Welcome to the third news this month.

The stablecoin industry keeps growing to new heights, with the reserves hitting a record $50B, as well as Amazon and Walmart making inroads. Similarly, TRON’s USDT supply has surged massively within months. Then, Solana celebrates milestones with Bybit and a proposed ETF approval.

Let’s get rolling. Shall we?

Amazon and Walmart plan to launch stablecoins

According to Wall Street reports, both Amazon and Walmart are evaluating a move into the stablecoin industry. It noted that their effort is part of a broader push to improve payment efficiency and reduce processing fees.

The report stated that the two retail giants are considering multiple options, including issuing their digital currencies or collaborating within a stablecoin consortium.

This initiative could mark a significant shift in how retail payments are processed. It would enable merchants to avoid traditional financial intermediaries, which often charge high fees and impose slow settlement times.

In contrast, stablecoins guarantee near-instant transaction finality and considerable cost reductions.

To that end, market observers pointed out that Amazon and Walmart’s initiative reflects an increasing desire among large companies to modernize payments using blockchain-based infrastructure.

Despite the growing interest in these assets, the success of Amazon and Walmart’s stablecoin ambitions may hinge on the evolving US regulatory environment.

US lawmakers are reviewing the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act). The bill recently advanced in the Senate and will soon be up for a final vote.

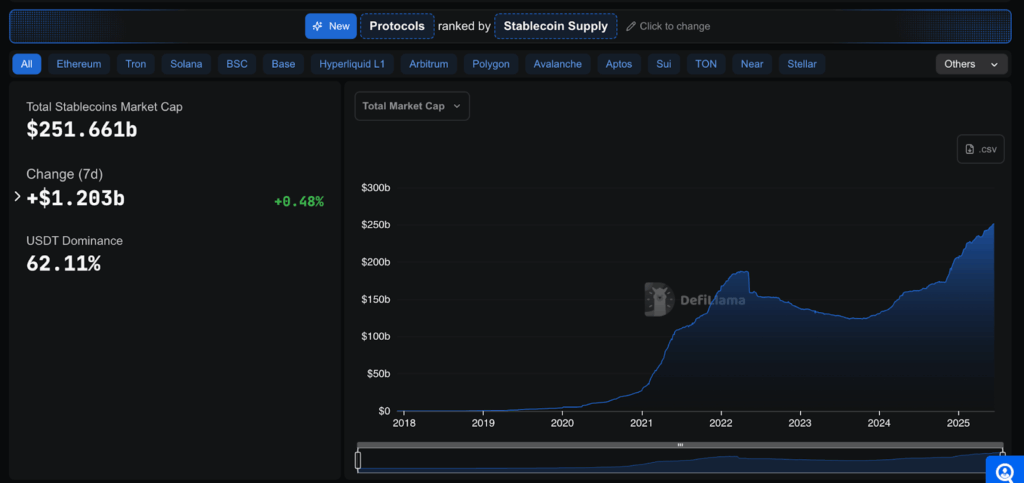

The proposed law aims to stabilize the $251 billion stablecoin market by setting clear rules for issuance, reserve backing, and consumer protection. Its supporters argue that the regulatory clarity would boost public trust and motivate innovation in the emerging industry.

However, the current version of the GENIUS Act explicitly prevents non-financial public companies from issuing stablecoins directly.

This limitation could pose a major hurdle, as some companies would need to obtain regulatory exemptions or operate through licensed banking subsidiaries. This would still involve navigating approvals from the Federal Reserve and the Treasury.

TRON’s USDT supply surges by 36% in 6 months

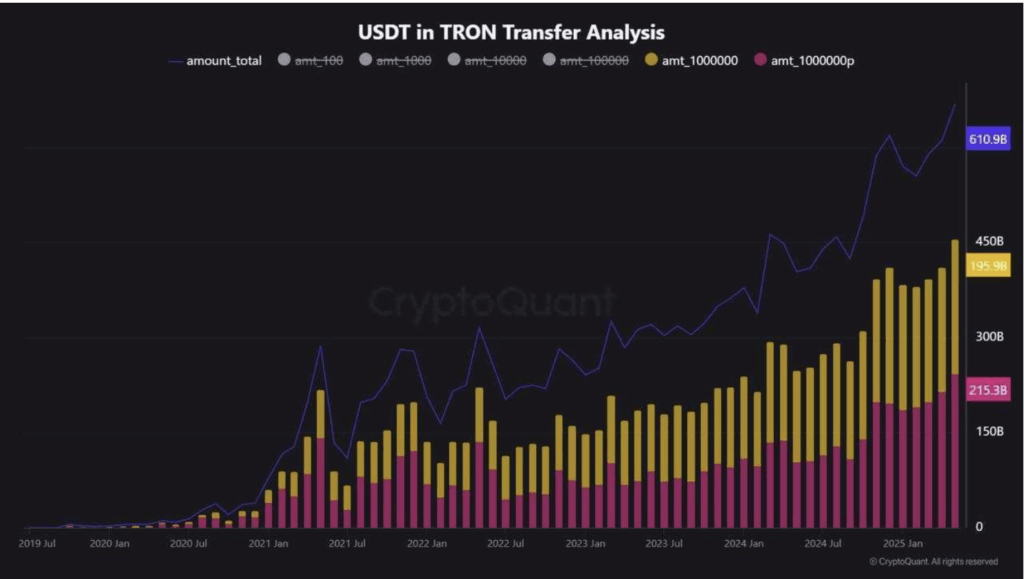

Crypto whales are increasingly turning to TRON for moving USDT, with on-chain data displaying a record $694.54 billion in transfers during May.

Almost 60% of these transfers came from transactions over $1 million. Consequently, USDT supply on TRON has increased by $21 billion in just six months, indicating a 36% growth.

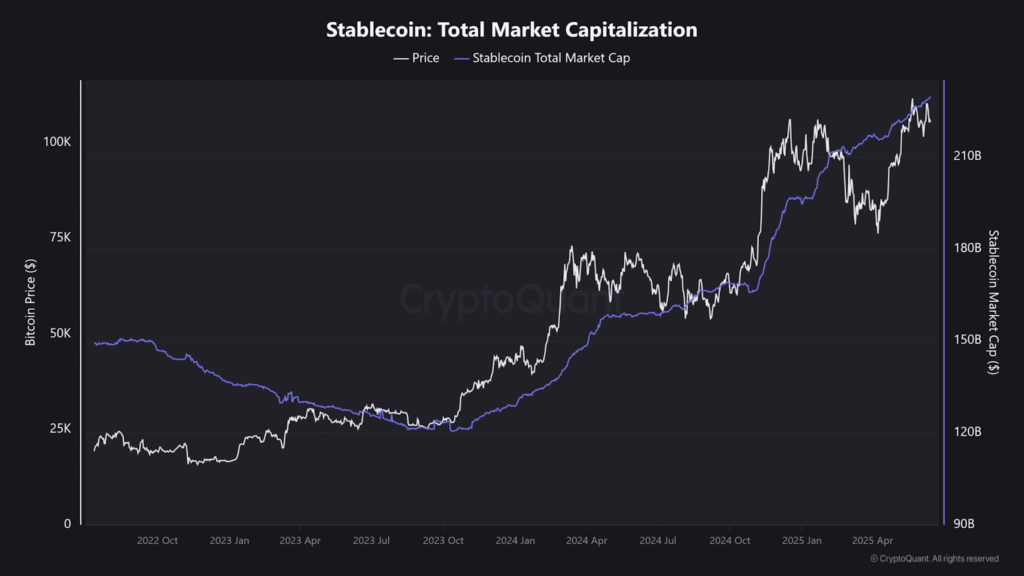

Stablecoins are increasingly gaining traction as a cornerstone of crypto adoption, with both on-chain activity and institutional interest reinforcing their growing influence.

The CryptoQuant chart below shows the total monthly USDT transferred on TRON. In May, it hit an all-time high of $694.54 billion, of which 59% of that volume came from transactions over $1 million.

The increase solidifies TRON’s role as the leading USDT transfer network and indicates how stablecoins have become vital for large-value transactions and institutional capital flows.

Tron’s magnificent growth in transaction volume and stablecoin activity is redefining its role in the crypto ecosystem. Last month, TRX achieved a new all-time high (ATH) in monthly transfer volume, reaching 490.3 billion tokens moved, equivalent to $121.2 billion at the time.

That lead became more evident this year as TRON surpassed Ethereum in total USDT supply and daily transactions. The number has since increased further, jumping from $58 billion to $79 billion – an impressive 36% increase.

With over 2.4 million daily USDT transfers and 423.7 billion in daily volume, TRON is quickly becoming the most preferred network for stablecoin payments globally.

The timing couldn’t have been any better, as the US Treasury forecasts that the stablecoin market could get to a $2 trillion market cap by 2028. This is due to rising institutional demand, tokenization of real-world assets, and broader payment integrations.

Solana ETF approval expectations increase

Seven asset managers revised their applications to launch Solana-based exchange-traded funds (ETFs), submitting amended filings to the US Securities and Exchange Commission (SEC) last weekend.

Industry expert Nate Geraci reported that the firms include Franklin Templeton, Grayscale, Bitwise, VanEck, 21Shares, Fidelity, and Canary.

According to him, the firms’ filings build upon recent developments and mark a shift in tone between the regulator and ETF issuers.

The amended filings specifically manage concerns raised by the Commission, including the use of in-kind redemptions and the role of staking in fund operations.

Meanwhile, one of the most notable changes is the inclusion of language around staking Solana tokens.

While formerly a gray area, recent SEC statements clarified that staking does not automatically make a product a securities offering. This interpretation has given ETF hopefuls room to consider staking as part of their fund strategy, offering additional yield to investors.

Despite this level of progress, the chances of an imminent approval remain slim.

Another analyst James Seffyart outlined parallels to the drawn-out process for spot Bitcoin ETFs and believes further correspondence will likely follow before any green light is given.

He said,

“I think there needs to be a back and forth with SEC and issuers to iron out details so I doubt it. If anyone remembers the Bitcoin ETF launch there were A LOT of filings over the preceding couple months before launch.”

Furthermore, despite the surge in Solana ETF activity, BlackRock, the world’s largest asset manager has yet to join the fray.

BlackRock’s crypto ETF footprint is already dominant. Its iShares Bitcoin Trust (IBIT) recently completed a 31-day inflow streak and now ranks among the top 25 ETFs by assets under management in the US – a feat described as historic by many.

Its Ethereum ETF has also captured a significant market share, with cumulative net inflows of more than $5 billion.

Given this context, Geraci believes a Solana filing from BlackRock is inevitable.

He stated,

“I still fully expect BlackRock to file for spot Solana and XRP ETFs. As the leader in spot BTC and ETH ETFs, it would make zero sense to cede other top crypto asset ETF categories to competitors.”

Bybit is launching a DEX on Solana

Bybit, one of the world’s leading centralized crypto exchanges, is preparing to enter the DeFi space with the launch of Byreal. This is its first on-chain leading platform.

Byreal is expected to go live on the Solana network, with its testnet debut set for June 30 and the mainnet launch expected in the third quarter of this year.

According to Bybit, Byreal is part of its broader ambition to bridge the gap between centralized and decentralized trading.

It incorporates features like Request for Quote (RFQ) and Concentrated Liquidity Market Maker (CLMM) routing to achieve this. These tools are designed to shield users from maximal extractable value (MEV) attacks and provide more efficient price execution.

Byreal will also roll out innovative features to improve user access and token distribution. These include the “Reset Launch” mechanism, which uses Smart Price Laddering and the Faishare Engine to ensure fairer token allocations.

Furthermore, the DEX will include a Revive Vault, offering curated yield opportunities for assets such as bbSOL and other Solana-based tokens.

Bybit CEO Ben Zhou described Byreal as a critical step in the company’s vision of hybrid finance – an emerging model that combines the advantages of centralized and decentralized exchanges.

This move sets it apart from competitors like Coinbase and Kraken, which have concentrated efforts on Layer 2 solutions. Instead, Bybit is positioning Byreal to go head-to-head with leading DEX platforms such as Uniswap, PancakeSwap, and Hyperliquid.

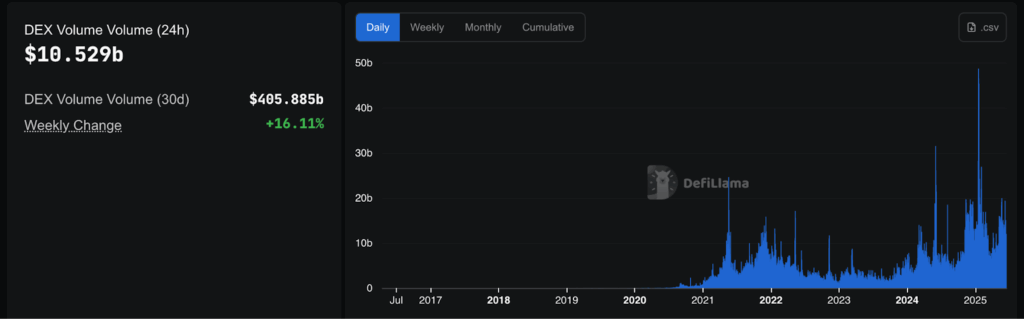

Notably, the timing aligns with renewed interest in decentralized trading activities, which grew by more than 15% over the past week.

Meanwhile, Byreal reflects Bybit’s renewed focus on strengthening its core products, following the $1.4 billion security breach in February.

Beyond the crypto industry, Bybit recently expanded its product suite to include US equities, commodities, and index trading.

Stablecoin reserves hit record $50B

Stablecoin reserves on crypto exchanges have surged to a record $50 billion, indicating rising market confidence and substantial liquidity.

According to CryptoQuant’s on-chain data, this marks the highest level since stablecoins were introduced.

The sharp uptick signifies that investors are preparing to re-enter the market – this time with significantly greater buying power – possibly paving the way for bullish momentum across digital assets.

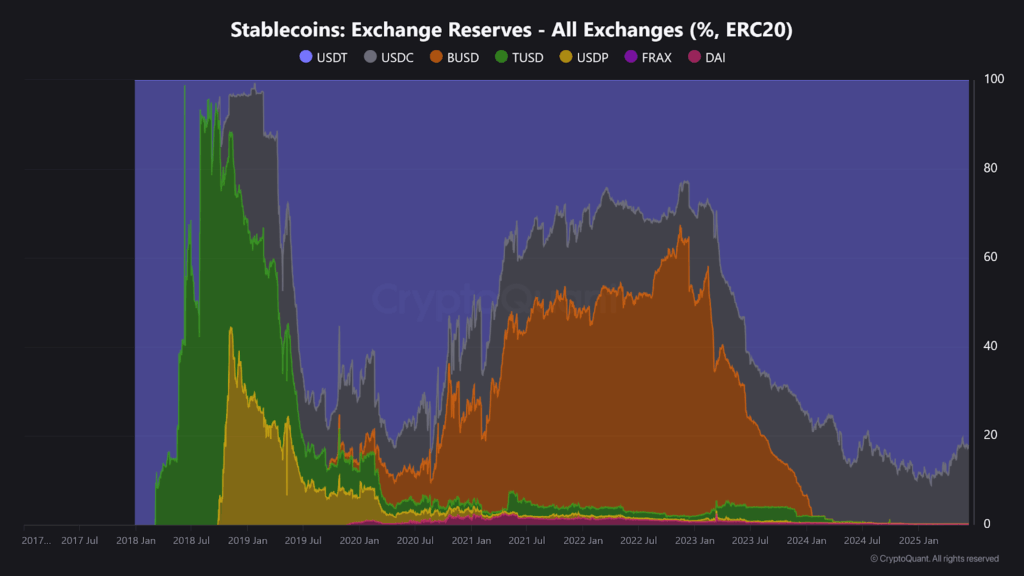

USDC, the second-largest stablecoin by market cap, almost doubled its presence on exchanges.

This sharp rise underscores a shift in investor preference, especially as USDC continues to benefit from its ties to regulated institutions and U.S. banking policies.

USDT remains the dominant player, but USDC’s growth hints at wider adoption and growing trust in fully-backed stablecoins, mostly in light of recent regulatory clarity in the United States.

The broader stablecoin market cap now stands at an all-time high of $255.9 billion, as of this writing. That is a 17% increase year-to-date, mainly driven by fresh demand from both institutional and retail investors.

Recent efforts by the U.S. policymakers to establish clearer regulatory guidelines around stablecoins appear to be having a positive effect. Market participants now have greater confidence that these dollar-pegged assets are being recognized as legitimate financial instruments.

As geopolitical tensions increase, investors are increasingly turning to crypto as a safe and flexible store of value, notably favoring stablecoins.

Their regulatory alignment, price stability, and transparency, coupled with a dollar peg, make them an ideal hedge against currency devaluation and a seamless entry point into crypto markets.

All indicators currently point to stablecoin dominance. But that begs the question: what is the implication for altcoins?

With stablecoin reserves on exchanges reaching all-time highs, institutional interest in altcoins could soon translate into active deployment.

The early signs are already visible – Bitcoin and Ethereum are regaining strength, and having stablecoins on hand enables traders to act swiftly when opportunities arise.

As liquidity builds and crypto whales reload their reserves, the stage may be set for the next bullish run. It may be sooner than many expect.

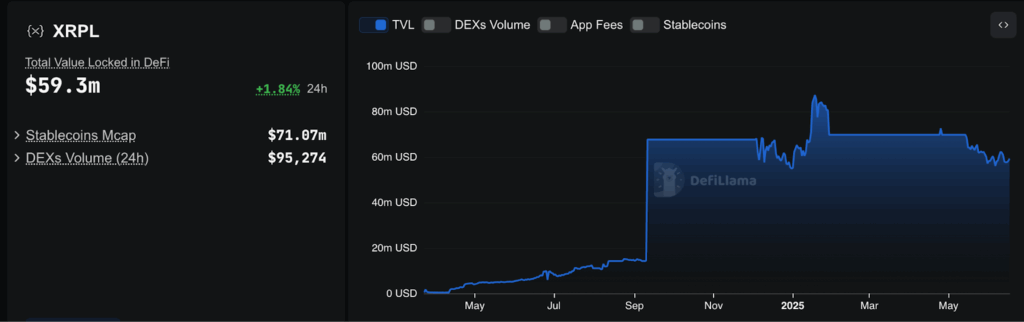

XRP hits whale wallet record

On-chain data in June signals a remarkable surge in activity and investor interest across the XRP Ledger (XRPL) ecosystem.

This comes as XRP received positive news and gained attention during crypto reserve accumulation by publicly listed companies.

According to the latest data from Santiment, the number of daily active XRP addresses exceeded 295,000 over the past week. That’s several times higher than the average of 35,000 – 40,000 addresses per day in the past three months.

This sharp rise indicates increased network usage, reflecting growing interest from the broader crypto community.

More notably, the number of XRP whale wallets holding at least 1 million XRP has now exceeded 2,700, marking a new all-time high in the asset’s 12-year history.

At current prices, each whale wallet holds approximately $2.25 million in value. The growth in whale addresses signals increasing confidence from both institutional and high-net-worth individual investors.

Charles Hoskinson, founder of Cardano, recently confirmed that the Cardano network is preparing to fully integrate with the XRP ecosystem. This includes Lace wallet support for XRP and exploration of XRP-based DeFi solutions such as Ripple’s RLUSD stablecoin.

Furthermore, Canada is set to launch its first XRP ETF, managed by Purpose Investments, on June 18, 2025. This milestone indicates the growing interest of traditional financial institutions in digital assets like XRP.

Some publicly traded companies, such as Worksport and VivoPower, have already chosen XRP as a strategic reserve asset.

However, the total value locked (TVL) on XRPL remains low, around $60 million, and has shown little change since September 2024. Daily DEX volume on XRPL also falls short of $100,000.

These figures indicate that XRP’s influence in the DeFi space is still limited and falls short of investor expectations.

Zypto Launches the Million Dollar Crypto Card

Zypto has just launched the Million Dollar Crypto Card – their Premium Physical VISA Card with transaction limits rarely seen in either the tradFi or crypto space.

Users can now spend up to $1,000,000, with individual transactions reaching $150,000 in-store and $175,000 online.

Despite the high limits, the card carries no monthly fee, and remains fully DeFi. Load from any DeFi wallet, and no need to deposit assets into a centralised exchange first. It’s available to order now exclusively inside the Zypto App.

Get full details here.

Closing Remark

Amazon and Walmart’s interest suggests that major retailers are preparing for a future where stablecoin payments become part of everyday commerce. This could mark a pivotal era in the crypto industry.

TRON’s rapid growth signals a major shift in how digital dollars move across the crypto ecosystem. The revised applications by the asset managers indicate that an approval for the Solana ETFs may be possible.

Byreal aims to offer users a seamless experience with CEX-level liquidity, rapid execution, and low slippage, all while preserving the transparency and autonomy native to DeFi.

Stablecoins’ record increase, led by institutional and retail investors, points to continued dominance. That begs the question: is the next bull run near?

FAQs

What plans do Amazon and Walmart have?

According to Wall Street reports, both Amazon and Walmart are evaluating a move into the stablecoin industry.

How high did TRON’s USDT supply surge to?

USDT supply on TRON has increased by $21 billion in just six months, indicating a 36% growth.

Which firms revised their Solana ETF applications?

They include Franklin Templeton, Grayscale, Bitwise, VanEck, 21Shares, Fidelity, and Canary.

What does Bybit plan to launch?

Bybit plans to launch Byreal, a DEX, on Solana this year.

Which level did stablecoin reserves reach?

Stablecoin reserves on crypto exchanges have surged to a record $50 billion.

0 Comments