There were some updates last weekend after President Trump met with other crypto leaders. Moreover, Trump’s comments caused market changes, and Bitcoin whales made some strategic moves.

Let’s dive in.

5 key crypto moves Trump has made in March

Last Friday, President Donald Trump hosted crypto leaders at the White House following his executive order designating a strategic crypto reserve.

The meeting signaled a welcome departure from the previous administration’s stern approach to digital asset regulation. It further positions the U.S. as the “crypto capital” of the world.

Here are five vital conclusions in March that indicate a significant policy shift regarding some of Trump’s crypto campaign promises.

Trump formalizes “never sell” BTC strategy

Trump told the attendees,

“From this day on, America will follow the rule that every Bitcoin(er) knows very well—never sell your Bitcoin.”

The executive order explicitly forbids the government from selling BTC in reserve.

Practically, this could lead to more expansive institutional adoption, heightened regulatory clarity, and accelerated crypto integration into mainstream finance.

In time, it could also position the U.S. to set global standards for crypto policy, enable domestic innovation, and encourage substantial geopolitical influence through digital asset holdings.

Crypto reserve to be funded with seized assets

The crypto reserve will be initially funded using an estimated 198,100 bitcoins valued at $16.7 billion, which the government already holds through civil and criminal asset forfeitures.

Such a move could set a precedent for other countries, normalizing the concept of sovereign crypto holdings funded by law enforcement actions. It could also introduce complex new legal and policy questions about asset seizure practices and governments’ position in crypto.

The dollar remains the reserve currency amidst stablecoin integration

Treasury Secretary Scott Bessent confirmed the administration would maintain the dollar as the world’s reserve currency while integrating stablecoins to ‘augment’ the U.S. balance sheet into that framework, balancing traditional finance with crypto innovation.

While this approach may increase the mainstream adoption of stablecoins, it also attracts intense scrutiny regarding regulatory oversight, financial stability, and the implications of stablecoin growth for monetary policy and traditional banking sectors.

The clear difference between BTC and other digital assets

The executive order clearly distinguishes Bitcoin and other digital assets, producing a distinct set of custodial accounts collectively known as the “United States Digital Asset Stockpile” for crypto beyond Bitcoin.

Trump stated on Sunday that such a stockpile would precisely include Ripple (XRP), Solana (SOL), and Cardano (ADA), sending market prices for those assets briefly soaring.

A White House official mentioned,

“I think the president just gave five examples of cryptocurrencies in his post. Those five have to be the largest by market cap, so I think people are reading into that a little bit too much.”

They added,

“The bottom line is, I think that what we’ve announced here is consistent with what the president has always said about the space.”

Building a “digital Fort Knox” with no taxpayer funding

President Trump’s crypto advisor, David Sacks, highlighted that the reserve would operate as “a digital Fort Knox” with no taxpayer funds for obtaining digital assets, addressing concerns about fiscal responsibility.

David Sacks mentioned that the Trump administration has not yet discussed selling government-held assets like gold to increase its Bitcoin holdings, primarily for the strategic crypto reserve. However, he noted key federal agencies will soon investigate possible strategies.

“Ultimately, it’ll be up to the Secretary of the Treasury and also the Secretary of Commerce to determine if there are budget-neutral ways of adding to our Bitcoin reserve. But we have not had conversations about what those might be yet.”

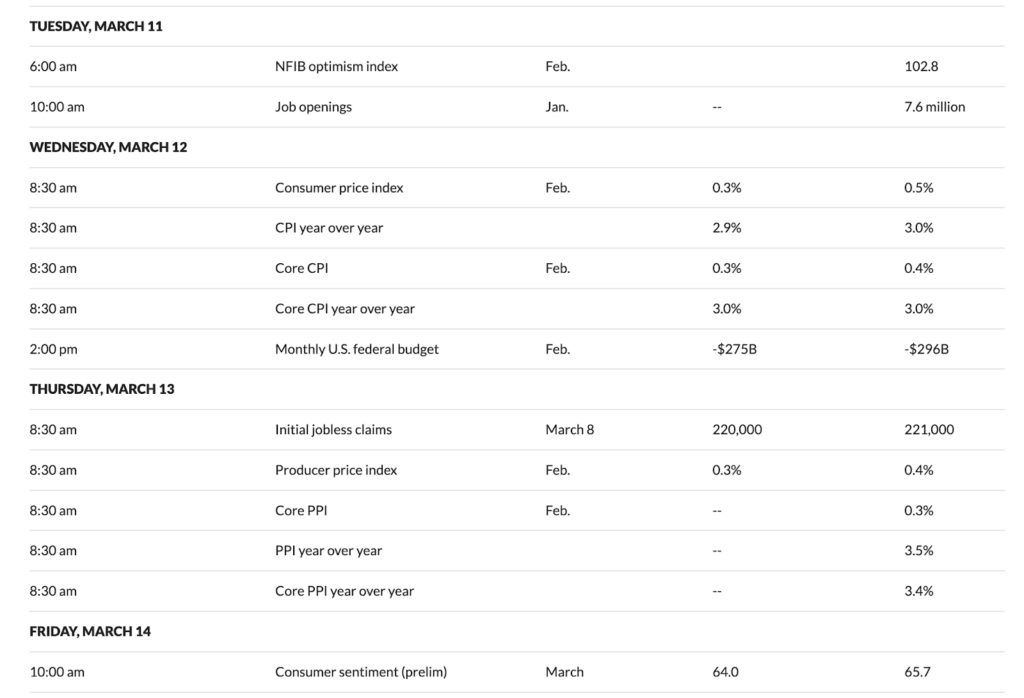

5 US Economic Data points set to impact BTC sentiment

With economic developments steadily influencing Bitcoin market sentiment, the crypto market is bracing for volatile days ahead. The key economic data are set to be released this week, starting from Tuesday, and could affect the portfolio of Bitcoin (BTC) holders.

JOLTS

First on the list is the Job Opening and Labor Turnover Survey (JOLTS), which will be released on Tuesday, March 11. This data point could massively swap Bitcoin sentiment by offering insights into the health of the labor market and broader economy.

If the data indicates a strong labor market with high job openings – perhaps surpassing the previous 7.6 million mark – it might indicate steady economic strength. This could reduce expectations for looming Federal Reserve (Fed) rate cuts.

Historically, a strong labor market can strengthen the US dollar and traditional assets like stocks, pushing investors away from riskier assets like BTC. This could diminish Bitcoin sentiment as investors perceive less need for a decentralized hedge against monetary easing.

On the other hand, if job openings come in lower than foreseen, it could elevate recession fears or signal a cooling economy. Such an outcome would result in speculation of Fed intervention through rate cuts. This scenario often boosts Bitcoin’s appeal as a “digital gold” or haven, possibly driving positive sentiment and price momentum among crypto enthusiasts.

CPI

The US CPI (Consumer Price Index) data, which will be released on Wednesday, March 12, could influence Bitcoin sentiment. These data will signal inflation trends that influence Fed policy.

A higher-than-expected CPI forecasted at 2.9% compared to 3.0% might indicate continuous inflation. This would reduce hopes for rate cuts and strengthen the dollar, reducing Bitcoin’s appeal as a hedge. Such a result could reduce sentiment and prices as investors prefer traditional assets.

Conversely, a softer CPI could increase sentiment among crypto traders by fostering expectations of looser monetary policy, weakening the dollar, and boosting Bitcoin as a risk asset.

Initial Jobless Claims

The US Initial Jobless Claims data, due Thursday, March 13, could also sway Bitcoin sentiment by mirroring labor market strength or weakness. If claims drop below the expected 220,000 (following last week’s 221,000), it might signal a strong economy.

This could strengthen the dollar and shift investor’s focus to traditional assets like stocks. Such an outcome would reduce Bitcoin’s appeal as a risk asset, diminishing sentiment.

Meanwhile, higher-than-expected claims suggest economic softening, increasing expectations for Fed rate cuts. This often boosts Bitcoin to hedge against fiat weakness, improving sentiment and prices.

PPI

The US PPI (Producer Price Index) data, scheduled for release on Thursday, March 13, could influence Bitcoin sentiment by displaying wholesale inflation trends.

A higher-than-expected PPI forecasted at 0.3% month-over-month indicates rising producer costs, likely signaling persistent inflation. This could reduce expectations for Fed rate cuts, strengthening the dollar and pressuring Bitcoin as a risk asset, thus negating sentiment.

However, a lower PPI could alleviate fears, boost rate-cut hopes, and improve Bitcoin’s appeal as an inflation hedge, improving sentiment.

Consumer sentiment

The US Consumer Sentiment Index, released on Friday by the University of Michigan, could massively influence Bitcoin sentiment by indicating public confidence in the economy.

A strong reading, above the anticipated 64.0 (based on recent trends), suggests optimism about economic stability, bolstering traditional markets and the dollar.

This could downplay Bitcoin’s allure as a hedge against uncertainty, leading to bearish sentiment among crypto investors, as funds might flow toward equities. On the other hand, a weaker figure than expected could indicate economic uncertainty, buttressing Bitcoin’s appeal as a decentralized asset amid fears of monetary inflation.

This would increase bullish sentiment, and Bitcoin’s strong reading, above the anticipated 64.0 (based on recent trends), suggests optimism about economic stability, bolstering traditional markets and the dollar.

This could downplay Bitcoin’s allure as a hedge against uncertainty, leading to bearish sentiment among crypto investors, as funds might flow toward equities. On the other hand, a weaker figure than expected could indicate economic uncertainty, buttressing Bitcoin’s appeal as a decentralized asset amid fears of economic inflation.

This would increase bullish sentiment and Bitcoin’s price. Due to Bitcoin’s sensitivity to macroeconomic cues, this data could sway trader’s instincts strongly.

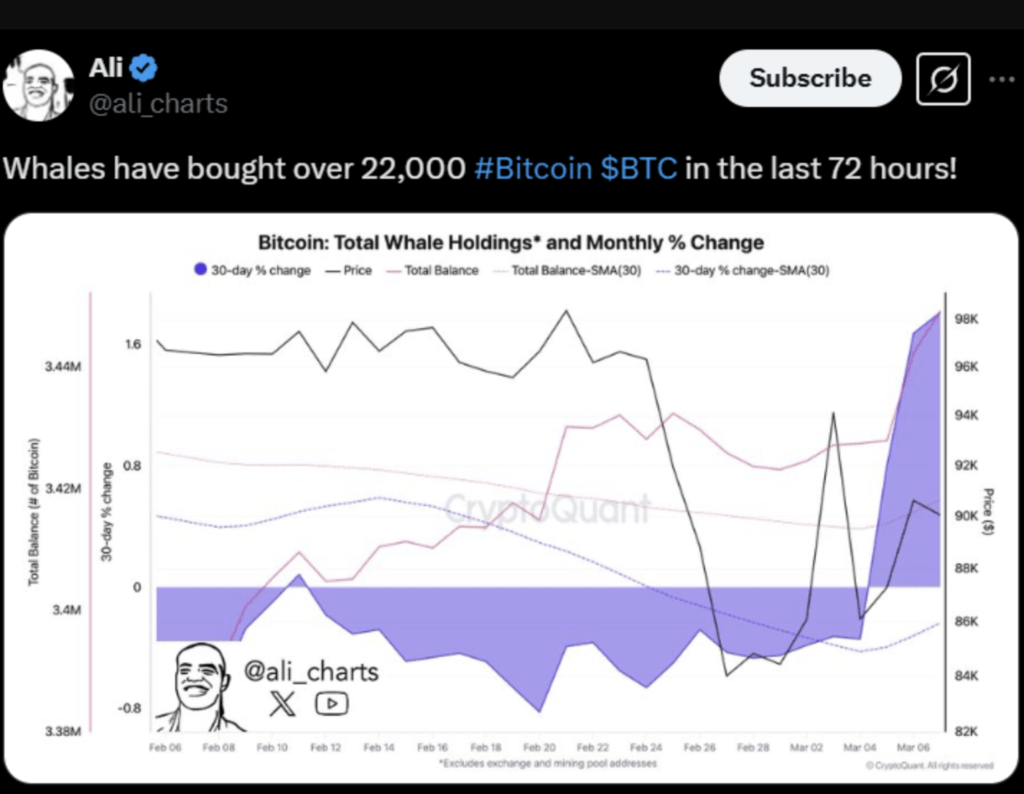

Bitcoin whales acquire over 22k BTC in 3 days

Large Bitcoin holders and retail investors have been acquiring at a high rate lately, indicating strong market confidence. On-chain data revealed that whales accumulated over 22,000 BTC in just three days. This took the total BTC whale holdings past 3.44 million BTC as Bitcoin traded slightly above $80,000.

Likewise, retail demand has increased dramatically. The number of accumulator addresses spiked to an all-time high of 320,000. This dual accumulation by large-scale investors and smaller holders hinted at a coordinated bullish momentum.

Now, the question on everybody’s mind is if the buying spree is sustainable.

What’s the implication?

A more in-depth look at Ali’s on-chain data showed a steady increase in whale Bitcoin holdings throughout February and early March. Over the past month, whales accumulated an estimated 60,000 BTC.

The similarity between whale activity and price movements seemed obvious. Bitcoin’s price fluctuated between $82,000 and $98,000, declining in late February and recovering strongly in early March.

The timing of these purchases indicated that, occasionally, large holders have been strategically acquiring during price corrections.

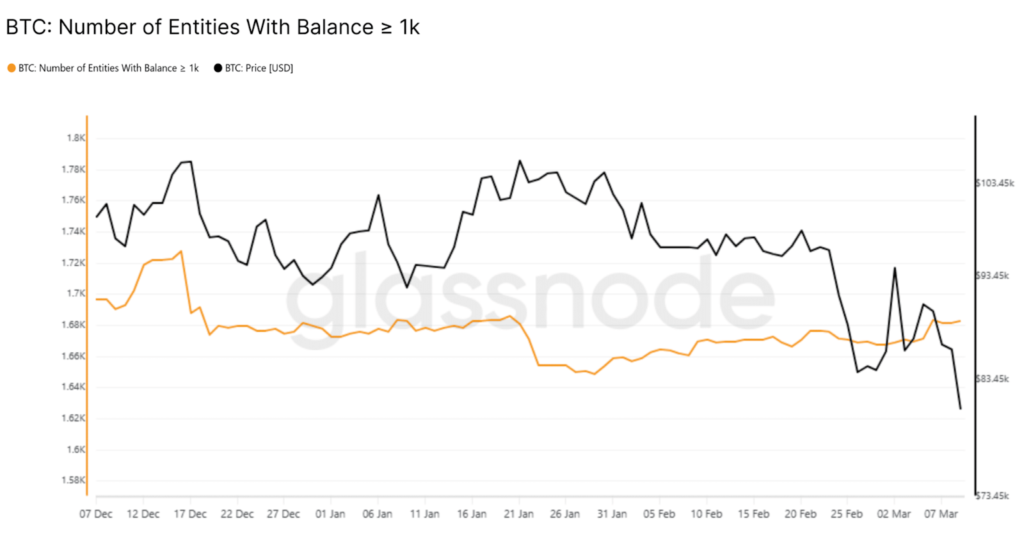

So, are the large holders leaving the table?

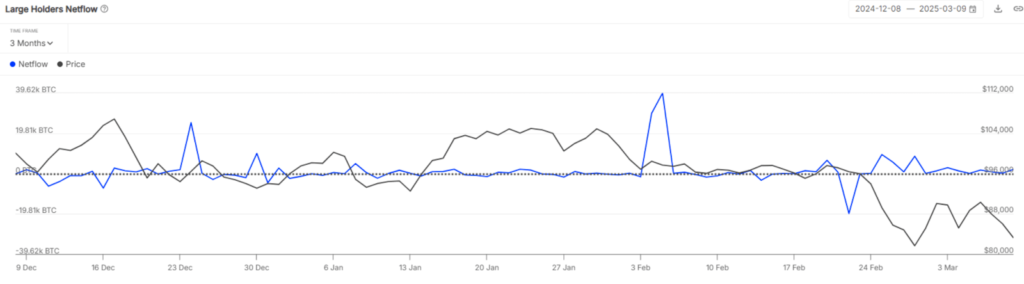

Data from Glassnode and IntoTheBlock revealed essential patterns in accumulation and distribution, indicating their impact on the price action of BTC.

Moreover, entries holding ≥1,000 BTC have reduced their holdings since Bitcoin peaked at $106,159 in January. The number of such entries reduced from 1,720+ in December to 1,683 by March, a decline of about 2.14% over three months.

This seemed to be in tandem with Bitcoin’s price reducing from $106k in January to $80k in March. Such a reduction indicated that whales either took profits or redistributed their holdings.

Between 7 and 9 March, whale entities experienced a sharp drop, which coincided with Bitcoin’s price falling from $84,197 to $80,795. Typically, such declines indicate major sell-offs or capital rotation into other assets.

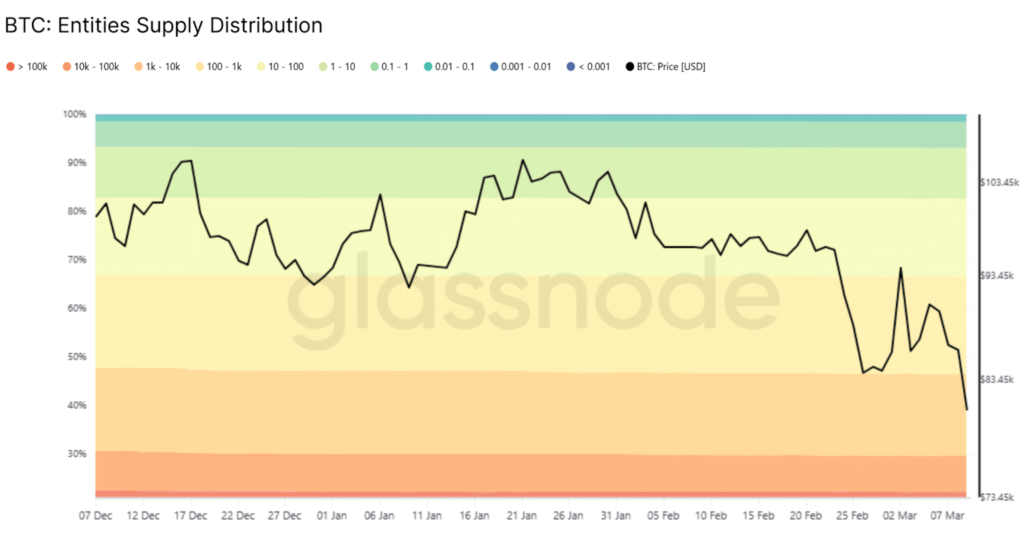

The supply held by whales (≥100k BTC) ranged from 22.26% in February to 22.17% in March, a small but noticeable reduction. The 1k-10k BTC cohort saw a more significant shift, falling from 16.96% in February to 16.19% in March, suggesting mid-sized whales have been selling more aggressively.

Retail addresses (<1 BTC) kept accumulating Bitcoin, displaying consistent growth despite volatility. The 10-100 BTC category remained stable, indicating that mid-sized holders are less reactive to price changes than whales.

The data confirmed a classic accumulation-distribution cycle, with large whales taking profits after the rally and smaller players stepping in. Netflow data from IntoTheBlock further confirmed whale behavior.

The most significant net inflows occurred on February 5, with +39.62k BTC entering large holders’ wallets at $97,692. This meant that whales were accumulating at high prices, anticipating further gains.

Yet, netflows dropped, with only +2.08k BTC on March 9 – a sign of reduced demand from large holders. Bitcoin’s price decline from $97k in early February to $80k in March aligned with the sharp fall in its netflows.

The 7-day netflow changes dropped by -27.69%, while the 30-day netflow declined by -546.90%. This points to a possible exhaustion in institutional accumulation.

Yet, looking at the bigger picture, the 1-year netflow was up by +714.19% at press time. This indicated that while short-term whale interest may fade, long-term conviction has not entirely vanished.

What’s next?

Whale activity has been behind Bitcoin’s recent price action. Large holders accumulated aggressively before the January peak of $106,000 but began distributing in February.

The reduction in netflows and the 1,000-10,000 BTC holders suggested that some whales are already cashing out—Bitcoin’s decline to $80,000 and below aligned with this distribution trend.

If whales keep offloading, BTC could face more price corrections. However, the persistent growth in retail demand and long-term netflows means that not all investors are losing faith.

Whether Bitcoin’s next move is another rally or a deeper pullback will depend on whether the remaining whales are still open to buying.

Crypto liquidations reach nearly $1 billion

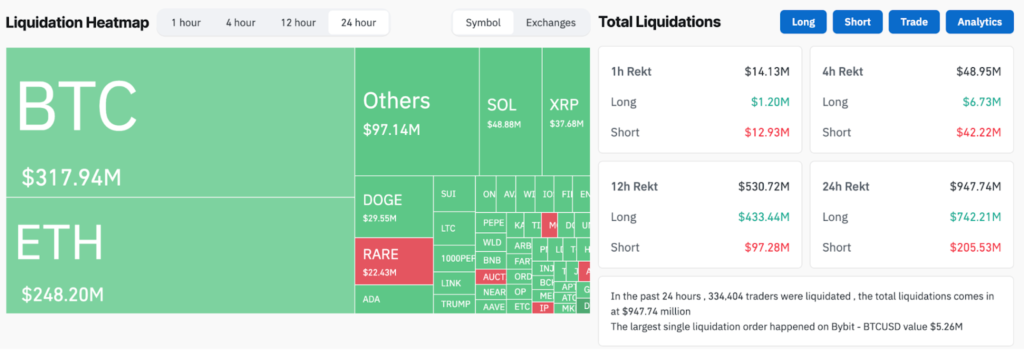

The crypto market experienced a substantial downturn, with nearly $1 billion in liquidations erasing traders’ positions. This sharp decline followed an unstable start to the week, which already saw $620.5 million in losses.

According to Coinglass, 334,404 traders were liquidated in the past 24 hours, totaling $947.7 million. Long positions were the most affected, with $742.2 million liquidated, while short positions had $205.5 million.

This signaled the market moved against those who expected prices to increase, leading to more significant financial losses.

Bitcoin (BTC) was the most affected, with $317.9 million erased. Of this, $242.1 million was from long positions and $75.8 million from shorts. Ether (ETH) had a similar trajectory, with $248.2 million in liquidations, $196.4 million of which came from long positions.

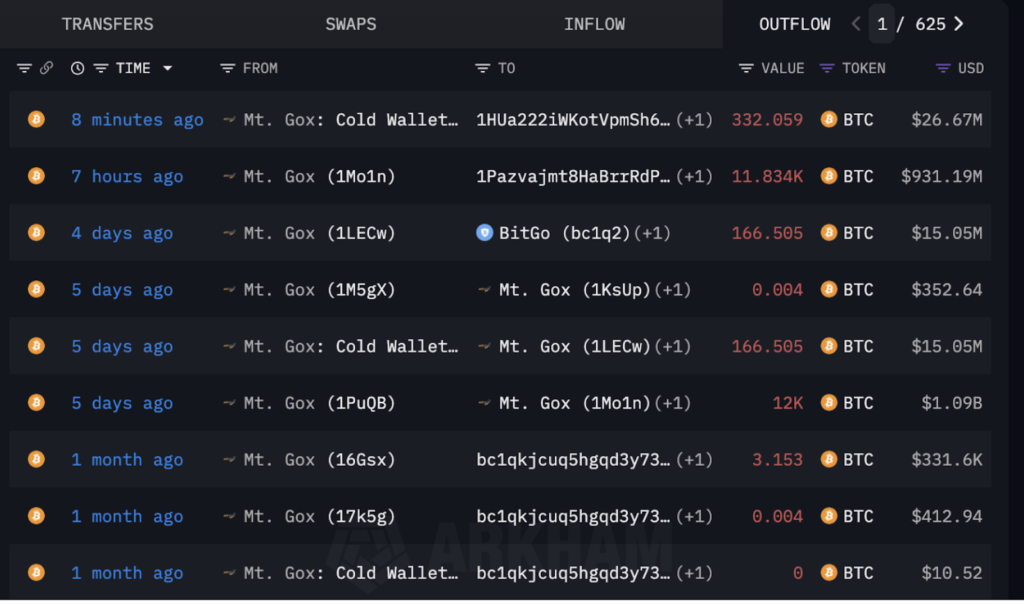

Furthermore, significant cryptocurrency movements by prominent players have increased fears of a broader sell-off, and according to Arkham Intelligence, Mt. Gox, the defunct exchange still distributing assets to creditors, transferred 11,834 BTC—valued at an estimated $931.1 million—to an unknown address.

A few hours later, Mt. Gox’s cold wallet again transferred 332 BTC worth $26.6 million to another address. These transfers came shortly after its earlier movement of 12,000 BTC worth $1 billion.

The latest volatility was sparked by comments from President Donald Trump, who hinted at an upcoming recession. He affirmed,

“Look, we’re going to have disruption, but we’re okay with that.”

His comments deeply affected the financial markets, with stocks crashing and cryptocurrencies. According to The Kobeissi Letter, a prominent financial newsletter, the decline discarded the post-US Reserve announcement rally. The post noted,

“Not only does this mean crypto’s bear market has begun, but it’s also down 35% in three months.”

Closing Remark

With President Trump making bold assertions and plans, his pro-crypto stance is a step in the right direction regarding positioning the US as the crypto capital in the world.

Also, the five US economic data revealed are essential in impacting the portfolio of Bitcoin (BTC) holders. Meanwhile, with large BTC holders and retail investors acquiring at a high rate lately, a coordinated bullish momentum may be on the horizon.

However, the crypto market also suffered heavy liquidation, with BTC being the worst hit. Worse still, Trump’s comments allegedly sparked volatility. As such, it’s a waiting game to see what impact Trump’s plans will have.

Zypto Launches New Virtual VISA Card and Integrates Pi Wallet Imports

Zypto has launched the new reloadable virtual Zypto VISA Card, featuring high limits, international availability and 3D secure. Moreover, Zypto has become the first third-party crypto app to support Pi Wallet imports, ahead of an upcoming SUI integration.

Find out more here.

President Trump may have announced some big plans for the crypto space, but do you agree with them? Share your thoughts in the comments section.

FAQs

What’s the executive order from the White House regarding crypto?

The executive order explicitly forbids the government from selling BTC in reserve.

What are the key crypto moves Trump has made in March?

They include formalizing a never-sell Bitcoin strategy, funding the crypto reserve with seized assets, keeping the dollar as the reserve currency amidst stablecoin integration, distinguishing between BTC and other digital assets, and Building a “digital Fort Knox” with no taxpayer funding.

Why have Bitcoin whales been accumulating at a high rate?

This indicates strong market confidence in BTC amidst a historic increase in retail demand.

How much will the crypto reserve be funded with?

The crypto reserve will be initially funded using an estimated 198,100 bitcoins valued at $16.7 billion from seized assets.

Why did the crypto market get heavily liquidated?

This stemmed from President Trump hinting at an upcoming recession.

0 Comments