins, such as SUI and SOL, witnessed concentrated bullish momentum, short positioning in other assets, such as TRX and XRP, has increased, adding to the growing skepticism in some quarters.

Unfortunately, fragmented sentiment leads to risks. A sudden end to a bullish momentum in certain altcoins can reduce market confidence. Conversely, sustained optimism in certain assets could attract sidelined capital, leading to a broader rally.

How is Bitcoin faring?

Despite a market-wide drop, Bitcoin (BTC) has yet to stay above the $90,000 level for weeks. Its volatile price action led it to rebound above $94,000 after briefly plunging below $92,500. This stability has restricted its recent losses, with the same leading to just 3.97% over the week and 5.49% over the month.

Bitcoin’s neutral long/short ratio underscored its alignment with macroeconomic uncertainty and traders’ preference for stability. With slower price momentum and weak trend signals, participants seem reluctant to take massive bets, preferring hedging strategies over speculative plays.

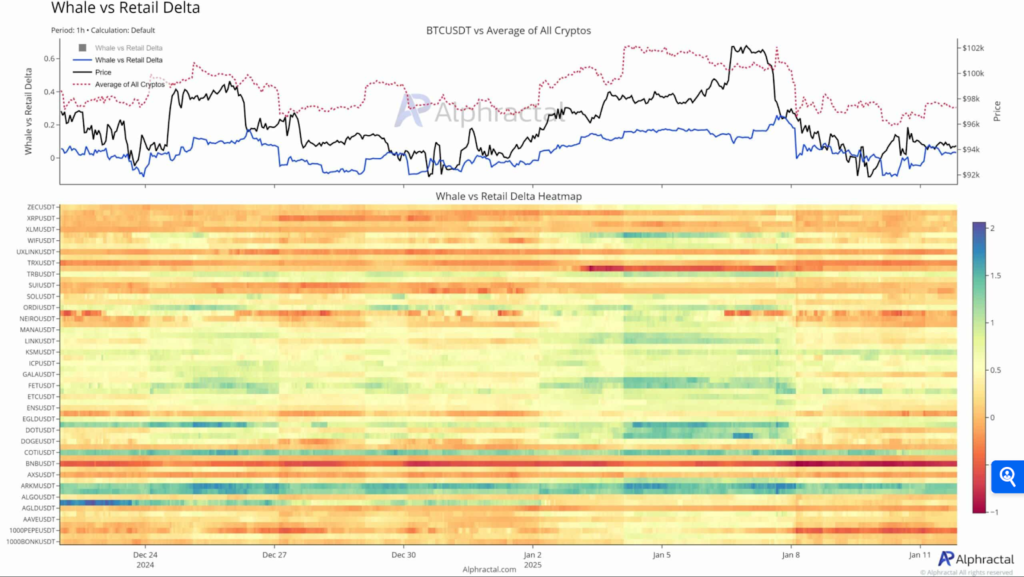

The Whale vs. Retail Delta heatmap displayed muted whale interest in BTC compared to other altcoins. This implied that large holders are not mainly accumulating or offloading. Instead, their behavior aligned with reinforcing stability rather than boosting volatility.

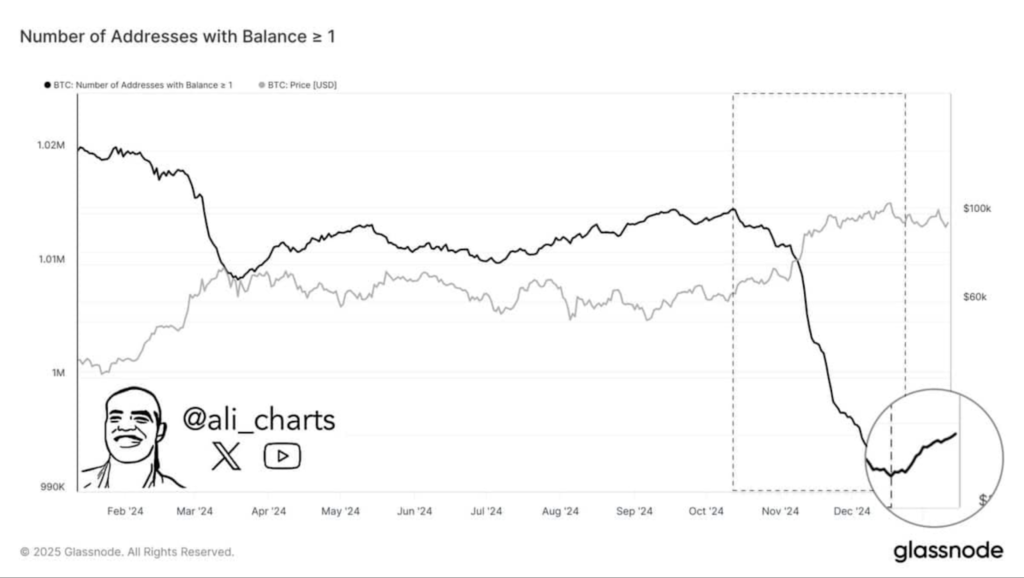

According to Glassnode’s data, the number of addresses holding more than 1 BTC has significantly increased. This points to a noticeable difference, especially following a lengthy selling phase by BTC holders that started in October.

Such accumulation indicates a revitalized sense of conviction in the market. When investors move from selling to holding, they predict maintained value and will likely retain the asset – possibly driving a rally.

Bitcoin’s volatile movement has also led some investors to question the cryptocurrency’s future amid rising market uncertainty.

Raoul Pal clarified that the market is in a consolidation phase following what he calls “Banana Zone Phase 1,” represented by last year’s price breakout. He likened this phase to the market conditions witnessed during the 2016-2017 cryptocurrency boom.

He also remarked that the market will eventually enter “Banana Zone Phase 3,” which he defines as the “concentration phase.” In this phase, the core winners explode and make much higher highs. This phase is expected to lead to the final surge in the cycle, with specific cryptocurrencies attaining new peaks.

That being said, BTC could rally again, with market sentiment displaying signs of shifting and traders increasing their buying activity.

Ripple whales accumulate 1 billion XRP

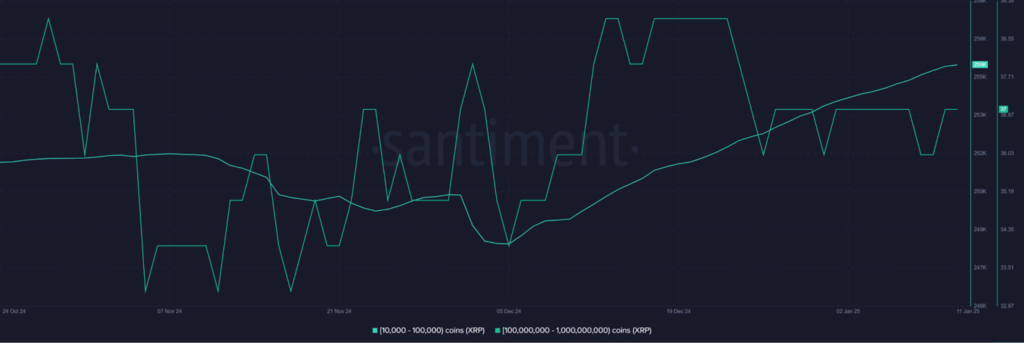

Ripple whales have added over 1 billion XRP tokens to their holdings in an unprecedented trend. This massive accumulation signals rekindled confidence in the digital asset.

Consequently, large holders with balances exceeding 10 million XRP witnessed a sharp increase in their holdings. This move could indicate anticipation of a price hike in the coming weeks or a strategic response to the recent market consolidation.

Typically, this accumulation impacts market liquidity and improves sentiment among smaller investors. Whale activity has historically aligned with significant market shifts, so this considerable accumulation has led to questions about its possible implications for Ripple’s network, price momentum, and broader market performance.

How does Ripple look right now?

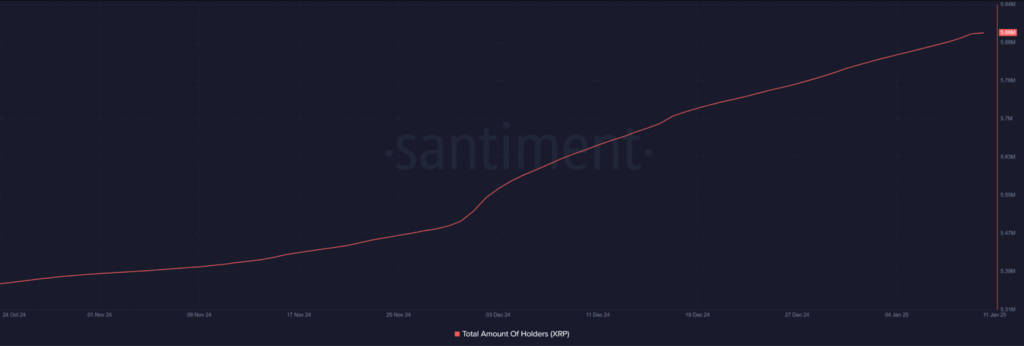

The total number of XRP holders has grown steadily, with the chart showing a near-linear rise over the past few months. As of January 2025, the total holder count surpassed 5.88 million, indicating an increasing base of investors.

This hike fits perfectly with whale accumulation periods, indicating a trickle-down effect where large whale purchases impact retail participation. This dynamic could improve market stability by distributing XRP evenly across multiple holder categories.

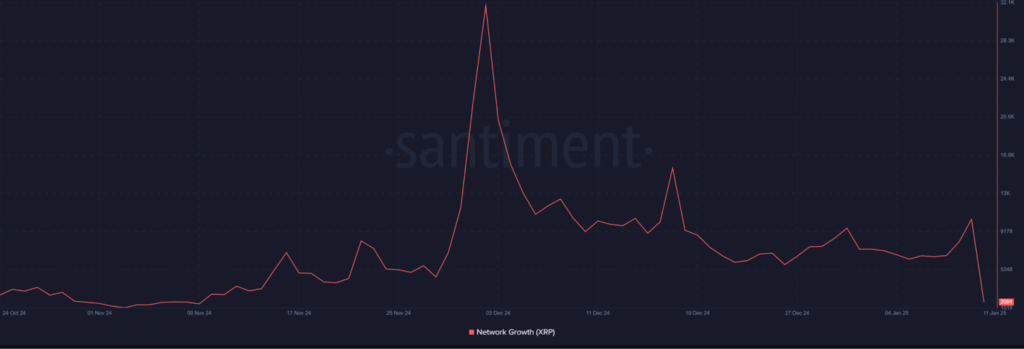

Remarkably, the network growth chart revealed another surprising narrative. While new wallet creation surged in December 2024, suggesting increased interest in the XRP ledger, a subsequent descent implied that the market might be cold.

Yet, consistent daily new addresses, even post-spike, showed that XRP continues to attract new participants. Analysis revealed that the number increased to over 10,000 on January 10 before declining at press time.

Thus, this pattern hinted at a mix of speculative and long-term interest.

While whale activity might have driven short-term growth, sustained address creation is a better sign of broader adoption. This is probably due to the increased utility of the XRP ledger in cross-border payments.

What is XRP’s price saying?

Even with the optimism, XRP struggled a bit on the price front. At press time, the altcoin had dropped by 2.63% to $2.45. Nevertheless, things may improve, as renowned analyst Peter Brandt predicted a tremendous 262% increase in XRP’s market cap, possibly reaching $500 billion.

If this happens, XRP’s value will be pushed to an estimated $8.70, based on its current price. Brandt’s bullish perspective hinges on forming a flag pattern on the charts, which implies that XRP may soon be poised for a transformative upswing.

“Half mast flags should be completed within six weeks; otherwise, they should be viewed with great suspicion. But if it is completed, a market cap of $500B is possible.”

What is Ripple’s future outlook?

Ripple’s growth has been defined by whale-driven accumulation and network increase. Still, the interaction between whale behavior, retail adoption, and other external factors, like regulatory decisions, will influence its short- to long-term prospects.

Finally, the network’s growth and total holder trends indicate resilience, while the price action highlighted essential levels to watch. If whales continue to accumulate and the network attracts new users, XRP may sustain its bullish momentum as long as no macroeconomic shocks occur.

Whales withdraw $5 million worth of PEPE tokens

A newly identified whale, ‘0x8f5,’ withdrew 280 billion PEPE tokens worth $5 million from Binance, marking a notable transaction in the token’s ecosystem.

The trend implies a strategic positioning by net-worth investors, likely in anticipation of a possible rally or market event. Typically, whale activity in meme-based tokens precedes price volatility, attracting traders looking to capitalize.

While sentiment around PEPE has lately shifted toward a bullish ecosystem, traders are advised to remain careful. Whale-driven accumulation can also lead to rapid sell-offs once profit targets are completed.

How is PEPE faring?

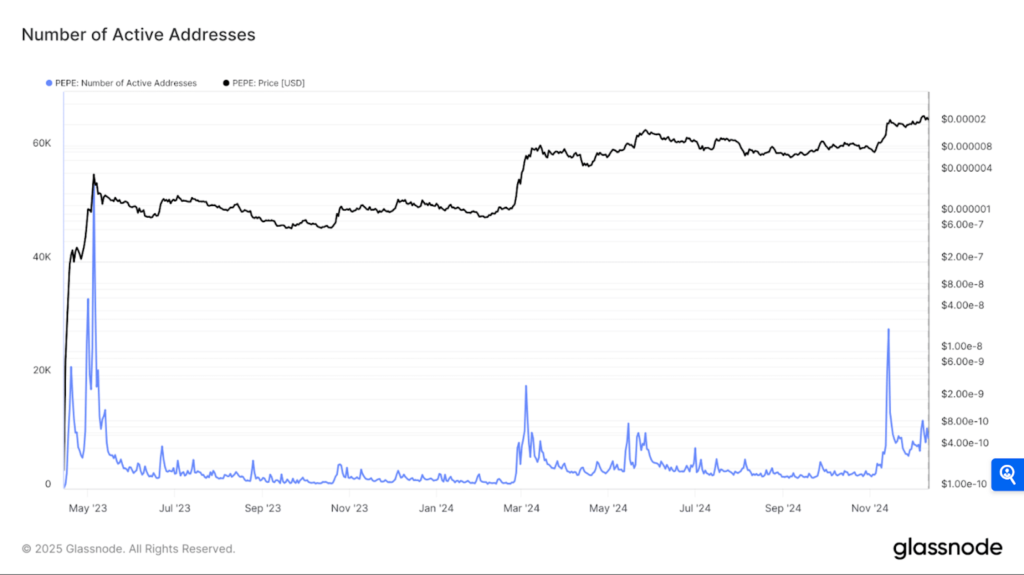

Firstly, on-chain data spotlighted a 15% increase in active wallet addresses, a sign of rising user engagement. This usually relates to price volatility, as it suggests increased market participation.

A sustained hike in active addresses could support a bullish stance, mainly if paired with consistent trading volume. However, traders should stay alert, as surges in active addresses may also emphasize distribution by larger holders to smaller traders.

Conversely, if activity levels decline, PEPE could face decreased liquidity, leading to sideways or bearish price action on the charts.

Then, at the time of writing, PEPE seemed to be displaying resilience in a volatile crypto market, trading near its critical support level of $0.0000019. Recent upticks in trading volume indicated rising interest from retail and institutional participants.

More significant market factors, like Bitcoin’s stability and altcoin recovery, have likely led to PEPE’s current performance. Nonetheless, traders should be wary of external economic developments or regulatory announcements that influence market dynamics.

Also, Open Interest (OI) for PEPE Futures contracts has risen 18% recently, which suggests an uptick in speculative activity. At the time of this writing, long positions overwhelm the market, accounting for 62% of the total OI, indicating optimism among traders.

If PEPE breaks above its resistance levels, OI could keep rising, possibly leading to a rally. Conversely, a decline below its support could lead to long liquidations, boosting downward pressure.

For now, neutral funding rates point to a balanced market, but traders should watch for shifts in these rates mainly since they may indicate growing bullish or bearish sentiment.

What is PEPE’s future outlook?

Overall, PEPE’s market position remains at a critical juncture. Whale accumulation, increasing active addresses, and rising Open Interest all suggest heightened market activity.

However, PEPE’s ability to maintain key support levels will determine its next move. Thus, careful optimism remains advised, as both bullish and bearish scenarios remain in play depending on market dynamics and broader crypto sentiment.

Solana-based FARTCOIN surges by 64%

Solana-based memecoin FARTCOIN dramatically surged by 64% to over $1. This price correction came after a prior decline of 57% on the charts. Moreover, the sudden surge happened despite struggles in its ecosystem.

The past few weeks have been difficult for the Solana-based memecoin space. FARTCOIN spiked by over 7900% before undergoing a sharp correction. WIF has struggled with a decline of 38.20%, while other tokens like BONK and PENGU have increased modestly by 18.39% and 16.83%, respectively.

Generally, the end of 2024 and the beginning of 2025 have been brutal for the memecoin space. Some factors like lowered liquidity, weakening hype, and investor caution have played a role in this struggle until FARTCOIN.

Why did FARTCOIN spike that high?

Firstly, FARTCOIN’s creation tied to the Truth Terminal AI agent, which reportedly holds 20 million FARTCOIN tokens, made headlines as the “first crypto millionaire AI.” Social media buzz made it go viral and attracted a larger audience.

Secondly, broader memecoin market dynamics, including FARTCOIN’s unique narrative and strong community, also helped it stand out. This further increased its demand.

Thirdly, there was a massive uptick of $210 million in its Futures Open Interest. An alignment that suggested that traders are actively positioning themselves, foreseeing more price movement. The price increase alongside the greater Open Interest is viewed as a bullish signal that indicates renewed optimism for FARTCOIN in the market.

Closing Remark

Due to volume data, network developments, and community-driven hype, there is enormous optimism about altcoins. Conversely, Bitcoin seemed neutral to slightly bearish. Yet, time will tell how both cryptocurrencies fare this year.

Whale activity has historically aligned with significant market shifts, so Ripple’s considerable accumulation seems to bode well for its ecosystem. For PEPE, careful optimism remains advised, as both bullish and bearish scenarios remain.

What are your thoughts on this week’s cryptonews? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

FAQs

What is the outlook for Altcoins in 2025?

There is enormous optimism around altcoins due to volume data, network developments, and community-driven hype.

What is the outlook for Bitcoin in 2025?

Bitcoin seems neutral to slightly bearish, but it could rally again, with market sentiment displaying signs of shifting and traders increasing their buying activity.

What is the impact of Ripple’s whales’ massive accumulation?

Ripple’s whale accumulation impacts market liquidity and improves sentiment among smaller investors.

What is the impact of PEPE’s whales’ massive withdrawal?

The trend implies a strategic positioning by net-worth investors, likely in anticipation of a possible rally or market event.

What is behind FARTCOIN’s surge

FARTCOIN’s surge can be traced to a social media buzz by its Truth Terminal AI agent, broader memecoin market dynamics, and a massive uptick in its Futures Open Interest.

In my Opinion, Bitcoin as well as Altcoins might both benefit from a globally strong inflationary Situation at Fiat Currencies as well as an ongoing spreading of Defi in general.

I could imagine a further increase at Bitcoin, due to it’s turn into a widely recognized Investment Asset. Including institutional Investors.

But in it’s shadow, other Crypto Currencies also benefit from the trend. For a chance/growth oriented Investors, Alts might appear more attractive, due to their estimatedly higher x potential.

Especially Zypto – as a Defi Utility Project – might benefit from either Development, as Zypto Token is an Altcoin but the Zypto Company benefits from any positive Defi/Crypto Development.

And via sustainable rewards to Zypto token holders, those can benefit from a token price increase or Zypto Gateway Volume Rewards or possibly even both at the same time.