This week in the crypto space was quite eventful.

Base network made history as it briefly topped Solana, Tron and other blockchain networks in transaction volume. Solana whales purchased SOL worth $35M, and with a busy few months left in the year, the price of the token can surge. Bitcoin ETF inflows increase due to investor activity and GRASS exceeds $1 after getting publicly listed.

Let’s dive into the stories properly.

Base network leads in stablecoin transactions and daily activity

Base marked some noteworthy milestones with a recent surge in activity during October. The Ethereum layer-2 network developed by Coinbase was dominant across different vital metrics within the same time frame.

Base crypto tops stablecoin volume with 30% market share

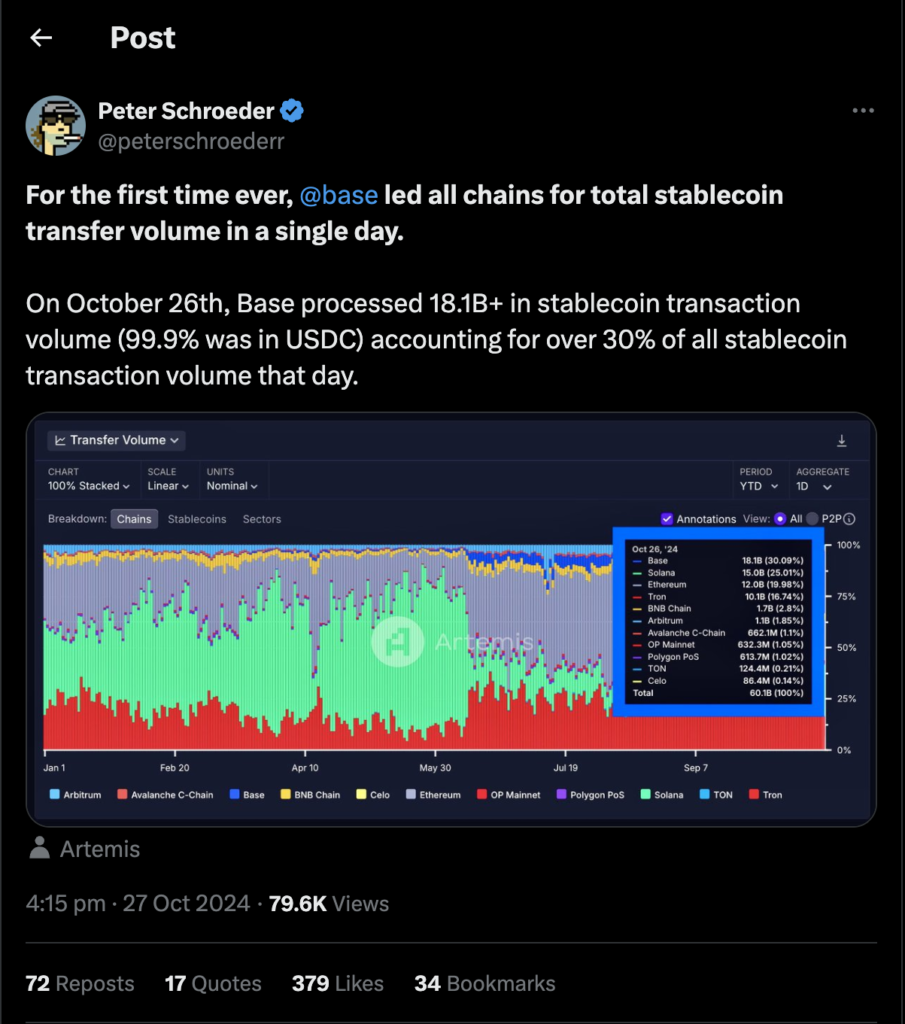

According to data from Artemis Terminal, Base crypto briefly hit the highest daily stablecoin transaction volume. Although a momentary achievement, this lead in stablecoin volume is a testament to Base’s current momentum in transaction activity and appeal within the DeFi ecosystem.

Peter Schroeder, a renowned analyst, shone a light on Base’s remarkable activity in an October 27 post on X (formerly known as Twitter)

With more than 30% market share of stablecoin volume, Base was higher than established platforms such as Solana, Ethereum and Tron. Solana wasn’t far behind with 25%, while Ethereum and Tron had 20% and 16.7% respectively.

Most of the transferred volume was in Circle’s USDC stablecoin, whose $37.3 billion worth of tokens was worth more than 62% of the volume. Next, with nearly 30% of the volume, was almost $18 billion worth of Tether’s USDT tokens, with DAI stablecoins in third with $4.5 billion, reflecting a mere 7.4% of the total.

Base’s sudden rise did not go unnoticed by prominent industry figures. Circle CEO Jeremy Allaire took to X to share his perspective, highlighting that if Base’s stablecoin volume trend continues, USD Coin (USDC) alone could reach an annualized transaction volume of $6.6 trillion on Base.

Some renowned industry stakeholders weighed in on the announcement.

Circle’s CEO Jeremy Allaire posted on X affirming that if Base’s volume trend persists, USDC could reach an annualized transaction volume of $6.6 trillion on the network.

X user and the head of DeFi for Base, Johnny_TVL, posted.

“Stablecoins provide a great opportunity to increase economic freedom. [Base] enables builders to create great products using stablecoins, and those products are rapidly gaining traction.”

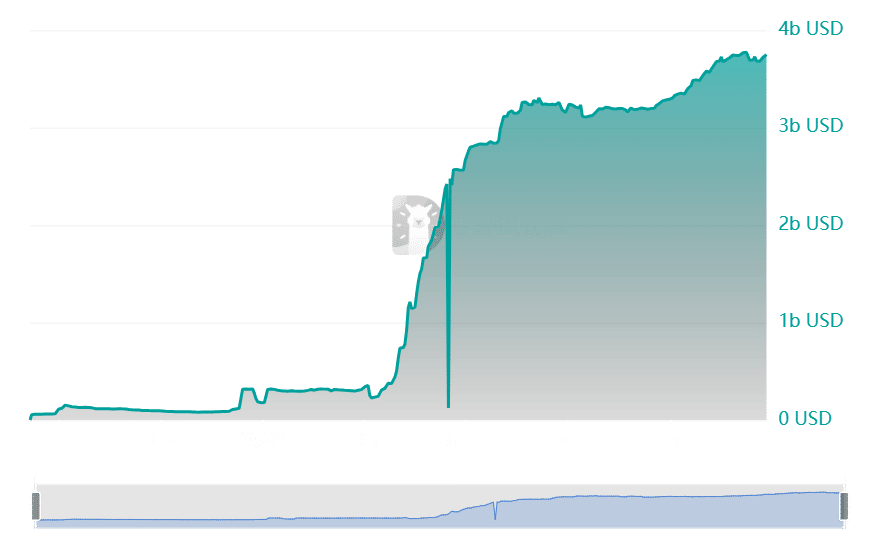

Furthermore, per data from DeFiLama, stablecoin volume on Base hit an all-time high of approximately $3.77 billion around mid-October. As of this writing, the volume stands at around $3.75 billion.

Base crypto sets record in transaction volume

Apart from recording the highest stablecoin transaction volume among blockchain networks, Base also recorded another milestone.

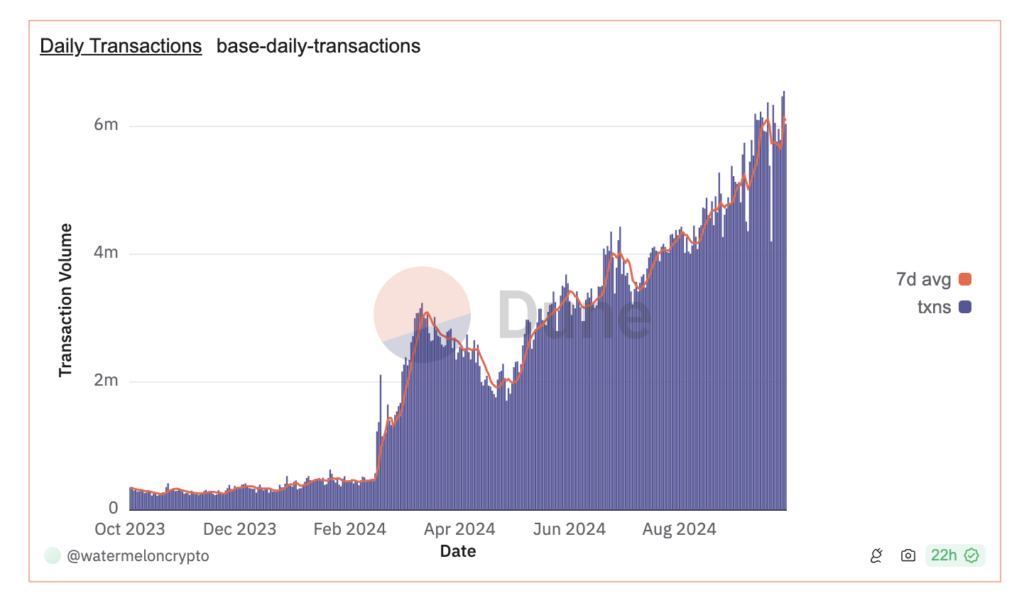

According to Dune Analytics, Base reached a record 5.6 million daily transactions, a 20% increase from the last month. It was unsurprising as it followed a trend of increased daily transactions throughout the busy month of October.

Furthermore, the Base’s total value locked (TVL) has displayed a solid upward trend. While slightly down from its peak of $2.54 billion on October 21, the TVL remains close to $2.5 billion. It is the second largest TVL among Layer-2 platforms, only behind Arbitrum.

The recent surge in transaction volume suggests increased adoption and implies that Base is quickly becoming a choice layer-2 solution for conducting large transactions.

Since its launch, Base has become an appealing layer for developers and end-users. This is due to its low fees and other features of Ethereum, such as scalability, security, and stability. Still, Base lags behind the big boys regarding total stablecoin volume.

What is the way forward for Base?

Although Base’s recent growth is outstanding, it still has some way to fully compete with more established blockchains.

For context, until June 2024, Solana has processed over $8.6 trillion in stablecoin volume, ahead of Ethereum with $6.1 trillion. The former was responsible for 60% of the total stablecoin volume across all significant blockchain networks.

Base is far from these numbers. Nonetheless, Base’s incremental growth – high transaction volume and TVL – points to a potential change of guard. Solana’s historical dominance in stablecoin transactions may be challenged at this juncture.

Solana whales purchase $35M in SOL

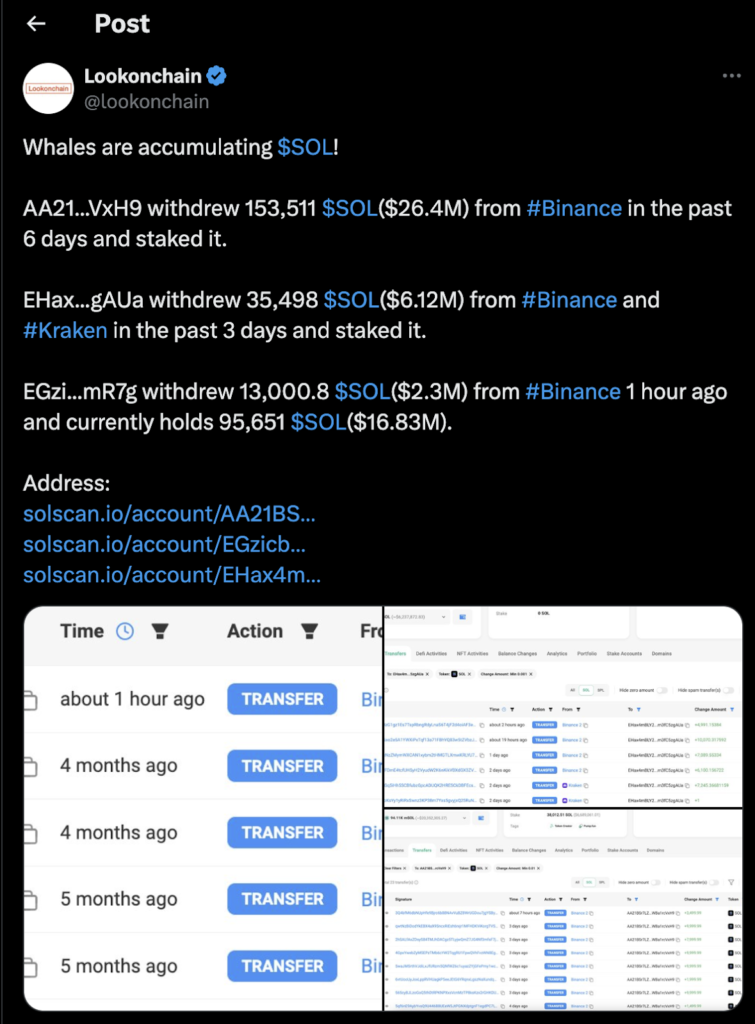

Blockchain-based transaction tracker Lookonchain posted on X that Solana whales amassed a massive 202,400 SOL worth $35 million the previous week. The whales have also staked their SOL tokens, indicating optimism among traders.

Only three whales made these remarkable SOL acquisitions. Plus, the withdrawals were made from Binance and Kraken cryptocurrency exchanges.

The whale wallet address “AA21BS” withdrew more than 153,511 SOL worth $26.4 million. Another one, “EHax,” withdrew 35,498 SOL worth $6.12 million and the last address “EGzi,” withdrew 13,000.8 SOL worth $2.3 million.

The data suggests that bulls dominate SOL, implying that bets on the long side are mainly on the high side. Yet, what effect does this have on the price of SOL?

What do the metrics say?

Even with the optimistic viewpoint, SOL on-chain metrics indicate a mixed sentiment.

According to Coinglass, SOL’s Long/Short ratio is 1.03, hinting at a bullish sentiment. Yet, its open interest has reduced by 7%, implying a possible liquidation of short positions even with the current rally.

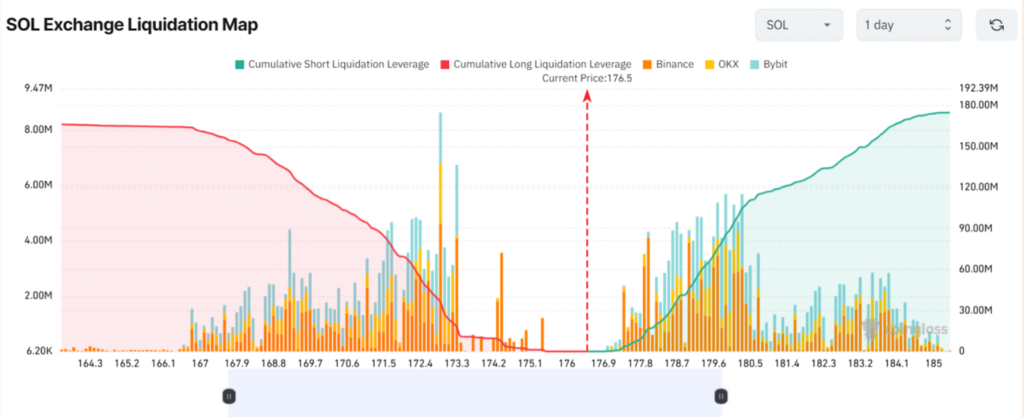

For now, the primary resistance levels are $172.9 on the lower side and $178 on the upper side.

If SOL’s sentiment remains intact and its value increases to $178, almost $16.70 million short positions will be liquidated. On the other hand, if the sentiment changes and the price decreases to $172.9, roughly $36.1 million worth of long positions will be liquidated.

Bitcoin ETF inflows increase to 22%

Since Bitcoin (BTC) exchange-traded funds (ETFs) were introduced to the ecosystem, it has increased massively in popularity.

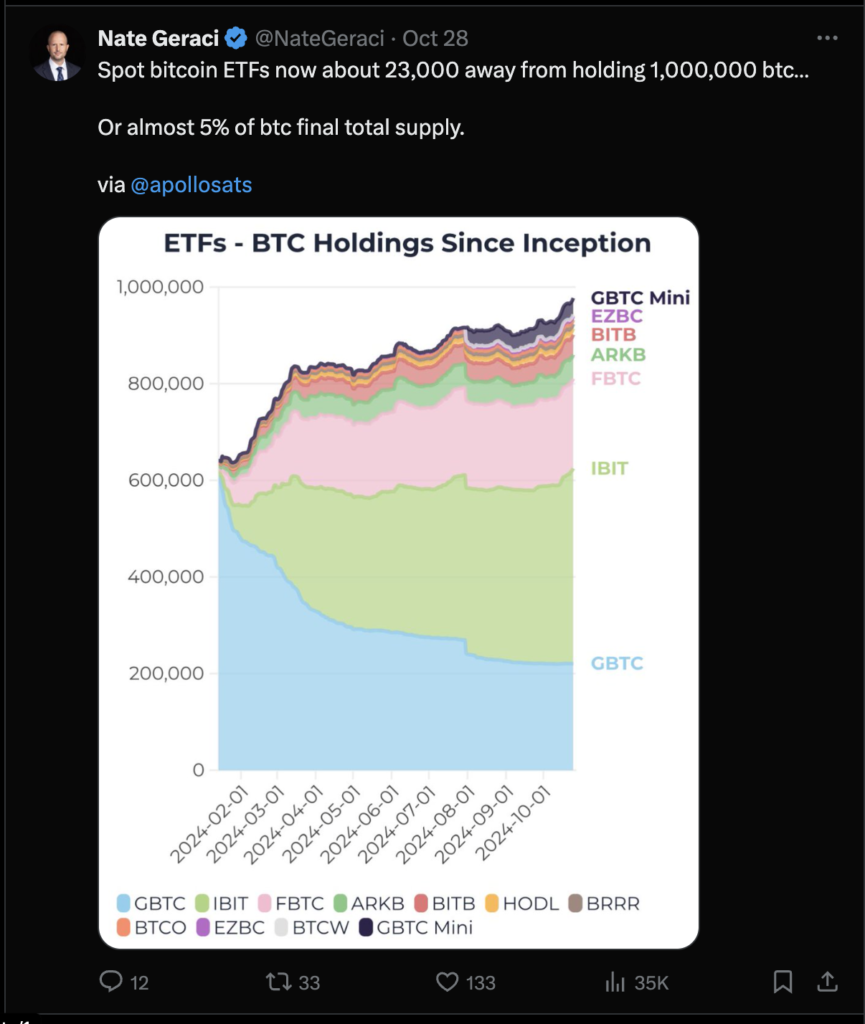

Now, Bitcoin ETF has accumulated inflows that have surpassed $22 billion. Some of the most active ETFs include BlackRock’s IBIT, which has $23 billion in inflow and Grayscale’s GBTC, with outflows of up to $20 billion.

As has been happening, the recent momentum in BTC ETFs continued, with almost $1 billion in net inflows documented last week. This makes it the most notable demand recorded in the previous six months.

Unsurprisingly, industry executives have chipped in with their two cents.

Nate Geraci, President of ETF Store, shared his thoughts on X (formerly Twitter):

Charles Edwards, Founder of Capriole Investments and The Ref, also noted on X:

What is behind the surge?

Based on an insightful report from crypto exchange Binance, retail investors are behind the growing demand of Bitcoin ETFs. Per the report, retail investors hold a huge 80% of the total assets in these ETFs.

The report documented,

“Spot Bitcoin (“BTC”) Exchange-traded funds (“ETFs”) have accumulated over 938.7K BTC (US$63.3B), and when including other similar funds, this figure comprises 5.2% of Bitcoin’s total supply.”

This inflow increase proves the importance of retail investors in the current market situation. Moreover, it outlines an evolution in the investment landscape, wherein investors are now more active and are influencing significant interest in Bitcoin through financial assets.

In addition, the report underscored a notable increase in activity within crypto ETFs as net inflows surpass 312,500 BTC (about $18.9 billion) and positive inflows recorded within 24 of the past 40 weeks.

These ETFs are reducing daily BTC in circulation by 1,100 – an aggressive buying approach. Consequently, this decrease in supply, coupled with increasing demand could push Bitcoin prices up and expand acceptance of Bitcoin investments through ETFs.

Furthermore, the report also outlines that spot BTC ETFs have totally outmatched early Gold ETFs, documenting net inflows of about $18.9 billion within a year, compared to a mere $1.5 billion for Gold ETFs. This has attracted more than 1,200 investors to Bitcoin ETFs – a 95% increase from Gold’s first year.

Conversely, Ethereum (ETH) ETFs have floundered, experiencing outflows of about 43,700 ETH (approximately $103.1 million) and negative flows in eight of the last eleven weeks.

To that end, Bitcoin ETFs have a more significant impact on market dynamics when adjusted for spot trading volume. This reflects more robust demand from institutions and increasing adoption.

GRASS price exceeds $1 after listing

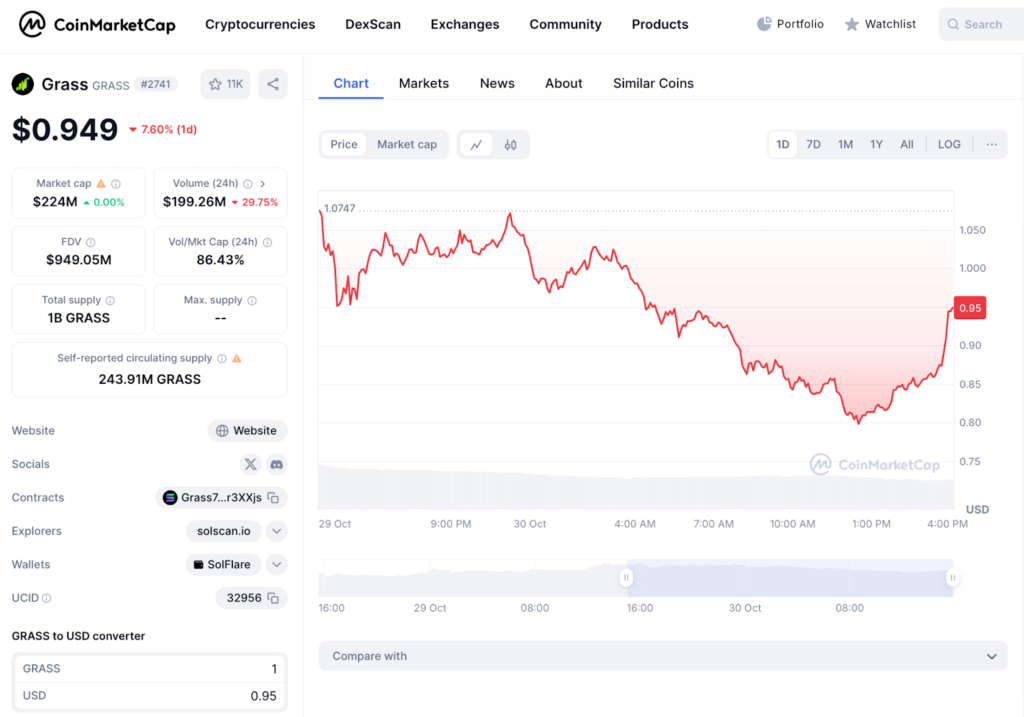

GRASS, the DePin project, has officially started trading on different crypto exchanges following its airdrop. Before now, GRASS was trading around $0.73 in the pre-market, but since its listing, the price surged to $1.10.

This increase indicates that the crypto market has valued GRASS’ fully diluted valuation (FDV) at more than $1 billion. For context sake, FDV refers to the total market capitalization of a cryptocurrency project when all its tokens, plus the ones not yet in circulation, are evaluated.

After the euphoria of surpassing $1, GRASS retraced to $0.95. Yet, this price remains higher than its pre-market level, indicating sustained investor optimism for this newly launched token.

To that end, GRASS is enjoying positive market sentiment, although daily unlocking activities can affect its price. With over $200 million traded, it has surpassed the likes of Render (RENDER), Bittensor (TAO), Filecoin (FIL), amongst others.

Still, it hasn’t all been rosy for the token as there has been a bit of a controversy regarding the initial circulating supply.

According to the monthly GRASS token distribution schedule, the initial circulating supply of GRASS is 25% of the total 1 billion GRASS. However, a recent analysis by an investor indicates that the actual circulating supply may be lesser.

Closing Remark

With Base leading blockchain networks in stablecoin transactions and daily activity, many are wondering if it can be a major threat to the dominance of the likes of Solana and Ethereum.

With the large number of SOL tokens purchased by Solana bulls, there can be further bullish actions. This can increase volatility and positive market sentiment.

Finally, the increase in Bitcoin ETF inflow indicates that investors are now more active and are influencing significant interest in Bitcoin through financial assets. Will that lead to a direct impact on Bitcoin’s price? Time will tell.

Zypto is committed to offering you the best and most secure crypto services. Our crypto services are tailored to cater to all your needs, with a smooth and fast onboarding process to get you started in the crypto space.

With the multi-faceted Zypto App, you can enjoy easy access to thousands of crypto and fiat currencies, fast cross-chain swaps and referral bonuses, amongst others.

Moreover, with Zypto Pay, you get an advanced crypto payment gateway for your business with with zero fees, easily integrates with online or POS checkouts and executes quick transactions.

What are your thoughts on this week’s crypto news? Did any particular development stand out for you? Leave a comment below and let us know your perspective.

Which milestones did Base mark in October?

Base was the blockchain network with the highest stablecoin transactions and daily activity.

Can Base become the dominant network for stablecoin transactions?

Although Solana and Ethereum, among others, are more developed blockchain networks, Base isn’t far behind. As shown by its all-time high transaction volume and TVL, Base is well on its way to the top.

How much SOL did the Solana whales buy?

Three Solana whales purchased 202,400 SOL worth $35 million.

Why did Bitcoin ETF inflows increase to 22%?

Based on a Binance report, retail investors are behind the growing demand of Bitcoin ETFs as they hold a huge 80% of the total assets in these ETFs.

Why is GRASS token enjoying positive market sentiment?

After GRASS launched, the token surpassed $1. With its price higher than its pre-market level, this indicates sustained investor optimism for the newly launched token.

0 Comments